Forex analysis review

Forex analysis review |

- Forecast for EUR/USD on November 30, 2020

- Forecast for AUD/USD on November 30, 2020

- Forecast for USD/JPY on November 30, 2020

- Forecast and trading signals for GBP/USD on November 30. COT report. Analysis of Friday. Recommendations for Monday

- Forecast and trading signals for EUR/USD on November 30. COT report. Analysis of Friday. Recommendations for Monday

- Overview of the GBP/USD pair. November 30. London and Brussels resumed negotiations. Dominic Raab says this week will be

- Overview of the EUR/USD pair. November 30. Warsaw and Budapest are firing a "warning shot" at the EU authorities over the

- Analytics and trading signals for beginners. How to trade GBP/USD on November 30? Analysis of Friday deals. Getting ready

- Analytics and trading signals for beginners. How to trade EUR/USD on November 30? Analysis of Friday deals. Getting ready

- Trading plan for the GBP/USD pair for the week of November 30-December 4. New COT (Commitments of Traders) report. The pound

- Trading plan for the EUR/USD pair for the week of November 30-December 4. New COT (Commitments of Traders) report. The growth

| Forecast for EUR/USD on November 30, 2020 Posted: 29 Nov 2020 07:01 PM PST EUR/USD The euro gained 49 points last Friday on small volumes and a thin market, its aspiration to enter the target range of 1.2010/40 continues to be realized with the risk of a reversal, which is indicated by the divergence with the Marlin oscillator on the daily chart.

Also, on a weekly scale, the signal line of the Marlin oscillator is declining in its own descending channel. At the same time, a range of three figures began to form, the growth within it was clearly speculative. We believe that the final days of this speculation are now passing.

There is a strong rally on the four-hour chart, but Marlin is already in the overbought zone, the signal line of the oscillator has gone up from the range, and this may turn out to be a false exit. We are watching. It's too late to buy, it's too early to sell. The EU has set another deadline for the Brexit talks, until December 4th. The parties will probably wait until the last one in order to complete this game with a decent face, even if there is nothing to talk about. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on November 30, 2020 Posted: 29 Nov 2020 06:58 PM PST AUD/USD The aussie is rising this morning, under the impression of growth in counter-dollar currencies in the thin market from the second half of last week. But despite the growth, there is still a technical divergence with the Marlin oscillator on the daily chart. A reversal may occur in the 0.7380-0.7440 range. The first significant support is the MACD line at 0.7252, just below it is the technical record level of 0.7222, the 0.7222/52 range is likely to become a target.

But the actual reversal is not yet available. The price has settled above the balance and MACD indicator lines on the four-hour chart and Marlin is moving up in the zone of positive values.

The Reserve Bank of Australia will hold a meeting tomorrow, which may shake the optimism of speculators. The Australian stock market can no longer withstand the tension, falling 0.73% from the open amid the general rise in Asian markets (Nikkei 225 0.04%, China A50 1.32%). The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on November 30, 2020 Posted: 29 Nov 2020 06:58 PM PST USD/JPY The Japanese yen is strengthening against the dollar for the fifth day, which shows that it follows the 7-month downward trend. This morning the price has overcome the technical support of 104.05, and now the price is facing the 103.18 level - the November 6 low, which is the nearest target. The Marlin oscillator turned to the downside from the border of the growth area. The quote could fall further towards the second target of 102.35.

The four-hour chart shows that the price has settled below the red balance indicator line, the Marlin oscillator is in the downward trend zone. The local trend is steady and decreasing. We are waiting for the pair to fall towards the designated target.

|

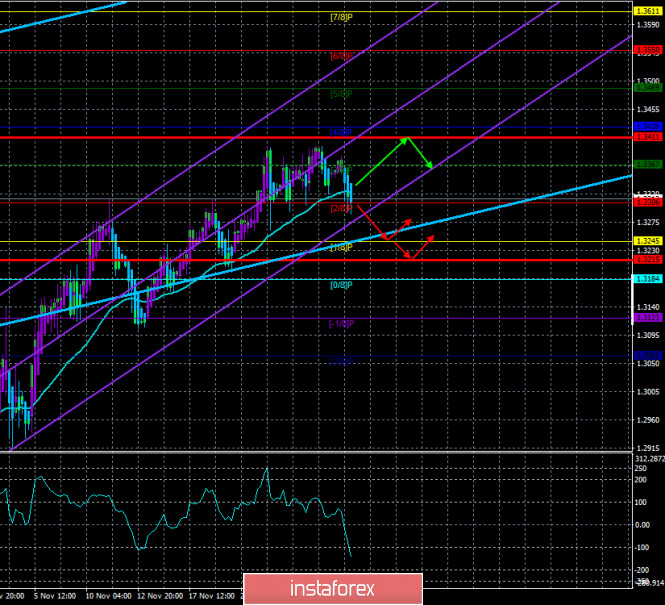

| Posted: 29 Nov 2020 06:06 PM PST GBP/USD 1H The GBP/USD pair started a round of downward movement on Friday, November 27, within which it left the rising channel. However, this is not the first change in trend in recent years. Previously, the pair has settled below the rising trend lines three times, afterwards the upward movement resumed anyway. Thus, buyers still held it in their hands despite the fact that most of the factors currently speak for the pound/dollar pair's fall. At the moment, the quotes have gone below the critical line, so we can expect a succeeding downward movement towards the Senkou Span B. An additional factor that speaks in favor of the dollar's growth is a double rebound from the 1.3397 level. In general, there are a huge number of factors in favor of the dollar, and not a single one in favor of the pound. Also, the fact that the pound is overbought should be added to this. GBP/USD 15M

Both linear regression channels are directed to the downside on the 15-minute timeframe, which is absolutely logical after the price failed to overcome the 1.3397 level. In the near future, we expect quotes to fall to the Senkou Span B line, near which the pair's succeeding fate for the next few days will be decided. COT report

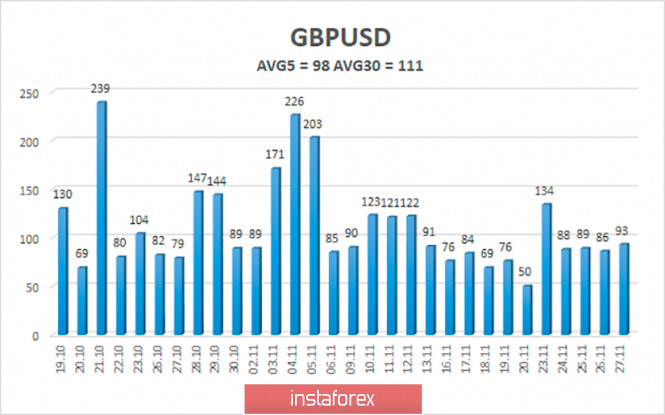

The GBP/USD pair rose by 135 points in the last reporting week (November 17-23), so we could expect an increase in the bullish mood of professional traders in the Commitment of Traders (COT) report for this period. We mentioned that changes were minimal when analyzing the report on the euro currency. However, they are not minimal in the pound's case, they simply do not exist. The most important group of non-commercial traders opened 533 Buy-contracts (longs) and 616 Sell-contracts (shorts) during the reporting week. That is, the net position for this group of traders fell by less than 100 contracts. The total number of open contracts is about 90,000. Consequently, the conclusion suggests that professional traders were resting during the reporting week. In principle, both indicators show the same thing. The first one has changed direction very often in recent months (the green and red lines are constantly unfolding), which indicates that there is no definite trend and clear mood among professional players. The second shows the same lack of trend in the mood of non-commercial traders. Thus, all the data from the COT report say only one thing: we can not make predictions, since there are very few changes. The fundamental backdrop for the pound remains upbeat. While the United States is moving away from several months of hassle associated with the elections, the UK and EU continue negotiations on a trade deal, the essence of which has not changed in recent months. All the same "serious disagreements remain between the parties", all the same "three issues remain unresolved", still London and Brussels blame each other and say that the deal depends on the opposite side. Traders have long believed that the deal would still be closed and that the British economy would not be knocked out in 2021. But faith alone will not go far. Sooner or later, optimism goes away and it seems that now traders are no longer ready to blindly buy the pound. As for other news and messages, now they do not matter at all. Markets cheerfully ignore the official, not too biased information about the course of the negotiations, so statistics and news regarding the coronavirus are of no interest to them at all. No important reports or events from the European Union and America on Monday. Market participants will monitor any news related to negotiations on a trade deal. True, talks have just resumed and it is unlikely that we will receive new information right away on Monday. And given the ability of both sides to give in and negotiate, we may not get new information very soon. We have said more than once that if we take the entire fundamental background into account, then the pound has no reason to rise in price against the dollar. Thus, we are still leaning towards the pound's fall. We have two trading ideas for November 30: 1) Buyers for the pound/dollar pair released the initiative and missed quotes below the Kijun-sen line (1.3330) and below the rising channel. Thus, we advise you to tradeupward while aiming for the resistance level of 1.3483 not earlier than a rebound from the Senkou Span B line or when the pair settles above the 1.3397 level. Take Profit in this case will be up to 70 points. 2) Sellers still managed to get the pair to settle below the rising channel, so they can finally move from words to deeds. We recommend selling the pair at this time with targets on the Senkou Span B line (1.3251) and the support level of 1.3191. Take Profit in this case can range from 60 to 120 points. Forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

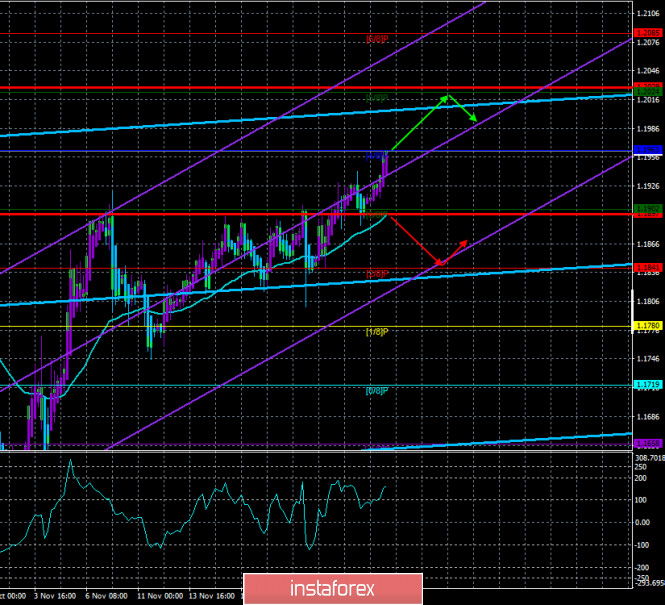

| Posted: 29 Nov 2020 06:03 PM PST EUR/USD 1H The EUR/USD pair continued to move up on the hourly timeframe on Friday, November 27. It looks impressive in the chart, but in fact it is not so strong. The pair's volatility is still rather low, but the rising movement seems assertive. A new upward channel appeared, within which the price is now moving. Thus, the initiative is now in the bulls' hands, as they continue to push the pair to the upside. However, we are still inclined to believe that the current upward movement is not justified. There is no particular reason for the euro to increase in price now. Moreover, most of the factors speak in favor of the fact that the euro should fall in price. Therefore, we do not believe that buyers will be able to move the pair above the 1.2000 psychological level. Bears should be on the alert and immediately attack if the price settles below the rising channel. We believe that the current levels are very attractive for selling the pair. Moreover, after rising by 1300 points in 2020, the US dollar has not normally corrected. EUR/USD 15M

Both linear regression channels are directed to the upside on the 15-minute timeframe. The nearest target is the 1.1976 level. Thus, so far the lower chart does not provide any reason to expect that the short-term upward trend would end. COT report

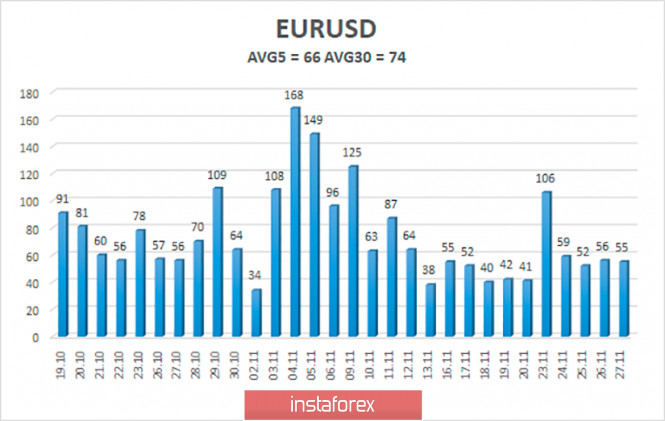

The EUR/USD pair fell by 10 points in the last reporting week (November 17-23). That is, the price changes were again minimal. This indicates a low activity from traders, primarily large traders, whose deals are displayed in the Commitment of Traders (COT) reports. What did the new report show us? Very little. As in the previous week, professional traders opened a small number of new contracts during the week, only about 3,700. Considering that the total number of contracts for the "non-commercial" group is more than 300,000, this means that 3,700 is only about 1%. There is absolutely nothing to say about the mood of the major players. There were 700 more Buy-contracts (longs) that were opened compared to Sell-contracts (shorts). As you can imagine, these changes do not allow us to conclude that the mood of professional traders has sharply become more bullish or bearish. The net position remained practically unchanged. Thus, as a result, we can say that there are practically no changes, and the general picture of the state of affairs remains the same. That is, the data from the COT reports still leaves a high probability that the upward trend was completed near the 1.2000 level. Even despite the fact that now the pair's quotes have come close to this level. Nevertheless, the first indicator shows the movement of green and red lines towards each other (net positions of commercial and non-commercial traders), which means that the euro should be depreciating, and the previous trend is over. The net position of non-commercial traders (second indicator) has been signaling a decline for several months now. This means that major players are looking more and more towards selling the euro. No important reports or events from the European Union and America on Friday. There was only a general fundamental background for the EUR/USD pair. But it did not have any particular impact on the mood of traders. There is practically no news from America now. There has been news from the European Union, but market participants ignore those. It seems that only a few players have been pushing the market to the upside, and the rest do not understand what is happening. European Central Bank President Christine Lagarde will give a speech on Monday, aside from that, no other events listed in the calendar. Thus, everything will depend on what exactly Lagarde will say. Based on her last speeches, we can conclude that she will not say anything optimistic. However, judging by the fact that the euro is getting more expensive again, the markets do not need optimistic statements. The European economy may face serious problems in the near future due to the second wave of COVID-2019 and the lockdown, but traders do not care about this fact at all. Even the threat of a conflict between the EU members does not frighten traders and does not discourage them from buying euros at this time. We have two trading ideas for November 30: 1) Buyers continue to move up after breaking through the resistance area of 1.1886-1.1912. Therefore, you are advised to continue trading upward with the targets at the resistance levels of 1.1976 and 1.2011 as long as the price is within the rising channel. Take Profit in this case will be no more than 45 points. 2) Bears are letting go of the pair more and more every day, nevertheless, the current fundamental background allows them to count on the pair's reversal to the downside soon. Thus, you are advised to open new sell orders while aiming for the Kijun-sen line (1.1881), in case the price settles below the rising channel. Take Profit in this case can be up to 45 points. Forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2020 04:38 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 164.1826 The British pound started a new round of corrective movement on Friday, November 27. However, at the moment, it is not clear what this round of correction means. Is it just a correction, after which the upward trend will resume? Or market participants have finally stopped believing in a trade agreement, which is highly likely not to happen? One way or another, the quotes of the pound/dollar pair have fixed below the moving average line, thus, the trend has changed to a downward one. Therefore, the downward movement may continue for some time. We have been waiting for several weeks in a row for the pound to start a prolonged fall. We believe that the British currency is overbought and most importantly - completely unreasonably overbought. However, Friday's movement does not make it possible to conclude that a new downward trend has begun. It's still too weak. Although market participants do not pay any attention to the statements of Boris Johnson, Michel Barnier, Ursula von der Leyen, and David Frost regarding the progress in the negotiation process, it is the topic of trade negotiations that remains the most important for the UK, the British economy and the British pound. In principle, since November 15, all traders are waiting for both sides to make a statement on the outcome of the negotiations. Recall that it was on November 15 that the negotiations were supposed to end to have time to ratify the agreement in the two parliaments later if there was one at all. On the weekend, fresh news was received from London. On November 28, Michel Barnier arrived in London to resume face-to-face talks. In other words, the negotiations are continuing, although all conceivable deadlines have already been violated. At the weekend, Michel Barnier said that "we are very close to the moment: either yes or no". A similar statement was made by his British counterpart David Frost, who also does not know whether there will be an agreement in the end. Barnier also said that "significant differences remain" between the parties, however, we have heard this many times before. It also became known over the weekend that Barnier made an offer to Frost regarding the most pressing issue of fishing. It is reported that Barnier offers to return from 15% to 18% of the value of fish stocks that are caught by European fleets in British waters. The offer is expected to bring in more than 100 million euros for the British fishing industry. What London thinks about this is still unknown, but we believe that this proposal will be rejected. 10 Downing Street has repeatedly stated that they want to have full control over their territorial waters. However, Boris Johnson himself still makes statements like: "There are significant and important differences that still need to be overcome, but we continue to work on this. The probability of a deal is largely determined by our friends and partners in the EU." That is, the British Prime Minister continues to "throw the ball" to half of the field of the European team as if to show that everything depends on them. And the EU does the same when the ball is on its side. Both sides have consistently stated that significant differences remain, and no one has ever said that there are fewer problematic issues. "It is late, but a deal is still possible, and I will continue to say this until it becomes clear that this is not the case," said British negotiator David Frost. At the same time, it became known that next week is likely to be the last in the negotiations. This was stated by British Foreign Secretary Dominic Raab when asked about the deadline. "This is a very important, really last week, when some further delays are still possible," Raab said. Thus, it is still unclear whether there will be an agreement in the end or not. It turns out that the British pound has grown in recent weeks solely on the belief of traders in a "bright future" (a trade deal). Because there was no economic reason to buy the pound. The British economy is reeling and swaying from side to side before it is dealt the final blow in the last 5 years. This blow is Brexit, a "hard" Brexit. But even if London and Brussels manage to reach an agreement, this does not mean that the British economy will not shrink in 2021. This will happen anyway. The only question is how hard the blow will be to the British economy. With a deal, it will be tolerable; without a deal, it will be terrifying. That's the difference. And of course, do not forget about the pandemic, the second "lockdown" and the consequences of these events in the Foggy Albion. Thus, the pound could grow all this time only due to the belief of market participants in the deal. Now, therefore, we need to understand whether the traders' faith has run out. London and Brussels can negotiate indefinitely, and we believe that they will continue in 2021. The pound can't grow all this time while the negotiations are going on. From a technical point of view, the pound/dollar pair is only slightly fixed below the moving average line. Thus, the downward movement may continue, but we remind you that in the last two months, the price regularly went below the moving average line, and then very quickly returned to the area above the moving average. Therefore, something similar may be happening now. Markets do not respond adequately to the fundamental background, ignore the macroeconomic background, COT reports do not bring any clarity to what is happening, and the technical picture is often contradictory.

The average volatility of the GBP/USD pair is currently 98 points per day. For the pound/dollar pair, this value is "average". On Monday, November 30, thus, we expect movement inside the channel, limited by the levels of 1.3215 and 1.3411. A reversal of the Heiken Ashi indicator to the top signals a possible resumption of the upward movement. Nearest support levels: S1 – 1.3306 S2 – 1.3245 S3 – 1.3184 Nearest resistance levels: R1 – 1.3367 R2 – 1.3428 R3 – 1.3489 Trading recommendations: The GBP/USD pair started a new round of downward movement on the 4-hour timeframe. Thus, today it is recommended to open short positions with targets of 1.3445 and 1.3215. You can keep them open until the Heiken Ashi indicator turns up. It is recommended to trade the pair again for an increase with targets of 1.3411 and 1.3428 if the price is fixed back above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2020 04:38 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 164.1826 The fifth trading day for the EUR/USD pair was again in an upward movement. Although the volatility in recent weeks is quite low, as can be seen from the volatility table below, nevertheless, the upward movement is still quite stable. In recent weeks, we have repeatedly been surprised by the fact that the British pound is showing growth against the dollar. We have repeatedly said that there were no fundamental reasons for strengthening the pound. Now, it seems that the European currency has caught the same disease. At a time when America was overwhelmed by all sorts of crises, the US dollar simply could not rise in price, which was logical. During the US election period, when many were skeptical of the dollar, it simply did not become more expensive. Now, when the situation in the United States has more or less stabilized, the US dollar for some reason began to fall again. Now, even theoretically, it is difficult to find a reason why the US currency is under pressure. Of course, under democratic presidents, the US currency often becomes cheaper than more expensive. However, this is a long-term issue. It is unlikely that investors and traders rushed to get rid of the US currency as soon as they learned that the next president will be Joe Biden. The most interesting thing is that only disappointing reports are coming from Europe right now. No, there is no outright negative. But at the same time, there is no positive. The EU has already faced the challenge of vetoing the seven-year budget and the post-pandemic recovery fund by Poland and Hungary. If at first, this problem did not seem to be a problem at all, because it is unlikely that the authorities of the EU and its two members could not agree. However, now, after some time, it becomes clear that a quick and painless agreement will not work. Warsaw and Budapest are demanding that the EU authorities review legislation that allows for cuts in funding from the general budget based on non-compliance with the rule of law directives. Recall that the problem is that Brussels accuses the Polish and Hungarian authorities of discrimination against political opponents, violations of the principle of democracy, and infringement of the rights of sexual minorities. The accused, on the other hand, believe that they have nothing wrong with democracy, and the proposed new legislation is proposed to force them to recognize same-sex marriages and accept refugees from the South. However, the EU's key accusation against Poland and Hungary is an attempt by local authorities to subdue the judicial systems. This violation, according to the EU, implies the development of corruption and, as a result, the theft of money from the European budget. However, as political analysts say, Budapest and Warsaw are unlikely to get anything out of this political demarche. The problem is that at this time it is proposed to consider and vote for a package consisting of the budget, the recovery fund, and new legislation in its entirety. This requires the approval of all EU member states. However, in certain cases, the approval of 55% of EU countries (15 or more out of 27) is sufficient to pass a certain bill. For example, the issue of new legislation requires the approval of at least 15 countries of the alliance. And if consent is obtained, the bill will be passed, despite the protests of Poland and Hungary. Thus, Brussels and Berlin can now simply divide the package of bills and vote on each separately. Therefore, if the "rule of law mechanism" is adopted, Poland and Hungary can veto it as much as they want. They will only achieve this by blocking their access to the 2021-2027 budget and the recovery fund. However, this also cannot be misunderstood in Warsaw and Budapest themselves. Lawyers from these countries probably know EU law and understand that if the alliance wants to adopt a new compliance mechanism, it will accept it. Accordingly, the purpose of vetoing can only be a "warning shot" to the European authorities. Warsaw and Budapest seem to show that if the "compliance mechanism" is adopted, then in the future they will block any other bills that require the unanimous approval of all EU member states. Thus, a conflict is brewing in the European Union and now it is not clear how it will end. Negative economic news is also coming from the EU. Over the past two weeks, Christine Lagarde, the ECB President, has made five or six speeches, and each time her speeches have been very pessimistic. The head of the ECB noted several times that in December the ECB will expand the package of stimulus measures, that the EU economy will again begin to experience problems at the end of 2020 due to a new wave of pandemic and a new "lockdown". Thus, the EU's GDP is likely to contract again in the fourth quarter. Experts have already estimated that in the fourth quarter, the economy may lose about 3%. This is the kind of news that has been coming in from the EU recently. Let's return to the question that we asked at the beginning of the article: on what grounds is the euro currency growing now? As we have said more than once, any currency can grow with absolutely any fundamental background. Just often, the fundamental background and the nature of the movement of a particular currency coincide. However, many patterns were broken in 2020. For example, for most of the year, market participants completely ignore macroeconomic statistics. Moreover, the pandemic has made adjustments in all areas. Thus, we are not personally surprised by the fact that the euro is now growing again. Before that, it had been standing in one place for 4 months, although the trader had reasons for more active trading. Therefore, we only remind you once again that any fundamental hypothesis requires technical confirmation. From a technical point of view, the euro/dollar pair continues to move to the previous high just above $1.20. We still believe that there is nothing for the pair to do above this level. This is supported by both the COT and foundation reports. Nevertheless, the "technique" now remains on the side of the European currency and the bulls for the EUR/USD pair. Therefore, we continue to recommend trading higher.

The volatility of the euro/dollar currency pair as of November 30 is 66 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1897 and 1.2029. A reversal of the Heiken Ashi indicator downwards signals a round of corrective movement. Nearest support levels: S1 – 1.1902 S2 – 1.1841 S3 – 1.1780 Nearest resistance levels: R1 – 1.1963 R2 – 1.2024 R3 – 1.2085 Trading recommendations: The EUR/USD pair continues its upward movement. Thus, today it is recommended to stay in buy orders with the target of the Murray level of "5/8"-1.2024 until the Heiken Ashi indicator turns down. It is recommended to consider sell orders if the pair is fixed below the moving average with targets of 1.1841 and 1.1780. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2020 01:29 PM PST Hourly chart of the GBP/USD pair

For the GBP/USD pair, the price has settled below the upward trend line, which now speaks in favor of further downward movement. Buyers of the pair failed to overcome the 1.3397 level, from which the quotes rebounded twice. Thus, technical factors now speak in favor of the pound's succeeding fall. And not only technical factors speak in favor of this option. The fact is that the pound has been growing in price for a fairly long period of time. To be more precise, from September 23rd. Moreover, it is still quite difficult to say why the pound has been increasing for so long and as a result, it has grown by as much as 700 points. It is one thing if it was a correction against the previous fall. But the current movement is too strong for a correction. Of course, formally 99% of the main movement is also a correction. However, in our case, the upward movement was still too strong. And most importantly, not justified, from a fundamental perspective. The fundamentals were rather weak last week. The UK services PMI fell, and no other macroeconomic reports were released in Great Britain. There have been several important reports in America and we can't say they were disappointing. For example, GDP was 33.1% in the third quarter, and orders for durable goods were higher than forecasted. But the pound rose in price anyway, although the most important fundamental topic for it is still the negotiations on a trade deal with the European Union, which is still not in favor of the pound. Last week, talks were put on hold, then resumed, then continued and there were still no results. London and Brussels are simply continuing talks that were supposed to end on the 15th November deadline. Both sides also continue to negotiate in the press, regularly accusing each other of unwillingness to concede, then declaring that an agreement is possible. No major reports scheduled for release in both the UK and America on Monday. Nevertheless, traders may continue to wait for information regarding trade talks between London and Brussels, since this is still the most important topic for the pound. If we receive information that negotiations have reached a deadlock again, this could contribute to the pound's fall. We are not expecting any important news from America at this time. Possible scenarios for November 30: 1) Traders failed to overcome the 1.3397 level, afterwards the price fell below the trend line. Therefore, long deals are irrelevant now. You need to wait for a new upward trend to appear or until the 1.3397 level has been overcome in order to expect an upward trend to form. 2) Short deals, from our point of view, are more convenient now, and for a number of reasons. The upward trend line has been overcome, the pound has been growing for a long time, the fundamental background is still not in favor of buyers. Thus, we believe that the downward movement will extend until next week. In order to be able to open short positions, novice traders are advised to wait for the upward correction, afterwards a new sell signal from MACD. Aim for support levels 1.3281 and 1.3242. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2020 01:29 PM PST Hourly chart of the EUR/USD pair

The EUR/USD pair went back to moving up last Friday, and updated its previous local high, so we concluded that the rising movement has returned. Last Friday, we advised beginners to trade bullish if a new buy signal from MACD appears, but we also warned about the increased risks of such a transaction. Fortunately, the buy signal was not false and traders could earn 20-30 points. Current volatility levels are not too high, so 20-30 points is an absolutely normal result. The upward trend line has been rebuilt, so it now supports bull traders again. The pair ended Friday near the day's highs, so on Monday traders need to wait for a downward correction and, if the price remains above the trend line, re-consider options for opening buy orders. Despite the fact that the euro/dollar pair left the 1.1700-1.1900 horizontal channel, we still advise you to be wary of the upward movement. From our point of view, it is not fully justified now. No important publications and news in America and the European Union last Friday. At least the US did not provide any particularly significant information. Nevertheless, the European currency has been actively growing in price for several days now and at this time it is very difficult to find out as to what this may be connected with. This is because there are several rather serious problems brewing in the European Union that may affect the European economy. Firstly, Poland and Hungary vetoed the EU budget for 2021-2027 and the Coronavirus Pandemic Recovery Fund. Secondly, the lockdown will inevitably lead to a contraction in business activity and the economy in the fourth quarter. There are no such problems yet in America, since a new hard quarantine was not introduced in this country. However, the euro is still rising despite all of these facts, which is a little strange. European Central Bank President Christine Lagarde is set to deliver a speech on Monday. Her previous speeches were of a pronounced black color. Lagarde expressed concerns about the prospects for the economy due to the increase in the number of cases in October-November, as well as because of the lockdown. She also announced the expansion of stimulus measures in December. Thus, the chief economist of the EU believes that the European economy will start to experience serious problems again this winter. Most likely, her rhetoric will remain unchanged, which means that you should not expect anything optimistic Possible scenarios for November 30: 1) Long positions are currently relevant since the upward trend line has been rebuilt. Now, in order to be able to open new long positions, you need to wait for a new round of downward correction. The price rebounding from the trend line or a buy signal from the MACD (after the indicator is discharged to the zero level) can be used for new buy positions on the euro with targets at 1.1969 and 1.1997. We do not see the pair moving above the 1.2000 level yet. 2) You are advised to not trade for a fall at this time. Only when the price settles below the trend line on Monday, which will lead to a change in the short-term trend to a downward trend. In this case, we recommend opening sell orders with a target near the 1.1903 level, which has been the upper border of the horizontal channel for a long time. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2020 01:15 AM PST GBP/USD – 24H. The GBP/USD currency pair has increased by about 20 points over the past week, which is a very weak volatility value for this pair. However, this is the final value of the week. Maybe the situation was different for each individual day? No. Volatility remained fairly low all week. At the same time, an upward trend continued in the long term, which has long caused surprise and doubts about its validity. However, as we have repeatedly warned, this is a currency market, and no one can predict its behavior by 100%. The fundamental background may be completely against the pound, but if market participants buy it (for any reason), it will grow. Thus, we always warn that any fundamental theory and hypothesis must be confirmed by "technology". As long as this is not the case, no matter what the "foundation", it is recommended to trade according to the trend, that is, to increase. The previous local high has not been updated yet (1.3481), so there are still theoretical chances of a new downward trend starting. Also, we would not particularly count on the "double top" pattern. COT report. During the last reporting week (November 17-23), the GBP/USD pair increased by 135 points, thus, in the COT report for this period, we could expect an increase in the "bullish" mood of professional traders. Analyzing the report on the euro currency, we said that the changes are minimal. In the case of the pound, they are not minimal, they simply do not exist. During the reporting week, the most important group of non-commercial traders opened 533 buy and 616 sell contracts. In other words, the net position for this group of traders decreased by less than 100 contracts. The total number of open contracts is about 90,000. Therefore, the conclusion is obvious: during the reporting week, professional traders had a rest. In principle, both indicators show the same thing. The first one has changed direction very often in recent months (the green and red lines are constantly unfolding), which indicates that there is no definite trend and a clear mood among professional players. The second one shows the same lack of trend in the mood of non-commercial traders. Thus, all the data in the COT report now says only one thing: no forecasts can be made, since there are very few changes. The fundamental background for the GBP/USD pair remained absolutely discouraging last week. It is only necessary to say that there was no news about the results of the negotiations between London and Brussels. That is, in principle, now we can conclude that this topic is not the main one for the pound/dollar pair. All the same, the British currency has shown growth in recent weeks, which is completely inconsistent with the risks that a "divorce" with the European Union without a trade agreement carries for the British economy. Andrew Bailey spoke about this, and many experts in the field of macroeconomics and many analysts speak about it. However, the pound still continues to grow. Hence the conclusion: traders either ignore the fundamental background or blindly believe that a deal between the EU and Britain will be concluded in any case. We do not undertake to judge whether these hopes are justified. From our point of view, the probability of reaching an agreement on this issue is still very low, since "serious differences remain" in the most important issues: fishing, fair competition and dispute resolution. Thus, the deal can be agreed upon by 95%, but without resolving these issues, it will not be signed. And most importantly, the parties have very little time left if they want to have time to ratify the agreement before the New Year, that is, before the end of the "transition period". Well, of course, not without mutual reproaches on both sides. According to London, the European Union does not want to give in and encroaches on the independence of Great Britain, trying to tie it as much as possible to its legislation. According to Brussels, Britain does not want to concede, but wants to retain all the privileges of EU membership, while not being in the EU. Thus, the parties still cannot agree. Trading plan for the week of November 30-December 4: 1) The upward movement has continued in recent weeks, although the resumption of the upward trend is still questionable. Until the maximum of September 1 is overcome, the current upward movement is interpreted as a correction. Most of all, the fundamental background continues to confuse, which absolutely does not support the British pound. Thus, for the time being, upward trends remain more preferable for working out on lower time frames. 2) Sellers now remain quite weak. The COT report shows minimal changes and minimal activity of major players from time to time. Sellers need to return the pair below the Ichimoku cloud in order to expect a downward trend to form again in the long term. We are still inclined to believe that the fall in the pound will resume and will be quite strong. But this hypothesis, like any other, needs technical confirmation. Explanation of the illustrations: Price levels of support and resistance (resistance/support) – target levels when opening purchases or sales. You can place Take Profit levels near them. Ichimoku indicators, Bollinger bands, MACD. Support and resistance areas – areas that the price has repeatedly bounced from before. Indicator 1 on the COT charts – shows the net position size of each category of traders. Indicator 2 on the COT charts – the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2020 01:15 AM PST EUR/USD – 24H. Over the past week, the EUR/USD pair has grown by more than 100 points. The pair's volatility increased slightly after the past week and a very remarkable event happened – the pair again tried to overcome the upper line of the side channel of 1.1700-1.1900. You can even say that it was successful. If in the middle of the week the quotes were pushing and stomping around the upper line of this channel, breaking it by 5-10 points, then on Friday a fairly powerful upward movement followed, which significantly increased the probability of forming a new upward trend. However, we remind traders that quotes have already left this channel twice and also rushed to the level of 1.2000 and then returned to the side channel again. Thus, we believe that this upward movement will not necessarily take the form of a new trend. Moreover, the fundamental background is now such that it is impossible to draw a clear conclusion. COT report. During the last reporting week (November 17-23), the EUR/USD pair declined by 10 points. That is, price changes were again minimal. This indicates a low activity of traders, primarily major traders, whose transactions are displayed in the COT reports. What did the new report show us? It showed us very little. As a week earlier, professional traders opened a small number of new contracts during the week - only about 3,700. Given that the total number of contracts in the "Non-commercial" group is more than 300 thousand, that 3,700 is only about 1%. There is absolutely nothing to say about the mood of the major players either. Buy-contracts were opened for 700 units more than sell-contracts. As you can imagine, these changes do not allow us to conclude that the mood of professional traders has sharply become more "bullish" or "bearish". The net position has not changed much. Thus, as a result, we can say that there are practically no changes, and the overall picture of the situation remains the same. That is, the COT report data still leaves a high probability that the upward trend was completed around the level of 1.2000. Even though the pair's quotes are now very close to this level back. However, the first indicator continues to show the movement of the green and red lines towards each other (net positions of commercial and non-commercial traders), which means that the euro currency should become cheaper, and the previous trend is over. The net position of non-commercial traders (the second indicator) has been signaling a decline for several months. This means that major players are looking more and more towards selling the euro currency. What can we say about the fundamental background of the past trading week? It was quite weak. At the very least, we can't single out any events that affected the course of trading. There were few macroeconomic reports, and most of them were ignored again. In general, there are no changes in the state of the US and EU economies. The heads of the US and EU central banks continue to look to the future with a high degree of fear, even despite the creation of a vaccine against the "coronavirus". Both Jerome Powell and Christine Lagarde insist that the economy requires new stimulus measures and call on governments to help, as well as prepare to expand their programs to support the economy. Thus, it is impossible to conclude that the situation in Europe or America has changed, so the euro currency has again started to enjoy high demand. Rather, the opposite is true. The fundamental background has not changed much over the past week, so it is quite strange for us to observe the resumption of the fall of the US currency when there are no good reasons for this. We were waiting for a new fall in the dollar for 2 or 3 weeks when the United States was completely under the water of a political crisis that also threatened to turn into a constitutional one. However, now in America, on the contrary, there is a lull. Donald Trump has agreed to hand over power. The current President lost all the courts. Of course, there are certain concerns about his activities in the last 2 months, but so far Trump has not done anything that could harm the US economy or the dollar. Moreover, we believe that it is the euro currency that looks less attractive at this time since the economy will shrink due to the "lockdown" in Europe. Trading plan for the week of November 30-December 4: 1) The pair's quotes are quite a big step towards a new upward trend (or a resumption of the old one), however, we still strongly doubt that the quotes will be able to go above the level of 1.2000. Both the fundamental background and COT reports speak against further growth of the euro. However, if there are no technical reasons to expect a fall (and there are none now), then you should expect growth and trade on the lower charts for an increase. 2) To be able to sell the EUR/USD pair, you need to at least wait for the price to consolidate below the Kijun-sen and Senkou Span B lines. But even in this case, the potential for a downward movement will be limited to the level of 1.1700. An upward trend has now formed on the lower timeframes, so short positions are not relevant. Explanation of the illustrations: Price levels of support and resistance (resistance/support) – target levels when opening purchases or sales. You can place Take Profit levels near them. Ichimoku indicators, Bollinger bands, MACD. Support and resistance areas – areas that the price has repeatedly bounced from before. Indicator 1 on the COT charts – shows the net position size of each category of traders. Indicator 2 on the COT charts – the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments