Forex analysis review

Forex analysis review |

- EUR/USD: Dollar sets sail as euro bears losses, fearing ECB could disappoint markets

- EUR/USD. Euro ignores geopolitics and COVID-factors, dollar gradually gains momentum

- February 8, 2021 : EUR/USD daily technical review and trading opportunities.

- February 8, 2021 : EUR/USD Intraday technical analysis and trading plan.

- February 8, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

- EUR/USD sentiment could change

- Ethereum false breakout?

- Gold attracted by 1,834 resistance

- Can stablecoins and the Fed's digital dollar be on the same horizon and coexist?

- GBP/USD analysis on February 8. Inflation in the UK is going to be extinguished at the expense of the population.

- EUR/USD analysis on February 8. The market froze, there is no news

- Investments in the cryptocurrency and blockchain sector in Singapore increased more than 10 times

- Inflation is still raging in Ukraine

- GBP/USD hot forecast on 8 February

- EUR/USD critical analysis on 8 February

- Investors disappointed in profits - futures fall

- Bitcoin: Bearish market sentiment is declining

- Trading signals for EUR/USD on February 8-9, 2022: sell below 1.1420 (3/8 - 21 SMA)

- U.S. Premarket on February 8, 2022

- BTC analysis for February 08,.2022 - Watch for the breakout

- Bitcoin reached new local high, rebounded from important resistance area, which could provoke correction

- Analysis of Gold for February 08,.2022 - Potential for upside continuation

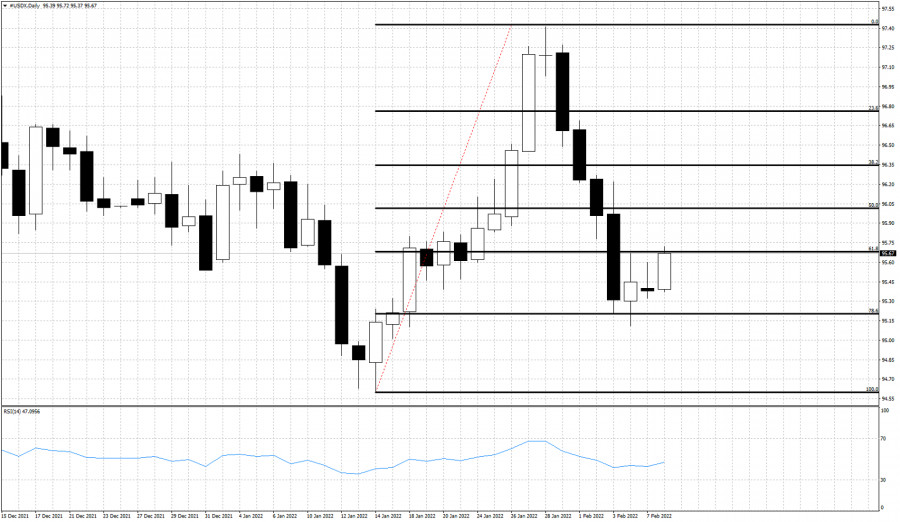

- Short-term view on the Dollar index.

- USD/CAD analysis for February 08, 2022 - Potential for bigger upside movement

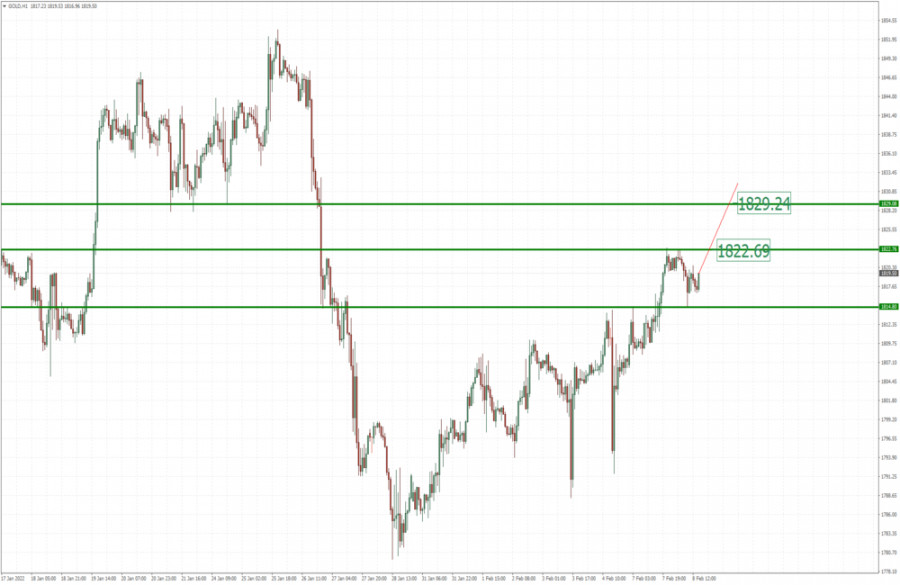

- Short-term view on Gold.

| EUR/USD: Dollar sets sail as euro bears losses, fearing ECB could disappoint markets Posted: 08 Feb 2022 01:24 PM PST

The EUR/USD pair remains at the mercy of expectations of how the differential of interest rates in the United States and the eurozone will change. The new rate expectations for both the Federal Reserve and the European Central Bank are setting the dollar and the euro against each other as to who will prevail. It is still difficult to say how the tug of war between these two forces will end. After the January ECB meeting, the EUR/USD pair was squeezed in a narrow range of 1.1400-1.1500. A breakdown of the lower boundary of this range may lead to a return to this year's lows in the region of 1.1120, while a breakthrough of the upper boundary will open the way to 1.1600. So far, the 1.1480 mark still acts as a kind of ceiling for EUR/USD. Having reached a 3-week peak near this mark on Friday, the pair was forced to retreat. Nevertheless, following the results of the last five days, the single currency strengthened against the US dollar by more than 2.5%, demonstrating the best week since March 2020. These successes were caused by a hawkish reversal on the part of the ECB. Pointing to rising inflation risks, the ECB last week opened the door to an interest rate hike later in 2022 and said the March 10 meeting would be essential to deciding how quickly the central bank would wind down its long-term bond-buying scheme, which is the cornerstone of its monetary stimulus efforts.

"The ECB found a hawk inside itself and joined many other central banks, hinting at tightening monetary policy in the future. We think that the prospects for inflation remain very uncertain, but we conclude that market pricing has become too tight," Nordea strategists noted. Deutsche Bank closed its recommendation to be in short positions on the euro and recommended clients to open a long position on EUR/USD on Thursday after ECB President Christine Lagarde acknowledged the growing inflation risks and refused to repeat the previous forecast that an interest rate hike this year is extremely unlikely. "In her comments, Lagarde clearly outlined a turn from a slow calendar forecast to something much more active," Deutsche Bank analysts said. "In fact, this confirms the release of the European interest rate curve this year and turns the European Central Bank into a living central bank," they added. The bank predicts that the ECB will raise the deposit rate, which currently stands at -0.5%, by a quarter of a percentage point in September and December, as a result of which it will be reset for the first time since 2014. Morgan Stanley experts also changed their EUR sentiment to bullish after the January ECB meeting and recommend long positions on the euro against the US dollar. "It seems that rising inflation expectations have caused unanimous concern among all members of the ECB Governing Council about inflation. It is increasingly likely that the central bank will implement a hawkish correction of the current exchange rate at the March monetary policy meeting," they said. However, not everyone is convinced of the ECB's hawkish bias. "We do not believe that the ECB is preparing for a sudden acceleration of tightening. We still believe that the Fed is on the way to significantly outperform its European counterpart by supporting the dollar," UBS Global Wealth Management analysts said. They expect the euro to fall to $1.10 by the end of the year. The employment report published on Friday in the United States, which turned out to be unexpectedly strong, returned traders' attention to the policy of the US central bank and helped the greenback to get rid of downward pressure.

Many analysts predicted that the American economy actually lost jobs last month amid a record increase in the number of cases of COVID-19. However, the data released at the end of last week showed that 467,000 jobs were created in the non-agricultural sector of the United States in January. "The surprisingly strong US employment report for January provided some support to the dollar and reminded us that the Fed is probably still at the head of the hawkish reassessment of central bank policies conducted around the world," ING analysts noted. On Monday, the greenback managed to maintain stability against other currencies, which did not allow the EUR/USD pair to restore the positions lost on Friday. The day before, it continued to retreat from 3-month peaks and ended yesterday's trading in negative territory near 1.1435. The statistics on Germany released on Monday did not add optimism to fans of the single currency. Thus, in December, the volume of industrial production in the country decreased by 0.3% compared to the previous month, while analysts expected an increase of 0.4%. The weakening of the euro was also facilitated by the comments that Lagarde recently made. She once again acknowledged that inflation risks in the eurozone are growing, but at the same time expressed hope that additional price pressure may still ease before it takes root in expectations.

"We should keep in mind that demand conditions in the euro area do not show the same signs of overheating that can be observed in other major economies. There is no need for a significant tightening of monetary policy in the eurozone, since inflation will slow down and may stabilize at about 2%," Lagarde said. She also noted that the ECB will not raise the interest rate until the end of purchases of net assets. "There is a certain sequence between the end of our net asset purchases and the start date of the rate hike, which will not occur until our net asset purchases are completed," Lagarde said. "Any adjustment of our policy will be gradual," she added. In order to raise the key rate in September, the ECB will need to complete quantitative easing earlier than planned, and until then investors can refrain from introducing aggressive policy tightening into quotes. In addition, if inflation starts to decline as supply chains recover and commodity markets cool, a rapid rate hike could be counterproductive. As a result, policy may suddenly turn out to be too tight, as happened with the ECB a decade ago. The ECB is also in no hurry to rush anywhere because the inflationary threat is hardly worse than the debt crisis, the ghost of which has been hovering over the eurozone for ten years since the Greek default, and which can be easily awakened again by abandoning the zero-interest policy. If last week the head of the ECB sent the ball in a positive direction for the euro, this week she has already tried to cool expectations about the hawkish turn of the central bank. Now the focus is shifting to US inflation, which the market will use to determine whether the Fed rate will rise by 25 basis points or 50 basis points next month. "The publication of the CPI report for January in the US is the main event this week. The consensus indicates an overall level of 7.3% with an increase in base prices to 5.9%," Nordea strategists said.

The futures market estimates the probability of raising the federal funds rate by 50 basis points in March by almost 1 to 3, and the CPI value at the highest level in four decades will increase this probability, which will provide even greater support to the dollar. Despite the sharp weakening of the greenback last week, it remains in a growing trend that originates from the lows of May 2021. As a rule, the momentum of the US currency's growth towards its main competitors weakens when several months pass after the Fed's key rate hike. Then it becomes clear that other central banks have already reached the same rate of interest rate increases, and are often even ready to act more decisively. However, we are not in this phase yet, and the monetary policy of the Fed, as well as US economic indicators, provide the dollar with a head start for growth in the near future. Based on this, the recent high on the USD index is not final. There is a possibility that the greenback will rise to the area of 100-103 by the middle of the year. "Eventually, investors will realize that in the coming months, interest rates in the United States will rise much more than in the eurozone," UniCredit analysts noted. While money markets forecast a cumulative Fed rate hike of as much as 134 basis points over the remainder of 2022, they expect the ECB to raise rates by 50 basis points over the same period. Scotiabank believes that the EUR/USD pair will fall to 1.1000 as soon as it becomes clear that the ECB will only slightly raise rates in 2022. "We believe that the ECB may disappoint markets expecting a 50 basis point rate hike this year. Therefore, we see the risk that the euro will turn around to $1.10 as soon as it becomes clear that the ECB will only slightly raise the rate in 2022, if at all," they said. On Tuesday, the EUR/USD pair declined for the second consecutive day - in the direction of the key support level at 1.1400. The greenback is strengthening ahead of the publication of US inflation data, which will be released later this week. The yield of 10-year treasuries is growing towards 2% today, helping the dollar to find demand. The US currency may extend the rebound if the yield of the "ten-year" rises above this level, which will put additional pressure on EUR/USD. If the pair breaks below the psychologically important level of 1.1400, the next target of the bears will be 1.1350, and then 1.1305. On the other hand, the resistance is located at 1.1480, and further - at 1.1500 and 1.1550. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Euro ignores geopolitics and COVID-factors, dollar gradually gains momentum Posted: 08 Feb 2022 01:24 PM PST The EUR/USD pair is gradually approaching the 13th figure, showing a decline for the second consecutive day. This dynamic is due to the growth of the US dollar index, which in turn reacts to the growth of the yield of treasuries. In general, the demand for the US currency is dictated by the strengthening of hawkish sentiment regarding the Federal Reserve's further actions. The rather strong January Nonfarm rates and the projected increase in inflation in the US suggest that the Fed will raise the interest rate at a very aggressive pace. In particular, there are rumors on the market again that the central bank will decide on a 50-point increase in March.

On the one hand, such hawkish assumptions may well bring down the greenback, if in the end it turns out that the Fed is more peaceful. Inflated market expectations are fraught with strong disappointment. But on the other hand, following the results of the January meeting, the US central bank was even able to "exceed the plan" by allowing an increase in the interest rate at literally every meeting. Therefore, at the moment, no options, even the most hawkish ones, can be excluded. And especially if the release of data on CPI growth in the United States comes out in the green zone. It is noteworthy that the single currency is getting cheaper not only in pairs with the dollar, but also in many crosses – in particular, we are talking about such pairs as EUR/GBP and EUR/CHF. The euro is losing ground despite some fundamental factors that could theoretically have the opposite effect. For example, traders ignored the results of yesterday's meeting between the French and Russian presidents. Emmanuel Macron held almost six-hour talks with Vladimir Putin. At a joint press conference, the French leader said that he had offered the Kremlin "certain steps towards", which would probably allow finding a diplomatic solution to the geopolitical conflict. It is not known for sure what it is about, but in general, the parties stated that they managed to find "points of contact". According to the AFP news agency, Macron's proposals include the commitment of the parties not to start military operations, the beginning of a new strategic dialogue and the revival of efforts to resolve the situation in the Donbas. The European currency ignored the results of the meeting. Traders also ignored the "coronavirus reports". So, despite the hegemony of Omicron, the Director of the Regional Office for Europe of the World Health Organization recently said that Europe will soon face a "long period of rest" in the fight against the pandemic. According to him, this is due to a combination of several factors – the arrival of spring, the high level of vaccination of the population and the relative "softness" of the new strain. Moreover, many European countries have already announced a significant easing of quarantine restrictions. In particular, Denmark became the first EU country to announce the complete abolition of COVID restrictions. Sweden and the Czech Republic have also weakened the quarantine as much as possible. By the way, the Czechs announced their decision on the same day when they broke the daily record for the incidence of coronavirus. Officials explained this by the fact that despite the increase in morbidity, the number of hospitalizations in the country has not increased. The fact that EUR/USD traders have completely abstracted from European events suggests that the euro will follow the dollar in the foreseeable future. The optimism of market participants regarding the "hawkishness" of European Central Bank President Christine Lagarde evaporated, since this hawkishness actually did not exist: Lagarde at her press conference only did not refute the relevant assumptions. The unreasonable euphoria about this quickly and naturally faded away. The ECB is still accumulating liquidity and keeping rates at the current level. The possible steps of the central bank towards normalization/tightening of monetary policy are currently hypothetical. Meanwhile, the US Fed has clearly and unambiguously outlined its line: a guaranteed rate hike in March, further tightening of monetary policy, and the winding down of the balance sheet. The prevailing fundamental background did not allow EUR/USD bulls to test the area of the 15th figure. The macroeconomic calendar for the pair is almost empty this week (with the exception of the US inflation release), and the euro ignores all other fundamental factors (geopolitics, coronavirus reports). It can be assumed that on the eve of the US inflation report, the dollar will continue to gain momentum, storming the 13th figure. If the main components of the release come out in the green zone, EUR/USD bears may swing to the nearest support level of 1.1330, which corresponds to the average line of the Bollinger Bands indicator on the D1 timeframe. It is advisable to go into short positions when overcoming the 1.1400 mark – today, throughout the day, bears are circling around this target, but they cannot break through it. Therefore, short positions will be relevant only when bears do push through this price barrier. The material has been provided by InstaForex Company - www.instaforex.com |

| February 8, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 08 Feb 2022 12:15 PM PST

During the past few weeks, the EURUSD pair has been trapped within a consolidation range between the price levels of 1.1700 and 1.1900. In late September, Re-closure below the price level of 1.1700 has initiated another downside movement towards 1.1540. Price levels around 1.1700 managed to hold prices for a short period of time before another price decline towards 1.1200. Since then, the EURUSD has been moving-up within the depicted movement channel until bearish breakout occurred by the end of last week's consolidations. Last week, the price zone of 1.1350 failed to offer sufficient bearish rejection that's why it was bypassed. On the other hand, the price zone around 1.1500 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon the current ascending movement. The material has been provided by InstaForex Company - www.instaforex.com |

| February 8, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 08 Feb 2022 12:13 PM PST

The bullish swing that originated around 1.1650 in August, failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was reached. Shortly after, significant bullish recovery has originated upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which stood as an Intraday Support zone. Hence, sideway movement was demonstrated until quick bearish decline occurred towards 1.1200. Please note that the current bullish movement above 1.1300-1.1350 should be considered as an early exit signal to offset any SELL trades. On the other hand, the price levels around 1.1520 remain a reference zone that can provide a valid SELL Entry when the recent bullish momentum vanishes. The material has been provided by InstaForex Company - www.instaforex.com |

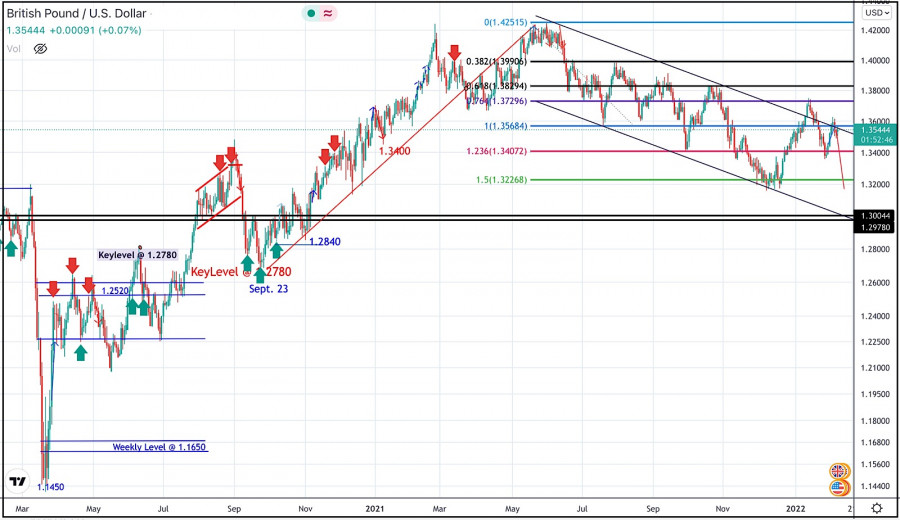

| February 8, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 08 Feb 2022 12:12 PM PST

The GBPUSD pair has been moving within the depicted bearish channel since July. Bearish extension took place towards 1.3220 where the lower limit of the current movement channel came to meet with Fibonacci level. Conservative traders should have taken BUY trades around 1.3200 price levels as suggested in previous articles. Recent bullish breakout off the depicted bearish channel has occurred few days ago. However, BUYERS were watching the price levels of 1.3730 to have some profits off their trades. Moreover, the price level of 1.3720 stood as a key-resistance which offered bearish rejection on last Thursday. Shortly after, the short-term outlook turned bearish when bearish decline below 1.3570 occurred earlier last week. As mentioned before, bearish decline below 1.3570 enhanced the bearish side of the market towards 1.3400 which brought the pair back towards 1.3570 for retesting. Moreover, the current bullish pullback towards 1.3570 should be considered for SELL trades as it corresponds to the upper limit of the ongoing bearish channel. The material has been provided by InstaForex Company - www.instaforex.com |

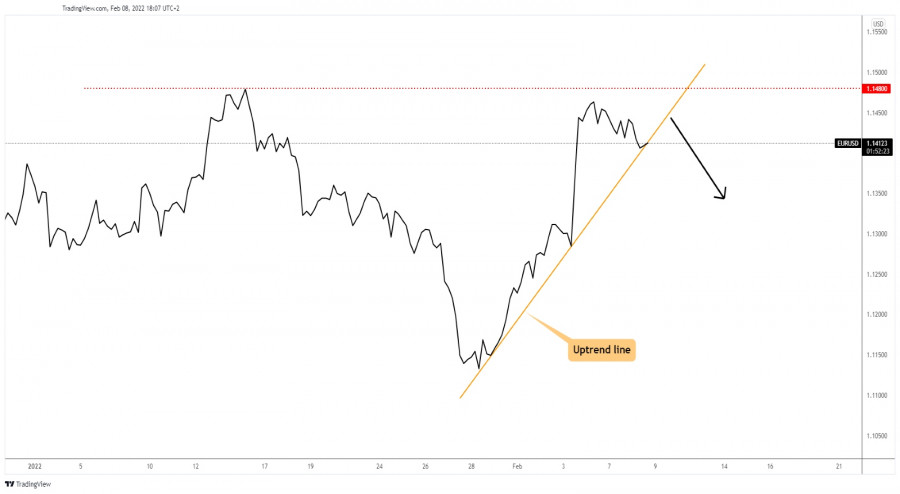

| EUR/USD sentiment could change Posted: 08 Feb 2022 10:14 AM PST

EUR/USD buyers could be exhaustedThe EUR/USD pair is likely to drop in the short term. It was traded at 1.1412 at the time of writing. As you can see on the h4 chart, the price challenges the uptrend line which represents a dynamic obstacle. If it stays above it, EUR/USD could resume its growth. The 1.1480 higher high is seen as an upside obstacle. Technically, dropping below the uptrend line and staying below the 1.1480 could announce that the upside movement ended. In my opinion, staying above the uptrend line and passing above the 1.1480 could signal an upside continuation. EUR/USD trading conclusionDropping below the uptrend line may announce that we may have a fresh downside movement. This scenario may bring selling opportunities as the EUR/USD's growth is likely to be over. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Feb 2022 10:13 AM PST Ethereum was trading in the red at the 3,052.46 level at the time of writing. After its amazing rally, a temporary decline is natural. Still, the retreat may be only a temporary one. It can only test and retest the immediate support levels before resuming its growth. ETH/USD drops following the price of Bitcoin. Also, BTC/USD's retreat may be only a temporary one. Ethereum dropped by 6.14% from today's high of 3,234.67 to the 3,036.11 daily low. ETH/USD up channel

As you can see on the h4 chart, the price jumped above the downtrend line, above the down channel's upside line but it has failed to stay near today's high. Now, it challenges the downtrend line. Staying above it may signal that ETH/USD could resume its growth after a temporary retreat. Technically, ETH/USD is located within an up channel. In my opinion, as long as it stays above the uptrend line, the bias will remain bullish in the short term. ETH/USD predictionA valid breakout above the downtrend line could announce a potential upside reversal. Testing and retesting the downtrend line and staying above the uptrend line could bring new long opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold attracted by 1,834 resistance Posted: 08 Feb 2022 10:10 AM PST Gold extends its growth as the Dollar Index remains sluggish. The yellow metal reached the level of 1,828.40 today registering a new high. Still, it remains to see if this will be larger growth or only a temporary rebound. In the short term, the bias is bullish, so it could approach and reach new upside obstacles. Surprisingly or not, XAU/USD rallied despite the fact that the US Trade Balance came in better than expected. The indicator was reported at -80.7B points above -83.0B expected. Gold rebounded ahead of the US inflation data. The CPI and Core CPI indicators will be released on Thursday. XAU/USD edges higher

Gold extended its growth after taking out the resistance represented by the weekly R1 (1,820.00). The next upside target is represented by the Ascending Pitchfork's median line (ml). Also, the weekly R2 (1,832.11) and the 1,834.19 are seen as upside obstacles as well. A valid breakout above these upside obstacles could confirm an upside continuation and could bring new long signals. On the contrary, false breakouts or a strong bearish pattern could announce a new leg down. Gold forecastXAU/USD could confirm a potential further growth towards the Ascending Pitchfork's upper median line (uml) only if it jumps and stabilizes above the median line (ml) and above the 1,834.19. The material has been provided by InstaForex Company - www.instaforex.com |

| Can stablecoins and the Fed's digital dollar be on the same horizon and coexist? Posted: 08 Feb 2022 10:03 AM PST

Senator Patrick Toomey and Fed Chairman Jerome Powell raised a really important question. Can stablecoins and the Fed's digital dollar be on the same horizon and coexist? The senator is not sure about the purpose of using stablecoins or the same traditional retail banks, especially for a long time. He also believes that the digital dollar can replace fiat in commercial banks in the future. Senator Toomey is sure that if Congress at the legislative level, as well as the Fed, put the digital dollar into use, it will lead to an extraordinary furore and people will refuse to use stablecoins, and over time they may become irrelevant at all. Eswar Prasad, professor of economics at Cornell University, is confident that the digital dollar will not be able to coexist. If the digital US dollar is available in everyday use and covers all the needs of Americans, then they will not use stablecoins. Although he noticed that stablecoins, which are issued by giant companies, may still be in demand, especially among users of these corporations. The digital dollar and stablecoins will be used. Stablecoins can be in great demand for conducting transactions on the Internet and withdrawing cryptocurrencies to them. Many critics believe that stablecoins can cause trouble for the US economy and be a threat to monetary policy. However, experts parry this judgment, they are sure that stablecoins are pegged to the dollar and are completely legal. Unlike the digital dollar, stablecoins are already very progressive and they really focus their attention on technological aspects, allow for the conversion of cryptocurrencies into stablecoins, and are also intermediaries between crypto exchange traders. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Feb 2022 09:45 AM PST

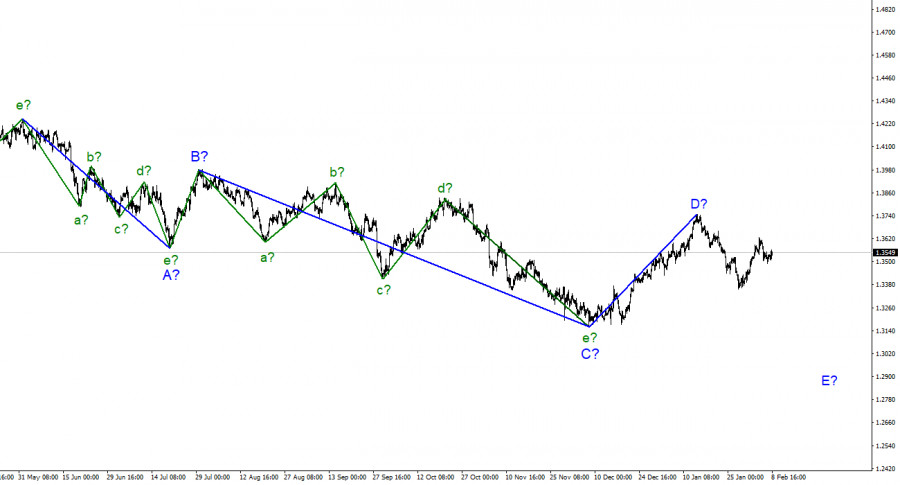

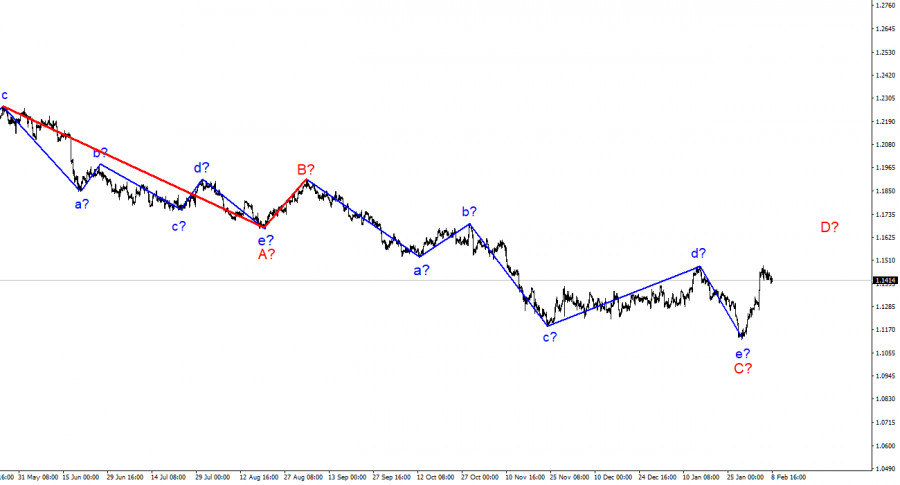

For the pound/dollar instrument, the wave markup continues to look very convincing. In the last few weeks, the instrument has been at the stage of building a new downward wave, which is currently interpreted as wave E of the downward trend segment. All last week, the increase continued, which can be interpreted as a wave b-E. If the current wave marking is correct, then the decline of the instrument has already resumed last Friday and the construction of wave c-E has begun. The instrument did not reach the level of 1.3643 just a little, so there was no signal to sell. Nevertheless, the wave marking is now quite eloquent. The proposed wave E can turn out to be very long, also five-wave, like the previous descending waves. If this is indeed the case, then the instrument can drop much lower than the 30 figure. As you can see, the increase in the interest rate by the Bank of England last week did not help the British to move to the construction of a new upward trend section. Andrew Bailey: It hurts, but we need to get through it as quickly as possible. The exchange rate of the pound/dollar instrument increased by 10 basis points during February 8, but in general, it has been trading almost horizontally for the last two days. The construction of a new downward wave has begun, but now the wave marking is such that it may require adjustments if something goes wrong. This week, hardly anything can go wrong, but there may be surprises. The most important report on inflation in the US should cause an increase in demand for the dollar, therefore, the downward wave should continue its construction. British statistics on Friday are unlikely to be able to reverse the trend. All the political twists and turns that Boris Johnson found himself in and which may lead to his resignation, it's interesting, but no more. At the same time, the governor of the Bank of England, Andrew Bailey, urged Britons to put up with the fall in real incomes and said that this is necessary to reduce inflation. He said that UK workers should not ask for a wage increase, but at the same time noted that the Bank of England understands that the real incomes of Britons may decrease by 2% in 2022. This could be the country's worst drop in living standards since 1990. Wages are now growing by an average of 5%, while inflation this year may reach 7%. Andrew Bailey said he understands the pain of British workers but calls for "help to survive this problem." According to Bailey, inflation will not be stopped only by raising the interest rate. The demand must decrease slightly, which can be achieved due to a lower rate of wage growth compared to price growth. I would also like to note that the Bank of England has already raised the rate twice and intends to do it two more times at least this year. General conclusions. The wave pattern of the pound/dollar instrument assumes the construction of an assumed E wave. At the moment, the construction of a downward wave has begun, because the sales of the British now look more promising. The wave marking does not allow for double interpretation yet. The instrument may once again return to the 1.3640 mark to build three waves inside b-E, but this is unlikely. As well as a successful breakout attempt of 1.3640. Therefore, I advise selling now with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci, for each MACD signal "down".

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend segment. The material has been provided by InstaForex Company - www.instaforex.com |

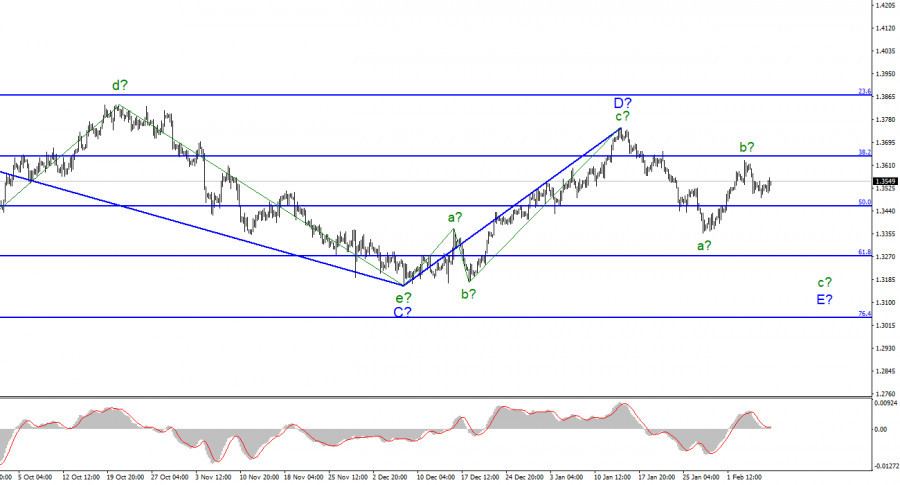

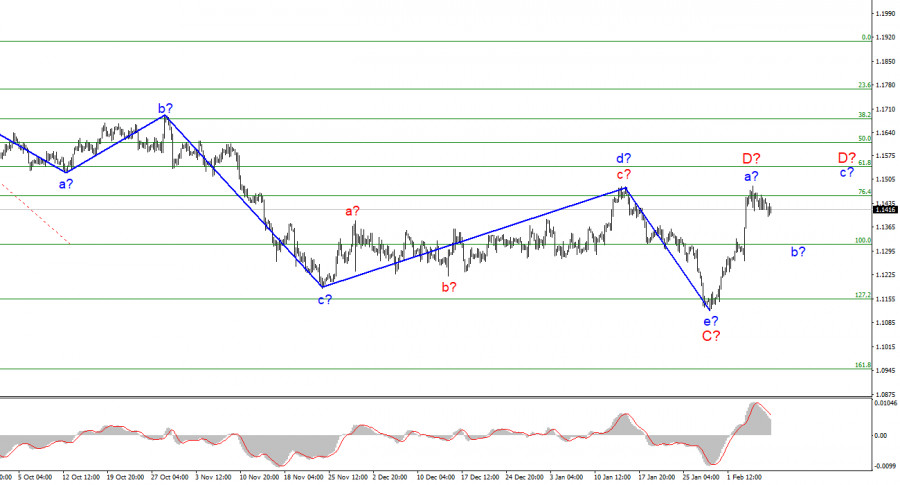

| EUR/USD analysis on February 8. The market froze, there is no news Posted: 08 Feb 2022 09:29 AM PST

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes, but nothing drastic. In the last week, a fairly strong increase in quotes continued. Thus, wave e-C is recognized as completed, since it turned out to be about the same size as the previous wave d-C. Therefore, the current upward wave is either D or 1. In the first case, the increase in the euro currency may already be completed. The picture below clearly shows that the correction wave B turned out to be shortened. The same can happen with wave D. An unsuccessful attempt to break through the 1.1455 mark, which corresponds to 76.4% Fibonacci, may become the second in recent weeks and lead to a departure of quotes from the reached highs, as well as to the end of the current wave. Thus, the wave marking now indicates a decline in quotes. And depending on how strong this decline will be, it will be possible to talk about which wave is being built now. The proposed wave D may turn out to be three-wave, but for now, this option looks like a backup. The market can only wait for the US inflation report The euro/dollar instrument fell by 30 basis points on Tuesday. Market activity remains very weak. The instrument continues its unhurried departure from the previously reached highs. Since the news background is now almost completely absent, the weak activity of the market does not raise any questions. In this case, if the market does not find reasons to trade more actively, it remains only to rely on those economic events that will take place this week. And the list here, I must say, is small. On Thursday, the US will release an inflation report for January. And perhaps that's all. I don't take into account those reports that the market reacts to once a year. But what can we expect from the inflation report? Forecasts suggest that this indicator will continue to grow and will amount to 7.3% y/y by the end of January. How will this affect the demand for the dollar? I believe that the only thing that can be expected with such a value of the indicator is a new increase in the US currency. There are two reasons for this. First, the wave markup now implies an increase in the dollar. Second, rising inflation will mean that the Fed will have to act even faster and even more aggressively in changing the parameters of monetary policy. The more inflation rises, the more difficult and longer it will be to bring it back to 2%, which is the "target" for the Fed. Therefore, I expect a slight decline in the instrument until Thursday, and on Thursday it may intensify. What will happen next largely depends on a successful or unsuccessful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci. General conclusions Based on the analysis, I conclude that the construction of the ascending wave C is completed. However, wave D may already be completed too. If so, now is a good time to sell the European currency. At least with a target located near the 1.1314 mark. Another upward wave can be built inside wave D. And if the current wave is recognized not as D, but as 1 as part of a new upward trend segment, then a new upward wave is guaranteed to go beyond the peak of February 4. Thus, now cautious sales are ready for new purchases.

On a larger scale, it can be seen that the construction of the proposed wave D has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and were approximately the same size, the same can be expected from the current wave. There are reasons to assume that wave D has already been completed, but a further increase in quotes will force us to reconsider this assumption. The material has been provided by InstaForex Company - www.instaforex.com |

| Investments in the cryptocurrency and blockchain sector in Singapore increased more than 10 times Posted: 08 Feb 2022 08:32 AM PST In 2021, investments in the cryptocurrency and blockchain sector in Singapore increased more than 10 times, setting a new record. Such data strengthens the status of the city-state as a crypto hub, even though it is still afraid of speculative digital assets.

According to the KPMG Pulse of Fintech report published on Tuesday, less than a hundred deals worth $1.48 billion were concluded last year. This significantly exceeds the results of 2020 in the amount of $ 110 million. Investors expect cryptocurrency investment in Singapore to remain high this year, even as authorities step up oversight. So, one of the many steps that caused concern in the industry was the government ban on crypto companies to refrain from advertising their services to the public. Already in January 2022, Singapore shut down crypto machines installed in public places. In general, the licensing process for permits to conduct a regulated cryptocurrency business in Singapore shows that most applicants intend to continue the development of the crypto business and would like more favorable conditions from the financial regulator. "Cryptocurrencies and blockchain are expected to remain very attractive areas for investment in 2022, and more and more crypto firms are turning to regulators for clear guidance on activities to promote the development and development of this space," said Singapore-based financial technology analyst Anton Ruddenklau. According to the report, most of the transactions with cryptocurrency and blockchain last year were aimed at software and basic infrastructure, not services. According to the report, this sector accounts for a third of total investments in Singapore's fintech industry, which reached a five-year high of $3.94 billion. Despite some bans by the authorities, Singapore is still leading the list of countries attractive to investors in tokens. Only in the third quarter of 2021, Singapore moves from third place to first. In terms of the share of the population owning cryptocurrencies, Singapore is in second place in the world. Of course, the drop in quotes can change the view of the authorities on the use of blockchain technology, but so far this small country still attracts many large crypto investors with both the tax regime and financial services. The material has been provided by InstaForex Company - www.instaforex.com |

| Inflation is still raging in Ukraine Posted: 08 Feb 2022 08:32 AM PST Inflation in Ukraine slowed only slightly in January - to 9.9%, as concerns about a military attack by Russia led not only to a depreciation of the hryvnia but also pressure on prices. The situation was not saved even by another increase in the interest rate. Inflation is still raging in Ukraine The annexation of Crimea in 2014 and the conflict in the east of the country turned out to be far from the last chapters in the complex history of relations between Russia and Ukraine. So, in recent weeks, Russia, according to Western analysts, has concentrated more than 100,000 troops at the Ukrainian border. Moscow denies that it is planning a further invasion. However, investors do not risk capital investments, preferring other currencies to the hryvnia. The median estimate of inflation in January from Ukrainian analysts from banks and brokerage companies was 9.9%, according to the survey, compared with 10% in December. "We expect it to decrease slightly in January," said Sergey Kolodiy from Raiffeisen Bank's Ukrainian subsidiary. "A particular risk for inflation is the devaluation of the hryvnia in the second half of January, mainly caused by geopolitical tensions," Kolodiy said. Indeed, the hryvnia has already lost about 5% against the US dollar in January, falling to 29/$1 for the first time since February 2015. This almost nullified the efforts of the central bank to curb price growth. Thus, as part of the fight against inflation, the National Bank of Ukraine in January raised the key interest rate by another percentage point - up to 10%. And this is another increase after the previous five in 2021 to combat inflation, which in September reached a three-year high of 11%. Nevertheless, analysts do not expect a further weakening of the hryvnia, which strengthened somewhat in early February and returned to the level of 28/$ 1. The median forecast in the survey shows the hryvnia at the level of 27.8/$1 at the end of February. "Russia's less aggressive rhetoric and significant NBU interventions have played in favor of the local currency," analysts say. Of course, while tensions remain at the borders, the hryvnia is under severe pressure. However, as soon as the conflict is resolved, Ukraine's economy may enter the Renaissance. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD hot forecast on 8 February Posted: 08 Feb 2022 07:39 AM PST

GBP/USD rose above 1.3550 on Tuesday but lost its traction in the early trading hours of the NA session. The greenback holds its ground against its rivals after the data from the US showed that the trade deficit widened to $101,4 billion in December. GBP/USD is moving up and down near the 100-period and 200-period SMAs on the four-hour chart. Additionally, the lack of directional strength is mirrored by the Relative Strength Index (RSI) indicator on the same chart, which continues to move sideways near 50. On the downside, 1.3520 (Fibonacci 38.2% retracement level of the latest uptrend) aligns as interim support before 1.3500 (psychological level, 50-period SMA, Fibonacci 50% retracement). In case a four-hour candle closes below the latter, the pair could stretch lower toward 1.3460 (Fibonacci 61.8% retracement). In order to regain its bullish momentum and target 1.3600 (psychological level), the pair needs to rise above 1.3560 (Fibonacci 23.6% retracement) and starts using that level as support. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD critical analysis on 8 February Posted: 08 Feb 2022 07:38 AM PST

EUR/USD recovered modestly ahead of the American session on Tuesday but seems to be having a difficult time gathering bullish momentum. With the 10-year US Treasury bond yield rising to 1.95%, the US Dollar Index is clinging to modest gains above 95.60 and weighing on EUR/USD. From a technical point of view, the latest EUR/USD slide seems corrective, as the pair met near-term buyers around the 23.6% retracement of its 1.1154/1.1483 rally at 1.1397. Technical readings in the daily chart suggest that the pair is losing bullish momentum but is still far from turning bearish. EUR/USD is still stuck around a mildly bearish 100 SMA, while above the 20 SMA, which converges with the next Fibonacci level at 1.1340. Meanwhile, technical indicators have turned marginally lower within positive levels. The near-term picture, however, hints at mounting bearish pressure. The pair has broken below its 20 SMA, which now provides intraday resistance, as technical indicators slide, the Momentum already within negative levels, and the RSI currently at around 53. A break through the daily low should favor a bearish extension toward the 1.1300 region, while further declines could extend to 1.1260, the 61.8% retracement of the aforementioned advance. Support levels: 1.1395 1.1340 1.1305 Resistance levels: 1.1440 1.1485 1.1520 The material has been provided by InstaForex Company - www.instaforex.com |

| Investors disappointed in profits - futures fall Posted: 08 Feb 2022 07:26 AM PST US stock index futures moved down Tuesday after several companies' disappointing quarterly reports. Investors are looking forward to this week's inflation data to make further predictions on interest rate dynamics. Pfizer Inc. stocks fell 3.4% in premarket trading after full-year sales estimates for the COVID-19 vaccine and drugs fell below Wall Street's expectations. Major Wall Street indexes fell on Monday after the Meta Platforms company stocks fell 5%. The company's stocks fell another 1.7% in premarket trading after the billionaire investor Peter Thiel decided to leave the company's board. At 07:01 a.m. ET, the Dow e-quotes were down 1 point, the S&P 500 e-quotes were down 6.5 points, or 0.15%, and the Nasdaq 100 e-quotes were down 35.5 points, or 0.24%. There have been numerous events affecting the key indices: worries about tougher US Federal Reserve policies, Ukrainian geopolitical problems, and ambiguous results of major technology companies. Everyone is waiting for U.S. consumer prices data which is on tap on Thursday, after last week's appallingly strong labor data in the U.S. drew additional attention to inflation. The figures are predicted to be 7.3% which is a historically high rate for the last 40 years. 78.3% of the 281 S&P 500 companies that gave their earnings reports on Monday exceeded analysts' expectations, compared with an average of 84% for the past four quarters. The material has been provided by InstaForex Company - www.instaforex.com |

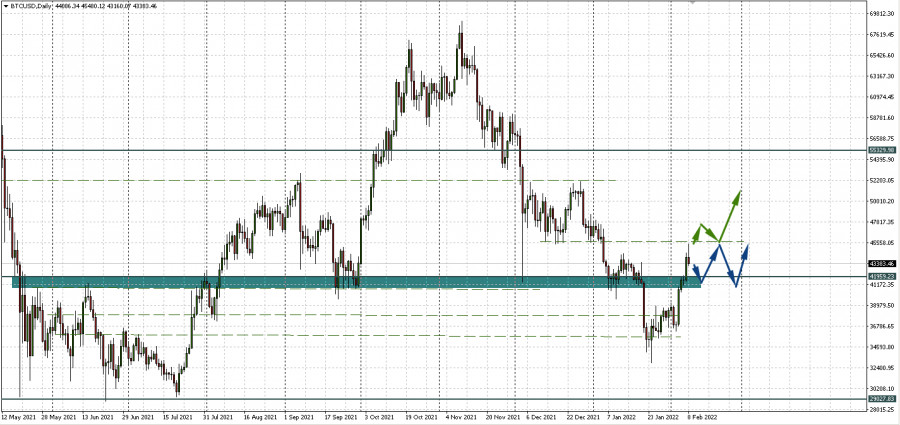

| Bitcoin: Bearish market sentiment is declining Posted: 08 Feb 2022 06:51 AM PST The main cryptocurrency technically confirmed the mirror resistance level of 45,744.38 on Tuesday. Despite the pullback, the Crypto Fear and Greed Index shows an improvement in risk appetite. Market sentiment has become less bearish after the recent price surge. Let's see if there is a chance for the main cryptocurrency to break higher. Inflation and the Fed - a threat and a headwind to growthNow the headwind for the demand for risky assets are fears about the possibility of a rapid tightening of the Fed's monetary policy. A strong inflation report to be released on Thursday may accelerate the rate hike. Investors expect that in March the rate may be raised by 50 basis points at once. And stronger than forecast CPI data can increase the probability. This is the threat of a new fall in stock indices, and after them - bitcoin, whose correlation with stock markets is increasing. Moods are improving, but so far only to the level of "neutral"The near-term medium-term outlook for the main cryptocurrency is becoming less bearish given the recent price spike that started on Friday. According to the Crypto Fear & Greed Index, the "fear" is gradually fading away and market sentiment is becoming "neutral." This index uses a set of factors to generate a nominal sentiment score from 0 to 100. On Tuesday it was at 48 points. By comparison, it spent most of January in "extreme fear" territory. Canadian Firm KPMG Adds Cryptocurrency to TreasuryPositive news about bitcoin also began to arrive, which was also favorable for improving sentiment. KPMG Canada said Bitcoin and Ethereum will be added to its corporate treasury as a "first-of-its-kind investment." Meanwhile, Tesla, in its annual report filed with the U.S. Securities and Exchange Commission (SEC), indicated that its bitcoin assets at the end of December were about $2 billion. The company views cryptocurrency as an investment and a liquid alternative to cash. Roadmap: Two Technical Scenarios for BitcoinAt the time of writing, BTCUSD has technically bounced down from the green dotted resistance at 45,744.38. The day is not over yet, which means that we will not rule out the possibility of returning to the green zone either. So far, there are two scenarios for BTC. The first is a sideways decline between the support zone 40,878.71 - 41,959.23 and the current mirror resistance 45,744.38. And if it is implemented, it is possible that the movement will continue in this flat trend. The second, optimistic, scenario is a breakout of the level 45,744.38 and a consolidation above it. Then the next growth target will be the range of $50,000-$52,000 per bitcoin.

|

| Trading signals for EUR/USD on February 8-9, 2022: sell below 1.1420 (3/8 - 21 SMA) Posted: 08 Feb 2022 06:43 AM PST

EUR/USD is going through a technical correction after braking again at 1.1480 forming a double top at the January high. The euro tries to hold above the 21 SMA at 1.1420 but lacks strength. Next strong support is at 2/8 Murray around 1.1352. With a daily close above 1.1440, the euro would point to further strength, enabling another test at 1.1480 and possibly 1.1535 (5/8 Murray). While tarding below 1.1400, a bearish extension to the 200 EMA located at 1.1331 would be expected, and could drop to 0/8 Murray at 1.1230. The US Dollar Index (USDX) has found support at 4/8 Murray around 95.31 and is now facing the 200 EMA at 95.90. A break above 96.00 could extend its bounce, weighing on EUR/USD and pushing it down to levels of 1.1200. The market sentiment report shows that there are 60.77% of traders who are selling the euro. This is a positive sign for the Euro. It is likely that after making a correction towards the 200 EMA, it could resume its uptrend again. On the other hand, if the number of traders who are buying the euro increases in the next few days above 40%, it is likely that the euro could weaken and we could expect a drop towards 0/8 Murray around 1.1230. The eagle indicator touched the extremely overbought zone around 95 points. This is a negative sign for the Euro and a correction is likely to be imminent in the next few hours towards 1.1330 and up to 1/8 Murray around 1.1291. Our trading plan for the next few hours is to expect the euro to trade below 1.1420 to sell with targets towards the 200 EMA at 1.1331. On the other hand, a technical bounce at 1.1331 could give us an opportunity to buy around this zone. Support and Resistance Levels for February 8 - 9, 2022 Resistance (3) 1.1516 Resistance (2) 1.1474 Resistance (1) 1.1440 ---------------------------- Support (1) 1.1389 Support (2) 1.1365 Support (3) 1.1331 *********************************************************** Scenario Timeframe H4 Recommendation: sell bellow Entry Point 1.1413 Take Profit 1.1352; 1.1331 Stop Loss 1.1345 Murray Levels 1.1230 (0/8), 1.1291 (1/8), 1.1352(2/8), 1.1413 (3/8), 1.1474 (4/8) *************************************************************************** The material has been provided by InstaForex Company - www.instaforex.com |

| U.S. Premarket on February 8, 2022 Posted: 08 Feb 2022 06:20 AM PST U.S. stock index futures are trading slightly above Tuesday's opening day as no one wants to take risks ahead of key inflation data later this week. So far, calmness and a decrease in volatility after two stormy weeks are only occasionally replaced by small movements in one direction or another, which usually occurs after the publication of reports by large U.S. companies. Futures contracts for the Dow Jones rose 45 points, or 0.13%. Futures on the S&P 500 and Nasdaq 100 remained virtually unchanged.

Of the news today, perhaps, attention will be attracted by data on the U.S. trade deficit, which could reach $82.8 billion, which would be a record. Meanwhile, Wall Street is on edge, watching how the Federal Reserve will react to increased price pressures. Bank of America announced Monday that they expect interest rates to rise by 1.75 percentage points - or seven times this year. According to the bank's economists, only this will help to stop the inflationary pressure expected this year. Against this background, Treasury bond yields have reached new pandemic-era highs. The 10-year U.S. Treasury bonds are already yielding 1.93%, based on January 2020 figures.

As for yesterday's results: the S&P 500 lost 0.37%, and the Nasdaq Composite lost 0.58%. Both were trading in a good plus, but over the past hour, they have sunk significantly. The Dow Jones Industrial Average ended Monday's trading session just 1 point above the opening level. At some point, the benchmark of 30 stocks added 235 points. Until it becomes clear exactly which way U.S. inflation is moving, as well as how aggressively the Fed will intervene in what is still considered overvalued in the stock market, we can expect sharp jumps and a surge in volatility. However, by the time interest rates rise in March this year, the "hysteria" should gradually subside, as investors will have a clear plan for further actions on the part of the central bank. On Thursday, the Department of Labor will publish data on the consumer price index for January. The data follows a stronger-than-expected January employment report. This may push the Fed to become more aggressive. Inflation data is expected to show prices rise 0.4% in January, up 7.2% from a year ago, the highest in nearly 40 years. The reporting season will also continue today. Data from Pfizer, Harley-Davidson, Lyft, Chipotle, and Yum China are expected.

Premarket Peloton shares fell 12.8% in premarket trading after the company said it would cut 2,800 jobs as part of a restructuring that would see CEO John Foley step down to take over as executive chairman. The report for the 4th quarter is also expected today after the market closes. Note that yesterday the shares rose by 20.9% after reports that the company could be taken over in the near future. Also in premarket trading, Spirit Airlines shares fell 1.32% after announcing that the company would merge with Frontier in a $6.6 billion deal. Alphabet, the parent company of Google, lost 2.9%, while Twitter, Match Group, and Netflix sank about 2%. As for the technical picture of the S&P 500 Today we can see another drawdown to $4,449, which will lead to an increase in demand and an attempt by index buyers to turn the market in their direction in order to break through $4,536, which they failed to do last Friday. This will help to reach $4,598. A break of this range will open a direct path to $4,665 and $4,722. If there is no one below $4,449, the pressure can return very quickly. In this case, we will surely see a drop to $4,378. The material has been provided by InstaForex Company - www.instaforex.com |

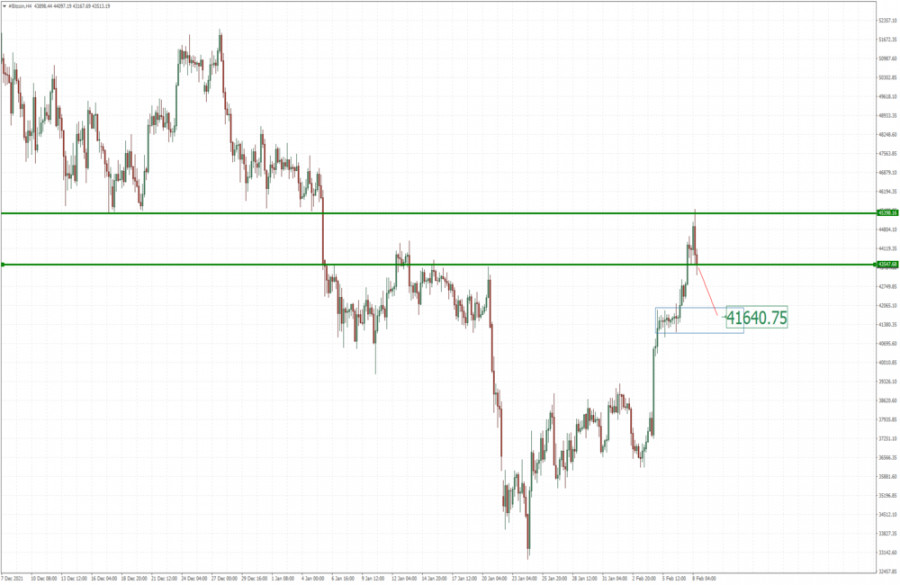

| BTC analysis for February 08,.2022 - Watch for the breakout Posted: 08 Feb 2022 06:06 AM PST Technical analysis:

BTC has been trading today and there is the rejection of the key resistance at $45,400. I see further downside movement towards the lower reference point. Trading recommendation: Due to rejection of key resistance in the background at $45,400, my advice is to watch for selling opportunities on the rallies. Downside objective is set at $41,640. Anyway, in case of the upside breakout of resistance at $45,620, watch for upside opportunities with the upside objective at $47,000 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Feb 2022 05:50 AM PST After a two-month correction, the main cryptocurrency continues to recover on large purchase volumes. During the Asian session, Bitcoin managed to test the important $45.5k level. The market has cheered up and is increasingly taking active steps towards cryptocurrency assets. But there is a high probability of "cooling" investors' fuse due to the $45.5k mark. This level is an important pivot point for bears and a mirror level where large sales volumes are concentrated. This level was an important support line in December, at the equator of the corrective movement. Now it has become a point of concentration of sell orders and descending resistance lines. I suppose that the market will meet fierce resistance here.

Most likely, we are waiting for a local rollback after a confident impulse upward movement. Let's start with the obvious facts: Bitcoin broke $8k with just one bounce and no visible corrective movements. At the same time, the number of long positions with large leverage increased significantly as it consolidated above $40.5k. This is displayed on technical indicators: the stochastic has jumped into the overbought zone, and the RSI is at the upper border of the green zone. All these data testify to the local overheating of the market.

Against the backdrop of an increase in the price of bitcoin, Glassnode recorded a massive withdrawal of BTC coins from cryptocurrency platforms. The total volumes reached $800 million, which is a sharp jump compared to the January period. A similar picture is in the futures market: open interest in BTC futures has reached a local maximum.

Let's not forget the stock market, which ended Monday on a negative note due to negative reporting and a historic drop in Meta (Facebook) shares. SPX and NASDAQ hold key support zones, but the price movement hints at a possible decline in the cryptocurrency market. With this in mind, I assume that in the near future Bitcoin is waiting for a local correction. The first significant support zone for the asset will be $39.6k-$40.2k. But if the price continues to stay in the current range of $43k-$45.5k for some time and a retest of $45.5k occurs, then a sharp squeeze to $36.1k may occur. This will cool the market and knock out high leverage longs. Subsequently, liquidity will be collected from the $36k-$42k range and the price will continue to recover.

|

| Analysis of Gold for February 08,.2022 - Potential for upside continuation Posted: 08 Feb 2022 05:41 AM PST Technical analysis:

Gold has been trading upside today and I see potential upside continuation towards upper references. There is the rejection of key support at $1,814 in the background, which is good sign for further upside movement. Trading recommendation: Due to rejection of key support at $1,814 in the background, I see further upside movement. Watch for buying opportunities on the intraday pullbacks with the upside objective at $1,829. The short-term trend is bullish.... Key support is set at $1,814 The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term view on the Dollar index. Posted: 08 Feb 2022 05:31 AM PST The Dollar index is bouncing higher. Price is now trading at 95.67 after making an important low last week at 95.11. The Dollar index has retraced 78.6% of the entire upward movement from 94.60 low to 97.41 highs.

The Dollar index can very well start a new upward move to new higher highs above 97.41 as long as price remains above the recent lows at 95.11. Bulls want to see price starting to form higher highs and higher lows. The decline was sharp and deep. If bulls want to continue having hopes for more upside, then they should defend the 95.11 low. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD analysis for February 08, 2022 - Potential for bigger upside movement Posted: 08 Feb 2022 05:30 AM PST Technical analysis:

USD/CAD has been trading upside today and I see potential upside continuation towards upper references. There is the rejection of key support at 1,2660 in the background, which is good sign for further upside movement. Trading recommendation: Due to rejection of key support at $1,2660 in the background, I see further upside movement. Watch for buying opportunities on the intraday pullbacks with the upside objective at 1,2785. Key support is set at 1,2650 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Feb 2022 05:27 AM PST Gold price is trading around $1,820. Gold price is in the middle with almost equal distance from key resistance and key support. In previous posts we noted the long-term triangle pattern Gold is inside.

Green line - support Gold price has key resistance at $1,855 and support at $1,785. Gold price has also retraced almost 61.8% of the entire decline from $1,854 to $1,779. If bulls manage to push above $1,825, then we could see price reach the red resistance trend line. A rejection at current levels could bring Gold price back towards the green support trend line. Until then traders need to be very cautious and patient. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments