Forex analysis review

Forex analysis review |

- Bitcoin's market capitalization will reach $5 trillion in 5-7 years

- Daily Video Analysis: ETHUSD, D1 Bearish Selling Opportunity

- JP Morgan believes that the US dollar still has the potential to grow

- OPEC revises its monthly production increase

- Analysis and trading tips for GBP/USD on February 3

- Forecast of London Bullion Market Association (LBMA) for 2022

- Australian dollar: one step forward, two steps back

- Lagarde's hints about the early start of an ECB interest rate hike will lead to the euro's growth

- Trading plan for starters of EUR/USD and GBP/USD on February 3, 2022

- Indicator analysis: Daily review of GBP/USD on February 3, 2022

- Forex forecast 02/03/2022 EUR/USD, GBP/USD, USDX and Bitcoin from Sebastian Seliga

- GBP/USD trading plan for February 3, 2022. Trading tips for beginners

- Crypto startups raise millions

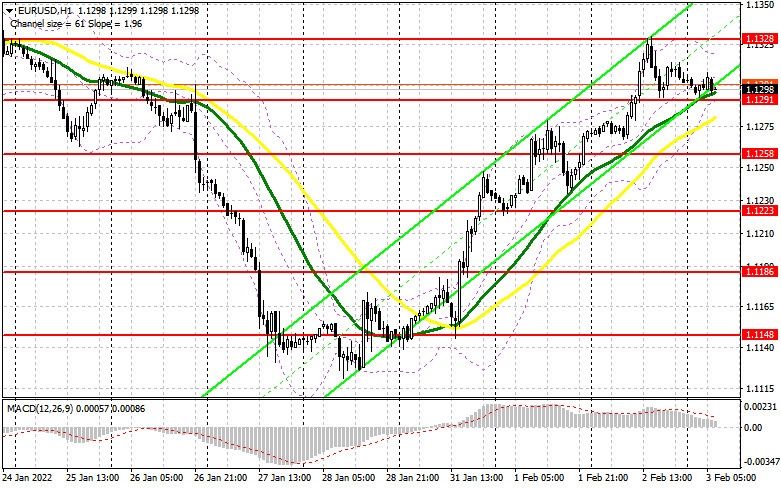

- Indicator analysis: Daily review of EUR/USD on February 3, 2022

- Trading plan for EUR/USD and GBP/USD on February 3, 2022

- Is the US dollar ready to dominate the market?

- US stock market on February 3, 2022

- Hot forecast for EUR/USD on 02/03/2022

- GBP/USD. Preview of BoE's February meeting: Subspecies of Omicron BA.2, rising inflation and falling unemployment

- GBP/USD: plan for the European session on February 3. COT reports. Bank of England to raise interest rates today

- Technical Analysis of ETH/USD for February 3, 2022

- Technical Analysis of BTC/USD for February 3, 2022

- EUR/USD: plan for the European session on February 3. COT reports. European Central Bank meeting

- Elliott Wave Analysis of Natural Gas for February 3, 2022

- Trading plan for Gold for February 03, 2022

| Bitcoin's market capitalization will reach $5 trillion in 5-7 years Posted: 03 Feb 2022 02:35 AM PST

Parallax Digital's founder and CEO, Robert Breedlove, said that Bitcoin's price should rise at least four to five times over the next few years. Breedlove believes that central banks will eventually start buying Bitcoin and this will put noticeable inflationary pressure on the price. He voiced such comments as US inflation hit a 40-year high and the latest consumer price index was 7%. Breedlove previously said that inflation is a real theft, and printing money is a counterfeit money, only legalized. "To begin with, inflation is a very confusing term. People usually call it price inflation because that's what we face in our daily life. But in reality, this is nothing more than an arbitrary expansion of the supply of fiat currency under the protection of a legitimate monopoly." Breedlove said. He also added that the US dollar is likely to hyperinflate by 2035. During that time, Bitcoin's price in dollar terms will be astronomical, rising up to 1, 5, or even 10 million dollars. If this happens, the US dollar will lose its value. Therefore, he said that it is not difficult to imagine that Bitcoin itself is a unit of account. As for Bitcoin's downside risks, the world's largest cryptocurrency may face a small number of existential threats – hacking cryptography on elliptical curves, and perhaps, some massive event or an electromagnetic pulse will destroy everything electronic in the world for a long period of time. Breedlove stated that all of this is a real threat. However, the biggest threat to Bitcoin is regulatory. Another thing that could change Breedlove's long-term bullish position on Bitcoin is an event like the "Black Swan" (speculative bubble), which can sharply lower the hash rate. Hash rate is how much capital and energy is spent on bitcoin production and security, which will be reflected in the price. A few months ago, China banned Bitcoin mining. The hash rate has fallen by 40%, and since then, it has exceeded its original maximum, which was before China banned mining.

|

| Daily Video Analysis: ETHUSD, D1 Bearish Selling Opportunity Posted: 03 Feb 2022 02:31 AM PST Today we take a look at ETHUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| JP Morgan believes that the US dollar still has the potential to grow Posted: 03 Feb 2022 02:05 AM PST

The American investment bank JP Morgan said that the US dollar may grow further in the near future. Economists noted that the US Fed will provide the basis for the movement, promising to ensure multiple rate hikes over the next two years. In January, the Fed reported that the US economy had reached full employment and so, they needed to raise interest rates to fight inflation.

Daniel Hui, one of JPMorgan's analysts, said that the market should be ready for what is likely to be the forthcoming tight policy of the Fed. Respectively, the dollar index should make another increase. If the rate is really raised up to 2.25% during the current year, then the US dollar may grow by 3%. This calculation is based on historical bid ratios. JPMorgan also suggests some reassessment of interest rates around the rest of the world as American yields rise. According to historical data, this 3% is also the average historical growth of the US dollar, which is usually observed 2-3 months from the time the Fed starts to raise the rate. At the same time, JP Morgan economists warn about the negative sides of global growth due to the geopolitical increase in energy prices. The US dollar would clearly benefit from this as other currencies with high growth sensitivity had to pull back. Currency strategists from the US investment bank also said that if they start to raise interest rates higher than expected, they expect to sell the euro and yen against the US dollar since they will be higher compared to interest rates in the Euro area and Japan. "The market will continue to be driven by two forces – policy divergences with a focus on the Fed and higher commodity prices. But, as is now evident, the geopolitical environment has also become an important risk factor." Daniel Hui said. The material has been provided by InstaForex Company - www.instaforex.com |

| OPEC revises its monthly production increase Posted: 03 Feb 2022 01:44 AM PST

OPEC is still expecting the world oil market to be in surplus this year. But they made adjustments to their monthly production increases, revising it to 1.3 million barrels per day. Initially, the group wanted to stick to their plan of adding 400,000 bpd to their total monthly output until production returned to pre-pandemic levels. But that proves to be difficult as some member countries struggle to meet quotas assigned to them. OPEC and its members have agreed to take almost 8 million bpd off the market in response to lockdowns by many countries. But those cuts, coupled with less investment in oil maintenance and exploration, have substantially reduced the group's spare capacity near its lowest point ever. That is why OPEC agreed to increase production again in March, albeit marginally since several members failed to meet their planned monthly increase. Oil prices closed in the red after the OPEC meeting:

After a brief meeting on Wednesday, OPEC approved a nominal 400,000 bpd production recovery in March. The group had made similar pledges in previous months, but a Bloomberg survey showed that several of its members barely managed to meet quotas in January due to problems such as lack of investment. The material has been provided by InstaForex Company - www.instaforex.com |

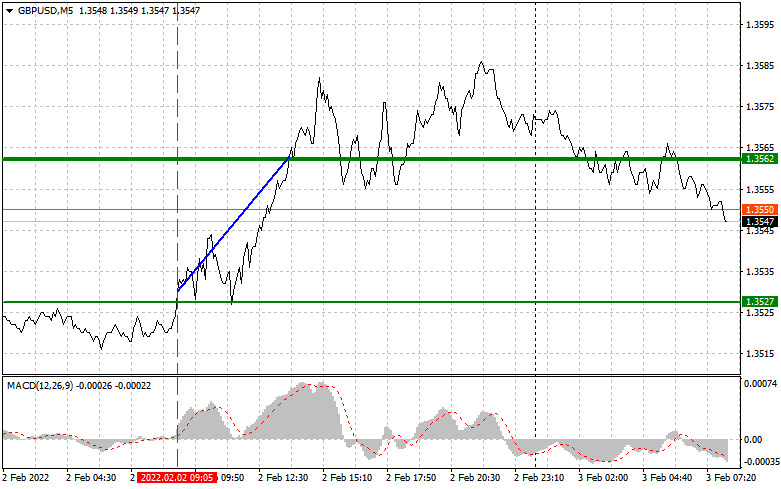

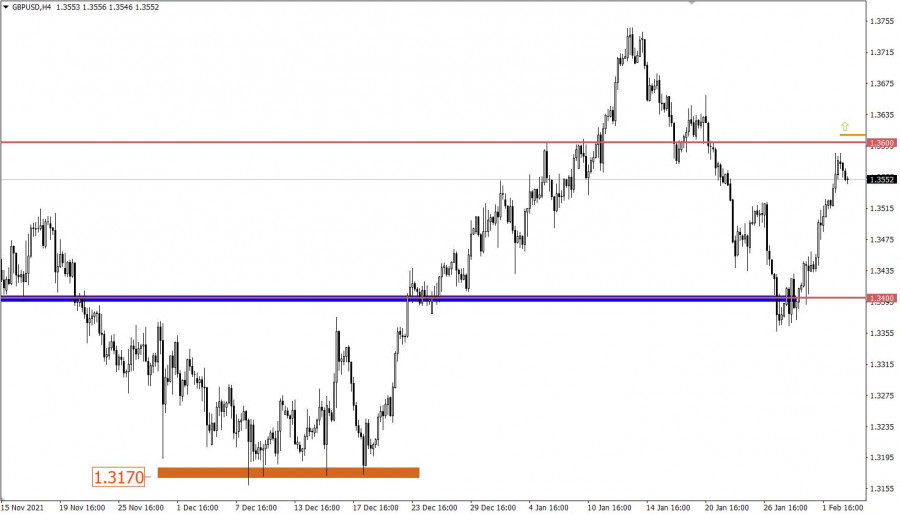

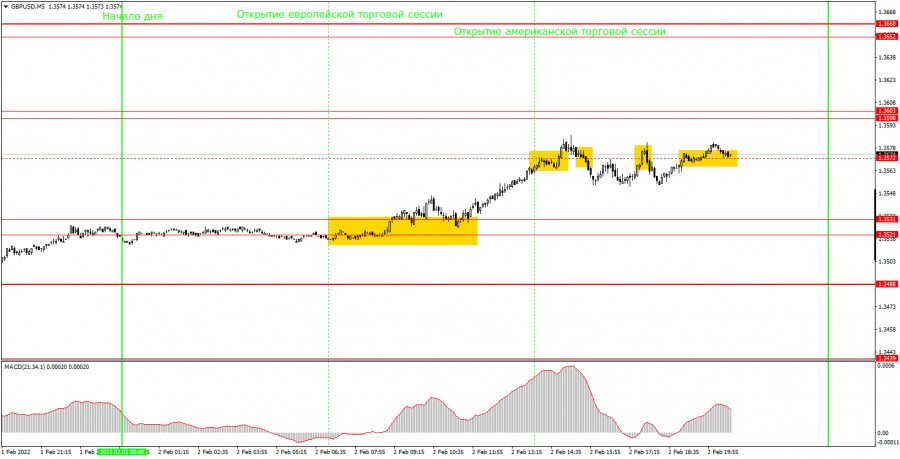

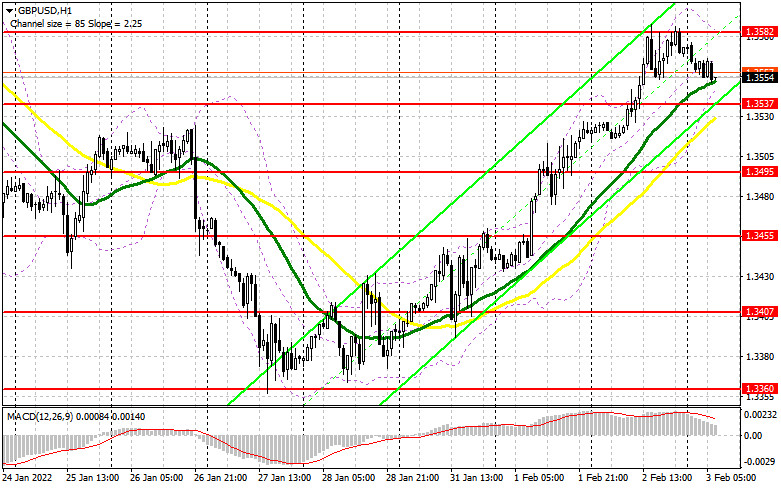

| Analysis and trading tips for GBP/USD on February 3 Posted: 03 Feb 2022 01:32 AM PST Analysis of transactions in the GBP / USD pair A signal to buy emerged after GBP/USD hit 1.3527. Coincidentally, the MACD line was above zero, so the pair increased by 35 pips. Meanwhile, selling at 1.3562 did not lead to the expected correction, so saw traders slight losses. No other signal appeared for the rest of the day.

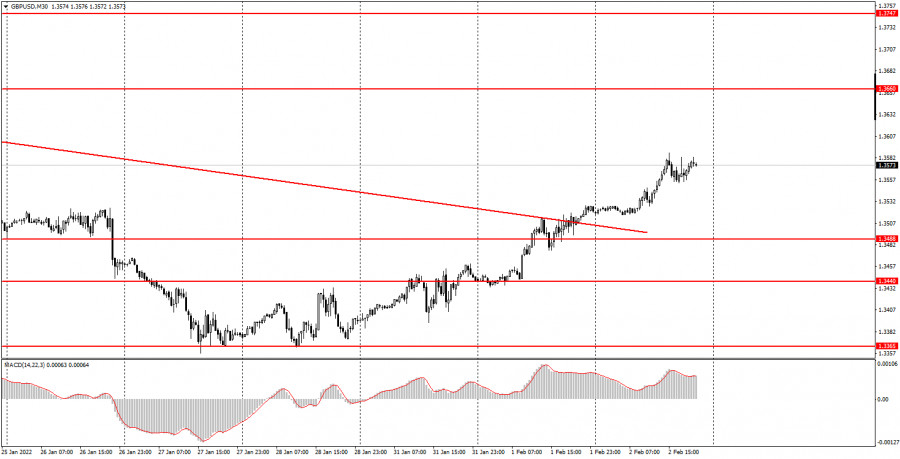

GBP/USD did not fall even though retail sales in the UK did not exceed expectations. Instead, a rally was seen in the afternoon because weak employment report from the ADP lowered demand for dollar. Most likely, this bullish move will continue as the Bank of England may take more aggressive actions to curb inflation. More specifically, a further increase in interest rates will prompt more demand for the pound. But weak PMI data could limit growth in the market, as will strong reports on the US economy. If business activity in the US exceeds expectations, demand for dollar will return, which will lead to a fall in GBP/USD. For long positions: Buy pound when the quote reaches 1.3564 (green line on the chart) and take profit at the price of 1.3613 (thicker green line on the chart). A rally will occur if the Bank of England announces further increase in interest rates. But before buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.3535, however, the MACD line should be in the oversold area as only by that will the market reverse to 1.3564 and 1.3613. For short positions: Sell pound when the quote reaches 1.3535 (red line on the chart) and take profit at the price of 1.3498. A decline will occur if Andrew Bailey says the Bank of England will stop raising interest rates. But before selling, make sure that the MACD line is below zero, or is starting to move down from it. Pound can also be sold at 1.3564, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.3535 and 1.3498.

What's on the chart: The thin green line is the key level at which you can place long positions in the GBP/USD pair. The thick green line is the target price, since the quote is unlikely to move above this level. The thin red line is the level at which you can place short positions in the GBP/USD pair. The thick red line is the target price, since the quote is unlikely to move below this level. MACD line - when entering the market, it is important to be guided by the overbought and oversold zones. Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast of London Bullion Market Association (LBMA) for 2022 Posted: 03 Feb 2022 01:30 AM PST

According to the forecast of London Bullion Market Association for 2022, analysts have moderated their enthusiasm after disappointing gold results last year. This week, the LBMA published the results of its annual predictive research. The 34 analysts who took part in this year's survey responded that gold prices will remain relatively stable, averaging around $1,801.90 an ounce in 2022, which is almost unchanged from last year's average price of $1,798.60 an ounce.

Assuming that the average price will be really relatively stable, analysts believe that the potential for price fluctuation will be within the range of $780. According to the report, economists are looking at three factors that will affect gold this year: higher interest rates, a growing threat of inflation, and higher market volatility. Degussa Chief Economist Torsten Polleit is very optimistic about gold, believing that its potential growth could reach $2,280 an ounce since he is unsure that the Fed will be able to keep inflation under control. However, Bernard Dahdah, Natixis precious metals analyst, was negative about gold's rise, saying that gold prices could decline to $1,630 an ounce. He expects the Fed to still try to normalize inflation by raising interest rates, although inflation may remain relatively high. Bernard Dahdah also shows pessimism towards silver, believing prices will average around $23.54 an ounce for the year, which is 6% below the 2021 average of $25.14 an ounce.

However, Sharps Pixley's analyst disagrees with Bernard Dahdah, as he thinks that silver prices will rise to $30 an ounce this year. Precious metals analyst at Bank of China, Yufei Liu, is also on the bearish side of silver, believing that the precious metal will drop to $17.20 an ounce. Meanwhile, some analysts do not see much potential for platinum with a projected average price of $1,063.40 an ounce, that is, 2.5% below the 2021 average of $1,090.20 an ounce.

But HSBC's precious metals analyst, James Steel, sees the biggest potential for platinum, with a high of $1,174. He is convinced that there will be no shortage of platinum during this year, which is predicted by 2023/24. Frank Shallenberger, LBBW Head of Commodity Research, expects platinum prices to drop to $771 an ounce based on fundamental factors. However, some analysts are more bullish on palladium than on platinum, assuming annual average prices of around $1,967.60 per ounce, or 18% below the 2021 average of $2,398.30 per ounce.

Philip Klapwijk, a precious metals analyst at Precious Metals Insights, predicts this metal to rise to $2,800 an ounce, whereas Frank Shallenberger has the opposite attitude to palladium with a price forecast of $1,313 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| Australian dollar: one step forward, two steps back Posted: 03 Feb 2022 01:11 AM PST

The Australian dollar dropped from its highs after this week's Reserve Bank of Australia (RBA) meeting. The aussie failed to consolidate its gains, although the currency may recover soon The Australian dollar dropped from its highs after this week's Reserve Bank of Australia (RBA) meeting. The aussie failed to consolidate its gains, although the currency may recover soon. On Thursday, February 3, the Australian dollar sank considerably amid investors' risk aversion. Earlier, experts drew attention to the intensification of risk appetite, which slipped the aussie. According to experts, the explosion of risk sentiment in the market caused a dissonance between the strength of the Australian dollar and a sharp fall in its yield. If the strengthening of risk appetite increases, AUD is likely to sharply fall in value. Economists estimate that in the future AUD may stay in the existing trading channel. Short-term strengthening of the aussie at the beginning of this week was promoted by profit fixation on short positions among investors. Earlier, before the RBA meeting results were released, experts had fixed the closing of short positions on the Australian dollar. Market participants expected the tapering of the bond buying program and the first steps to raise interest rates in Australia. According to preliminary estimates, a U-turn in the RBA monetary policy was expected in Q3 of 2022. Earlier this week, the Australian regulator surprised the markets. It kept the interest rate at 0.1% and said it was ready to reduce the bond-buying program by 4 billion AUD weekly. However, the termination of the QE program does not mean an early increase in rates, the RBA noted. However, the market participants, who were expecting hawkish actions from the regulator, were unpleasantly surprised by the RBA's dovish decision. The board emphasized that the halt in quantitative easing did not imply a near-term hike in interest rates as it was still prepared to be patient. The regulator plans to monitor the current economic situation and the unwinding of the inflationary spiral. The authorities are going to take measures in case of an urgent need. As a result, on Tuesday morning, February 1, AUD was among the outsiders. The Aussie reached a certain equilibrium, rising against the dollar on Wednesday, February 2. The current RBA meeting was seen by experts as dovish compared to market expectations. Officials at the RBA have argued that inflation is likely to fall below 3% in 2022 and that the 2% target is just around the corner. The bank believes that the inflation rate is related to rising gasoline prices and disruptions in global supply chains. The RBA pointed to wage growth, which is slowly returning to pre-pandemic levels. Going forward, the regulator expects wage growth to accelerate as labor market conditions tighten. The uncertainty over the early rise in interest rates significantly hurt the aussie. As a result, further strengthening of AUD was questioned. The tense situation collapsed the AUD/USD pair from the highs of late December 2021 to lows near 0.7000. On Thursday, February 3, AUD increased by 0.14% to 0.7136. Later, the AUD/USD pair slipped slightly towards 0.7125.

In the short term, the Australian dollar will be closely correlated with risk appetites in the markets. According to economists, the AUD/USD pair should rise to the area of 0.7200-0.7250 to make a reverse. According to analysts, the correlation of the AUD/USD pair with the risk appetite in the markets and the unexpected dovish decision of the RBA may push the pair upwards. In the near future the fall of the Australian dollar is likely to stop. In this case, many investors in AUD believe that sooner or later the RBA will follow the path of the Fed and other global regulators. The material has been provided by InstaForex Company - www.instaforex.com |

| Lagarde's hints about the early start of an ECB interest rate hike will lead to the euro's growth Posted: 03 Feb 2022 12:45 AM PST The employment data from ADP released yesterday was extremely disappointing, but it failed to have a significant negative impact on the US stock market, although it somewhat halted the upward pullback that began last Friday after the January correction. According to the presented data, the US economy not only did not gain new jobs in January but also lost another 301,000. This picture was last observed at the beginning of 2020 during the start of the COVID-19 pandemic. So why didn't the market react to this generally extremely bad news? There are possible two reasons for this. One lies in the fact that investors already understand that the situation in the American economy is terrible amid high inflation, which is why the Fed actually made it clear that it would already start raising interest rates at the March meeting. This topic is already taken into account in market prices. Another likely reason is that the market has decided to focus on the official figures on the number of new jobs, which will be announced this Friday. Some kind of logical reaction can already be expected from here. The result of the meetings of the ECB and the Bank of England on monetary policy is the most important event for today. It is expected that the European regulator will keep all monetary policy parameters unchanged, including the zero level for the main interest rate. Meanwhile, the BoE is expected to raise the cost of borrowing by 0.25% to 0.50%, but at the same time unchanged measures to support the economy at around 875 billion pounds. What should be expected after the results of the meetings of these two largest world Central Banks? We believe that the ECB's keeping the monetary policy unchanged will not surprise anyone. Investors will expect future plans from the regulator. They will expect the reaction of the ECB President, C. Lagarde, to the publication of inflation data in the region, which surged from 5.0% to 5.1% despite the consensus forecast of its deceleration to 4.4%. If she mentions the topic of the timing of interest rate hike at the press conference, this will provide significant support for the euro in the currency market. On the other hand, it may negatively affect the stock market, causing its possible correction. But if this topic is not discussed, the euro will clearly be under pressure primarily against the US dollar, and the European stock market will calmly receive support. But again, it is worth noting that the likelihood of raising the topic of changing the monetary rate from soft to tighter is more relevant, so the probability of the continuation of the euro's growth and a weakening of demand for European shares may take place. With regard to the reaction of the market to the Bank of England's rate hike, we note that this decision is expected and may already be taken into account in the pound's rate. What can be surprising is either an increase in the rate immediately by 0.50% or the decision not to do so will lead to a noticeable movement in the British currency. However, such a development of the situation is unlikely. Most likely, noticeable movements will be observed in the currency market, stock markets, and commodity markets tomorrow after the results of the publication of US employment data. Forecast of the day: The EUR/USD pair is trading above the level of 1.1280. Any signals about the probability of an earlier rate hike will support the pair. On this wave, it can further rise to the level of 1.1370. The GBP/USD pair is trading above the level of 1.3545. A rate hike by the Bank of England can only provide local support for the pair and contribute to its growth to 1.3635.

|

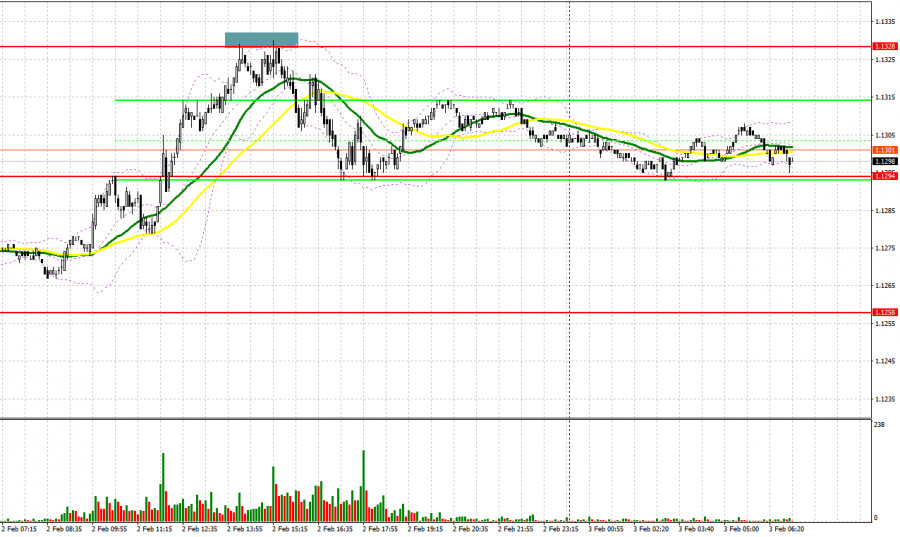

| Trading plan for starters of EUR/USD and GBP/USD on February 3, 2022 Posted: 03 Feb 2022 12:18 AM PST Here are the details of the economic calendar for February 2:Eurozone's inflation has set a new record. So, the growth of consumer prices in January in annual terms accelerated to 5.1%, while it was forecasted to decline to 4.5%. The current indicator is the maximum value since the beginning of the department's reporting. Against this background, speculators continued to increase the volume of long positions in the euro, which led to a price increase. The ADP report on US employment was published during the American trading session, where we saw a decrease for the first time since December 2020. Here, employment in January fell by 301 thousand against the expected growth of 207 thousand. The indicator is very bad, so the market stood still in disbelief when the report was announced. Analysis of trading charts from February 2: The EUR/USD pair strengthened by 200 points during the correction. This led to a price reversal to the resistance area of 1.1270/1.1320, where a local reduction in the volume of long positions occurred. But despite such a significant upward trend, the medium-term trend is still down. The pound's value strengthened by 220 points for 4 trading days, which led to the convergence of prices with the resistance level of 1.3600. Such a sharp growth is explained by the high interest of traders in speculative operations due to informational noise. On the daily chart, there was a signal earlier about a gradual recovery of downward interest. Due to the prolonged correction, the signal may turn out to be false if the quote remains above the level of 1.3600. |

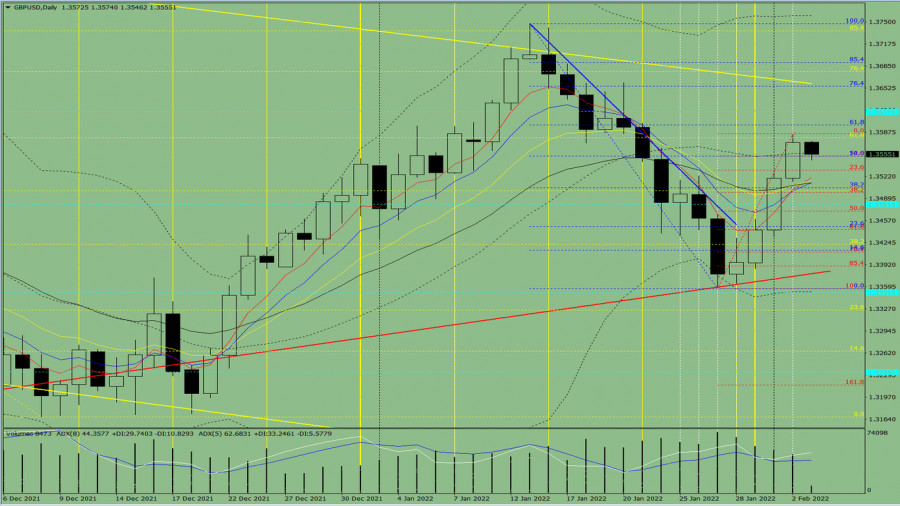

| Indicator analysis: Daily review of GBP/USD on February 3, 2022 Posted: 02 Feb 2022 11:53 PM PST Trend analysis (Fig. 1). The market may move down on Thursday from the level of 1.3572 (close of yesterday's daily candle) to test 1.3531, the 23.6% retracement level (red dotted line). Upon reaching this level, the price may start moving up to the target level of 1.3598, the 61.8% retracement level (blue dotted line).

Fig. 1 (daily chart) Comprehensive analysis: - Indicator analysis - down; - Fibonacci levels - down; - Volumes - down; - Candlestick analysis - down; - Trend analysis - up; - Bollinger bands - up; - Weekly chart - up. General conclusion: The price may move down today from the level of 1.3572 (close of yesterday's daily candle) to test 1.3531, the 23.6% retracement level (red dotted line). Upon reaching this level, the price may start moving up to the target level of 1.3598, the 61.8% retracement level (blue dotted line). Alternative scenario: from the level of 1.3572 (close of yesterday's daily candle), the price may start to move down to test 1.3498, the 38.2% retracement level (red dotted line). Upon reaching this level, the price may start moving up to the target level of 1.3598, the 61.8% retracement level (blue dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

| Forex forecast 02/03/2022 EUR/USD, GBP/USD, USDX and Bitcoin from Sebastian Seliga Posted: 02 Feb 2022 11:49 PM PST Let's take a look at the technical picture of EUR/USD, GBP/USD, USDX and Bitcoin ahead of Bank of England and ECB interest rate decision today. The material has been provided by InstaForex Company - www.instaforex.com |

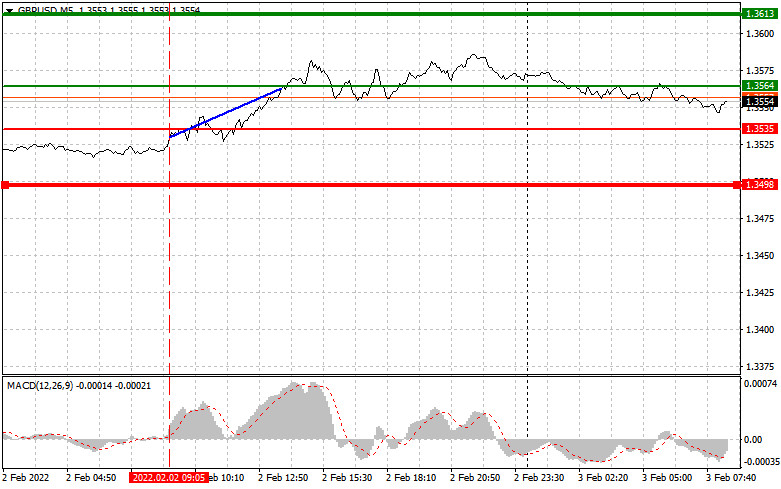

| GBP/USD trading plan for February 3, 2022. Trading tips for beginners Posted: 02 Feb 2022 11:48 PM PST Analysis of Wednesday's trades:30M chart of GBP/USD

The pound/dollar pair extended the bull run on Wednesday after it had consolidated above the descending trendline. So, the downtrend has stopped and the uptrend may now extend. However, the Bank of England's interest rate decision may have a strong effect on the pound/dollar pair. It is unclear how the quote will move on Thursday. On the one hand, there is a 95% chance of a rate hike by the BoE, which is surely a bullish factor. On the other hand, the pound sterling has been bullish for three days. Therefore, it can be assumed that the rate hike has already been priced in by market participants. Generally speaking, there are more questions than answers to them. If the pair moved sideways or showed modest growth, we would expect the market to react to the regulator's decision. But taking into account the 3-day bull run, anything could happen. M5 chart of GBP/USD

In the M5 time frame, the price moved in a clear trend. A rebound from the 1.3521-1.3531 range produced a buy signal. The quote then rose by 50 pips and broke through 1.13572. This level is no longer valid, so it has been removed. Long positions were supposed to be closed after consolidation below this mark. The price had fixed above it several times and went lower afterward. So, beginners could incur losses there as the signals were false. In the second half of the day, traders became less active. They seemed to had done everything they could ahead of the Bank of England's meeting. So, they are now awaiting the bank's decision. We remind beginners that the pair may be extremely very volatile on Thursday and that its reactions could not be foreseen in advance. Trading plan for ThursdayIn the 30M time frame, the downtrend ended. Technically, the pound may now extend the bull run. However, it will only be possible after the BoE meeting. The price behavior will remain unclear before that. The target levels in the 5M time frame are seen at 1.3488, 1.3521-1.3531, 1.3598-1.3603, and 1.3652-1.3660. The Bank of England will announce its decision on interest rates and Governor Andrew Bailey will speak on Thursday. Both events are of utmost importance. In the United States, the ISM non-manufacturing PMI will be released but it will not receive as much attention as the BoE meeting. Basic principles of the trading system:1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal. 2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored. 3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading. 4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually. 5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel. 6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area. How to interpret a chart:Support and resistance price levels can serve as targets when buying or selling. You can place Take Profit near them. Red lines are channels or trend lines that display the current trend and show which direction is better to trade. MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines. Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in long-term trading. The material has been provided by InstaForex Company - www.instaforex.com |

| Crypto startups raise millions Posted: 02 Feb 2022 11:47 PM PST Many crypto companies continue raising funds despite seeing a huge dip in the market recently. For example, FTX and its US affiliate obtained $800 million in January, while Fireblocks and Blockdaemon raised $550 million and $155 million, respectively. CB Insights said it seems that this year will be a blockbuster year for crypto startups. The recently-observed decline in the crypto market made investors worried about their funds, and the term "crypto winter" began to be heard again. The last time that such an event occurred was late 2017 and early 2018, when Bitcoin fell 80% from its then all-time high. "If we enter a 'crypto winter', it will have nothing to do with the bear market that we have seen before," said Konstantin Richter, CEO and founder of Blockdaemon.

There is certain truth in Richter's words because at present, the crypto market already has institutional recognition and its liquidity is far different from that in 2017-2018. Several investors are also optimistic on crypto and blockchain technologies. And as mentioned before, crypto startups have raised millions, with Fireblocks attaining $8 billion in a $550 million round. Its rival, Blockdaemon, made $155 million on a $1.3 billion valuation. Some negotiations on these deals began at the end of last year.

So far, the market is under pressure because of the scheduled rate hike in March. But a common investment argument in favor of Bitcoin is that it can act as a store of value and a hedge against inflation, so if the Fed begins to fight price pressure, investors are likely to leave part of their money to the cryptocurrencies market, counting on more profitable and safe offers for US bonds. CEO and co-founder of Mythical Games, John Linden, said a bear market may not be the worst thing that could happen right now. Technical analysis for bitcoin BTC rose above $36,000, but activity lagged around $38,5000, so there is a chance that the price will dip today to $36,000 and then to $32,900. Only going beyond $39,200 will lead to a rise to $41,340 and $43,120, and then to $46,150.

Technical analysis for Ethereum ETH hit $2,720. If bullish activity persists, its price could reach $2,980. But if sellers manage to control the market, it could dip to $2,720 and then to $2,470 or $2,430. The material has been provided by InstaForex Company - www.instaforex.com |

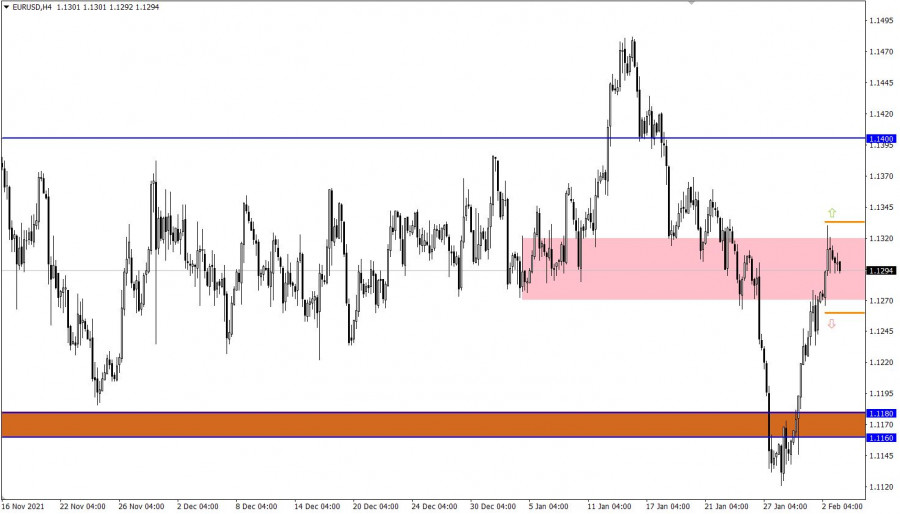

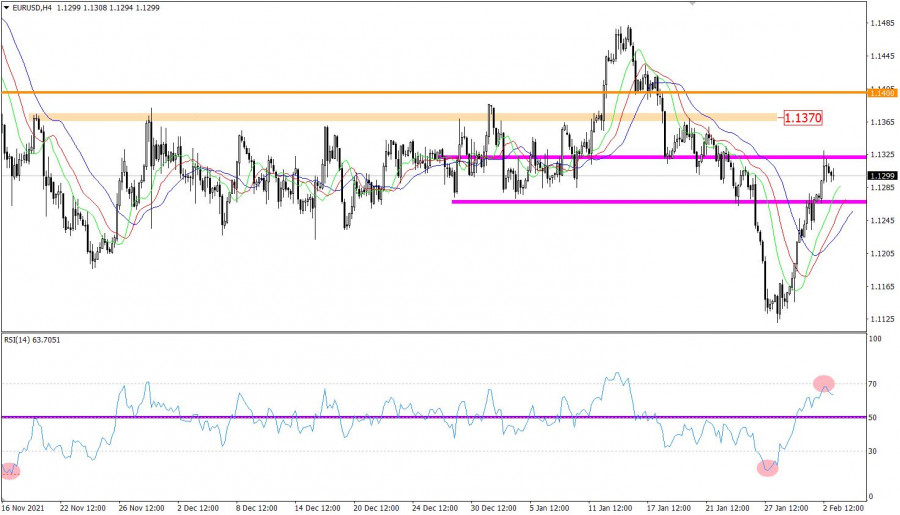

| Indicator analysis: Daily review of EUR/USD on February 3, 2022 Posted: 02 Feb 2022 11:43 PM PST Trend analysis (Fig. 1). The market may move down on Thursday from the level of 1.1303 (close of yesterday's daily candle) to test 1.1280, the 23.6% retracement level (red dotted line). Upon reaching this level, the price may start moving upwards to the target level of 1.1344, the 61.8% retracement level (yellow dotted line).

Fig. 1 (daily chart) Comprehensive analysis: - Indicator analysis - down; - Fibonacci levels - down; - Volumes - down; - Candlestick analysis - down; - Trend analysis - up; - Bollinger bands - up; - Weekly chart - up. General conclusion: The price may move down today from the level of 1.1303 (close of yesterday's daily candle) to test 1.1280, the 23.6% retracement level (red dotted line). Upon reaching this level, the price may start moving upwards to the target level of 1.1344, the 61.8% retracement level (yellow dotted line). Alternative scenario: from the level of 1.1303 (close of yesterday's daily candle), the price may start to move down to test 1.1250, the 38.2% retracement level (red dotted line). Upon reaching this level, the price may start moving upwards to the target level of 1.1301, the 50.0% retracement level (yellow dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

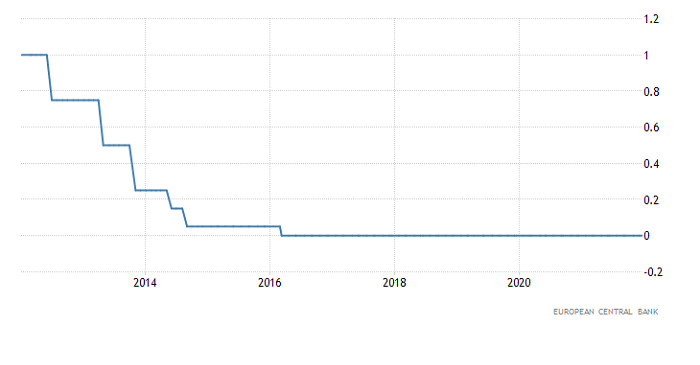

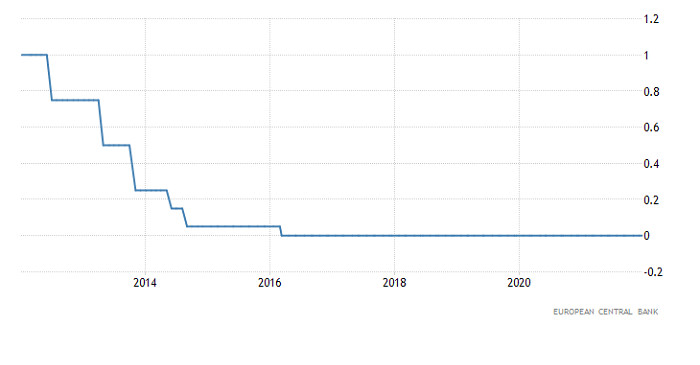

| Trading plan for EUR/USD and GBP/USD on February 3, 2022 Posted: 02 Feb 2022 11:40 PM PST The only thing that matters for the pound today is the results of the meeting of the Board of the Bank of England. Moreover, the probability of an increase in the refinancing rate from 0.25% to 0.50% is extremely high. Last December, the British regulator raised the rate from 0.10% to 0.25%, which led to a long, and most importantly impressive, growth of the pound. Now, it is quite possible that exactly the same thing will happen today and we will witness another whole month of non-stop strengthening of the British currency. However, the December decision came as a complete surprise to everyone, which is the main reason for such a sharp growth of the pound. This time, the market as a whole is ready for an increase in the refinancing rate, and this will not be something unexpected for market participants. Therefore, such an aggressive reaction is clearly not worth waiting for. Nevertheless, there are suspicions that the results of the meeting will somewhat surprise market participants. After all, the refinancing rate was raised only a month and a half ago, and too little time has passed since then to be able to assess the effect of this decision. A logical step would be to wait at least three months before taking further steps to tighten monetary policy. In this case, the Bank of England might leave everything as it is today, while market participants are already ready by the expectation of rising interest rates. If so, the pound will inevitably lose its position. Refinancing rate (UK):

It is possible that the main event of not only the week, but the whole of February will be today's meeting of the Board of the European Central Bank, after which plans to tighten monetary policy up to an increase in the refinancing rate will be announced before the end of this year. The actions of both the BoE and the Fed suggest such reflections. And if these expectations are justified, then the euro will begin a fairly long growth. This process may extend for a whole month, right up to the next meeting of the Federal Committee on Open Market Operations. However, if the European Central Bank does not say anything again, but only repeats the words about the need to maintain the stability of economic recovery and the like, then there is no need to talk about any growth of the euro. The trend to strengthen the US dollar will simply resume. Refinancing rate (Europe):

The EUR/USD pair is moving in a corrective course from a local low of 1.1121, which resulted in the strengthening of the euro by more than 200 points. The local overbought status has already been received, but this did not lead to a reversal. There is currently a stagnation, which is due to the upcoming event. It can be assumed that a new wave of speculation will emerge very soon. The levels of 1.1240 and 1.1335 will act as signal levels, whose breakdown will indicate the subsequent path of speculators. The GBP/USD pair approached the resistance level of 1.3600, where there was a reduction in the volume of long positions. This led to a price pullback due to the high overbought level. So, an increase in downward interest may occur after the price is kept below the level of 1.3530. At the same time, the prolongation of the upward cycle will be considered after holding the price above the level of 1.3600. |

| Is the US dollar ready to dominate the market? Posted: 02 Feb 2022 11:25 PM PST

The US dollar wants to show who is the leader by regaining its former dominant position. Its attempts to strengthen are quite successful, but the euro does not give up and tries to push the leading currency on the side. Many analysts believe that the US dollar's further growth will require a boost from the Fed, particularly its actions aimed at normalizing the monetary policy and containing inflation. According to preliminary calculations, the "dominance" of the USD will last within 3-6 months. Reuters believes that a fundamental change in market expectations regarding the Fed's rate hike is needed to give the US currency a rapid increase. Some experts admit that tightening the Fed's monetary policy will slightly change the situation. However, they also believe that the regulator was late in tightening the monetary policy and a series of rate hikes will not give the desired result. Experts are wondering whether the Fed will stop the unwinding of the inflationary spiral, and come to the conclusion that it is extremely difficult to do this. The regulator will have to maintain stable market expectations without provoking a recession. The Fed is being indecisive, which can collapse at any moment and pull the US dollar with it. The US dollar's relative strengthening was facilitated by a decline in risk appetite in world markets. In this situation, the EUR/USD pair rose to the psychologically important level of 1.1300 but later slowed down this movement. On Thursday morning, the pair rose again to a round level. In the short-term planning range, experts expect the EUR/USD pair to break through the level of 1.1340, that is, the upper limit of the wide range of 1.1200-1.1350.

Analysts said that traders should foresee the possibility of a strong decline in the USD and develop a strategy for this case. According to current calculations, as long as the EUR/USD pair is below the level of 1.1500, the US currency remains valid. According to experts, the pair will reach this level by the end of February. But if this scenario is implemented right away, the EUR/USD pair will rise to 1.1500 by the end of this week. Such a development of events will 100% correct the fall of the pair recorded in the second half of January. In view of this, the EUR/USD pair will stabilize in the range of 1.1350–1.1500 in the coming weeks. Like the American one, the euro is trying to gain dominance before the ECB meeting. The euro rose for the third day in a row on Wednesday, breaking a 20-month low. The reason for this is the off-scale inflation in the eurozone, the strengthening of which contributes to the expectation of an early rise in rates from the ECB. At the end of January 2022, the EU's consumer prices soared by 5.1% year-on-year. According to the calculations of Eurostat, this is a record figure in history, which is more than twice the target 2%. It can be recalled that in December 2021, the inflation rate in the eurozone was also extremely high (5%). In January, the cost of energy in the EU surged by an impressive 28.6% from 25.9% in December. Industrial goods also rose by 2.3%. By the end of this week, the euro strengthened by 0.45% against the US dollar, reaching a nine-day high. The reason is the high probability of a faster tightening of the monetary policy by the European regulator following the meeting today. According to market participants, consistent high inflation will force the ECB to raise interest rates several times. Experts expect at least two rate hikes in 2022. According to currency strategists at Scotiabank, if the ECB stays true to its principles and does not raise rates during the year, this will slow down the euro. Currently, the US and European currencies are in standby mode. The EUR/USD pair is actively looking for a way out and along the way, they are strengthening their positions, using the current gains as a reason to further rise. The material has been provided by InstaForex Company - www.instaforex.com |

| US stock market on February 3, 2022 Posted: 02 Feb 2022 11:17 PM PST

S&P500

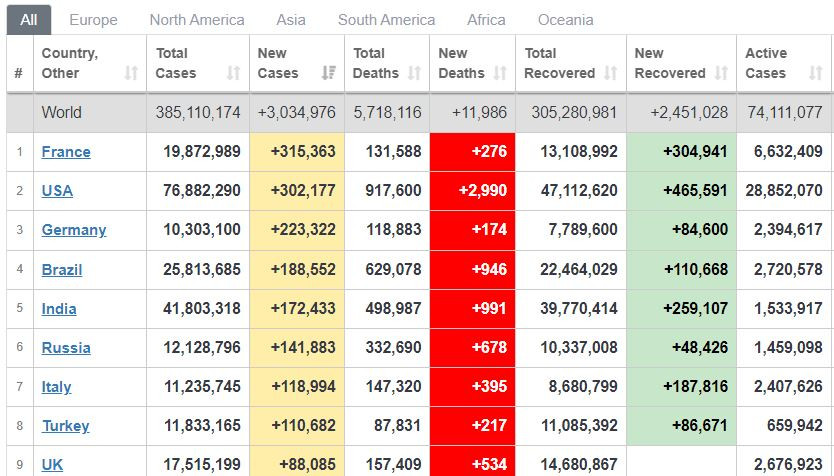

COVID-19 statistics as of early February 3 On Wednesday, the US stock market closed higher, extending its February rally and booking a fourth straight day of gains. The Dow Jones added 0.6%, the NASDAQ gained 0.5%, and the S&P 500 advanced by 0.9%. In Japan, the Nikkei 225 lost 1.2% early on Thursday. The price of Brent crude oil edged up to $89 per barrel, but failed to shatter the $90 milestone. OPEC+ countries agreed to raise production quotas by 400,000 barrels in February. The increase is unlikely to fully cover the deficit in the market, which could potentially push oil prices higher. In the US, oil stockpiles declined by 1 million barrels over the week. Distillate inventories dropped by 2 million barrels, while gasoline stockpiles climbed by 2.1 million barrels. The number of Omicron infections has peaked, with 3 million cases reported worldwide on Wednesday. 300,000 infections were reported in the US and France, while 220,000 cases were registered in Germany. The current wave of the pandemic seems to be slowing down. The S&P 500 is trading at 4,589 and is expected to be in the 4,560-4,610 range. The US market made gains yesterday despite weak ADP payrolls data due to the spread of Omicron. The number of new jobs in the US economy fell by 300,000 in January, compared to a 776,000 increase in December. Investors remain highly bullish, despite disappointing data releases. Shares of General Motors went up on the company's strong earnings report. GM's revenues have increased to $10 billion over the year. Meta Platforms stock tumbled by 20% yesterday, limiting the NASDAQ's upside movement. The sell-off was triggered by a weak quarterly report indicating lower than expected revenues for Facebook's parent company. The US national debt topped $30 trillion for the first time. An interest rate increase by the Federal Reserve would increase US interest payments. At some point, it could put pressure on the US dollar and send economic shockwaves worldwide. The US, being the world's strongest economy, could escape the full force of the resulting shock unlike other nations. Today, US weekly employment report and the ISM services PMI are due, The index is expected to decline to 59.5% compared to 62% in December. USDX is trading at 96.0 and is expected to be in the 95.70-96.30 range. The US dollar has been losing ground for the past three days amid the US equities rally. EUR/USD closed in positive territory on Wednesday, boosted by EU inflation data. The eurozone's annual inflation rose by 5.1% in December. Economists expected inflation to rise by 4.4%. Germany's CPI increased by 4.9%. Today, the ECB is conducting its monetary policy meeting. The regulator is expected to address soaring inflation and comment on the potential interest rate increase, particularly taking into account the upcoming Fed rate hike. EUR could rise sharply today. USD/CAD is trading at 1.2690 and is expected to be in the 1.2600-1.2800 range. If there are no significant changes in oil prices, the pair will likely remain within that range until March. The US market is on the upswing. However, it is likely that the rally could be followed by a downward correction. The material has been provided by InstaForex Company - www.instaforex.com |

| Hot forecast for EUR/USD on 02/03/2022 Posted: 02 Feb 2022 11:02 PM PST Probably the main event not only of the week, but of the whole of January will be today's meeting of the Board of the European Central Bank, following which, as expected, plans to tighten monetary policy will be announced. Up to an increase in the refinancing rate. And not ever, but before the end of this year. Similar reflections are suggested by the actions of both the Bank of England and the Federal Reserve. And if these expectations are met, then a fairly long growth will begin for the single European currency. This process may well last for a whole month, right up to the next meeting of the Federal Open Market Committee. If the ECB once again does not say anything, but only repeats the words about the need to maintain the stability of the economic recovery and the like, then there will be no need to talk about any growth of the euro. Simply resume the trend to strengthen the dollar. Refinancing rate (Europe):

During the corrective movement, the euro exchange rate strengthened by 200 points against the dollar. This led to a reverse movement of the price to the resistance area of 1.1270/1.1320, where a local reduction in the volume of long positions occurred. The RSI technical instrument approached the level of 70 in a four-hour period, which signals the euro's overbought status. The Alligator indicator changed the direction of the moving lines from a downward to an upward cycle in a four-hour period. Alligator D1 is still leaning towards the downward development of the market, there is no MA line crossing. There is a downward trend on the chart of the daily period, in the structure of which there is a correction cycle. Expectations and prospects: In this situation, traders are considering a temporary price fluctuation within the resistance area of 1.1270/1.1320, but everything can change in case of new speculative jumps. For this reason, the values of 1.1240 and 1.1335 will become signals, where a breakthrough of one of the levels will indicate the subsequent path of speculators. Complex indicator analysis gives a buy signal based on the short-term and intraday periods due to price correction. Indicators in the medium term signal a sale due to a downward trend.

|

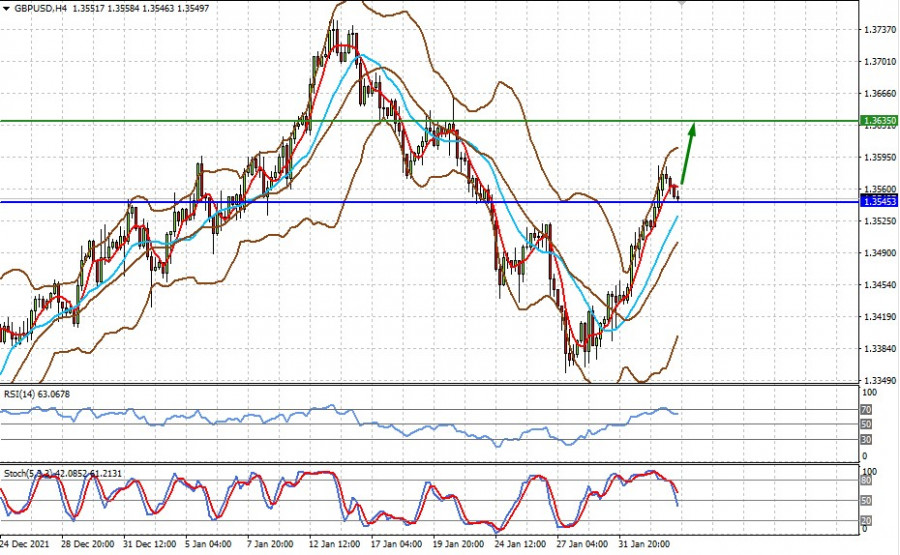

| Posted: 02 Feb 2022 10:46 PM PST The GBP/USD pair's price has been rising for several trading days, breaking through resistance levels. Since last Friday, the pound has gradually gained momentum, recovering its lost position. In less than a week, the pair has strengthened by more than 200 points, rising from the level of 1.3364 to a local high of 1.3587. But despite the upward impulse, the buyers did not dare to attack the 1.36 level. During Thursday's Asian session, the pair left from the weekly high and flatted around the level of 1.3550. The point here is not only that the dollar index has slowed down its decline: the pound is waiting for BoE's February meeting, the results of which will be announced today in the afternoon.

In general, hawkish decisions are expected from the English regulator. According to Goldman Sachs' analysts, the Central Bank will raise interest rates three times by the end of 2022. Moreover, the first increase by 25 basis points is expected today. However, not only GS currency strategists are talking about today's round of monetary policy tightening, most experts predict a rate hike to 0.5% following the February meeting. This fact is already considered in prices, and can cause strong volatility for the pair only if it does not become a reality. If the regulator still lives up to market expectations in this part, the pound will receive some support. However, the prospects for GBP/USD will depend on the rhetoric of the Bank of England regarding the fate of QE and the pace of tightening monetary policy. The "basic" hawkish scenario assumes three rate hikes (February, May, August), the end of reinvestment under the QE program, and the announcement of the sale of securities from its balance sheet starting in autumn (October-November). If the British regulator retreats from at least one point of the "program", the pound may be under some pressure, even despite the rate increase at today's meeting. There are many fundamental factors in favor of the hawkish scenario. First of all, this is a record inflation growth in the country. The overall consumer price index in annual terms showed a sharp growth, being at around 5.4%. This is an almost 30-year record, which is the strongest growth rate since March 1992. Core inflation showed similar dynamics. The core consumer price index increased to 4.2%. The British labor market was not disappointing either. According to the latest data, the unemployment rate in the country fell to 4.1%, as well as the number of applications for unemployment benefits (-43 thousand). However, there is one problem - a decrease in the level of average earnings (both with bonuses and without this component). But in general, almost all of the above components of the release were in the "green zone", reflecting the recovery of the UK economy. Following the publication of these macroeconomic reports, the market began to win back in advance the almost guaranteed increase in interest rates at the February meeting. But after passing 200 points up, traders stopped. It seems that they thought that the Bank of England give an additional impetus to the pound. Will the regulator reach the overstated bar of market expectations? These unanswered questions stopped the British currency. The GBP/USD pair fell by almost 40 points during today's Asian session. We believe that the doubts of market participants are not groundless. As already known a new and even more infectious sub-variant of the Omicron strain, BA.2, is now actively spreading in the UK. In the first ten days of January alone, at least 400 people were infected with it. And although Omicron is more easily tolerated than Delta (this also applies to subspecies BA.2), the new strain is still dangerous for members of the risk group. In particular, 534 deaths from COVID-19 were recorded yesterday in Britain - this is the highest figure in a year. Over the past day, more than 88 thousand new cases of coronavirus were registered. It appears that cases in the UK will rise again as the BA.2 subspecies are more likely to re-infect humans, according to the findings of the British Health Safety Agency. At the same time, this virus has become much more contagious than its parent version. For example, if infected with Omicron BA.1, family members will be infected with a probability of 30%, then for BA.2, this indicator is already a third higher. The UK authorities are currently not talking about the return of lockdowns or any additional quarantine restrictions. But the uncertainty associated with the spread of a new subspecies of coronavirus could negatively affect the decisiveness of members of the Bank of England. That is, a scenario is likely in which the regulator, on the one hand, will raise the interest rate based on the results of today's meeting, but on the other hand, will not justify the hopes placed on it by the markets in terms of a further increase in the rate. A similar alignment will be interpreted by the market against the British currency. Therefore, the results of the BoE's February meeting may unpleasantly surprise buyers of GBP/USD, even despite the increase in interest rates. In this case, it is risky to open longs for the pair now, using the downward pullback. At the moment, it is advisable to take a wait-and-see attitude, waiting for the announcement of the result. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Feb 2022 10:26 PM PST To open long positions on GBP/USD, you need: Yesterday, only one signal was formed to sell the pound in the first half of the day, which turned out to be unprofitable. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.3536 and advised you to make decisions on entering the market. Growth and the formation of a false breakout at this level in the first half of the day resulted in creating a sell signal for the pound, but it was not possible to achieve a larger downward correction. As a result, losses were recorded on the transaction and the pound continued its upward correction against the US dollar. There were no signals to enter the market in the afternoon.

Today is quite an important day for us and many are counting on an interest rate increase from the Bank of England, which will increase the British pound's appeal. However, it should be understood that the planned increase has already been taken into account in the quotes, and if the central bank does not announce anything new in its summary, the pound may even plunge. It is very important that BoE Governor Andrew Bailey speaks out more aggressively regarding further monetary policy – this will be a catalyst for the pound's growth. An important task for today is to protect the support of 1.3537, where the moving averages are playing on their side. From this range, we can count on the continuation of the upward correction for the pair. It is important to form a false breakout at 1.3537. Only this will create the first entry point into long positions, and good data on the PMI index for the UK services sector will return demand for the British pound. An equally important task is to break through and test 1.3582 from top to bottom, which will provide another buy signal with the goal of returning to 1.3622. A more difficult task is to update the 1.3656 area, but this will clearly happen only in case of aggressive changes in the central bank's policy after today's meeting. I recommend taking profits there. In case GBP/USD falls during the European session after weak fundamental data and lack of activity at 1.3537, it is better not to rush into buying risky assets. I advise you to wait for the test of the next major level of 1.3495. Only the formation of a false breakout will provide an entry point to long positions. You can buy the pound immediately for a rebound from 1.3455, or even lower - from this month's low of 1.3407, counting on a correction of 20-25 points within the day. To open short positions on GBP/USD, you need: The bears remain on the sidelines and will obviously closely monitor the results of the BoE meeting. A lot will depend on the degree of hawkish policy, so no one will sell the pound even from the current highs yet.

The primary task is to protect the 1.3582 level, where the bullish momentum was stopped yesterday. Forming a false breakout in this range, along with the divergence that is being formed now on the MACD indicator, all this creates the first entry point into short positions, counting on the resumption of the bear market and the pair's decline to the intermediate support area of 1.3537, formed by yesterday's results. A breakdown and a test of 1.3537 from the bottom up will provide another entry point for short positions on the pound with the goal of falling to 1.3495 and 1.3455, where I recommend taking profits. If the pair grows during the European session and bears are weak at 1.3582, and good data on the UK composite PMI will be a good sign of stable economic growth - then it is best to postpone short positions until the next major resistance at 1.3622. I also advise you to open short positions there only in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from 1.3656, or even higher - from the high in the area of 1.3697, counting on the pair's rebound down by 20-25 points within the day. I recommend for review: The Commitment of Traders (COT) report for January 25 showed that short positions increased and a sharp reduction in long ones. All this has led to a return of the market to the bears' side, but this week the situation may change dramatically. As the bears did not try to continue the downward trend, it turned out quite badly. The bears were not helped by the Federal Reserve's statements after the monetary policy meeting that the central bank would start raising interest rates in the United States in March. Most likely, the demand for the pound will gradually recover, as a meeting of the Bank of England committee will be held this Thursday, at which it will be decided to raise interest rates. However, the pressure on the pound will remain due to the observed fundamental picture, which creates a number of more serious moments limiting the upward potential. However, if you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. In any case, the BoE's decision to raise interest rates further this year will push the pound to new highs. The COT report for January 25 indicated that long non-commercial positions decreased from the level of 39,760 to the level of 36,666, while short non-commercial positions increased from the level of 40,007 to the level of 44,429. This led to a drop in the negative non-commercial net position from -247 to -7,763. The weekly closing price dropped from the level of 1.3647 to the level of 1.3488. Indicator signals: Trading is conducted above the 30 and 50 moving averages, which indicates continued growth of the pound in the short term. Moving averages Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart. Bollinger Bands A breakthrough of the upper limit of the indicator in the area of 1.3582 will lead to an increase in the pound. Crossing the lower limit in the 1.3540 area will increase the pressure on the pair. Description of indicators

|

| Technical Analysis of ETH/USD for February 3, 2022 Posted: 02 Feb 2022 10:18 PM PST Crypto Industry News: Ethereum software company ConsenSys acquired the Ethereum MyCrypto interface with the goal of integrating MyCrypto into the MetaMask wallet and improving the security of all products. MetaMask is an extension that allows you to access distributed applications that support Ethereum or "Dapps" in your web browser. MetaMask co-founder Dan Finlay said the combination of the MetaMask mobile app and browser extension with the web product and MyCrypto desktop application "will connect people to the world of Web3 in more ways." The tremendous opportunities of the NFT metaverse are changing the situation for Metamask, a wallet service provider. The company announced that it has surpassed 10 million monthly active users (MAUs), placing it among the most active wallets used in the digital currency ecosystem. ConsenSys noted that the MyCrypto team's experience in building smart contract integrations will make those in MetaMask richer. In November, ConsenSys, the blockchain startup behind the Metamask portfolio, raised $ 200 million in a new funding round, boosting its valuation to $ 3.2 billion. Technical Market Outlook The ETH/USD pair has made a new local high at the level of $2,812 and is heading higher towards the next target seen at $2,930 and $3,000. So fat the bulls has manage to keep the market above the trend line support, however, if the up move is capped and the down move would resume, then the next target for bears is seen at the level of $2,190, $2,000, $1,941 and $1,731 - this is the line in sand before a collapse under the $1,000 level. The market conditions are extremely oversold on Daily time frame and are slowly moving up, so this might help the bulls to bounce higher. Weekly Pivot Points: WR3 - $3,405 WR2 - $3,068 WR1 - $2,823 Weekly Pivot - $2,486 WS1 - $2,264 WS2 - $1,931 WS3 - $1,682 Trading Outlook: The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.

|

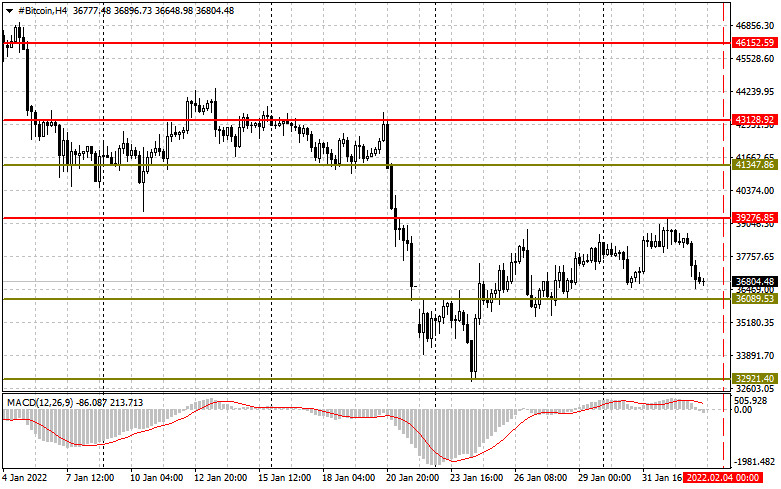

| Technical Analysis of BTC/USD for February 3, 2022 Posted: 02 Feb 2022 10:14 PM PST Crypto Industry News: The company is investigating the integration of blockchain technology into its flagship products and services, according to Tuesday's statement by Alphabet CEO Sundar Pichai. When asked how the company views Web3, Pichai said Alphabet had several "areas of interest" pointing to augmented reality and exploring how blockchain technology could be used for services like YouTube and Google Maps: "Every time there is an innovation, I find it exciting and I think it's something we want to support as best we can [...]" Pichai also noted that the Google cloud team is researching how to meet customer demands using blockchain-based platforms. It is worth noting that these are only the first ideas that Alphabet has put forward in relation to the new decentralized network. Other organizations, including Silicon Valley, are much more active in implementing Web3 than Google. Blok, Twitter, Microsoft and Meta have revealed their plans for Web3 and cryptocurrency-based services. Polygon (MATIC) has teamed up with co-founder Reddit to launch a $ 200 million Web3 gaming project. Google, however, has so far remained aloof. Technical Market Outlook The BTC/USD pair bounce had been capped just below the 61% Fibonacci retracement level at $39,417 as the local high was made at $39,239. The up move had ended with a Pin Bar candlestick,so the bears started the down move and broke below the short-term trend line support around the level of $38,000. The local low was made at the level of $36,537, but the key short-term technical support is seen at $35,912. The market conditions are still extremely oversold at daily time-frame chart, but the momentum is still weak and negative. This is not a good situation for bulls as the bears are still in control and might push the price way lower soon. The next technical support is seen at $35,912 and $34,632. Weekly Pivot Points: WR3 - $46,518 WR2 - $42,733 WR1 - $40,610 Weekly Pivot - $36,641 WS1 - $34,413 WS2 - $30,618 WS3 - $28,634 Trading Outlook: The market is controlled by bears that pushed the price way below the level of $40k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $69,654 and the next long-term technical support is located at $29,254. The corrective cycle is still in progress and is much more complex and time-consuming than anticipated.

|

| EUR/USD: plan for the European session on February 3. COT reports. European Central Bank meeting Posted: 02 Feb 2022 10:13 PM PST To open long positions on EUR/USD, you need: Yesterday, several signals were formed to sell the euro. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I drew attention to the importance of eurozone inflation and the 1.1297 level, and also advised you to make decisions on entering the market. The sharp inflationary jump in the eurozone in January this year to 5.1% per annum surprised many economists who expected it to decrease to 4.4%. Against this background, the bulls achieved a breakthrough of 1.1297 resistance, but it never reached the reverse test of this level from top to bottom. As a result, there were no signals to enter the market in the first half of the day. During the US session, it was possible to observe the active movement of the pair up to 1.1328. Several unsuccessful attempts to settle above this range led to signals to sell the euro. As a result, the downward movement amounted to more than 30 points.

This morning, the focus will be placed on important data on the PMI index for the eurozone services sector, as well as on the European Central Bank's decision on interest rates. The fact that inflationary pressure in the eurozone turned out to be much higher than expected at the beginning of this year once again proves the need for more active opposition from the ECB. Today's decisions can have a very serious impact on the market, so I recommend that you pay special attention to them. The upward trend in the euro continues, and today's press conference of ECB President Christine Lagarde may serve as another driver of euro growth. An important task for bulls is to protect the support of 1.1291, where the moving averages are, while playing on their side. Forming a false breakout at 1.1291 creates an excellent entry point into long positions in continuation of the upward trend. An equally important task for euro bulls is to control the resistance of 1.1328, above which it was not possible yesterday even after very weak statistics on the US labor market from ADP. A breakthrough and a reverse test from the top down of this range, together with strong data on the eurozone producer price index, the PMI index for the services sector and the composite PMI index of the eurozone, will lead to another buy signal and open the possibility of recovery in the area: 1.1358 and 1.1390. The level of 1.1419 will be a more distant target, but it is only possible to count on an update of this range if Lagarde makes hawkish statements after the press conference. I recommend taking profits there. If the pair declines during the European session and there is no bull activity at 1.1291, the pressure on the euro may seriously increase. In this case, it is best to postpone long positions to a low of 1.1258. However, I advise you to open long positions there when forming a false breakout. You can buy the euro immediately for a rebound from the 1.1223 level with the goal of an upward correction of 20-25 points within the day. To open short positions on EUR/USD, you need: Bears remain on the sidelines, focusing on today's ECB meeting. To stop today's upward trend, you need to try very hard not to miss the level of 1.1328. Bullish divergence forming on the MACD indicator can help, although yesterday it was not possible to achieve a downward correction based on this indicator. Forming a false breakout at 1.1328 will be a signal to open short positions in order to pull EUR/USD to the area of 1.1291. A breakthrough of this area depends entirely on the market's reaction to the inflation data for the eurozone, as well as on the PMI report for the services sector.

If the growth slows down, we will see a breakdown of 1.1291. A reverse test from the bottom up of this range will provide another signal to open short positions with the prospect of falling to large lows: 1.1258 and 1.1223. The 1.1186 level will be a more distant target, but it is available only if the ECB maintains an ultra-soft policy following the results of today's meeting. I recommend taking profits there. In case the euro grows and the bears are not active at 1.1328, it is best not to rush with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1358. You can sell EUR/USD immediately on a rebound from 1.1390, or even higher - around 1.1419 while aiming for a downward correction of 15-20 points. I recommend for review: The Commitment of Traders (COT) report for January 25 showed that long positions had increased while short ones decreased, which led to a further increase in the positive delta. The demand for risky assets will continue to persist, because even after the results of the Federal Reserve meeting, where there were clear hints of an increase in interest rates in March 2022, the market did not react with a serious drop in risky assets, and the changing balance of power speaks for itself. This week, everyone is waiting for the results of the European Central Bank meeting, at which a decision on monetary policy will be made. Some traders expect that the central bank may resort to more aggressive statements aimed at policy changes in the near future and to abandon measures to support the economy due to the threat of high inflation. However, most analysts do not expect changes from the ECB. Much will depend on whether the ECB agrees to fully complete its emergency bond purchase program as early as March this year, or not. If so, the demand for the euro will only increase, since such actions will sooner or later lead to an increase in interest rates in the eurozone. The COT report indicates that long non-commercial positions rose from the level of 211,901 to the level of 213,408, while short non-commercial positions fell from the level of 187,317 to the level of 181,848. This suggests that traders continue to build up long positions on the euro in hopes of building an upward trend. At the end of the week, the total non-commercial net position remained positive and amounted to 31,569 against 24,584. But the weekly closing price decreased and amounted to 1.1323 against 1.1410 a week earlier. Indicator signals: Trading is above the 30 and 50 daily moving averages, which indicates an upward correction for the pair. Moving averages Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart. Bollinger Bands Crossing the lower border of the indicator in the area of 1.1291 will lead to a fall in the euro. A breakthrough of the upper border of the indicator in the area of 1.1320 will lead to an increase for the euro. Description of indicators

|

| Elliott Wave Analysis of Natural Gas for February 3, 2022 Posted: 02 Feb 2022 10:09 PM PST

Natural Gas has rallied nicely out of the 3.53 low and is headed towards the former peak at 6.47 and a break above here will call for a continuation closer to 8.26 and possibly even higher. If, however resistance at 6.47 caps the upside, we could see a more complex correction unfolding and maybe even a return to support near 3.53 in a flat correction. This is not our preferred view at the moment, but we need to keep the possible options in front of our eyes or the Market will catch us on the wrong foot. So stay flexible, and keep your eye on resistance at 6.47 for now and let's see what happens there. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for Gold for February 03, 2022 Posted: 02 Feb 2022 10:08 PM PST

Technical outlook:Gold prices are looking poised to push higher through $1,825-30 zone in the next few trading sessions. The yellow metal is producing a counter trend rally after dropping to $1,780 lows over the last week. Ideally, prices are expected to stay below $1,853 mark to keep the above bearish structure intact going forward. Gold prices might drop to $1,798-1,790 levels during the day before finding support again. Bulls are poised to remain in control and complete the down gartley wave structure pushing through $1,825 levels at least. Also note that $1,826 is the Fibonacci 0.618 retracement of the recent downswing between $1,853 and $1,780 levels respectively. High probability remains for Gold prices to resume lower from $1,826 levels and drag below $1,753 in the next few trading sessions. Only a consistent break above $1,837 levels will open the door to test $1,853 and push higher through $1,900-20 zone. For now, the metal remains a good candidate to be sold on rallies towards $1,825. Trading plan:Potential rally through $1,825 against $1,775 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments