Forex analysis review

Forex analysis review |

- Evening review of EURUSD 12/24. Significant news almost ignored: EU and UK agree to deal

- GBP/USD. "We bought on rumors, now we sell on facts": pound temporarily retreats

- Short-term view for NZDUSD remains bearish

- Gold price forms bearish channel.

- Ichimoku cloud indicator Daily analysis of EURUSD

- Asian stock indices trade mixed

- December 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- US dollar comes under pressure again

- December 24, 2020 : EUR/USD daily technical review and trade recommendations.

- December 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- USD/CHF Could This Be A Larger Rebound?

- Trading Signal for GBP/USD for December 24 - 25, 2020

- BTC analysis for December 24,.2020 - Potential for the rise towards the resistance of the bracket

- Analysis of Gold for December 24,.2020 - Successful Test of the rising trendline and potetnial for the rally towards $1.906

- Gold climbing ladder, facing downwards. Forecast for January 2021

- Trading Signal for EUR/USD for December 24 - 25, 2020

- EUR/USD analysis for December 24 2020 - Risin trendline and potential for the rally towards 1.2215

- Bitcoin Points To New Highs!

- Gold prices to hit $4,800. Is it possible?

- Outlook for GBP/USD. Speculators price in news about trade agreement

- GBP/JPY Price Analysis for 24 December

- GBP/USD price forecast for 24 December

- EUR/USD Price Analysis for 24 December

- Gold demonstrates a steady increase amid a weakening dollar

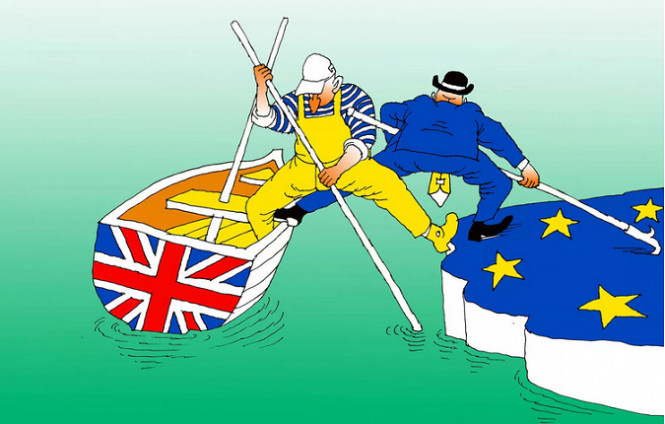

- UK and EU remained divided over issue on fishing

| Evening review of EURUSD 12/24. Significant news almost ignored: EU and UK agree to deal Posted: 24 Dec 2020 01:26 PM PST

EURUSD - no change. Important: There is an agreement between the EU and Britain. If this deal had not been concluded - then from January 1, all tariffs and duties would fall on business from both sides. Nevertheless: a) the deal was concluded; b) there is no market reaction. Everyone's gone for Christmas! Here's the answer. We keep buying euros from 1.2190 and below. We turn down from 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. "We bought on rumors, now we sell on facts": pound temporarily retreats Posted: 24 Dec 2020 01:25 PM PST "Buy on rumors, sell on facts" - this trading principle is now actively implemented by traders of the pound-dollar pair. The British pound was actively strengthening throughout the market during the day, reacting to optimistic rumors about the prospects for a trade deal. Yesterday morning, traders recorded a price low at around 1.3350, while today the pair jumped to 1.3618. The nearly 300-point growth was driven solely by Brexit. The news was contradictory, but traders staked on a positive outcome of the negotiations. And they did not lose: on the eve of the Christmas weekend, the parties nevertheless reached a compromise solution and "shook hands." But the pound fell under a wave of selloff as soon as the agreement was officially announced.

The reasons for this behavior are quite banal: market participants in large numbers began to take profits on the GBP/USD pair, leaving long positions. Ahead the long weekend, which will last until Tuesday. Then a small "break" and again the holidays, this time New Year's. On the eve of the festive time, traders do not risk leaving open orders, especially when the price is at such high values. On the other hand, this does not mean that the market has won back the Brexit deal. It's just that the politicians came to a compromise at the most inopportune moment, from the foreign exchange market's perspective: in the pre-new year period, traders are forced to trade in conditions of low liquidity and, roughly speaking, are not able to adequately respond to the ongoing processes. At the same time, it is worth recognizing that today there was an event that would have an impact on the pound not only in the medium term, but also in the long term. The achievement of the fortieth figures can now be discussed not only in a hypothetical context – this price horizon will serve as a kind of beacon for GBP/USD buyers in 2021. But it will be possible to consider the pound's growth prospects in a practical plane after New Year's, as in the near future we will increasingly face abnormal price movements. Traders and market makers, as a rule, close both the month and the year in the final week, so the New Year's eve price celebrations have already become a kind of tradition. Now a few words about the deal itself. According to the Reuters news agency, the British made significant concessions over the last day of negotiations – including on the distribution of quotas for fishing in the UK's exclusive economic zone. It is noteworthy that such a scenario was voiced by insiders of the Financial Times publication last week. Then journalists warned that the deal will be concluded at the last moment, and actually on the terms of the Europeans. London was not really going to lose the single market, as the affected party would eventually be Britain, not the European Union. At least for the reason that the UK sends more than 40% of its exports to the EU countries, while the key countries of the bloc send only 5-6% of their exports to the British. It is worth noting that the details of the agreement have not yet been made public. Prime Minister Boris Johnson only noted that the deal will provide the country with a trade turnover of 660 billion pounds a year, protect jobs and allow exporting products without tariffs and quotas. Also, according to him, London has ensured that the European Court will not be able to resolve disputes that may arise between London and Brussels in the future. In turn, the chief negotiator from the EU Michel Barnier said that the UK and the European Union maintain a visa-free regime and "full access to each other's territory and maritime space." However, the deal does not include general positions on foreign policy, but allows for synchronization of sanctions. They also announced that the parties agreed to create a Joint Partnership Council, which will monitor compliance with the deal and facilitate discussion of controversial issues. We do not know how this Council will be formed and what leverage it will have.

It is obvious that all information gaps will be filled in the very near future, as the parties have yet to ratify the approved deal. The British Parliament will meet for an emergency session on December 30. But the European Parliament will not have time to consider this issue this year, so the parties agreed to apply a special legal mechanism, thanks to which the deal will be de facto effective from January 1, even without ratification by the European Parliament. It is better not to open any trading deals on the GBP/USD pair right now: the thin market can present unpleasant surprises. But in general, long positions remain a priority in the medium term (not to mention the long term). The first target is this year's high at 1.3624. The main target is located slightly higher - the upper line of the Bollinger Bands indicator on the monthly chart, which corresponds to 1.3680. Overcoming this resistance level will open the way to the 37th figure area. The material has been provided by InstaForex Company - www.instaforex.com |

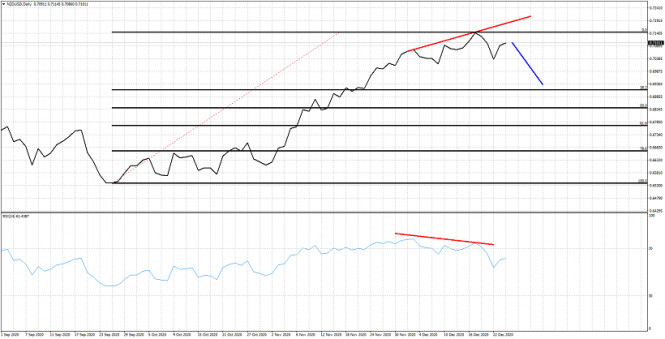

| Short-term view for NZDUSD remains bearish Posted: 24 Dec 2020 08:36 AM PST NZDUSD is trading at 0.71 and our expectations remain bearish. We continue to expect a move lower towards 0.69 and the 38% Fibonacci retracement. Price is vulnerable to a move lower and this is portrayed by the bearish RSI divergence.

Blue line -expected path Black lines -Fibonacci retracement levels We believe it is most probable to have seen a short-term top at least at recent highs of 0.7168. Short-term support is at 0.7025-0.70 area. Breaking below this level will increase pressure on NZDUSD and eventually push price lower towards 0.69 which is our first target area for a pull back, The RSI bearish divergence is just a warning sign and not a reversal sign. However at current levels we prefer to at least be neutral if not bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price forms bearish channel. Posted: 24 Dec 2020 07:58 AM PST Gold price got recently rejected at $1,900. Price is still forming higher highs and higher lows if we see the price action from recent lows at $1,763. If we look price action from the all time highs back in August, price is making lower lows and lower highs. Price has recently made a rejection at the upper channel boundary.

Gold price is trading near $1,880. Price is close to key channel resistance. Bulls need to be very cautious. Support is at $1,850 and next to $1,800. Breaking below each level will push price towards the next. If bulls are unable to hold price at $1,800 we should then expect a move below $1,763 low. Next target could be at $1,714. Resistance is found at $1,900. Recapturing it is key for bulls. Inability to do so will be a sign of weakness, The material has been provided by InstaForex Company - www.instaforex.com |

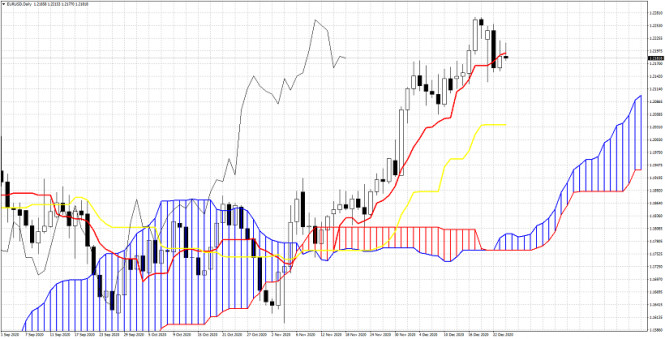

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 24 Dec 2020 07:49 AM PST EURUSD is under pressure again. Price could not remain above the tenkan-sen for a second day and 1.22 has been lost. This weakness is a short-term worrying sign, that implies a move lower is imminent.

|

| Asian stock indices trade mixed Posted: 24 Dec 2020 07:12 AM PST This morning, in the stock markets of the Asia-Pacific region, there was an increase, which affected most stock indicators. However, the overall activity is still extremely low. In fact, it was quite predictable due to the Catholic Christmas Eve. Despite the fact that the end of 2020 has been quite challenging for global markets, including a revision of the stock portfolio, investors' mood remains positive. They still hope that the world will be able to cope with all the difficulties caused by the coronavirus pandemic. In particular, the Asian markets are supported by the news coming from their European counterparts. According to the latest data, the UK and the EU are likely to sign a trade agreement. Only over the past two days, the British authorities unexpectedly agreed to make huge concessions on the thorniest issues. However, earlier, the UK position looked very firm. For example, one of the most important issues related to fishing was positively resolved. Of course, such information boosted investors' sentiment. This, in turn, may lead to a rise in the stock markets. Japan's Nikkei 225 Index advanced by 0.54%. China's Shanghai Composite index fell by 0.57% in almost a day and was among those that continue to feel pressure from external negative factors. The Hong Kong Hang Seng index did not support the negative trend this time and went up by 0.16%. Chinese market participants are worried about the news that the country's official authorities have organized an investigation against the online retailer Alibaba over the issue of its violation of the antitrust law. This could seriously shake investor confidence and cause a collapse in the company's shares. South Korea's KOSPI index jumped by 1.7%, upgrading its all-time high. Australia's S&P/ASX 200 index advanced by up 0.33%. The material has been provided by InstaForex Company - www.instaforex.com |

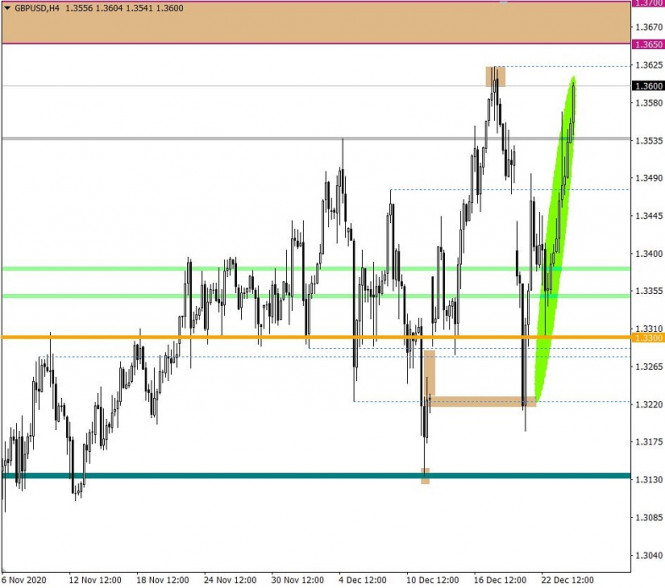

| December 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 24 Dec 2020 06:57 AM PST

In December, the price levels of (1.3380-1.3400) have prevented further bullish movement for the past few weeks. Bearish target was targeted around 1.3300. However, the pair has failed to pursue towards lower targets. Instead, a bullish spike was expressed towards 1.3480-1.3500 where the upper limit of the depicted movement channel has previously provided temporary bearish pressure on the pair. Shortly after, another bullish spike has recently been demonstrated towards 1.3600 where the upper limit applied considerable bearish rejection again. Recently, the GBPUSD pair looked overbought while consolidating above the key-level of 1.3400. As expected, bearish reversal was recently initiated around 1.3600. A quick bearish decline was demonstrated towards 1.3200. Intermediate-term outlook could turn into bearish provided that the pair maintains movement below 1.3400. However, the pair has failed to maintain bearish decline below 1.3200. Instead, bullish persistence above 1.3400 invalidates the bearish scenario for the short-term. Hence, another bullish movement towards 1.3700 (the channel's upper limit) should be expected. The material has been provided by InstaForex Company - www.instaforex.com |

| US dollar comes under pressure again Posted: 24 Dec 2020 06:41 AM PST This year, the US dollar index has been down by more than 13%. The greenback continues to suffer losses as investors are betting that the Fed will maintain a super-soft monetary policy and a new round of economic relief and stimulus will help the national economy recover in 2021. The fact that investors expect the US dollar to continue losing ground supports the stock markets. Since the beginning of the year, the S&P 500 has been up by 15%, despite the economic hardships caused by the coronavirus spread in the United States. For every 10 percent drop in the dollar, S&P 500 profits on a per share basis increase by 3 percent, according to Bank of America. Stocks opened the previous trading day with gains amid reports that US President Donald Trump could veto a bipartisan economic rescue bill. However, this news took a back seat as investors decided that Congress could easily bypass Trump's veto. In addition, stocks were supported by the statements of medical experts that the already developed vaccine against COVID-19 should be effective against a new coronavirus strain. As a result, the S&P 500 index rose by 0.1% to 3,690.01 points on Wednesday. Apparently, the market is currently mulling over the recent rally and is waiting for another driver for growth shortly before the new year. "The fact that equity indices traded mostly in the green this morning reflects a consensus expectation that Trump will sign the budget into law, although he could wait until the eleventh hour," a strategist at Rabobank said in a statement. On Wednesday, the US currency extended weakness against its main competitors amid disappointing statistics from the United States. Although initial unemployment claims in the country did not grow as much as expected, it still exceeds the 800 thousand mark. In November, US orders for durable goods slowed down, household income and expenses decreased, and new home sales fell sharply. The day before, the US dollar index sank by 0.3%. On Thursday, it was down by more than 0.2% to 90.1. The main currency pair has advanced for the second consecutive trading session. However, it is obvious that it does not have enough momentum to go beyond the range formed in early December. The pre-holiday mood and thin market keep traders from aggressive bets. The euro/dollar pair has been able to defend the weekly trend support level, which is currently taking place in the area of 1.2170. In case the price breaks through it and consolidates below it, this will be the first sign of fading bullish momentum. If the price dips below 1.2100, a bearish breakout will be confirmed and the pair will go towards the psychologically important level of 1.2000 at an accelerated pace. Meanwhile, if the price is able to rise above 1.2270-1.2175 (annual highs), the pair will move towards the levels of 1.2300 and 1.2340. In this case, the price is likely to face the round mark of 1.2400 (for the first time since April 2018). The safe-haven greenback continues to trade under pressure amid hopes for a UK-EU trade deal. The final Brexit deadline is rapidly approaching. However, the very fact that talks between London and Brussels still continue on Christmas Eve signals the parties' willingness to do everything to prevent an exit without a deal. If the parties finally reach a compromise on this crucial issue, we may see a rally not only in the pound but also in many other risky currencies. In this scenario, the pound/dollar pair may jump to 1.4000. If the negotiations fail, it risks falling by 3-5%. The material has been provided by InstaForex Company - www.instaforex.com |

| December 24, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 24 Dec 2020 06:31 AM PST

After the demonstrated sideway movement took place in November, evident signs of BUYING Pressure has originated around the depicted price zone of 1.1800-1.1840. Shortly after, the EUR/USD pair has demonstrated a significant upside movement after the recent breakout above the depicted price zone (1.1750-1.1780) was achieved. As mentioned in the previous article, the pair has targeted the price levels around 1.1990 which exerted considerable bearish pressure bringing the pair back towards 1.1920 which constituted a temporary KEY-Zone for the EUR/USD pair. That's why, another episode of upside movement was expressed towards 1.2160 where a false breakout above the price level of 1.2200 was regarded as a false bearish reversal signal. By the end of Last week, a short-term reversal pattern has been demonstrated around 1.2265. Intraday downside retracement to the downside was expected to occur. On the other hand, Bearish closure below the mentioned price zone of 1.2200 - 1.2170 is needed to turn the intermediate outlook for the pair into bearish and enhance a quick bearish decline towards 1.2040 and 1.1920. Trade Recommendations :- Conservative traders should be looking only for SELL Positions around higher price levels near 1.2250-1.2270. Exit level should be placed above 1.2300. The material has been provided by InstaForex Company - www.instaforex.com |

| December 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Dec 2020 06:29 AM PST

Recently, the EURUSD pair was trapped below the previous key-level (1.2000) until bullish breakout occured to the upside.Further quick bullish advancement was expressed towards 1.2150 just as expected after failing to find sufficient bearish pressure at retesting of the backside of the broken channel around 1.1950-1.1970 which corresponds roughly to Fibonacci Level of 0% at 1.2000. Recently, the pair looked overbought while approaching the price levels of 1.2250 (138% Fibonacci Level).That's why, conservative traders were advised to look for low risk trades around lower price levels. Bearish closure and persistence below 1.2160 then 1.2000 is needed to abort the ongoing bullish momentum to initiate a bearish movement at least towards 1.1860 and 1.1770. Otherwise, the intermediate-outlook for the pair would remain bullish with the price level around 1.2000-1.1975 arcting as a solid Demand Zone to offer bullish SUPPORT for the EURUSD pair. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CHF Could This Be A Larger Rebound? Posted: 24 Dec 2020 06:24 AM PST USD/CHF is struggling to recover after a larger downside movement. The price is traded at the 0.8902 level and it could pass beyond the 0.8919 high soon. The pair has shown oversold signs lately, but it was premature to go long only based on a bullish divergence. The pair could grow in the upcoming weeks if a risk-on sentiment will dominate the markets. Otherwise, USD/CHF could drop deeper. The US has managed versus CHF even if the US data have come in mixed. USD/CHF Bullish Reversal!

Technically, the price has escaped from a minor down channel, falling wedge, after retesting the lower median line (LML) of the ascending pitchfork. I believe that a new higher high, bullish closure above 0.8919 could suggest buying with a potential upside target at the median line (ML). The short-term bias will be bullish as long USD/CHF stays above the lower median line (LML) of the ascending pitchfork. A drop under this line signals further drop.

Buy a bullish closure above the R2 (0.8921) with a potential upside target at the median line (ML), around the 0.9050 level. Sell a new lower low, drop under 0.8822 level. Dropping below the lower median line (LML) without reaching the median line (ML) represents a selling signal. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for GBP/USD for December 24 - 25, 2020 Posted: 24 Dec 2020 06:23 AM PST The optimism about Brexit continues to support GBP / USD giving bullish momentum and also giving it bullish strength in global equity markets and putting some downward pressure on USDX US dollar, which acts as a safe haven. The Irish Foreign Minister. Simon Coveney said there was a last minute problem related to language about fishing rights. This data prevented the British pound from exceeding its high of 1.3619 leaving a double top, on the other hand, the growing conviction of the market that a Brexit trade agreement will be announced in a few hours supports the prospects of a new bullish movement in the short term for the GBP / USD. On a technical level, on the 4-hour charts we note that the GBP / USD is trading above 7/8 Murray and slightly making a correction after double-toping at 1.3620. Since the market optimism is bullish, we should expect a correction to a new bullish wave, with targets at 1.3670 and 1.3790, strong resistance zone on 4-hour charts. The eagle indicator is showing an overbought signal, and has touched the 95 area, the British pound is most likely to fall back to take a new bullish momentum and break its monthly maximum of 1.3625. Our recommendation remains bullish for this pair, until the Brexit deal is finalized, so if you see it pull back to the 7/8 of 0f murray support at 1.3549, it would be a good point to buy with targets at 1.3620 and 1.3670 (8/8 murray). On the contrary, if the GBP / USD breaks the 1.3549 zone, and trades below that level, we should expect a rebound from the 21-period SMA around 1.3427, which also coincides with the 6/8 of Murray strong support.

Trading tip for GBP/USD for December 24 – 25 Buy if rebound 1.3550 (7/8) with take profit at 1.3620 and 1.3670 (8/8), Stop below 1.3510. Sell below 1.3540 (7/8 murray), with take profit at 1.3417 (6/8 and SMA 21), stop loss above 1.3575. Buy if rebound at 1.3427 (SMA 21), with take profit 1.3549 and 1.3670, stop loss below 1.3390. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for December 24,.2020 - Potential for the rise towards the resistance of the bracket Posted: 24 Dec 2020 05:24 AM PST Further Development

Analyzing the current trading chart of BTC, I found that BTC is trading in side of the well developed trading range between the price of $24,180 and $22,580. Stochastic oscillator looks like another bullish confirmation and potential to continue with the upside. Key Levels: Resistances: $24,180 Support level: $22,580 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Dec 2020 05:18 AM PST BOJ's Kuroda: Don't see need to change yield curve control in upcoming policy examination If there is room for improvement in making policy more effective and sustainable, we will put such steps into place

Much like what the ECB is doing with its strategic review, the BOJ will also undergo a thorough examination of its policy framework and release its findings in March next year. That said, I wouldn't expect any major change to follow - particularly since they have already expressed clearly their 'overshoot' commitment (similar to the Fed).

Further Development

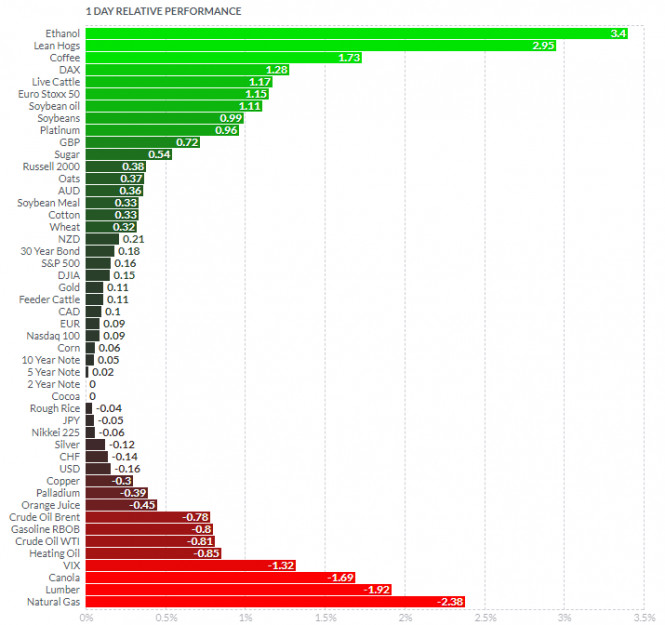

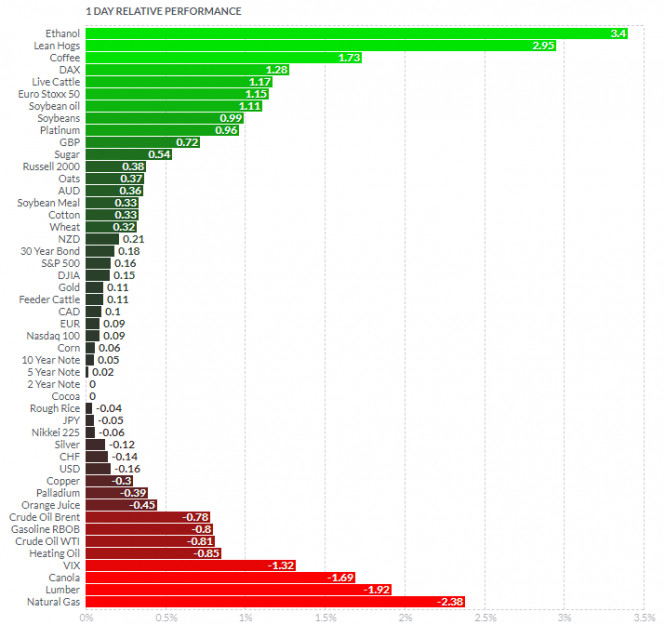

Analyzing the current trading chart of Gold, I found that there is the rising ttrendline active and potential for the bullish continuation as I wrote yesterday. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lean Hogs today and on the bottom Natural Gas and Lumber. Gold is slightly positive for today.... Key Levels: Resistances: $1,884 and $1,906 Support levels: $1,860 and $1,855 The material has been provided by InstaForex Company - www.instaforex.com |

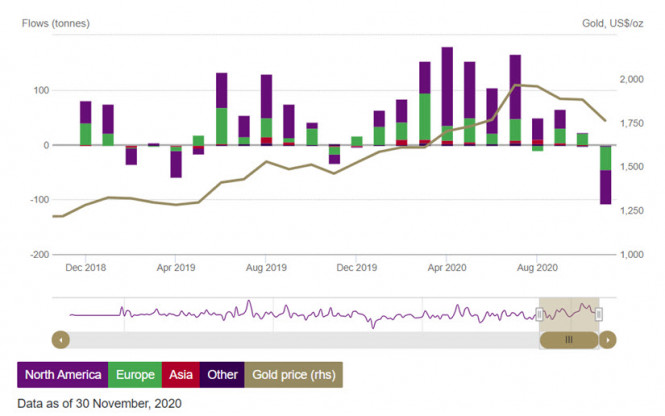

| Gold climbing ladder, facing downwards. Forecast for January 2021 Posted: 24 Dec 2020 05:13 AM PST Hi dear colleagues! In 2020, gold offers lucrative investment opportunities, so multi-year patience of investors has been eventually rewarded. The precious metal opened the 2020 year at $1,560 per troy ounce. It is finishing the year at near $1,900, thus bringing those who hold it in their portfolios a 20% profit in US dollars. Nevertheless, gold faced a challenge in the second half of the year. Having soared to $2,075 in August, the yellow metal plunged to $1,780 in December. Such a dynamic proves the market wisdom that trees do grow as high as the heaven and a trend retraces to its average values. What are prospects of gold for the next year? Let's try to figure it out for different time frames – for the short and medium term. I suggest that we find out levels to be carefully watched. To begin with, let's agree that we are going to appeal to facts but not emotions. A long-term investor who buys gold as a physical asset or who invests in an ETF can afford a mistake. Indeed, there is no big difference whether to buy gold at $1,900 or $1,800. On the other hand, a trader who works with leverage and pays a swap for every day of operating in the market cannot afford such mistakes. A trader will have to pay dearly for a pleasure of opening a position prematurely. Gold is denominated in US dollars. Therefore, monetary policy of the Federal Reserve is the key to understanding what's going on in the gold market. Nevertheless, it is not enough to open a position. The FOMC meeting, that was held last week, took a decision about an "eternal" QE program. It will go on until the US labor reached nearly full employment and consumer prices achieve stability at a target level set by the central bank. At first glance, it would be a good idea to buy gold and be happy. In fact, things are not so simple. Demand for gold is sensitive to a variety of factors. In the short term, it depends on sentiment of investors in exchange traded funds (ETFs) and traders in the futures market. Here comes the problem. In essence, market participants are unwilling to buy gold at the current prices. According to a survey by the World Gold Council, exchange traded funds with physical replication of the precious metal (gold ETF) logged a significant outflow of investments in November 2020. Picture 1 shows that last month investors rushed to withdraw their capital from gold. Amid massive selling, gold prices tumbled to a local low of $1,765. Even the weak US dollar could not support gold. It proves that despite the second COVID-19 pandemic wave, American and European investors are not keen on buying gold at the moment. Perhaps there are other options for fat profits. Picture 1: Capital flow of exchange traded funds with physical replication of gold In December, the situation improved a bit and gold regained footing from November lows. However, despite a positive signal to the precious metal market, the Fed's decision has not overcome the negative trend of the recent 4 months. In fact, the ongoing picture should be viewed as an upward correction following a decline in August – September. The situation in the futures market does not cheer up investors. Waning demand for gold is especially clearly seen through the open interest. Since August, the number of futures contracts decreased from 1.14 million to 773,000. In the next couples of weeks, demand revived and the open interest grew again. Speculators, who are the main buyers, added long positions. However, the question is still open whether it means a recovery of the gold prices. A short-term uptrend has not ruined yet the medium-term downtrend. Now the gold chart suggests growth in the long term, roughly for 1 year. The target level is expected at $2,250 per troy ounce. The medium-term for a period of 3 to 6 months supposes a decline towards $1,675 (picture 2). This trend lasts for 4 straight months. The short-term trend could lift the gold price to $1,937, though it is cannot be said for sure. By the way, of the gold price manages to close the month above the level of $1,900, it could mean the end of the medium-term downtrend and the beginning of a new upward wave. The target level is $2,065. Besides, the price is expected to set a new historic high following $2,250. It looks like Three Elder Screens (long-term growth, medium-term decline, and short-term growth). Still, this scenario could be implemented on condition the price closes the month above $1,900. Picture 2: Schemes of scenarios for gold development Those readers, who keep track of analytical reviews, can be irritated about different scenarios. "What the hell? Where will the price go eventually?" I understand this frustration. The future always has a few scenarios. I cannot predict the future. Nevertheless, being aware of the price developments, I can suggest that before the price moves to $2,069 and $2,225, it should break the orders of the downtrend channel and fix above the level of $1,900. Interestingly, after the gold price sank below this level in early November, it has never managed to close the week above it. So, make sure you watch carefully this key level. To sum up, we can conclude that at the moment the odds are that the gold price will decline to $1,700. There is a less likelihood that it will grow to $2,069. However, of gold closes the week and the month above $1,900, the situation changes for the opposite. Thus, traders willing to sell gold can open short positions setting a stop loss above $1,975. On the other hand, traders willing to buy gold would rather wait until the gold price climbs above $1,900. Then, they should consider buying opportunities, but not earlier. No one knows what will happen in the future. So, the essential skill of any trader is to follow the ongoing trend and manage a capital in such a way that an accidental event could not destroy a deposit. Be careful and cautious! Merry Christmas to all those who are celebrating today! The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for EUR/USD for December 24 - 25, 2020 Posted: 24 Dec 2020 05:10 AM PST The EUR / USD during the last days, remained within a range consolidating near the level of 1.22 zone of highs in years. The bullish momentum remains unchanged on daily charts, although it has lost bullish strength after failing to overcome 1.2270. The EUR / USD pair this morning of the American session, is trading within a symmetrical triangle, trading just below the 21-period SMA, and near the lower edge of the triangle, a break below 1.2070, we would expect a decline until the support of 1.2085, on the contrary, a break of the upper edge of the triangle, we could expect a boost to 1.2268. In 4-hour charts it shows that the pair remains consolidating in the triangle pattern, below the 21 SMA slightly bearish, the eagle indicator is showing bearish signal. Market liquidity is likely to decrease during these days, and we could see movements of a lot of volatility, so we must be careful. The EUR / USD pair is trading below the 8/8 murray which acts as a strong resistance, if the to remain below this level, there will most likely be a correction to the 1.2140 and 1.2085 area. (6/8 of murray). Our recommendation for today December 24 is to watch the area drawn in yellow on the 4-hour chart, if the pair is trading below that level of 1.2180, we could sell with targets at 1.2146, and if the downward pressure accompanies it up to the 1.2085 level. The market sentiment for this morning of December 24th is showing that there are 62% of traders that are selling the EUR / USD, this shows that we could see a slight drop to the support of 1.2085 in the short term.

Trading tip for EUR/USD for December 24 – 25 Sell below (SMA 21) around 1.2180, with take profit at 1.2146 (7/8 of murray) and 1.2085, stop loss above 1.2220. Buy above 1.2205 , with take profit at 1.2268 (+1/8 of murray) , stop loss below 1.2170. Buy if breaks above 1.2230, (triangle pattern), with take profit at 1.2270, stop los below 1.2200. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for December 24 2020 - Risin trendline and potential for the rally towards 1.2215 Posted: 24 Dec 2020 05:05 AM PST Brexit: Still waiting on a deal to be announced Not much else happening at this point as the UK and EU are still finalising a Brexit trade agreementNo change to the narrative besides some last-minute hitch to fisheries, but that will surely be resolved one way or another as the political will is certainly there. Both sides will want to get this out of the way before the Christmas break and hopefully before the evening today but there's no promises for how long this "delay" may be. The announcement is imminent and the pound is looking a little anxious, though thinner market conditions may also be a factor. Cable still sitting around 1.3585 after testing 1.3600 earlier, trading up by nearly 100 pips on the day currently. I'll stick around for a bit more in case there's anything but if not, I'd like to wish everyone a Merry Christmas and happy holidays! To those already off on an extended break, I wish you a very happy new year as well and may 2021 promise to be a better year! Further Development

Analyzing the current trading chart of EUR/USD, I found that there is the rising treeline active and potential for the bullish flag pattern to complete, which is sign for the further potential rise.... 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lean Hogs today and on the bottom Natural Gas and Lumber. EUR is slightly positive for today.... Key Levels: Resistance: 1,2215 and 1,2254 Support levels: 1,2173 and 1,2160 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Dec 2020 04:58 AM PST

BTC/USD moves sideways in the short term accumulating more energy before resuming its upwards movement. The price is traded far above the uptrend line, so the outlook is bullish, Bitcoin could continue to increase even if it has reached a fresh all-time high of 24,300. Moving sideways, BTC/USD tries to attract more buyers after the most recent aggressive growth. The rate has decreased a little only because there were traders and investors who decided to close their long positions.

The price could increase anytime again as long it stays above the uptrend line. Passing and stabilizing above 24,300 indicates further growth towards 25,000 psychological level or even higher. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold prices to hit $4,800. Is it possible? Posted: 24 Dec 2020 04:21 AM PST

Ronald Stoferle, the author of "In Gold we trust", estimates that gold will hit $4,800 per ounce within ten years. Gold will rise amid uncertainties in financial markets and financial assistance from states. Central banks continue printing a large amount of unsecured money to support the economy. As a result, government debts are soaring and an oversupply of liquidity may arise. A jump in gold prices to $4,800 by 2030 sounds unrealistic now. However, to reach this level, gold must advance by 10.1% annually. Thus, it seems quite real, such growth is quite achievable, the analyst believes. The expert also noted that due to the current situation, people have no confidence in the future. Investors are extremely restrained and cautious; the consumption of goods has decreased. However, news of a successful vaccination will gradually restore the economy and people's confidence. Moreover, huge liquidity may appear in the market. This may lead to a rapid rise in inflation. This, in turn, will support the rise in the price of gold. Currently, the yellow metal cannot break the level of $1,900 per ounce. However, experts advise not to rush to sell off your gold. Experts believe that in 2021, gold will surpass $2,000 per ounce. In their opinion, the governments of some countries will continue to stimulate the economy in 2021, as the situation is still difficult. Central banks are unlikely to raise interest rates, thus boosting gold and depreciating the US dollar. Today gold is trading at $1872.17.

|

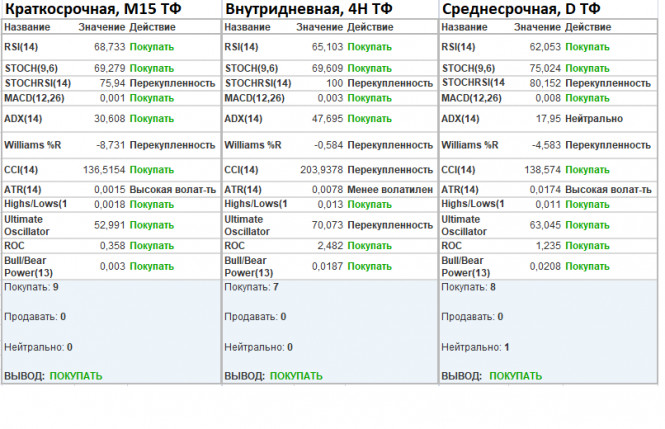

| Outlook for GBP/USD. Speculators price in news about trade agreement Posted: 24 Dec 2020 04:18 AM PST After 4.5 years of tense negotiations, politicians have almost reached the agreement. Yesterday, representatives of both parties said that the UK was ready to make further concessions to the European Union concerning the fisheries issue. According to the source familiar with the situation, Boris Johnson agreed that the share of fish caught by EU vessels in UK waters should decline by 25% in the following five years. Initially, the UK demanded a drop of 80% in just 3 years. Then, it proposed to cut the share by 30%, but the block opposed this idea. Boris Jonson's active participation in the talks allowed the politicians to solve the thorniest issues. Recently, the UK had to make concessions all the time. In fact, the deadline for a Brexit deal is just in seven days. Even if the parties manage to come to a consensus, the project should be ratified by the UK Parliament and the EU Parliament. They may not have enough time to do this. Notably, today is Christmas Eve. Germany has already gone on holidays and most other countries have a short day today. Tomorrow is an official holiday and markets will be closed. Thus, there is only one question: when they will ratify the deal? Yesterday, the pound sterling jumped by 1.5% amid expectations of a positive outcome of the Brexit talks. This is a significant jump even amid such high market activity. The price was hovering near the local high of the mid-term uptrend. This points to the fact that speculators do not take into account the fact that the British pound is overbought. They also almost ignore signs of pressure on the quote. Notably, the pair has been trading at the levels logged in 2018 for three weeks already. Significant changes may take place, if the price breaks the level of 1.4300. In this case, the quote will move to the levels logged in 2016. The pair may change the long-term trend. Curiously, the market has been under the influence of news flow for a long time already. Traders ignore such fundamental factors as the UK's deepest recession, virus-induced crisis, and a new strain of COVID-19. The trade agreement is extremely positive news. However, traders may soon realize that the pound sterling is significantly overbought. After that, the British currency may slump. Recently, the market dynamics has been above 100 pips. This week, volatility has exceeded 200 pips. At the moment, markets are looking forward to the press conference. Boris Johnson and Ursula von der Leyen are expected to unveil details of the deal. Since the beginning of the day, the pound sterling has advanced by more than 110 pips. If the deal is signed and ratified, the currency may continue gaining in value reaching the levels of 1.3650-1.3700. If the price consolidates above 1.3700 on the four-hour chart, it may hit the level of 1.4000 amid positive news flow. In any case, it is recommended to monitor fresh news about Brexit as any changes may lead to higher speculative activity. Positive news will boost the pound sterling whereas negative information may lead to its depreciation. To keep abreast of the latest news, you can read our Analytics section, or browse such websites as Bloomberg, Wall Street Journal, and Reuters. Indicator analysis Analyzing various time frames, we can see that technical indicators provide us with a buy signal due to a sharp rise. Volatility for the week/Measurement of volatility: month, quarter, year The volatility measurement reflects the average daily fluctuation calculated for a month/quarter/year. At the moment, dynamics is 115 pips. However, it is not the limit. Acceleration is still possible amid fresh news about the trade deal. Key levels Resistance levels: 1.3650**; 1.3850; 1.4000***; 1.4350**. Support levels: 1.3300**; 1.3000***; 1.2840/1.2860/1.2885; 1.2770**; 1.2620; 1.2500; 1.2350**; 1.2250; 1.2150**; 1.2000*** (1.1957). * Periodic level ** Range level ***Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/JPY Price Analysis for 24 December Posted: 24 Dec 2020 04:06 AM PST

The GBP/JPY cross built on the previous day's strong positive move and continued scaling higher through the first half of the European trading action and rallied further beyond the 141.00 mark to hit near four-month tops in the last hour. A combination of supporting factors assisted the cross to build on the overnight positive move and gain some strong follow-through traction for the second consecutive session on Thursday. A subsequent buying above the previous monthly swing highs, around the 140.70 region, might have already set the stage for additional gains for the GBP/JPY cross. The momentum seems strong enough to push the GBP/JPY cross further beyond the 141.00 mark, towards the 141.40 region. The bullish trajectory could get extended to September daily closing highs, around the 141.75-80 region en-route the 142.00 round-figure. On the flip side, any pullback below the 141.00 round figure mark is a buying opportunity . This, in turn, should help limit the downside near the key 140.00 psychological breakpoint might now be seen as a buying opportunity amid hopes for an imminent Brexit deal. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD price forecast for 24 December Posted: 24 Dec 2020 03:38 AM PST GBP/USD is trading close to 1.3600 amid Brexit optimism. The UK Parliament is said to approve a Brexit deal on Dec 30, according to media reports.

From a technical perspective, the momentum seems strong enough to push the pair further beyond the 1.3600 round figure mark, towards testing last week's swing highs, around the 1.3625 region. This coincides with the top end of a three-month-old ascending trend-channel, which if cleared decisively will awaken bullish traders. This should assist bulls to aim to reclaim the 1.3700 mark for the first time since May 2018. On the flip side, the key 1.3500 psychological mark might now supports the immediate downside. Bearish traders might now wait for sustained weakness below 1.3500. Any subsequent fall might now be seen as a buying opportunity. Failure to defend the mentioned support levels might prompt some technical selling and turn the pair vulnerable to slide back below the 1.3400 round-figure mark. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD Price Analysis for 24 December Posted: 24 Dec 2020 03:24 AM PST EUR/USD eases from highs, clinging onto the 1.2200 level. The bulls ride the Brexit optimism wave, with a potential breakthrough likely to be announced. The optimism is the key driver behind the US dollar's decline so far this Thursday.

From a technical perspective, the pair, so far, has managed to defend the weekly trend-line support, currently near the 1.2170 region. This is closely followed by 1.2130 which coincides with Monday's panic lows and should now act as a key pivotal point for short-term traders. A convincing break below will be seen as the first sign of bullish exhaustion and turn the pair vulnerable. Some follow-through selling below the 1.2100 mark and accelerate the fall further towards challenging the key 1.2000 psychological mark. On the flip side, the 1.2200 round-figure mark now seems to act as immediate resistance, above which the pair is likely to climb back to the 2020 High (1.2270) . Bulls might then wait for a sustained strength beyond the 1.2280 region, before positioning for any further gains to push the pair to the 1.2300 and next hurdle near the 1.2340 region. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold demonstrates a steady increase amid a weakening dollar Posted: 24 Dec 2020 03:22 AM PST Gold increased steadily this morning. In particular, when the US dollar declined amid optimism over the Brexit trade deal. Therefore, at the opening of trading in the New York Mercantile Exchange, the cost of February gold futures rose by 0.08% ($ 1.55) and reached $ 1879.65 per troy ounce, while March silver futures rose 0.11% and traded at $ 25.95 an ounce. March copper futures, meanwhile, rose 0.09% and reached $ 3.5490 a pound. As for the USD Index, which shows the ratio of the US dollar against other world currencies, price sank by 0.23%, reaching a value of $ 90.132. Clearly, demand for the dollar declined amid optimism on the Brexit trade deal. Yesterday night, it was reported that negotiations between the UK and the EU have entered the final stage, therefore, a deal may be concluded soon. Many media outlets suggested that the parties could sign an agreement as early as Thursday morning. In this regard, gold started to climb up in the market, resuming its sharp growth earlier, when traders resorted to the asset during the coronavirus crisis. But since COVID-19 incidence persists, traders should continue to monitor the situation, especially in the United States and Europe. According to the World Health Organization (WHO), the total number of infections in the world has reached 76.8 million, where the US accounts for almost 18 million, and India - another 10 million. In many European countries, the daily growth rate remains close to the peak record. Therefore, the only hope for investors is that the developed COVID-19 vaccines will be able to stop the pandemic and support global economic recovery. In another note, trading volume will be reduced on Thursday and Friday due to the Christmas holidays. So, on December 24, many markets will close earlier than usual, and on Friday, trading in the US and Europe, and on some Asian exchanges will not be held. The material has been provided by InstaForex Company - www.instaforex.com |

| UK and EU remained divided over issue on fishing Posted: 24 Dec 2020 02:59 AM PST

On Wednesday, the UK and the EU, while trying to strike a trade deal in time to avoid a violent split at the end of the year, remained divided over competition and fishing. Ireland said it is still possible to reach an agreement before the UK leaves the EU on December 31, 11 months after it officially left the bloc and entered the transition period, keeping it in the customs union and the European single market until the end of the year. But with a dizzying array of conflicting opinions coming from both sides, Britain has still not agreed to ease the pain of its departure, by maintaining access to the single market with zero tariffs and zero quotas. UK Housing Secretary Robert Jenrick told Sky News that "there is currently no progress in negotiations." In particular, Irish Prime Minister Michelle Martin said the deadlock is caused by the issue of fishing rights. The two parties still can not compromise on the production volume of EU fishing vessels in the UK waters, especially since Britain believes that its amount should be reduced, as well as specified, in the contract. Nonetheless, Martin said that given the progress that has been made, there should be an agreement soon. Failure to agree would deal a heavy blow to the economy. Therefore, UK Prime Minister Boris Johnson and European Commission President Ursula von der Leyen are in close contact and are expected to have another telephone conversation. UK said the negotiations remain "difficult" and highlighted differences. Meanwhile, the EU was more optimistic. In any case, Johnson said he would not sign any deal that would undermine UK's sovereignty. The failure of negotiations may draw applause from many Brexit supporters, however, it would also cause huge disruptions in merchandise trading, which accounts for half of the annual EU-UK trade, which amounts to nearly a trillion dollars. The scale of Brexit's possible disruption was highlighted when France closed its borders with the UK for 48 hours, when a new strain of coronavirus was discovered in the UK. During this time, thousands of European truckers found themselves stranded in the south of England, thereby disrupting food supplies. Martin said that if there is a positive breakthrough on Wednesday or Thursday, Europe could work on the text on Christmas Day. "I am still quite optimistic, but I don't have any news to tell you this morning," said Robert Jenrik."There is still a lot of disagreement over fishing or equal treatment." In terms of competition, EU leaders fear that following Brexit, the UK may loosen regulation to disrupt other markets and increase EU market share. And aside from competition, the parties are arguing about what and how much the EU can fish in UK waters. This speaks of the complete distrust of both parties in each other. EU chief negotiator, Michel Barnier said EU diplomats called the UK's latest proposal "completely unacceptable." The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments