forexsystem.me

forexsystem.me |

- How to SCALP like a PRO using HTF bias – Forex Made Easy

- Benefits of Paperless Payroll – business.com

- THE BEST FOREX INDICATORS (Use These 2 Indicators Or Struggle FOREVER!)

- 1099-MISC vs. 1099-NEC – business.com

- Best forex broker for Australia 2021 �� TOP 3 ��

- Cryptocurrency Options in Employee 401(k) Plans

- Trade kaybetme serileri (forex para kaybedenler)

- What Is Discretionary Access Control?

- 301 Moved Permanently

- Copy Trading Forex Explained in Detail

| How to SCALP like a PRO using HTF bias – Forex Made Easy Posted: 28 Oct 2021 04:14 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Scalping is a skill you build in time…but once you get a hold of it, you’ll never want to leave it! Let’s meet on socials: DISCLAIMER: Don’t take this as trading advice. Trading is risky. Do your own research. source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benefits of Paperless Payroll – business.com Posted: 28 Oct 2021 03:52 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ As evermore business needs go digital, payroll follows suit: Paper checks and manual payroll tabulation are largely on the way out in favor of paperless payroll. Below, learn everything you should know as you consider making the switch. What is paperless payroll?Paperless payroll is any entirely electronic payroll system. It typically includes fully electronic tools for delivering pay stubs and tax forms, tracking employee time, creating payroll reports, and paying employees. Typically, one payroll software platform is all you need to implement all these functions. That said, no two paperless payroll platforms look quite the same, but the best payroll software has all these features. How does paperless payroll typically work?Paperless payroll typically works through the following steps: 1. Install paperless payroll software.Paperless payroll begins with the installation of payroll software or HR software that includes payroll. Initially installing these platforms is typically easy, but implementing them and training your team in them can present some challenges. (We’ll address these obstacles and their solutions later.) 2. Have your employees sign up for the payroll software.Once you install your paperless payroll solution, your employees must create accounts within the program. From their accounts, they can receive pay stubs, tax forms and, most importantly, paychecks. For the latter purpose, your employees will need to add certain information. 3. Have your employees input banking information.To enable direct deposit, your employees must add their banking information to your payroll software. Once employees add their bank account and routing numbers, all should be in place for direct deposit. 4. Integrate payroll software with your time-tracking system.A key function of payroll software is to link your employees’ time worked with the amount of pay they should receive for that period. Many payroll platforms achieve this task more deftly when integrated with a scheduling or time-tracking tool. This integration means you and your employees don’t have to manually enter hours worked into two platforms. It also minimizes errors that could lead to overpayment or underpayment.

5. Train your employees on the system and seek consent.Some training will likely be necessary to get your employees up to speed on the new payroll platform, and it’s on you to provide this training. Sometimes, your payroll provider will include guided training and onboarding, relieving you of this burden. If not, you should gather your team for a debrief on how to get started. In some states, you may need employees’ consent to pay them electronically. Learn and follow your state’s laws on the matter before onboarding employees to your paperless payroll system. In all states, you must obtain your employees’ consent to provide their W-2 forms electronically. Employees who decline must receive paper forms. 6. Generate tax forms and payroll reports.When it comes time to pay your yearly or quarterly taxes, you’ll need tax forms to do so compliantly. Paperless payroll software generates these forms for you and can send copies to your employees as needed. It can also generate payroll reports that further detail your tax liabilities. These reports also come in handy for other needs, such as verifying employee vacation time. Types of paperless payroll solutionsMost paperless payroll platforms fall into one of three categories: electronic payroll records, employee self-service or electronic funds transfer.

9 benefits of paperless payrollThese are some reasons you might choose to incorporate paperless payroll:

4 drawbacks of paperless payrollThe power of paperless payroll systems is clear, but like any business technology, these platforms have some inherent drawbacks.

As you can see, unless your employees lack internet access or bank accounts, paperless payroll is often the way to go. To make the choice between paper and electronic paychecks, assess your team’s access, then figure out what would work based on that.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BEST FOREX INDICATORS (Use These 2 Indicators Or Struggle FOREVER!) Posted: 28 Oct 2021 03:12 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ The Best Forex Indicators (Use These 2 Indicators Or Struggle FOREVER!) You may be wondering what’s the best forex indicator on MT4? Or whats the best combination of forex indicators? Sadly most indicators have no ability to predict whats going to happen with price. However, if you’re looking for the best forex indicator strategy, then there are 2 indicators that when used together will give you an unfair advantage in the markets. One is common, and one is quite uncommon… and YES using them this way is legal! Using these 2 in conjunction is arguable one of the best forex trading strategies! #bestforexindicators #forexindicators #bestforexindicator

More Helpful Videos:

Disclaimer: Trading FX and futures is not appropriate for everyone. Trading and investing involve substantial risk of loss. You should trade or invest only using risk capital – money you can afford to lose. No representation is being made that utilizing the referenced strategy or trading robot will ensure profitable trading or freedom from risk of loss. Some or all of the referenced trades may not be actual trades and instead could be hypothetical trades or simulated trades. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, such as the costs of commissions or other fees. Because the trades underlying these examples may not have been actually executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Simulated trading results in general are also designed with the benefit of hindsight, which may not be relevant to actual trading. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of the financial risk of actual trading. The strategy producing the referenced performance may have made or lost money before or after the referenced trade(s) was/were executed, and the referenced trade(s) may not necessarily be representative of the average subscriber's experience or performance utilizing the strategy. No representation is being made that you will achieve the same or similar results as the referenced results. The performance referenced in any testimonial may not be representative of all reasonably comparable accounts, and although Blue Edge believes the information contained in the testimonial is accurate and reliable, Blue Edge has not independently verified the accuracy. source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

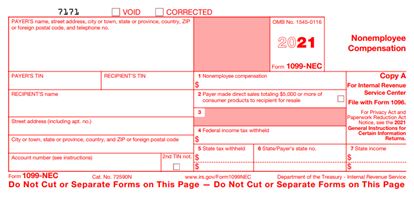

| 1099-MISC vs. 1099-NEC – business.com Posted: 28 Oct 2021 02:49 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Most freelancers and contractors are aware of the 1099-MISC form. The 1099-MISC is used to track income throughout the year that was not already taxed. In 2020, the IRS added a new form to the tax catalog, a 1099-NEC, short for “nonemployee compensation.” In this article, we will outline what you need to know about the new form, the differences between a 1099-MISC and a 1099-NEC, and how to minimize tax mistakes for your small business. What is a 1099-NEC form?The 1099-NEC is a simplified way of reporting independent contractor wages. You can view the sample form here. However, you cannot download the document directly from the IRS website. Instead, the form must be ordered or filed online via the FIRE system. The 1099-NEC should be used instead of the reporting independent contractor payments in box 7 of the 1099-MISC form. Who gets a 1099-NEC form?Self-employed individuals who supply services to a business that exceeded $600 may receive a 1099-NEC from the company that they provided services for. In addition, freelancers and contractors may receive a 1099-NEC, as they are not W-2 employees of the business. If you provide services to an individual, you will not receive a 1099-NEC. However, you still need to report that income when you file your tax return. What is reported on a 1099-NEC?A 1099-NEC covers several types of income. The information you will fill out on this form includes:

What is a 1099-MISC form?The 1099-MISC form is used if a $600 or more payment was paid to an individual or LLC. Rent, legal fees and prize winnings all qualify to be reported on a 1099-MISC.

Who gets a 1099-MISC form?Payees who are eligible for the 1099-MISC form should complete a W-9 form. All payments, including attorneys’ fees, awards, healthcare, royalties and rents, should be reported if totaling $600 or more. What is reported on a 1099-MISC?Here’s a closer look at the items a 1099-NEC includes.

Differences between 1099-MISC and 1099-NECAs of 2020, the 1099-NEC form is for all independent contractor income. The 1099-MISC is still a valid form. However, it is reserved for payments that fall outside of contractor or freelancer wages, such as rent or attorneys’ fees.

The due dates for the forms are different as well. For example, the 1099-NEC is due Jan. 31, whereas the due date for the 1099-MISC is March 1 if filed by paper and March 31 if filed electronically. Example of 1099-NEC form Source: IRS How to file a 1099-NECForm 1099-NEC has two copies: Copy A and Copy B. Copy A should be filed with the IRS, and Copy B should be sent directly to the contractor. Any contractor you hired and paid $600 or more for services rendered in a calendar year must report those earnings. Contractors receiving Copy B of 1099-NEC are not required to file the said form. However, you should receive a copy of 1099-NEC and can request one from the employer if needed for your records. Report any self-employment income on Schedule C. State requirementsSome locations also require you to file your 1099 with your state. The following states are exempt from 1099 filing:

Some states have additional rules about filing electronically regarding 1099. Always consult your CPA to make sure you are IRS compliant with your forms, including 1099. How to fill out a 1099-NECCompanies that need to file a 1099-NEC will first need a W-9 form from the contractor. A W-9 form includes the contractor’s legal name or business name, business entity, current address, and taxpayer identification number. Use the W-9 information to fill out the 1099-NEC, double-check payment totals and note this on the form. Where to send the 1099-NECSince the 1099-NEC cannot be downloaded from the IRS website, you will need to plan to make sure you file on time. Copy ASend Copy A to the IRS by Jan. 31. You can either mail the form or file it electronically. To receive a paper copy of the 1099-NEC, request one through the IRS website. If you are mailing the 1099-NEC, you will need Form 1096 as a cover sheet. Fill out both forms and then mail them to the IRS. Filing electronically also requires some prep work. To use IRS’s FIRE System (Filing Information Returns Electronically), you must use compatible software that converts IRS forms into the proper format. No scanning of documents is accepted. Before you work with FIRE, you will need a Transmitter Control Code. To get a TCC, fill out Form 4419 and submit it to the IRS at least 30 days before the 1099-NEC tax deadline. Early submittal of Form 4419 will allow the IRS enough time to provide you with your TCC. Once you receive your TCC, create your account with FIRE. Copy BCopy B can be physically or electronically sent to the individual contractor. However, you must have consent from the contractor to send the form electronically. Obtain consent by emailing the freelancer. If permission is not received, you will need to mail the 1099-NEC to the address you have on file from the W-9. To follow IRS rules when gathering consent, include the following information for the freelancer:

When to send the 1099-NECCopy A (IRS) and Copy B (contractor) of the 1099-NEC form will be received by Jan. 31 of the following year. If Jan. 31 does not fall on a business day, forms will be received on the next business day. Benefits of payroll softwareFinding the right payroll software for your business can help prevent pain points by automatically staying on top of changing tax laws and streamlining tedious processes. It can also help you keep employee, contractor and vendor data all in one place; provide a variety of payment options to employees; give you access to payroll experts; and offer tax penalty forgiveness. GustoOur review of Gusto found the cloud-based all-in-one software able to handle payroll processing, tax requirements and human resources. In addition, the software offers a combo package for businesses that need to automate more than one area of accounting and an a la carte approach that meets the needs of small businesses. Other features include health insurance administration, paid time off management, time tracking, employee onboarding and access to HR professionals. PaychexFrom small business to enterprise, read our Paychex review to see if they have a service plan for you. From payroll processing to tax obligations, Paychex offers custom payment options for your W-2 employees as well as seamless solutions for contractors and freelancers. Larger businesses can benefit from HR services, onboarding, employee background checks, benefits, compliance and more. Plus, you can pay your employees with direct deposit, paper checks or prepaid debit cards. OnPayOur OnPay review found that the software integrates with QuickBooks, Xero and more. The company claims it can save business owners over 15 hours a month with its mobile-friendly system that is easy to learn. In addition, OnPay helps you automate payroll and taxes, helps you streamline HR and employee self-onboarding, and gives you top benefit options by state.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Best forex broker for Australia 2021 �� TOP 3 �� Posted: 28 Oct 2021 02:11 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Best forex broker for Australia 2021  TOP 3 TOP 3  Who are Forex Broker Australia? Eventually, they are Forex Brokers based in Australia, while for the last years Australian proposal widely spread its offering and became one of the leading online-trading hubs which made Australia an important world center of the trading industry. Australia has quietly become a top destination for international Forex / CFD brokers, while it remains popular among domestic Australian Forex traders. The Australian Securities and Investments Commission (ASIC) regulates all domestic Forex brokers. Founded in July 1998, it is one of the most capable and trusted regulators globally, second only to the UK Financial Conduct Authority (FCA). Therefore, Australian regulated Forex brokers have emerged as some of the most sought-after brokers, offering the most competitive and secure trading environment available today. 1. AvaTrade: AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. Avatrade review: https://www.youtube.com/watch?v=dTLs-ZX064k&t 2. eToro: eToro is a winner for its easy-to-use copy-trading platform where traders can copy the trades of investors across over 2300 instruments, including exchange-traded securities, forex, CFDs, and popular cryptocurrencies. eToro Full review: https://www.youtube.com/watch?v=BUWFLy_n-84 3. Plus500: Plus500 is a London Stock Exchange-listed global CFD broker that was founded in 2008 in Israel. It is regulated by several international financial authorities, including top-tier ones like the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Plus500 is considered secure because it is listed on a stock exchange, discloses its financials, and is regulated by several top-tier financial authorities. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Plus500 Full review: https://www.youtube.com/watch?v=NtKR_7mE0Ww You can also like

So, keep watching and don't forget to Like, Comment, and Subscribe. #topbrokeraustralia #beginnersbroker source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cryptocurrency Options in Employee 401(k) Plans Posted: 28 Oct 2021 01:47 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  While major cryptocurrencies such as Bitcoin are now household names, most Americans haven't bought into this fast-growing asset class. One reason for this discrepancy is because the average American's exposure to the broader investment market takes place through their employer-sponsored 401(k) plans. And with so much volatility and so little regulation in cryptocurrency markets, traditionally risk-averse retirement managers have generally shied away from cryptocurrency investments. But fresh data suggest the handful of companies already offering cryptocurrency retirement options are ahead of the curve. New research on full-time employees preferences suggests that workers are interested in this new retirement savings option. These data suggest there is an untapped well of enthusiasm for cryptocurrency investments through a 401(k) plan; however,there remain variations in attitudes towards cryptocurrency investments depending on one's age and current investments. Key Findings

Benefits of Including Cryptocurrencies in 401(k)sBecause cryptocurrency is ultimately a high-risk, high-reward investment, it began as a niche asset class that only a small group of investors were willing to stake their money on. As more and more retail investors have entered the market in recent years, many hunting voraciously and sometimes recklessly for short-term gains, the ranks of investors interested in cryptocurrencies have swelled. The hype has been heightened by the regular media stories highlighting amateur investors who have netted eye-watering returns. Part of the appeal of a cryptocurrency 401(k) could be its potential to grant an investor exposure to the asset, while hopefully dampening some of the downsides. For example, an individual investor may feel more confident navigating the uncertain cryptocurrency regulatory environment with access to an employer-approved retirement planner. But ultimately the appeal of investing in cryptocurrencies through a 401(k) plan lies in the unique tax advantages that the 401(k) investment vehicle offers. And finally, we've all heard about the importance of having a diversified portfolio, particularly for something as crucial as the savings meant to tide us over in our old age. When utilized responsibly, cryptocurrencies could become part of a balanced retirement plan. Who's Ready to Make the Investment?The overwhelming majority (87 percent) of respondents were at least slightly interested in a theoretical 401(k) program from their employer that would offer the ability to invest in cryptocurrencies.

Three-quarters of workers in the survey currently participate in their employer's 401(k) plan (without cryptocurrency options). Interest in a theoretical cryptocurrency retirement option was strongest among this group: 38 percent of these respondents said they were extremely interested in a cryptocurrency 401(k) program through their employer. In contrast, just 17 percent of those who do not presently have a 401(k) plan through their employer expressed the same intense level of interest. Interest in cryptocurrency 401(k) optionsBy current 401(k) participation with employer and current cryptocurrency ownership

Workers who already have cryptocurrency investments were naturally more interested in the possibility of 401(k) options featuring cryptocurrencies. But perhaps more tellingly, even among those with no exposure to cryptocurrency at all, one in five was highly interested in a cryptocurrency 401(k) offering. This suggests that the cryptocurrency is shaking off the shackles of its previously niche status, and that people who aren't yet "in" on cryptocurrency are willing to put skin in the game. While cryptocurrency is moving towards the mainstream, some demographic attributes stand out in the data. Perhaps unsurprisingly, younger workers (those under 50) are the most interested in cryptocurrency 401(k) plans. Interest declined slightly in the 50-plus group, likely because these older participants are closer to retirement and more comfortable with traditional, lower-risk investments. Interest in cryptocurrency 401(k) optionsBy age group

But it is worth noting that even among workers aged 50 and up, three-quarters of respondents are at least slightly interested in cryptocurrency as a retirement option. This report suggests that some Gen-X and Baby Boomer workers are concerned about under-saving for their retirements, and are looking for higher returns on some of their retirement investments. Interest also waxes and wanes based on how long a respondent has until they retire. Interest in cryptocurrency 401(k) optionsBy estimated retirement date

Workers retiring in the next five years are less willing to risk their savings on cryptocurrency investments. But even among this group, which can see their retirement just over the horizon, 30 percent were very interested in a 401(k) with cryptocurrency options. Confidence in Cryptocurrency as a Retirement OptionFinancial advisers often point to a strong 401(k) as a pillar of one's plan for retirement. For many, it is the primary source of income once they leave the workforce. Retirement plans generally are made up of assets that will provide a steady return over decades. Because cryptocurrency remains a volatile asset, money managers generally advise their clients to keep their cryptocurrency holdings at under five percent of their portfolio. When asked how much of their retirement they are willing to stake on cryptocurrencies, sentiment varies by current cryptocurrency holdings and by years until retirement. Again, a commanding majority of Americans want to allocate at least some of their 401(k) to cryptocurrency investments. Around a quarter would be willing to put up to 10 percent of their retirement contributions into cryptocurrencies.

Current cryptocurrency owners were more open to larger allocations. In fact, more than half of cryptocurrency owners (57 percent) said they'd be willing to invest 25 percent or more of their 401(k) into crypto. Americans who did not own any cryptocurrency weren't as enthusiastic. But even among these respondents, 37 percent would be willing to put a modest amount of their 401(k) into cryptocurrency (up to 10 percent). Most popular currencies for retirement investmentsNow that we know there is broad interest in cryptocurrency retirement options, let's look at the currencies people have the most confidence in. The cryptocurrency market welcomes new players every day in the form of tokens that range from the heavy favorite (Bitcoin) to the serious alternative (Ethereum) to the farcical (Dogecoin and its ilk). We asked workers if they had to concentrate their hypothetical retirement allocations into just one cryptocurrency. Almost half of all respondents would prefer to place some of their retirement investments in Bitcoin, which is the most mainstream of the cryptocurrencies. That means that over half are willing to invest in one of the other alternative currencies, or "altcoins". While these currencies have advantages and disadvantages over Bitcoin,one fairly certain point is that they haven't been around as long as Bitcoin, which makes them untested and potentially more risky. One could argue that the lack of consolidation in the cryptocurrency space has led to confusion among investors as to which, if any, of the tokens will be around when they retire.

ConclusionThere is clearly a significant desire for more mainstream ways to invest in cryptocurrencies. Our research confirms that workers see employer 401(k) plans as potent – but still largely potential – vehicles for granting more Americans access to this asset class. Much of this enthusiasm needs to be tempered considering various regulatory and structural obstacles to broader adoption of employer 401(k) programs with cryptocurrency offerings. But considering that the past decade has seen cryptocurrency grow from a largely theoretical concept to a mainstream investment, it is likely a matter of time before we see more and more ways for investors to put their dollars – or Bitcoins – into the asset class. Our dataBusiness.com surveyed 958 full-time employees about their interest in cryptocurrency 401(k) options in August 2021. 75 percent currently participate in their employer-sponsored 401(k) program and 63 percent currently own cryptocurrencies. Results may be impacted by respondents' exaggeration, or telescoping.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trade kaybetme serileri (forex para kaybedenler) Posted: 28 Oct 2021 01:09 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ forex kaybetme serileri, forex para kaybedenler, trade kaybetme serileri, forex eğitimi, forex eğitimleri, forex trader eğitimi konularında birol kiraz kanalı eğitim videosudur. #forexeğitimi #forexeğitimleri #forextradereğitimi Diğer videolar; UYARI! : Bu videoda anlatılanlar kesinlikle yatırım tavsiyesi değildir. Sadece eğitim amaçlıdır.Her yatırımcı yatırım kararlarını kendisi almalıdır. Sosyal medya hesapları; instagram : https://www.instagram.com/birolkirazfx/ Intro and autro music: source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Is Discretionary Access Control? Posted: 28 Oct 2021 12:45 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ When running a business, you need to keep it secure. Your physical location, your files, your website and your employees all need to be protected. Those security measures include restricting access to whatever you are trying to protect. Make sure that the right people or departments have the access they need to your business’s digital assets. That’s where discretionary access control (DAC) systems come in. When you use a DAC system, you get a versatile, customizable and easy way to add a basic layer of security for any business. It provides safeguards to keep unwanted eyes away from your information, along with a way to recover it if your data or system becomes compromised.

Editor’s note: Looking for the right access control system for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. What is discretionary access control?Discretionary access control is a computer security access control system that restricts digital objects to specific users or groups. It’s essentially a password-controlled security system that allows the right people access to a file without worrying about user levels or access groups. Have you ever shared a Google Doc with a specific colleague or friend? That’s a type of DAC. A DAC creates a robust and effective firewall with security protocols ranging from 128-bit to 256-bit encryption in an effort to prevent malware attacks or other types of malicious data breaches. This creates a beneficial basic layer of security by ensuring that your people, and only your people, can access your corporate information. DAC is not to be confused with mandatory access control (MAC), which uses a broad, level-based computer security system that grants access by group. In contrast, DAC allows the owners of a specific object, like a file or a folder, to grant access to individual users. For example, you might find a MAC security system that uses “top secret,” “confidential,” or “unclassified” access control levels, and assigns users to a specific access group. [If you want to check out the best access control systems, check out the options we recommend for small businesses.] A DAC-based security system is a great option for businesses looking to collaborate with smaller teams. It’s especially helpful as more businesses take a work-from-anywhere approach.

What are the features of discretionary access control?These are some of the key features of discretionary access control: Flexible security optionsOnce you have a DAC in place, you’ll have an easy way to set up access policies. You’ll be able to quickly provide access to specific objects however you see fit. By preventing who can see a given document, you’ll be able to keep that data safe and pristine, without unwanted users viewing or editing a set of information. Intuitive functionalityAny given DAC should be easy to use, offering a way to police what’s going on within your network. By giving permission to specific users to access different pieces of data, you create a paper trail for any future audits or security review. A DAC security system also allows you to monitor specific access points, like a physical entryway that requires an RFID keycard, to see who’s coming and going. Data redundancyAny business can set up a DAC that also backs up data regularly, creating redundancies if a server crashes or an individual system gets corrupted. Better yet, a DAC can also create a streamlined security setup to prevent any data breaches in the first place. And when you keep unwanted users out while backing up data to multiple locations, it’s a lot easier to maintain clean, comprehensive corporate records. What are the benefits of discretionary access control?These are some of the top benefits of discretionary access control:

Here is a breakdown of each benefit: Optimized securityBy adding a DAC firewall to your network, you ensure a basic level of security that can be optimized by maintaining meticulous records and common cybersecurity practices, such as regularly changing a password, or using a virtual private network (VPN) to further encrypt your data. When you take these basic precautions for network security, not only do you prevent successful cyberattacks, you also bolster your reputation throughout your industry. By adopting reliable and effective security practices, you can create a stable network that allows you to provide reliable service. Your business will be one that your clients enjoy working with because they’ll have the peace of mind that their corporate secrets will stay secret. [Read related article: How Does VPN Encryption Work?] Improved complianceWhen implementing DAC standards, you can also automate your overall security system, including surveillance cameras. By observing activity on access points throughout your network, a DAC can immediately alert you to any attempted breaches. A cyberattack can come at any time and in many different forms. Sometimes you may not even be aware that an attack has occurred. But with a DAC keeping watch over your network, you have an extra eye in the sky looking out for you. High customizationSince there’s a wide variety of ways to implement a discretionary access control system, it offers a flexible and customizable security option. DAC system administrators can assign access rights to every member of the team in the most effective way for them. If a user wants to log in to a system only once, a DAC can allow them to do that. If you’d like a more stringent policy that requires a login every time a specific service is accessed, a DAC can do that too. Speed and efficiencyBecause a DAC security system can be automated, implementation can unlock a new level of efficiency for your entire information technology (IT) team. You can create a new user and password in a matter of seconds. You can be instantly alerted to any access request that comes in. You could even set up an automated denial of entry to a user if they request unauthorized access multiple times over a short period.

Cost-effectivenessA DAC system isn’t labor-intensive, so a small IT team could manage your entire DAC configuration, lowering the cost and resources required to maintain basic security standards. Because of all the preventative and recovery measures a DAC has to offer, it can also keep costs from skyrocketing out of control if there’s a sophisticated cyberattack. Instead, it’ll prevent cybercriminals from getting through in the first place.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Oct 2021 12:23 PM PDT

Product Name: 301 Moved Permanently   Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Click here to get 301 Moved Permanently at discounted price while it’s still available… All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Description:  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click here to get 301 Moved Permanently at discounted price while it’s still available… All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors. Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Copy Trading Forex Explained in Detail Posted: 28 Oct 2021 12:07 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ The concept of copy trading has become more like a fad these days. Individuals are flocking to websites or platforms that allow them to participate in this activity. Complete Guide to Copy Trading: https://forexmonopoly.com/blog/complete-guide-to-copy-trading/ 00:00 – Introduction to Copy Trading But what exactly is copy trading? Let's find out. If you are considering copy trading then I seriously So copy trading is an activity through which individuals can take the same trades as another individual or a trader. Just as the name suggests, the trades that are taken are a complete copy. Copy-trading has both its benefits and drawbacks. The time required in copy trading. And I honestly don’t think anyone who has enough time to learn trading should risk their hard-earned money based on someone who they don’t even know properly. Forex Monopoly – https://forexmonopoly.com ………………………………………………………………………………………. Our Social Links Instagram – https://www.instagram.com/forexmonopoly/ source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Tip: Consider these

Tip: Consider these  FYI: Paperless payroll platforms come in three types: electronic payroll records, employee self-service and electronic funds transfer.

FYI: Paperless payroll platforms come in three types: electronic payroll records, employee self-service and electronic funds transfer. Try The Bank’s Secret Indicator (proprietary sentiment & trend indicator) FREE for 7 Days: https://blueedgefx.com/free-trial/?el=youtube

Try The Bank’s Secret Indicator (proprietary sentiment & trend indicator) FREE for 7 Days: https://blueedgefx.com/free-trial/?el=youtube Download the FREE Edge Trading Secrets Book here: https://blueedgefinancial.com/free-book-new/?el=youtube

Download the FREE Edge Trading Secrets Book here: https://blueedgefinancial.com/free-book-new/?el=youtube Subscribe to our YouTube channel: https://www.youtube.com/blueedgefinancial

Subscribe to our YouTube channel: https://www.youtube.com/blueedgefinancial Did you know? Payments to corporations are not usually reported. However, if a corporation you made payments to provides medical or healthcare services, you must note all payments.

Did you know? Payments to corporations are not usually reported. However, if a corporation you made payments to provides medical or healthcare services, you must note all payments. Best Forex broker for beginners: https://www.youtube.com/watch?v=sMiayTUI5Mg

Best Forex broker for beginners: https://www.youtube.com/watch?v=sMiayTUI5Mg Tip: DAC is recommended for smaller businesses that may not have the IT infrastructure or support to create a

Tip: DAC is recommended for smaller businesses that may not have the IT infrastructure or support to create a

, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Comments