forexsystem.me

forexsystem.me |

- How To Start Forex Trading For Beginners – In 3 Minutes! (DO THIS OR STRUGGLE)

- A Guide to Payroll Forms for Employers

- Cara Untuk Tahu Uptrend atau Downtrend | Belajar Forex Percuma Episod 07

- The Best Human Resources Outsourcing (HRO) Services of 2021

- Article Master Series :: 15000 No Restriction PLR Articles Pack

- What Navin Prithyani Learned From The Best Indicator Trading Strategies | Urban Forex

- The Best Remote PC Access Software Reviews of 2021

- Belajar Fundamental Forex Yang Benar II Learning The Right Forex Fundamental

- The Best SMS Marketing Services of 2021

- Trading Price Action Using Line Charts (Old School Forex & Stock Trading Strategies)

| How To Start Forex Trading For Beginners – In 3 Minutes! (DO THIS OR STRUGGLE) Posted: 31 Oct 2021 04:26 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ How To Start Forex Trading For Beginners – In 3 Minutes! (BEGINNERS DO THIS OR STRUGGLE) In this video you’ll discover how to start forex trading for beginners & how to trade forex! 0:00 How To Start Forex Trading Here are the RESOURCES mentioned in the video:

Other Helpful Videos For You:

Disclaimer: Trading FX and futures is not appropriate for everyone. Trading and investing involve substantial risk of loss. You should trade or invest only using risk capital – money you can afford to lose. No representation is being made that utilizing the referenced strategy or trading robot will ensure profitable trading or freedom from risk of loss. Some or all of the referenced trades may not be actual trades and instead could be hypothetical trades or simulated trades. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, such as the costs of commissions or other fees. Because the trades underlying these examples may not have been actually executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Simulated trading results in general are also designed with the benefit of hindsight, which may not be relevant to actual trading. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of the financial risk of actual trading. The strategy producing the referenced performance may have made or lost money before or after the referenced trade(s) was/were executed, and the referenced trade(s) may not necessarily be representative of the average subscriber's experience or performance utilizing the strategy. No representation is being made that you will achieve the same or similar results as the referenced results. The performance referenced in any testimonial may not be representative of all reasonably comparable accounts, and although Blue Edge believes the information contained in the testimonial is accurate and reliable, Blue Edge has not independently verified the accuracy. source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| A Guide to Payroll Forms for Employers Posted: 31 Oct 2021 03:55 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ When welcoming a new hire to the team, small business owners must do a lot more than train them on their positions. One big task is making sure new employees get paid properly and that all the necessary payroll forms are filled out correctly. While owning a business can be rewarding on many levels, managing payroll forms might be a pain if you’re not familiar with the ones you need. There are many forms to consider depending on your employees and business type, and it’s important to get them right. The Internal Revenue Service penalizes businesses for filing incorrectly or failing to pay employment taxes. Fines vary by charge level, with federal offenses typically more expensive than state ones. In previous years, the IRS implemented nearly 7 million payroll tax penalties, which amounted to $4.5 billion. This is a sign of how seriously the IRS takes these penalties and why it’s important to understand each form and when it’s due. Editor’s note: Looking for the right payroll service for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. What payroll tax forms do you need to know about?Missing a payroll tax deadline or filing the wrong form can have expensive consequences. Below we’ll explain the payroll report forms that you need to keep on your radar.

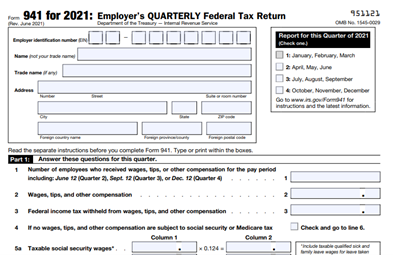

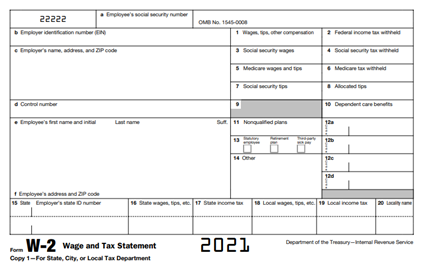

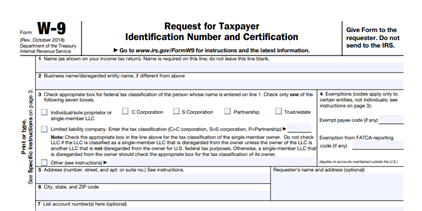

Payroll report formsA payroll report form informs the government of your employment tax liabilities. On this form, document the taxes you withheld from employee wages and the payroll taxes you paid. Be sure to submit payroll reports for both federal and state taxes. 1. Form 941 Source: IRS Form 941, the Employer’s Quarterly Federal Tax Return, reports the number of employees you have, their wages and taxable tips, and the federal income taxes you withheld. Social Security, Medicare taxes and sick pay are also documented here, along with any adjustments made to them. You must file this payroll tax form unless you have already submitted a final return, are a seasonal employer, or employ farm or household workers. A payroll form should be filed quarterly. Due dates: April 30, July 31, Oct. 31, Jan. 31 2. Form 944Very small businesses sometimes use Form 944 instead of Form 941. This form is the Employer Annual Tax Return, and the only businesses that qualify to use it are those with $1,000 or less in annual liabilities for Social Security, Medicare and federal income taxes. Additionally, you must have a written notification from the IRS permitting you to use this form instead of Form 941. This payroll tax form is submitted annually instead of quarterly, so if you’re qualified to use it, you should. Due date: Jan. 31 3. Form 940Form 940 is the Employer’s Annual Federal Unemployment Tax Return. This payroll tax form is used to report the federal unemployment tax, or the FUTA tax, in reference to the Federal Unemployment Tax Act. This tax funds unemployment compensation to employees who have recently lost their jobs. Your business must pay FUTA taxes if you paid at least $1,500 in wages in a quarter within the past two years. These taxes are paid quarterly but reported once per year. Due date: Jan. 31 4. Form W-2 Source: IRS The W-2 is one of the better-known forms and should be given to each employee at the end of each year. It is used to report each employee’s annual compensation and all federal, state, and other payroll tax withholdings. This does not need to be filled out for independent contractor workers; you’ll fill out Form 1099 for them instead. Due date: Jan. 31 5. Form W-3The W-3 is a condensed version of your W-2 forms. For example, one W-3 can represent 10 W-2s. This form is called the Transmittal of Wage and Tax Statements. It includes total earnings, FICA wages, federal income wages, and tax amount withheld. You do not need to give W-3s to your employees. Your W-3 should be sent to federal and state governments along with your W-2 forms. Due date: Jan. 31 6. Form 1095-BIf you provide a health insurance plan for your employees that meets or exceeds what the Affordable Care Act (ACA) calls “minimum essential coverage,” file Form 1095-B. On it, you’ll note the type of health insurance, whether dependents are covered, and the coverage period for the prior year. Your employees will use this form to prove they have qualifying health insurance that exempts them from paying a penalty when they file their tax returns. If your business has at least 50 full-time employees and is what the ACA calls an “applicable large employer,” fill out Form 1095-C instead. Due date: Jan. 31 7. Form 1094-BForm 1094-B is the Transmittal of Health Coverage Information Returns, which is similar to the W-3 in that it summarizes Form 1095-B with the number of forms you’re submitting. It also gives the IRS your name and phone number so it can contact you if it has questions about the forms. You don’t have to send Form 1094-B to employees; submit it to the IRS along with the 1095-B forms. If your business is classified as an “applicable large employer,” fill out Form 1094-C instead. Due date: Feb. 28 8. Form I-9Form I-9 must be included as part of your onboarding package for new hires. The form confirms employee eligibility within the United States. Both U.S. citizens and non-citizens complete Form I-9 before receiving payment for their work. The employee attests authorization to work in the United States while providing documentation (like a birth certificate or driver’s license) to prove eligibility. Employers must review the documents and confirm that the papers appear genuine and are not falsified. The employer should keep Form I-9 on file in case of government review. The Department of U.S. Citizenship and Immigration Services states that the form is required within three days of hiring a new employee. For example, if the employee starts work on a Tuesday, the form must be submitted to the employer by that Friday. Due date: Three days after the hire date 9. Form W-9 Source: IRS Form W-9 is specifically for companies that hire independent contractors. If the company pays the independent contractor more than $600 in a tax year, the company must report those payments to the IRS using Form 1099-MISC. On Form W-9, the employer asks the contractor (or freelancer) for the tax filer’s name, address, and tax identification number. Since the W-9 is not filed, there isn’t a specific due date for the form. However, companies should request the form be completed before paying the independent contractor. Due date: At the time contract work is ordered 10. Form 1099-MISCUse the 1099-MISC form when you make a payment of $600 or more to an individual or LLC. This includes attorney fees, awards, healthcare, royalties and rents. Due date: March 1 if filed by paper, March 31 if filed electronically

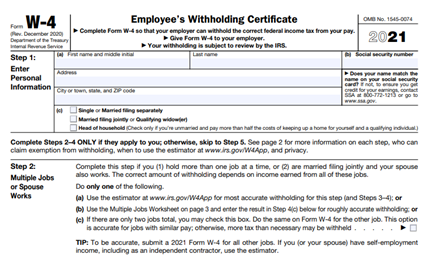

11. Form 1099-NEC Beginning with the 2020 tax year, the 1099-NEC is a simplified way to report over $600 paid to a self-employed individual, freelancer, or contractor who supplied services to your business. The 1099-NEC covers fees, benefits, commissions, prizes, awards, etc., for non-employee-provided services. Due date: Jan. 31 (distributed to recipients and filed with the IRS) 12. Form W-4 Source: IRS Provide a W-4 form to all new hires. Employees receiving the form should complete it before or on the first day of their new job. Form W-4 provides the employer with personalized tax withholding information that aids in maintaining an accurate payroll. Holding a W-4 for each employee streamlines the W-2 form preparation. Due date: Feb. 15 13. Form 8027Form 8027 is not a standard form. It only applies to companies employing more than 10 workers on a normal business day in industries where tipping is customary. Hospitality and food service companies are the most common industries that will use Form 8027. It reports any tip income an employee received while working directly for the business. If the tip amounts are too low for the size of the business, the company may be required to pay out allocated tips. Form 8027 calculates this formula for any amounts due. Due date: March 1 if filed by paper, March 31 if filed electronically What’s a payroll direct deposit form?A payroll direct deposit authorization form allows employers to send money to employees’ bank accounts. Most employers ask employees to provide a voided check to fill out the form, as it provides the ABA routing number that identifies the employee’s bank and account number. After the employee signs the form and gives it back to the employer, their money can be sent directly to their account. Banks typically use the Automated Clearing House to coordinate these payments. This solution is not only greener and more secure than paper checks, it also cuts out the hassle of depositing a check or waiting for it in the mail. What are certified payroll forms?Businesses with government contracts need to submit a certified payroll form, also known as Form WH-347. When a payroll report is certified, it means employees have been paid according to the Davis-Bacon Act prevailing wage requirement. Certification includes a signed statement of approval that confirms the payroll forms are complete and correct. A certified payroll report includes the names of every employee, the nature of the work they did, wages, hours worked, and amounts withheld. It’s typically due on the last day of the payroll period. When filing certified payroll forms, keep in mind that every state has its own requirements and may ask for multiple forms and filings. Be careful not to overlook your state’s conditions. How do you add an employee to payroll?Adding an employee to payroll takes some prep work. Creating a payroll structure that works for your business and complying with federal and state labor laws streamlines the process of adding new employees. Step 1: Obtain an EIN (employer identification number) from the IRS by submitting Form SS-4. You may also need to get state and local tax IDs. Step 2: Verify that your new employee is eligible to work in the U.S. For you to do this, your employee must fill out the employment eligibility form, Form I-9, and an employee’s withholding certificate, better known as a W-4, to make sure you withhold the correct tax amounts from each paycheck. Step 3: Schedule pay periods and have compensation plans for holidays, vacations and other forms of leave. Step 4: Once you have the completed forms from your employee, add them to your payroll. If you use a top payroll service, you’ll need to contact the company to add your new employee to your plan. Always report your payroll taxes to the IRS on time to avoid penalties.

What’s the difference between a payroll status change form and a payroll deduction form?Payroll status change forms and deduction forms accomplish different things, but you need both when hiring employees. Payroll status change formAs your business grows, you may have an employee whose status or position changes. This can affect their pay, whether they work full or part time, their position or job title, and the department in which they work. It’s important to document these changes with a payroll status change form, which is then placed in the employee’s personnel file as part of their employment history. Payroll deduction formsA payroll deduction form does just what its name suggests: It helps you determine and record how much money will be withheld from an employee’s payroll check. Some deductions are mandatory, such as taxes, while other deductions are voluntary, like 401(k) plans, insurance plans, and union and uniform dues. Court-ordered payments, such as child support payments, may also be garnished from employee wages. This form gives your payroll provider the information it needs to withhold the proper amounts from your employees’ paychecks. Tips to avoid payroll mistakesThere’s no shame in asking for help. If you’re unsure how to set up payroll for your employees, or if you want to save yourself the trouble of navigating payroll regulations, sign up for a payroll service or hire an accountant. It’s better to pay for the service and have it done correctly than to pay fines for your mistakes. Here are three tips to help you avoid common payroll mistakes:

Julie Thompson contributed to the writing and research in this article.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| Cara Untuk Tahu Uptrend atau Downtrend | Belajar Forex Percuma Episod 07 Posted: 31 Oct 2021 03:24 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ DAFTAR AKAUN UNTUK TRADE FOREX, GOLD, WTI OIL, SAHAM, INDEKS dan CRYPTO DAN DAPATKAN FREE $5 MODAL TRADE : https://moshed.com/free5usd Join Telegram Rasmi saya untuk tak terlepas update, tips, info dan nasihat tentang trading dalam pasaran kewangan : https://t.me/moshedmohamad Siri pembelajaran percuma ini menggunakan Buku Panduan Lengkap Mula Trade Forex sebagai Buku Teks. Jadi sesiapa belum dapatkan boleh dapatkan di link ini : https://intraday.my/mulatradeforex/ Tak paksa pun, nak beli, serius nak belajar beli lah. Taknak pun takpe, terpulang kepada anda. Dalam Buku tersebut sudah tentu anda lebih senang nak rujuk bila saya buat video-video pembelajaran. Saya cuba sehabis baik untuk SHARE ilmu agar bermanfaat untuk anda. JANGAN LUPA SUBSCRIBE YOUTUBE CHANNEL MOSHED! Nak Mula Belajar Forex? INTRADAY – Website Pasaran Kewangan No 1 Malaysia Website Rujukan Forex No 1 : https://intraday.my/ DAFTAR AKAUN UNTUK TRADE FOREX, GOLD, WTI OIL, SAHAM, INDEKS dan CRYPTO DAN DAPATKAN FREE $5 MODAL TRADE : https://moshed.com/free5usd FOLLOW SAYA: #BelajarForex #INTRADAY #Moshed source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| The Best Human Resources Outsourcing (HRO) Services of 2021 Posted: 31 Oct 2021 02:53 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  TriNet is a full-service HR solution for small and midsize businesses. It specializes in several industries, such as architecture, engineering, consulting, education, e-commerce, financial services, life sciences, manufacturing, marketing and advertising, nonprofits, retail and wholesale, and technology. What separates TriNet from some of its competitors is its customer support. Its team of skilled HR experts can facilitate compliant and efficient HR processes for your business. Editor’s score: 9.2/10 Unlike many of its competitors, TriNet makes its customer support available 24/7. The ability to reach an HR expert at any time of day can be a game-changer, especially for businesses with nonstandard hours. With various ways for you to reach its support agents (by phone, mobile text, instant message, email or contact form), TriNet has mastered the practice of being truly available to its customers. Businesses partner with TriNet for many HR services, such as payroll processing and tax administration, expense management, time and attendance tracking, employee benefits administration, risk management, workforce analytics, and compensation management. The TriNet mobile app lets your employees view their pay details, monitor their expenses and approvals, view their benefits, and manage and submit time-off requests. Your managers and administrators can use the app to view a plethora of HR information, including workforce data. July 2021: Firms working in the financial services industry will appreciate TriNet’s premier HR solution, TriNet Financial Services Preferred. This new solution will be available by October, offering key support services such as guided onboarding, a dedicated HR specialist, risk and compliance management, enhanced payroll, tax, and benefits expertise, and support for partnerships and other entities.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| Article Master Series :: 15000 No Restriction PLR Articles Pack Posted: 31 Oct 2021 02:24 PM PDT

Product Name: Article Master Series :: 15000 No Restriction PLR Articles Pack   Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Description: “Who Content, Just look at some of the topics in this MASSIVE remote control helicopters Renting A House Or Apartment Affiliate Marketing On The Internet Making Money With Articles Mini Blinds or Wood Shutters Mini-Blinds-or-Wood-Shutters New Years Eve Party Planning Outsourcing Ebooks and Software Holiday Games & Activities Wedding Games & Activities Choosing the Right Golf Clubs Private Label Resell Rights creating an online business Self Improvement Articles Diesel VS Gasoline vehicles Diesel-VS-Gasoline-vehicles Thanksgiving Party Articles Travel Tips To European Countries Health_Insurance_articles High Definition Video Cameras High-Definition-Video-Cameras Arguably Become A PLR Content Provider What Can You Do With These PLR Earn Compile Compile Compile Publish Plug In short, you can do absolutely anything NewSocialClick.com P.S. Not sure if this is for You have  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors. Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| What Navin Prithyani Learned From The Best Indicator Trading Strategies | Urban Forex Posted: 31 Oct 2021 02:22 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Navin Prithyani has personally gone through all the strategies, indicators and other things that promise golden returns. He made this webinar so you won’t have to go this road too. Many of you will have gone through some of these as well and you will recognize some of the things Navin discusses in this webinar. Like most traders Navin started with indicators. What many of you by now also know, is that indicators can create very mixed results in terms of trading. Especially you add up another indicator as a filter to make sure that first indicator works properly. And before you know it, the whole screen is full of indicators. Needless to say, that is not the way. It will only drive you to being a mad scientist. However, indicators taught Navin some valuable lessons. So he created a few strategies that include our human analysis into the indicators. One of those is the Pro Trading Strategy, which is very good and making a change for many of our students. Please rate, like and subscribe if you like the video. Useful Links

source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| The Best Remote PC Access Software Reviews of 2021 Posted: 31 Oct 2021 01:51 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Zoho Assist is our choice as the best all-in-one remote PC support and access solution. It’s a cloud-based remote access and control solution that has something for everyone: a free plan, three remote support plans, two unattended access plans, and add-ons for storage and VoIP call credits. Affordable pricing is available on a monthly or annual billing cycle, giving you even more flexibility to find a solution that fits your needs. We like that Zoho Assist is a pay-as-you-go service, meaning you can cancel, upgrade, or downgrade your service to meet your current business needs. Zoho Assist is compatible with various devices (Windows, Mac, Linux, Chrome OS, Android and iOS) and doesn’t require installation, so you can quickly connect to a remote device through a web browser. Every plan includes essential features like multi-monitor navigation, clipboard sharing, instant chat, two-factor authentication, idle-session timeout, organization roles and user management. Zoho works securely through firewalls and proxies, has end-to-end SSL and AES 256-bit encryption, and is compatible with antivirus software. On advanced plans, you can even access session recording and auditing, session notes, and voice and video chat. Other essential things to look for in an all-in-one remote support and access plan are scalability, training opportunities, and compliance – all of which Zoho offers.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| Belajar Fundamental Forex Yang Benar II Learning The Right Forex Fundamental Posted: 31 Oct 2021 01:20 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Analisis Fundamental menjadi salah satu analisa yang dapat dimanfaatkan untuk mengambil peluang cukup besar. Ketika terjadi rilis news maka pasar akan bergerak dengan cepat. Seperti pisau bermata dua news ini juga bisa menyebabkan kerugian sangat besar. Fundamental analysis is an analysis that can be used to take big chances. When a news release occurs, the market will move quickly. Like the two-edged knife, this news can also cause huge losses. Info: untuk daftar Demo dan download MetaTrader bisa disini https://bit.ly/3z6jDLq More info : source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| The Best SMS Marketing Services of 2021 Posted: 31 Oct 2021 12:49 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Is text message marketing effective?Text message marketing is a highly effective, quick, and easy way to reach customers. More than 90% of text messages are read within three minutes of being received, so your audience will almost always see your messages. Text message marketing messages are also effective because they’re so easy to personalize, making the customer feel seen and valued, and thus more likely to engage with your business. When should businesses use text message marketing?Businesses should use text message marketing whenever they have quick, pertinent information to distribute to their audiences, such as a new discount code, an update on store hours, or information about an event. Try to send them only during normal business hours, between 9 a.m. and 6 p.m., in a customer’s time zone. Why is text message marketing important?Text message marketing is important because it opens a clear, dedicated line of communication between the customer and your business. It also allows you to customize all the messages you send to your target audience, which can improve customer satisfaction, engagement and your brand reputation. How do I set up text message marketing for my business?While the precise steps to create a text campaign depend on your provider, the basic steps are the same across most platforms:

What do your employees need to know to use text message marketing?It is not necessary to train all of your employees in text message marketing. Focus on training only those who will be responsible for creating and managing the campaigns. They should understand how to create campaigns, choose contacts, manage analytics and troubleshoot minor issues. How can text or SMS marketing attract new customers to your business?Using text message marketing can show new customers that your business is committed to customer support and a personalized customer experience. This can enhance your credibility. How can text or SMS marketing help you keep the customers you already have?Your existing customers can benefit from your text messages if you keep them in the loop about deals, opportunities and news from your business. These updates keep your business on their minds and, especially if you offer them special deals for being loyal customers, incentivize them to keep buying from you. What do text message marketing services typically cost?While prices vary by provider, text message marketing services typically offer a variety of monthly or annual plans starting at around $20 to $40 a month and reaching $2,000 to $4,000 per month for advanced services. The price will also depend on the number of messages and keywords your business requires each month. Is text message marketing legal?Yes, it is legal to send messages to customers via SMS — as long as your company follows the rules set forth by the Federal Communications Commission (FCC). The FCC’s two primary laws, the Telephone Consumer Protection Act (TCPA) and the CAN-SPAM Act, are designed to protect consumers from unsolicited messages if they opt out or block a number. Penalties range from $500 to $1,500 per violation. What is the best way to get consent from customers to send them text messages?Companies that wish to send marketing text messages to customers must obtain express written consent from each individual number on their marketing list. According to the TCPA, the terms of consent must be “clear and conspicuous” so customers understand exactly what they are agreeing to when they provide their phone number. The most common way to get consent is by having a consumer provide their phone number on an online or written form that includes the required terms. Do consumers actually open text messages?On average, about 98% of text messages are opened, proving the utility of text message marketing. Compared to the smaller 20% of email marketing messages that are opened, there may be a case for refocusing marketing outreach to target the larger percentage of people opening an SMS. How can I track my text message marketing campaigns?There are two important steps to follow to track and ensure the success of a text message marketing campaign. First, confirm that the messages you've sent were delivered. Analyze your rate of delivery success. Then, use a tool like Google Analytics to track how many people visited your website from the SMS message you sent.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||

| Trading Price Action Using Line Charts (Old School Forex & Stock Trading Strategies) Posted: 31 Oct 2021 12:18 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ In this video you'll discover: • what are line charts and how line charts work in Forex and stock market

Trade with confidence with our RECOMMENDED online stock trading TOOLS, best online Forex trading platforms and Metatrader platforms, stock trading simulators, stock screeners, penny stock screeners, stock trading picks, investment portfolio tools (and discover our online stock trading sites and stock firms recommendations)

Check out our Playlists | Learn to trade Fx – Online Fx Trading | How To Trade Stocks And Shares | Stock Trading Techniques | Trading For Dummies |Trend Trading Forex | MT4 trading systems

RISK DISCLAIMER: Please be advised that I am not telling anyone how to spend or invest their money. Take all of my videos as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this channel. This content is for educational purposes only, and is not tax, legal, financial or professional advice. Any action you take on the information in this video is strictly at your own risk. We therefore recommend that you contact a personal financial advisor before carrying out specific transactions and investments. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. TheSecretMindset.com and all individuals affiliated with this channel assume no responsibilities for your trading and investment results. AFFILIATE DISCLOSURE: Please note that some of the links above are affiliate links, and at no additional cost to you, we will earn a commission if you decide to make a purchase after clicking through the link. We only promote those products or services that we have investigated and truly feel deliver value to you. source Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

7 Day FREE Trial to Edge Trading Academy: https://blueedgefx.com/free-trial/blue-edge-financial-free-trial/?el=youtube

7 Day FREE Trial to Edge Trading Academy: https://blueedgefx.com/free-trial/blue-edge-financial-free-trial/?el=youtube Download the FREE Edge Trading Secrets Book here: https://blueedgefinancial.com/free-book-new/?el=youtube

Download the FREE Edge Trading Secrets Book here: https://blueedgefinancial.com/free-book-new/?el=youtube Subscribe to our YouTube channel: https://www.youtube.com/blueedgefinancial

Subscribe to our YouTube channel: https://www.youtube.com/blueedgefinancial FYI:

FYI:  Tip: To avoid payroll headaches, read our article on the

Tip: To avoid payroll headaches, read our article on the

, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Register to the upcoming LIVE Webinar: https://www.urbanforex.com/webinar-notifications

Register to the upcoming LIVE Webinar: https://www.urbanforex.com/webinar-notifications Urban Forex Website: https://www.urbanforex.com

Urban Forex Website: https://www.urbanforex.com Improve your trading NOW

Improve your trading NOW  Try the Mastering Price Action 2.0 Course for FREE: https://www.urbanforex.com/mpa-2-0-free-trial-information

Try the Mastering Price Action 2.0 Course for FREE: https://www.urbanforex.com/mpa-2-0-free-trial-information Urban Forex Mobile Apps: https://www.urbanforex.com/app-store

Urban Forex Mobile Apps: https://www.urbanforex.com/app-store In this video, Navin is using the software TradingView to look at his charts, get your access to the same charts here : https://www.urbanforex.com/tradingview

In this video, Navin is using the software TradingView to look at his charts, get your access to the same charts here : https://www.urbanforex.com/tradingview

Ready for some TRADING and INVESTING action?

Ready for some TRADING and INVESTING action?

Comments