Forex analysis review

Forex analysis review |

- Analysis of GBP/USD on February 19. The correction wave has been delayed in its construction, but it must be completed.

- EUR/USD analysis on February 19. A boring end to a boring week.

- Bitcoin may reach $31,100 but not everyone believes it

- Signs of capital flow from risky assets to protective ones are observed in all markets.

- Bulls retreated from the market. Bitcoin collapsed on expectations of an escalation of the conflict in Eastern Europe.

- Trading week analysis for February 14 - 18 on GBP/USD. COT report. Pound fails to break out of sideways channel

- Trading week analysis for February 13 - 18 on EUR/USD. COT report. Focus on geopolitics

| Posted: 19 Feb 2022 07:12 AM PST

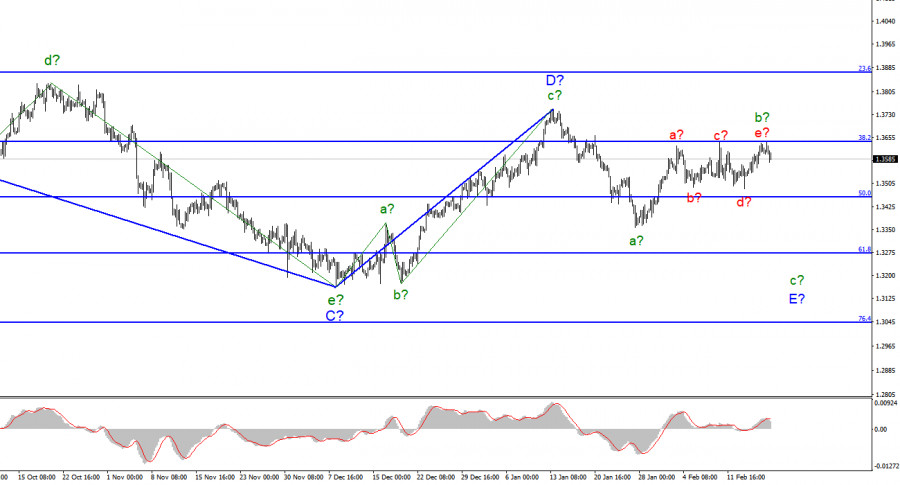

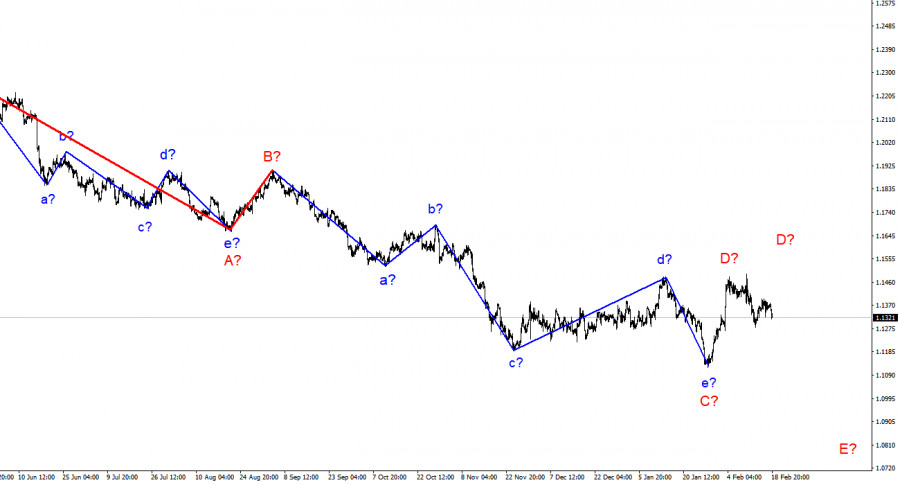

For the pound/dollar instrument, the wave markup continues to look very convincing, but in the near future, it may become somewhat more complicated. The increase in quotes last week complicates the expected wave b and it turns out to be longer than wave a. Since three internal waves are already being viewed inside wave b, this wave must be completed. However, it does not end, and the decline of the instrument does not begin. Based on this, I assume that wave b can take an even more extended form, a five-wave one, and more waves d and e will be built. However, there are no internal waves visible in wave a-E, so this complication of wave b looks strange. At the same time, a three-wave structure is visible inside wave D, so it cannot be the first impulse wave of a new upward trend segment. And the entire downward section of the trend, which originates on June 1, 2021, can be both three-wave and five-wave. Thus, the wave picture is ambiguous now, but I still tend to believe that another descending wave E will be built. Important statistics did not interest the market. The exchange rate of the pound/dollar instrument decreased by 25 basis points during February 18. There was no information background on Friday, however, the market moved quite active during the day. I cannot say that it moved under the impression of geopolitical news. It is quite possible that this is not the case. But since there was no economic news at all, the market had to observe only the geopolitical situation in the Donbas. Not even in Ukraine, not in Russia, but the Donbas. Because it was there that new shelling from both sides began, as well as the evacuation of civilians from the unrecognized republics of the DPR and LPR. From my point of view, an escalation of the conflict is brewing, since no one will simply evacuate several million civilians. Moreover, the conflict in the Donbas has been dragging on for 8 years. No one had ever thought of evacuating anyone before. Moreover, the local male population received summonses to the military enlistment offices, that is, the LNR and DNR will form their army. All this "smells" very bad. The probability of deterioration of the geopolitical situation is growing. And if it happens, then the foreign exchange market, like other markets, may start to panic. In this case, the movements will become more complicated and may not take place in accordance with the current wave marking or at least common sense. General conclusions. The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The construction of the proposed wave b is completed, or this wave is not b. The instrument made two unsuccessful attempts to break the 1.3645 mark, and wave b acquired a five-wave appearance. Already on Monday, the decline in quotes should begin, and I believe that a wave c-E will still be built. Therefore, I advise now selling with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci, until a successful attempt to break through the 1.3645 mark. Otherwise, the wave pattern will require additions.

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be a three-wave, so I cannot interpret it as wave 1 of a new upward trend segment. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis on February 19. A boring end to a boring week. Posted: 19 Feb 2022 06:50 AM PST

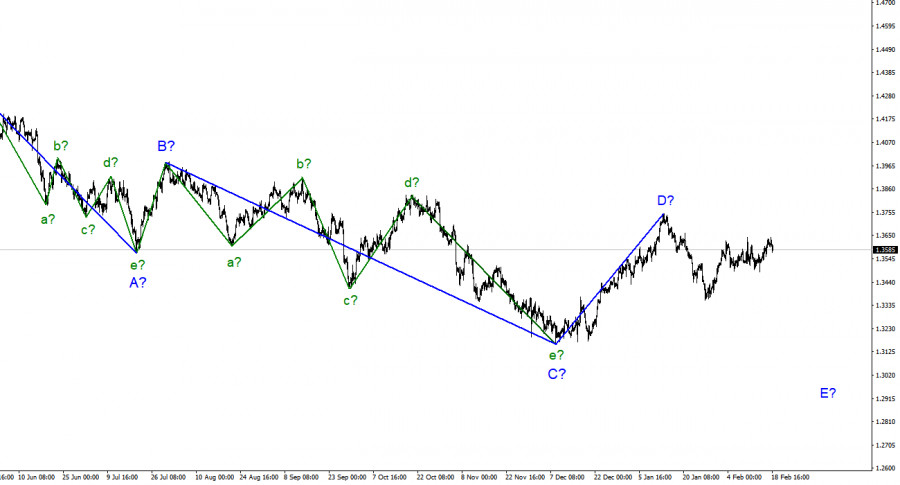

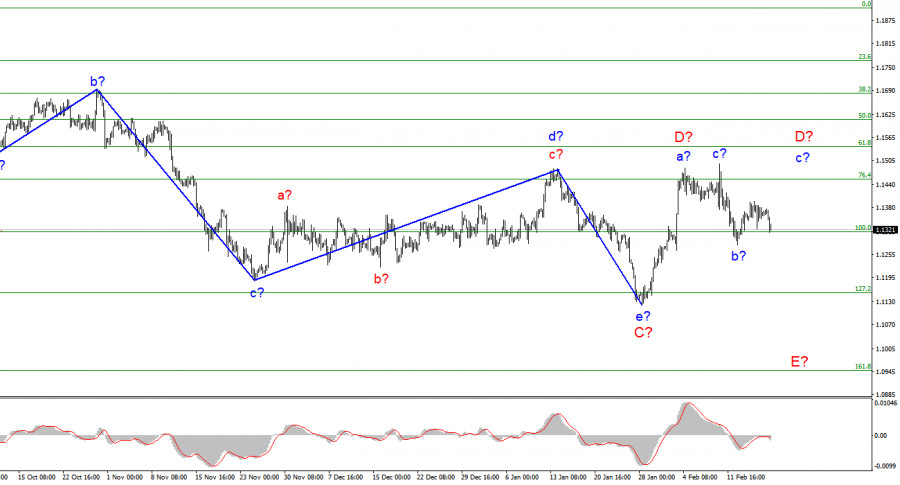

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Last week, there was a decline in quotes, which may be a wave E, or it may be a wave b-D. I believe that wave D is over, as the news background openly supports the rise of the US currency. Moreover, there are no clear internal waves inside wave C. Thus, they may not be inside wave D either. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that wave D will take a more complex form, a three-wave one, but even in this case, it may already be completed. There is also a backup option with the completion of the construction of a downward trend section. In this case, on January 28, the construction of a new upward trend section began. But the same news background now does not give any reason to expect that an upward section of the trend will be built. A successful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci, will indicate that the market is ready for new sales of the European. The market is in complete confusion. The euro/dollar instrument continued to trade with a small amplitude on Friday. It was only 30 basis points. Throughout the day, the market showed no desire to trade. The information background of the economic plan was absent on Friday. Therefore, geopolitics again came to the fore, but even it could not greatly affect the mood of the market. In the afternoon, the demand for the dollar rose slightly, which allowed it to rise by 60 points. Agree, such a movement could not be connected with anything at all. Although, on the other hand, it was on Friday that new reports began to arrive from Ukraine about the aggravation of the military conflict in the Donetsk and Luhansk regions. Let me remind you that now the LPR and the DPR, which are not recognized by anyone, have been created there. It is unclear for what reasons, the local authorities began evacuating civilians to Russia. Also yesterday. Thus, the markets could react to this news with an increase in demand for the dollar. Like most analysts, I believe that the deterioration of the geopolitical situation in Ukraine can help the US currency. Demand for it may increase due to the flight of investors from risky currencies (hryvnia, ruble) to less risky ones (yen, dollar). However, now even the wave marking implies an increase in demand for the US currency. Therefore, we can assume that the puzzle has developed. General conclusions. Based on the analysis, I conclude that the construction of wave D is completed. If so, now is a good time to sell the European currency with targets located around the 1.1153 mark, which corresponds to 127.2% Fibonacci, for each MACD signal "down". Another upward wave may be built inside wave D, but for now, this option is a backup. A successful breakout attempt of 1.1314 will indicate that the market is ready for new sales of the instrument.

On a larger scale, it can be seen that the construction of the proposed D wave has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is reason to assume that wave D has already been completed. Then the construction of wave E began. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin may reach $31,100 but not everyone believes it Posted: 19 Feb 2022 03:50 AM PST

On Saturday, bitcoin is continuing Friday's decline. Yesterday, the flagship cryptocurrency depreciated by $4,000 and has now fallen below the psychological level of $40,000. Obviously, it's all about geopolitical tensions, as there was nothing else for the market to react to yesterday when new shelling in Donbas and mass evacuations of its residents began. Nevertheless, some cryptocurrency experts believe that bitcoin may still rise in 2022. For example, there is an opinion that the stock market may suffer the most because of the upcoming rate hike in the US. Some experts believe that stock returns are likely to decline because of the rate hike, but the Fed has no direct influence on the cryptocurrency market. Therefore, the capital may not flow from risky assets to safe-haven ones, but from the stock market to cryptocurrencies and hedging assets. Some believe that geopolitical tensions could play into the hands of cryptocurrencies, which provide high returns. However, they also agree that bulls are not dominant right now, which means bitcoin may fall. Some experts say bitcoin has been trading sideways within the trading range of $30,000 - $55,000 for the recent months. Frankly, it is hard to imagine what kind of a flat is with a channel width almost equal to the value of the asset itself. We might as well say that the EUR/USD pair has been trading sideways for the last 20 years between the levels of $0.6 and $1.4. These experts believe that institutional investors will save bitcoin and that good news will come to the market that will bring retail investors back to it. Many call $30,000 a critical level. Bitcoin fell to this level last summer, and presumably, there are pending buy orders around that level that may keep bitcoin from falling lower. At the same time, if you could be 100% sure of anything in any market, trading would be easy and simple. However, the markets remain a place where many traders suffer losses. We think bitcoin could very well reach the $10,000 mark in the next couple of years. This is supported by the fact that the Fed is just about to raise the rate and reduce its balance sheet over the next few years. The fact that every bull trend for bitcoin has ended with an 80-90% collapse in value. Geopolitics may also have a strong impact on its quotes. Currently, Western Europe is on the brink of a military conflict that could engulf the region for years to come. There will be consequences for all countries. Bitcoin remains a risky asset, which is usually dumped first in favor of gold and the US dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| Signs of capital flow from risky assets to protective ones are observed in all markets. Posted: 19 Feb 2022 01:47 AM PST

So, at the moment, bitcoin is trying to form a new downward trend. Unfortunately, bitcoin, which is just beginning to rise from its knees, came under a sharp stream of criticism last week. In particular, he was criticized by Warren Buffett's business partner and billionaire Charlie Munger. Earlier, the manager of Fundstrat, Tom Lee, said that "billionaire pensioners" who are skeptical about cryptocurrencies and do not want to invest in them, although the main capital in the United States is concentrated in their hands, are to blame for everything. Thus, even the culprit was found that new-fangled investors who believe that they just need to buy more bitcoin and wait cannot get rich at the expense of those who have earned money wisely, with the right approach and years of training. This is exactly the idea voiced by Charlie Munger, calling bitcoin "garbage". Of course, geopolitics is of the highest importance now. This week, we could already see how gold is rising in price, the US stock market is falling, and all cryptocurrencies are declining. What is it if not the flow of capital from risky assets to safe ones? Geopolitical tensions in Europe and the Fed's rate hike may cause a new drop in bitcoin. A lot has already been saying about geopolitics this week. In principle, the whole world was talking only about geopolitics. Even US President Joe Biden, who, unlike Donald Trump, does not like to give interviews and speak in public, has stated several times that the situation remains a crisis, and a military conflict could begin any day. However, JPMorgan investment bank expert David Kelly also expects a negative scenario. He said that as soon as the Fed starts raising the rate, a collapse may occur in the cryptocurrency market. Kelly notes that the last "bullish" trend occurred during a period of ultra-soft monetary policy and money coming from nowhere into the economy. Now, when the reverse process begins, bitcoin can show the "opposite". We fully agree with David Kelly's position, despite all the piles of forecasts from pseudo-experts who continue to say that bitcoin will grow and will conquer the $ 100,000 mark by the end of this year alone. Recall that last year we heard the same predictions that did not come true. The apotheosis of what is happening was the new forecast of the analyst PlanB, which with its Stock-to-Flow model has gained some popularity in the cryptocurrency community. However, his predictions came true in 2021, did not come true at the beginning of 2022 and now he believes that we should wait for the growth of bitcoin and the renewal of the highs by the end of 2022. In general, those who are personally interested in the growth of cryptocurrencies continue to say that bitcoin will grow. Because it is profitable for them.

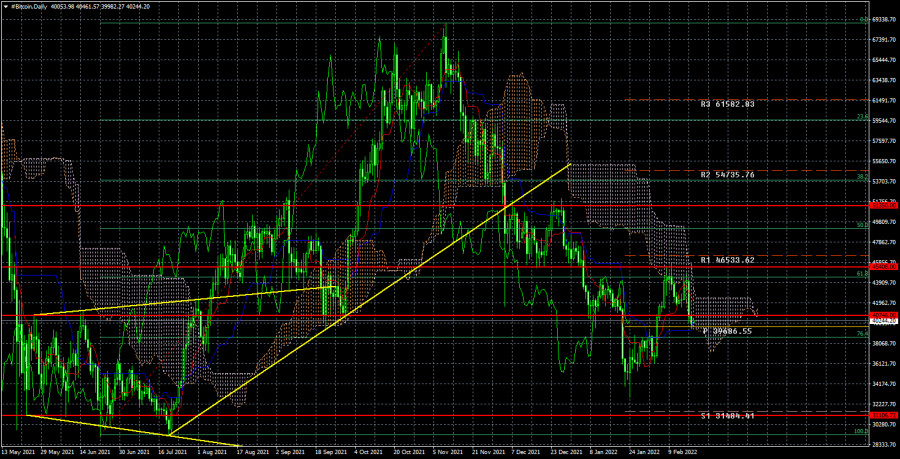

In the 24-hour timeframe, the quotes of the "bitcoin" failed to overcome the Ichimoku cloud and fell today to the critical line. Now there is only one obstacle on the way to the $ 31,100 level - Kijun-sen. If traders manage to overcome it, then the drop in quotes of the "bitcoin" will continue almost guaranteed. Well, unless, of course, only tomorrow Elon Musk announced that now Tesla works only with bitcoin and refuses fiat money, and SpaceX will launch satellites and rockets funded only by cryptocurrencies. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Feb 2022 01:20 AM PST

The current week for bitcoin, as well as for the entire cryptocurrency market, turned out to be negative. In principle, this is not surprising. We have said more than once that the fundamental background for bitcoin remains extremely negative. The Fed makes it clear with each subsequent speech of its representative that it will start raising the key rate in March. Moreover, many experts believe that it can be increased immediately by 0.5%, and there will be 7 increases in total this year. This is a serious tightening of monetary policy and bitcoin's reaction will not be long in coming. In addition, this summer the Fed may begin unloading its balance sheet, which will mean the withdrawal of excess money from the American economy. Thus, there will be less money. And if bitcoin grew steadily on the increase in the money supply, now it will fall. Or at least will not be able to show a bullish trend this year. In addition, the issue of geopolitics has become acute in the last couple of weeks. The conflict in Eastern Europe has escalated to the limit. All Western media are trumpeting about the "offensive of the Russian Federation from day to day." The evacuation of residents has begun in the Donbas. Naturally, bitcoin, as the most risky instrument, began to lose ground on such news. Now the question is how much it will fall. Technology no longer speaks in favor of bitcoin's growth. In addition to the negative fundamental background, bitcoin has also lost technical support. Until recently, the cryptocurrency was trading above the ascending trend line on the 4-hour TF, but just yesterday it fell below this line. And at the same time below the important support level of $ 40,746. Thus, the short-term upward trend has been broken and now it is reasonable to assume that the decline will continue. The goal we have already called is the level of $ 31,100, which was never worked out during the last fall. In general, the price failed to overcome the level of $ 45,408 twice, and the whole movement of the last month now looks like a correction against a longer downward trend. From our point of view, any deterioration of the geopolitical situation in Eastern Europe, in Ukraine, will put new pressure on the cryptocurrency market. Unfortunately, now the situation is such that there is "no smell of de-escalation." Moreover, the threat of military conflict is growing. Therefore, in the coming weeks, bitcoin and its "brothers" may react very painfully to any news coming from the "front". In favor of the new growth of the cryptocurrency, only the inflation that continues to grow can play now. Both in the EU countries and the UK and the USA. However, there is reason to assume that central banks will raise rates, which will lead to a slowdown in the consumer price index. Therefore, this year bitcoin may lose its status as an inflation hedging tool. In general, we are not seeing anything positive for the "bitcoin" right now.

The trend on the 4-hour timeframe has changed to a downward one. At this time, the price has fallen below the trend line, below the Ichimoku cloud, and below the $40,746 level. Thus, now the way is open to the level of $ 31,100, and we recommend selling cryptocurrency at this time. So far, there are no grounds to expect a recovery of the "bullish" trend. Absolutely all factors, technical, fundamental, geopolitical, speak in favor of the fact that the fall will continue. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Feb 2022 12:27 AM PST Long term outlook

The GBP/USD pair failed to start the upward movement again. The pound was rising, but in fact, it only managed to test the upper boundary of the sideways channel, which can be seen on the 4-hour and hourly charts. Unfortunately, this channel does not have any distinct boundaries. We can only assume that they pass through 1.3489 and 1.3643. The channel is not narrow, so it is quite difficult to predict the price movements inside this channel. The problem is that the price may move several days from one boundary to the other. Nevertheless, the price rebounded from the upper boundary of the channel on Friday, so we expect the pound to fall next week. There are no special reasons for the pound to move according to the trend right now. The euro is also trading in a flat, and there is no important information to be released in the UK this week, which might contribute to a different movement of the pound/dollar pair. The markets are under the impression of the geopolitical events of the last weeks and are refraining from making trading decisions. Consequently, the pound, as well as the euro, may trade unpredictably for some time. If a panic bursts in the market, which cannot be excluded completely, then the movements can not be predicted at all. We can see that markets react to the situation in Ukraine to a certain extent. For example, US stock indices are falling, bitcoin and other cryptocurrencies are getting cheaper. These are the riskiest assets, so investors get rid of them first in turbulent periods. The currency market is waiting for official decisions to be made in the highest political circles. COT report analysis

The latest COT report on the pound showed a stronger bullish sentiment among professional traders. For the first time in several months, the number of buy contracts in the "Non-commercial" group exceeded the number of sell contracts, so we can assume that the annual downtrend is over. The situation with the COT reports on the pound is very similar to the euro. The big players there also increase the purchases, but at the same time, the euro continues to be very close to its low for the year, and in fact, it's not growing. The pound shows a smaller drop against the dollar and grows more confidently. At the moment, it is much farther away from its yearly lows, so we think that if there is a new fall, the pound may fall less than the euro. If there is a new rise, the pound may rise more than the euro. This can be explained by the fact that the ECB simply refuses to raise its key rate in 2022, while the Bank of England has already raised its rate twice. Thus, due to this discrepancy in the rates on tightening of monetary policy, the pound takes a more favorable position in comparison with the euro. Moreover, non-commercial traders on the pound were bearish just recently, which is eloquently demonstrated by the green line in the first indicator or the second indicator in the picture above. However, over the last couple of months, these traders have become much more bullish. Fundamental events analysisThe fundamental background for the GBP/USD pair this week was of medium strength. However, the markets are sitting on the fence in alert mode. In other words, they feared an escalation of military conflict in the East of Europe, so all macroeconomic data was ignored. In the UK this week, it became known that average wages rose more than expected and the unemployment rate was unchanged. Also, there was an inflation report which showed its faster growth compared to the forecasts. So, the pound had a reason to grow this week. However, the situation is very unstable now because of geopolitics, so the interpretation of the fundamental background may be unpredictable next week. Much will depend on the Ukrainian-Russian conflict, which may pull so many strings that lead to Europe and the West that the situation may worsen not only in Ukraine or Russia. Trading plan for February 21 - 25:1) The GBP/USD pair is ignoring technical indicators at the moment. During the last couple of weeks, the price has broken through the Kijun-Sen line on the daily chart, but it has not managed to bear fruit yet. That is why there is no conclusion as to what price movement we should expect. The fundamental background is ambiguous and the situation may change rapidly. 2) The same refers to the prospects of the downward movement. At the moment, the pair is near the Kijun-Sen line in the sideways channel, so it is impossible to make any conclusion now. If the pair manages to break out of this channel, then it will be possible to talk about a trend movement again. However, the question is, through which boundary the breakout will be made. Explanations to pictures:Price levels of support and resistance, Fibonacci levels - levels, which are the targets for the opening of purchases or sales. Take-profit orders can be placed near them. Ichimoku indicator (standard settings), Bollinger Bands (standard settings), MACD(5, 34, 5). Indicator 1 on the COT charts - the size of the net position of each category of traders. Indicator 2 on the COT charts - the size of the net position for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading week analysis for February 13 - 18 on EUR/USD. COT report. Focus on geopolitics Posted: 18 Feb 2022 10:58 PM PST Long term outlook

The EUR/USD pair showed weak trading this week. On the one hand, it is quite strange, because there were some macroeconomic statistics, and there was a fundamental and geopolitical background as well. However, markets ignored almost all the macroeconomic and fundamental data. At the same time, traders did not pay much attention to geopolitics. It seems that the market just got scared. It was afraid of uncertainty and now simply does not know how to conduct trading. In case of a worsening of the geopolitical situation in important regions of the world, the US dollar may increase. The outflow of investments from the dangerous assets has begun, and global investors are looking for safe-haven assets and currencies to protect their capital from possible depreciation. What could be more serious than a military conflict over a vast area in Eastern Europe? In fact, there is no invasion. The situation is as follows: Russian troops continue to build up near the Ukrainian borders, but no attempts to cross these borders have been made. The situation so far has only escalated in the Donbas, in the so-called LNR and DNR, where a mass evacuation of civilians to the Rostov region of the Russian Federation began yesterday. However, the region has been turbulent for eight years, so this news does not have a strong impact on the US dollar. Nevertheless, the West and the EU continue to argue that Moscow may order an attack on Ukraine in the near future, and US President Joe Biden said late last night that such an order had already been given. Thus, within the next couple of days, the situation could become very tense, and military actions could start in Donetsk and Luhansk regions. COT report analysis

The fresh COT report was released on Friday. It showed a new strengthening of bullish sentiment among professional traders. This time the "Non-commercial" group closed about 7,000 euro sell contracts and opened 5,000 buy contracts. Thus, the net position has increased by 12 000, which is clearly seen in the second indicator in the picture above. The total amount of Buy contracts exceeds the number of Sell contracts by 50,000, so now we can really say that a new uptrend is beginning to form. It could be said, but there is always a twist. The euro is not growing. It doesn't grow even when there are technical reasons for it. The pair has been falling for 14 months, so the correction is a quite probable scenario. However, the fundamental data do not let the euro grow, so it is very close to its annual lows. In fact, only 100 points from them. Moreover, after the late November quotes fell to 1.1180, traders failed to make a proper correction to the currency pair. The maximum deviation from the lows was 360 pips. So, the COT report does not coincide with the fundamental background and technical picture that we see daily. This is very strange, given the small influence of central banks on the money supply at this time. Fundamental events analysisThere were several quite important events, which were ignored by the market. On Monday, ECB head Christine Lagarde gave a speech, who once again said that the regulator has no plans to raise its key rate this year. The US retail sales report was very strong, but traders ignored it. The Fed's minutes did not trigger any reaction in the market, though it is fair to say that it did not contain any new information. As a result, the situation turned out, when there was news, but the market didn't want to react to them. This situation may persist in the coming week, as the whole world is now watching the possible escalation of the conflict in Ukraine and seems to be preparing to react exactly to this news. Only if this news is official and reflects decisions taken at the highest level, rather than rumors and speculation. Overall, I believe that the situation is very unstable right now. Trading plan for February 21 - 25:1) On the daily chart, the pair tried again to start a new uptrend, but could not break through the Senkou Span B line. The pair rebounded and now it is trading between the Senkou Span B and Kijun Sen lines. It may start trading sideways in the long term, or it might be the beginning of a new spiral of the downtrend. One thing is for sure, there are almost no reasons for an uptrend now. Moreover, almost all factors suggest that the euro is likely to fall and the dollar will rise. 2) As for the EUR/USD selling, it needs to be fixed again below the critical line. Between 1.1100 and 1.1200 traders have already shown that they are not ready to continue selling the euro, so it is highly likely that the downtrend is over. However, a lack of reasons for the pair's growth and traders' unwillingness to buy the euro might lead to a resumption of the decline. Explanations to pictures:Price levels of support and resistance, Fibonacci levels - levels, which are targets for the opening of purchases or sales. Take-profit orders can be placed near them. Ichimoku indicator (standard settings), Bollinger Bands (standard settings), MACD(5, 34, 5). Indicator 1 on the COT charts - the size of the net position of each category of traders. Indicator 2 on the COT charts - the size of the net position for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments