Forex analysis review

Forex analysis review |

- EUR/GBP Technical Analysis and Trading Tips on April 20, 2022

- Trading plan for USDJPY for April 20, 2022

- Gold's trip to $2000 ended in fiasco

- Daily Video Analysis: EURUSD, H4 Bullish Breakout Opportunity

- Technical review for AUD/USD: price could continue to grow

- Technical review for USD/CAD: prices could dip again

- Gold slumps on Tuesday and could continue moving in a wide range

- Tips for beginner traders in EUR/USD and GBP/USD on April 20, 2022

- GBP/USD, AUD/USD, USD/CHF, USD/CAD simplified wave analysis and forecast on April 20, 2022

- EU embargo may hurt Russian oil

- Review of USD, CAD, and JPY: Rising US Treasury yields create stable demand for USD

- Trading tips for CAD/CHF and USD/CHF

- EUR/USD: euro avoids deep fall while dollar remains strong

- Analysis and trading tips for GBP/USD on April 20

- Technical analysis of EUR/USD and GBP/USD on April 20, 2022

- Hedge funds return to precious metals amid rising inflation and geopolitical risks

- Bitcoin forms massive buyer support: is this enough for a long-term upward trend?

- US stock market rallies strongly amid heavy fighting in Eastern Ukraine

- Analysis and trading tips for EUR/USD on April 20

- GBP/USD: new upwards movement?

- Indicator analysis of GBP/USD on April 20, 2022

- USD/JPY: dollar at its 20-year high versus Japanese yen

- AUDUSD Potential For Bullish Continuation | 20th April 2022

- Indicator analysis of EUR/USD on April 20, 2022

- EURUSD Potential For Bullish Continuation | 20th April 2022

| EUR/GBP Technical Analysis and Trading Tips on April 20, 2022 Posted: 20 Apr 2022 04:50 AM PDT Having reached a local high of 0.8510 at the end of last month, EUR/GBP subsequently moved to a decline, returning to a long-term downward trend that began in January 2021.

EUR/GBP is likely to decline while staying in the zone below the important long-term resistance levels of 0.8450 (200 EMA on the daily chart) and 0.8625 (200 EMA, 144 EMA on the weekly chart). A breakdown of the key support level of 0.8145 (200 EMA on the monthly chart) will finally move the currency pair into the long-term bear market zone.

However, there is currently an upward correction after hitting a local 5-week low at 0.8249 last week. As the pair remains under pressure below the key resistance levels of 0.8412 (144 EMA on the daily chart) and 0.8450, the current rise can be seen as an opportune time to enter short positions, both on the market and when reaching resistance levels of 0.8340 (144 EMA on the 4-hour chart), 0.8346 (200 EMA on the 4-hour chart), and 0.8353 (50 EMA on the daily chart).

For more cautious traders, a sell signal will be a breakdown of the support level of 0.8309 (200 EMA on the 1-hour chart).

We are not considering an alternative scenario and growth above the resistance level of 0.8353, including against the background of strong fundamental factors. Support levels: 0.8309, 0.8300, 0.8277, 0.8260, 0.8230, 0.8200, 0.8145 Resistance levels: 0.8340, 0.8346, 0.8353, 0.8380, 0.8400, 0.8412, 0.8450 Trading tips Sell Limit 0.8340, 0.8346, 0.8353. Stop Loss 0.8385. Sell Stop 0.8305. Stop-Loss 0.8337. Take-Profit 0.8300, 0.8277, 0.8260, 0.8230, 0.8200, 0.8145 The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for USDJPY for April 20, 2022 Posted: 20 Apr 2022 04:29 AM PDT

Technical outlook:USDJPY continued to defy resistance and pushed through fresh highs around 129.40 mark in the early Asian session on Wednesday. The currency has found resistance there and it has pulled back through 127.60 lows intraday. Probability remains for a major top in place but bears need to drag below 125.10 level to confirm. USDJPY is seen to be trading just below the 128.00 mark at this point in writing and is expected to continue further towards 127.20 at least near term. Immediate price resistance is now seen around 129.50 levels while initial support comes in around 125.10 as labelled on the chart here. A break lower will confirm a meaningful pullback is on its way and that bears are back in control. USDJPY was in a triangle consolidation earlier and broke out higher above 116.50 mark. It has produced a thrust wave close to 1300 pips close to 129.40 mark. A meaningful retracement should be on its way soon, which could drag prices back towards 116.35 at least, if not lower. Watch ut for a break below 125.10 in the next few trading sessions. Trading plan:Potential drop towards 116.35 against 130.00 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

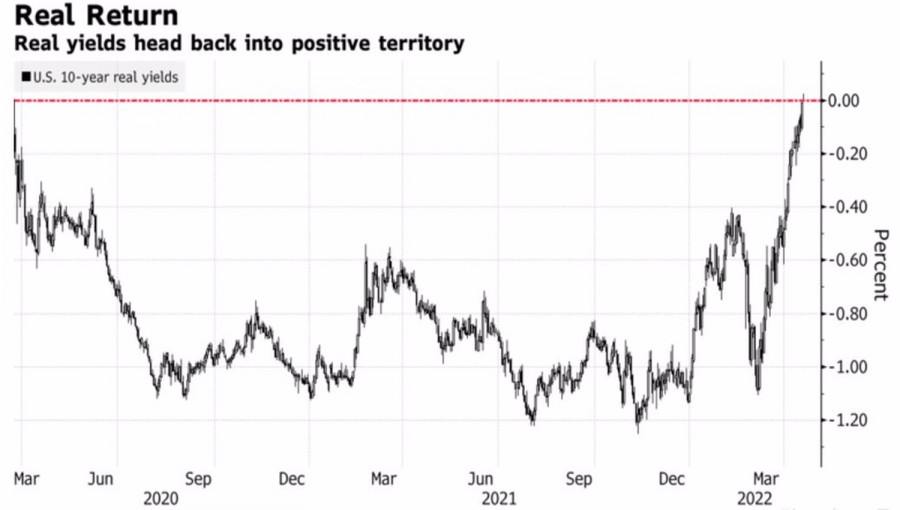

| Gold's trip to $2000 ended in fiasco Posted: 20 Apr 2022 04:19 AM PDT For a long time, investors were surprised by the growth of XAUUSD quotes against the backdrop of a rapid rally in the yield of treasury bonds and the US dollar. Gold is quoted in US currency, the increase in the USD index makes it more expensive in other countries, but the precious metal stubbornly refused to pay attention to this historical fact. As well as the inverse correlation with debt market instruments. Sooner or later, its exploits had to end. And another trip to $2,000 per ounce again turned into a fiasco. The main driver of the upward movement in XAUUSD is the armed conflict in Ukraine, which should potentially further accelerate inflation and provoke a slowdown in global economic growth. The IMF has lowered its forecast for global GDP for 2022 from 4.4% to 3.6%. The largest sharpening, from 3.9% to 2.8%, was subjected to the assessment of the gross domestic product of the eurozone due to its proximity to the war zone and the EU's dependence on Russian oil and gas supplies. For a long time, gold received preferences both as a safe-haven asset and as a tool for hedging inflationary risks. In the second decade of April, the situation changed. Real yields on 10-year U.S. Treasury bonds are back in positive territory for the first time in more than two years, and globally traded negative-rate debt is down $9 trillion since early 2022 to $2.7 trillion. This circumstance signals that the global economy is returning to normal conditions, which is bad news for the precious metal. Its weakness stems from the fact that nominal yields are rising faster than inflationary expectations. Dynamics of the real yield of US Treasury bonds

Of course, the hawkish rhetoric of the FOMC members influenced the rally in debt rates. A number of them spoke of raising borrowing costs by as much as 75 bp all at once, citing the experience of 1994, when Alan Greenspan and his colleagues managed to achieve a soft landing. At present, the futures market is quoting its instruments with a 140 bp increase in the federal funds rate at the next three meetings of the Open Market Committee. That is to say, investors believe that the big move will be made at least twice, which has not happened since 1984. In such an atmosphere of anticipation, Jerome Powell's hawkish rhetoric at the IMF-World Bank meeting accelerates Treasury bond yields and the US dollar, which negatively affects gold. What's next? Much will depend on the duration of the armed conflict in Ukraine. The longer, the more likely the EU will join the embargo on Russian oil. This will lead to a further increase in inflation and, most likely, to a recession in the German economy. Fears about this support the "bulls" on XAUUSD. Technically, on the daily chart of gold, there is a transformation of the splash and shelf pattern into a false breakout pattern. The return of gold quotes to the middle of the consolidation range near $1930 per ounce could be the basis for sales. Gold, Daily chart

|

| Daily Video Analysis: EURUSD, H4 Bullish Breakout Opportunity Posted: 20 Apr 2022 04:14 AM PDT Today we take a look at EURUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical review for AUD/USD: price could continue to grow Posted: 20 Apr 2022 03:57 AM PDT AUD/USD found support at 0.7345, thanks to the rise in prices for commodities and the decision of the Central Bank of China to leave the main interest rate at the same level of 3.7%, which is a signal to maintain support for the Chinese economy, and hence imports from Australia to China. Technical picture: The quote is currently above the middle line of the Bollinger indicator, above SMA 5 and SMA 14, which have crossed and gives a signal to buy the pair. The relative strength index (RSI) is below 50% and is declining, while the stochastic indicator is entering the overbought zone. Forecast for today: A rise above 0.7410 may lead to a further price increase to 0.7490. But this will happen only if market sentiment is positive.

|

| Technical review for USD/CAD: prices could dip again Posted: 20 Apr 2022 03:43 AM PDT USD/CAD is forming a triangle pattern in anticipation of the data on consumer inflation in Canada, which will be released today. If it shows continued growth, the Central Bank of Canada will be forced to continue raising interest rates, which, coupled with high crude oil prices, may lead to a local reversal of the pair. Technical picture: The quote is currently at the lower line of the Bollinger indicator, below SMA 5 and SMA 14. The RSI is below 50% and is declining, while the stochastic indicator is in the oversold zone. Forecast for today: The decline of the pair below 1.2565 amid a possible rise in inflation may lead to a further fall to 1.2465.

|

| Gold slumps on Tuesday and could continue moving in a wide range Posted: 20 Apr 2022 03:34 AM PDT Precious metals fell sharply on Tuesday, then continued to decline this morning. Gold dipped from 1977.00 to 1940.00 even though investors were expecting a more aggressive pace of interest rate hikes from the Fed. The first reason is the high demand for dollar, which persists despite the possible rate hikes at the upcoming monetary policy meetings. In addition, the Fed is actively reducing its balance sheet, limiting measures to support the economy. The second reason is probably some of the statements by Fed members recently. Those make it clear that they are worried that the US economy will plunge into recession if rates are raised aggressively. So if the Fed really increases rates by 0.25% like before, there may be a rebound in the stock market and a simultaneous decrease in gold prices. The third and final reason is the position of the Central Bank of China in relation to the level of interest rates on one-year and five-year loans, which seems to be leading to a contraction in interest in gold in Asia. Contrary to expectations, China kept its benchmark lending rates for corporate and private loans at April levels as Beijing became more cautious in its easing measures to help the slowing economy. All in all, gold prices fell because of the growth of interest rates and dollar, as well as the position of the Central Bank of China. But the decline is limited because the threat of recession forces many market players to buy safe assets. The ongoing conflict in Ukraine affects the price movements as well. The current state of affairs, characterized by high uncertainty in the markets, will continue, which means that gold will remain near historical highs, but with no prospect for further growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Tips for beginner traders in EUR/USD and GBP/USD on April 20, 2022 Posted: 20 Apr 2022 03:29 AM PDT Details of the economic calendar from April 19The US construction sector data showed growth instead of the predicted decline. So, it was expected that all indicators, without exception, would fall in the period of March, but that was not the case. New housing starts increased by 0.3%, while the number of building permits issued increased by 0.4%. Positive statistics only temporarily strengthened dollar positions. Most of the time the quote stood still during the past day. Analysis of trading charts from April 19The EURUSD currency pair has a slight pullback from the 1.0800 support area. With all this movement, the downward cycle, as before, is considered by traders as the main move in the medium term. The GBPUSD currency pair has been moving along the 1.3000 support level for several days in a row. This movement indicates the characteristic uncertainty of market participants who are on the verge of prolongation of the medium-term downward trend.

Economic calendar for April 20Today at 09:00 UTC, data on industrial production in Europe were published, where a decline of 1.5% was replaced by an increase of 2.0%. It is worth considering that these data were for February, and they are no longer relevant due to the current situation in the world. The March figures will definitely be worse. During the American trading session, data on existing home sales in the United States for March will be published, where they predict a decline in the indicator. This is a negative indicator for the US real estate market, but it will put little pressure on the dollar. Time targeting US Existing Home Sales - 12:00 UTC Trading plan for EUR/USD on April 20Despite the breakdown of the support level, traders still need to get confirmation from the market. A sell signal will be taken into account at the moment the price is kept below 1.0750. Until then, the stagnation-pullback will continue in the market.

Trading plan for GBP/USD on April 20In this situation, the stagnation within the psychological level of 1.3000 changed to a local pullback. This movement does not break the clock component of the downward trend. The signal to sell the pound sterling and prolong the medium-term trend will be received when the price holds below 1.2950 in a four-hour period.

What is reflected in the trading charts?A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices. Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market. Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future. The up/down arrows are the reference points of the possible price direction in the future. The material has been provided by InstaForex Company - www.instaforex.com |

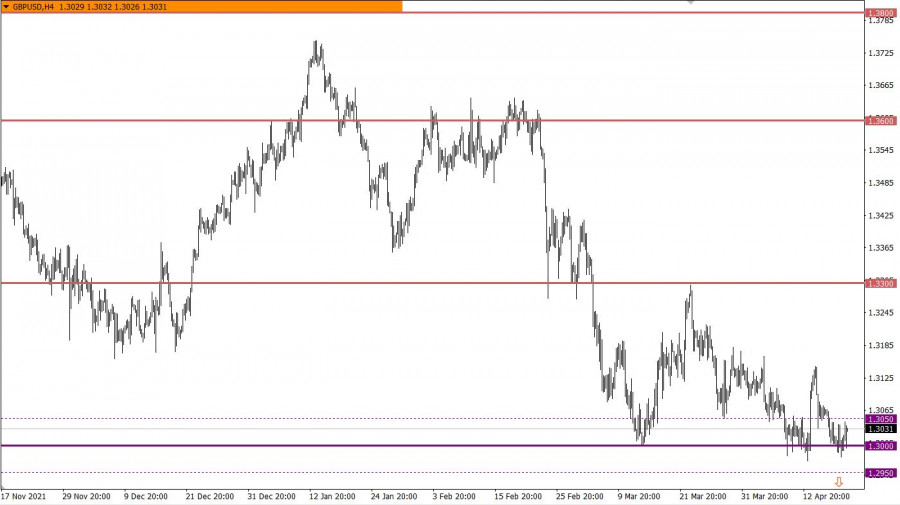

| GBP/USD, AUD/USD, USD/CHF, USD/CAD simplified wave analysis and forecast on April 20, 2022 Posted: 20 Apr 2022 03:02 AM PDT GBP/USD Analysis: GBP/USD continues the downtrend. The unfinished wave section dates back to March 23. A week ago, the final part (C) started to form. In recent days, an intermediate pullback has been formed within this wave section. Forecast: Today, the pair is expected to move sideways. In the first half of the day, the price is likely to move upwards toward the estimated resistance level. At the end of the day or tomorrow, the price may resume the downtrend. Potential reversal zones Resistance: - 1.3060/1.3090 Support: - 1.2940/1.2910 Recommendations: In the coming sessions, trading in the GBP/USD market will be possible only with a scalping technique. Selling from the resistance zone seems a better option. It is advisable to refrain from entering the market until the current uptrend is finished.

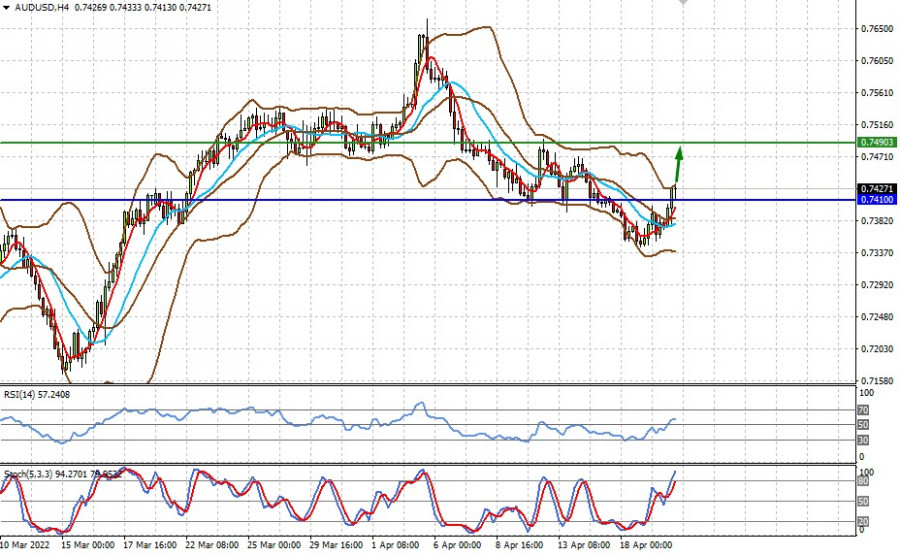

AUD/USD Analysis: In the course of the uptrend, the AUD/USD pair ended up in a strong potential reversal zone. Since April 5, the price has been forming an opposite correction that corresponds with the entire previous wave. The ascending section from April 18 goes well with the trajectory of the emerging pullback and looks like a sideways channel. At the time of writing, the price is approaching the lower boundary of the intermediate resistance on the daily time frame. Forecast: Today, AUD/USD is expected to complete the uptrend, forming a reversal near the resistance zone and resuming the downward movement. Potential reversal zones Resistance: - 0.7430/0.7460 Support: - 0.7360/0.7330 Recommendations: At the moment, there are no conditions for going long on AUD/USD. It is recommended to sell the pair only after getting confirmed signals of a reversal near the resistance zone.

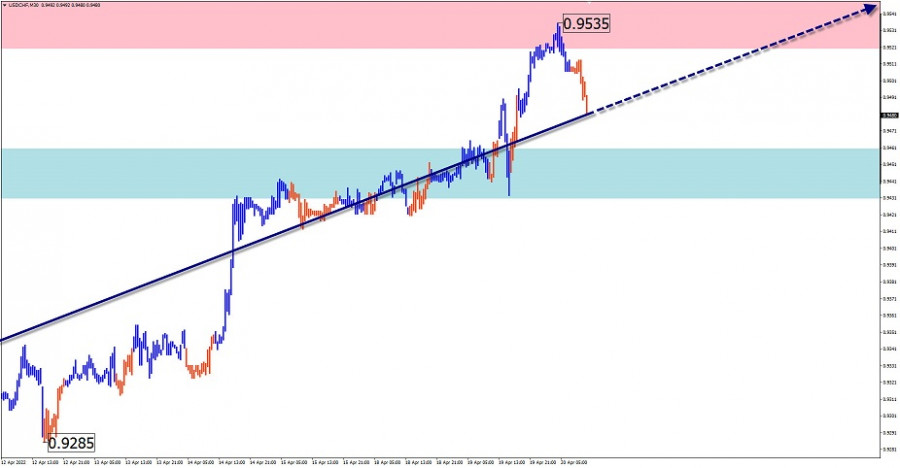

USD/CHF Analysis: The fluctuations of the past months have changed the current wave layout. A rise from January 14 is part of a separate wave structure which, in turn, completes a larger wave initiated in May 2021. At the moment of writing, the quotes have reached the lower line of a strong resistance area. There are no reversal signals on the chart. Forecast: In the next 24 hours, the price is expected to fluctuate between the two opposite zones. During the day, a downward movement is more likely. Later on, the pair may resume growth and make another attempt to test resistance. Potential reversal zones Resistance: - 0.9520/0.9550 Support: - 0.9460/0.9430 Recommendations: Selling USD/CHF is risky today and can lead to losses. It is recommended to refrain from entering the market until the decline is completed. You can buy the pair after getting a reversal signal near the support area.

USD/CAD Analysis: The incomplete wave structure on the USD/CAD chart is pointing upwards. A correction has been forming within this wave since last summer. The current descending wave was formed on March 8. Within its structure, a corrective wave section (B) has been developing for the past month. Forecast: In the coming sessions, the USD/CAD pair is expected to stay in a flat channel. In the first half of the day, the quote may decline to the support levels. Later in the day or tomorrow, the pair is likely to resume growth. Potential reversal zones Resistance: - 1.2610/1.2640 Support: - 1.2510/1.2480 Recommendations: During the day, it is possible to open sell positions for the short term with a fractional lot. The upcoming decline may have a short-lived nature. It is better to wait until a confirmed buy signal appears near the support area.

Explanation: In simplified wave analysis (SWA), waves consist of 3 parts (A-B-C). We analyze the last unfinished wave. The solid arrow background shows the structure that has been formed. The dashed lines show the expected movements. Note: The wave algorithm does not take into account the duration of the instrument's movements over time! The material has been provided by InstaForex Company - www.instaforex.com |

| EU embargo may hurt Russian oil Posted: 20 Apr 2022 02:55 AM PDT

Prices in the oil market continue to fluctuate. The fluctuations are caused by uncertain prospects on the supply side and the EU oil embargo may lead to its sharp decrease. On Wednesday morning, oil quotations started to grow steadily after yesterday's crashing fall. The day before, oil closed trading at a one-week low. The cost of benchmark oil fell by 5.2% each on Tuesday. June futures on Brent dropped by $5.91 to $107.25 and May futures on WTI fell by $5.65 to $102.56. The pressure on the commodity market was put by the strong US dollar. Yesterday, the US dollar index rose to the highest level in 2 years. The greenback was supported by the hawkish Fed policy. Now more US central bank officials are voting for a more aggressive tightening of monetary policy. Another negative factor for oil was the revised growth forecast for the global economy from the International Monetary Fund. Given higher inflation expectations, the IMF has significantly lowered the reading for 2022. This is a bad sign for oil, predicting a possible decline in energy demand. Expectations that demand may exceed supply, on the contrary, are strengthening the quotations of oil. Thus, on Monday, they reached a monthly high amid the news about the suspension of crude shipments in two ports of Libya. This has raised already high supply concerns in the oil market. The escalation of the Russian-Ukrainian conflict these days could force the EU to sharply refuse to import crude from Russia. What is the threat of this? According to estimates of the US bank JPMorgan, an abrupt rather than gradual introduction of the embargo will force more than 4 million barrels of oil out of the market. In conditions of acute shortage, oil prices may soar by 65%, up to $185. By comparison, Europe's phase-out of Russian oil would reduce supply by 2.1 million barrels by the end of the year. In this case, it is unlikely that the price of oil will be able to reach another record-high level. Nevertheless, experts remain bullish on oil prices. In the medium term, quotes may increase due to increased demand for crude in China. Investors are now concerned that the easing of restrictive measures in China will lead to a recovery in the auto and air transport industries. According to the latest data, traffic activity in China's capital city has already exceeded 100% of its 2019 level. Once the lockdown eases, the indicator may grow several times over. Shanghai announced this morning that it has again weakened the strict quarantine regulations imposed due to the COVID-19 outbreak. This news instantly sent oil prices skyrocketing. At the time of writing, the price of Brent rose by 1.19%, to $108.53, and WTI jumped by 1.25%, to $103.33. The material has been provided by InstaForex Company - www.instaforex.com |

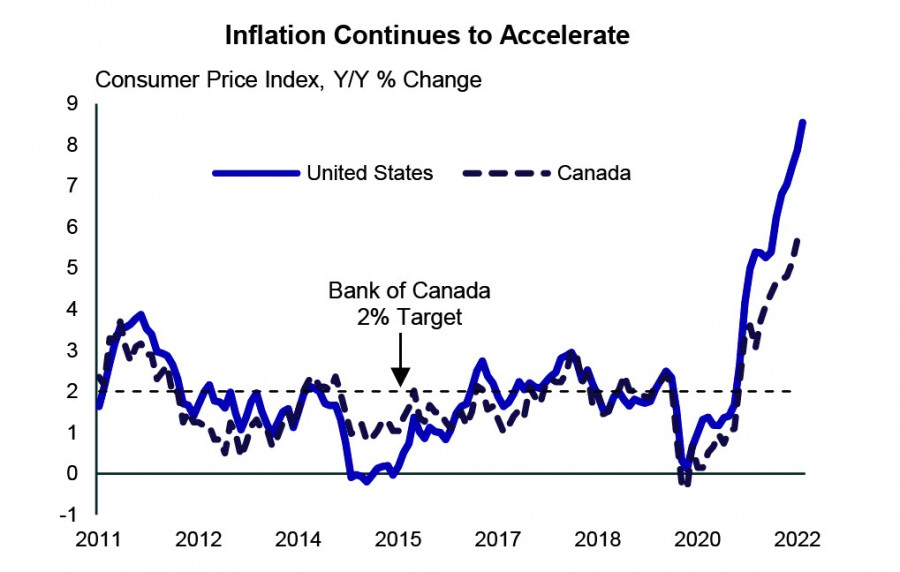

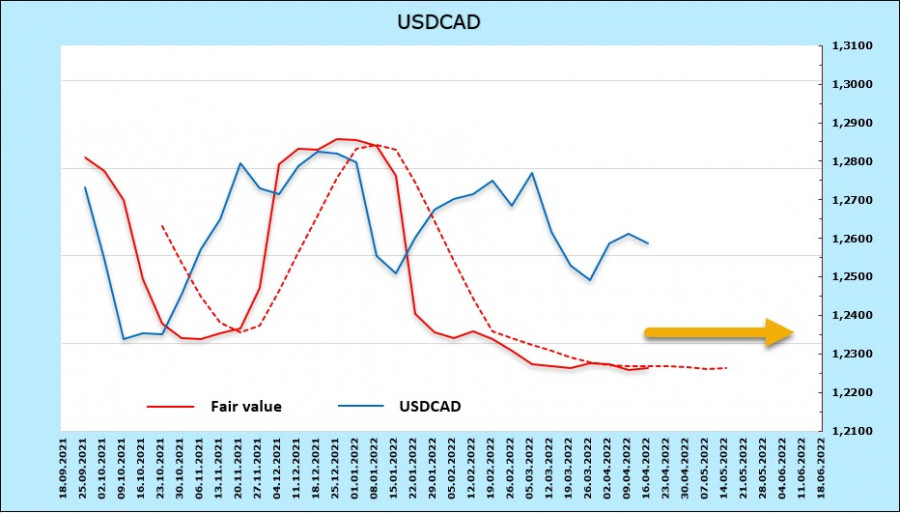

| Review of USD, CAD, and JPY: Rising US Treasury yields create stable demand for USD Posted: 20 Apr 2022 02:45 AM PDT Markets continue to be dominated by rapid growth in US yields, with 10-year UST approaching close to 3%, which contributes to a steady increase in demand for the dollar. Assumptions began to be voiced that the Fed may raise rates not by 50 but by 75 points at its June meeting, and rate futures show a 39% probability of just such a move as of Wednesday morning. Dynamics in favor of the US dollar. USDCAD The Bank of Canada, as predicted, raised the rate by 0.5% for the first time in 22 years, also announcing the beginning of quantitative tightening (QT) on April 25, which will eventually lead to a reduction in the balance sheet. The accompanying statement was hawkish, it is expected that at the meeting on June 1, the rate will be raised by another 0.5%, and by the end of the year, it will be brought to at least 2%. The GDP forecast remains positive despite global risks. The BoC expects real GDP at 4.2% this year and 3.2% next. As for inflation, the forecast has been revised upwards, and data for March is expected at 6.1% YoY, which is less than in the US, but the trend is obvious.

Higher interest rates will make borrowing and servicing accumulated debt more expensive, but this is a problem that all major economies will face except Japan, where efforts to keep yields below the target continue. The net long position in CAD, as follows from the CFTC report, increased during the reporting week by 407 million, to 962 million. The excess is not expressed. Moreover, the dynamics of UST yield growth outpaces the growth of yields in Canada, which levels out the advantage in futures.

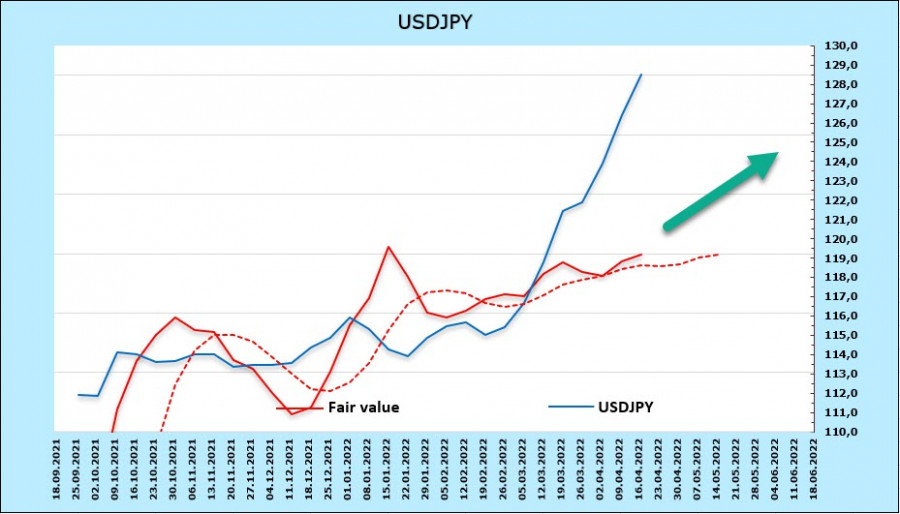

The Canadian dollar has been trading in a range for several months now, its exit is not yet ripe. Given the tightening of the position of the Bank of Canada and the growing likelihood of a continuation of the price rally, a movement to a local minimum of 1.24 looks more likely. USD/JPY The Japanese yen is rapidly depreciating as the Bank of Japan is the only bank in the major economies that is focused not on fighting global inflation, but on curbing profitability. Again and again, the BoJ buys bonds at a fixed price as soon as the 10-year yield approaches the 2.5% target, which leads to additional liquidity in the market. The Fed announces a decrease in available liquidity and an increase in the cost of financial services, while the Bank of Japan announces the preservation of financial policy. As a result, the yen went to a 20-year low. The monetary policy of the BoJ will undoubtedly change, because if it is maintained, then by the summer it will be possible to see the rate of 140 and above, but this will not happen in the near future. Prime Minister Fumio Kishida told the Upper House plenary meeting on April 15 that "the Bank of Japan (BOJ) is conducting monetary policy to achieve its 2% inflation target, not to manipulate currency rates." BoJ Governor Haruhiko Kuroda said that "we need to take into account the negative effect" of the weak yen but stresses that he hasn't changed his mind that a weaker yen is a positive factor for the economy as a whole. Thus, we must proceed from the fact that there are no objective factors for the strengthening of the yen. The net short position on the yen rose by 648 million in the reporting week, a bearish margin of -11.149 billion. Speculators continue to bet on the weakening of the yen.

The bullish momentum has not yet been exhausted, with the January 2002 high at 135.19 now the main target. Even 3 months ago, such an assumption would have been absolute fantasy. The material has been provided by InstaForex Company - www.instaforex.com |

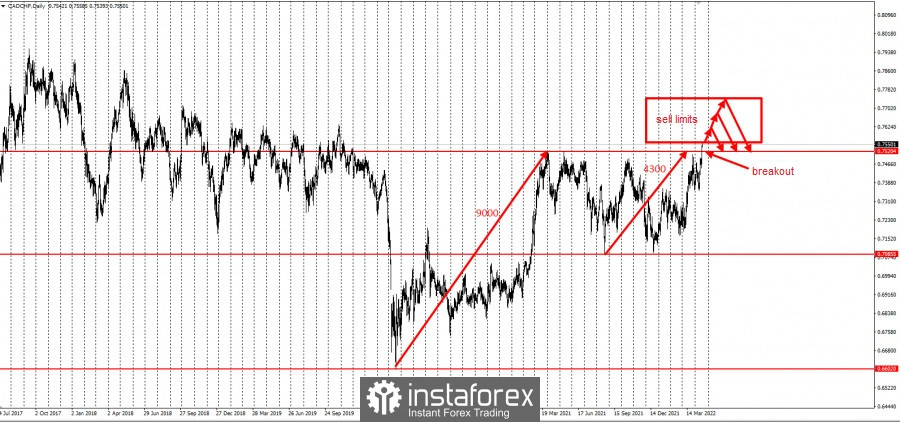

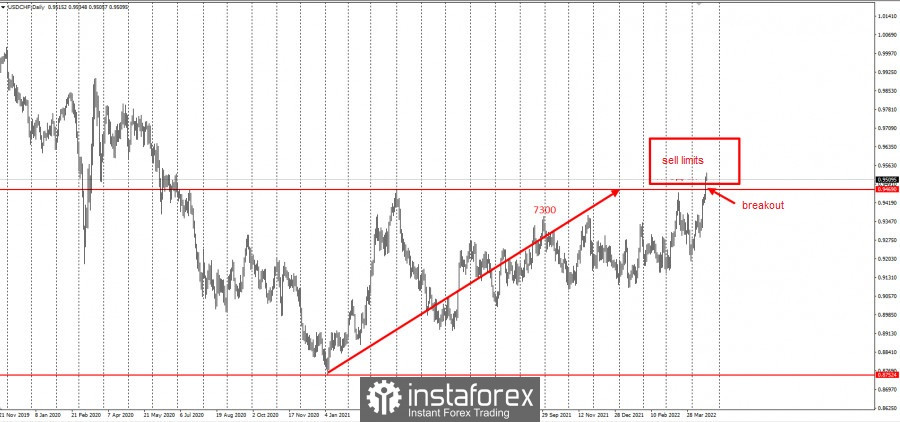

| Trading tips for CAD/CHF and USD/CHF Posted: 20 Apr 2022 02:35 AM PDT There was a breakout of important key levels in CAD/CHF and USD/CHF, which opens the opportunity to set sell limits in the market. In CAD/CHF, as planned last April 18 , there was a breakout around 0.75300.

Meanwhile, in USD/CHF, there was a breakout around 0.94700, as planned the day before .

It is best to divide the volume of limits between the two pairs, and the increment should be 300-500 pips. This is in accordance with the grid trading strategy, which is usually used on cross rates. Good luck and have a nice day! The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: euro avoids deep fall while dollar remains strong Posted: 20 Apr 2022 02:00 AM PDT

The single European currency recovered slightly after a strong fall. Now it is trying to develop an uptrend. At the same time, the greenback remains strong despite a short-term decline. The euro is mainly pressured by two fundamental factors: the difference in the strategies of the European and American central banks and the ongoing Russia-Ukraine conflict. In these conditions, the risk-off sentiment is getting stronger, thus putting additional pressure on EUR. As a result, investors prefer the US dollar which makes it even more attractive as a safe-haven asset. The difference in the monetary policies of the Fed and the ECB supports the US currency. This is the main factor to determine the trajectory of the EUR/USD pair in the near future. The geopolitical instability is another factor that limits the upside potential of the pair. On April 20, EUR/USD was trading at 1.0820 after recouping its previous losses.

Currently, the euro is trading 12% above the so-called Death Cross chart pattern that has formed over the past month. Against this background, experts see a further decline in the euro/dollar pair in the short and medium terms. A rise in the 10-year Treasury yield is another risk factor for the pair that pushes it into the bear market. For your reference, the yield on the 10-year Treasury note has recently reached 2.9%, its highest level since December 2018. The US dollar seems to be more resilient compared to the euro. The greenback has managed to withstand both internal and external impact and maintain its leading position. Apart from the geopolitical instability, the current uptrend in USD is sustained by the upcoming monetary tightening by the Fed. The dollar also gains strength from the fact that it is considered a major currency used in international settlements. Experts are sure that nothing can threaten the dominance of the US dollar in the near future. Expectations of higher inflation also support the US currency. According to Bob Schwartz, senior economist at Oxford Economics, inflation in the US has not reached its peak yet and could accelerate to 9%. In March, the indicator stood at 8.5%. By the end of the year, the inflation rate is expected to decline to 5%, the expert believes. In this situation, markets will count on the Fed to take a more aggressive approach. The majority of analysts (90%) expect the regulator to raise the rate to 0.75%-1% at its May meeting. This step may help stabilize the EUR/USD pair. The material has been provided by InstaForex Company - www.instaforex.com |

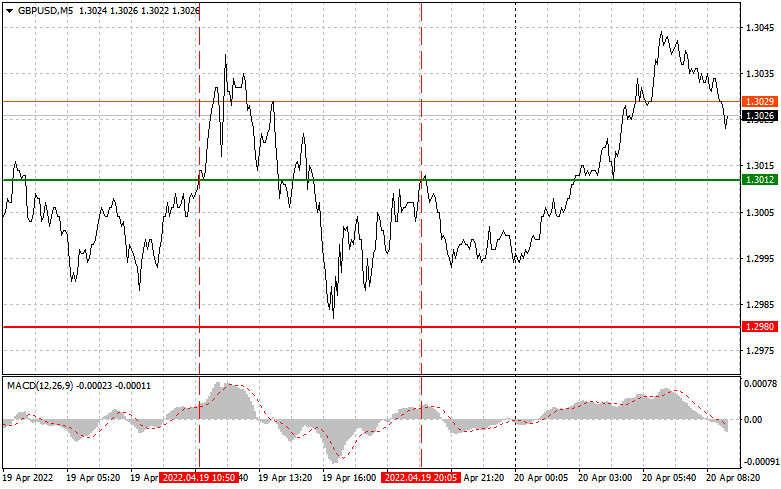

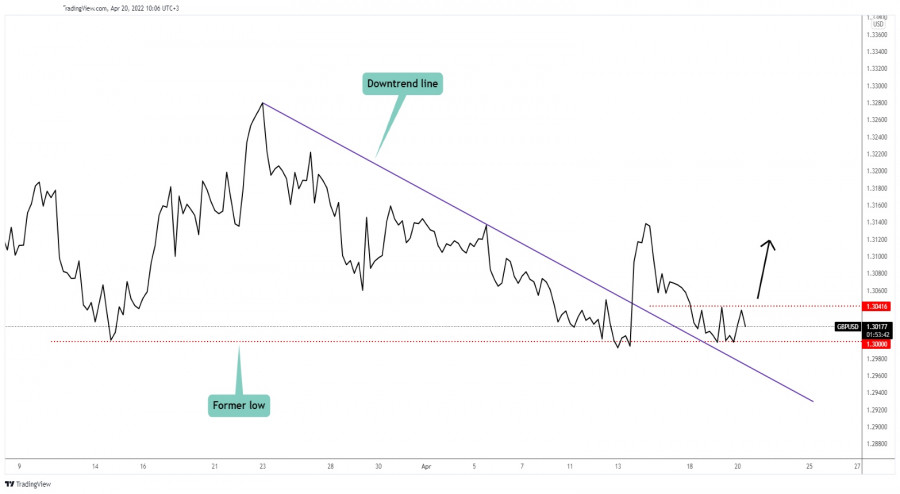

| Analysis and trading tips for GBP/USD on April 20 Posted: 20 Apr 2022 01:46 AM PDT Analysis of transactions in the GBP / USD pair A signal to buy emerged after GBP/USD hit 1.3012. However, there was no sharp increase because the MACD line being far from zero limited the upside potential of the pair. It only rose by 20 pips before turning down again. In the afternoon, another test of the level took place, but the same scenario occurred as the MACD line was still far from zero. No other signal appeared for the rest of the day.

Demand for dollar rose yesterday because of the statements made by FOMC member Charles Evans. However, it did not lead to a sharp sell-off in GBP/USD because few people want to do it at the current lows. There is no UK data today, so buyers can take advantage of this moment to push to new weekly highs. In the afternoon, there will be a report on the US secondary housing market, but that is unlikely to have any effect. Instead, traders should focus on the statements of FOMC members Mary Daly and Charles Evans, which could hint at a half-point rate hike next month. For long positions: Buy pound when the quote reaches 1.3036 (green line on the chart) and take profit at the price of 1.3069 (thicker green line on the chart). There is a chance for a rally today, but it will be limited because of the current state of the economy and high inflation, which the Bank of England is in no hurry to fight. In any case, when buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.3013, but the MACD line should be in the oversold area as only by that will the market reverse to 1.3036 and 1.3069. For short positions: Sell pound when the quote reaches 1.3013 (red line on the chart) and take profit at the price of 1.2982. Pressure is likely to return on the market, especially given how traders feel about the US dollar right now. However, before selling, make sure that the MACD line is below zero, or is starting to move down from it. Pound can also be sold at 1.3036, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.3013 and 1.2982.

What's on the chart: The thin green line is the key level at which you can place long positions in the GBP/USD pair. The thick green line is the target price, since the quote is unlikely to move above this level. The thin red line is the level at which you can place short positions in the GBP/USD pair. The thick red line is the target price, since the quote is unlikely to move below this level. MACD line - when entering the market, it is important to be guided by the overbought and oversold zones. Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader. The material has been provided by InstaForex Company - www.instaforex.com |

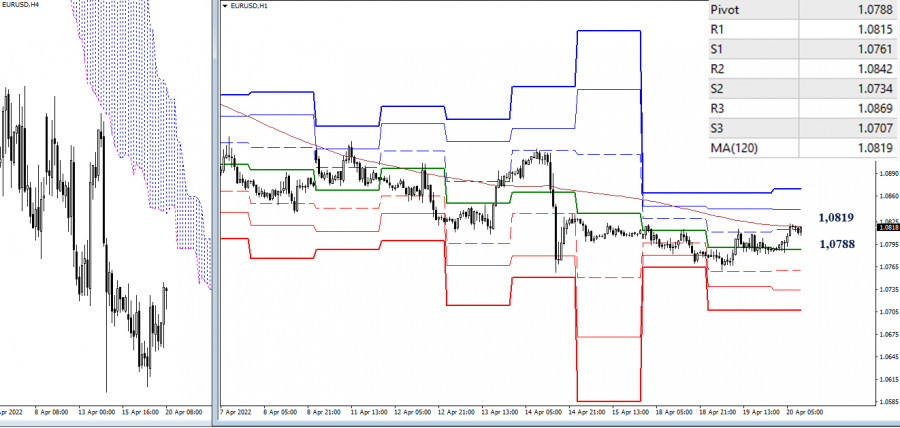

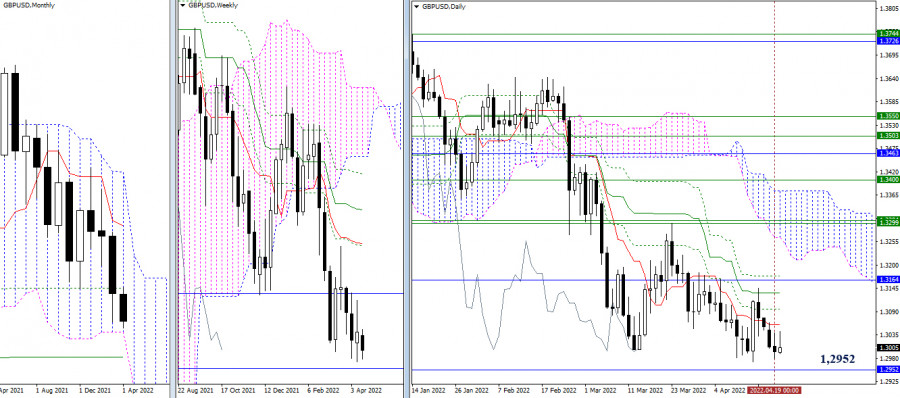

| Technical analysis of EUR/USD and GBP/USD on April 20, 2022 Posted: 20 Apr 2022 01:35 AM PDT EUR/USD

Higher time frames Yesterday, the pair failed to break through the weekly low of 1.0758, and a small bullish candlestick was formed by the close of the day. We may well expect the quote to retrace up. Importantly, the price is still under the influence of the 100% retracement level of 1.0806. In case of consolidation above the mark, the pair will ascend and test the area of 1.0846/1.0921/1.0972/1.1022 resistance levels of the daily death cross of the Ichimoku indicator. In the event of a fall, targets are seen at the support levels of 1.0721 and 1.0539.

H4 – H1 In lower time frames, bulls and bears are trying to establish control over the key levels of 1.0788 (central Pivot level) and 1.0819 (weekly long-term trend). Bullish sentiment will grow if the quote consolidates above those levels. Additional reference points stand at 1.0842 (R2) and 1.0869 (R3). The downtrend will resume if the price leaves the corrective zone and updates the 1.0758 low. Intraday bearish targets are seen at classical Pivot support levels of 1.0761/1.0734/1.0707. *** GBP/USD

Higher time frames The nearest support is still seen at 1.2952, the lower limit of the monthly Ichimoku Cloud. Meanwhile, 1.2830 (monthly medium-term trend) serves as the next support level. The resistance zone is marked by levels 1.3059/1.3097/1.3135/1.3173 (daily Ichimoku cross) and gains from the monthly level around 1.3164.

H4 – H1 In lower time frames, the quote still trades in the range between 1.3005 (central Pivot level) and 1.3048 (weekly long-term trend). Downward intraday targets are seen at 1.2970/1.2945/1.2910 (classical Pivot resistance levels). If the quote settles above the key levels of 1.3005 and 1.3048 and the moving average reverses, the uptrend may resume with targets at 1.3065 and 1.3090 (classical Pivot resistance levels). *** Technical indicators used: Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels H1 – Pivot Points (classical) + Moving Average 120 (weekly long-term trend) The material has been provided by InstaForex Company - www.instaforex.com |

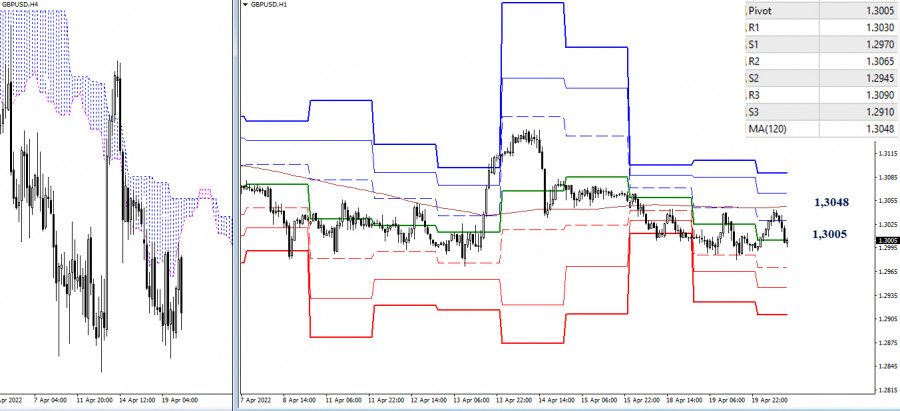

| Hedge funds return to precious metals amid rising inflation and geopolitical risks Posted: 20 Apr 2022 01:29 AM PDT

The latest trading data from the Commodity Futures Trading Commission shows that the current geopolitical tensions in Ukraine continue to push hedge funds into the gold market, even as the precious metal faces a growing headwind of monetary tightening around the world. In the CFTC disaggregated report for the week, money managers on the Comex increased their speculative long positions in gold futures by 16,924 contracts to 165,244. At the same time, short positions also rose, but only by 1,526 contracts, to 48,219. Gold net length now is 117,025 contracts, which is 15% more than the previous week. The increase ends a five-week decline in bullish rates.

Bullish betting pushed $3 billion into gold last week, analysts say. The precious metal, despite the hawkish tightening of the Fed's monetary policy, was supported by inflationary risks and sanctions against Russia. Meanwhile, hedge funds have increased their bullish bets on silver, despite yesterday's decline in price. The disaggregated report showed that speculative long positions in Comex silver futures rose by 2,523 contracts to 54,935. At the same time, short positions decreased by 592 contracts to 12,855. The net length of silver is 42,080 contracts, up almost 8% from the previous week.

Analysts say that, like gold, silver is a safe-haven asset as investors seek to protect themselves from geopolitical uncertainty and rising inflationary pressures. The material has been provided by InstaForex Company - www.instaforex.com |

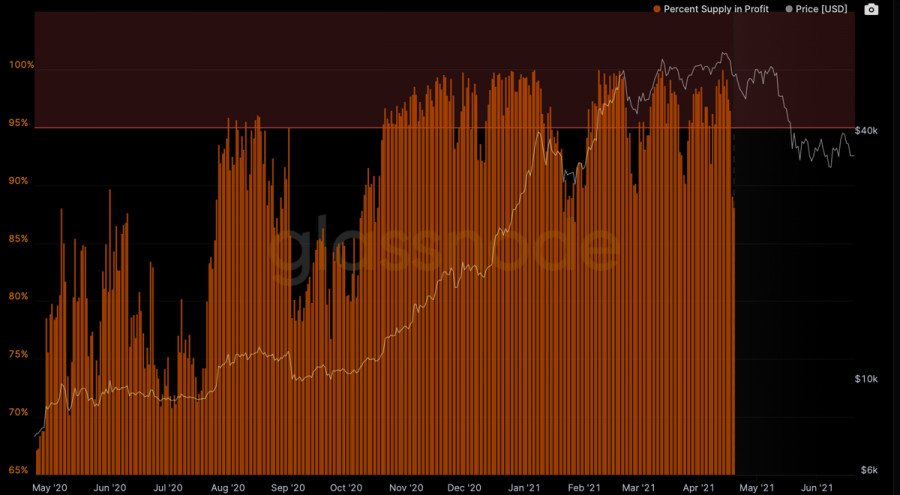

| Bitcoin forms massive buyer support: is this enough for a long-term upward trend? Posted: 20 Apr 2022 01:03 AM PDT After two bearish weeks, Bitcoin managed to gain a foothold above the $40k mark again. In many ways, this was made possible thanks to the purchasing activity in the areas of key support zones. This speaks to the current strategy of large and long-term investors in relation to Bitcoin. Also, after a while, we can say that several long-term trends have formed in the BTC market, which can positively affect the quotes of the main cryptocurrency. But first, let's look at the current situation around Bitcoin. It became obvious that buyers are active only in case of a threat to the upward trend. When breaking through round marks or other support levels, bulls behave with restraint. However, when important levels are reached, buyers make a sharp and powerful price rebound. This suggests that the current investment strategy of the bulls is adjusting to the new realities of monetary policy. In other words, buyers are ready to protect the upward channel within which BTC moves, but will not use liquidity volumes for local purposes.

The influence of the Fed's policy is also reflected in the upward trend of the cryptocurrency. Despite a fairly confident bounce and the formation of a "bullish engulfing" pattern, the subsequent green candle turned out to be uncertain. This indicates the absence of large volumes after the protection of the structure of the upward trend. In other words, investors are not ready and do not fully believe in the successful launch of a bullish rally at the moment.

Despite all the facts, the cryptocurrency has formed important support zones, and investors are ready to defend the upward trend. Several established trends contributed to this. We have already dealt with the first one: it lies in the fact that the bulls protect the key support zones of the ascending structure. This is a positive long-term signal, demonstrating the confidence of Bitcoin investors that a bullish rally is coming. Here, too, it is crucial to note that the $38.4k support zone has withstood the selling volumes accumulated over the weekend. This is a positive signal, again indicating the strength of the bulls. The outflow of BTC coins from cryptocurrency exchanges also continues. Crypto exchange balances have fallen to a 4-year low. Santiment also noticed signs of "buy the dip" on April 19th. It is important to understand that more than 60% of the coins are in profit, and even despite this, investors continue to increase stocks. This behavior is a clear sign of preparation for a bullish trend.

This also suggests that investors are confidently coping with partial profit taking by medium-term investors. There is also a longer-term perspective. Thanks to the active accumulation of BTC coins, open interest in the coin is growing, as stocks on exchanges are declining. Under such conditions, artificially created greed will push the price up.

Given the current macroeconomic situation, one cannot be completely sure about the short-term prospects of cryptocurrency. However, even now there is no doubt that the asset will resume its upward movement in the coming months. The next event that will determine the short-term fate of the cryptocurrency will be the launch of the quantitative reduction program in May 2022. Here, Bitcoin can follow the stock markets to $30k, or it can break the correlation by changing the investment strategy for cryptocurrency. The material has been provided by InstaForex Company - www.instaforex.com |

| US stock market rallies strongly amid heavy fighting in Eastern Ukraine Posted: 20 Apr 2022 12:56 AM PDT

S&P500 US stock indexes rallied strongly on Tuesday, with the Dow Jones gaining 1.5%, and the NASDAQ rising by 2.2%. The S&P 500 increased by 1.6%. The S&P 500 is trading at 4,462 and is expected to be in the 4,430-4,490 range. Shares of Netflix plunged by 20% in after-hours trading after the streaming giant reported a loss of 200,000 subscribers over the past 3 months. Netflix lost 700,000 Russian subscribers after exiting Russia, but gained 500,000 subscriptions elsewhere. US indexes advanced on Tuesday as investors assumed high inflation and the Fed funds rate hike were unlikely to severely affect company earnings. Furthermore, on Monday and Tuesday the S&P 500 traded 10% below its starting price at the beginning of 2022, attracting investors expecting the market to regain its previous highs. Crude oil prices fell by 5% or $5 on Tuesday. Brent crude is trading at $108 per barrel on Wednesday. The commodity retreated as the IMF revised its global economic growth outlook downwards, pushing down the projected demand for oil as well. Oil decreased amid a strong rally in the US stock market. Natural gas prices have been highly volatile, with commodity prices at the ICE falling to $950 on Tuesday and jumping to $1050 early on Wednesday. New car sales in the EU fell in March by 20% amid high fuel prices. US crude oil stockpiles decreased by 4.5 million barrels over the past week. The International Monetary Fund has decreased its EU GDP growth outlook to 2.8%, well below its previous forecast of 3.9%. The US economic growth outlook was lowered to 3.7% from 4%. USDX is trading at 100.70 and is expected to be in the 100.40-101.00 range The US dollar index found strong resistance at the 101.00 mark, which stopped its upward movement. USDX remains within the price range. EUR is trying to reverse upwards. USD/CAD is trading at 1.2575 and is expected to be in the 1.2500-1.2650 range. The pair remains withing the price range, as retreating US dollar was counterbalanced by falling oil prices. The US market is expected to continue its upward trend. At this point, Fed tightening does not influence indexes, and long positions could be opened during retracements. Heavy fighting continues in Eastern Ukraine for the second straight day, as Russian troops try to push Ukrainian forces out of Donetsk and Luhansk regions, which are claimed by Moscow as territories of the Donetsk and Luhansk People's Republics. The Azovstal steel works, the last remaining pocket of Ukrainian resistance in Mariupol, has been bombed with 3-ton bombs. Its defenders have refused Russia's ultimatum to surrender. Russia has yet to make any gains since the beginning of the new offensive. Peace talks have been halted as Moscow wants a military victory to strengthen its negotiating position, while Kyiv is fervently resisting. In the meantime, Western military support for Ukraine is increasing. The Ukrainian army is now receiving more and more equipment, including heavy weaponry. The outcome of the battle and the war in general would be decided before May. The course of the battle would likely be clear over the next few days. The material has been provided by InstaForex Company - www.instaforex.com |

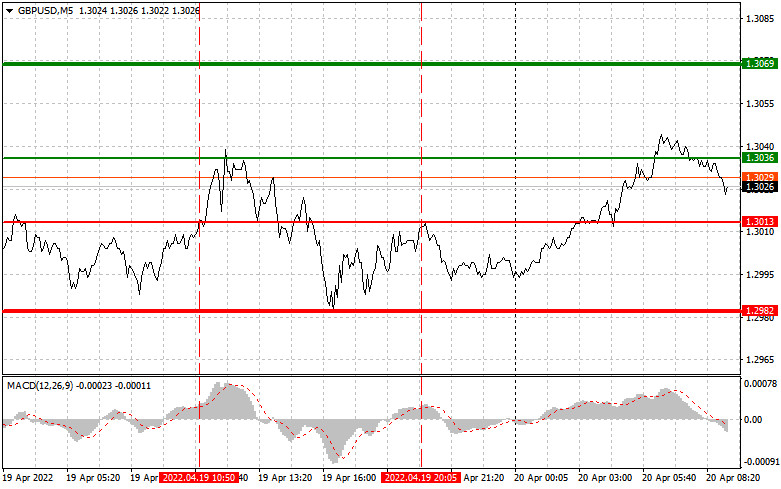

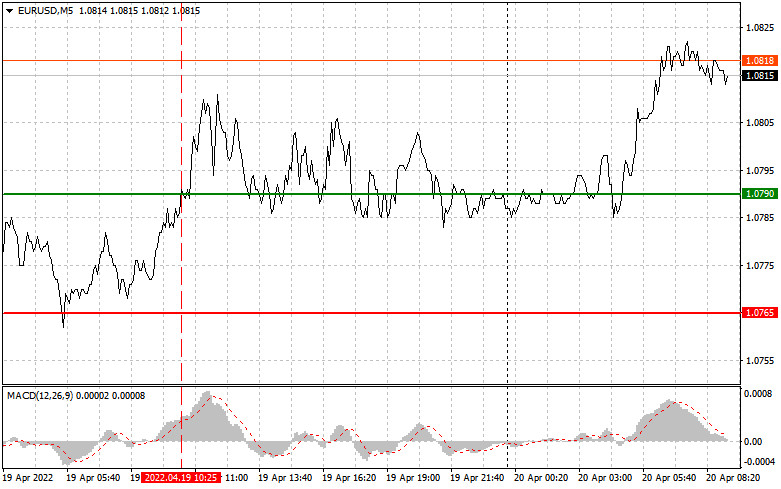

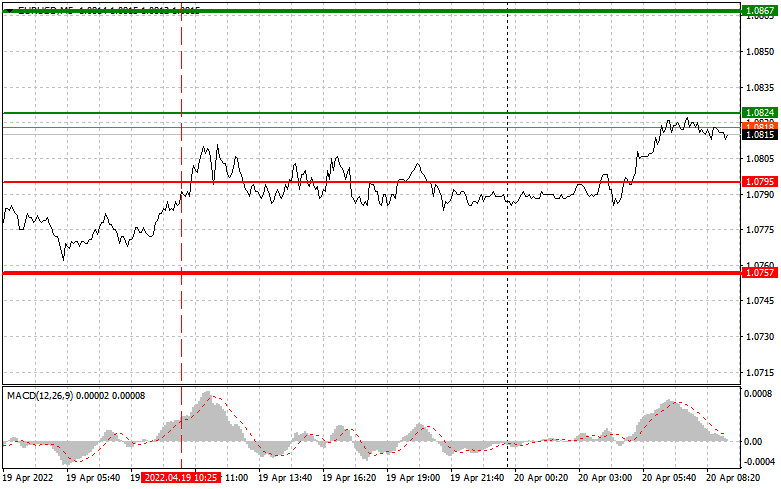

| Analysis and trading tips for EUR/USD on April 20 Posted: 20 Apr 2022 12:43 AM PDT Analysis of transactions in the EUR / USD pair A signal to buy emerged after EUR/USD hit 1.0790. However, there was no sharp increase because the MACD line being far from zero limited the upside potential of the pair. No other signal appeared for the rest of the day.

Given that there were no statistics on the euro area yesterday, traders focused on the published data on the US economy, as well as on the speech of Fed member Charles Evans. Although those had a positive impact on dollar, it did not lead to serious pressure in EUR/USD. Today appears to be a busy day because in the morning, Germany will release reports on producer prices, business environment, current situation and economic expectations. Many expect that these will indicate some slow down, primarily because of the issues that arose this April. February data on EU's industrial production and foreign trade balance are unlikely to affect the market, while the speech of ECB Board Member Joachim Nagel, on the other hand, could provoke a surge in volatility and increase in EUR/USD. In the afternoon, there will be a report on the US secondary housing market, but that is unlikely to have any effect. Instead, traders should focus on the statements of FOMC members Mary Daly and Charles Evans, which could hint at a half-point rate hike next month. For long positions: Buy euro when the quote reaches 1.0824 (green line on the chart) and take profit at the price of 1.0867 (thicker green line on the chart). However, a further increase will occur only if there are strong statistics in Germany and the Eurozone. In any case, when buying, make sure that the MACD line is above zero or is starting to rise from it. It is also possible to buy at 1.0795, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0824 and 1.0867. For short positions: Sell euro when the quote reaches 1.0795 (red line on the chart) and take profit at the price of 1.0757. Pressure is likely to return because risk appetite is seriously deteriorating. But before selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.0824, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.0795 and 1.0757.

What's on the chart: The thin green line is the key level at which you can place long positions in the EUR/USD pair. The thick green line is the target price, since the quote is unlikely to move above this level. The thin red line is the level at which you can place short positions in the EUR/USD pair. The thick red line is the target price, since the quote is unlikely to move below this level. MACD line - when entering the market, it is important to be guided by the overbought and oversold zones. Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: new upwards movement? Posted: 20 Apr 2022 12:35 AM PDT

GBP/USD Above Demand Level!The GBP/USD pair is located at 1.3014 at the time of writing. After jumping above the downtrend line, the price was expected to grow. The upside movement was stopped by 1.3139, so the former high represents an upside obstacle. 1.3000 psychological level stopped the price in the past, that's why this is seen as a downside obstacle. As long as it stays above it, the price could try to increase again. GBP/USD Trading Conclusion!Staying above 1.3000 and jumping above the immediate high of 1.3041 could validate further growth and could bring new buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis of GBP/USD on April 20, 2022 Posted: 20 Apr 2022 12:34 AM PDT Trend analysis (Fig. 1). The pound-dollar pair may move up from the level of 1.2994 (close of yesterday's daily candle) to 1.3047, the 23.6% retracement level (red dotted line). In case of testing this level, the price may continue to move upward with the target at 1.3095, the 38.2% retracement level (red dotted line). From this level, downward movement is possible.

Fig. 1 (daily chart). Comprehensive analysis:

General conclusion: Today, the price may move up from the level of 1.2994 (close of yesterday's daily candle) to 1.3047, the 23.6% retracement level (red dotted line). In case of testing this level, the price may continue to move upward with the target at 1.3095, the 38.2% retracement level (red dotted line). From this level, downward movement is possible. Unlikely scenario: from the level of 1.2994 (close of yesterday's daily candle), the price may move upward to 1.3047, the 23.6% retracement level (red dotted line). In case of testing this level, the price may move down to the support level at 1.2990 (thick red line). The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY: dollar at its 20-year high versus Japanese yen Posted: 20 Apr 2022 12:30 AM PDT

Pressure on the yen has returned. On Wednesday morning, USD bulls pushed the pair to the psychological level of 130. The greenback is getting stronger versus the Japanese yen amid the difference in the monetary policies of their central banks as well as strong divergence between Japanese and US bond yields. Earlier today, the dollar surged to its 20-year high against the yen. Eventually, USD/JPY skyrocketed to 129.43 and then bounced to 128.615. The dollar swelled on hawkish comments by a Fed official, hinting at even more aggressive moves by the US regulator. The ongoing lockdown in China aimed at curbing the spread of COVID-19 is believed to only make things worse when it comes to global supply chains. Against such a backdrop, inflation will accelerate and the Fed will have to resort to emergency measures to tame it. In this light, the US Treasury yield has extended the rally. During the Asian session, yields hit the high of 2.981% that was previously recorded in December 2018. Unlike its American counterpart, the Bank of Japan still sticks to its dovish monetary policy stance. On Wednesday, the regulator offered to buy an unlimited amount of 10-year bonds at 0.25% to defend the yield target. The Bank of Japan is committed to maintaining yields at around zero percent, which is the main driver for USD/JPY. The pair is now on track for its second monthly rally in a row. USD/JPY grew by 5.8% in March and advanced by more than 5% in April. Geopolitical uncertainty and the escalation of the Russia-Ukraine conflict are playing on the side of the greenback with demand for the safe haven being on the rise. Earlier today, USDX increased to 101.01 and then fell to 100.76 versus the basket of 6 major currencies. The greenback has received additional support from the dovish People's Bank of China. On Wednesday, the Chinese central bank announced it would maintain its benchmark interest rates for corporate and household loans unchanged. In this light, the Chinese yuan dropped against the dollar to its October 2021 low of 6.4115. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD Potential For Bullish Continuation | 20th April 2022 Posted: 20 Apr 2022 12:22 AM PDT

On the H4 timeframe, price is abiding by the ascending trendline. We expect a bullish continuation from 1st support level of 0.74019 in line with 23.6% Fibonacci retracement rising towards 1st resistance level of 0.74767 along with a graphical pull back resistance. Alternatively, price might break 1st support level and head towards the 2nd support level of 0.73294 which in line with 61.8% Fibonacci retracement, 61.8% Fibonacci projection, 161.8% Fibonacci extension and -27.2% Fibonacci expansion. Trading Recommendation Entry: 0.74019 Reason for Entry: 23.6% Fibonacci retracement Take Profit: : 0.74767 Reason for Take Profit: graphical pull back resistance. Stop Loss: 0.73294 Reason for Stop Loss: 61.8% Fibonacci retracement, 61.8% Fibonacci projection, 161.8% Fibonacci extension and -27.2% Fibonacci expansion. The material has been provided by InstaForex Company - www.instaforex.com |

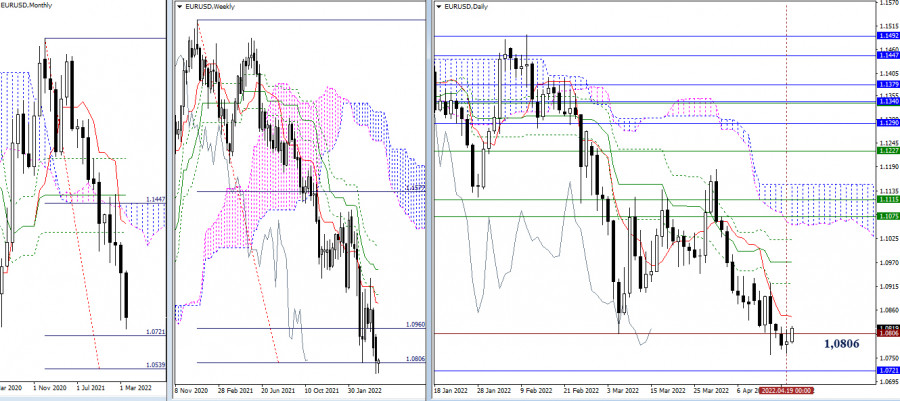

| Indicator analysis of EUR/USD on April 20, 2022 Posted: 20 Apr 2022 12:22 AM PDT Trend analysis (Fig. 1). The euro-dollar pair may move up from the level of 1.0786 (close of yesterday's daily candle) with the target at 1.0819, the 14.6% retracement level (red dotted line). After testing this level, the price may continue to move up with the target at 1.0858, the 23.6% retracement level (red dotted line). From this level, the upward movement may continue.

Fig. 1 (daily chart). Comprehensive analysis:

General conclusion: Today, the price may move up from the level of 1.0786 (close of yesterday's daily candle) with the target at 1.0819, the 14.6% retracement level (red dotted line). After testing this level, the price may continue to move up with the target at 1.0858, the 23.6% retracement level (red dotted line). From this level, the upward movement may continue. Unlikely scenario: from the level of 1.0786 (close of yesterday's daily candle), the price may continue to move up with the target at 1.0819, the 14.6% retracement level (red dotted line). After testing this level, the price may move down to the support level at 1.0743 (thick red line). After testing this level, the price may start moving up with the target at 1.0819, the 14.6% retracement level (red dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD Potential For Bullish Continuation | 20th April 2022 Posted: 20 Apr 2022 12:18 AM PDT

On the H4 timeframe, price is near to the key pivot level and it is on a bullish momentum. We are expecting price to potentially rise from the 1st resistance level of 1.08183 which is in line with a horizontal pullback resistance towards the 2nd resistance level of 1.09368 which is in line with 38.2% Fibonacci retracement. Alternatively, price might drop to the 1st support level of 1.07627 which is in line with 61.8% Fibonacci projection. Trading Recommendation Entry: 1.08183 Reason for Entry: Horizontal pullback resistance. Take Profit: 1.09368 Reason for Take Profit:38.2% Fibonacci retracement. Stop Loss: 1.07627 Reason for Stop Loss: 61.8% Fibonacci projection. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments