Forex analysis review

Forex analysis review |

- Forecast and trading signals for GBP/USD on December 28. COT report. Analysis of Thursday. Recommendations for Monday

- Forecast and trading signals for EUR/USD on December 28. COT report. Analysis of Thursday. Recommendations for Monday

- Analytics and trading signals for beginners. How to trade the GBP/USD currency pair on December 28? Analysis of Thursday's

- Analytics and trading signals for beginners. How to trade the EUR/USD currency pair on December 28? Analysis of Thursday's

- European Central Bank kept euro from rising until the end of the year

- EUR/USD, GBP/USD - results of the week and future prospects

- GBP/USD. What will change with the coming to power of the new US President Joe Biden? Part 2.

- EUR/USD. What will change with the coming to power of the new US President Joe Biden? Part 1.

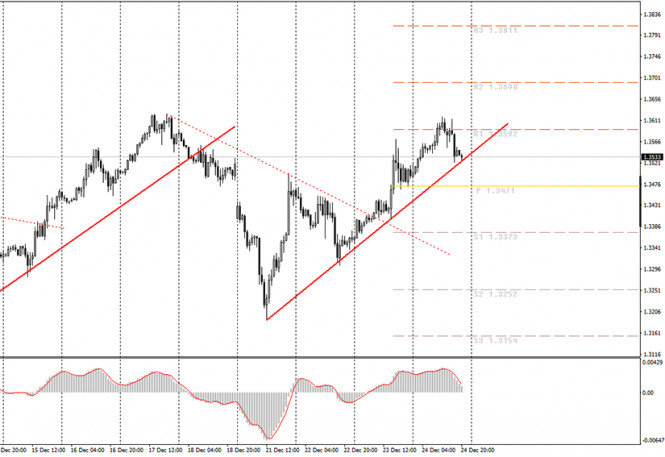

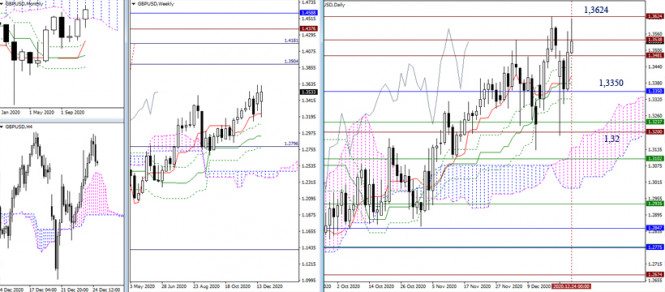

| Posted: 27 Dec 2020 07:09 PM PST GBP/USD 15M Both linear regression channels are directed to the upside on the 15-minute timeframe. Thus, the upward trend continues in the short-term and there are no signs of it ending at the moment. GBP/USD 1H The GBP/USD pair continued the upward movement, which started a couple of days before, on Thursday. The pound had no reason to stand still, like the euro. The EU and the UK had agreed on a trade deal just a week before the end of the transition period. Thus, the markets bought the British pound on a new wave of optimism, until it rose back to the resistance area of 1.3608-1.3628. A rebound occurred from this area and the price began a new round of corrective movement towards the upward trend line. Now everything depends on which of the obstacles the price will overcome. If the area is 1.3608-1.3628, then a new round of upward movement is possible. If there is a trendline, then a downward trend may start. We are still leaning towards the option of starting a downward trend, considering that the pound has exhausted its growth potential a long time ago. Now, when the deal is agreed, and the very fact that traders have already worked this out a bunch of times, we expect a downward movement. COT report The GBP/USD pair increased by 80 points during the last reporting week (December 8-14). Small price changes, but in general, the pound remains in a steady upward trend. But the latest Commitment of Traders (COT) report gave us data that does not allow us to draw any specific conclusions and forecasts. The changes were minimal and contradictory. Professional traders closed 4,000 Buy-contracts (longs) and 2,300 Sell-contracts (shorts) during the reporting week. Thus, the net position of the most important group of traders decreased by 2,300, which is not much. This means that major players have become more bearish. But it is best to pay attention to the first indicator in order to understand what is happening with the mood of non-commercial traders. The green line (as well as the red one) constantly changes the direction of movement: up and down. This indicates the lack of a clear and firm attitude of the non-commercial group. So now it is impossible to draw any conclusions. The pound has continued to rise for three months (and this is only the last round of its growth), but COT reports do not state that the mood among non-commercial traders became more bullish. Or even that any group of traders at this time actively increased purchases of the pound. The new COT report did not come out on Friday because of Christmas. The fundamental background for the pound was very interesting on Thursday and the rest of Christmas week. First, the agreement on a trade deal was announced. This time it's official. Closer to the weekend, it became known that the ambassadors of the European Council agreed to temporary approval of the trade deal, after which a personal meeting of all 27 ambassadors took place, at which the text of the draft was discussed. "It will take a few days, because only the basic agreement on trade and cooperation with the EU already includes 1246 pages of legal text," said EU Germany Presidency Spokesman of the EU Council Sebastian Fischer. Thus, the European Council will allow the "temporary application" of the deal without approval and ratification by the European parliament. However, even despite the positive ending of this epic, the absolute majority of experts say that the British economy will still suffer losses due to Brexit. However, we have already mentioned this earlier. The trade deal with the EU is designed only to minimize the risks and losses from the "divorce" of the UK and the EU. The Bank of England, for example, expects a loss of 1% of GDP in the first quarter of 2021 due to Brexit "with a deal". Many agencies and media outlets list a whole list of deterioration that will occur in relations between the EU and Britain. No news or reports scheduled for Monday. Which is not surprising. We just need to wait for the verdict of the British Parliament, but we believe that there should be no problems with this. The British opposition does not have enough power in Parliament to block the agreement even if it does not suit it. Thus, Prime Minister Boris Johnson can rejoice, and everyone else will study the details of the trade deal, set out on 1246 pages and published on the website of the European Commission. We have two trading ideas for December 28: 1) Buyers for the pound/dollar pair still have the initiative in the market. At the moment, the upward trend persists, so you are advised to trade up while aiming for 1.3608-1.3628 and the resistance level of 1.3668 when the price rebounds from the upward trend line. Take Profit in this case will be from 70 to 130 points. 2) Sellers are still out of work, but they still have a chance to form a new downward trend in the near future. Thus, we recommend selling the GBP/USD pair while aiming for the Kijun-Sen line (1.3402) if the price manages to overcome the upward line. Take Profit in this case can be up to 110 points. Forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

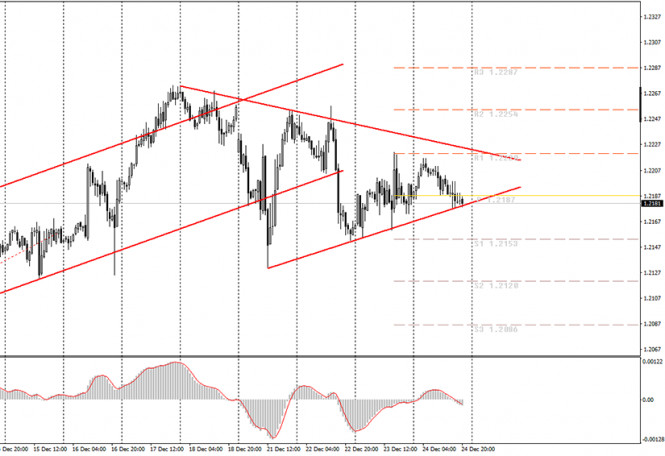

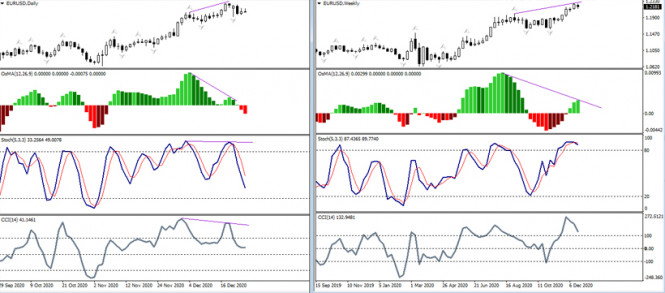

| Posted: 27 Dec 2020 07:09 PM PST EUR/USD 15M The technical picture is more than eloquent in the 15-minute timeframe. Both linear regression channels are directed sideways, which signals a full flat, at least in the short term. Therefore, if the situation does not change on Monday, then we state a flat and do not recommend trading in it. EUR/USD 1H The EUR/USD pair was calmly trading on the hourly timeframe on December 24. Most of the market participants were already celebrating Christmas with their thoughts and preparing for the New Year. We have already said that the New Year's week, which begins with Christmas, is different every year. Sometimes it is overactive, since the market is very thin at this time, sometimes it is super calm, since most traders do not want to trade at this time. This year, so far, everything is moving towards the fact that the New Year's week will be low-volatile and calm. At the moment, the pair's quotes remain between two trend lines, the most important of which is the downward trend. However, in essence, the price remains stuck between these lines and last Thursday, it did not find the strength to leave this range. The pair's quotes dropped to the rising trend line, and the Kijun-sen line was crossed several times, which now speaks of its weakness. In fact, a flat has begun, so both important lines of the Ichimoku indicator, Senkou Span B and Kijun-sen, are not strong now. A signal for a new movement is when the price surpasses any trend line. But even in this case, you need to be careful when making trading decisions, since the price can continue to move sideways and sooner or later will get out of the range. However, such an exit will not be a buy or sell signal. COT report The EUR/USD pair increased by 30 points during the last reporting week (December 8-14). Recall that over the past few weeks, the Commitment of Traders (COT) reports have shown an increase in the net position of non-commercial traders. That is, the mood of professional players became more bullish, although before that they were already preparing for a massive sell off of the euro for several months. The non-commercial group closed 5,200 Buy-contracts (longs) and opened 10,800 Sell-contracts (shorts) in the last reporting week. That is, the net position decreased by 16,000, which is quite a lot. Professional players are looking into selling the euro. And if we take the long-term perspective into account, then non-commercial traders continue to lean towards selling the euro. The single currency has been growing for a full nine months. All this time, it has been extremely difficult for the dollar to even adjust. Therefore, the euro is now overbought, and very much so. As for the indicators, they show the same decrease in the net position of non-commercial traders. The green line of the first indicator began to move again to meet the red line (net position of commercial traders), which, we recall, is a signal of the end of the trend. Therefore, we still expect the end of the euro's growth, but at the same time, we remind you that until there are technical signals about the end of the upward trend, it is not recommended to trade down. The new COT report was supposed to be released on Friday, December 25, but due to the celebration of Christmas, it was postponed to Monday. No important news or reports last Thursday, December 24. So it is not surprising that traders were not active. Also, the holidays have already begun. This week, for example, there are no publications or important events scheduled at all. Thus, market participants can only focus on general topics. Nothing is happening in the European Union and the United States. The EU has just agreed on a trade deal with the UK, but this event affects the pound more than the euro. Donald Trump continues to be loud in America, who blocked the provision of assistance to Americans and the unemployed, as well as the defense budget, which was previously approved by Congress. Moreover, Trump continues to fight for the election and tries to attract as many people as possible to his side, calling for a review of the results. This time, Trump appealed to Republican senators, urging them to do everything possible to "fight for the presidency." "It's time for Republican senators to step up and fight, as Democrats would have done if they had actually won. The evidence is indisputable." Trump did not consider it necessary to report that he made another unfounded statement from his post. We have two trading ideas for December 28: 1) Buyers have temporarily released the pair from their hands, but the bears have not significantly pulled the pair down. As long as the price is below the downward trend line, the bearish mood is formally maintained. You are advised to open new long positions if the price settles above the downward trend line while aiming for the resistance level of 1.2314. Take Profit in this case can be up to 80 points. 2) Bears remain very weak at this time and have failed to settle below 1.2157. Moreover, a rising trend line has been created, which restrains sellers from significantly pulling the pair down. Thus, you are advised to open short positions if the bears manage to overcome the lower line of the rising channel in order to target the support level of 1.2058. Take Profit in this case can be up to 80 points. Forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Dec 2020 06:39 AM PST The hourly chart of the GBP/USD pair.

The GBP/USD pair was trading quite actively on Thursday, December 24. The pair's quotes returned to the highs of the year. At the same time, it returned to the 2.5-year highs, however, it could not update and began a round of downward correction. As a result, the price fell to the upward trend line and now traders have to decide: either overcome this line or bounce back and resume the upward trend. To be honest, given how long the pound has been growing, even if there is a trade deal, it is hard to believe in its further growth. But this is the foreign exchange market. If arguments like "hard to believe" worked here, everything would be easy and simple, like in a fairy tale. Therefore, technically, the chances of growth or decline are 50/50. We are more inclined to fall, as the pound has grown in recent months solely on expectations of a trade deal between London and Brussels. There is such an expression in Forex: "Buy on rumors, sell on facts." Perhaps it will be implemented this time with a vengeance. But for its implementation, you will still need a technical signal in the form of fixing the price below the trend line. Well, the deal is agreed, there are only small things that the EU and the UK are sure to be able to settle before the New Year. However, according to many experts, the British economy will still not be saved from a new fall (decline in GDP) of the economy at the beginning of 2021. The negative effect of Brexit will still be there, and the presence of a trade deal will only slightly smooth it out. Thus, in the fourth quarter, the British economy may suffer losses due to the second "lockdown" and stricter quarantine due to a new strain of "coronavirus", and in the first quarter of the new year – thanks to Brexit. Therefore, we should not expect positive economic news from Britain in the near future. Based on this alone, we would have predicted a fall in the British pound. Plus, the pound is heavily overbought. But, as mentioned above, this is a market, so you can not be 100% sure of anything. Therefore, you need to wait for a technical signal. As of December 28, the following scenarios are possible: 1) Buy orders now remain relevant, as the upward trend continues. Thus, novice traders can now wait for a new buy signal in the form of a price rebound from the trend line. The target for buying, in this case, is the resistance level of 1.3690, which is located much higher than the current highs of the pair. We remind you that you need a clear rebound from the trend line. 2) Sales are now impractical, since the downward trend has been canceled, and the new one has not yet been formed. Thus, now you need to wait for the quotes to consolidate below the upward trend line and only then sell the pair with the support levels of 1.3471 and 1.3373. This consolidation can occur immediately at the opening of trading on Monday night. What's on the chart: Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and show which direction is preferable to trade now. Up/down arrows – show when you reach or overcome what obstacles you should trade for an increase or decrease. MACD indicator – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines(channels, trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Dec 2020 06:12 AM PST Hourly chart of the EUR USD pair.

The EUR/USD currency pair during the last working day of this week began to fall to the upward trend line, however, they did not overcome it. We still consider the downward trend line to be stronger, so we continue to recommend trading lower rather than higher. At the same time, if a rebound follows from the lower trend line, then it will be possible to open long positions, as the price can rise by 40 points. However, this will require a rebound, without false breakouts of the trend line itself. We are more inclined to the option that the upward trend line will be overcome, and the downward movement will continue. In the case of such a scenario, we recommend resuming trading on the downside. The problem with new year's week is that the flat may persist. So far, only Wednesday and Thursday can be called flat days. However, these days were pre-Christmas, and the whole next week will be new year's eve. Thus, low-volatility trading can continue, and the euro/dollar pair can continue to move sideways, so no overcoming of any trend line may not happen. The price will simply go out of the limit of these lines, moving sideways. In this case, the signal will not be generated. On Thursday, December 24, not a single macroeconomic report was published in the European Union and America. And, in principle, there was no news, which is evident from the same volatility of the currency pair. On Monday, the situation will not change much, as the new year's week news calendars are empty. There will be only one more or less significant report on applications for unemployment benefits in the United States on Thursday. In general, the fundamental background will be empty. Based on this, novice traders will have to make decisions based on technical factors next week. If the market remains flat, we do not recommend entering the market for beginners at all, as it will be very difficult to predict the direction of the pair's movement. On December 28, the following scenarios are possible: 1) Long positions are not relevant at the moment, as there is a downward trend line. Thus, we would recommend opening purchases only after the price is fixed above this trend line with the targets of the resistance levels of 1.2254 and 1.2287. It should also be remembered that you need to confidently overcome this line, and not gradually go beyond it through the "flat". Small purchases of the pair are also possible if there is a confident rebound from the lower trend line with a Take Profit of 30-40 points. 2) Trading on the downside looks more appropriate now. If the price overcomes the lower trend line (again, confidently and without false breakouts), then it is recommended to open new short positions with targets at the levels of 1.2153 and 1.2120. However, it should be remembered that the volatility is now low, so the pair can go no more than 40-50 points in one direction. What's on the chart: Price support and resistance levels are levels that – targets when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and show which direction is preferable to trade now. Up/down arrows – show when you reach or overcome what obstacles you should trade for an increase or decrease. MACD indicator (14,22,3) – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines (channels, trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

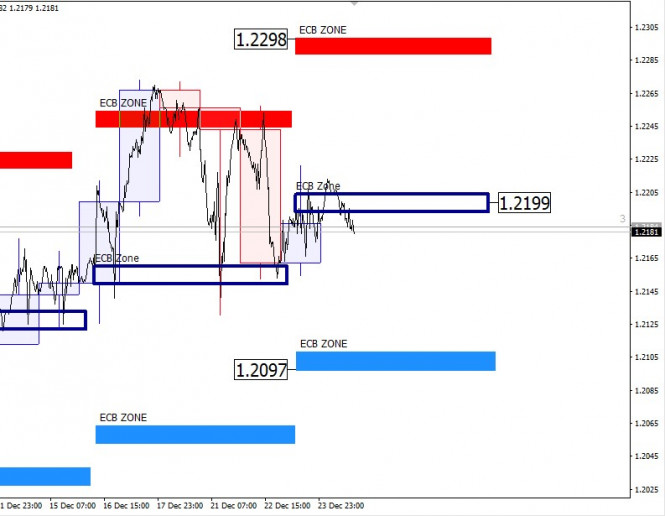

| European Central Bank kept euro from rising until the end of the year Posted: 27 Dec 2020 06:00 AM PST Trading closed below the 1.2199 level last week. This indicates that the upward momentum has stopped. The main target for a decline is the lower area at 1.2097. Reaching this level will make it possible to buy EURUSD at favorable prices, expecting to sustain the upward medium-term momentum.

Corrective selling is possible in case the 1.2199 level has been retested. Take note that the downward movement will remain corrective for now, so taking a short position will be required. The pair has been forming a local accumulation zone for the last two weeks. This makes it possible to work in a flat phase. The limits of the flat will serve as excellent reference points for finding entry and exit points from trades. It is important to understand that there is a 70% probability that the pair will stay within the 1.2097 level before the year ends. The material has been provided by InstaForex Company - www.instaforex.com |

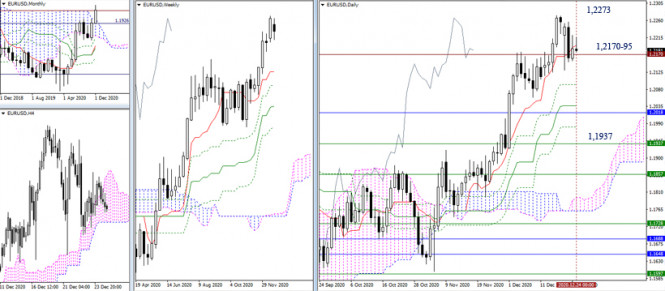

| EUR/USD, GBP/USD - results of the week and future prospects Posted: 27 Dec 2020 05:34 AM PST EUR/USD

The shape of the weekly candle can be attributed to the Harami variants. With proper confirmation, a new and effective correctional decline is likely to follow in the near future. The main reference point for the bearish weekly Harami will be the weekly short-term trend, the level is currently located at 1.1937. The development path of the weekly correction goes through eliminating the daily golden cross (1.2092 - 1.2037 - 1.1981) and the border of the monthly cloud (December 1.2018), which will leave the level (1.1891) in January. If the current global financial trends still suggest a bullish advantage and that there is a possibility to sustain the upward trend on the EUR/USD chart, then the situation will take more time and the pair will settle in an appealing area at the 1.2195-70 level (daily short-term trend + record level). The nearest bullish reference is the high at 1.2273. Getting the pair to settle above this level will make it possible for us to consider new perspectives.

Daily bearish divergences formed peaks and received confirmation in the form of a corrective discharge. Over the weeks, the OSMA indicator still creates the prerequisites for a creating a divergence, and to do so a new activity and the effectiveness of the players for a decline are necessary to create the divergence. GBP/USD

The bulls were unable to fully recover their positions, although they closed the downward gap on Monday, which provoked a sharp large-scale decline. The pair remained in an appealing zone of record levels at 1.3481-1.3538. To restore the upward trend and the emergence of new prospects, it is necessary to update the high (1.3624) and ensure that the pair settles above it. Subsequent upward targets can still be noted at 1.3904-1.4181 - 1.4376-1.4588 (weekly target for the breakout of the Ichimoku cloud + record level + upper border of the monthly cloud). The lower border of the monthly cloud (1.3350), which will retain its position in January, is still the key support for this area.

The daily timeframe has not created divergences, but the weekly time interval continues to preserve divergences, and the prerequisites to create them. Breaking the support of the trend line will probably help to defuse the situation of bearish divergences. Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. What will change with the coming to power of the new US President Joe Biden? Part 2. Posted: 27 Dec 2020 03:42 AM PST In the first part of the article, we listed the most important election statements of Joe Biden. In this part, we will continue to understand the promises of the Democrats and draw certain conclusions. Joe Biden also pays very high attention to health care. Even those issues that are not related to the pandemic. Under Barack Obama, a major reform of the health care system was carried out, which Donald Trump has always disliked. Biden promises to continue working toward providing Americans with higher-quality medicine, more convenient and cheaper. The Democrat promises to lower the age thresholds for older Americans in accessing the Medicare program, as well as introduce a new state insurance program, as a result of which the total number of uninsured Americans should fall from 8.5% to 3%. "Green" energy. Biden promises to take climate change very seriously. According to the Paris agreement, by 2025, greenhouse gas emissions in the United States should be reduced to 28%, and in 2050 – reduced to zero. Thus, the entire civilized world is slowly beginning to switch to "green" energy within the framework of the program of environmental protection, climate change, and increase in the average annual temperature, which has been observed in all parts of the world in recent years. Biden promises to invest $ 2 trillion in this direction and create millions of jobs. The Democrat also promises to make education more accessible to Americans. First, it is planned to create free colleges throughout the country. Secondly, some Americans who receive higher education on credit are offered to forgive part of their debts in exchange for spending a certain amount of time in public service. Third, parents of young parents will be provided with benefits to pay for child care. On the international stage, Biden promises to expand cooperation with NATO, increase pressure on Moscow, and counter the growing influence of China by uniting with allied states. In general, if you compare this election program with many others, you can find a lot of similarities. Every presidential candidate tries to promise as much as possible. But what can be done later is the second question. This is a disease of almost all democratic countries of the world. Thus, the standard package of promises "we will reduce taxes to the poor, we will raise the rich, we will improve the health care and education system" sounds from the lips of absolutely any presidential candidate. Much more important is how Biden will behave on issues that are not a major part of his campaign agenda. After all, this program is designed for ordinary Americans. What do ordinary people care about? Their well-being and standard of living. They care little about the confrontation with China, the pressure on the Kremlin, the conquest of space, the construction of colonies on Mars, and so on. They are interested in taxes, health care, job availability, and salary levels. Therefore, promises consist of 90% of "meeting" these needs of the population. More importantly, how will Biden conduct foreign economic policy? What kind of relations will he build with China, how will he conduct a dialogue with Vladimir Putin and Kim Jong-Un, how will he react to the nuclear program with Iran? However, there is no doubt that Biden will not get worse results than Trump. Trump has ruined his relationship with everyone he could, and in the international arena and domestically. Everyone was constantly fighting against him, from doctors and epidemiologists, who regularly refuted the president's words about the "coronavirus", to Democrats, who tried to block almost any initiative of Trump and discredit him. Thus, Biden can only behave approximately the same as Barack Obama, with which there will be no special problems. What does all this mean for the US currency? There is a tendency that under Republican presidents, the US dollar is growing, while under Democrats - it is decreasing. With Trump, this trend did not work, as for 4 years of his presidency, the US currency lost 13 cents against the European currency. However, most of the losses occurred in the last year – that is, the pandemic and the global crisis. We have repeatedly noted that in 2020, the markets almost stopped responding to macroeconomic statistics and various fundamental news. Thus, the true reasons for the fall of the US dollar in the last 9 months can be any reason. We remind you that the supply and demand for a particular currency determine the rate of any pair. If the dollar falls, the demand for it is low, or, conversely, the supply is high. How can this factor be fulfilled? For example, if major players in the foreign exchange market get rid of the US currency in the last 9 months. There can be a lot of reasons and most of them may not be available to the general public. Hypothetically, we can imagine that many large banks and investors are afraid of a slowdown in the US economy in 2021(although in theory, it should recover) and therefore are not going to invest money in it, respectively, they do not need dollars. They sell them. Or another situation: the Fed, with the help of an infusion of huge sums of money, increases the supply of the US currency on the market, which negatively affects the exchange rate. After all, the Fed is beyond the control of even the US President. It is an almost completely independent institution. Thus, it can declare some amounts within the framework of QE programs and others to stimulate the economy, but in practice, these amounts can be many times more. In general, in 2020, the exchange rates could not be more dependent on the actions of major players, who rule the ball. In normal, peaceful times, Central banks don't have to fight for every half percent of GDP, and the future of the economy isn't at stake. Thus, Central banks resort to currency interventions very rarely, because such actions are condemned on the world stage. All countries of the world are tied to each other through import-export operations and artificial undervaluation of any currency is good for some but bad for others. Those who feel bad will not sit and be silent, will influence the exchange rate of their currency, or impose sanctions, duties, and restrictions. Now, any Central Bank is fighting for its economy, so most likely, there are large-scale interventions. Thus, it is because of the global crisis, the deepest in the last 100 years, and the foreign exchange market is not trading quite "according to the rules". Recommendations for the GBP/USD pair: The pound/dollar pair continues to trade near its 2.5-year highs. Thus, the downward trend continues for the dollar. And since it persists, it is recommended to trade the pound/dollar pair further on the increase, until there are specific technical signals about the end of the uptrend. We have been waiting for its completion for a long time, but for the reasons listed above, the dollar's decline can continue for as long as you want. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. What will change with the coming to power of the new US President Joe Biden? Part 1. Posted: 27 Dec 2020 03:42 AM PST 2020 has become one of the most murderous years in the 21st century. Pandemic, record drop in global GDP, Brexit, and US elections. We believe that the elections in America can be put on a par with such events as the pandemic. The fact is that it was about Donald Trump in the election. We note once again that for many Americans this was not the Donald Trump-Joe Biden election, it was the Donald Trump-Not Donald Trump election. The world could already observe the same thing at the parliamentary elections in Great Britain when people voted for Brexit (conservatives) or against Brexit (everyone else). Thus, the fact that Donald Trump did not win the American elections very eloquently shows how satisfied American residents are with the policy of the current president. Trump lost by a wide margin. The difference in the final results of the vote was 7 million votes and 74 "electoral votes". In principle, the absolute majority of experts, political scientists, and journalists put on the fact that Trump will lose the election. We will not once again list all the merits of Trump, as in less than a month, the inauguration of Joe Biden will take place. And all Trump's attempts through the courts and the Senate to invalidate the election results look like "waving his fists after a fight". Trump lost and did not lose by a minimal margin, which could be attributed to small machinations, incorrect vote counting, and so on. 7 million votes can't be faked. At least in the United States. But along with all this, traders and readers have a question, what can Joe Biden offer the United States? Recall that Biden was Vice President under Barack Obama, so he is familiar with the duties of the president of the country. After all, 8 years of being Vice President is a colossal experience. Thus, Biden looks like a much more competent politician. Trump is a businessman to the core, who does not disdain any methods to achieve the goal. However, Americans and the media quickly realized that Trump's words should be divided by 8 or 28. Ratings of major analytical agencies about how many times a day Trump lies, making public statements or posts on social networks, is generally something unique. It is unlikely that this information will be contained in textbooks on American history. In general, over time, trust in Trump fell so much that his speeches began to be treated as an entertainment show. To be honest, we are still surprised at how Trump collected 74 million votes in the election. However, let us go back to Joe Biden, who won the election solely thanks to Trump. In principle, we can judge what Joe Biden will be like as president of the country only from the election promises of the Democrat himself. The first and most important thing that Biden promised is a more attentive and serious attitude to the "coronavirus". One of the main complaints against Trump was his negligent attitude to the pandemic. It is Trump who is blamed by American doctors for constantly refusing to tighten quarantine and putting the economy above American lives. As a result, America remains in first place in the world in terms of the number of cases of the disease(at the moment, almost 19 million and 200 thousand new cases per day). Biden also promises to provide all Americans with a free vaccine against COVID-2019, free tests, and also return to the WHO, from where Trump brought the states with such pomp, accusing at the same time this organization of complicity with China, "because of which the whole world was enveloped by a terrible pandemic". Biden also promised to strengthen the middle class in the United States, expand lending programs for small and medium-sized businesses, introduce new programs to provide money at no cost and raise the minimum wage for hired workers. The standard package of promises of the candidate from the Democratic Party, which is the complete opposite of Trump, who put above all the highest class of the population. Of course, Biden also promises to raise taxes for the rich (those who earn more than $ 400,000 a year) to raise additional funds. The third problem that has emerged under Donald Trump is racism. Of course, you can not blame the US President for absolutely all the troubles, but when mass rallies and protests broke out across America because of the murder of George Floyd (and then another black man, who was also opened fire by white police officers), Trump again showed himself not at his best, intending to disperse the rallies with the help of the US army. And only the refusal of the head of the Pentagon stopped Trump from implementing this crazy plan, which is unclear what would have ended. However, Trump still sent special units to some particularly blazing righteous anger of the city special forces, which "put things in order" in the end. In any case, President Trump has failed to address the issue of racism and reassure the American community. Many note that under President Trump, the problem of racism has become much more acute. Also, Trump allowed some "racist statements" in his addresses and speeches. Also, do not forget how Trump treated female representatives. He never showed any respect for women, regularly insulting journalists who asked him the wrong questions, and there is nothing to say about the Speaker of the House of Representatives Nancy Pelosi. Trump constantly called her "crazy". Biden promises to eliminate racial and gender discrimination, as well as create a $ 30 billion investment fund to support businessmen belonging to sexual minorities. Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair shows that it continues to move upwards in general, so now it is still recommended to consider buying the euro currency, even though there are no visible fundamental reasons for this. As long as the quotes are above the critical line, the prospects for the euro remain very good. On the lower charts, you should look for upward trends The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments