Forex analysis review

Forex analysis review |

- December 25, 2020 : EUR/USD daily technical review and trade recommendations.

- December 25, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- December 25, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Trading Signal for EUR/USD for December 25 - 28, 2020

- Trading Signal for GBP/USD for December 25 - 28, 2020

- Credit Suisse: pandemic causes changes in world order

- BTC analysis for December 25,.2020 - Potential test of the upper part of the trading range at $24.180

- EUR/USD analysis for December 25 2020 - gtrendline and potential for the rally towards 1.2215

- Analysis of Gold for December 25,.2020 - First upside target at the price of $1.884 has been reached. Second target set

- US dollar still unsinkable

- Asian stock markets celebrate holidays

- Stock markets grew ahead of the holidays

- Saxo Bank: Oil prices to fall due to COVID-19 mutation

- Technical analysis of EUR/USD for December 25, 2020

- Overview of the GBP/USD currency pair from December 25, 2020

- Vaccinations are underway in many countries

- Analysis and technical picture for EUR/USD on December 25, 2020

- Technical analysis of AUD/USD for December 25, 2020

- EUR/USD. December 25. COT report. The European currency went on Christmas holidays

- GBP/USD. December 25. COT report. The deal has been agreed and submitted to the parliaments for consideration

- How will EUR/USD behave in 2021?

- Simplified wave analysis and forecast for EUR/USD and AUD/USD on December 25

- Trading plan for the EUR/USD pair on December 25.

- Forecast for EUR/USD on December 25, 2020

- Forecast for USD/JPY on December 25, 2020

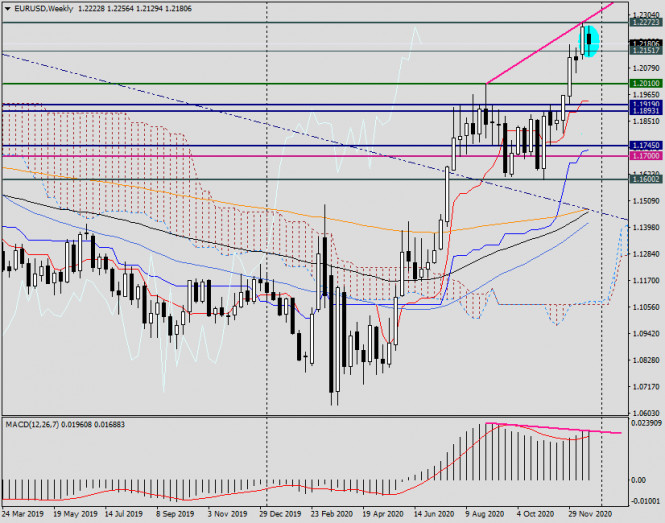

| December 25, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 25 Dec 2020 07:45 AM PST

After the demonstrated sideway movement took place in November, evident signs of BUYING Pressure has originated around the depicted price zone of 1.1800-1.1840. Shortly after, the EUR/USD pair has demonstrated a significant upside movement after the recent breakout above the depicted price zone (1.1750-1.1780) was achieved. As mentioned in the previous article, the pair has targeted the price levels around 1.1990 which exerted considerable bearish pressure bringing the pair back towards 1.1920 which constituted a temporary KEY-Zone for the EUR/USD pair. That's why, another episode of upside movement was expressed towards 1.2160 where a false breakout above the price level of 1.2200 was regarded as a false bearish reversal signal. By the end of Last week, a short-term reversal pattern has been demonstrated around 1.2265. Intraday downside retracement to the downside was expected to occur. On the other hand, Bearish closure below the mentioned price zone of 1.2200 - 1.2170 is needed to turn the intermediate outlook for the pair into bearish and enhance a quick bearish decline towards 1.2040 and 1.1920. Trade Recommendations :- Conservative traders were advised to look for SELL Positions around higher price levels near 1.2250-1.2270. Exit level should be placed above 1.2300. The material has been provided by InstaForex Company - www.instaforex.com |

| December 25, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 Dec 2020 07:29 AM PST

Recently, the EURUSD pair was trapped below the previous key-level (1.2000) until bullish breakout occured to the upside.Further quick bullish advancement was expressed towards 1.2150 just as expected after failing to find sufficient bearish pressure at retesting of the backside of the broken channel around 1.1950-1.1970 which corresponds roughly to Fibonacci Level of 0% at 1.2000. Recently, the pair looked overbought while approaching the price levels of 1.2250 (138% Fibonacci Level).That's why, conservative traders were advised to look for low risk trades around lower price levels. Bearish closure and persistence below 1.2160 then 1.2000 is needed to abort the ongoing bullish momentum to initiate a bearish movement at least towards 1.1860 and 1.1770. Otherwise, the intermediate-outlook for the pair would remain bullish at least towards 1.2330 where 150% Fibonacci Level is located. The price zone around 1.2000-1.1975 remains a Demand Zone to offer bullish SUPPORT for the EURUSD pair if any bearish pullback occurs The material has been provided by InstaForex Company - www.instaforex.com |

| December 25, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 25 Dec 2020 07:22 AM PST

In December, the price levels of (1.3380-1.3400) have prevented further bullish movement for the past few weeks. Bearish target was targeted around 1.3300. However, the pair has failed to pursue towards lower targets. Instead, a bullish spike was expressed towards 1.3480-1.3500 where the upper limit of the depicted movement channel has previously provided temporary bearish pressure on the pair. Shortly after, another bullish spike has recently been demonstrated towards 1.3600 where the upper limit applied considerable bearish rejection again. Recently, the GBPUSD pair looked overbought while consolidating above the key-level of 1.3400. As expected, bearish reversal was recently initiated around 1.3600. A quick bearish decline was demonstrated towards 1.3200. Intermediate-term outlook could turn into bearish provided that the pair maintains movement below 1.3400. However, the pair has failed to maintain bearish decline below 1.3200. Instead, bullish persistence above 1.3400 invalidates the bearish scenario for the short-term. Hence, another bullish movement may be expressed towards 1.3700 (the channel's upper limit) where bearish rejection should be anticipated. The material has been provided by InstaForex Company - www.instaforex.com |

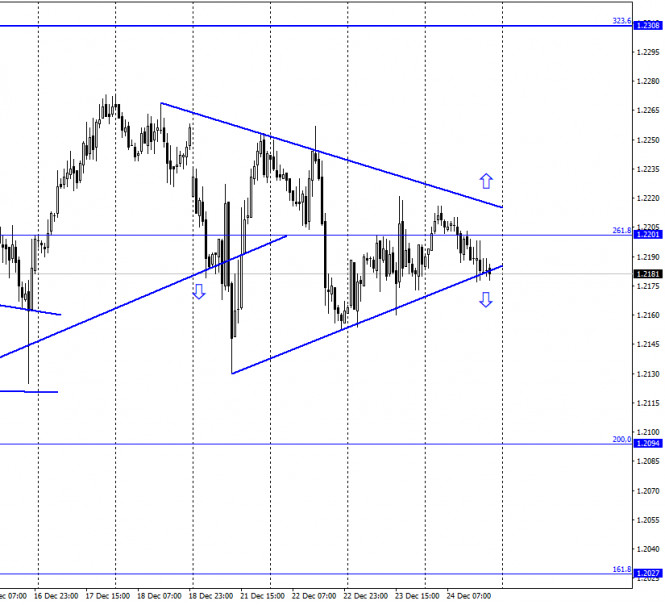

| Trading Signal for EUR/USD for December 25 - 28, 2020 Posted: 25 Dec 2020 06:31 AM PST Trading tip for EUR/USD for December 25 – 28 Sell below (EMA 200 and SMA 21) around 1.2170, with take profit at 1.2146 (7/8 of murray) and 1.2085, stop loss above 1.2210. Buy if the pair rebounds around 1.2146 (7/8 of murray), with take profit at 1.2207 (8/8 of murray) and 1.2268, stop loss below 1.2115. Sell if the pair breaks through 1.2140, (7/8) with take profit at 1.2085, stop loss above 1.2175.

The EUR/USD pair is trading within a technical pattern called a symmetric triangle, this pattern could give us a bearish target if it breaks through the bottom of the triangle line with the targets at 6/8 Murray at 1.2085. If it fails to break out and EUR/USD consolidates and trades above the 21 SMA around 1.2205, we could buy with the target at +1/8 murray, 1.2268. Support And Resistance Levels For December 25-28 Resistance (1) 1.2216 Resistance (2) 1.2252 Resistance (3) 1.2284 Support (1) 1.2149 Support (2) 1.2118 Support (3) 1.2082 The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for GBP/USD for December 25 - 28, 2020 Posted: 25 Dec 2020 06:20 AM PST Trading tip for GBP/USD for December 25 – 28 Sell below 1.3545 (7/8 murray), with take profit at 1.3427 (6/8 and SMA 21), stop loss above 1.3580. Buy if there is a rebound at 1.3427 (SMA 21), with take profit 1.3549 and 1.3670, stop loss below 1.3390. Buy around (EMA 200), with take profit 1.3427 and 1.3549, stop below 1.3305

The GBP/USD pair has left a double top at the high of 1.3620, where it has started a technical correction, to develop the upward momentum. The eagle indicator is supporting this correction on the British pound. We hope that if it remains below the 1.3549 level, where the 7/8 of murray is located, there could be a correction to the 21day SMA. At this level, there will be another good opportunity to buy. Support And Resistance Levels For December 25-28 Resistance (1) 1.3588 Resistance (2) 1.3690 Resistance (3) 1.3812 Support (1) 1.3366 Support (2) 1.3244 Support (3) 1.3142 The material has been provided by InstaForex Company - www.instaforex.com |

| Credit Suisse: pandemic causes changes in world order Posted: 25 Dec 2020 05:17 AM PST Experts at Credit Suisse, one of the largest Swiss financial conglomerates, suppose that the pandemic has boosted the development of tendencies in the world order that appeared before the outbreak. This mainly concerns the strengthening of the state by means of budgetary expansion and growing control over citizens. Can we avoid global inflation? The global economy has entered a deep recession during the pandemic. Almost all countries have been suffering the economic slump. However, analysts at Credit Suisse think that the economic consequences are not that grave as during the previous pandemics. Of course, the coronavirus led to a smaller number of deaths than, for example, plague or Spanish flu. Young and middle-aged people usually carry the disease much easier than old people. Moreover, nowadays, medicine and science have reached high levels. Notably, mass vaccination was launched just several months after the outbreak. That is why the consequence will hardly be so disastrous as analysts initially thought. Nevertheless, leaders of most countries of the world have resorted to various restrictive measures in order to protect the population from the virus. The global economic crisis caused the allocation of a huge amount of fiscal and monetary stimulus. Thus, according to October data from the IMF, states have allocated about $12 trillion to support the economy during the crisis. Many economists believe that such a decision will inevitably lead the world economy to the overall inflation. This view is supported by the fact that the assets of such central banks as the US Fed, the European Central Bank, the Bank of Japan and, the People's Bank of China jumped by as much as 41.5% in annual terms by November of this year, reaching about $27.9 trillion. Thus, the global money supply M2, namely cash and non-cash funds, as well as other monetary aggregates, suddenly increased against the background of the existing crisis. Nevertheless, Credit Suisse believes that the growth of the money supply and the consumer price index have not been correlating for more than 30 years. Moreover, it is unlikely that this ratio will recover in the near future. If authorities continue increasing monetary expenditures and the degree of transformation of budget expenditures into consumption, the overall inflation will be inevitable. Credit Suisse experts believe that after the pandemic, the world will recover at a slow pace, and inflation will be barely noticeable. Nevertheless, analysts do not deny that the world may face higher inflation due to the demographic changes or political factors. Intention to limit dependence between countries International economic relations as well as the role of multilateral institutions began to disappear even before the pandemic. To date, we can see how this trend has only intensified. That is why President of the United States Donald Trump withdrew American troops from Iraq, Syria, and Afghanistan. He also planned to reduce the military presence in Germany and left several international agreements. At the same time, China is becoming the main opponent of the United States. Thus, it is obvious that economic relations between these countries are becoming sourer. In other words, most countries are trying to obtain independence from each other. This policy makes countries move back their firms from countries with more lucrative conditions. This, in turn, causes changes in supply chains. As part of this policy, China plans to reduce some projects in Latin America and the Middle East, focusing its influence on Southeast Asia. States strengthening and "subcutaneous control" States have expanded their powers during the crisis. In this situation, some state leaders began to make decisions, bypassing parliaments. Credit Suisse experts believe that at the end of the crisis, some political leaders will not want to change their policies. This global practice contributes to the creation of a certain type of citizens who will eventually lose the incentive to compete, expecting financial assistance from the state. During the pandemic, most countries began using technologies for control and mass collection of personal data. Thus, even companies began possessing a huge amount of personal information about citizens. Many experts suppose that governments may introduce the so-called "subcutaneous control" over their citizens. We are talking about special technologies that will allow you to collect and analyze information about people's health. Such technologies may also be used as an influence on voters during democratic elections. Rising interest in small towns. Social inequality. During the pandemic, the remote work has become very popular. With a huge number of people in many countries working at home, small towns will be in much greater demand than before. In addition, in many countries, there is a significant number of vacancies in the informal sector. Such organizations do not provide people with basic social guarantees. During the pandemic, workers in these spheres were primarily at risk of losing their earnings. Credit Suisse experts believe that the need to overcome social inequality will lead to new redistributive taxes. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Dec 2020 04:48 AM PST Further Development

Analyzing the current trading chart of BTC, I found that BTC is still trading in the trading range. Watch for buying opportunities with the potential test of $24,180. Stochastic oscillator got the fresh bull cross, which is good confirmation for the upside continuation. The long term trend is still bullish.... Key Levels: Resistance: $24,180 Support level: $22,580 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for December 25 2020 - gtrendline and potential for the rally towards 1.2215 Posted: 25 Dec 2020 04:44 AM PST Further Development

Analyzing the current trading chart of EUR/USD, I found that there is rising trend line and support on the test. Stochastic oscillator is is bearish but waiting for the fresh bull cross signal can be good strategy. Key Levels: Resistance: 1,1215 Support level: 1,2175 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Dec 2020 04:39 AM PST Further Development

Analyzing the current trading chart of Gold, I found that there is the rejection of the rising trendline and that buyers can continue with more upside. Key Lvels: Resistance: $1,906 Support level: $1,855 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Dec 2020 04:11 AM PST Contrary to popular belief about a weaker US dollar, some analysts do not believe in such an outcome. Currency strategists analyzed the existing misconceptions about the upcoming decline in the greenback, noting that it is too early to draw such conclusions. The reason for pessimism over the American currency was a number of factors. First of all, one of the causes was its fall on the eve of Catholic Christmas. In early trade on Friday, the euro/dollar pair was trading around 1.2199. Then the quotes advanced to the area of 1.2200-1.2201 and consolidated near the level of 1.2200. At the same time, analysts do not rule out that the pair will continue its correction. The nearest support level is 1.2100. In case the quotes consolidate above 1.2200, the level of 1.2500 can be seen as the next target. According to experts, in the current conditions and amid a weaker dollar, the European currency stands to gain, which has already added 0.10%. This was largely due to the fact the UK and EU have finally concluded a trade agreement. On Thursday evening, December 24, the parties agreed on Brexit. The agreement will enter into force on January 1, 2021, experts emphasize. The long-awaited positive changes in the market increased investor risk appetite, provoking pressure on safe-haven assets, primarily on the US currency. The greenback tried its best to hold on at the current levels, but it turned out to be rather difficult. Analysts have debunked four myths, pointing to a further decline in the US dollar, although many opponents see it as inevitable. Experts believe that the first misconception is that investors' interest in the US dollar may disappear amid growing uncertainty. However, on the eve of the year 2021, the level of anxiety and uncertainty caused by the COVID-19 pandemic has dropped sharply. This was facilitated by the development of effective vaccines against the coronavirus. As a result, interest in the greenback as a safe-haven asset has declined, but this is a temporary phenomenon. As for the euro/dollar pair, market participants have taken this factor into account, analysts say. The second misconception about the US dollar's collapse is the US Federal Reserve's monetary policy. Many experts argued that the dollar would suffer even greater losses if the regulator kept printing money, but that's not true. Undoubtedly, the Fed's steps to expand the balance sheet and ease its monetary policy were much more aggressive than other central banks' actions. However, the American regulator managed to stop and it did not cross the line separating fiscal aid from flooding the market with cash. At the same time, other central banks, in particular the ECB, cannot boast of similar actions yet. The third misconception about the dollar's fall is the US federal budget deficit that could sink the currency. However, the United States has long had two deficits: the budget deficit and the current account deficit, which are financed by capital imports from abroad. To attract foreign capital, it is necessary to increase the attractiveness of US assets by making the greenback cheaper. This so-called "double deficit" was a powerful argument for supporters of the dollar's collapse during the financial crisis. However, the greenback turned out to be more stable than expected. According to analysts, the US budget deficit continues to grow, but it is unlikely to have a severe impact on the US currency. Experts believe that the fourth misconception about a weaker US dollar is the end of the US geopolitical dominance, which could result in a collapse in the main world currency. The United States' economic dominance started to fade due to Donald Trump's unstable policies, dragging the US dollar down. However, many experts hold the opposite views, believing that the current situation is ambiguous, and the arrival of new President Joe Biden will help resolve this issue. Despite a 10% decline in the US dollar index since March 2020, the greenback remains a leader in the global market. Of course, it is trading under pressure from a number of negative factors, but the US dollar is still taking the lead. Many experts are confident that the dollar's downward trend will continue in the coming year, and the greenback will sink by 20% or more. However, their opponents believe that the risks have been greatly exaggerated, otherwise the collapse would have occurred long ago. The US currency is unsinkable, and its difficulties are temporary, experts sum up. The material has been provided by InstaForex Company - www.instaforex.com |

| Asian stock markets celebrate holidays Posted: 25 Dec 2020 03:44 AM PST

This morning, there are no significant dynamics in the Japanese and Chinese stock markets. Stock indicators behave with restraint and are in no hurry to show activity. Trading platforms in Hong Kong, South Korea, and Australia did not open at all today due to the holidays on the occasion of Catholic Christmas. Japan's Nikkei 225 index was lower in the morning. However, the drop was quite insignificant - minus 0.03%. The main reason for this reduction is the profit-taking by investors, which occurred after a significant rise in the background of positive news about the long-awaited adoption of a package of financial incentives in the United States of America. However, everything changed dramatically yesterday. Once again, insurmountable circumstances have arisen that make signing the long-awaited bill almost impossible. According to the latest data, the current US President refused to sign the draft program, because he considered the amount of payments to citizens of the state too low. He demanded that the government increase the aid package, and quite significantly - from $ 600 to $ 2,000. Naturally, the Republican Party strongly criticized this demand, while the Democrats willingly supported it. One way or another, once again there are difficulties on the way to the adoption of the bill, which will be very difficult to overcome. This can not but affect the mood of investors, who will hurry to reduce their activity in the market in anticipation of specific decisions and positive changes. At the same time, there are good statistics on economic growth in Japan itself. In particular, the level of retail sales in the country in the last month of autumn increased by 0.7% compared to the same period last year. Nevertheless, it is worth noting that the increase slowed slightly compared to the previous month when a rapid increase of 6.4% was noted. Preliminary forecasts of analysts were also slightly better than real data: an increase of at least 1.7% was expected. The unemployment rate in Japan in the penultimate month of the year has significantly decreased, reaching even the minimum values last recorded in the early summer of this year. The drop reached a level of 2.2%. China's Shanghai Composite index rose to 0.8% in the morning. At the same time, the main pressure on the indicator comes from the news from the national bank of the country. According to the latest data, the main regulator has allocated 40 billion yuan or $ 6.13 billion to banks for reverse repo operations. All this news will be enough to support the positive background on the trading platforms of the Asia-Pacific region during the holidays. However, the whole situation will again depend on macroeconomic indicators and political decisions. The material has been provided by InstaForex Company - www.instaforex.com |

| Stock markets grew ahead of the holidays Posted: 25 Dec 2020 02:55 AM PST

US stock indices rose on Thursday, which raised hopes for a positive future. Today, markets are closed due to the Christmas holiday, but traders are still closely monitoring the situation around the negotiations over a new US stimulus. There are a lot of doubts that a bill will be signed, especially since Donald Trump still refuses to approve it. According to him, payments to households should be increased, because in his opinion, the sizes that the Congress approved were too small. Accordingly, Democrats rushed to side with Trump, since his stance is extremely close to the ideas they had been promoting earlier. However, without the approval of the Republicans, it will be impossible to ratify an increase in payments. But the Republicans themselves are categorically against any increases. Just yesterday, there was an unsuccessful meeting between House Speaker Nancy Pelosi and the Republicans, during which Pelosi tried to convince her colleagues to approve an increase. The negotiations, however, reached an impasse, which in turn made investors nervous, putting more pressure on stock markets. Negotiations on the issue will start again on Monday. Another driving force in stock markets is news about the COVID-19 vaccine. According to the latest reports, a campaign for mass vaccination has already started in the US, and to date, about 1 million have been vaccinated against the coronavirus. Authorities are aiming to vaccinate at least 20 million people before the new year. Because of this, at the close of trading yesterday, the Dow Jones Industrial Average grew by 0.23% or 70.04 points, reaching a level of 30,199.87 points. The S&P 500, meanwhile, climbed 0.35% or 13.05 points, pushing it to 3,703.06 points. The NASDAQ Composite gained 0.26% or 33.62 points, and closed at 12,804.73 points. As for the European stock exchanges, major indices increased yesterday on the news that the UK and the EU finally concluded a trade deal. An agreement was reached after a long and grueling negotiation process, which periodically reached a dead end on the most pressing issues. On December 30, the UK parliament will have to meet in order to ratify the deal. Of course, this was great news for market participants, thereby leading to the rise of stock indices in the short term. STOXX Europe 600 increased by 0.12% and reached 395.98 points, while the FTSE 100 climbed 0.1%. The IBEX 35, meanwhile, went up by 0.47%, while the CAC 40 declined a bit by 0.1%. Trading floors in Germany and Italy were closed. The material has been provided by InstaForex Company - www.instaforex.com |

| Saxo Bank: Oil prices to fall due to COVID-19 mutation Posted: 25 Dec 2020 02:38 AM PST

Recently, it became known that the coronavirus mutated and a more infectious genetic variant appeared. Experts believe that this could lead to a 10% drop in oil prices due to possible lockdowns. Nevertheless, in 2021, oil will rise in price, but the short-term prospects for oil have worsened. On December 14, the UK Ministry of Health announced the discovery of a new type of coronavirus. Medical experts noted that the new type of virus is spreading faster than the "familiar" SARS-CoV-2. The new genetic variant of the coronavirus may be 70% more infectious. Today, the price level of $51-52 per barrel is likely to be the maximum, as there is no steadily growing demand, experts say. Brent may drop by 10% to $46 per barrel before finding support. However, news about the start of coronavirus vaccinations may support the oil market. Today, December 25, oil prices increased slightly during the trading. WTI crude futures for February delivery grew by 0.37% to trade at $48.24 per barrel. Brent crude for March delivery rose by 0.25% to hit $51.37 per barrel. The difference in price between the Brent and WTI contracts is $3.07 per barrel.

The US Dollar Index, which measures the US dollar against a basket of six major currencies, rose by 0.10% to trade at $90.250. The material has been provided by InstaForex Company - www.instaforex.com |

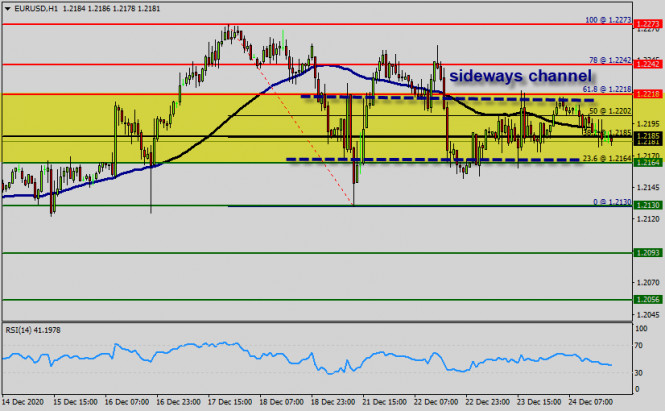

| Technical analysis of EUR/USD for December 25, 2020 Posted: 25 Dec 2020 01:47 AM PST Overview : The EUR/USD pair is neutral-to-bearish in the near-term and could move alongside the EUR/USD during the upcoming thinned sessions. The one-hour chart shows that it's trading around a moderate bearish 100 SMA. The RSI indicators are directionless just below their midlines. The EUR/USD pair movement was debatable as it took place in a narrow sideways channel for a while. The market showed signs of instability (but we guess a bearish market in coming hours). Amid the previous events, the price is still moving between the levels of 1.2218 and 1.2164. The daily resistance and support are seen at the levels of 1.2218 and 1.2164 respectively. In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed. On the H1 chart, the price spot of 1.2218 remains a significant resistance zone. Therefore, there is a possibility that the EUR/USD pair will move to the downside and the fall structure does not look corrective. Resistance is seen at the level of 1.2218 today. So, sell below 1.2218 with the first target at 1.2164. In overall, we still prefer the bearish scenario as long as the price is below the level of 1.2218. Furthermore, if the EUR/USD pair is able to break out the first support at 1.2164, the market will decline further to 1.2130 to test yesterday's bottom. However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 1.2218. The material has been provided by InstaForex Company - www.instaforex.com |

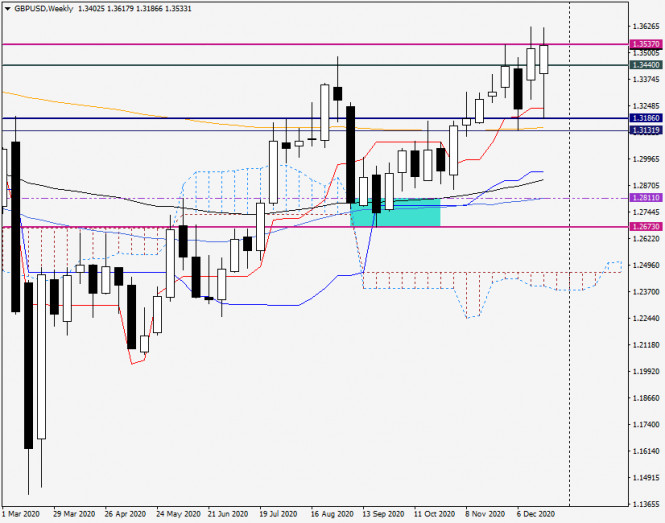

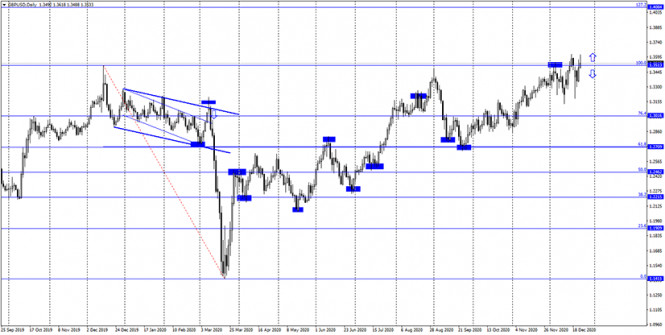

| Overview of the GBP/USD currency pair from December 25, 2020 Posted: 25 Dec 2020 01:37 AM PST Yesterday in the afternoon, Michel Barnier proudly said: "We did it!". We are talking about signing a document on trade relations between the UK and the European Union after Brexit. This is a real Christmas gift, however, the European Parliament and the House of Commons of the British Parliament must vote "for" this document now. European lawmakers will begin to verify the agreement reached next Monday, the House of Commons of the UK Parliament will try to ratify the deal on December 30, right on New Year's eve. And here some difficulties may arise, primarily related to the current problem of fishing in British territorial waters. Also, we should not forget that Scotland is opposed to the UK's withdrawal from the EU and even threatened to hold its referendum on this issue. In general, a lot will depend on the political will of British lawmakers. As for investors, they are encouraged by the agreement reached and the British pound sterling ended the last five days of trading with a strong growth against the US dollar. Weekly

Unlike the single European currency, the "Briton" ended the week's trading with a confident and fairly strong growth against the US currency. The weekly chart shows how volatile and nervous trading was. After falling to 1.3186, the GBP/USD pair turned on the rise and ended the week at 1.3533. However, there are two important points here. First, the bulls on the pound could not break through the strong resistance of sellers at 1.3537. Secondly, the highs of the last candle were lower than the maximum values of the previous candle. A lot will depend on how Monday's trading opens. And the most important day will be December 30, when the House of Commons will vote on the agreement reached between the parting parties. In principle, British Prime Minister Boris Johnson has every opportunity to extend the deal, since he can enlist the support of at least 80 parliamentarians. If everything goes well and the document is accepted, the pound will fly up and break not only the resistance of 1.3537 but also the strong price zone of 1.3600-1.3620. Daily

However, on the daily chart, the last candle with a sufficiently long upper shadow does not exclude a decline in the exchange rate. When the upper shadow is larger than the bullish body itself, very often this leads to a decrease in the quote. However, the current situation is not quite typical, so we can expect any development of the situation. We just have to wait for the opening of trading on the night from Sunday to Monday and only then build our trading plans. The material has been provided by InstaForex Company - www.instaforex.com |

| Vaccinations are underway in many countries Posted: 25 Dec 2020 01:32 AM PST

The vaccine developed by Chinese company, Sinovac, has been reported to be more than 50% effective against COVID-19. However, key supporting data have not been released, which could delay its approval and introduction. Meanwhile, another pharmaceutical group, Sinopharm, has applied for the approval of its coronavirus vaccine. In another note, President Aung San Suu Kyi has announced that Myanmar will purchase COVID-19 vaccines from India. She said that priority will be given to frontline medical workers, and that it could take several months to vaccinate the entire population. Meanwhile, Mexico has introduced the first live COVID-19 vaccine in Latin America, which was broadcast in a daily press briefing by President Andres Manuel Lopez Obrador. On Thursday, about 3,000 people were vaccinated with Pfizer's drug in the country, which authorities have called a "trial run". The next batch is about 50,000 doses, and by the end of January, periodic deliveries will reach 1.4 million. Epidemiologist Hugo Lopez-Gatell said the vaccine will be free and universal in Mexico. Chile and Costa Rica are also expected to launch their vaccination campaigns using Pfizer's drug. As for the European Union, governments are gearing up for an unprecedented vaccination campaign, after regulatory authorities approved the vaccine. France's National Health Administration has authorized the Pfizer-BioNTech vaccine for people aged 16 and over, so a vaccination program is scheduled to begin on Sunday. Meanwhile, the UK has already vaccinated more than half a million patients in less than two weeks, starting on December 8 to December 20, 2020. A total of 521,594 people have been vaccinated, most of whom were 80 years of age or older. Iran is also finding a way to buy the COVID-19 vaccine despite US sanctions. In Canada, authorities have approved Moderna's drug, which came two weeks after the Pfizer-BioNTech vaccine was approved in the country. Several thousand doses of the vaccine have already been administered. Ontario expects to receive 53,000 doses of Moderna's vaccine by the end of December. Moderna's vaccine has been called a "tipping point" in the fight against COVID-19 because, unlike its Pfizer-BioNTech counterpart, it does not need to be stored at ultra-low temperatures, making it easier to deliver directly over time. According to Operation Warp Speed, the frequency of allergic reactions to the Pfizer vaccine is higher than expected. This was announced on Wednesday by Chief Adviser Dr. Moncef Slaoui. Slaoui said the last time he has seen an allergic reaction was on Tuesday, in six cases. He also noted that the data on vaccinations lagged behind the real numbers, and that there are negotiations underway between vaccine manufacturers and the National Institutes of Health to conduct clinical trials of COVID-19 vaccines in allergy groups. Slaoui said these tests would help understand the rate of allergic reactions and their triggers. Accordingly, rush and mass vaccination at this time is clearly not safe! The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and technical picture for EUR/USD on December 25, 2020 Posted: 25 Dec 2020 01:29 AM PST Well, despite the author's pessimistic forecasts about the possibility of concluding a trade agreement between the UK and the European Union before the end of this year, right on the eve of the Christmas holidays, like in a good old fairy tale, negotiators from the EU and the UK reported reaching an agreement on further trade agreements between the parties. This news came yesterday afternoon. However, the final point should be put on the issue of fishing, after which the European Parliament and the British Parliament will have to ratify the bill before the end of this year. Let me remind you that such an option (reaching an agreement at the very last moment) was previously assumed, and this is exactly what happened. However, European parliamentarians were ready to meet for the next meeting if the deal was concluded before December 20, however, the parties did not have time to agree by this date. Nevertheless, the importance of the issue of further trade relations between the former allies is too great, so the European Parliament will meet and consider the approval of this document. Will the House of Commons of the British Parliament support the deal that Prime Minister Boris Johnson concluded with the European Union? Earlier, British parliamentarians twice rejected the version of the deal proposed by the previous Prime Minister Theresa May. However, Johnson has the necessary majority in this situation, consisting of 80 deputies of the House of Commons. Therefore, the current head of the British Cabinet of Ministers has much more support, which means that the deal with the EU can be ratified. As for the technical picture for the main currency pair, since the markets are closed today on the occasion of the celebration of Catholic Christmas, it is already possible to conclude the results of weekly trading. Weekly

The picture on the weekly timeframe is very interesting and leaves big questions about the future ability of the main currency pair of the Forex market to continue moving in a northerly direction. As can be seen on the chart, after a fairly significant increase from 1.1600, under the strong resistance of sellers at 1.2272, which did not submit to the euro bulls, a reversal model of the candle analysis "harami" appeared. The essence of this model is that the last small bearish candle is located inside the body of the previous bullish one. Also, it is necessary to note the bearish divergence of the MACD indicator, which is an additional signal for a possible decline. It is difficult to assume that it will be a corrective pullback or a trend change. Here, I would like to note that the reversal model "harami" is not as strong as the "tombstone" or "hanged" and is less often worked out by the market. The fact that it appeared right under the strong resistance level of 1.2272 increases the chances of working out the extended reversal model, and is also confirmed by the bearish divergence of the MACD. In general, there is something to think about. Although everything will depend on how the auction opens on the night from Sunday to Monday. It is quite possible that, given the agreement on Brexit, the next weekly session will open with an upward price gap. This will be especially possible if the document on trade relations between the EU and the UK is ratified. So now the floor belongs to the parliamentarians, who will start working from Monday. The material has been provided by InstaForex Company - www.instaforex.com |

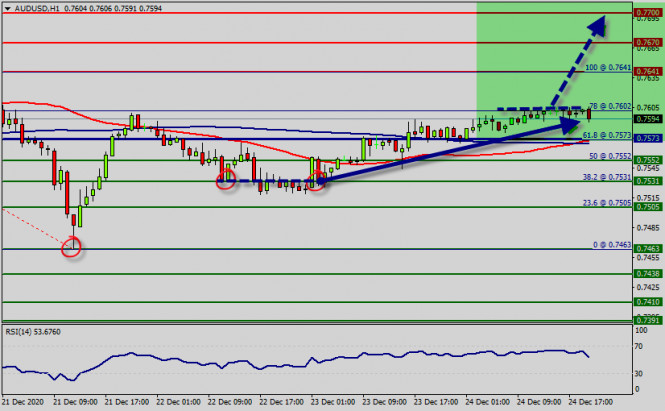

| Technical analysis of AUD/USD for December 25, 2020 Posted: 25 Dec 2020 01:05 AM PST Overview : The AUD/USD pair is forming another ascending wave from the area of 0.7550 - 0.7580 in the H1 chart. The AUD/USD pair currency exchange rate is likely to edge higher during this trading session (25/12/2020). In the fact, the AUD/USD pair rallied a bit yesterday heading into the holidays. The market looks likely to continue going higher into the new year. Reaching towards the 0.7602 handle. Today, the AUD/USD pair continues to move upwards from the level of 0.7573. The first support level is currently seen at 0.7573, the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 0.7573, which coincides with the 61.8% Fibonacci retracement level. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 0.7573. So, the market is likely to show signs of a bullish trend around 0.7573 - 0.7602. This zone of 0.7573 - 0.7602 has rejected several times confirming the veracity of an uptrend today. According to the previous events, we expect the AUD/USD pair to trade between 0.7573 and 0.7641. The market is likely to show signs of a bullish trend around the spot of 0.7573. In other words, buy orders are recommended above the region of 0.7573/0.7602 with the first target at the level of 0.7641; and continue towards 0.7670 (R2) - major resistance stands at 0.7700 (R3). If we were to break down below the 100 day SMA which sits just below the 0.7552 handle we could see a bit further downside. Longer-term trades do lead that we probably go higher based upon motivation and general against US dollar trading. Forecast : According to the previous events the price is expected to remain between 0.7573 and 0.7700 levels in long term. Buy-deals are recommended above 0.7573 with the first target seen at 0.7641. The movement is likely to resume to the point 0.7670 and further to the point 0.7700. The material has been provided by InstaForex Company - www.instaforex.com |

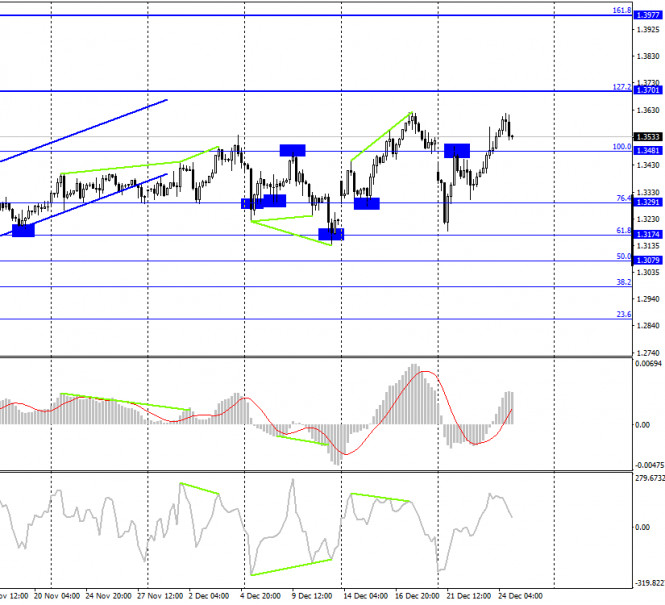

| EUR/USD. December 25. COT report. The European currency went on Christmas holidays Posted: 25 Dec 2020 12:54 AM PST EUR/USD – 1H.

On December 24, the EUR/USD pair performed a reversal in favor of the US currency and returned to the upward trend line. The rebound of quotes from this line will allow traders to count on a reversal in favor of the EU and the resumption of growth in the direction of the downward trend line. However, traders should wait for the exit from the "narrowing triangle" now. It is unclear whether it will take place during the new year's week. After all, we are interested in the signals that will be generated in this case. But it may well end with the usual movement in the side corridor and a little activity. Thus, next week, you need to remember that there are little news and reports now, as well as the desire of traders to trade. Already this week, it was clear that traders are celebrating Christmas in their minds. There was some news, however, the number of traders working on it was getting smaller and smaller every day. In fairness, it should be noted that there were practically no really important messages. Donald Trump's actions did not surprise anyone, thus, his blocking of the aid package for American citizens and the country's economy did not worry traders. The same goes for the defense budget. And nothing else interesting happened in America. In the European Union, all the attention of absolutely everyone was turned to the trade deal with the UK, which was reached only yesterday. However, this deal is much more important for Britain than for the EU, so the euro currency reacted to any news about Brexit 10 times weaker than the pound. EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the US dollar and began a very calm decline in the direction of the ascending trend line, which continues to characterize the current mood of traders as "bullish". The rebound of quotes from this trend line will work in favor of the euro and the resumption of growth in the direction of the corrective level of 200.0% (1.2353). Anchoring below the trend line will increase the likelihood of further falls. EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair makes a consolidation under the level of 323.6%, there are still high chances of growth. EUR/USD – Weekly.

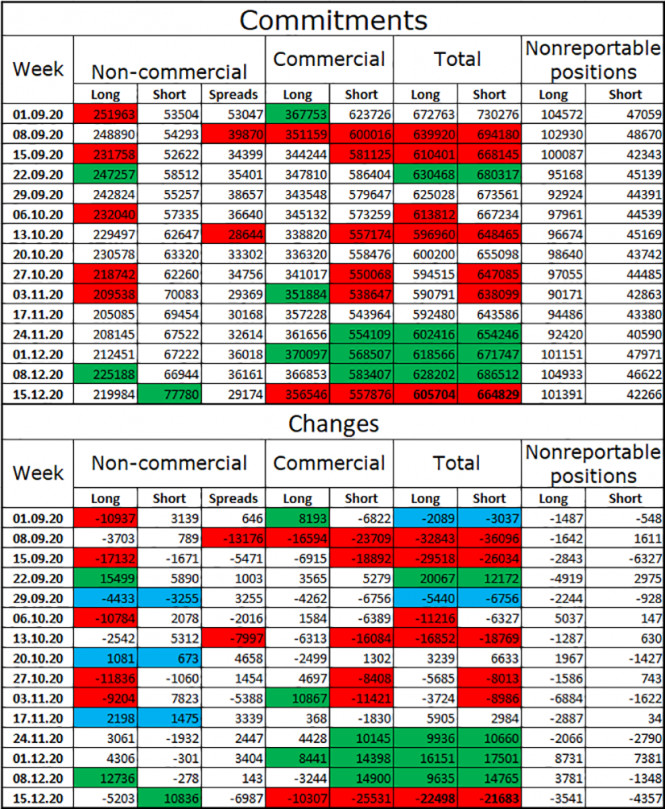

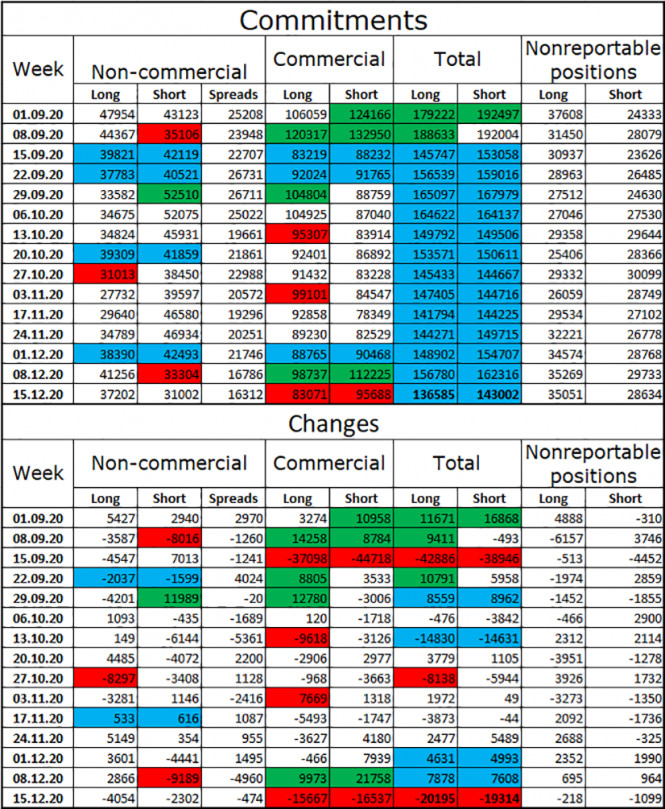

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term. Overview of fundamentals: On December 24, there was not a single important news or report in the United States and the European Union. There was no information background. News calendar for the United States and the European Union: On December 25, there will again be no reports and news in America and the European Union. The foreign exchange market is closed today and trading will resume on Monday. COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5,200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately fall. The latest COT report shows that speculators are once again preparing for a fall in the euro currency or at least for the end of its growth. EUR/USD forecast and recommendations for traders: On Monday, I recommend selling the euro currency in case the price is fixed under the lower trend line on the hourly chart with the target level of 200.0% (1.2094). New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the descending trend line on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

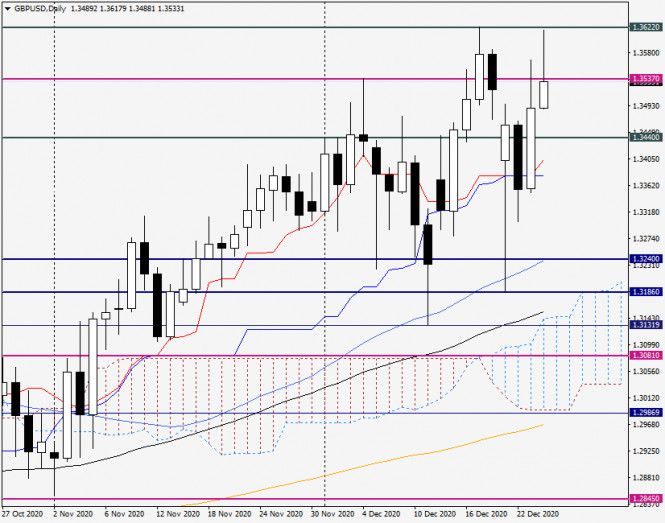

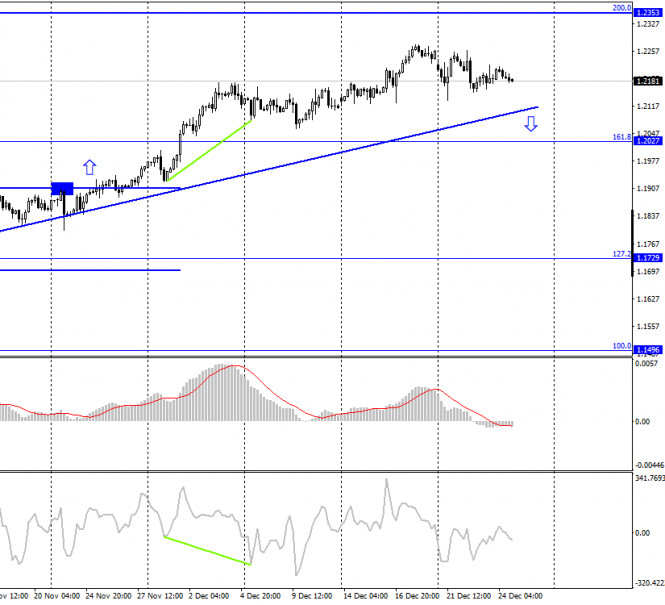

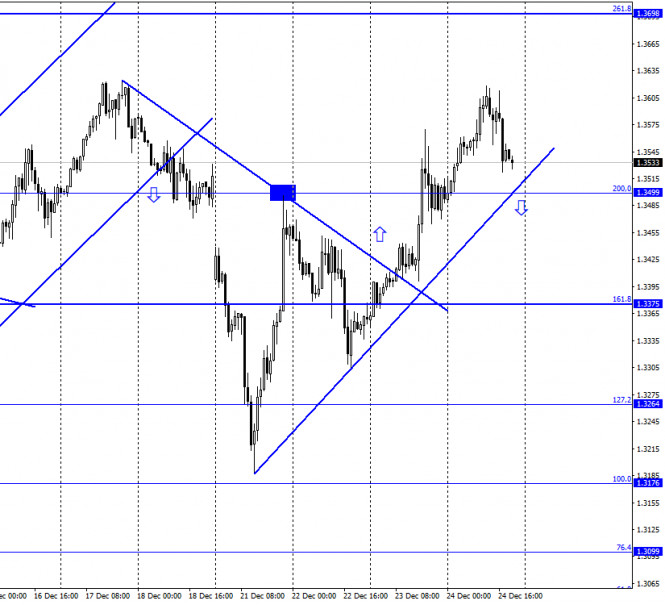

| Posted: 25 Dec 2020 12:54 AM PST GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair continued for some time on December 24, the process of growth over the ascending trend line, which still characterizes the current mood of traders as "bullish". In the afternoon, a reversal was made in favor of the US currency, and the process of falling in the direction of the upward trend line began. The rebound of quotes from this line will work in favor of the British and the resumption of growth in the direction of the corrective level of 261.8% (1.3698). Fixing under it will increase the chances of a further fall in the direction of the Fibo level of 161.8% (1.3375). "The deal is done," Boris Johnson said. The trade deal between the UK and the European Union is fully agreed upon, although few people believed it. Nevertheless, London and Brussels still managed to settle all the disputed issues. Now the case remains small: the agreement must be approved by the parliaments of the UK and the EU. I believe that there will be no special problems with this, even though the time remains until the end of Brexit is catastrophically short. It is already known that if the parliaments do not have time to ratify, the European Council will recognize the agreement as valid, using the corresponding article in EU legislation. This will make it possible to continue trading with Britain without duties and commission from January 1, and parliaments will be able to vote on this agreement later. Today, the foreign exchange market is closed and trading will resume on Monday. GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and also began the process of falling in the direction of the corrective level of 100.0% (1.3481). The rebound of quotes from this level will work in favor of resuming the growth process, and fixing under it will increase the probability of continuing the fall. GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). A new rebound from this level will again work in favor of the US dollar and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016). GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes. Overview of fundamentals: On Thursday, there were no economic reports in the UK, however, the British pound was still trading quite actively. The economic calendar for the US and the UK: On December 25, the calendar of economic events in the UK and the US is empty. Markets are closed today. COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the British and the information background. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound sterling. GBP/USD forecast and recommendations for traders: It is recommended to open new purchases of the British dollar on Monday in case of a rebound from the ascending trend line on the hourly chart with the target level of 261.8% (1.3698). I recommend selling the pound sterling when it is fixed under the ascending trend line on the hourly chart with a target of 1.3375. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

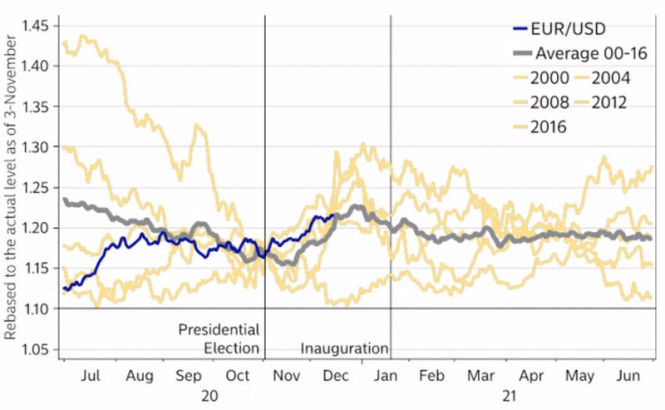

| How will EUR/USD behave in 2021? Posted: 25 Dec 2020 12:49 AM PST For the past 4 years, Bloomberg experts have made a mistake when giving forecasts for the EUR / USD pair. At the end of 2016, they said the euro will decline, but thanks to the rapid growth of the eurozone's GDP, EUR / USD jumped 14%. In 2018-2019, estimates were also incorrect, and this is because of the trade wars that happened. Now, in 2020, the euro rose instead of the expected decline, although those who bet on its strengthening from the very beginning of the year found themselves in a deep minus. For 2021, forecasts say EUR / USD will reach 1.25. However, it is very doubtful whether this will come true or if it will become a mistake once again. Aside from that, next year, there is a high chance that the US dollar will grow, especially because of these factors: increased uncertainty and a divergence in economic growth (of the US and the Euro area). Meanwhile, an ineffective vaccination, the emergence of new strains of COVID-19 that do not respond to vaccinations, the political crisis in the US in the form of Joe Biden's clashes with Republicans in Congress, and a new round of trade and diplomatic conflict between US and China seem unlikely events. As for the dynamics of the US GDP, judging by the financial conditions and business activity, it will be a bit mediocre, at least in the first quarter. Dynamics of financial conditions and business activity:

At the moment, tough restrictions have been implemented in many countries, but as the third quarter report shows, economic recovery has grown faster. Defeating COVID-19 will revive international trade and support the currencies of export-oriented countries and regions, in particular, the euro area and the euro. Therefore, EUR / USD will see drivers for growth, at least for the first half of 2021. Then, most likely, the bullish trend of the euro will change if the Fed adjusts its outlook, which will only happen if inflation accelerates. Currently, the FOMC does not plan to raise interest rates before 2024, but who knows for sure that this stance will remain until the end of 2021. As long as the Fed is "dovish" and does not think about normalizing monetary policy, the US dollar will be sold, which will accordingly lead to the rise of the euro. However, there is also a chance that EUR / USD will repeat what happened during the US presidential elections, when it peaked and then fell sharply right after. EUR / USD's reaction to the US presidential election

In my opinion, the euro is capable of reaching $ 1.25-1.27. However, this may be the limit of its capabilities. Nonetheless, on the EUR/USD daily chart, several bars have formed, and the exit from short-term consolidation will provide a hint about the further dynamics of the pair. In any case, long positions should be placed from 1.204-1.208, or on the breakout of 1.2245 and 1.2265. EUR/USD daily chart:

|

| Simplified wave analysis and forecast for EUR/USD and AUD/USD on December 25 Posted: 25 Dec 2020 12:27 AM PST EUR/USD Analysis: The chart of the major European currency continues to be dominated by an upward trend. After the correction wave that ended on December 21, a reversal pattern is developing on the chart. It will be followed by a breakthrough on the main course. Forecast: In the coming day, a general sideways movement is expected. The probable limits of the daily price corridor limit the counter zones. In the first half of the day, you can expect a downward movement vector. Potential reversal zones Resistance: - 1.2200/1.2230 Support: - 1.2120/1.2090 Recommendations: The downward trend contradicts the main trend of the euro, thus, sales can be unprofitable. It is recommended to skip this section of the movement and track the buy signals at the end of it.

AUD/USD Analysis: The upward trend of the Australian dollar that began in March continues. In the last unfinished section of November 2, a hidden correction was completed last week. A new section was launched on December 21. Before further breakout of the price up, the price needs to form an intermediate correction. Forecast: Today, there is a high probability of price movement in the lateral plane. A short-term decline in the exchange rate is possible, not further than support. The beginning of price growth is expected at the end of the day or next week. Potential reversal zones Resistance: - 0.7610/0.7640 Support: - 0.7550/0.7520 Recommendations: There are no conditions for selling the pair today. It is recommended to skip the correction and look for long position entry signals at its end.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements. Attention: The wave algorithm does not take into account the duration of the instrument's movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

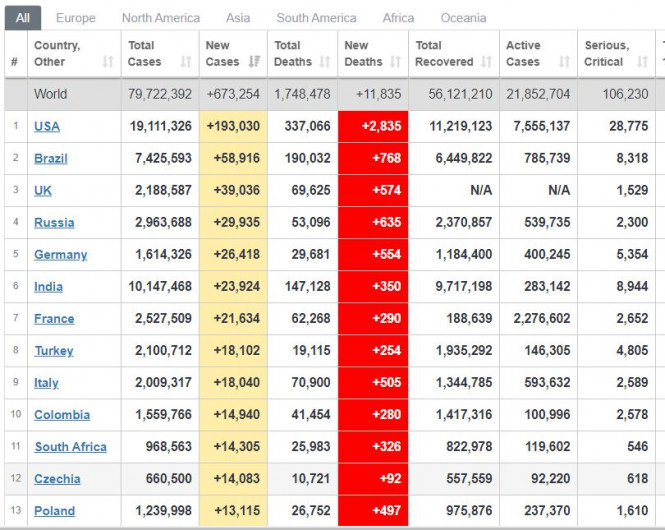

| Trading plan for the EUR/USD pair on December 25. Posted: 24 Dec 2020 11:59 PM PST

COVID-19 is on the rise again. A global incidence of about 673,000 was recorded yesterday. In the United States, new cases have decreased to below 200,000, while in Brazil, a sharp jump to 58,000 was observed. Growth was seen in Europe as well, as the UK listed 39,000 new cases and Germany recorded 26,000 new infections. As a result, Europe imposed strict quarantine restrictions, especially for the holidays. On the positive side: a) Vaccination is active both in the US and the UK, while Europe will begin on December 27 Vaccinations will also start in South America after Christmas. b) The Brexit crisis is over. Finally, the EU and the UK has concluded a trade deal, so now, parliaments must ratify the agreement on December 30.

S&P 500 - the US market grew sharply, reaching record highs before the holidays. A new and small growth is expected, followed by a strong correction.

EUR/USD: Expect a sharp growth after the weekend. Open long positions from 1.2190. Open short positions from 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

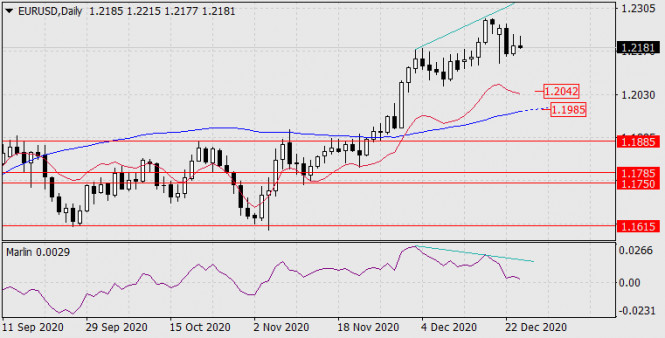

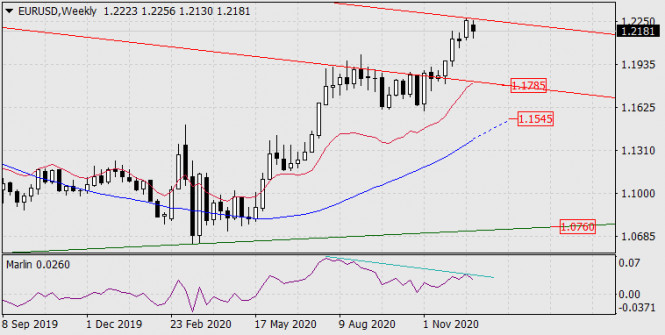

| Forecast for EUR/USD on December 25, 2020 Posted: 24 Dec 2020 09:03 PM PST EUR/USD Last night, the main negotiators on the EU-UK trade deal gave their countries a Christmas present - they agreed on all the points of the agreement after the final decision on the fishing issue. Today and tomorrow the MPs of both parties will study the document in order to have time to ratify it before the new year. Probably, this event prevented the speculative attacks on the European currencies, which we expected. But the markets did not rise, for example, the euro closed the day five points lower than Wednesday's close. This all speaks of the likely intention of market participants to sell European currencies after the holidays and the ratification of the agreement, since current prices already include a positive outcome of the transaction, but the main reason, in our opinion, which we have already discussed more than once, is even a good deal (and accepted deal is not very good) will look worse than economic relations between the two regions before Brexit. Investors will return to work on Monday (except for the UK, Canada, Australia), and the technical picture is not favorable for long deals: the price divergence with the Marlin oscillator persists and develops on the daily chart:

The first target for the decline is the 1.1985-1.2042 range formed by the MACD line and the embedded price channel line. Then we wait for the price in the target range of 1.1750/85.

In the medium term, the euro will be waiting for the MACD line on the weekly timeframe in the 1.1545 region, even deeper than 1.0760 - support for the upward trend line of the monthly timeframe. But this decline will be largely dependent on US policy. Take note that the price has formed a reversal divergence with the oscillator on the weekly chart.

The four-hour chart shows that the price has reversed to the downside from the MACD line yesterday. The situation is developing normally. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on December 25, 2020 Posted: 24 Dec 2020 08:52 PM PST USD/JPY USD/JPY gained 13 points within the trading range of the last three days. Today the Japanese trading floors are open, at the moment the pair is quoted at 103.54, that is, it is already 14 points lower than yesterday's close. Japanese investors seem to be preparing for a negative turn of events from the opening of the new week. We keep our previous forecast that the price will move under the 103.18 level and its successive decline to 102.35.

The four-hour chart shows that the signal line of the Marlin oscillator has already reached the top of its own wedge. Exit from the wedge, respectively, we wait downward, the oscillator will soon leave the negative zone and accelerate the fall.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments