Forex analysis review

Forex analysis review |

| Posted: 29 Apr 2022 11:18 PM PDT Long-term perspective.

The GBP/USD currency pair has fallen by another 270 points during the current week. If we also take into account the fall of the Friday before last, then in total the pound has fallen in price by 500 points in 6 trading days. It could have been more if the pair had not grown by 115 points this Friday. Thus, the pound continues to almost collapse, which is caused by a whole range of factors that we have repeatedly listed. There is complicated "geopolitics" for the European continent, there are impending energy and food crises, there is high inflation, which will be much more difficult for Europe to deal with than for the States, there is the weakness of the British economy in comparison with the American one, and much more. However, in the last week, even with all these factors, questions began to arise about such a strong collapse of the British currency. The pound is getting cheaper too fast and too much, whatever the factors, from our point of view. However, the market knows better, and as long as the fall continues, of course, purchases of the British currency should not be considered. From a technical point of view, this week the pair fell to the Fibonacci level of 61.8%-1.2494. Taking into account all of the above factors, the entire downward movement over the past year and a half does not look at all like a correction against the 2020 trend. Accordingly, the next target may be the Fibonacci level of 76.4%-1.2080. There was not a single interesting event in the UK this week, but a new meeting of the Bank of England will be held next week, during which a decision to raise the key rate by another 0.25% may be announced. Unfortunately, the current pace of the pound's decline does not allow us to count on a "bullish" market reaction. If BA refuses to raise the rate, this will theoretically provoke an even greater fall in the pound. In practice, it practically does not matter what decision the BA makes. Traders are now ignoring many macroeconomic events. COT analysis. The latest COT report on the British pound has witnessed a new strengthening of the "bearish" mood among professional traders. During the week, the Non-commercial group opened 3.6 thousand buy contracts and 14.3 thousand sell contracts. Thus, the net position of non-commercial traders decreased by another 11 thousand. For the pound, such changes are significant. The Non-commercial group has already opened a total of 110 thousand sales contracts and only 40 thousand purchase contracts. Thus, the difference between these numbers is almost threefold. This means that the mood of professional traders is now "pronounced bearish" and this is another factor that speaks in favor of continuing the fall of the British currency. Note that in the case of the pound sterling, the COT reports data very accurately reflect what is happening in the market. The mood of traders is "bearish", and the pound is falling against the US dollar. We do not see any reason to assume the completion of the downward trend now. COT reports, "foundation", geopolitics, "macroeconomics", and "technology", all speak in favor of the fall of the pound and the growth of the dollar. Of course, the fall of the pound/dollar pair cannot last forever, there must be at least upward corrections, but so far, based on COT reports, we cannot assume when the downward trend will end. Analysis of fundamental events. As already mentioned, there was not a single important event or publication in the UK this week. There were several secondary reports in the States, but since the pair moved only in one direction for most of the weeks, it is hardly possible to conclude the market reaction to these data. Important information began to arrive only on Thursday when the US GDP report was published. It was disappointing, but the market continued to buy the US currency. On Friday, when the US currency fell slightly, no important reports were published overseas. The change in the levels of income and spending of the population was higher than expected, so it could not provoke a drop in the dollar, and the consumer sentiment index from the University of Michigan decreased by only 0.5 points, which also could not provoke a strong drop in the dollar. As a result, there were practically no important events this week, if you do not take into account geopolitics. The US Congress has decided on the lend-lease program for Ukraine, which means that weapons for the fight against Russia will now be supplied in any volume and of any type. Trading plan for the week of May 2-6: 1) The pound/dollar pair declined to the level of 1.2494-61.8% by Fibonacci. Now, if the price bounces off it, then an upward correction to the critical line may begin. We believe that the probability of a correction is quite high, however, given the general market mood, COT reports, geopolitical and fundamental backgrounds, it is unlikely that strong growth of the British currency can be expected now. Overcoming the level of 1.2494 will open for traders the next target for sales of 1.2080. 2) The prospects for the British currency remain rather vague and so far there is no reason to buy the pound/dollar pair. We believe that it is simply impractical to buy a pair on such a strong downtrend, no matter how attractive the current levels look. We believe that it will be possible to open long positions only above the Ichimoku cloud, and such price consolidation is unlikely to happen in the near future. Explanations of the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). Indicator 1 on the COT charts - the net position size of each category of traders. Indicator 2 on the COT charts - the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Apr 2022 11:18 PM PDT Long-term perspective.

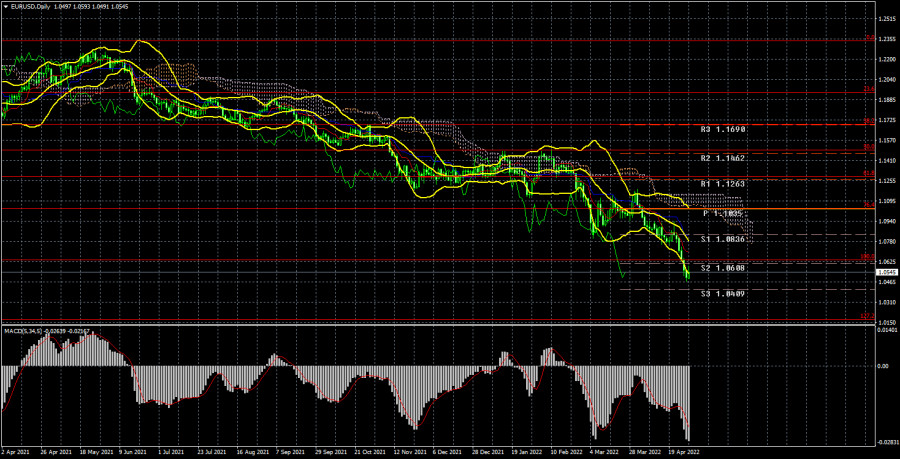

The EUR/USD currency pair did not even try to start an upward correction during the current week, and the last attempt ended even faster than it began. As a result, this week the European currency fell by another 260 points and broke through its 5-year lows. Now the pair is racing at full speed to the lows for 20 years, which are just above the 3rd level. And there, the price parity between the euro and the dollar is not far away. We expected that, while maintaining the current fundamental and geopolitical background, this level (1.0000) could be reached by the end of the year. However, as we can see, the bears can take this level much faster, because at this time the euro is extremely weak. We are even starting to think about whether the euro is too weak? Yes, the difference between the monetary approaches of the ECB and the Fed is huge. Last week, ECB Vice-Chairman Luis de Guindos tried to make a "knight's move" and announced a possible rate hike in July, but this information was not confirmed by Christine Lagarde. But still, the European currency has already fallen in price quite a lot, it can't fall all the time while the Fed rates are higher than the ECB rates. The same applies to the geopolitical background. The situation in Ukraine will not improve in the near future and even, most likely, until the end of 2022. This means that a food crisis is looming in Europe since it is already quite clear that Ukraine will not be able to harvest a full harvest this year. The food crisis is not the only problem of the EU. Along with it, the energy crisis is also coming to Europe. Moscow decided that the oil and gas embargo would sooner or later be imposed by the EU countries and took the first step themselves. Gas is no longer sold to Poland and Bulgaria, and several other European countries are in line. Thus, there are huge problems with oil and gas in the European Union and it's not even about high prices anymore. We urgently need to look for other suppliers who will be able to make up for all the volumes of fuel losses from the Russian Federation. And this is not so easy to do. As a result, the euro currency has every reason to fall, but there are a few "buts". COT analysis. The latest COT reports on the euro currency raised more questions than they answered. Major players, starting in January 2022, maintain a bullish mood, and the euro currency, starting in January 2022, maintains a downward trend. During this time, it has already fallen by almost 10 cents, however, all this time the mood has remained "bullish". During the reporting week, the number of buy contracts increased by 2 thousand, and the number of shorts from the "Non-commercial" group - by 11 thousand. Thus, the net position decreased by 9 thousand contracts. This means that the "bullish" mood has weakened, but it remains "bullish" since the number of buy contracts now exceeds the number of sell contracts for non-commercial traders by 22 thousand. Accordingly, the paradox persists and it lies in the fact that professional players generally buy euros more than they sell, but the euro currency continues to fall almost non-stop, which is seen in the illustration above. We have already explained earlier that this effect is achieved by higher demand for the US dollar (there are simply no other options). The demand for the dollar is higher than the demand for the euro, which is why the dollar is growing in pairs with the euro. Therefore, the data of COT reports on the euro currency now do not allow predicting the further movement of the pair. The longer the phase of active hostilities in Ukraine persists, the higher the probability of serious consequences of the food and energy crises for the European Union, and the dollar may continue to grow due to its status as a "reserve" currency and the stability of the American economy. Analysis of fundamental events. There were several macroeconomic reports during the current week, but they were very important. It is a pity that the market did not think so and did not work them out at all. It all started with the publication of the US GDP report for the first quarter, which unexpectedly for everyone amounted to -1.4% q/q with a forecast of +1.1% and the previous value of +6.9%. Thus, on Thursday, the probability of a Fed rate hike to 2.5-3.0% during 2022 sharply decreased. The American economy was on the verge of recession, although, of course, one quarter is not an indicator. On Friday, EU GDP data for the same quarter was released. Everything is much simpler and more stable here. +0.2% with the forecast +0.3% and the previous value +0.3%. The annual growth rate of the economy is weaker than in the States. Inflation in April rose to 7.5% y/y and this is still very good since the increase was only 0.1%. Nevertheless, this is still a very high value, and the growth rates of the EU economy in the last two quarters hardly allow the ECB to start raising rates. Trading plan for the week of May 2-6: 1) In the 24-hour timeframe, the pair continued its downward movement and took the course to the level of 1.0340 - the minimum for the last 20 years. Almost all factors still speak in favor of the growth of the US dollar, but still, we believe that the fall of the euro currency is already too strong. The price is below the Ichimoku cloud, so there is still little chance of growth for the euro currency. At the moment, sales remain the most relevant. 2) As for purchases of the euro/dollar pair, it is not recommended to consider them now. There is not a single technical signal that an upward trend may begin. The "foundation" and "macroeconomics" continue to exert strong pressure on the euro. "Geopolitics" can continue to put pressure on traders and investors who still believe that in any unclear situation, you need to buy the dollar. Europe is on the verge of an energy and food crisis. Only overcoming the Senkou Span B line we would consider as the basis for a new upward trend. Explanations of the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). Indicator 1 on the COT charts - the net position size of each category of traders. Indicator 2 on the COT charts - the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments