Forex analysis review

Forex analysis review |

- Forecast and trading signals for GBP/USD on December 24. COT report. Analysis of Wednesday. Recommendations for Thursday

- Overview of the EUR/USD pair. December 24. Donald Trump continues to "put a spoke in the wheels" of the Democrats and prepares

- Overview of the GBP/USD pair. December 24. A deal has been reached or negotiations will continue after the New Year, and

- Analytics and trading signals for beginners. How to trade GBP/USD on December 24? Analysis of Wednesday deals. Getting ready

- Analytics and trading signals for beginners. How to trade EUR/USD on December 24? Analysis of Wednesday deals. Getting ready

- Evening review EURUSD 12/23. Weak US data left the market in thought

- Dollar devaluation in 2021 may be inevitable

- December 23, 2020 : EUR/USD daily technical review and trade recommendations.

- December 23, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Where will the pre-holiday swing take the EUR/USD pair?

- December 23, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- GBPUSD weekly breakout

- Gold respects support

- EURUSD respects bullish channel

- GBP/USD hot forecast

- Analysis of GBP/USD on December 23, 2020. Brussels and London left with one issue to agree on

- EUR/USD price analysis, 23 December

- Trading Signal for GBP/USD for December 23 - 24, 2020

- Trading Signal for EUR/USD for December 23 - 24, 2020

- Stocks in Europe and Asia are rising, but the pace is declining amid the holidays

- AUD/USD Ready To Drop!

- GBP/USD: plan for the American session on December 23 (analysis of morning deals)

- EUR/USD: trading plan for American session on December 23 (overview of morning trade). Market at standstill amid lack of

- BTC analysis for December 23,.2020 - First target at the price of $24.170 has been reached, Potential test of next target

- EUR/USD analysis for December 23 2020 - Contraction on the Early Europe session and potentiual for the breakout

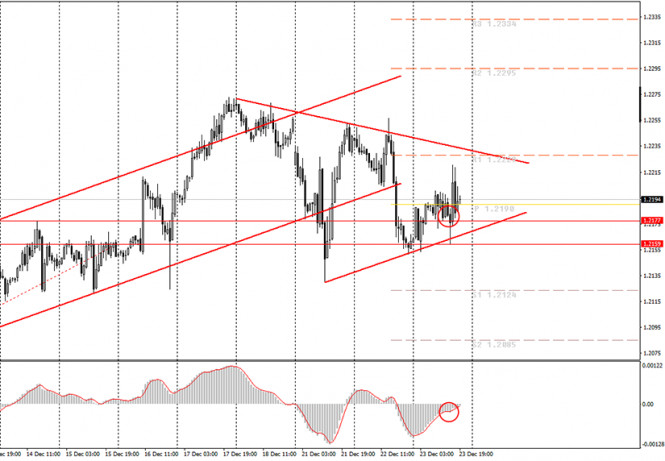

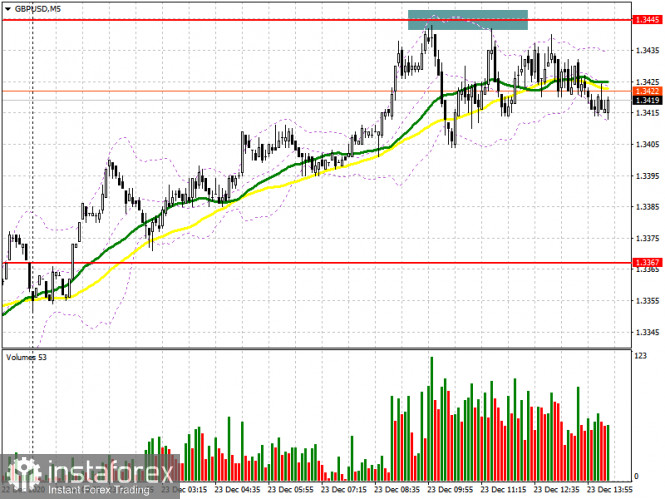

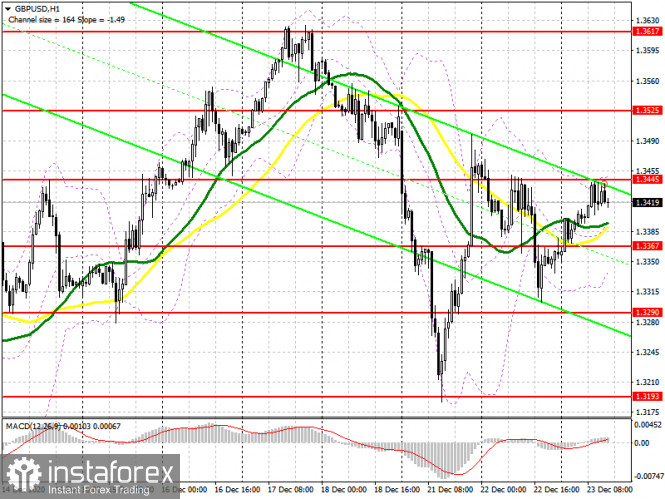

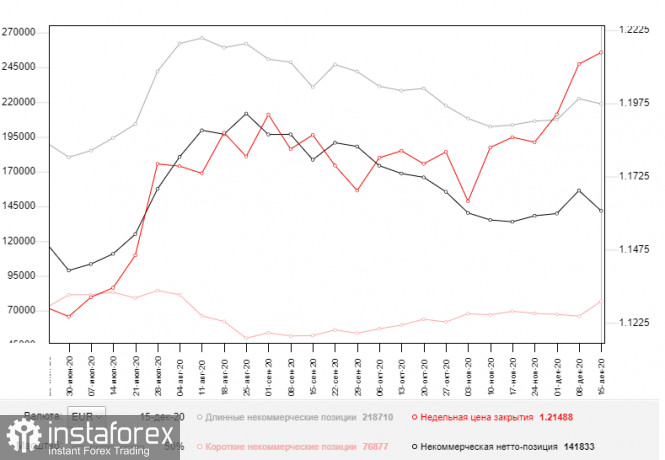

| Posted: 23 Dec 2020 07:18 PM PST GBP/USD 15M The higher linear regression channel is directed sideways on the 15-minute timeframe, the lower one is directed to the upside. An upward trend has formed in the short-term, which corresponds to what is happening on the hourly timeframe. The Senkou Span B line was unbreakable yesterday, so the rising movement began. GBP/USD 1H The GBP/USD pair went back to moving up on Wednesday, successfully breaking the downward trend line. Thus, as we recommended in the previous review, traders could open long positions on this signal. Also, as we warned that the quotes would not reach the first target since it is too far away. However, the upward trend has resumed, which is why you should consider bull trading. In general, the pound/dollar pair has started an upward movement again, which is very difficult to explain. However, the foundation will be discussed below, and here - technique. In the coming days, we expect the upward movement to continue as long as the price is above the new trend line. But we do not know as to whether it will be able to renew the 2.5-year highs that it reached only a couple of days ago. Much will depend on the news regarding the results of the negotiations between London and Brussels. COT report The GBP/USD pair grew by 80 points in the last reporting week (December 8-14). Slight price changes and the overall upward trend are still present for the pound. But the Commitment of Traders (COT) report in the last reporting week gave us data that does not allow us to make any specific conclusions and forecasts. The changes were again minimal and contradictory. Professional traders closed 4,000 Buy-contracts (longs) and 2,300 Sell-contracts (shorts) during the reporting week. Thus, the net position of the most important group of traders decreased by 2,300, which is not much. This means that major players have become more bearish. But the best thing to do now is to pay attention to the first indicator in order to understand what is happening with the mood of non-commercial traders. The green line (as well as the red one) constantly changes the direction of movement: up and down. This speaks precisely of the lack of a clear and firm attitude of the "non-commercial" group. So now it is impossible to draw any conclusions at all. The pound has been rallying for almost three months (and this is only the last round of its upward movement), but the COT reports does not show that non-commercial traders are becoming more bullish at this time. Or that any group of traders at this time are actively increasing purchases of the pound. The fundamental backdrop for the British currency was varied on Wednesday, but almost all of the information were rumors. However, market participants had enough rumors to resume buying the pound. According to a journalist, London and Brussels had supposedly reached an agreement. There was no official information yet, however, the markets, as usual, began to work out the information they want to see and in which they continue to believe. Therefore, the pound has grown. Its succeeding growth looks doubtful, since the pound is already very overbought. Without official confirmation of the deal, we believe that the pound will not continue to rise. However, take note that if technical factors continue to point to an upward trend, then you should trade upward. Fundamental hypotheses require technical confirmation. No major reports or events scheduled in the UK and the US on Thursday. Christmas is about to begin, so the markets slowly leave to celebrate. However, the groups of Michel Barnier and David Frost are unlikely to get on the holidays, which will continue negotiations until the moment when they come to an agreement. Or they will not declare a complete failure. Thus, despite the semi-weekend status of Thursday and Friday, the volatility for the pound/dollar pair may remain quite high, and important information may continue to flow to traders. We have two trading ideas for December 24: 1) Buyers for the pound/dollar pair will be active due to the next portion of rumors. At the moment, a new upward trend has formed, so you are advised to trade up, and the initial target will be the resistance level of 1.3668, which is located very far away. Take Profit in this case will be up to 160 points, but it may take several days to cover this distance. You can search for new entry points on a lower timeframe, for example, rebounding from the lower lines of the linear regression channels. 2) Sellers refuse to let go of the initiative, and failed to overcome the Senkou Span B line (yesterday it was at the 1.3335 level). Thus, we recommend selling the pound/dollar pair again while aiming for the 1.3323 level and the support area of 1.3160-1.3184, if the price manages to surpass the upward trend line and the Senkou Span B line (1.3378). Take Profit in this case can range from 35 to 180 points. Forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 23 Dec 2020 05:35 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -93.1191 If at the beginning of the trading week, the EUR/USD pair showed signs of life and even intended to start a new downward trend, then by the middle of the week it became clear that this was just an accident. Markets were agitated on Monday due to news about a new strain of "coronavirus", which, as it turned out later, is not the only "brother" of COVID-2019. Thus, on Tuesday, traders behaved less actively, and on Wednesday, volatility decreased even more. What is most important is the absence of a downward movement. After such a long and strong strengthening of the European currency, we still expect either a strong correction or a new downward trend. However, all that the bears were capable of was a decrease of 140 points, and even then against the background of Monday's epidemiological news. In general, the news for the US currency is still sad. By the way, yesterday, we listed all sorts of reasons that could trigger the fall of the euro/dollar pair and in the end concluded that perhaps all of them have nothing to do with the current movement. For example, today, it became known that the current US President Donald Trump is not going to sign a bill that involves the allocation of assistance to the American economy in the amount of $ 900 billion. The US President called the stimulus package agreed and approved by Congress "shameful" and added that the $ 600 payments it provides for all Americans are "ridiculously low." Trump calls for increasing payments to at least $ 2,000. Also, Donald Trump, in his usual manner, "rode" on his opponents in Congress, saying "that not everyone read the document, as it is too long and complex". Trump is waiting for a new bill to be signed, which will eliminate "unnecessary spending" and higher assistance to American families. Once again, we are wondering if Trump is tired of fighting against Congress and the Democrats? That's it, Trump lost the election. Joe Biden's inauguration is less than a month away. Trump lost all the courts and even the US Supreme Court, in which six of the nine judges are appointed to their posts by Republicans, rejected the lawsuit of Texas and 17 other states that called for a review of the results of elections in four states. Why block a bill to help the American economy if it will not affect your political ratings in any way? After all, it is not only about helping American families but also businesses and the unemployed. The new stimulus package includes "coronavirus surcharges" for unemployment payments of $ 300 weekly, as well as a $ 284 billion small business loan program. Also, it provides for the allocation of assistance to schools, universities, and airlines. There is one hypothesis about this, which is not a hypothesis. The fact is that Donald Trump is seriously intending to run for a second term. He, unlike many other former presidents, is not going to retire from business and leave politics. Under American law, the President can spend no more than two terms in the White House. That is, Trump is going to run for President in 2024. What's the problem? Yes, Trump will then be 78 years old. The same age as Joe Biden is now. Thus, as we said earlier, it is now profitable for Donald Trump to do everything to interfere with the work of the future President of the country. We have absolutely no doubt that Trump will "forget" to hand over a lot of official documents to Biden or "accidentally" lose them. We have little doubt that as long as Trump can, he will put a spoke in the wheels of Joe Biden, doing everything to make life difficult for him in the chair of the President of the country. The more difficult and uncomfortable a Democrat feels, the more likely it is that his results will be weak. If before November 3, Joe Biden had the advantage, since he could openly criticize almost any action and statement of Trump as President for four years (while he was in the shadows, since there was not much to criticize him for), now the Republican and Democrat can switch places. Now Trump will criticize "sleepy Joe" for any mistake or blunder, for unsatisfactory results, for weak economic growth, and so on. And if in four years it turns out that Trump's results were better than Biden's, then who will Americans vote for in 2024? Thus, it is safe to say that now Trump is building a springboard for future elections. Therefore, he is unlikely to sign the stimulus package that Congress offers him. He needs to knock out "his version", then to declare that he cares for the American people and in general "Americans are the best people on Earth". Well, the US dollar still does not find any reason to start strengthening. We still believe that, from a fundamental point of view, the European currency has long been showing an unjustified upward movement. The ward currency was fairly weak in late spring, summer, and early autumn. But now all the fundamental and macroeconomic factors do not look in favor of the euro currency at all. Moreover, as we have already said, the European economy will lose a few percent in the fourth quarter due to the repeated "lockdown", and the American economy will not. But even if you do not take this factor into account, the euro is now heavily overbought, and the dollar is heavily oversold. Therefore, we continue to wait for the current upward trend to end. But at the same time, it continues to recommend trading for an increase if technical indicators indicate an upward trend. No need to try to guess the reversal of the global downward trend. It's impossible. It is better to always follow the trend, but at the same time clearly understand what the "foundation" is now and what can be expected from the pair based on it. Recall that the "oil bubble" was inflated for a very long time, the same can be with the depreciation of the US currency.

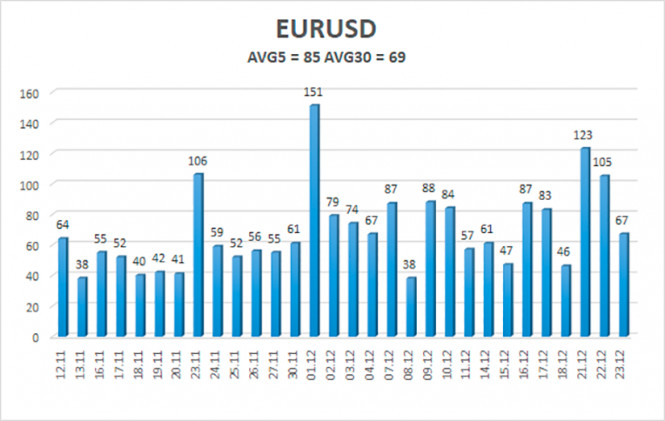

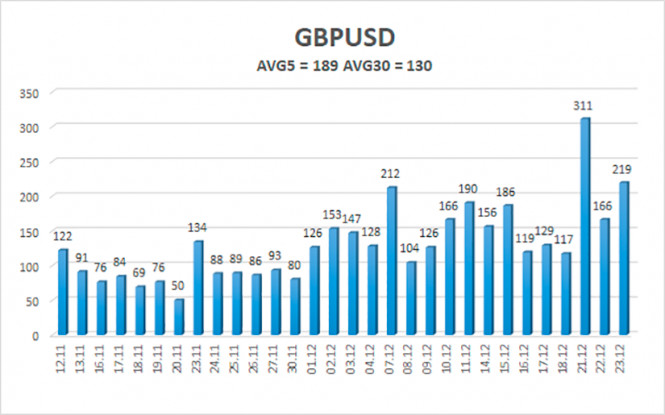

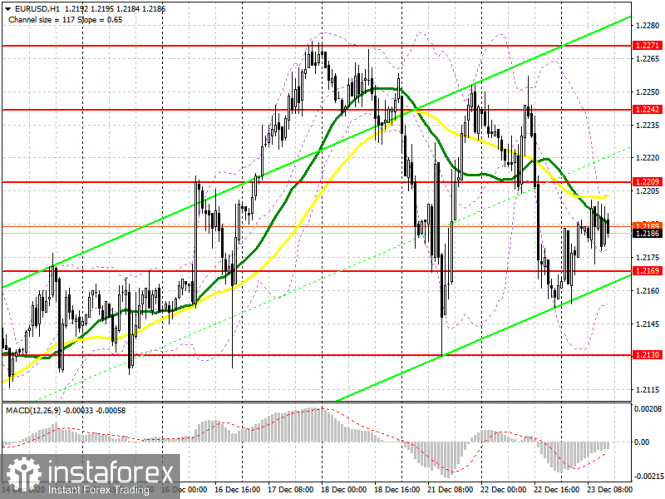

The volatility of the euro/dollar currency pair as of December 24 is 85 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.2096 and 1.2262. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement. Nearest support levels: S1 – 1.2146 S2 – 1.2085 S3 – 1.2024 Nearest resistance levels: R1 – 1.2207 R2 – 1.2268 R3 – 1.2329 Trading recommendations: The EUR/USD pair is trying to continue its downward movement. Thus, today it is recommended to stay in sell orders with targets of 1.2146 and 1.2096 until the price fixes above the moving average. It is recommended to consider buy orders if the pair is again fixed above the moving average with targets of 1.2262 and 1.2329. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 23 Dec 2020 05:35 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: 35.0173 The British currency paired with the US currency again rushed up in trading on Wednesday, December 23. We will talk about the possible causes and the "foundation" a little later, and here we will deal with the "technique". After a short stay of the price below the moving average line, the pair returned to the area above this line, thus, the upward trend has been restored. In the near future, the pound may update its 2.5-year highs, as well as continue to rise in price in pair with the dollar. We once again conclude that the pound is extremely overbought and even if the UK and the European Union manage to agree on a trade agreement by some miracle, it is still already taken into account in the current exchange rate of the pound. If it is reported that a trade deal is ready, and both parliaments ratify it before January 1, then the pound may again begin to fall because it is impossible to get more expensive all the time on the same factor. At what is still very doubtful at this time. After all, if you calculate that the pound has been growing non-stop since the end of September, it has grown by 9 cents during this time. Of course, you can blame everything on the weakness of the dollar, because the euro is also growing all this time. But finding the reasons why the dollar is getting cheaper is even more difficult than finding the reasons why the pound is growing. "The deal is ready." That's what Sky News correspondent Joe Pike wrote on Twitter, citing his sources close to the British Prime Minister. This message alone was enough for the markets to resume buying the British currency. This is all you need to know about the logic and validity of the reaction of the markets to the "foundation". We remind you that over the past 4 years, the pound sterling has repeatedly risen in price solely on rumors, speculation, hopes, and faith. Each time, after expectations were not met, the fall in the pound's quotes was much stronger than the previous growth. Perhaps Brussels and London will agree eventually. It may even happen in the near future, however, it is unlikely until December 31, 2020. After all, we do not deny that the parties can agree with each other. The only question is that time is catastrophically short and all possible deadlines have already been exceeded. For example, the European Parliament made clear last week that it was ready to agree to an emergency meeting on December 28 if the deal itself was agreed before December 20. It is understandable, the document, which will contain several hundred pages and determine the relationship between the Bloc and the Kingdom in the coming years should be studied in as much detail as possible. However, this deadline has also been exceeded. Thus, even if a Sky News journalist does have truthful information, this still does not mean that from January 1, London and Brussels will have relations based on this deal. By the way, there were no official statements from either side. So it turns out that sources close to Boris Johnson are aware of what is happening, but no one wants to make an official statement? In any case, now information regarding Brexit will be received every day. However, another source close to the negotiation process, but at the same time far from 10 Downing Street, says about the EU's proposal to continue negotiations in 2021. According to this source in the EU, the negotiations on Tuesday again ended without a result. It is reported that the issue of fishing in British waters remains the most acute, but it is not reported whether the parties were able to reach a consensus on other issues? For example, on the issue of fair competition or dispute resolution. Recall that the entire list of issues on which there were "serious disagreements" is quite large. And not once in recent weeks has either Michel Barnier or David Frost said that this or that issue has been successfully resolved. The EU's chief negotiator only said that "differences on the fisheries issue remain difficult to overcome, and the UK is not yet moving enough towards the EU to conclude a fair deal on fisheries". In general, it is now completely unclear at what stage the negotiation process is. It is completely unclear what the parties agreed on and what they did not agree on. It is unclear whether the deal will be completed in 2020. But the pound sterling still resumed growth. Well, one thing is for sure: in the next few days, everything will be decided for sure. Either the EU and Britain agree on an extension of the "transition period", or sign the deal "retroactively" and continue negotiations in 2021, or declare a complete failure (unlikely). We still believe that the parties will not have time to ratify the agreement this year, so negotiations are likely to continue next year. Meanwhile, in the UK, not only the economic and political situation but also the epidemiological situation continues to be serious and tense. Recall that on Monday, a new strain of "coronavirus" was announced, which is 70% more contagious than usual. Yesterday, it became known that the UK post office stops sending letters and parcels to Europe due to a new strain. Maybe the new vaccines will cope with the new strain as well as with the usual "coronavirus", but there is also no denying the danger of a strain that is almost twice as contagious. Again, even if no one dies from the new strain at all, if half the country gets sick, the economy will be paralyzed, and the medical system may collapse. Therefore, the danger of a new strain is not how many people will die (although this is also the case) from it, but in what consequences it will cause for the economy. In the UK, quarantine measures have already been tightened, which means that the economy may contract again in December and January.

The average volatility of the GBP/USD pair is currently 189 points per day. For the pound/dollar pair, this value is "high". On Thursday, December 24, thus, we expect movement inside the channel, limited by the levels of 1.3297 and 1.3675. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement. Nearest support levels: S1 – 1.3428 S2 – 1.3367 S3 – 1.3306 Nearest resistance levels: R1 – 1.3489 R2 – 1.3550 R3 – 1.3611 Trading recommendations: The GBP/USD pair on the 4-hour timeframe is now in a new round of upward movement. Thus, today it is recommended to keep long positions open with targets of 1.3611 and 1.3672 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down again with the targets of 1.3367 and 1.3306 if the price is fixed below the moving average line. In general, now the "swing" has begun again. Not a good time to trade. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 23 Dec 2020 01:22 PM PST Hourly chart of the GBP/USD pair

The GBP/USD pair traded quite nicely in technical terms on Wednesday. The pound/dollar pair crossed the downward trend line during the day, which is now marked with a dotted line in the chart. Thus, a buy signal was generated, which novice traders had every right to work out, according to our recommendations. If they did this, then at the moment (taking into account the fall in the pair's quotes in the last few hours), they are in profit by around 50 points. If they closed deals near the resistance level of 1.3543, from which the price rebounded, then they earned around 100 points. In any case, we have repeatedly said that a small profit is better than a large loss. Novice traders must learn how to make a little money and only then should they try to master more serious trading methods, more complex systems. At the moment, an upward trend has already appeared, as well as a new upward trend line. Therefore, it is now recommended to consider buy orders. As always, you need to wait for the MACD indicator to discharge and create a new buy signal. The pound began to rise again on Wednesday, since the market received information from journalists that the EU and the UK have both agreed on a trade deal. This is a classic situation that shows how the markets can react to this or that news, even if it is not official and unconfirmed. It's just that everyone is waiting for a trade deal to be agreed upon (thanks to which the pound has been growing for several consecutive months), so any relatively truthful information is interpreted by traders as an official statement. In general, the pound has risen in price out of the blue again and in general continues to trade near 2.5-year highs. However, if in the coming days (it is unclear how it will be if tomorrow, the day after tomorrow are holidays, and on 26, 27 - weekends) we do not receive confirmation from Michel Barnier or David Frost, then the pound may fall, paring today's growth. No macroeconomic releases scheduled for Thursday, December 24, both in the UK and US. However, the markets will continue to wait for official information regarding the Brexit talks. So if we manage to receive information, then the pound/dollar pair may be very volatile. On the other hand, no one knows when the official information will come and what it will be. It is quite possible that in reality Barnier and Frost (the heads of the EU and British negotiating groups) did not come to any agreement. Thus, buyers of the pound will be seriously disappointed. Possible scenarios for December 24: 1) Long positions are relevant again, since the upward trend is present. So now novice traders can close longs that should have been opened today and wait for a new buy signal. It can be from the MACD indicator, if it manages to discharge to the zero mark, or from the trend line, from which a rebound can occur as part of the correction. In both cases, you are advised to buy the pair again while aiming for 1.3543 and 1.3617. 2) Selling is now impractical as the downward trend has been canceled. So now you need to wait for the quotes to settle below the upward trend line and only after that should you sell the pair while aiming for support levels of 1.3377 and 1.3285. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

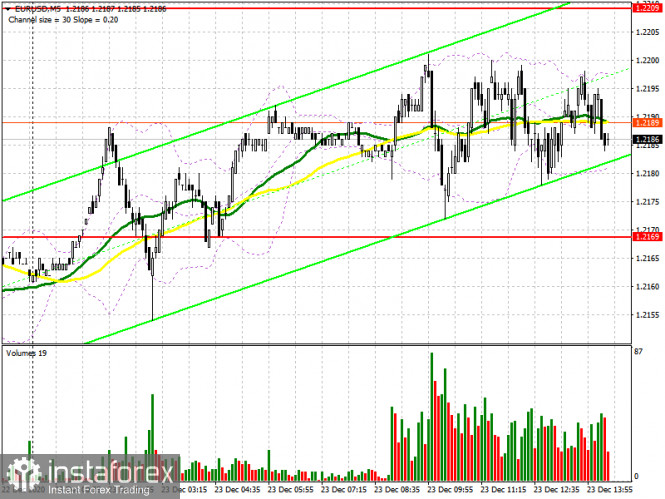

| Posted: 23 Dec 2020 01:22 PM PST Hourly chart of the EUR/USD pair

The EUR/USD pair continued to correct within the framework of a new downward trend on Wednesday, which is signaled by a downward trend line. The price tried to start a new round of downward movement, and the MACD indicator generated a sell signal. However, the indicator turned to the downside, below the zero mark. The indicator did not have time to discharge, therefore, it took some time for the signal to appear, and secondly, it was weak. According to yesterday's recommendations, novice traders should not have opened short positions on this signal. Since there weren't any signals during the day, and today, beginners did not have to enter the market for the EUR/USD pair at all. However, take note that the movements from the last few days made it possible for us to create an upward trend line, so now we have a kind of triangle, inside which the quotes are located. Logically, now the pair will try to move towards the downward trend line, rebounding from it can provoke a new round of downward trend. Getting the price to settle above this line will be a strong enough signal for long deals. But getting the pair to settle below the upward trend line will be a powerful signal for new short deals on the pair. No important news from the European Union and the US on Wednesday, but several relatively important reports were published. Take note that the most important report on orders for durable goods exceeded the forecast value of + 0.6% m/m and reached +0.9%. But the data on personal income and spending of Americans turned out to be much weaker than forecasts. The income level of the population fell by 1.1%, while the level of expenditures - by 0.4%. At the same time, the number of new initial applications for unemployment benefits reached 803,000 (forecast of 882,000), and the number of repeated applications decreased to 5.3 million against the forecast of 5.55 million. In general, today's news could be interpreted in favor of the dollar, but it received market support for only half an hour, and was falling for most of the day (growth of the euro/dollar pair = fall of the dollar). No macroeconomic events in the US and the European Union on Thursday. The celebration of Christmas begins, so many exchanges, banks and other subjects of the financial system will be closed on Thursday and Friday. Consequently, there will be very little news these days. Unfortunately, now there is not a single global fundamental theme that would constantly influence the pair's movement. So novice traders should pay more attention to technical analysis tomorrow and the day after tomorrow. Volatility can be low these days. Possible scenarios for December 24: 1) Long positions are currently irrelevant, since a downward trend has formed and there is a trend line. Therefore, we would not recommend opening long positions until this line is crossed. The targets in this case will be near the resistance level of 1.2295. 2) Trading down looks more appropriate, but the correction is still present. So we should wait for it to end, the MACD indicator is already sufficiently discharged (to the zero level), and a sell signal is being created. The upward trend line will provide some resistance to the downward movement, but once it is surpassed, short deals can be left open with the target at 1.2124. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review EURUSD 12/23. Weak US data left the market in thought Posted: 23 Dec 2020 01:22 PM PST

EURUSD Last important data came out before Christmas. Tomorrow is sluggish trade, on Friday - Christmas. US Employment Report: Long-term unemployment fell by less than 200K to 5.300K - much slower than expected. Consumer income fell -1.1%, inflation = 0%. At the same time, Congress approved a program of assistance to the economy for $900 billion - within the package, support for citizens of $600, support for small business and medicine. We keep buying the euro from 1.2190. Flip down from 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

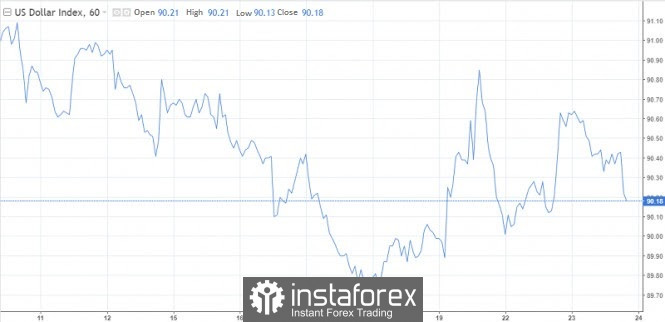

| Dollar devaluation in 2021 may be inevitable Posted: 23 Dec 2020 08:18 AM PST It seems that incentives are not yet expected any time soon after Donald Trump did not sign the $900 billion aid package proposed by Congress. The markets somehow managed to react without an emotional shake-up and maintained a moderately positive mood. Perhaps they do not care much about the opinion of the outgoing President, they consider the allocation of incentives to be almost resolved. However, it is possible that we will witness a delayed reaction. The growth of the dollar, which at the beginning of the week was a factor of pressure on risky assets, has slowed down at present. The USD index rose by 0.6% on Tuesday and recorded a loss of 0.10% at the opening of the US session on Wednesday. Further, the downward trend intensified. Nevertheless, it is not worth counting on a further decline in the dollar. The global markets are currently undergoing a correction, the so-called sluggish sales will allow you to release steam after the rally and, alternatively, form the basis for new growth momentum. We are likely to see a corrective rebound to 90.7 and higher on the dollar index. Growth to 91.40 is possible. With a prolonged correction, the indicator can reach the levels of 92.2 and 93.90 The EUR/USD pair may end the year around the 1.21– 1.22 mark, this will happen in the case of soft corrective movements. If the risk is sold off more aggressively, the main currency pair of the Forex market risks falling by one or two figures, that is, in the area of 1.20. A more pessimistic scenario suggests a decline to 1.17. Dollar in 2021 In addition to the short-term prospects, investors are also interested in the longer-term prospects for the US dollar. Many expect that the current weakness of the dollar, which has lost more than 6% against a basket of 6 currencies since the beginning of 2020, will be a turning point. In the coming year, growth can be recorded everywhere, from US stocks and EM markets to industrial metals. One of the catalysts for the growth of demand is low-interest rates and massive fiscal stimulus in the United States. Participants in a recent Reuters poll believe that the dollar will continue to fall in early 2021. The downward trend will last at least until the middle of the year. This is due to the fact that market players will continue to be interested in buying risk and strive for higher returns. U.S. exporters will welcome a weaker dollar, as it will make their products more competitive outside the states. The winners will be U.S. multinationals and equity investors. The downward movement of the dollar also contributes to the maintenance of commodity prices. These goods are in the US dollar and when it falls, they become more accessible to foreign investors. "The fall in the dollar is a double incentive for commodities, not only because most commodities are priced in dollars, but also because periods of dollar weakness usually coincide with faster growth," Robeco said. A weak dollar is a real boon for emerging markets, as it makes it easier to service the debt of those countries that borrowed in dollars. The MSCI Emerging Markets index, which measures the performance of stocks, has risen 13% since January 2020. Societe Generale analysts reported a reduction in the share of the greenback in its portfolio of assets to a record low. Their recommendation is to increase the share of EM shares, with the greatest emphasis on Korean and Indonesian companies. Many expect the dollar to go down the beaten path in the new year, but not all. Therefore, betting against the greenback can not be called a one-way street. Events in the new year may develop in favor of the dollar. For example, the Federal Reserve will decide to tighten monetary policy ahead of time, which will contribute to the upward trend of the dollar. In addition, the greenback tends to become more expensive when something akin to a coronavirus happens in the world. For example, earlier this week it became known about the emergence of a new type of this infection, which the world has been fighting for almost a year. The mutation has caused unrest and resulted in an almost asleep dollar in motion. This is quite a revealing episode, and the dollar, no matter what they say, remains the safest asset. The material has been provided by InstaForex Company - www.instaforex.com |

| December 23, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 23 Dec 2020 08:16 AM PST

After the demonstrated sideway movement took place in November, evident signs of BUYING Pressure has originated around the depicted price zone of 1.1800-1.1840. Shortly after, the EUR/USD pair has demonstrated a significant upside movement after the recent breakout above the depicted price zone (1.1750-1.1780) was achieved. As mentioned in the previous article, the pair has targeted the price levels around 1.1990 which exerted considerable bearish pressure bringing the pair back towards 1.1920 which constituted a temporary KEY-Zone for the EUR/USD pair. That's why, another episode of upside movement was expressed towards 1.2160 where a false breakout above the price level of 1.2200 was regarded as a false bearish reversal signal. By the end of Last week, a short-term reversal pattern has been demonstrated around 1.2265. Intraday downside retracement to the downside was expected to occur. On the other hand, Bearish closure below the mentioned price zone of 1.2200 - 1.2170 wasneeded to turn the intermediate outlook for the pair into bearish and enhance a quick bearish decline towards 1.2040 and 1.1920. Trade Recommendations :- Conservative traders should be looking only for SELL Positions around the price level of 1.2250-1.2270. Exit level should be placed above 1.2300. The material has been provided by InstaForex Company - www.instaforex.com |

| December 23, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 23 Dec 2020 08:12 AM PST

Recently, the EURUSD pair was trapped below the previous key-level (1.2000) until bullish breakout occured to the upside.Further quick bullish advancement was expressed towards 1.2150 just as expected after failing to find sufficient bearish pressure at retesting of the backside of the broken channel around 1.1950-1.1970 which corresponds roughly to Fibonacci Level of 0% at 1.2000. Recently, the pair looked overbought while approaching the price levels of 1.2250 (138% Fibonacci Level).That's why, conservative traders should be looking for low risk trades around lower price levels. Bearish closure and persistence below 1.2160 then 1.2000 is needed to abort the ongoing bullish momentum to initiate a bearish movement at least towards 1.1860 and 1.1770. Otherwise, the intermediate-outlook for the pair remains bullish with the price level around 1.2000-1.1975 arcting as a solid Demand Zone to offer bullish SUPPORT for the EURUSD pair. The material has been provided by InstaForex Company - www.instaforex.com |

| Where will the pre-holiday swing take the EUR/USD pair? Posted: 23 Dec 2020 08:11 AM PST

The main currency pair is showing increased volatility ahead of the Christmas holidays. In the absence of significant releases for the eurozone, EUR / USD is trading under the influence of the dynamics of the dollar, demand for risk, as well as news from the coronavirus front and the situation around the next package of economic incentives in the United States. The sudden dip in risk sentiment on Monday over reports of a new COVID-19 mutation triggered strong moves across asset classes. The greenback surged sharply against the backdrop of low market liquidity, while American stocks fell. However, afterward, everything went backward and quickly returned to its starting points. In particular, the S&P500 index fell by 0.44% on Monday, although at some point there was a decline of 3.2%. A similar situation was observed in the foreign exchange market, where the EUR/USD pair ended the first day of the week with a decline of 0.1%, although within the day its losses exceeded 1%. On Tuesday, reports of the new COVID-19 strain continued to weigh on investor sentiment. The EUR/USD pair failed to capitalize on the previous day's rebound of more than 130 pips from three-day lows. Instead, it met an offer amid a broad strengthening of the US dollar, dipping below 1.2200, ending yesterday's trading near 1.2150. The greenback rose by almost 0.6% on Tuesday, rising above 90.6 points. On Wednesday, it decreased by about 0.5%. The EUR/USD pair has managed to attract buyers around 1.2150 and is retesting the resistance around 1.2200. Concerns about a new coronavirus mutation have begun to subside as representatives from the World Health Organization (WHO) said that already developed vaccines against COVID-19 should work against the new strain of the virus. Meanwhile, the still acting President of the United States, Donald Trump, refused to sign the $900 billion economic aid package approved by the US Congress, demanding amendments to it. The market does not yet really trust Trump and believes that the stimulus package will be adopted in one way or another in the very near future. "The market's muffled reaction suggests that it is still awaiting the passage of the bill in one form or another," said strategists at Barclays. "The adoption of a large stimulus package could lead to higher inflation in the US, making the US dollar less attractive to investors. Therefore, we expect the greenback to remain weak," they added. It is assumed that in this case, the USD will remain at its lows until the end of the year, and the main currency pair will make more than one attempt to approach the 1.2300 mark. If the approval of fiscal stimulus in the US fails, it will benefit the dollar, as investors will again be forced to turn to it as a safe haven asset. In this scenario, the EUR/USD pair may sink to the area of 1.2000-1.2100, and a more active sell-off of risky assets can lead it to 1.1800. The material has been provided by InstaForex Company - www.instaforex.com |

| December 23, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 23 Dec 2020 08:09 AM PST

In December, the price levels of (1.3380-1.3400) have prevented further bullish movement for the past few weeks. Bearish target was targeted around 1.3300. However, the pair has failed to pursue towards lower targets. Instead, a bullish spike was expressed towards 1.3480-1.3500 where the upper limit of the depicted movement channel has previously provided temporary bearish pressure on the pair. Shortly after, another bullish spike has recently been demonstrated towards 1.3600 where the upper limit applied considerable bearish rejection again. Recently, the GBPUSD pair looked overbought while consolidating above the key-level of 1.3400. As expected, bearish reversal was recently initiated around 1.3600. A quick bearish decline was demonstrated towards 1.3200. Hence, intermediate-term outlook can turn into bearish provided that the pair maintains movement below 1.3400. However, the pair has failed to maintain bearish decline below 1.3200. Instead, bullish persistence above 1.3400 invalidates the bearish scenario for the short-term. Hence, another bullish movement towards 1.3700 (the channel's upper limit) shouldn't be excluded. The material has been provided by InstaForex Company - www.instaforex.com |

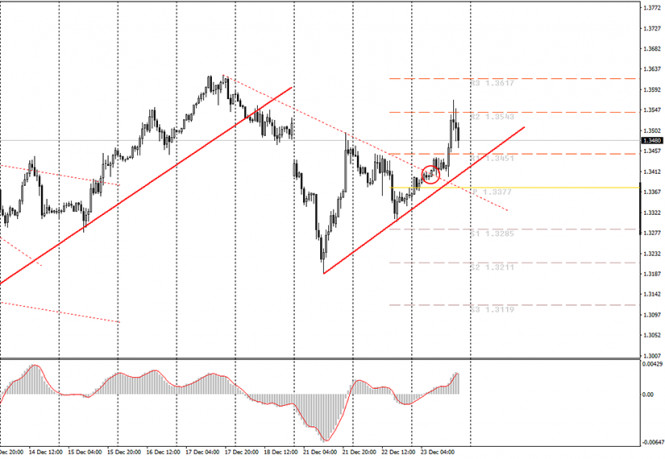

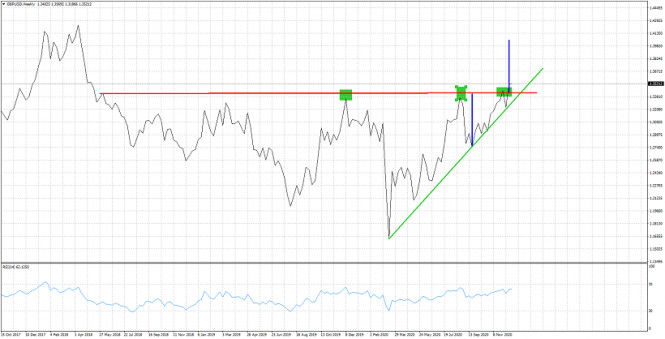

| Posted: 23 Dec 2020 07:54 AM PST GBPUSD is trading above 1.35. In a previous analysis we noted that key resistance is found in the area of 1.35. Price got rejected three times before at this area and it is a confirmed key resistance. Breaking above it will open the way for a move towards 1.40.

Green line - support trend line Green rectangles- rejections Blue lines -size of upward move expected GBPUSD is in a bullish trend. Price continues making higher highs and higher lows respecting the green support trend line. As long as price is above the green trend line resistance we remain bullish. Support now is found at 1.3280. GBPUSD has the potential for a move towards 1.40 as long as it stays above 1.35 and the green trend line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 23 Dec 2020 07:49 AM PST Gold price pulled back yesterday to $1,855 challenging recent low and trend line support. Price today is bouncing. Trend remains bullish as long as price is above $1,855 and the upward sloping trend line support.

Red line - support trend line Gold price has now the potential to continue higher towards the major resistance trend line. This resistance is now at $1,910. Breaking above it will be a big win for bulls. Short-term resistance is at $1,885. Bulls need to recapture this level. Support at yesterday's lows around $1,855. Bears need to break below $1,855 in order to get momentum. As long as price is above the red support trend line we remain bullish looking for another move towards $1,900 and higher. The material has been provided by InstaForex Company - www.instaforex.com |

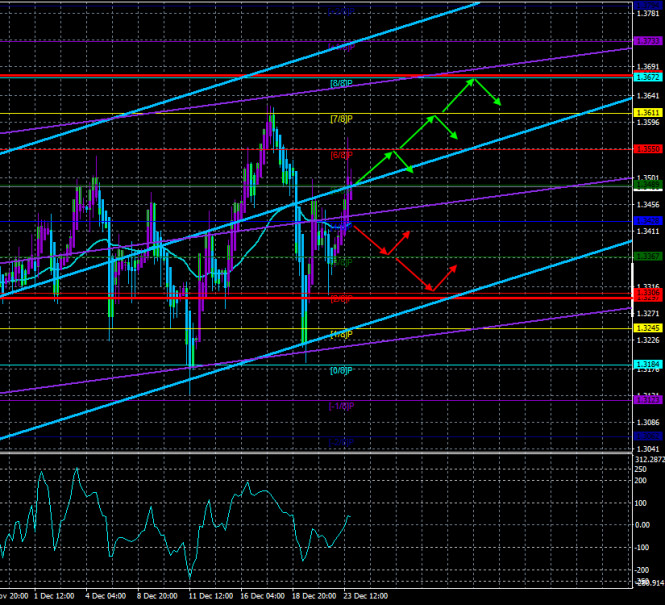

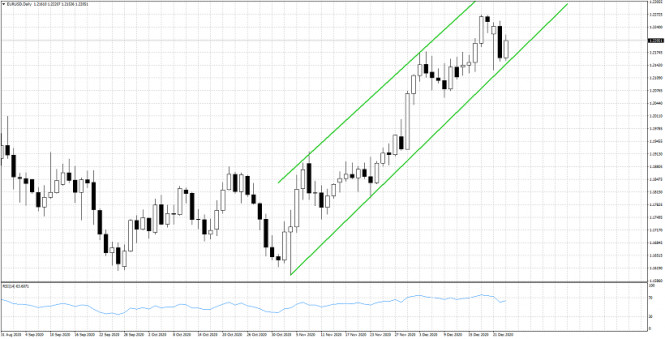

| EURUSD respects bullish channel Posted: 23 Dec 2020 07:45 AM PST EURUSD price pulled back yesterday towards 1.2150 and very close to the lower channel boundary. Price is bouncing today to 1.22. Price so far respects the lower channel boundary and as long as this is the case, bulls will remain in control of the short-term trend.

EURUSD remains inside the green upward sloping channel. Price so far is making higher highs and higher lows. Recent low at 1.2129 is key support as we mentioned in our previous analysis. Staying above it is key to short-term bullish trend. Bulls yesterday tested this support and today price is bouncing higher again off the lower channel boundary. All this price action is bullish. The bullish scenario will be strengthened if price breaks above the short-term resistance and yesterday's highs at 1.2256. As long as price is above the lower channel boundary we prefer to be bullish. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 23 Dec 2020 07:22 AM PST From a technical perspective, the two-way price moves since the beginning of this week point to indecision and warrants some caution for aggressive traders

GBP/USD held on to its intraday gains and once again advances to test 2020 high around the 1.36 region.Looking at the technical picture, the pair on Wednesday broke through a near one-week-old descending trend-line resistance on the hourly chart . This, in turn, supports the additional gains amid optimism over the possibility of a last-minute Brexit deal. That said, traders might still wait for some follow-through buying beyond the 2020 swing highs, around mid-1.3600s, before placing bullish bets. The GBP/USD pair might then make a fresh attempt to reclaim the key 1.3500 psychological mark . The momentum could further get extended to last week's swing highs,and above that the pair seems to prolong its recent strong upward trajectory. On the flip side, bearish traders might now wait for sustained weakness below the 1.3400 mark. A subsequent fall will be seen as a fresh trigger for bearish traders and drag the GBP/USD pair to the 1.3300.The pair might then turn vulnerable to accelerate the fall back towards challenging the lower boundary of a three-month-old ascending trend-channel. The downward trajectory could further get extended to the weekly lows, around the 1.3200-1.3190 region. The material has been provided by InstaForex Company - www.instaforex.com |

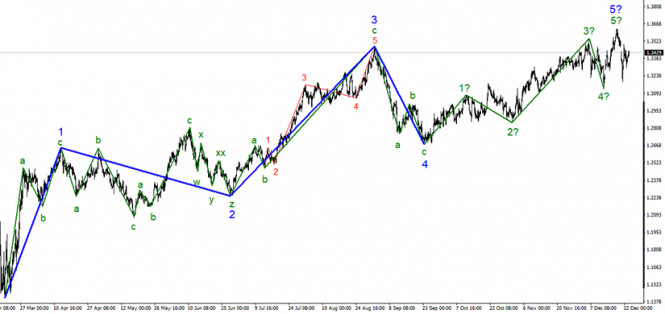

| Analysis of GBP/USD on December 23, 2020. Brussels and London left with one issue to agree on Posted: 23 Dec 2020 07:18 AM PST

The section of the trend, which originates on September 23, finally took a five-wave form. And the view is quite complete. Of course, the wave layout can become more complicated once again, as it has done more than once, but at the moment everything looks like a complete wave structure. If this is indeed the case, then the decline in quotes will continue within the new downward trend section with targets located near the 30th figure, and possibly even lower.

The lower chart clearly shows the wave 5 in 5 of the upward trend section, which updated the maximum of the previous wave 3.Thus, the construction of the upward trend section can really be completed. If this assumption is correct, then the decline in quotes will resume within the expected wave c. Until a successful attempt to break the maximum of the current wave 5 in 5, the working option will be the option with the construction of a downward trend section. The pound sterling has lost a total of 400 points over the past week. However, this decline has long been over, and in recent days the instrument is already rising. So far, everything is similar to the construction of correction waves a and b, with wave b taking a three-wave form. Thus, if this assumption is correct, then between the 35th figure and the 1.3550 mark, there should be a downward reversal and a resumption of the decline in the instrument's quotes. At the same time, if the demand for the pound sterling continues to remain so high, then the entire upward section of the trend may become more complicated more than once. Despite the fact that in the past few months, officials from Britain and the European Union have always said that the chances of a trade agreement is extremely low, and time sorely lacking, recent reports suggest that the parties are now down to one issue to agree on – the question of fisheries. Let me remind you that in monetary terms, this is not such an acute issue. European fishermen catch no more than 1 billion fish in British waters each year. However, London wants to establish full control over its waters, which is inherent in any independent state. At least, that's what Boris Johnson thinks. I do not know whether to say that everything should be resolved in the near future, since this "near future" has been dragging on for a couple of months. The markets seem to believe again that a deal is possible, and London and Brussels are just "breaking the Comedy". It is on the basis of this belief that the pound could rise in recent days. Recall that the UK and US GDP for the third quarter were both higher than market expectations. But at the same time, the pound sterling is growing in general, contrary to the dollar, which is having a very hard time after March 2020. General conclusions and recommendations: The Pound-Dollar instrument has presumably started building a new downward trend section. Thus, I currently recommend selling the GBP/USD instrument for each MACD signal "down" with targets located around the 31st and 30th figures, within the expected first (global) wave of a new downward trend section. A successful attempt to break the maximum of the wave 5 in 5 will indicate the readiness of traders for new purchases of the pound sterling and cancel the option of building a new downward trend. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD price analysis, 23 December Posted: 23 Dec 2020 06:43 AM PST EUR/USD is retreating from around 1.2200, with pre-holiday trading.

From a technical perspective, the pair, so far, has managed to defend a seven-week-old ascending trend-line. EUR/USD price are back in bull flag carved out in two weeks of December, following the bullish breakout above sideways range resistance . EUR/USD is closely followed by the 1.2170 horizontal and trend-line support , which if broken decisively will be seen as the first sign of bullish exhaustion that would generate initial reversal signal .Some follow-through selling below the 1.2100 mark will add strength to the bearish break and turn the pair vulnerable to accelerate the fall further towards the key 1.2000 psychological mark. On the flip side, the 1.2200 round-figure mark now seems to act as immediate resistance, above which the pair is likely to climb back to the 2020 High (1.2270) . Bulls might then wait for a sustained strength beyond the 1.2280 region, before positioning for any further gains to push the pair to the 1.2300 and next hurdle near the 1.2340 region. The material has been provided by InstaForex Company - www.instaforex.com |

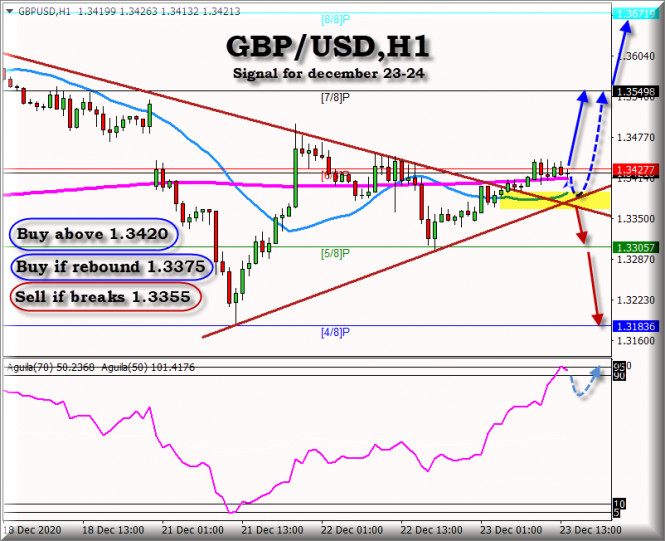

| Trading Signal for GBP/USD for December 23 - 24, 2020 Posted: 23 Dec 2020 06:19 AM PST The GBP / USD pair at the opening of the American session is trading above the 200 EMA and above the 21 SMA, with upward force in 1 hour charts, as long as the pair remains above these levels is likely there is a bullish move for the next few hours. In the 1 hour chart you can see that the GBP / USD has not yet covered the Gap that it left in the opening of negotiations this week, it is likely that we will see a strong bullish momentum, only if it remains above the EMA of 200. On the contrary, a break below 1.3355, below the yellow zone that we have indicated on the chart, we could expect a downward movement to the level of 1.3305 and 1.3183. The eagle indicator is showing a bullish signal, reaching overbought levels, we could expect the GBP / USD to cover its GAP at 1.3530 and then a bearish retracement may occur to the level of 1.32. Our recommendation is to buy only if the pair remains above the 21 SMA and 200 EMA on 1 hour charts, above these levels we can expect bullish momentum to the resistance of 1.3549 7/8 murray zone. We invite you to review our GBP / USD signal where we analyze the bullish pattern.

Trading tip for GBP/USD for December 23 – 24 Buy above 1.3420 (EMA 200 and SMA 21) with take profit at 1.3549 (GAP) an 1.3670 (8/8 of murray), Stop below 1.3380. Buy if the pair rebound around 1.3375 (trend line) with take profit at 1.3549( GAP and 7/8), stop los below 1.3340. Sell if breaks 1.3355 (Below SMA 21), with take profit at 1.3305 (5/8) and 1.3185, stop loss above 1.3390. The material has been provided by InstaForex Company - www.instaforex.com |

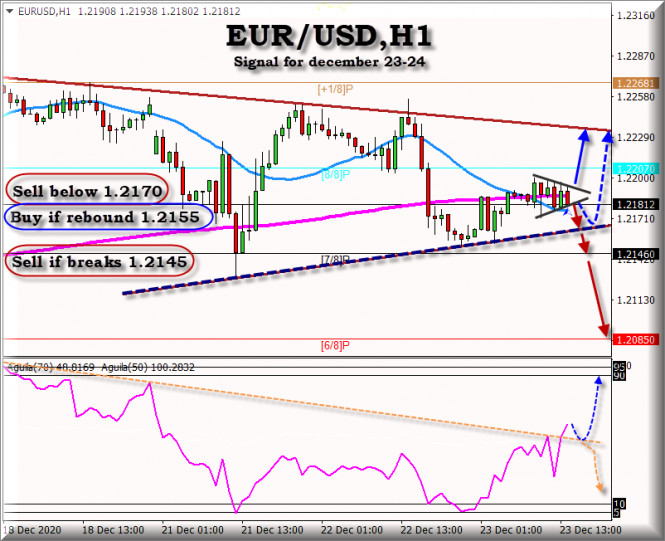

| Trading Signal for EUR/USD for December 23 - 24, 2020 Posted: 23 Dec 2020 05:57 AM PST The EUR / USD at the opening of the American session is trading within a small triangle of 1 hour, below the EMA 200, and under downward pressure, a definitive break of 1.2150, we could expect a fall to 6/8 of murray. In the United States, while an agreement has not yet been reached on the $ 900 billion covid relief stimulus bill. USDX will continue to gain strength and this could push the euro-dollar to 1.2085 levels. On the contrary, we could see a rally to the 1.2230 and 1.2268 (+1/8 murray) area of very strong resistance. Eagle indicator is showing bullish strength this morning, breaking the bearish signal line, and going to the area 90, it is likely that this increased volume of negotiations, pending fiscal stimulus in the United States. Market sentiment for today December 23 is showing that there are 62% of traders that are selling this pair, we have noticed a decrease of 5% since the beginning of the week, this could be a sign of a probable downward movement of the EUR / USD for the next few days. Our recommendation is to sell, as long as the pair is below the 200 EMA in 1 hour charts, and below the 21 SMA, if you see that the EUR / USD pair is trading below these levels, we recommend selling with targets at 1.2085.

Trading tip for EUR/USD for December 23 – 24 Sell below (EMA 200 and SMA 21) around 1.2180, with take profit at 1.2146 (7/8 of murray) and 1.2085, stop loss above 1.2210. Buy if the pair rebound around 1.2155 (trend line), with take profit at 1.2207 (8/8 of murray) and 1.2235, stop loss below 1.2115. Sell if breaks 1.2140, (7/8) with take profit at 1.2085, stop los above 1.2175. The material has been provided by InstaForex Company - www.instaforex.com |

| Stocks in Europe and Asia are rising, but the pace is declining amid the holidays Posted: 23 Dec 2020 05:53 AM PST

The major stock indexes in the European stock exchanges climbed on Wednesday amid news that there are hopes for a positive outcome of the negotiation process between the UK and the EU over agreements after the former leaves the Union. The general index of large enterprises in the European region STOXX Europe 600 rose 0.37% in the morning. Its current level moved to the mark of 392.69 points. Germany's DAX index jumped 0.6%. France's CAC 40 index gained 0.62%. Italy's FTSE MIB index added 0.52%. Spain's IBEX 35 index rose 0.62%. The UK FTSE 100 index was the only one that ignored the positive trend and showed a reduction of 0.15%. According to the latest reports, the negotiation process between the UK and the EU is finally coming to an end. To date, the parties have moved to a crucial stage, which, according to experts, should lead to a positive conclusion. However, the parties still need additional impetus to put an end to some, particularly controversial issues. Of course, the very fact that the UK and the EU still managed to come to at least some consensus sparks optimism among market participants. However, the news about the spread of coronavirus infection in the region becomes a fly in the ointment. Recall that an increasing number of European states, as well as countries around the globe, are stopping transport links with the UK against the background of the identification of a new, particularly dangerous and rapidly spreading strain of COVID-19. The European Commission has rushed to issue recommendations to ban secondary visits to the country while clarifying the circumstances with the coronavirus mutation. And for the citizens of the state itself, increasingly stringent quarantine measures are being introduced to stop the next wave of infection. Only residents of the United Kingdom who are traveling to their place of permanent residence, as well as third-country citizens who enjoy the right of free movement, are exempt from restrictions on movement. Meanwhile, the statistics on the economic growth of the EU countries turned out to be quite ambiguous. For example, the level of GDP in Spain for the third quarter of this year is expected to increase at 16.4%, which was earlier expected to grow to 16.7%. Nevertheless, even such growth rates will already be the highest for the entire period of observation of the indicator. In terms of the year, the rate of change in Spain's GDP should still be in the negative zone, that is, a reduction of about 9% is expected. All this is due to a significant drop, which was recorded at the height of the coronavirus pandemic in the second quarter of the outgoing year. Asia-Pacific stock exchanges, on the other hand, exhibited a slow change in the major stock indexes, which in general still turned out to be in the green zone. Market participants almost ignored the fact that the current President of the United States refused to sign the draft program of financial incentives adopted in Congress, citing the fact that the amount of payments to the civilian population is too small and this figure needs to be increased. More concerns are now caused by news about the appearance and spread of a new strain of coronavirus infection, which is found in the UK. Japan has rushed to restrict the entry of citizens from the United Kingdom. And the South Korean authorities decided to suspend all air traffic with it until the end of this month. Japan's Nikkei 225 index rose 0.33%. At the same time, it is worth noting that the growth is observed for the first time after a series of cuts. China's Shanghai Composite index rose 0.76%. Hong Kong's Hang Seng index supported the trend and increased 0.86%. The mood of local investors was supported by the news that the current stimulating monetary policy in the country will continue. Moreover, China's GDP growth forecasts are also improving. It is expected that the indicator will increase by 2% this year and by 7.9% next year. South Korea's KOSPI index rose 0.96%, which allowed it to come close to its maximum values. Australia's S&P/ASX 200 index went up by 0.66%, which happened after several days of negativity. The material has been provided by InstaForex Company - www.instaforex.com |

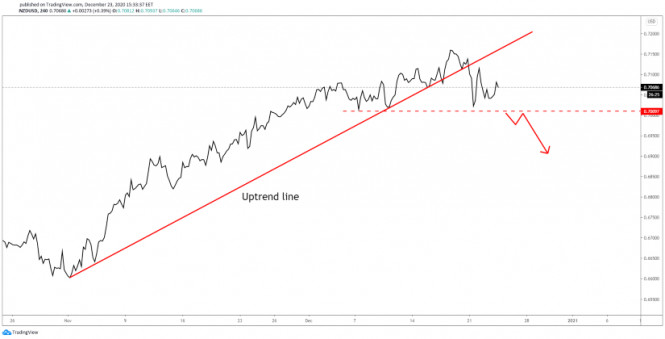

| Posted: 23 Dec 2020 05:47 AM PST

AUD/USD has dropped through the uptrend line, it has tried to retest it without success, so now is somehow expected to drop again. The 0.7000 psychological level is seen as critical support. Dropping and stabilizing under this level suggests selling as AUD/USD will be expected to approach and reach new lows. The bullish bias remains intact as long the rate stays above the 0.7 area even if the price has dropped under the uptrend line. AUD/USD could resume its upside movement if it jumps above the 0.7161 former high.

Dropping below the former lows and under the 0.7000 critical support brings a selling opportunity with a first downside target at the 0.6900 level. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on December 23 (analysis of morning deals) Posted: 23 Dec 2020 05:08 AM PST To open long positions on GBPUSD, you need to: The news that the EU rejected the UK's fishing proposal, which was made the day before, did not lead to a strong fall in the British pound, although it put some pressure on the pair. The risk of disruption of the trade agreement remains quite high, so I do not advise you to rush to buy the pound. In the first half of the day, a sell signal for the pound was formed, similar to yesterday. However, you should pay attention to the fact that there was no false breakout of the level of 1.3445, and if you missed this trade, then it's okay since there was no real confirmation to enter short positions on the system. On the 5-minute chart, the area from where it was possible to sell the pound further along the trend is visible.

The technical picture has not changed in any way and the benchmarks have remained the same. The task of buyers today in the second half of the day today is to once again maintain control over the level of 1.3367. The formation of a false breakout will be a signal to open long positions in the expectation of recovery of GBP/USD in the short term to the resistance of 1.3445. The main goal will be to break through and consolidate above this range, which was not possible during the European session. Only a test of this level from top to bottom forms an additional entry point into long positions intending to reach the maximum of 1.3525, where I recommend fixing the profits. The longer-term target remains the resistances of 1.3617 and 1.3690, however, they will only be available if there is good news on the Brexit agreement. In the scenario of a lack of bull activity in the support area of 1.3367, as it was yesterday in the afternoon when buyers failed to protect the level of 1.3367 after the second test, it is best not to rush to buy but to wait for the update of the minimum of 1.3290. However, I recommend opening long positions from this level only after the formation of a false breakout. A larger support area is seen in the area of 1.3193, where you can buy GBP/USD immediately on the rebound with the expectation of a correction of 35-40 points. To open short positions on GBPUSD, you need to: Bears coped with the task for the first half of the day and did not let the pound above the resistance of 1.3445, which is quite problematic for the British pound. As long as trading is below this range, there is a possibility that the pressure on GBP/USD will return in the near future, especially if the fundamental data on the US economy turn out to be better than economists' forecasts. I recommend paying attention to the data on the number of initial applications for unemployment benefits in the United States, as well as changes in the level of spending and income of Americans. In a downward movement, the sellers' goal will be to test the support of 1.3367, on which a lot depends. A breakthrough of this level with a test from the bottom up forms a good signal to open short positions in the continuation of the downward trend already to reduce to the lows of 1.3290 and 1.3193, from which strong demand was observed at the beginning of the week. Only bad news on the trade agreement will lead to a larger collapse of GBP/USD to the area of the minimum of 1.3114. If the bulls manage to defend the level of 1.3367 and break above 1.3445, I recommend opening short positions immediately on the rebound from the maximum in the area of 1.3525 with the aim of a downward correction of 30-35 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for December 15, there is a decrease in interest in the British pound, both buyers and sellers. Long non-profit positions fell from 39,344 to 35,128, while short non-profit positions fell from 33,634 to 31,060. As a result, the non-profit net position remained positive, but fell to the level of 4,068, against 5,710 a week earlier. All this suggests that traders are taking a wait-and-see position, although a small preponderance of buyers, even in the current situation, continues to be observed. Given that the UK has imposed strict quarantine measures due to a new strain of coronavirus that is out of control and for which there is no vaccine yet, it will not be the right decision to expect a further strengthening of the pound at the end of this year. Only good news on Brexit can bring new players back to the market, betting on the growth of GBPUSD. Indicator signals: Moving averages Trading is above 30 and 50 daily averages, however, the probability of further growth of the pound raises several questions. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break of the upper limit of the indicator in the area of 1.3445 will lead to a new upward wave of the pound. In case of a decline, the lower limit of the indicator in the area of 1.3335 will provide support. Description of indicators

|

| Posted: 23 Dec 2020 04:50 AM PST What is needed to open long positions on EUR/USD EUR/USD is still trading on the range-bound market amid low volatility under the empty economic calendar for the Eurozone. Targets which I pointed out in my morning market review have not been reached yet. Hence, there have been no signals for a market entry to discuss. The technical picture of the currency pair remains the same for the second half of the trading day. So, I recommend trading on the same principles which I unveiled in the morning article. The buyers will be focused on defending support at 1.2169. Only if a fake breakout is formed there in the second half of the trading day, this will generate a signal to open long positions on EUR/USD. During the American trade, investors will get to know a series of macroeconomic data from the US. Please make sure you don't miss initial unemployment claims in the US as well as personal income and spending data. In case of upbeat data and lack of activity around support of 1.2169, you would rather postpone long positions until the price hits a lower low after a one-week low of 1.2130. Besides, it is possible to buy EUR/USD at a bounce from a local low at 1.2083 bearing in mind a 20-25 pips intraday correction. However, the buyers will be able to rule the market again on condition that the price breaks and holds firmly above the level of 1.2209. Moving averages that are playing on the sellers' side are passing slightly below this level. The test of 1.2209 downwards will generate an extra buy signal with the target at resistance of 1.2242 where I recommend profit taking. What is needed to open short positions on EUR/USD The sellers aim to regain control over the level of 1.2169. If the price fixes below this level and tests it from the opposite side, this will create selling pressure, thus providing a good market entry point with short positions. This scenario will be implemented after macroeconomic data from the US is released. In this case, the main target of the bears will be a low of this week at near 1.2130. This level is likely to be breached after the news on first cases of the mutant COVID-19 strain in Germany or France. If so, the pair is expected to move downwards to 1.2083. The key target of the bears is seen at 1.2042 where I recommend profit taking. If the bulls manage to defend support of 1.2169, we can expect a minor climb of EUR/USD to a high of 1.2209. However, it would be a good idea to open short positions from there only after a fake breakout. It would be better to open short positions after 1.2242 and 1.2271 are tested within a downward 20-25 pips intraday correction. Let me remind you that the COT report (Commitment of Traders report) from December 15 logged an increase in short positions and a fall in long positions. Buyers of risky assets believe in bullish prospects for EUR/USD amid expectations of mass vaccination in the Eurozone that will be launched on December 25-27. Nevertheless, fewer traders are willing to buy the pair at current highs. So, long non-commercial positions declined from 222,521 to 218,710. At the same time, short non-commercial positions increased from 66,092 to 76,877. The overall non-commercial net position dropped to 141,833 against 156,429 a week ago. The delta has stopped its growth which has been posted for three weeks in a row. In this context, the euro will hardly finish the year with a buoyant rally. Traders can rely on the euro's rally on condition the EU and UK leaders nail down a post-Brexit trade deal. Signals of technical indicators Moving averages The pair is trading below 30- and 50-period moving averages. It indicates further selling pressure on EUR. Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart. Bollinger Bands A breakout of the upper indicator's border at near 1.2200 will trigger a new wave of EUR growth. In case the currency pair trades lower, the lower border at near 1.2155 will act as support. Definitions of technical indicators

|

| Posted: 23 Dec 2020 04:45 AM PST Further Development

Analyzing the current trading chart of BTC, I found that BTC tested our first upside target from yesterday at the price of $24,170. Anyway, I still expect upside continuation and the confirmation will happen if the BTC breaks the resistance at $24,085. Key Levels: Resistances: $24,170 Support levels: $22,400 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 23 Dec 2020 04:34 AM PST Pfizer, BioNTech to supply the US with 100 million additional coronavirus vaccine doses The US government will pay $1.95 billion for the additional 100 million dosesThe deal will include option for an additional 400 million doses, with Pfizer noting that they expect the whole initial 200 million doses to be delivered by 31 July 2021. That's some additional good news on the vaccine front and for risk sentiment as well, which has been keeping steadier through European morning trade despite a hiccup on the US stimulus front with Trump having called to amend the virus relief bill. Further Development

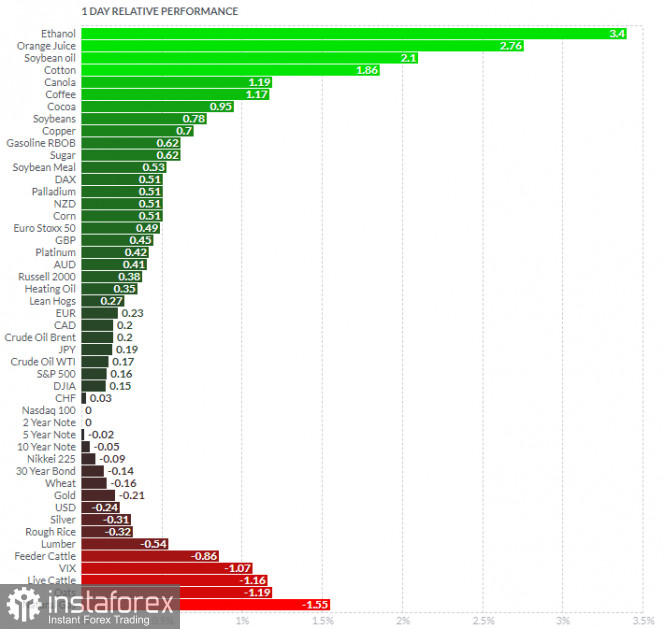

Analyzing the current trading chart of EURUSD, I found that there is contraction and trading range condition in last few hours, which is sign of indecision. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Orange Juice today and on the bottom Natural Gas and Oats. Key Levels: Resistances: 1,2200 Support levels: 1,2178 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments