Forex analysis review

Forex analysis review |

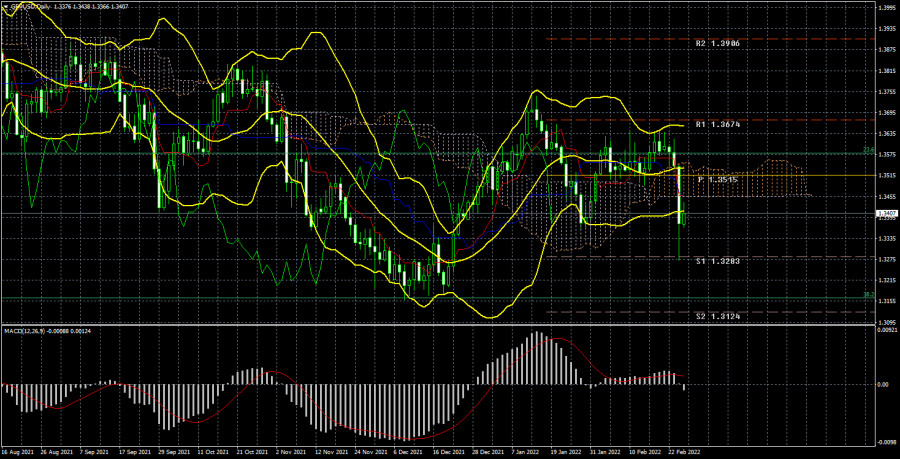

| Posted: 26 Feb 2022 11:34 PM PST Long-term perspective.

The GBP/USD currency pair has fallen by 200 points during the current week. In principle, no one even has any doubts now about what exactly caused the collapse on Thursday. The British currency is considered less stable than the euro, especially after Brexit. Although over the past 14 months it has been the pound that has risen in price against the dollar more actively and has become cheaper more reluctantly, on Thursday, it collapsed down by 300 points. No macroeconomic statistics or fundamental events mattered to traders this week. And it should be noted that there were not many of them. Andrew Bailey's speech once again confirmed the Bank of England's readiness to raise the rate further to fight inflation. Business activity indices in the UK did not matter at all. The British pound began to decline on Tuesday as if anticipating a catastrophe. Thus, by and large, there are no macroeconomic factors for analysis now. And those that were not taken into account by the market. The technical picture even before the military conflict in Ukraine was very strange. First, the pair has been flat for some time. Second, the price completely ignored the Ichimoku indicator lines on the 24-hour TF. Third, on other timeframes, the picture was also very complicated. And the collapse that happened this Thursday was clearly of a "shock" nature, that is, it cannot be considered an adequate behavior of market participants. Since there is unrest in Europe right now, European currencies can "fly" from side to side. Accordingly, it makes no sense to talk about any technical forecasting now. Geopolitics has too much influence on the foreign exchange market. COT analysis.

The latest COT report on the British pound showed an increase in the "bearish" mood among professional traders. Last week, for the first time in several months, the number of purchase contracts from the Non-commercial group exceeded the number of sales contracts, but this picture was not observed for long. Already this week, it became known that non-commercial traders started closing longs again and their total number fell to 44 thousand, while the total number of shorts remained at 48 thousand. Thus, formally, the mood among the major players is "bearish" now. However, all events of a geopolitical nature were not included in the latest COT report. That is, the next COT report may show a much stronger change in the net position of each group of traders and a sharp change in mood. In addition, the first indicator in the illustration above shows that the mood of commercial and non-commercial traders is now essentially "neutral" since both lines (red and green) are near zero. Thus, although in recent months there has been a tendency to reduce short positions and build up long ones, now there is a complete balance in the market, and geopolitics can affect the balance of power and may affect it in the next few weeks/months. Therefore, no conclusions can be drawn based on COT reports now. Or it doesn't make sense. Unfortunately, the whole world is in tension right now, and comprehensive sanctions will affect the global economy and the mood of traders and investors. Analysis of fundamental events. The fundamental background for the pound/dollar pair was weak this week if we talk about the economy. In the UK, there was not a single important report or event, and in the US, ordinary business activity indices and the second estimate of GDP for the fourth quarter were published. There were several other minor reports, but they were published on Thursday when the market was in shock from what was happening in Ukraine. Thus, no macroeconomic events had any effect on the movement of the pair. A new week begins tomorrow and all attention will be focused again on geopolitics, stock markets, the Russian ruble. It is expected that the Russian currency will collapse again due to the disconnection of some Russian banks from the SWIFT system. However, the Central Bank of the Russian Federation probably has a "backup plan". But the Russian stock market is likely to suffer again. In general, now the focus of the market is not the British pound and the United Kingdom. Trading plan for the week of February 28 - March 4: 1) The pound/dollar pair is currently trading "out of technique". Over the past couple of weeks, the price has repeatedly crossed the Kijun-sen line on the 24-hour TF, but could not extract anything worthwhile from this. Therefore, it is not yet possible to conclude in which direction the movement will continue, especially given the geopolitical factor, because of which the markets are literally "storming". The fundamental background is ambiguous now, and the situation can change rapidly. 2) The same applies to the prospects of a downward movement. At the moment, the pair is below the Kijun-sen line, but after the collapse this week, it may begin to recover. If the geopolitical situation continues to deteriorate, it may lead to a new "storm" in the foreign exchange market, which will affect all major currency pairs. Now you need to trade as carefully as possible and on junior TF. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). Indicator 1 on the COT charts - the net position size of each category of traders. Indicator 2 on the COT charts - the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

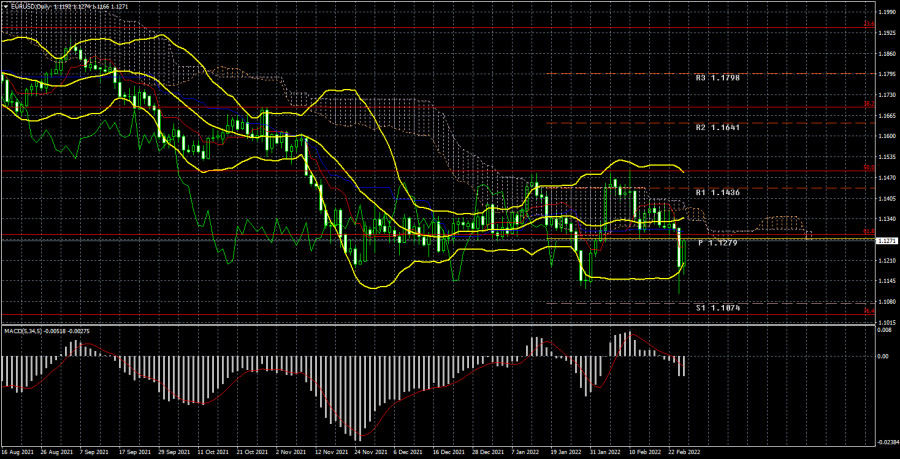

| Posted: 26 Feb 2022 10:11 PM PST Long-term perspective.

The EUR/USD currency pair has collapsed by 130 points during the current week. Moreover, the fall was much stronger, but on Friday, the market recovered a little and bought off some of the losses. Thus, only minus 130 points. In principle, there is nothing to discuss now. All week, the markets have been closely following the Ukraine-Russia conflict, as well as the reaction of the whole world to it. Macroeconomics has moved not even to the second, but the twenty-second plan. No one was interested in economic news, statements by representatives of the Fed and Christine Lagarde. And reports, there were practically none. We have repeatedly stated that the foreign exchange market ignores the military conflict in Europe for the time being. And when it became known about the Russian operation in Ukraine, the market could not stand it and collapse. And not only the foreign exchange market. The US dollar, which has the status of a world reserve currency, began to grow, as a massive outflow of capital began from the countries involved in the conflict. And of course in dollars, the demand for which grew instantly. Risky assets have started to be converted into safe ones, and the dollar, according to many investors and traders, is one of the safest and most liquid assets. Even despite the wild inflation now in the US. As for the technical picture, it is now secondary. We cannot conclude that a new downward trend or a resumption of the old one is being formed at this time. The fact is that the market is now in a state of shock, so the movements may be in different directions and it is extremely difficult to predict them. To a large extent, movements in the foreign exchange market will now depend on the Ukrainian-Russian conflict and US and European sanctions against Russia. COT analysis. The new COT report, which was released on Friday, showed a new strengthening of the "bullish" mood among professional traders. This time, the "Non-commercial" group closed about 17 thousand contracts for the sale of euros and 5.5 thousand contracts for the purchase. Thus, the net position increased by 12 thousand, which is visible on the second indicator in the illustration above. The total number of purchase contracts exceeds the number of sale contracts by 60 thousand, so now we can say that a new upward trend is beginning to form. It would be possible to say, if not for one "but". The European currency is not growing. It does not grow even at a time when there seem to be "corrective" grounds for this. Recall that the euro currency has been getting cheaper in one way or another for 14 months. It does not grow even when the participants of the foreign exchange market themselves increase their purchases. It seems that geopolitics remains in the foreground, so COT reports in some way lose their significance. Remember, when the Fed was actively pumping its economy with dollars, the data from the COT reports also did not always coincide with the trend in the market itself. This was because the money supply in the US was growing very fast, so it was not always important what actions the players in the market were taking. The "Fed factor" was more important. And now the factor of geopolitics is more important. Analysis of fundamental events. What to say about the "foundation" this week? The indices of business activity in the European Union, the inflation report in the second assessment for January, and the speech of Christine Lagarde. None of these events caused any market reaction. Business activity indices are far from the most important data, especially now. Christine Lagarde again did not report anything important. The EU inflation report was no different from its first estimate. There was simply nothing to react to. But geopolitics collapsed the euro exchange rate towards the end of the week and in the near future, all the attention of the market will remain on it. At this time, such processes are taking place that can have a serious impact on the entire world economy. Sanctions against the Russian Federation, Russian banks, Russian businessmen, Russian companies will affect not only the sanctioned entities but also their partners in Europe and overseas. Moreover, Moscow is going to respond with its sanctions. Therefore, it will be a "sanctions war", which cannot but affect the economy. Remember the "trade war" between China and the United States. Trading plan for the week of February 28 - March 4: 1) On the 24-hour timeframe, the pair again tried to start a new upward trend, but again could not overcome the Senkou Span line B. A new rebound followed and now the price is near its 14-month lows. It may be a long-term flat, it may be the beginning of a new round of a downtrend. But one thing is for sure, there are practically no grounds for an upward trend right now. Moreover, almost all factors indicate that the euro will fall and the dollar will grow. 2) As for the sales of the euro/dollar pair, they are relevant now, since the price is located below the critical line. However, too much now depends on geopolitics. We all saw that on Friday there was already a reverse movement, although what were the grounds for this? Thus, the pair may "storm" for some time, and the movements will be as unpredictable as possible. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). Indicator 1 on the COT charts - the net position size of each category of traders. Indicator 2 on the COT charts - the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments