Forex analysis review

Forex analysis review |

- Forecast for EUR/USD on December 31, 2020

- Forecast for GBP/USD on December 31, 2020

- Forecast for AUD/USD on December 31, 2020

- Forecast for USD/JPY on December 31, 2020

- Oil, Gold. Results of the outgoing year 2020 - prospects for 2021

- EUR/USD. When the risk is justified: buyers of the pair storming the 23rd figure

- December 30, 2020 : EUR/USD daily technical review and trade recommendations.

- Will 2021 bring relief to the dollar, or is the USD doomed to fall?

- December 30, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- December 30, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- No change in Gold outlook

- EURUSD hits new highs at 1.23

- GBPUSD weekly analysis

- Dollar prepares for a trend change

- Evening review on EUR/USD for December 30, 2020

- New coronavirus variant: May it destroy the global economy?

- BTC analysis for December 30,.2020 - First target at $28.400 reached and pottential for downside rotattion towards $27.500

- EUR/USD analysis for December 30 2020 - Breakout of the ascending triangle and potential for the bigger rise towards 1.2365

- Analysis of Gold for December 30,.2020 - Testing of the rising trendline and potential for upside continuation towards $1.896

- Oil prices climbed up during the Asian session

- Technical analysis of GBP/USD for December 30, 2020

- Stocks in the US began to retreat, while Europe went multidirectional on the eve of the holidays

- Technical analysis of EUR/USD for December 30, 2020

- GBP/USD analysis on December 30. Pound is rising again amid expectations of UK and EU's formal signing of trade agreement

- Analysis and Forecast on GBP/USD for December 30, 2020

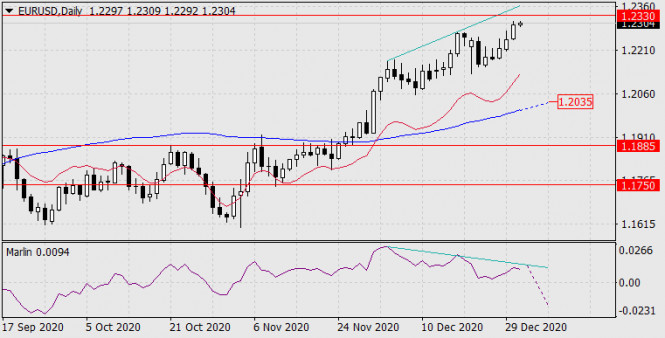

| Forecast for EUR/USD on December 31, 2020 Posted: 30 Dec 2020 07:06 PM PST EUR/USD The euro decided to leave the final days of the outgoing year more beautifully than expected. It continues to grow throughout the week, very little is left to the target level of 1.2330, afterwards a double divergence will be formed on the daily chart and the euro will go into the unknown in 2021.

The first task in the new year is to reach the consolidation range of August-November at 1.1750-1.1885. The first target in order to fall to 1.2035 is the MACD line.

Growth continues on the four-hour chart. There is a possibility of forming a divergence, due to which the signal line of the Marlin oscillator has clearly slowed down its growth and lies a little in the horizon. The material has been provided by InstaForex Company - www.instaforex.com |

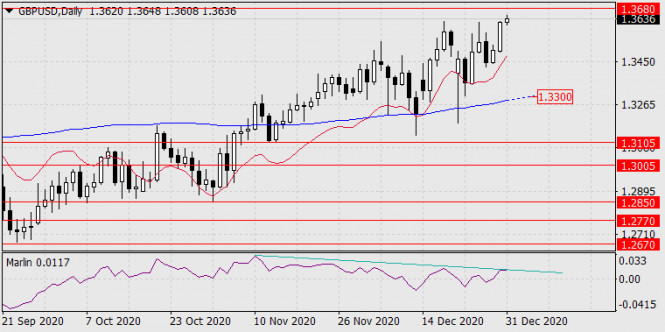

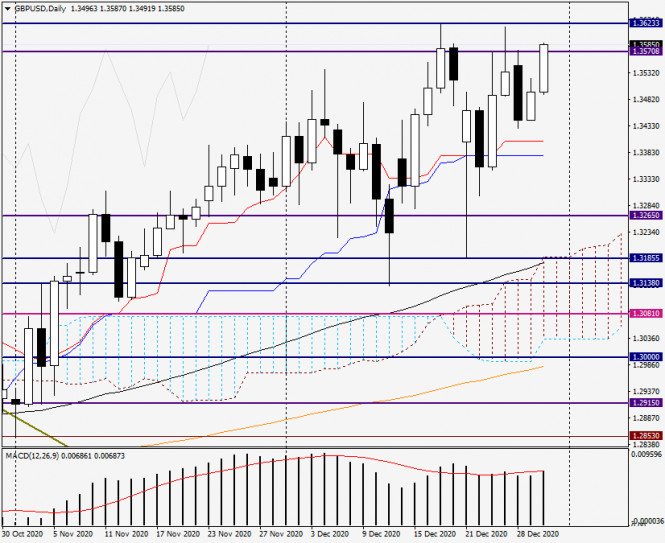

| Forecast for GBP/USD on December 31, 2020 Posted: 30 Dec 2020 07:06 PM PST GBP/USD The pound sharply grew yesterday, approaching the target level of 1.3680. But when this level is reached, there is an 80% probability that the pound will fall (that is, the MACD line will be surpassed in the 1.3300 level, which will be the first sign of a change in the medium-term trend), since the price prepares a double divergence with Marlin.

The price continues to rise without signs of a reversal on the four-hour chart. Obviously, it will only happen in January. The first sign will be when the price drifts below the MACD line around 1.3515.

|

| Forecast for AUD/USD on December 31, 2020 Posted: 30 Dec 2020 07:06 PM PST AUD/USD The Australian dollar threw itself a holiday yesterday and grew stronger than the market (78 points). It surpassed the 0.7675 target level, and the signal line of the Marlin oscillator returned to the tilted path, from which, it would seem, it had already left on the 22nd. Now the aussie's target is the 0.7770 level.

As with other leading currencies, the euro and the pound, with the establishment of a new high, AUD/USD will form a reversal divergence with the Marlin oscillator. There will be a double divergence for AUD/USD. Accordingly, the reversal factor will increase. The target levels of the downward trend were revised, now they are: 0.7465, 0.7285 and others, marked on the daily chart.

The price continues to rapidly rise on the four-hour chart. Its decline under the MACD line, below 0.7642, will be the first sign of a reversal in the Australian dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on December 31, 2020 Posted: 30 Dec 2020 07:06 PM PST USD/JPY The yen has finally rallied and crossed the target level of 103.18 yesterday, opening the target level of 102.35. Further development of the Japanese currency will largely depend on the US dollar. If the greenback starts a large-scale offensive that we are expecting, then the USD/JPY pair will move up from the target level.

But several powerful uncertain risks can intervene at once: an outbreak of a post-epidemic, a collapse of stock markets, the emergence of new hot spots on the geopolitical map. And the yen's reaction is unpredictable. In general, given the decline in the role of the yen as a safe-haven currency, the main pressure on the pair will increase. Trading the yen in 2021 will be challenging.

The price has settled below the signal-target level of 103.18 (November 16 low ) and, without external signs of a reversal, is heading towards the target level of 102.35 on the four-hour chart. The material has been provided by InstaForex Company - www.instaforex.com |

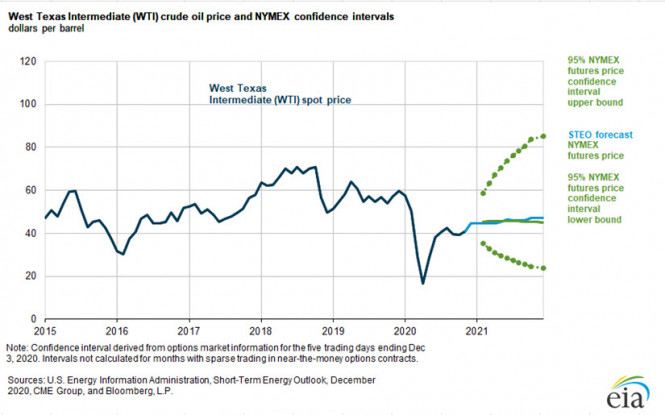

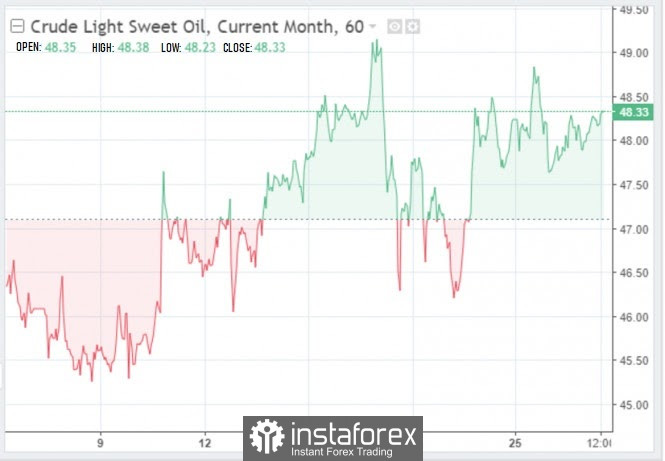

| Oil, Gold. Results of the outgoing year 2020 - prospects for 2021 Posted: 30 Dec 2020 03:17 PM PST Dear colleagues! By tradition, at the end of the outgoing year, it is customary to sum up the results and assess plans for the future. Therefore, I would like to dedicate an article on this topic. It will be all the more interesting to compare forecasts that were given last year with what we received today. Given the extraordinary circumstances in which the world economy finds itself this year, it would be at least naive to expect that December 2019 ideas can be implemented on the value of certain assets in December 2020, but at least it will be very useful. Let's start summing up the outgoing year with the oil price. In December 2019, the US Energy Information Agency - US EIA - assumed the price of North American WTI oil in December 2020 would be at $60 per barrel, however, NYMEX traders were more pessimistic and considered the most likely price of WTI #CL grade at $55. As you can see, the collective mind turned out to be stronger and more accurately determined the price than a host of analysts on the US government salary.

Figure 1: WTI #CL Oil Price Forecast for 2021 The US EIA's forecast for next year is $46 a barrel, and NYMEX traders are forecasting $45, which is not bad considering that the coronavirus hit the oil industry in 2020. Moreover, the Agency assumes that by the end of next year, WTI #CL oil will be at $47. Naturally, if it weren't for the OPEC+ deal and the measures taken to cut production, the market situation would have been completely different. However, in fairness, take note that price planning has shown high efficiency, and the Covid-19 epidemic has dealt a heavy blow on American oil companies that did not take part in the deal. In 2019, US oil production was 12.25 million barrels per day. In 2020, production dropped to 11.34 million barrels, and in 2021 it is projected even lower, at 11.10 million. Thus, more than a million barrels of American shale oil will leave the market, and the United States will actually lose the exporter status that it received in 2019. This is a success. Moreover, the number of drilling rigs in the United States and Canada has decreased by 457 units compared to last year, more than twice, and the current price increase does not make it possible for shale oil production to recover. In this sense, investing in US shale producers is a very dubious story. It can be assumed that the Joe Biden administration that came to power is unlikely to lobby for the interests of oil producers by introducing a ban on hydraulic fracturing technology on federal lands, which will actually put an end to the United States as an oil exporter. Thus, with the price of oil at $50 per barrel, the growth of oil consumption by the world economy will bring benefits to countries that are members of the OPEC+ agreement, as well as corporations engaged in traditional production methods. In turn, American shale producers will experience a lack of capital investment, which means that they are unlikely to be able to significantly reduce the cost of production technologies in the foreseeable future. Given the current circumstances - falling oil consumption in the world and falling production in the United States - inflationary processes that may occur in the event of a decline in the dollar will pose as a great danger for oil producers. If OPEC+ manages to meet the interests of the parties by increasing production and preventing a sharp increase in the price of oil, then in the long term this may finally, if not bury, then significantly limit the possibilities of shale production in the United States. If oil producers prefer short-term benefits to strategic goals, they risk facing not only resurrected shale oil producers, but also competition from alternative energy sources. The most successful prediction in 2019 was the growth in the price of gold. However, take note that since it updated the record high, the yellow metal exceeded analysts' expectations, bringing investors a yield of 20% per annum in US dollars. Given the work of the printing press on both sides of the ocean, as well as low interest rates, in 2021, we can assume a further increase in the price of gold against all currencies. In an environment where money does not generate income, and rates are close to zero or have a negative value, investors will by compulsion be forced to consider gold as an alternative to other investments. The global economic recovery from the stress of 2020 could spur demand from the jewelry industry, pushing the price of gold and gold miners further higher. However, it is unlikely that we should assume the price will soar, rather, traders and investors can count on a 15% rise in gold quotes to the level of $2,250 per troy ounce. At the same time, one cannot exclude the possibility that next year gold will not be able to renew the current year's high and it will not bring significant returns to investors. The average return in US dollars that gold has generated over the past ten years has been around 8%. This year was an exception, so if in 2021 gold adds 10% to its value and ends the year above the $2000 level, it can already be considered a good result. Happy New Year, be careful and follow the rules of money management, may the coronavirus pass us by! The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. When the risk is justified: buyers of the pair storming the 23rd figure Posted: 30 Dec 2020 01:39 PM PST Trading on the eve of a long New Year's weekend is a risk. This period is characterized by impulsive and poorly predictable price movements amid low liquidity and profit taking. This applies to absolutely all currency pairs, not to mention the most popular ones - dollar ones. Many traders and market makers today or tomorrow will close the month, quarter and year, which is why corrective pullbacks are possible. Therefore, short-term trading is not worth considering now. If we talk about medium and long term prospects, the situation here is somewhat different. The general trend, due to the weakening of the dollar, is likely to continue at the beginning of next year (according to some forecasts, the greenback will lose ground throughout the entire 2021). Therefore, trading strategies based on the game against the dollar will be relevant in January as well.

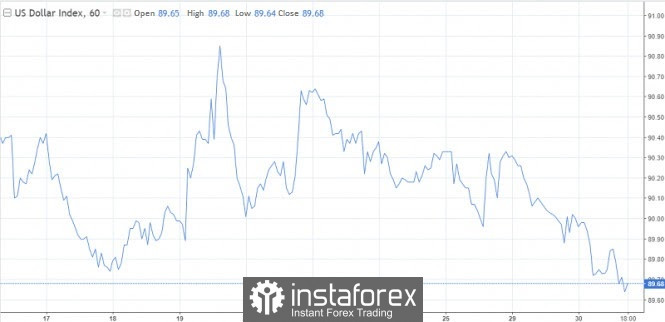

Take note that the US dollar index has been gradually decreasing since the beginning of November, reflecting the skepticism of traders towards the greenback. If two months ago the index was at the level of 94 points, then at the moment it has dropped below the 90th mark. And although the downward trend was accompanied by upward pullbacks, the overall trend is visible to the naked eye. This situation made it possible for buyers of the euro-dollar pair to strengthen by more than 700 points. Since November, the EUR/USD bulls have managed to climb from 1.1595 to today's high of 1.2310. And apparently, traders will not limit themselves to conquering the 23rd figure: the main target for growth is the 1.2415 level - this is the price high of April 2018. In the next few weeks, this price target will become a kind of beacon for the pair's buyers. The locomotive of EUR/USD growth is the dollar, which is weakening throughout the market. The euro's positions do not appear so confident, but at the same time it does not pull the price to the bottom, like an anchor. Thanks to this combination, we are witnessing a fairly stable upward trend. Why is the dollar getting cheaper? Because traders have lost interest in protective instruments, which include the US currency. The market is dominated by general optimism, due to which the main favorites of the foreign exchange market are risky/commodity currencies. Market optimism, in turn, is driven by several factors. First, the US economy received $900 billion in additional aid. Negotiations between Democrats, Republicans and representatives of the White House have been going on for six months - from the end of May. And the compromise bill has only been approved now, which includes one-time subsidies to Americans, additional unemployment benefits, support for certain industries, and so on. In addition, the new package provides for the allocation of nearly $300 billion for the Paycheck Protection Program. This program is designed to help businesses maintain jobs at a time when the economic pressure of the pandemic could lead to additional layoffs. After the bill was passed, the US stock market rallied, reflecting the general optimistic sentiment of investors. The so-called coronavirus factor has been some sort of ally for the dollar for a long time now. The panic of traders created excitement around the greenback, which was used by the market as the main protective tool. However, at the moment the situation is mirrored. After Europe and the United States approved the first vaccines against COVID, the notorious coronavirus factor has ceased to provoke spikes in anti-risk sentiment. Even the recently discovered new strain, which turned out to be more infectious, did not allow the dollar bulls to fully manifest their character.

The fact is that vaccination against coronavirus has already started in 22 countries around the world. In particular, to date, 2,230,000 doses of vaccines have already been introduced in the United States. In West Virginia, Alaska, North and South Dakota, vaccination rates have reached almost two percent. Similar dynamics is observed in other large states. In particular, a million doses of the vaccine have already been introduced in China, more than 600,000 in the UK, and more than 400,000 in Israel and Russia. Europe has just started vaccination (since December 27), so the results here are much more modest. In other words, the financial world at the end of the outgoing 2020 saw the light at the end of the tunnel, which allows us to meet the new, 2021 year with optimism. All this speaks about the persisting potential of the EUR/USD pair's growth and about the inability of the bears to reverse the trend - at least in the medium term. From a technical point of view, long positions on the pair are also a priority. The price is on the upper line of the Bollinger Bands indicator on the daily chart, as well as above all of the Ichimoku indicator lines (including the Kumo cloud). You can consider longs on the pair - with the first intermediate target of 1.2310 (2.5-year high, which was updated today). If buyers overcome this target and settle above it, the next stop will be the 1.2350 level. The material has been provided by InstaForex Company - www.instaforex.com |

| December 30, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 30 Dec 2020 07:50 AM PST

By the end of November, Signs of BUYING Pressure have been initiated around the depicted price zone of 1.1800-1.1840.Shortly after, the EUR/USD pair has demonstrated a quick upside movement.The pair has targeted the price levels around 1.1990 initially which exerted considerable bearish pressure bringing the pair back towards 1.1920 which constituted a temporary KEY-Zone for the EUR/USD pair.That's why, another episode of upside movement was expressed towards 1.2160 where a false breakout above the price level of 1.2200 was regarded as a considerable bearish reversal signal.Two weeks ago, a short-term reversal pattern has been demonstrated around 1.2265. Intraday downside retracement to the downside was expected to occur.Bearish closure below the mentioned price zone of 1.2200 - 1.2170 was needed to turn the intermediate outlook for the pair into bearish and enhance a quick bearish decline towards 1.2040 then 1.1920.However, the EUR/USD pair has failed to pursue towards lower price levels. Instead, the pair is currently spiking above the depicted Weekly HIGH around 1.2270.Trade Recommendations :-Conservative traders are advised to look for SELL Positions around higher price levels near 1.2270-1.2290. Exit level should be placed above 1.2300. Target levels should be located around 1.2200, 1.2170 then 1.2120. The material has been provided by InstaForex Company - www.instaforex.com |

| Will 2021 bring relief to the dollar, or is the USD doomed to fall? Posted: 30 Dec 2020 07:18 AM PST

Positive sentiment prevailing in the market continues to put pressure on the greenback. On Wednesday, the USD index hit its lowest level in more than two years, dropping below 89.7 points. Investors effectively ignored yet another delay in adopting further US fiscal stimulus. The leader of the Republican majority in the Senate Mitch McConnell postponed a vote on increasing payments to Americans under incentives from $600 to $2,000. While the amount of payments is still uncertain, many experts argue that the US currency will weaken even more next year. They assume that newly elected US President Joe Biden will push for even greater economic support measures. Another negative factor for the greenback is the expectation that the Federal Reserve will keep interest rates low for quite some time. "Investors now have a lot of reasons to sell the dollar. The Fed changed its monetary policy strategy, which leaves little chance of its normalization, and the growth of the double deficit of the US (the state budget and the current account) makes life easier for the bears on USD," strategists at Mizuho Bank said. Analysts from Goldman Sachs noted that a number of factors, including negative real profitability in the United States, overvalued US assets and the country's current account deficit, will weigh on the greenback next year. "We expect that the USD rate will continue to decline in 2021. The dynamics of liquidity and the flow of news about the pandemic may affect the timing of the dollar's weakening, but not necessarily its medium-term downtrend, " the bank's analysts said. Meanwhile, some analysts believe that the further trajectory of the greenback will largely depend on how well the US authorities manage to contain the coronavirus in 2021, as well as on the prospects for fiscal stimulus in the country. Mass vaccination against COVID-19 in the United States has just begun, and it is too early to draw conclusions about its effectiveness. At any moment, a new leap in uncertainty in this regard could cause the dollar to rise. Newly elected US President Joe Biden has already announced that he plans to offer Congress a broader package of support for the national economy after his inauguration on January 20. However, in order to move from words to deeds, the new US administration must break the political impasse that is now being created by the Republican-controlled Senate. On January 5, 2021, Georgia will host the second rounds of elections for two senatorial seats. To change the alignment of forces in the Senate, both of them must go to the Democrats. In the case of Victoria, the latter, fiscal stimulus in the US will be generous, which is likely to cause the dollar to fall. At the same time, the mere victory of the Republicans in Georgia will be enough to put Washington in a difficult situation, because of which it will not be possible to organize significant support for the American economy, which, most likely, will contribute to the greenback's growth. The material has been provided by InstaForex Company - www.instaforex.com |

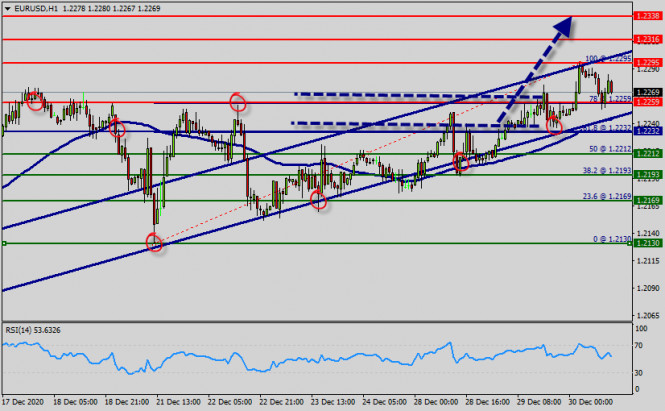

| December 30, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 30 Dec 2020 07:14 AM PST

The EURUSD pair was trapped below the previous key-level (1.2000) until bullish breakout occured to the upside recently in December.Further quick bullish advancement was expressed towards 1.2150 just as expected after failing to find sufficient bearish pressure at retesting of the backside of the broken channel around 1.1970-1.2000 which corresponds roughly to Fibonacci Level of 0%.Recently, the pair looked overbought while approaching the price levels of 1.2250 (138% Fibonacci Level).That's why, conservative traders were advised to look either for SELL Positions or low risk BUY trades around lower price levels.Bearish closure and persistence below 1.2160 then 1.2000 is needed to abort the ongoing bullish momentum to initiate a bearish movement at least towards 1.1860 and 1.1770.Otherwise, the intermediate-outlook for the pair would remain bullish at least towards 1.2330 where 150% Fibonacci Level is located. This is where an Intraday SELL Entry may be offeredThe price zone around 1.2000-1.1975 remains a Demand Zone to offer bullish SUPPORT for the EURUSD pair if any bearish pullback occurs. The material has been provided by InstaForex Company - www.instaforex.com |

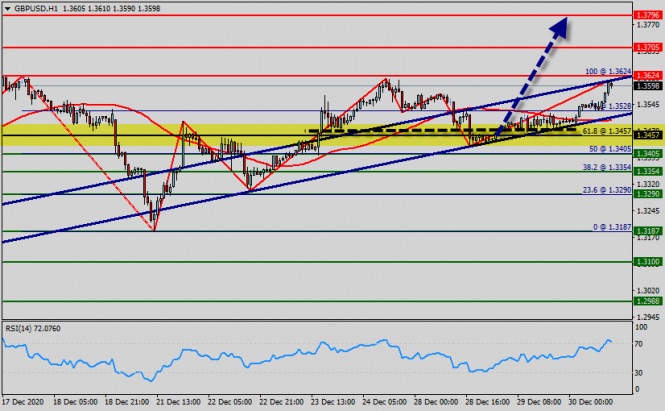

| December 30, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 30 Dec 2020 07:11 AM PST

In December, the price levels of (1.3380-1.3400) have prevented further bullish movement for the past few weeks. Bearish target was targeted around 1.3300. However, the pair has failed to pursue towards lower targets.Instead, a bullish spike was expressed towards 1.3480-1.3500 where the upper limit of the depicted movement channel has previously provided temporary bearish pressure on the pair.Shortly after, another bullish spike has recently been demonstrated towards 1.3600 where the upper limit applied considerable bearish rejection again.Recently, the GBPUSD pair looked overbought while consolidating above the key-level of 1.3400.As expected, bearish reversal was recently initiated around 1.3600. A quick bearish decline was demonstrated towards 1.3200.Intermediate-term outlook could turn into bearish if only the EUR/USD pair maintains movement below 1.3400.However, the pair has failed to maintain bearish decline below 1.3200.Instead, bullish persistence above 1.3400 invalidates the bearish scenario for the short-term.As Expected, another temporary bullish movement may be expressed towards 1.3700 (the channel's upper limit) where bearish rejection and a valid SELL Entryshould be anticipated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Dec 2020 06:52 AM PST Gold price remains trapped between $1,900 and $1,850. So far bulls remain in control as price continues to climb the upward sloping support trend line. Price is still below major resistance trend line but as long as support does not fail, bulls have hopes for a break out above $1,900 and a move towards $1,950.

Red line -support trend line Gold price so far made two attempts on the green resistance trend line and each time price got rejected. We can clearly see the two attempts by the long upper tail on those two candlesticks. Supportive of the bullish case is the fact that price continues to hold above the red trend line. How long will this last. We expect over the next few sessions to have an important trading signal for Gold. We do not know if it will be bullish or bearish, that is why it is preferred to be neutral until then. Traders that want to take extra risk would prefer to be short as long as price is below $1,900 expecting a downward reversal and another rejection soon. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Dec 2020 06:47 AM PST EURUSD remains in a bullish trend. Over the past month we explained in several posts that the pattern in EURUSD remained bullish as price was making higher highs and higher lows. Every pull back was shallow and never challenged or broke below key support levels.

Our first target of 1.2260 has been achieved and we are now underway for our second target area of 1.2350-1.24. Our analysis since early December so far remains valid. Price so far respected the channel boundaries. Eventually this up trend will end, however there is no sign yet of such a reversal. So bulls remain in control. Going against the trend is risky. Better bears be patient and wait for a reversal signal. Such a signal would be if price broke down of the bullish channel and below recent low at 1.2150. The material has been provided by InstaForex Company - www.instaforex.com |

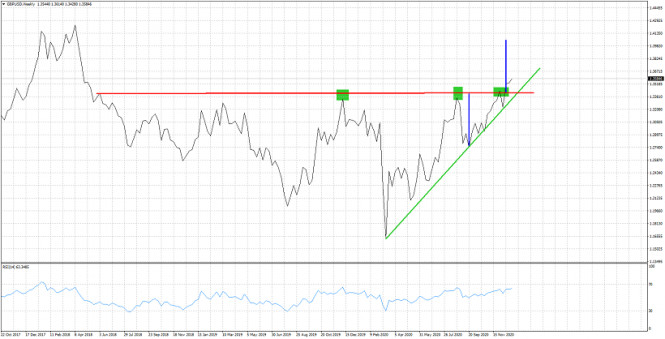

| Posted: 30 Dec 2020 06:41 AM PST GBPUSD is trading firmly above 1.35. Price has broken above weekly resistance and bulls now try to recapture 1.36. Our breakout target is around 1.40 as we explained in previous analysis. Trend remains bullish as long as price is above 1.3350.

Green line - support Green rectangles - tests of 1.35 GBPUSD continues to make higher highs and higher lows. Trend is clearly bullish. We expect bulls to remain under control of the trend as long as price respects the green support trend line. This support is at 1.3350. Of course any reversal below the break out area of 1.35 would be a bearish sign, trend changes on a break below the green line. Until then, target is 1.40. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar prepares for a trend change Posted: 30 Dec 2020 06:38 AM PST New Year's Eve purchases on global markets continue, pushing the US dollar index even lower. Investors are focused on optimism and ignore the emergence of negative fundamentals. U.S. Senate majority leader Mitch McConnell on Tuesday blocked a vote to increase payments to Americans to $2,000 from the previously planned $600, but the markets ignored it. Investors continue to bet that a deal on fiscal stimulus will eventually be reached, further reducing demand for the safe-haven dollar. Most analysts are inclined to predict a further decline in the dollar in 2021. This is also because the next US President, Joe Biden, is expected to push for even greater support measures for the US economy. Risk sentiment peaked during the Asian session, while it eased slightly in the European session. Trading in the United States began neutrally. The dollar index continued its downward trend, losing more than 0.3%. The 90 mark is broken and it seems that sellers have set a goal to gain a foothold below. Having a downward mood for the dollar, we can talk about the priority of transactions for the sale of the US currency In Europe, sentiment was buoyed by the fact that Britain became the first country in the world to approve the COVID-19 vaccine. The pound rose against the dollar but was little changed against the euro as traders returning from the Christmas break grapple with the December 24 Brexit deal. The agreement certainly avoids a chaotic Brexit, but it does not apply to services, which make up 80% of the British economy. The fact that the deal does not provide an equivalent framework for financial services and growing support for Scottish independence could create further headwinds for the British currency, Commonwealth Bank of Australia strategists write. The weakening dollar is mainly helping sterling to stay afloat around the 1.35 mark. Despite the strong downward trend in the USD, doubts are creeping in about the continuation of this dynamic at the very beginning of the new year. In the medium term, the decline of the dollar has not yet been canceled, but a respite, or correction, is brewing. Extremely high volumes of bets on the fall of the greenback, the deterioration of the epidemiological situation in the world create prerequisites for a sharp turn in the market. There are doubts that "the American currency may become much cheaper in the near future. Moreover, the average forecast of experts surveyed by Bloomberg implies that in the first quarter the dollar will rise in price against all currencies from the G10, "analysts write. There are doubts that "the US currency may soon become much cheaper. Moreover, the average forecast of experts surveyed by Bloomberg implies that in the first quarter, the dollar will rise in price against all currencies from the G10, " analysts write. Thus, in the near term, a sudden rise in the dollar may take everyone by surprise. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EUR/USD for December 30, 2020 Posted: 30 Dec 2020 05:40 AM PST

EUR/USD maintains growth You may keep purchasing from 1.2190 and below. In case of a complete downward reversal, sell from 1.2180. The material has been provided by InstaForex Company - www.instaforex.com |

| New coronavirus variant: May it destroy the global economy? Posted: 30 Dec 2020 05:29 AM PST

Recently, it became known about a new strain of coronavirus in the UK and Europe, which is more infectious and fast-spreading. Countries are reintroducing strict quarantines and closing recently opened borders. People are revolting against such measures. They are afraid of falling below the poverty line, while entrepreneurs are afraid of going bankrupt. Economists believe that the collapse of the world economy may occur very soon. If countries continue introducing strict quarantines, the drop in GDP will accelerate to 10%. The repeated quarantine may finally kill the entire small business. The service industry, hotel business, tourism, and restaurant sectors have been hit hard and now, they are trying to stay afloat. The fact is these organizations were banned from working on New Year's holidays. The ECB will again have to allocate billions of euros to support the Europeans. By the way, the EU has recently agreed on a basic stimulus package of €1.8 trillion. Initially, it was assumed that the money would be used to recover from the first wave of the pandemic. However, it is obvious that this amount will also be used to restrain the economy from a deeper decline during the second wave. Experts do not exclude that the EU, following the example of the United States, will expand the program of support measures next year. They also noted that the introduction of a new anti-crisis package of measures would depend on the effectiveness of vaccination and the absence or presence of new strains of coronavirus. BRITAIN ON THE EDGE OF CRISIS In the UK, it is forbidden to travel to other regions, as the epidemiological situation in the country is extremely difficult. Experts believe that shutting down a country that has found an unknown type of virus is a good decision. However, on the other hand, the consequences are harmful: rising inflation, weakening of the pound sterling, and closure of some small businesses. The UK government will have to re-approve a package of assistance to the population and small businesses. The total size may reach 50 billion pounds, the economy can be reduced up to 8-10% of GDP, experts say. In addition, from January 1, 2021, the UK will leave the EU and will have full political and economic independence. Definitely, this will cause even greater damage to the economy. Many factories in the country focused on free access to EU markets. Now, along with the lockdown, logistics, services, and manufacturing will be paralyzed. Many experts say that Great Britain is entering a crisis. The country's government has already advised supermarkets to stock up on food. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Dec 2020 04:36 AM PST Further Development

Analyzing the current trading chart of BTC, I found that BTTC reached my major upside target from yesterday at the price of $28,400. IT is very important to watch price action around key pivot at $28,400 in order to confirm further direction. There is potential for the downside rotation towards support levels at $27,000 and $25,760. Stochastic oscillator got the fresh bear cross, which is another sign for the potential downside rotation..... The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Dec 2020 04:32 AM PST Comments by UK health secretary, Matt Hancock We'll see about that. As the vaccines are being rolled out, it is easy for lawmakers to talk things up right now but delivering on those expectations will be another matter. In fact, the UK government has done a rather poor job on that front throughout the whole crisis so there's that to consider when reading into the remark by Hancock above. As for the latest on the AstraZeneca/Oxford vaccine, it is also one that requires two doses with the timing from the first to the second dose taking up to 12 weeks. Further Development

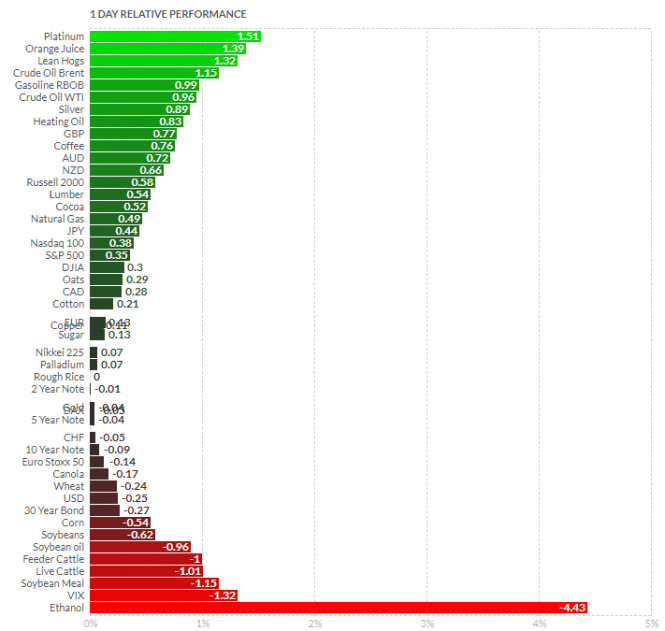

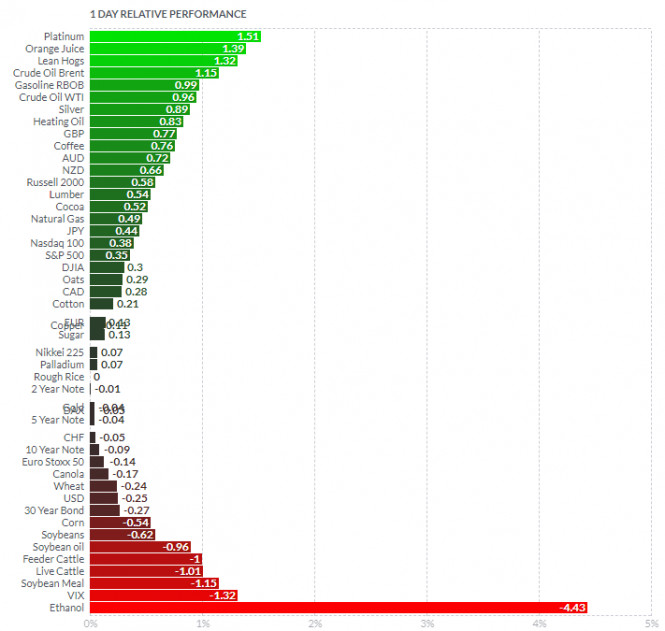

Analyzing the current trading chart of EURUSD, I found that there is the breakout of the ascending triangle on the 4H time-frame, which is sign for the further upside continuation. Watch for buying opportunities with the upside target at 1,2365. The trend is bullish and the longer time-frame money is bullish. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Orange Juice today and on the bottom Ethanol and VIX. Key Levels: Resistance:1,2365 Support levels: 1,2270 and 1,2250 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Dec 2020 04:25 AM PST Prior 103.5; revised to 103.7 A slightly better reading than the previous month, which reflects some better optimism surrounding the economy. This is likely to do with vaccine optimism but we'll see how things play out as we get into the new year with the virus still rampant in the region. The data measures the future trends of overall economic activity in the Swiss economy.

Further Development

Analyzing the current trading chart of Gold, I found that there is test of the rising line at the price of $1,878. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Orange Juice today and on the bottom Ethanol and VIX. Gold is neutral today... Key Levels: Resistance: $1,895 Support levels: $1,878 and $1,870 The material has been provided by InstaForex Company - www.instaforex.com |

| Oil prices climbed up during the Asian session Posted: 30 Dec 2020 03:50 AM PST Oil prices increased today during the Asian session. In the New York Mercantile Exchange, February WTI futures traded at $ 48.35 a barrel, which is 0.69% higher than its price yesterday. March Brent futures, meanwhile, rose by 0.61% and hit $ 51.53 a barrel. It seems that the continuous decline of the dollar is favorable to the oil market. At the moment, the USD index is trading at a very low level, that is, below 90 points. In particular, it dropped by 0.17% and is trading at $ 89.77. This low price of the dollar makes oil more affordable when purchased in another currency. Aside from that, oil also grew on the news that energy reserves in the United States have significantly decreased. Instead of the expected decline of 2.6 million barrels, reserves depleted by 4.8 million barrels. Now, oil has gained almost 6% since the beginning of December. Its main driver was the optimistic sentiment of market participants associated with the emergence of COVID-19 vaccines. However, the introduction of these vaccines is unlikely to be massive and widespread in the near future, especially with the active dissemination of conspiracy theories. To add to that, global incidence is still very high, which may lead to tougher restrictions and new lockdowns. These, in turn, will significantly limit the demand for oil. At the same time, hopes for larger payments to US households, as part of the new stimulus package, still fall short. The current bill provides for $ 600 payment to each American, which Donald Trump called "ridiculous". Unfortunately, Senate Majority Leader Mitch McConnell blocked the proposal to increase payments from $ 600 to $ 2,000. Increased payments could have had a beneficial effect on energy demand. In the current situation, demand is likely to slow, which will ultimately constrain oil prices. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for December 30, 2020 Posted: 30 Dec 2020 03:49 AM PST The GBP/USD pair broke the resistance that turned into strong support at the level of 1.3457 this week. The level of 1.3457 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as a major support on the H1 chart today. Consequently, the first support is set at the level of 1.3457. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 1.3457. So, the market is likely to show signs of a bullish trend around 1.3457 - 1.3500. In other words, buy orders are recommended above the ratio of 61.8% Fibonacci (0.9966) with the first target at the level of 1.3705 in order to test first resistance in the same time frame. If the pair succeeds to pass through the level of 1.3705, the market will probably continue towards the next objective at 1.3796. The daily strong support is seen at 1.3457 - 1.3500. Thus, if a breakout happens at the support level of 1.3457 / 1.3500, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Stocks in the US began to retreat, while Europe went multidirectional on the eve of the holidays Posted: 30 Dec 2020 03:48 AM PST

The US stock exchanges underwent a contraction on Tuesday. The major stock indexes showed a pullback from their historical maximum values, which they managed to reach the day before. The Dow Jones Industrial Average fell 0.22% or 68.3 points. Its current level was 30,335. 67 points. The S&P 500 index fell similarly by 0.22% or 8.32 points, which moved it to the area of 3,727. 04 points. The NASDAQ Composite index lost 0.38% or 49.2 points. Its current level began to consolidate at 12,850. 22 points. According to the latest data, a bill increasing direct payments to American citizens as aid against the background of the impact of coronavirus infection was blocked by the Republican majority leader in the Senate. This was a completely predictable decision, which analysts had warned about in advance. On Sunday, US President Donald Trump signed the draft budget for the year 2021 with the condition that the amount of payments will be revised from $600 to $2,000. However, after a positive vote in the House of Representatives, the bill again faced global problems that will most likely not be resolved quickly. In addition, there is an active discussion on the issue of extending the program to support small and medium-sized businesses in the country. On Tuesday, the Department of Treasury and the Federal Reserve have already decided to extend it until January 8, 2021. The previous term of the program ended on December 31, 2020. Of course, this measure slightly improved the mood of market participants, but this is not enough for sustained growth to continue. The main wave of positive news came from the signing of the budget for 2021, which took place last Sunday. This event has also almost exhausted itself and can no longer provide significant support to the markets, even though the budget payments include a package of assistance totaling $900 billion. Note that under the influence of certain factors, which, in particular, include mass vaccination, ratification of fiscal incentives, soft monetary policy, the stock market is unlikely to lose hope for the future. Investors have no great reason to be nervous, so a global reduction should not be expected. Nevertheless, a minor negative correction is necessary. But don't take it too seriously. One of the most problematic areas is still the deteriorating epidemiological situation in the United States. The increase in new cases of infection is recorded every day, and its pace is constantly increasing, which makes it doubtful that the economy will be able to move to a sustainable recovery in the near future. Over the past week alone, more than 184,000 new coronavirus infections have been detected in America every day. Meanwhile, European stock exchanges did not record any significant dynamics on Wednesday morning. The major stock indexes are in no hurry to change and show almost no significant movement. First of all, market participants are trying to assess the situation around the spread of coronavirus infection, including a new, more dangerous strain detected in the UK. Another important development was the approval of another COVID-19 vaccine developed by AstraZeneca. The UK plans to start using it early next month. In addition, the signing of a post-Brexit trade agreement between Brussels and London becomes an exciting topic. The main agreements have been reached, and three documents were already ratified on Tuesday. The general index of large enterprises of the European region STOXX Europe 600 gained 0.2% and moved to the level of 402.4 points. The UK FTSE 100 index gained 0.19%. France's CAC 40 index rose 0.11%. Italy's FTSE MIB index added 0.15%. Germany's DAX index slipped slightly by 0.07%. Spain's IBEX 35 index followed suit and fell 0.04%. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for December 30, 2020 Posted: 30 Dec 2020 03:39 AM PST EUR/USD : Further close above the high end may cause a rally towards 1.2259. Nonetheless, the weekly resistance level and zone should be considered. The EUR/USD pair will continue to rise from the level of 1.2259. The support is found at the level of 1.2232, which represents the 61.8% Fibonacci retracement level in the H1 time frame. The price is likely to form a double bottom. Today, the major support is seen at 1.2232, while immediate resistance is seen at 1.2295. Accordingly, the EUR/USD pair is showing signs of strength following a breakout of a high at 1.2259. So, buy above the level of 1.2259 with the first target at 1.2295 in order to test the daily resistance 1 and move further to 1.2316. Also, the level of 1.2295 is a good place to take profit because it will form a double top. Amid the previous events, the pair is still in an uptrend; for that we expect the EUR/USD pair to climb from 1.2232 to 1.2316 today. At the same time, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.2232, a further decline to 1.2130 can occur, which would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

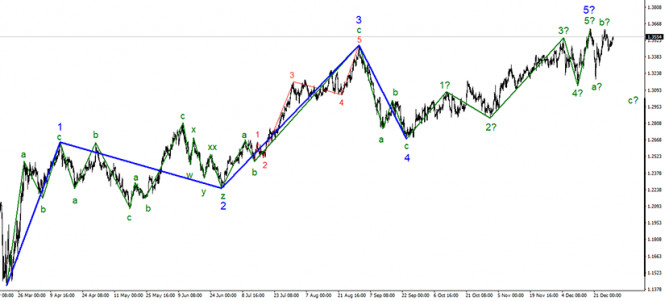

| Posted: 30 Dec 2020 03:24 AM PST

The trend section, which originated on September 23, finally took a complete five-wave form. In this case, the wave pattern can become much more complicated, but currently, everything seems to be a completed wave structure. Even last week's price growth of the instrument is still interpreted as a corrective wave b as part of a new downward correction pattern of waves. However, a successful attempt to break the high of the expected wave 5-5 will indicate the readiness of the markets to make new purchases of the pound.

In the smaller time frame, the wave marking also looks quite convincing and allows the option in which the entire section of the trend will take a more complex form. At the moment, the pair's quotes declined and began to retreat, while approaching the high of the expected 5 in 5. Thus, the current wave marking has been maintained and so, we can assume the construction of a descending wave c with targets located below the low of the expected wave a. At the same time, a successful attempt to break the maximum of waves 5 and b will indicate markets' desire to continue buying the British currency. In terms of news background, a trade deal between the UK and the EU is likely to be signed by both parties today. However, this is just a formality, which no longer has any special meaning. London and Brussels have already agreed and this is the most important thing. Nevertheless, the markets can still see today's event as a positive development. Moreover, if we also consider the evening news from the United States, where Congress approved to increase the one-time financial aid to Americans from $ 600 to $ 2,000, which the markets regarded as a negative moment, then it is logical why the pound is rising again, and the dollar is declining. At the end of 2020, the wave pattern and the mood of the markets remain unchanged. The British currency is likely to break through the highs of the previous two waves today or tomorrow before the New Year, which will lead to an even greater complication of the upward trend section. At the same time, markets are still unwilling or unable to find a reason to buy the dollar, since its unrestrained decline is very hard to stop. Thus, this situation can persist for a long time. In this case, we can expect the wave pattern to simply become more complex and lengthen. General conclusions and recommendations: The pound/dollar instrument has presumably started building a new downward trend section. Thus, I currently recommend selling it for each MACD "sell" signal with targets located around 32nd and 31st figures, within the expected first (global) wave of a new downward trend section. A successful attempt to break the high of wave 5-5 will indicate trader's readiness to buy the pound, which will cancel the option of building a new downward trend. The material has been provided by InstaForex Company - www.instaforex.com |

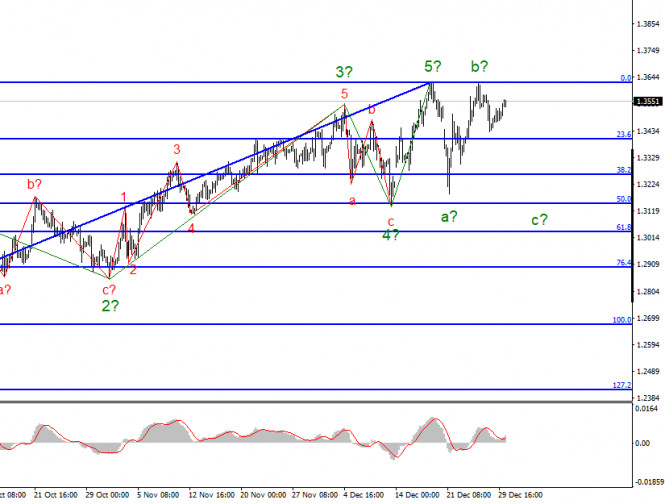

| Analysis and Forecast on GBP/USD for December 30, 2020 Posted: 30 Dec 2020 03:13 AM PST After a corrective pullback, which took place at the auction on December 28, the pound/dollar currency pair returned to an upward trend and demonstrates growth for the second day in a row. Before proceeding to the consideration of the GBP/USD price charts, let's discuss a little bit about the external background and those events that may affect the course of trading in the pound sterling. As you know, today the House of Commons of the British Parliament will begin the process of ratifying the trade agreement that Boris Johnson concluded with his European opponents. As already suggested in today's article on EUR/USD, this document will most likely not be adopted easily and simply, but still, to a greater extent, you can count on a positive result, since a hard Brexit will hit the British economy hard, which, therefore, is far from in the best situation. Now it is worth touching on the topical issue of the COVID-19 pandemic. As you know, the UK has become the most affected country from the coronavirus after Italy. In total, 71,000 deaths from the COVID-19 epidemic were recorded, and over the past day, the number of infected people in the United Kingdom amounted to 53,000. The medical system in the UK is running at its limit, hospitals are overloaded, and there are not always enough necessary medicines. According to experts, the British health care system is quite expensive and inefficient. This problem did not appear yesterday and radical reforms are needed here. However, the UK government first needs to finalize the divorce with the European Union, and with the least losses for the country. Looking at today's economic calendar, you can pay attention to the data from the United States of America, which will begin to arrive starting from 13:30 UTC. Daily

As already noted at the beginning of the article, yesterday and today(at the time of writing), the pound/dollar currency pair is showing growth and is now trading near 1.3578. At this point in time, there is a breakdown of the resistance of sellers at 1.3570, or rather, attempts to overcome this strong technical level. However, there is an equally strong technical zone located nearby (1.3600-1.3620), overcoming which will send the pair to the area of 1.3700. At this stage of time, the key resistance of sellers is in the area of 1.3618-1.3623, where the maximum trading values were shown on December 17 and 24, respectively. Trading recommendations for the GBP/USD pair mostly involve buying sterling, but the vote in the British parliament can lead to increased volatility, so you need to be careful and not rush to enter the market. In my opinion, the best option for opening long positions on the pound is to look for after a short-term decline of the pair in the price area of 1.3500-1.3480. However, a short-term drop may be more significant and reach the price zone of 1.3450-1.3430. In the event of negative news from the UK on the ratification of the agreement with the EU and the appearance of today's reversal model of candle analysis, it will be possible to think about selling the pair. But, if there is such an option, we will consider it in tomorrow's article. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments