Forex analysis review

Forex analysis review |

- Bitcoin downside invalidated, upside reversal favored

- February 4, 2021 : EUR/USD daily technical review and trading opportunities.

- February 4, 2021 : EUR/USD Intraday technical analysis and trading plan.

- February 4, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

- Analysis of Gold for February 04,.2022 - Potential for downside continuation

- GBP/USD update for February 04, 2022 - Breakout of the rising trendline in the background

- US now classifies Bitcoin and other digital assets as cash, all companies will be required to report transactions above $10,000

- EUR/USD. Food for Thought: January Nonfarm Payrolls Complicated an Already Difficult Rebus

- Crypto companies from South Africa target the US

- Bitcoin has launched an assault on $40.5k: what to expect from the cryptocurrency in the near future?

- How does taxation of cryptocurrencies in US contribute to the development of the industry and how does the SEC oppose it?

- Trading signals for EUR/USD on February 4-7, 2022: sell below 1.1474 (4/8- double top)

- Is the bullish trend in Oil sustainable?

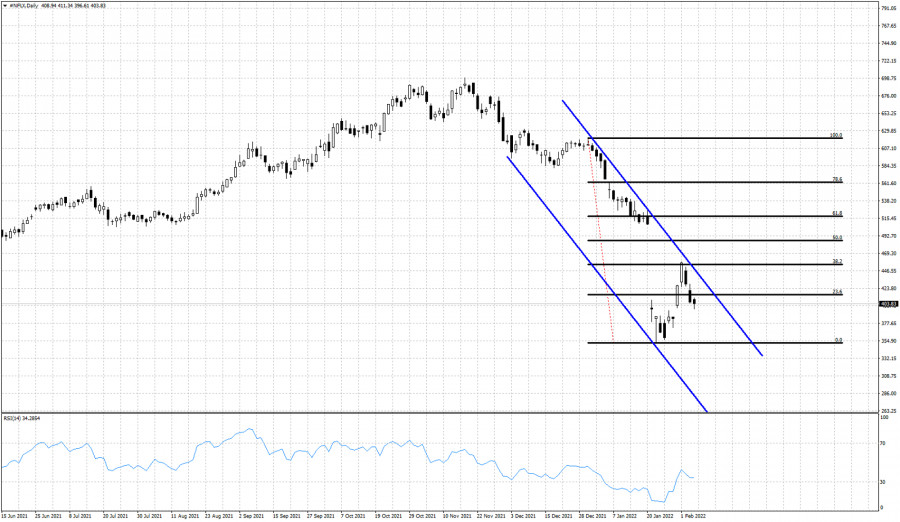

- Is NFLX bounce over?

- GBPUSD under pressure.

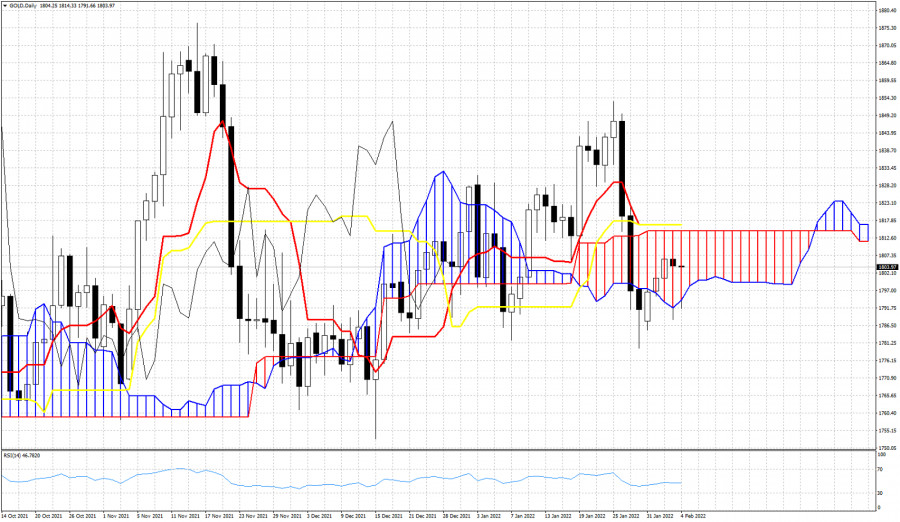

- Ichimoku cloud indicator analysis on Gold for February 4, 2022.

- Ichimoku cloud indicator analysis on EURUSD for February 4, 2022.

- US futures decline after US jobs report

- BTC analysis for February 04,.2022 - Breakout of consolidation zone

- Euro joins the race

- Video market update for February 04,,2022

- Trading tips for Meta (Facebook)

- Euro is rising amid Lagarde's statement and US dollar is depreciating while US futures up

- Trading tips for gold

- Meta lost over $200 billion and affected stock indices

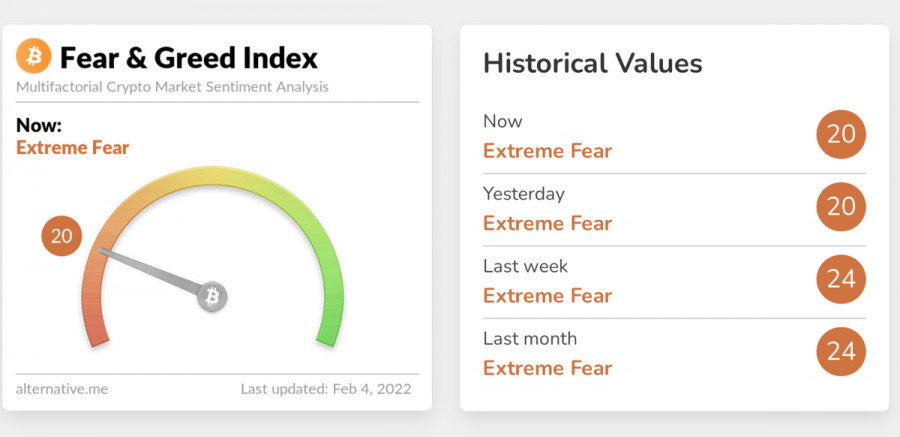

| Bitcoin downside invalidated, upside reversal favored Posted: 04 Feb 2022 11:42 AM PST Bitcoin rallied today. At the moment of writing, it was traded at 40,465.70 below 40,694.23 daily high. BTC/USD registered a 12.21% growth from 36,264.55 yesterday's low to 40,694.23 today's high. Technically, the crypto moved somehow sideways in the short term being undecided. BTC/USD invalidated a potential new sell-off and now it has ignored the immediate resistance levels signaling potential upside reversal. The current rally helped the altcoins to turn to the upside as well. Bitcoin surged by 23.50% from 32,950.72 low but we still need strong confirmation that the crypto will develop a bullish reversal. BTC/USD upside breakout

If you remember from my previous analysis, a valid breakdown below the weekly pivot point (36,600.08) may activate more declines. As you can see, BTC/USD registered only false breakdowns below the pivot point indicating that the bulls' area is still in the game. BTC/USD ignored the near-term static resistance levels. At the moment of writing, it was traded above the Descending Pitchfork's upper median line (uml) which represents a dynamic resistance and above the weekly R1 (40,280). Bitcoin predictionValidating the breakout above the R1 and above the upper median line (uml) could really announce potential further growth and could bring new long opportunities. You should be careful because if the price invalidates the breakout, BTC/USD is likely to print a new sell-off. The material has been provided by InstaForex Company - www.instaforex.com |

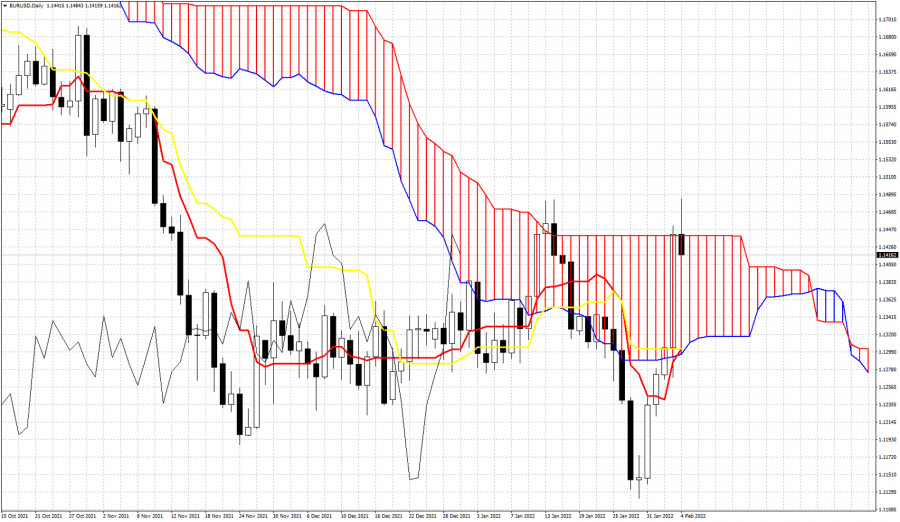

| February 4, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 04 Feb 2022 11:25 AM PST

During the past few weeks, the EURUSD pair has been trapped within a consolidation range between the price levels of 1.1700 and 1.1900. In late September, Re-closure below the price level of 1.1700 has initiated another downside movement towards 1.1540. Price levels around 1.1700 managed to hold prices for a short period of time before another price decline towards 1.1200. Since then, the EURUSD has been moving-up within the depicted movement channel until bearish breakout occurred by the end of last week's consolidations. Today, the price zone of 1.1350 failed to offer sufficient bearish rejection that's why it was bypassed. On the other hand, the price zone around 1.1500 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon the current ascending movement. The material has been provided by InstaForex Company - www.instaforex.com |

| February 4, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 04 Feb 2022 11:22 AM PST

The bullish swing that originated around 1.1650 in August, failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was reached. Shortly after, significant bullish recovery has originated upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which stood as an Intraday Support zone. Hence, sideway movement was demonstrated until quick bearish decline occurred towards 1.1200. Please note that the current bullish movement above 1.1300-1.1350 should be considered as an early exit signal to offset any SELL trades. On the other hand, the price levels around 1.1520 remain a reference zone that can provide a valid SELL Entry when th current bullish momentum vanishes. The material has been provided by InstaForex Company - www.instaforex.com |

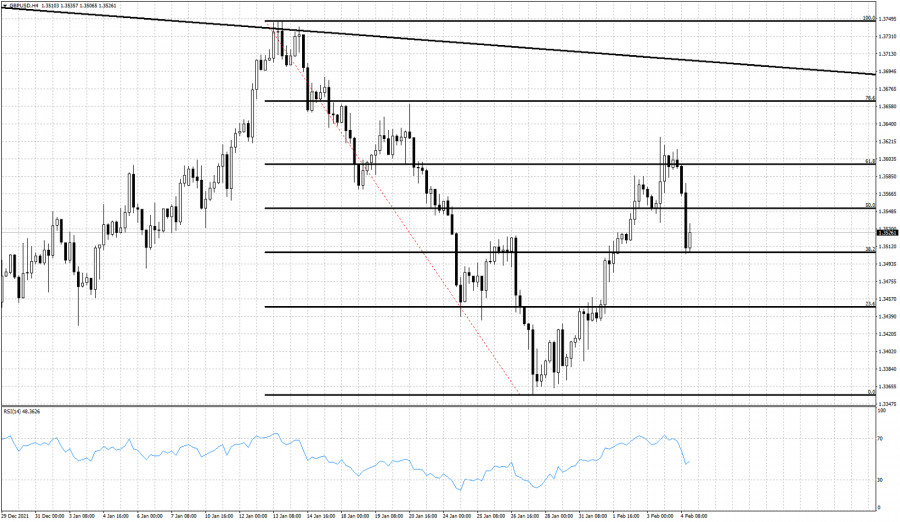

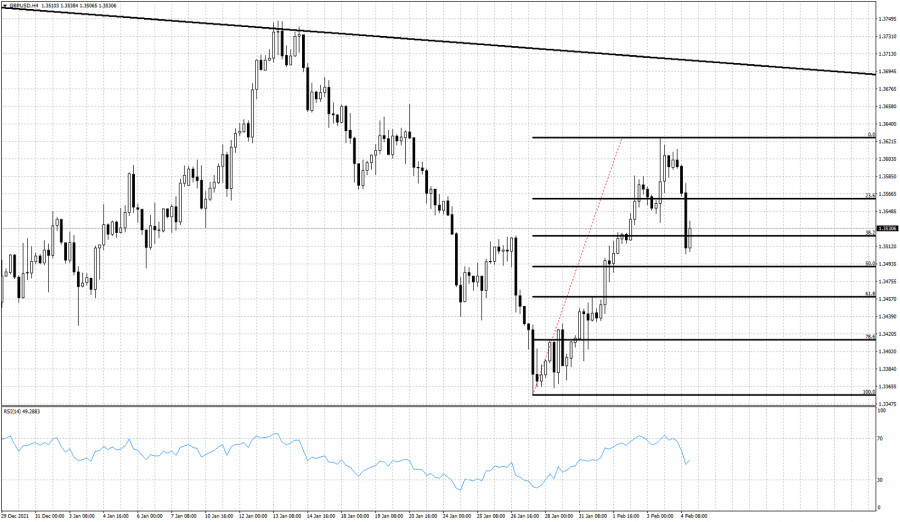

| February 4, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 04 Feb 2022 11:20 AM PST

The GBPUSD pair has been moving within the depicted bearish channel since July. Bearish extension took place towards 1.3220 where the lower limit of the current movement channel came to meet with Fibonacci level. Conservative traders should have taken BUY trades around 1.3200 price levels as suggested in previous articles. Recent bullish breakout off the depicted bearish channel has occurred few days ago. However, BUYERS were watching the price levels of 1.3730 to have some profits off their trades. Moreover, the price level of 1.3720 stood as a key-resistance which offered bearish rejection on last Thursday. Shortly after, the short-term outlook turned bearish when bearish decline below 1.3570 occurred earlier last week. As mentioned before, bearish decline below 1.3570 enhanced the bearish side of the market towards 1.3400 which brought the pair back towards 1.3570 for retesting Moreover, the current bullish pullback towards 1.3570 should be considered for SELL trades as it corresponds to the upper limit of the ongoing bearish channel. The material has been provided by InstaForex Company - www.instaforex.com |

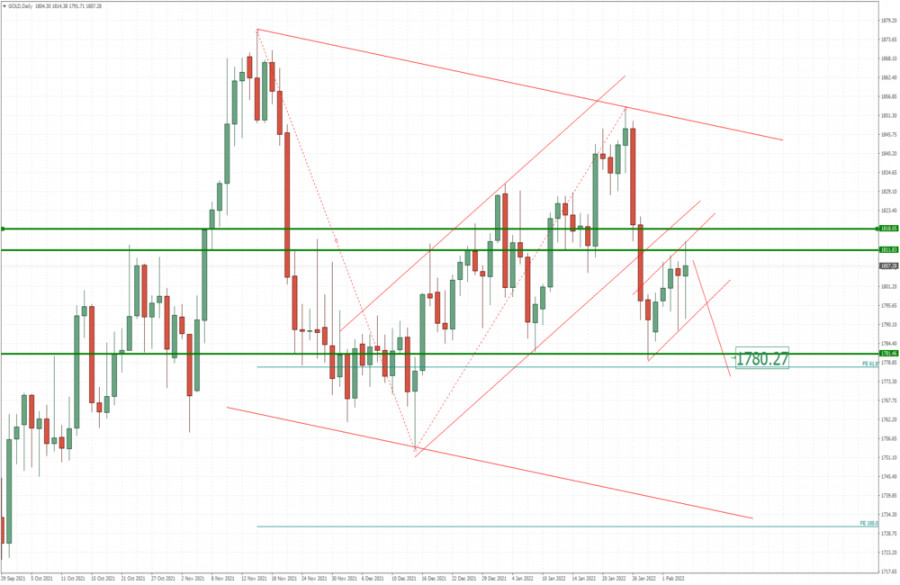

| Analysis of Gold for February 04,.2022 - Potential for downside continuation Posted: 04 Feb 2022 10:46 AM PST Technical analysis:

Gold has been trading sideways in last couple of the days and I see potential for the downside movement. Trading recommendation: Due to the breakout of the rising channel in the background and potential for bear flag formation, I see potential for the downside continuation in next period. Watch for selling opportunities with the downside objective at the price of $1,780 Key resistance is set at the price of $1,850 The material has been provided by InstaForex Company - www.instaforex.com |

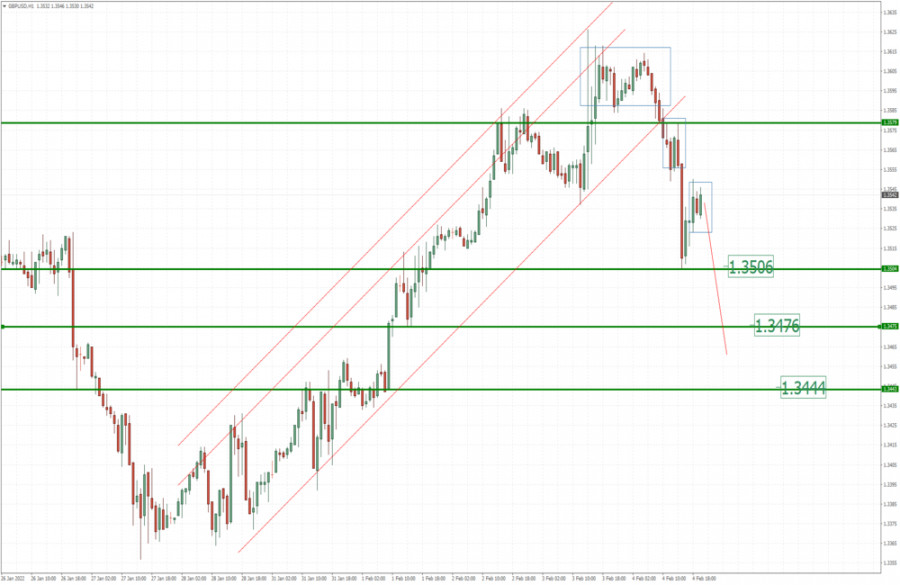

| GBP/USD update for February 04, 2022 - Breakout of the rising trendline in the background Posted: 04 Feb 2022 10:28 AM PST Technical analysis:

GBP/USD has been trading sideways in last few hours and there is the breakout of rising treeline in the background, which is sign for further downside movement. Trading recommendation: Due to the breakout of the rising trend line in the background , I see potential for the downside continuation. Watch for selling opportunities in case of the downside breakout of support at 1,3525. Downside objectives are set at the price of 1,3505, 1,3475 and 1,3445 Resistance level is set at 1,3550 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Feb 2022 10:23 AM PST

The United States Infrastructure Bill, dated November 2021, brings with it a whole list of new rules that will be aimed at strict regulation and control of cryptocurrencies. Any companies that transact more than $10,000 in bitcoin or other altcoins must now be transparent to the U.S. government. One of the most important changes is contained in section 60501 of the US Internal Revenue Code, which states in black and white that cryptocurrencies are cash. Many crypto enthusiasts would not repeat the opposite and blame this statement from the section. If you go back in time and look at the Bitcoin white paper dating back to 2008, then Bitcoin is considered a P2P electronic cash system. Also, the tax code sets out in great detail all the reporting requirements for financial transactions, the amounts of which exceed $10,000. Transactions must collect data such as phone numbers, social security numbers, names, addresses, and anything else that might be important to the IRS. Also, companies will be required to inform the authorities about the details of these transactions, the amount and date of the transaction. Failure to provide this information may result in criminal liability. Previously, any other foreign currencies in excess of $10,000 were already included in this bill, and now cryptocurrencies have been added here. This regulatory bill can have very serious consequences for the cryptocurrency market, since the lion's share of transactions are now carried out intraday and on exchanges. Now it will be impossible to hide all large transactions over $10,000 and not report them. All cryptocurrency companies and exchanges will have to clearly report to the state. This will apply not only to cryptocurrencies, but also to DeFi products and NFTs. Bitcoin itself returned to the rate of $40,000 on Friday. Mark Elenowitz, president of securities exchange services firm Horizon, is confident that Bitcoin will face various headwinds and will constantly go up as long as macroeconomic conditions remain the same. The material has been provided by InstaForex Company - www.instaforex.com |

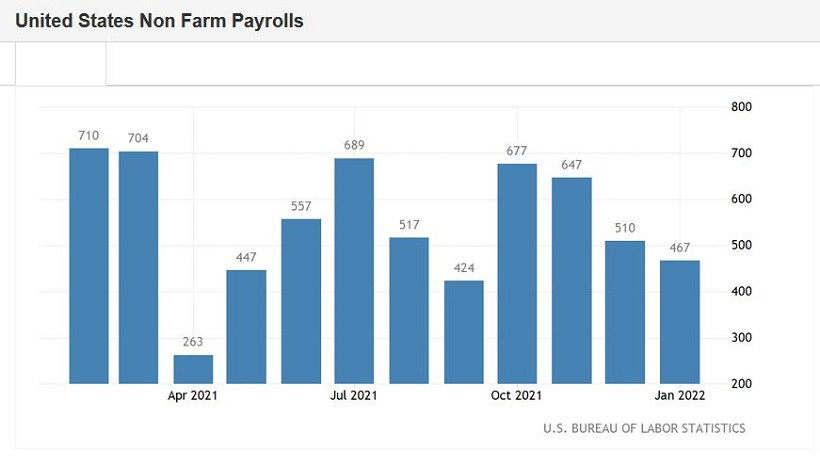

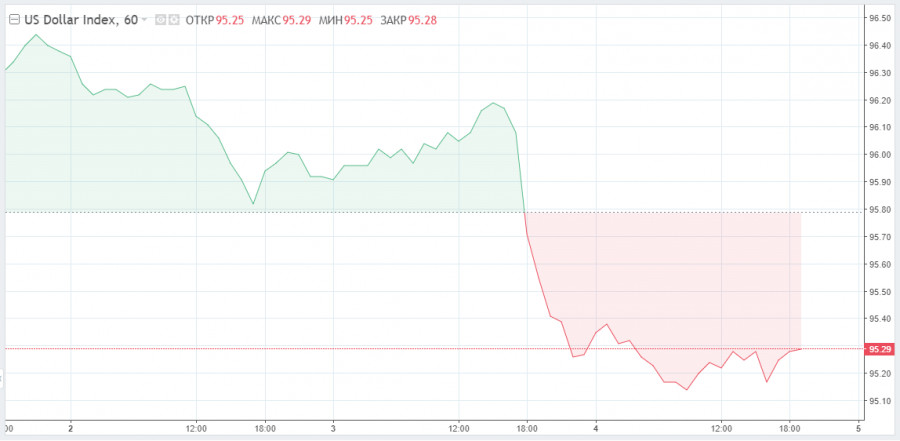

| EUR/USD. Food for Thought: January Nonfarm Payrolls Complicated an Already Difficult Rebus Posted: 04 Feb 2022 10:06 AM PST The euro-dollar pair at the beginning of the day updated a three-month high, reaching 1.1484. It would seem that everything was in favor of the further development of the upward movement. The euro strengthened across the market amid a hawkish ECB, while the dollar index showed a reverse trend, falling to the bottom of the 95-point mark. As they say, nothing foreshadowed trouble – buyers of EUR/USD had every chance to get close to the 15th figure, confirming the strength of the upward movement. But life has made its own adjustments, complicating the already difficult rebus of a fundamental nature. The January Nonfarm Payrolls turned out to be on the side of the dollar, allowing the EUR/USD bears to remind of their existence. The pair retreated from the boundaries of the 15th figure, but did not show a protracted decline. Traders are clearly discouraged by Friday's result, so they cannot decide on the vector of price movement.

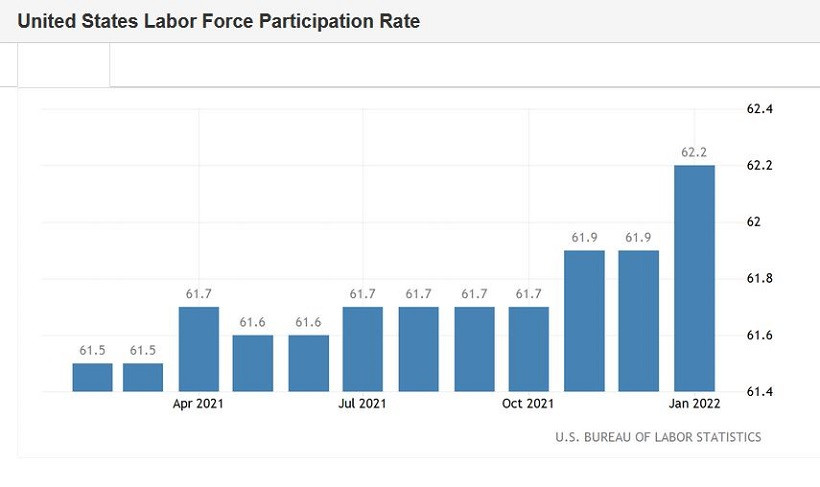

The storyline for the euro-dollar pair is really full of surprises. Just Thursday, the single currency received a powerful 200-point support from the European Central Bank. The regulator is finally worried about record inflation in the eurozone. ECB President Christine Lagarde agreed that eurozone inflation will remain high "longer than previously thought." At the same time, she focused her attention on the negative consequences of high inflation: a decrease in citizens' incomes, a decline in consumer activity and a decrease in investment. However, Lagarde did not say the main thing: is the regulator ready to start raising the interest rate? Answering relevant questions from journalists, she said that any decision on the rate would depend on incoming macroeconomic data. Lagarde also de facto did not answer the repeated clarifying question on this topic. But at the same time, she did not repeat the well-worn phrase that the ECB will not tighten monetary policy this year. Actually, this factor became decisive for the euro: the market came to the conclusion that the head of the ECB voiced a tacit agreement with the hawkish scenario. On Friday, reporters from the Reuters news agency added fuel to the fire. Citing informed (but anonymous) sources in the Central Bank, they said that the regulator is ready to take active steps already at the March meeting. Especially if the February inflation will be in the "green zone." However, we are not talking about raising the rate. For starters, the European Central Bank plans to speed up the phasing out of the asset purchase program (APP). According to the December decision of the Central Bank, APP after the completion of the pandemic emergency purchase program (PEPP) will be 40 billion euros per month in the second quarter, 30 billion in the third, and 20 billion in the fourth quarter. It is obvious that in March the ECB will accelerate the pace of curtailing the program. As for the interest rate, there are no insiders here, but there are experts' assumptions. In particular, according to currency strategists at Deutsche Bank and Goldman Sachs, the European Central Bank will decide to take this step as early as September of this year and will return to this issue again in December. As a result, by the end of 2022, the deposit rate will increase to zero. Admittedly, this is the most hawkish forecast of all, but it reflects the general sentiment among traders. Lagarde's "taciturnity" was taken too seriously, on the principle of "no denial=consent." At least, many analysts of the foreign exchange market came to such conclusions. But the cloudless weather for EUR/USD buyers did not last long. After all, the Fed also intends to tighten monetary policy, and much more likely and much more aggressively. Fed Chair Jerome Powell has not ruled out a rate hike at every meeting this year. But at the same time, he "tied" this issue to the main macroeconomic indicators, primarily in the field of the labor market and inflation. And on Friday the first exam for the dollar took place, which was successfully passed. The January Nonfarm Payrolls report did not disappoint for the most part, some components exceeded the forecast levels, while the December figures were revised upwards. So, almost all components of Friday's Nonfarm Payrolls report came out in the green zone. The number of people employed in the non-agricultural sector increased by 467,000 (against the forecast of growth by 110,000). In the private sector of the economy, the indicator jumped to 444,000 (against the forecast of growth by 150,000). Also, the failed ADP report was published the day before yesterday, which came out at -330,000. As you can see, in this case, we can talk about a significant correlation, which was interpreted in favor of the dollar. The rate of wage growth did not disappoint either. Friday's figures (0.7% MoM and 5.7% YoY) supplemented recent inflation releases. The share of the economically active population also increased to 62.2%. This is the best result since April 2020. The headline figure let us down a little: the unemployment rate rose to 4.0%, while most experts were sure that it will remain at the level of December, that is, at around 3.9%. But this nuance did not spoil the overall picture, especially since some indicators of the previous month were revised upwards - according to updated data, the number of people employed in the non-agricultural sector increased by 510,000 in December (the initial estimate was 199,000).

In other words, Friday's release suggests that the Fed will remain hawkish at its March meeting on the prospects for monetary tightening. This fact strengthened the position of the U.S. currency throughout the market, although it is in pair with the euro that the greenback feels most insecure. The EUR/USD buyers are counterattacking and do not allow the sellers to develop the peremptory downward momentum. Plus, there is the "Friday factor," which does not allow an objective assessment of the current situation. Next week it will become clear where the scales will tip: traders will either "believe" in the hypothetical probability of an ECB rate hike, or "return" to the dollar, which has a more straightforward Fed as its allies. For now, it is risky to open any trading positions. As you can see, the EUR/USD pair jumped to the multi-week high at 1.1484 at the beginning of the day, then updated the low at 1.1418, but eventually flattened around the opening price. Market participants cannot decide on the vector of price movement, especially on the eve of the weekend. In such circumstances, it is best to take a wait-and-see position - at least until Monday, when it becomes clear in which direction the pendulum will swing. The material has been provided by InstaForex Company - www.instaforex.com |

| Crypto companies from South Africa target the US Posted: 04 Feb 2022 09:03 AM PST Africa's largest cryptocurrency exchange, Luno, is looking to gain a foothold in the U.S. legal field to try to expand its client base with one of the world's largest digital asset investor groups. Owned by conglomerate Digital Currency Group Inc., the Luno exchange is evaluating regulatory regimes in all American states to ensure its implementation during 2022, said Marius Reitz, the company's general manager for Africa.

"It is more complex than launching in an individual market because of the different states and different regulations within each of these states, so there's lots of moving parts," Reitz said. "But it is a company focus for us for 2022." A number of fast-growing cryptocurrency exchange brands such as FTX and Binance are also entering the U.S. market. Many of them cooperate as much as possible with legislators, create insurance funds for their clients, trying to legitimize the sector. According to CB Insights, the world's largest economy hosts more than half of the world's crypto unicorns (A unicorn is a privately held startup that has reached a valuation of at least $1 billion). A recent Pew Research Center poll showed that about 16% of Americans have invested, traded or used cryptocurrencies. Digital Currency Group was the first investor in Luno and later fully acquired it in 2020. Just a year later, the company reached a $10 billion valuation, also thanks to the raising of about $700 million in a deal led by SoftBank Group Corp. Luno's other early supporters included Cape Town technology investor Naspers Ltd. is the largest listed company in Africa. Luno, founded in 2013, has 9 million users so far, spanning Asia to Africa. The exchange currently offers trading in tokens including Bitcoin, Ethereum and Ripple, and may soon add new coins selected from the top 10 most liquid cryptocurrencies in the world, Reitz claims. "A lot of the operation time goes into security and custody," he said. Until 2021, the spread of cryptocurrencies in Africa was concentrated in Nigeria and South Africa, where almost a fifth of the population owns some form of digital assets. This compares with the global average of just over 10% (according to recent Finbold data). Luno has also expanded into East Africa, Reitz said. So, it already has users in Uganda. South Africa is waiting for the green lightReitz also said that the entire industry, including Luno, is waiting for new rules in the crypto market, which, according to him, are "inevitable" and should help protect consumer rights. For example, the changes should allow platforms, including Luno, to attract institutional investors that are currently out of the market. Rules may also make it possible to list more complex products. Reitz said that in a year or two, he expects offerings such as cryptocurrency exchange-traded funds (crypto-ETFs), which allow investors to hold a basket of coins without having to buy them. South African stock exchange operator JSE Ltd. previously rejected attempts to list ETFs, citing the lack of a regulatory framework in the country, but the company expects to expand legislation in this area. "We have got all these asset managers sitting on the sidelines wanting to launch their own crypto products, but they're not able to do so," Reitz said. "As soon as we see regulation, you'll see a flurry of crypto products being offered to investors in South Africa." On Friday, February 4, bitcoin is rising despite the fact that the S&P 500 is expected to go down a bit amid strong employment data. The material has been provided by InstaForex Company - www.instaforex.com |

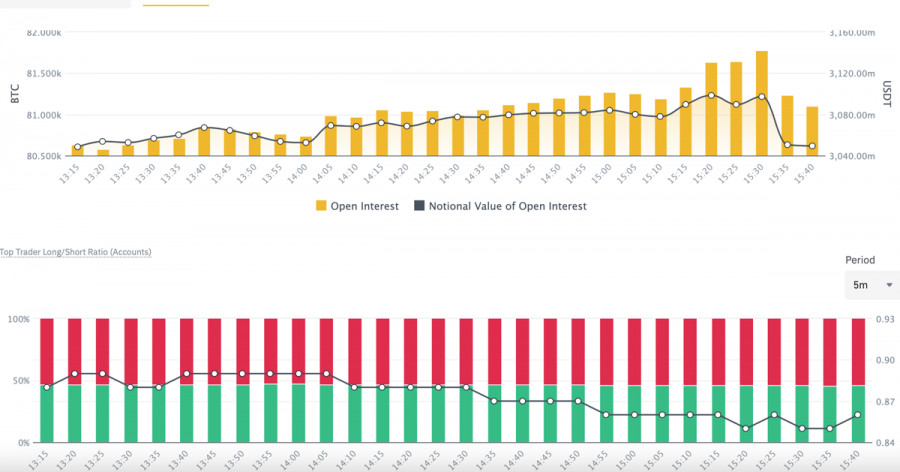

| Posted: 04 Feb 2022 08:59 AM PST Over the past 10 days, Bitcoin has touched the downward trend line twice, which prevented the coin from gaining a foothold above $40k. After local consolidation, the cryptocurrency is again approaching the $40.5k mark. The growth of BTC is accompanied by a surge in consumer activity and a sharp upward movement of technical indicators. On the hourly timeframe, we see the formation of a powerful bullish candle, which confirms the fact of a retest of the $40.5k level. Technical indicators support the upward mood of buyers and go into the overbought zone. But at the same time, the first signs of sellers' activation are visible. In the area of the downward trend line, the bears began to buy off the growth and push the price down, as can be seen by the growing upper wick. Sellers are trying to seize the initiative. The four-hour chart gives us a more complete picture, where it can be seen that the upward movement began within the rebound from the support level of $36.2k. In the area of $37.3k and $37.8k, local clusters of sales were broken through, thanks to which the price received additional fuel to move to $40k. The 4H chart confirms that there is a struggle for the local area of $39.3k-$39.5k. Bulls are holding positions, but bears are increasing the pressure. Despite this, technical indicators indicate a further increase: the MACD has moved into the green zone, and stochastic and RSI are in the overbought zone. The daily chart indicates the approach to the final part of the resistance area. Bitcoin has received a significant acceleration due to the growth of volumes and the appearance of large buyers. Technical indicators indicate the continuation of the current trend of price movement due to growing volumes. But the presence of bears is beginning to be felt on a daily timeframe. Taking into account the volumes that have appeared, as well as the third retest of this zone over the past two weeks, it can be assumed that the $40.5k level will be broken. But subsequently, buyers are unlikely to be able to hold the $40k milestone with a pullback movement, since buyers' positions are very weak globally. Most likely, we are waiting for a downward trend or a false breakdown, as a result of which the price will go to collect liquidity in the range of $32k-$35k. If the price reaches $40.5k and manages to gain a foothold above it after a pullback movement, we can talk about another consolidation period. Subsequently, the price will decline again beyond the $40k mark, where the $38.9k level will become an important support zone. In any case, a bullish breakdown and consolidation above $40k will be an important bullish signal that will mark the completion of the first stage of the recovery of BTC/ USD quotes. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Feb 2022 08:44 AM PST Microstrategy CEO Michael Saylor said that there is nothing wrong with regulating the cryptocurrency market. Saylor is confident that with the right approach and prescribing rules for the regulation of digital assets, the institutionalization of the industry as a whole will increase. The U.S. Congress listened to the opinion of the entrepreneur and will soon consider a bill on fair taxation of cryptocurrencies. But the most radical statement of recent days was the statement of SEC Chairman Gary Gensler in an interview with Bloomberg. Gensler said that if cryptocurrency companies do not want to cooperate, tough measures will be taken to force cooperation in order to protect the rights of investors. However, at the same time, Gensler is confident that the laws governing investment activities in the United States and adopted in the 30s of the last century remain relevant.

Considering the position of the SEC chairman, we can conclude that in the near future there are no fundamental changes in the regulator's position regarding investment products based on cryptocurrency. This statement by the head of the regulator did not go unnoticed by the public, and Michael Saylor said that investing in MicroStrategy shares is the best alternative to ETFs. This is due to the fact that the acquisition and ownership of the company's securities is not subject to commission.

Liberal taxationDespite the principled position of the head of the SEC, the U.S. Congress is going to consider a bill on the taxation of cryptocurrencies. At the same time, it is reported that the Internal Revenue Service is not going to tax digital assets that are on savings wallets or received during staking. In addition, it is planned to exclude taxation of transactions with cryptocurrencies in the amount of less than $200. Such a decision speaks of awareness and possession of the necessary information by members of Congress, and therefore one can count on democratic taxation of the industry. In general, the position of the U.S. authorities was positively perceived by the market and strengthened the position of cryptocurrencies among other financial instruments. As a result, Bitcoin came close to the downward trend line, while the SPX and NASDAQ fell in sync to significant support areas. The divergence in the movement of BTC and stock indices may also indicate a difference in approaches to regulation. This, in turn, can become an important argument for investors when choosing an investment instrument. Given the benefits of cryptocurrencies such as increased profitability, decentralization and security, taxation can be a key factor influencing investment flows in U.S. markets. In technical terms, Bitcoin looks confident due to the positive fundamental and news background. There is also a positive trend in the MACD indicator, which for the first time in 82 days is approaching the green zone. The presence of this indicator within the bullish range is accompanied by a breakout rally to local highs. In addition, the equality in the ratio of shorts/longs is of interest, which indicates the stabilization of the market. In a situation where there is no obvious dominant, the price goes in the direction according to the trend. Now the asset is in the stage of a local uptward rend. Fear is also gradually leaving investors, and therefore we can count on another attempt to break through $40.5k. This mark is the final point of the monthly range of fluctuations, and therefore its break may provoke a local bullish "BOOM" in the market.

But I want to note that the bullish candles formed after the confident red candle of February 2 look uncertain and indicate the weakness of buyers and the absence of impressive buying volumes. Therefore, a reversal to the local bottom also remains relevant. If the bulls fail to increase volumes during the $39k-$40.5k trade, then the price will fall to the bottom like a stone. The material has been provided by InstaForex Company - www.instaforex.com |

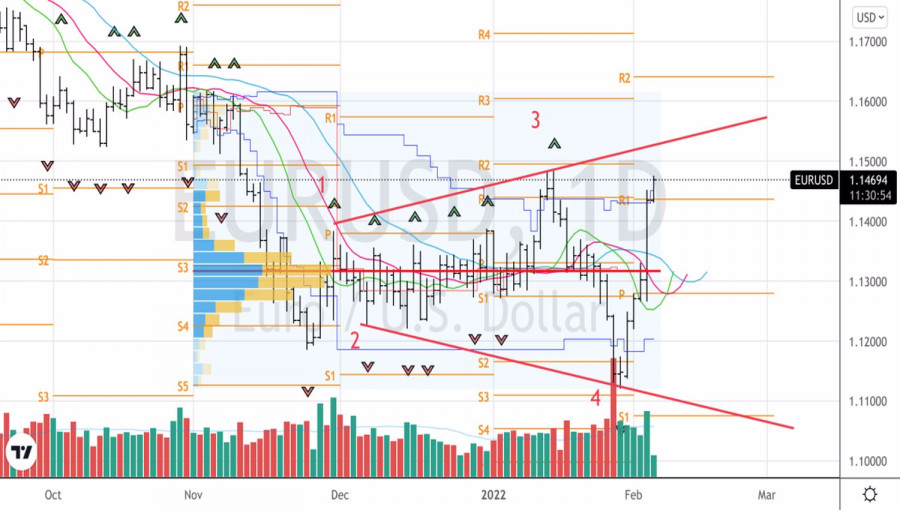

| Trading signals for EUR/USD on February 4-7, 2022: sell below 1.1474 (4/8- double top) Posted: 04 Feb 2022 08:09 AM PST

EUR/USD is rising for the sixth day in a row, ahead of the US NFP report. The pair just hit the highest level since November 2021 at 1.1483. Following the European Central Bank (ECB) meeting on Thursday, the euro began a bullish rally, which is still underway. Technically, it has reached the 4/8 Murray high zone of January 12th. This level is strong resistance and could act as a barrier for the Euro. If the US nonfarm payrolls are positive for the US dollar, EUR/USD is expected to drop below 4/8 Murray. Then, there will be an opportunity to sell around 1.1482 with targets at 1.1413 and up to 1.1352. The Eagle indicator is approaching an overbought area. It is likely to touch the 95-point level, then a technical correction will be imminent for the euro. If you can see on the 4-hour chart the levels that the eagle indicator has touched at 95 and 5-points just in the reversal zone, this has been very successful, both for buying and selling. So, we are confident that the euro could make a correction in the next few hours, as the eagle indicator supports our bearish strategy. Given that the Euro is consolidating above the 200 EMA and above the 21 SMA, this drop will be seen as an opportunity to continue buying in the coming days. The key level we can expect is a technical bounce around the 200 zone of EMA at 1.1334 or at 2/8 Murray at 1.1352. Support and Resistance Levels for February 4 - 7, 2022 Resistance (3) 1.1567 Resistance (2) 1.1535 Resistance (1) 1.1501 ---------------------------- Support (1) 1.1427 Support (2) 1.1384 Support (3) 1.1352 *********************************************************** Scenario Timeframe H4 Recommendation: sell bellow Entry Point 1.1474 Take Profit 1.1413; 1.1352 Stop Loss 1.1503 Murray Levels 1.1291 (1/8) 1.1352 (2/8) 1.1413 (3/8) 1.1474 (4/8) *************************************************************************** The material has been provided by InstaForex Company - www.instaforex.com |

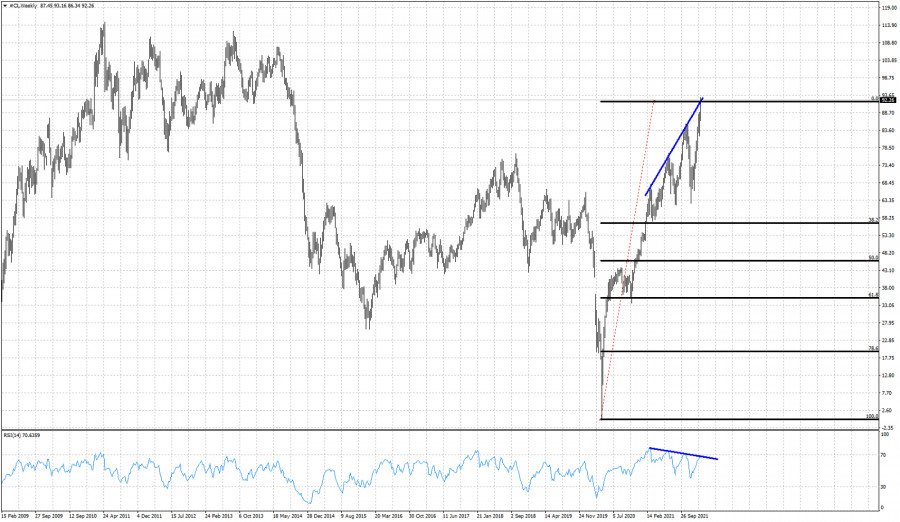

| Is the bullish trend in Oil sustainable? Posted: 04 Feb 2022 07:57 AM PST In short no. I believe Oil prices are at their final stages of advance. Traders should be looking to take profits and protect their gains, as we believe it is a matter of time before a major reversal unfolds and Oil is back below $80.

Black lines- Fibonacci retracement Oil prices are technically in a bullish trend making higher highs and higher lows. The weekly RSI is providing us with an important warning. The RSI is not following price to new higher highs. This bearish divergence is an important warning that should not be ignored. This divergence is not a sell or reversal signal. Only a warning.

|

| Posted: 04 Feb 2022 07:47 AM PST Last week NFLX was on the spot light for all the wrong reasons. Price plummeted towards $350 while two months ago it was trading around $650-$700. In previous posts we warned traders that a reversal was imminent and that the warning signs were there. Our bearish signal came when price broke below $580.

Black lines -Fibonacci retracements NFLX is in a bearish trend making lower lows and lower highs. Price has formed a bearish channel in the Daily chart. Price got rejected at the upper channel boundary and 38% Fibonacci retracement of the last leg down. Both are bearish signals. As long as price is below this week's high, we remain bearish NFLX looking for at least a retest of the $350 area if not a move lower. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Feb 2022 07:24 AM PST GBPUSD is trading around 1.3525 after reaching as high as 1.3626. Price reached important Fibonacci resistance as we mentioned in a previous post. Price got rejected at the 61.8% Fibonacci level. Bulls now want to see price form a higher low. Where can this decline stop?

GBPUSD has most probably completed the upward move from 1.3356. Price is now pulling back. The big question is whether we will see a higher low and the resumption of the up trend or this upward move was just a pause to the longer-term downward trend from 1.4247.

Black lines- Fibonacci retracements Short-term support by the Fibonacci retracement levels is found at 1.3459. Around this price level or above it, we should see this decline stop, in order to hope for a bigger move higher. If price fails to hold above this support area, we should expect more downside to come, even below 1.34. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator analysis on Gold for February 4, 2022. Posted: 04 Feb 2022 07:17 AM PST Gold price had increased volatility the last 24 hours as price fell as low as $1,788 yesterday, closed above $1,800 and today price fell again towards $1,790 while now it is trading at $1,805. Gold price is inside the Daily Kumo which means that trend is neutral. However the long lower tails in the last two candlesticks, show that price is supported.

|

| Ichimoku cloud indicator analysis on EURUSD for February 4, 2022. Posted: 04 Feb 2022 07:09 AM PST EURUSD is trading above 1.14. Today price reached 1.1484 marginally surpassing the January highs. Price has also broken above the Ichimoku cloud in the Daily chart but so far bulls seem unable to stay above the cloud.

|

| US futures decline after US jobs report Posted: 04 Feb 2022 06:39 AM PST US futures are falling again due to strong jobs data. Investors are now poised to increase their confidence in Fed monetary policy tightening, offsetting small gains owing to Amazon's report. US futures decline after US jobs reportOn Friday, February 4 the contracts for the S&P 500 futures fell again due to the news. Last month, US employers closed most of the applications for vacant jobs. The gains exceeded the forecasts despite a spike in Covid-19 infections and related closures. Thus, the increase in nonfarm employment was 467,000 jobs. Besides, about 444,000 of these jobs were in the private sector.

Salaries in the US also rose by 0.7%, compared to the previous month. Besides, it is a three-month high. As for January 2021, the increase totaled 5.7%. Moreover, average hourly wages rose by 0.7% more than expected compared to the previous month. This data is interpreted positively. However, if other figures are considered, the unemployment rate is also quite high, exceeding the median expert estimate by 0.1%. It comes at 4%, although that is roughly the target level that the Fed aims as the cue to cut the bailout. The working week was also shorter than in December, which is a holiday in the US. This fact probably reflects the need for many infected Americans to be isolated. Based on these figures, the Federal Reserve will most likely implement hawkish policy. Tom Essaye, Sevens Report research founder, wrote that the data reminded that Fed policy expectations had a key impact on the market at the moment. He believes that next week's hot inflation data will cause the Fed's hawkish fears. It was certainly a volatile week in the markets. Investors digested positive reports from the banking sector and oil and gas production. However, they were shocked by the weak performance of the US tech giants. Markets were deeply shaken by weak data from Meta Platforms Inc., owning Facebook. It lost more than $250 billion of its market value in a day. However, this dip seems too significant as this company can be called a new BTC. However, it is also a great opportunity to invest for the future. After a broad pullback in the tech index, positive earnings from Amazon helped raise the sentiment amid news of its intentions to increase its market capitalization by $184 billion if its premarket gains hold up in the regular session. The Nasdaq 100 was little changed today after yesterday's 2.3% gain. Moreover, the auto and parts makers showed worse performance than the tech giants. They made up the weakest industry group. Alon Rosin, head of institutional equity at Oppenheimer and Co. said that currently little FOMO was observed as everyone saw positive figures in post-market movements at the moment. Out of the 272 companies in the S&P 500 that reported their results, 82% met or beat estimates. Besides, their earnings were 8.8% higher than forecasted. Traders who bought the dip are still counting on a stronger reporting season to keep stocks attractive and dispel some concerns about monetary policy tightening in the face of higher inflation. Besides, amid the Chinese New Year, cash flows again headed into US markets, surpassing three-week highs. Besides, signs of persistent price pressure continue to support uncertainty. For example, US gasoline prices rose to their highest level in more than seven years. Crude oil hit a new seven-year high in early trading. Moreover, the banks including Goldman Sachs Group Inc. are predicting that Brent will briefly reach $100 a barrel. WTI crude oil, having recently shown a promising decline, is up 2%. Notably, despite the addition of workers, manufacturing dropped in January, consumer confidence is falling and the real estate market is shrinking. Analyst Chris Harvey said that they were overdue in the cycle and the market was becoming more selective. He noted that the market would be less dovish. Harvey added that investors would have to cut their losses quickly and focus on margins rather than the top or bottom line. The spot dollar went up 0.2% today, while the pound and yen are declining. 10-year bond yields are rising and gold futures are falling. Hawkish comments of European Central Bank President Christine Lagarde and the Bank of England's interest rate hike underscored global risks related to inflation. While the sell-off in regional bonds eased on Friday, stock market sentiment worsened. The European Stoxx 600 fell by 1% again, continuing its weekly trend as expectations of a rate hike reduced risk appetite. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for February 04,.2022 - Breakout of consolidation zone Posted: 04 Feb 2022 06:23 AM PST Technical analysis:

BTC has been trading downside today and there is breakout of the balanced regime in the background, which is sign that BTC can trade lower in next period. Trading recommendation: Due to the downside breakout of the multi-hour balance, I see potential for the selling opportunities on the rallies with the downside objectives at :36,775, $36,285 and $35,420. Key resistance is set at the price of $38,200 The material has been provided by InstaForex Company - www.instaforex.com |

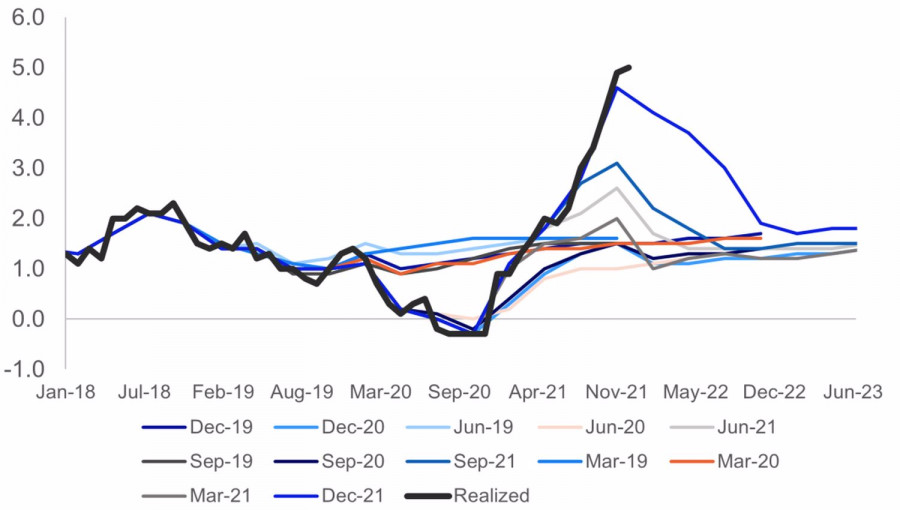

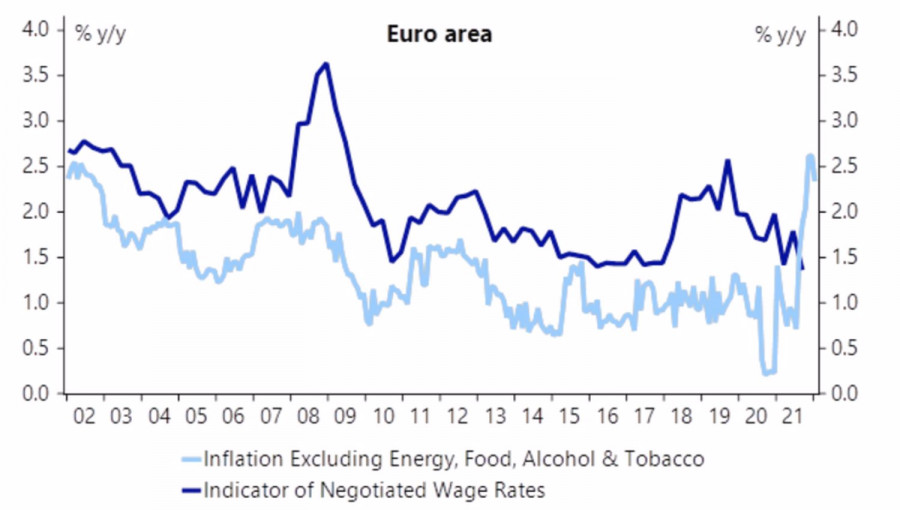

| Posted: 04 Feb 2022 06:07 AM PST All trends reverse sooner or later. And while the EURUSD bears are still holding on to the idea of a more aggressive Fed than the ECB in 2022, you can't get away from the market. It is growing on expectations, and the U.S. dollar has already won back its expectations. The last thing it could find strength for was the best advance against the euro in the last seven months in the week to January 28. Alas, the victory of the U.S. dollar turned out to be pyrrhic. It was followed by the worst five-day week in two years. ECB President Christine Lagarde's speech at the press conference following the January meeting of the Governing Council was filled with hawkish rhetoric. Lagarde no longer claimed that rates would not rise in 2022, she noted that there was serious concern about inflation indicators at the meeting table. Reaching a record high of 5.1%, consumer prices may remain high longer than the European Central Bank predicted. Indeed, inflation in the Eurozone regularly exceeded Bloomberg's estimates, forcing Lagarde and her colleagues to raise their forecasts. Most likely, they will do it in March. Dynamics of ECB inflation forecasts

At the same time, there will be a test of the three criteria that Lagarde referred to earlier when justifying the ECB's reluctance to raise rates in 2022. From her point of view, the European Central Bank has fewer reasons for concern than the Fed, because due to large-scale fiscal stimulus, demand in the United States increased by 30% of the pre-pandemic level. Indeed, wages in the currency bloc are not rising as fast as in the U.S., which still leaves hope for a slowdown in CPI this year. Dynamics of Core Inflation and Wages in the Eurozone

If the ECB had remained dovish, it would have lost control of inflationary expectations, which would have led to a further rise in consumer prices. The transition to hawkish rhetoric is a necessary measure, and the markets reacted quite violently to this. They are counting on an increase in the deposit rate by as much as 45 basis points in 2022 and by 100 basis points over the next 12 months. Investors haven't been this aggressive since 2018. What's next? If U.S. inflation slows down, the Fed will tighten monetary policy not five times, but a smaller number of times, which will negatively affect the dollar. If the CPI continues to accelerate, the Fed will act aggressively, but such a strategy would result in the ECB quickly withdrawing stimulus. And in this scenario, the "bears" on EURUSD will have a hard time. Most likely, the downward trend is broken and the pair should be bought on dips. At the same time, the week by February 11 may give a reason to do this. Its key event is the release of U.S. inflation data for January. Technically, the return of EURUSD quotes above the fair value of 1.132 is a signal of a reversal of the bearish trend. In order to make sure of this, the pair needs to grow above 1.15. In this case, the "Rising Wedge" pattern will be activated, followed by a pullback in the direction of 23.6%, 38.2%, and 50% Fibonacci levels from waves 4-5. It should be used to buy the euro towards the pivot levels at $1.16 and $1.172. EURUSD, Daily chart

|

| Video market update for February 04,,2022 Posted: 04 Feb 2022 06:04 AM PST Upside continuation on the the Crude oil in the play.... The material has been provided by InstaForex Company - www.instaforex.com |

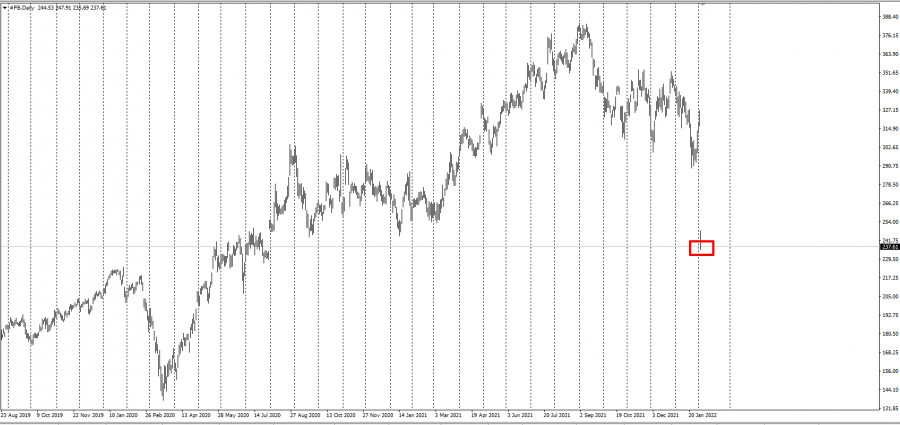

| Trading tips for Meta (Facebook) Posted: 04 Feb 2022 05:44 AM PST

Meta's shares fell 25% after the company made a disappointing quarterly outlook. The dip cost the company a more-than-$200 billion loss, which also took a toll on the tech-heavy Nasdaq 100. But if we look at the medium-term, having a price of $200 per share looks attractive. It is even more ideal if the price is lower.

This means that investors can buy shares at the current price or lower than $200. The most ideal move is to buy every $10, but that works only in the medium-term. Good luck and have a nice day! The material has been provided by InstaForex Company - www.instaforex.com |

| Euro is rising amid Lagarde's statement and US dollar is depreciating while US futures up Posted: 04 Feb 2022 05:37 AM PST

The ECB did not raise interest rates, but the euro strengthened on Thursday. The single currency is testing its highest level in three months and may show its best performance since March 2020. The Bank of England decided to tighten monetary policy and the European Central Bank did not follow suit, but the euro outperformed the pound by four times in Thursday's trading. The weakness of the British pound can be explained by the fact that the likelihood of a rate hike in the UK has already been priced in the quotes, in addition, a 25 basis points rate hike was for many investors insufficient tightening, some predicted a more aggressive scenario. Notably, the Bank of England by its signals did not justify the hopes of the market, which cannot be said about the rhetoric of the ECB. The head of the European Central Bank Christine Lagarde during a press conference after the meeting finally admitted that the situation in the euro area is really alarming. Inflation at the moment is at an exorbitantly high level and has been going on for quite a long time. We should admit that Lagarde's statements were quite expected. Sooner or later, the European Central Bank would have had to admit that the price pressure in the eurozone was too high. However, no matter how it was, few expected the sharp hawkish rhetoric of the regulator so soon, especially if we remember the recent comments of Lagarde that the ECB has no urgent need to repeat the actions of the Fed. The ECB surprised the markets, and that is a fact. At the time of writing the EUR/USD pair rose by 0.21% to $1.1460. Against the background of an unexpectedly sharp change of the ECB policy, the euro is going to show the largest increase since March 2020.

The US dollar weakened on Friday amid a strong rise in US futures, which made investors' need to invest in safer assets disappear. The US dollar index, which tracks its exchange rate against six major currencies, fell by 0.09% to 94.28 on Friday.

As we can see, demand for the currency may return if the market receives a signal about the policy changes. The market today is already full of expectations of a rate hike from the ECB by December and by at least 50 basis points. What matters is not just when central banks are going to implement their policy tightening, but how quickly and for how much they may raise rates. From now on, this applies not only to the Fed but also to the Bank of England, the ECB, and even the Reserve Bank of Australia. US market data for January will be released today, which could shake up the US dollar and stock prices. This data will signal to investors and traders how much policy tightening by the US Federal Reserve will be active and how much inflation is entrenched in wages. In addition, the jobs data will help determine if the US economy is losing momentum or not. According to the latest consensus of market analysts, the data will show an increase in employment by about 110,000 (in December the figure was at 199,000). By the way, at the beginning of the week, 165,000 were expected, but later the information was corrected. If the data show a decline in employment, it will be much harder for the Fed to implement a sharp tightening of monetary policy. However, if it becomes clear that wage growth has accelerated, the Fed will simply have no choice but to make every effort to cool down economic and business activity. Optimistic employment and average hourly earnings data are likely to boost the dollar. If it becomes clear that wage growth has slowed down and job creation is sluggish, the dollar may fall into correction after hitting 1.5-year highs recently. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Feb 2022 05:33 AM PST

Gold has been testing the resistance levels in the daily chart over the past year. It created prerequisites for pressure and a possible breakdown.

Yesterday, another increase was seen, thanks to strong data on US jobless claims.

This bullish move could extend today if data on unemployment turns out to be weaker than forecasts. Gold may even trade higher than $ 2,000. If that happens, long positions should be taken, while short positions should be avoided. This follows the strategy of "Price Action" and "Stop Hunting". Good luck and have a nice day! The material has been provided by InstaForex Company - www.instaforex.com |

| Meta lost over $200 billion and affected stock indices Posted: 04 Feb 2022 05:13 AM PST

US stocks edged lower on Thursday because of disappointing results from Meta Platforms. ECB concerns on the persistently high inflation halted stock rally as well. Both the S&P 500 and Nasdaq 100 posted declines after Meta reported more than $200 billion loss in its market value.

The weak performance from US tech giants surprised investors because most hoped for a strong reporting season that would keep stocks attractive. Supposedly, growth in earnings will allay some of their fears, especially in monetary tightening. After all, have swung sharply after markets officials cut stimulus to curb inflation. "As focus on large-scale advanced-country monetary policy and investor sentiment around the world shifts, economic activity data releases will be the key," said Marilyn Watson, head of global fixed income fundamental strategy at BlackRock. On a different note, growth in the US services sector slowed in January, while initial jobless claims fell more-than-expected last week to 238,000. Tom Essaye, a former Merrill Lynch trader who founded "The Sevens Report" newsletter, said the upcoming report on US payrolls will remind everyone that Fed policy expectations are a key influence on the markets because if data, especially inflation, exceed expectations, the Fed will be forced to tighten policy, which would return market volatility. "The bottom line is that Fed policy is still very important to this market," Essaye said. Other key events for today are: - earnings reports from Amazon and Ford Motor; - US payrolls report for January (Friday); - start of Winter Olympic Games in China (Friday) The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments