Forex analysis review

Forex analysis review |

- How to trade GBP/USD on June 20? Simple tips for beginners.

- How to trade EUR/USD on June 20? Simple tips for beginners.

- EUR/USD. Results of the week. The dollar is back in the big game

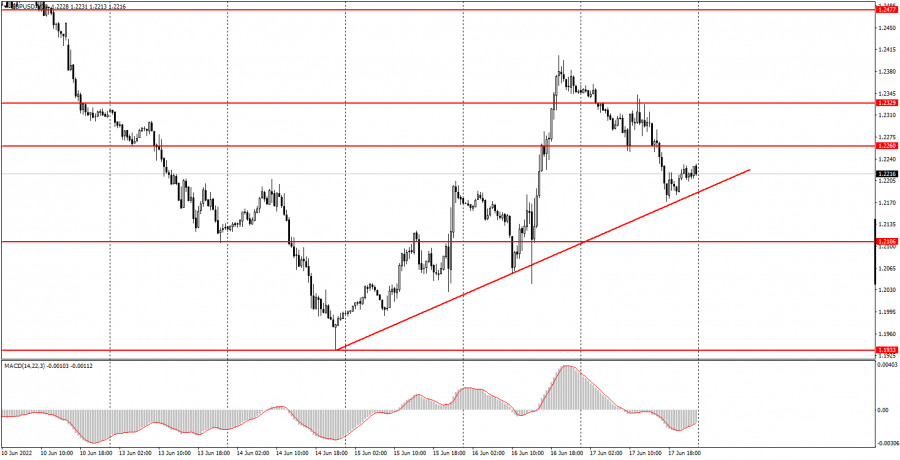

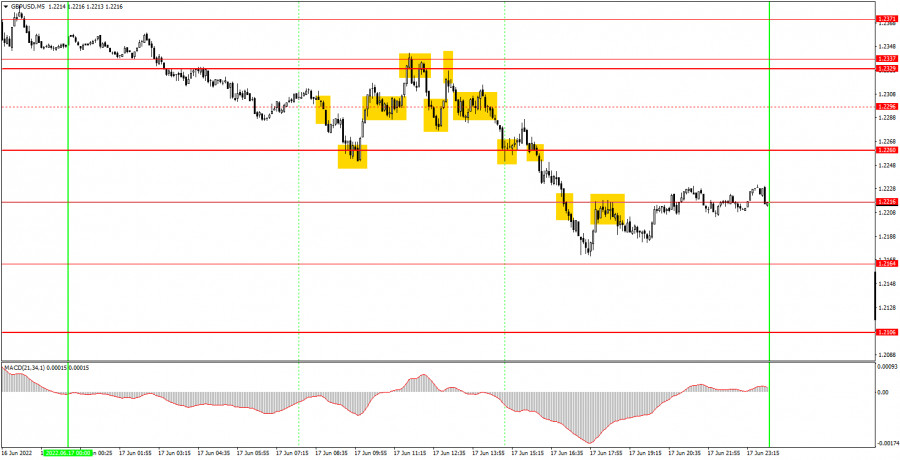

| How to trade GBP/USD on June 20? Simple tips for beginners. Posted: 19 Jun 2022 07:19 AM PDT Analysis of Monday's deals:30M chart of the GBP/USD pair

The GBP/USD pair was also correcting on Friday. The downward movement was quite strong, although there were no important fundamental or macroeconomic events during the day that could provoke such a movement. Nevertheless, the pound fell by 135 points by the end of the day. We have formed an ascending trend line which is not strong. At this time, the price is already near it, so it may try to overcome it on Monday. The pound has the same grounds for growth as the euro. That is purely technical. Still, the pound falls regularly and very strongly. Therefore, upward corrections are required from time to time. This is the only reason to expect the pair to strengthen next week. But consolidating quotes below the trend line is likely to lead to the resumption of the global downward trend. The results of the two meetings of the central banks have already been fully worked out, so volatility may decrease. 5M chart of the GBP/USD pair

The pair again formed a huge number of trading signals on the 5-minute timeframe on Friday. The pair traded between the levels of 1.2260 and 1.2329 throughout the European trading session. And 1.2296 was between these levels, which was recognized as irrelevant by the end of the day. Nevertheless, at least eight signals were formed in this range on Friday. Let's start to figure it out. The first sell signal should have been ignored, since the price at the time of its formation was already near the level of 1.2260. The second - we are working on, the movement ended around 1.2329, profit - 43 points. The fourth - we are working on - closed at Stop Loss at breakeven. The sixth one is being worked out, the movement ended near the level of 1.2260, the profit is 30 points. Some signals duplicated the previous ones, so we do not consider them. The US trading session began with a false rebound from the level of 1.2260. Novice traders lost 35 points on this long position. However, the very next sell signal, when the price settled below 1.2260, was profitable and the last one to be worked out. The price dropped almost to the level of 1.2164, but did not form a single buy signal after that. Therefore, the deal had to be closed manually in the late afternoon. Profit on it amounted to about 50 points. As a result, the day turned out to be quite profitable. How to trade on Monday:We formally have an upward trend and a trend line on the 30-minute timeframe. However, it can be overcome as early as Monday. The pound is still very weak, so we can only count on corrective growth. On the 5-minute TF, it is recommended to trade at the levels 1.2040, 1.2106, 1.2164, 1.2216, 1.2260, 1.2329-1.2337, 1.2371, 1.2471-1.2477. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. No major events planned for the UK and the US, so there will be nothing for the market to react to. However, this does not mean that the pair, which has shown hyper volatility in recent months, will stand in one place all day. We believe that active movements may continue on Monday, and the trend line will serve as a reference. Basic rules of the trading system:1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart:Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

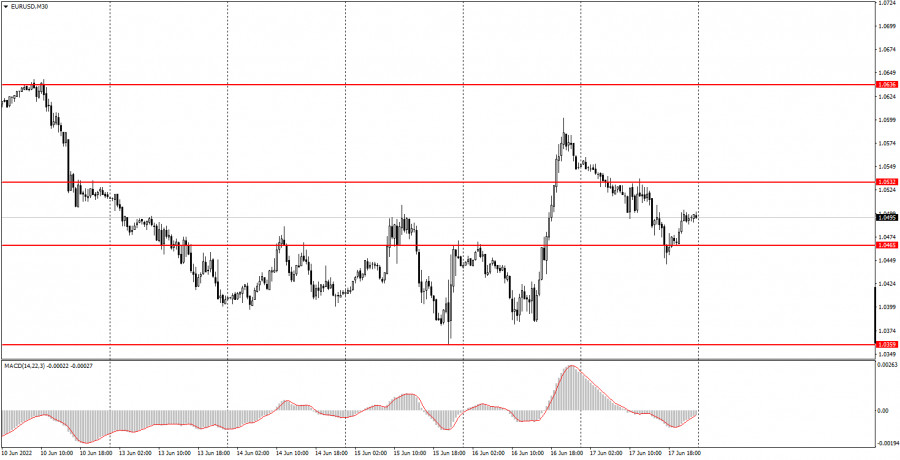

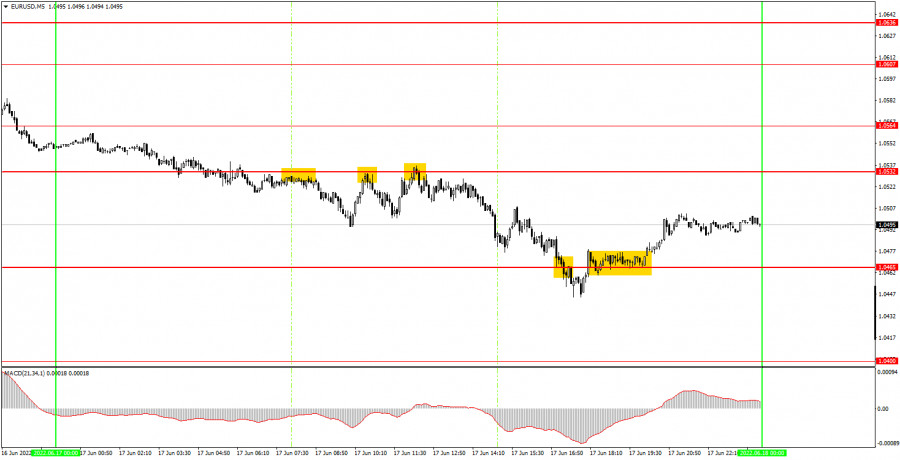

| How to trade EUR/USD on June 20? Simple tips for beginners. Posted: 19 Jun 2022 07:09 AM PDT Analysis of Monday's deals:30M chart of the EUR/USD pair

The EUR/USD currency pair started a downward correction on Friday, which was about the same size as the previous upward movement. As a result, by the end of the day the pair was again near the level of 1.0465. Those macroeconomic reports, which were published on Friday, had no effect on the pair's movement. Inflation in the European Union for the month of May was no different in the second estimate from the first. Industrial production in the US in May turned out to be worse than expected, but this did not affect the strengthening of the US currency throughout the day. Thus, at this time, the pair is again very close to its local lows, from which it is near 20-year lows. There is no trend line or channel at this time. Formally, it would be possible to form an upward trend line, but at the moment the upward movement lasts only a little more than two days. This is clearly not a trend. Moreover, given the fundamental and macroeconomic background, it will be extremely difficult for the euro to continue to grow. This week we expect a high for corrective growth with targets slightly higher than the previous local peak, that is, slightly above 1.0600. 5M chart of the EUR/USD pair

The technical picture doesn't look too bad on the 5-minute timeframe, but it's not perfect either. The first three sell signals were almost identical as the price bounced off the 1.0532 level three times. Each time it went down at least 15 points, so the first two sell trades should have had Stop Loss set to breakeven, on which they were closed. With the third sell signal, everything is more complicated, since the first two turned out to be false. It should not have been worked out, but it was after it that a strong downward movement began. The next sell signal was formed near the level of 1.0465 and turned out to be false again, as the price could not go down even 15 points. And the next buy signal was formed too late, it should not have been worked out. Therefore, in the worst case, novice traders ended the day with a minimal loss. At best, if they worked out the third sell signal near the level of 1.0532, in a small profit. How to trade on Monday:The pair started a powerful upward movement on the 30-minute timeframe, but could already complete it. So far, the formal upward trend remains, but settling below the level of 1.0465, most likely, will mean a resumption of the global downward trend. There will be a very small number of important fundamental and macroeconomic events next week, so volatility should decrease slightly. On the 5-minute TF, it is recommended to trade at the levels of 1.0400, 1.0465, 1.0532, 1.0564, 1.0607, 1.0636. When passing 15 points in the right direction, you should set Stop Loss to breakeven. No important event or report in the European Union and the United States on Monday. Thus, beginners will have nothing to pay attention to during the day. But we can understand the mood of the market. If it takes the pair below the level of 1.0465, then the price may return to 1.0359. Basic rules of the trading system:1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart:Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Results of the week. The dollar is back in the big game Posted: 19 Jun 2022 06:42 AM PDT The next trading week was marked by the strengthening of the US currency. The greenback strengthened its positions in almost all dollar pairs of the "major group". Perhaps the only exception here is the dollar-franc pair, which collapsed by 400 points due to the Swiss National Bank's decision to increase the interest rate for the first time in 15 years. The greenback maintained its advantage in all other dollar pairs – to one extent or another.

If we talk directly about the euro-dollar pair, then the advantage of the US currency was not so pronounced here. The bears were able to return to the area of 5-year lows (1.0360), but at the same time they could not approach the "red line" again, which separates the area of five-year lows from 20-year lows. We are talking about the 1.0339 mark, which was last reached in 2017. The price was below this target only in 2002. If we roll back the time to the beginning of the "zero", then we will see not only parity, but also such marks as 0.83-0.85. To date, they have started talking about parity again – but rather cautiously and with great reservations. Let me remind you that at the beginning of May, bears tried to overcome the key price line in order to go to the base of the third figure and claim the area of 1.0250-1.0320 (with a claim to parity). But after reaching 1.0349, traders recorded a profit – they did not dare to storm the five-year price low. After that, bulls seized the initiative and tried to develop a large-scale correction. Admittedly, they did it: after the April inflation data (which reflected a slowdown in CPI and PCE growth), the dollar weakened throughout the market, allowing greenback opponents to regain lost positions. At the Federal Reserve's May meeting, Committee members even discussed a possible pause in the process of tightening monetary policy after the September rate hike. Representatives of the European Central Bank – on the contrary – finally announced two rounds of rate hikes. In addition, the risk appetite on the market increased significantly after US President Joe Biden admitted the possibility of partial cancellation of anti-Chinese import duties (however, these words remained words, but at that time the US stock market reacted quite violently). Due to the combination of all the aforementioned fundamental factors, the EUR/USD pair rose by 400 points in May, but stalled around the resistance level of 1.0760. After several unsuccessful attempts to approach the 8th figure, bulls gave up: a large-scale corrective pullback was completed. Over the past two weeks, the dollar has been actively returning lost points. By and large, the greenback "returned to the game" only thanks to US inflation. Although the EUR/USD pair began to decline even before the May report was released – on the strengthening of the oil market. But the rise in the price of oil can also be viewed through the prism of inflationary processes, given the fact that energy prices "push" the CPI up. After the release of the May data on the growth of inflation in the United States, it became clear that now the Fed is forced to choose between two scenarios: hawkish and "ultra-hawkish". Conversations about a possible pause have completely lost their relevance. Therefore, the EUR/USD pair was actively declining ahead of the Fed meeting, and after the announcement of the results of the June meeting, it collapsed to the 1.0360 mark. As you know, the US central bank decided to raise the rate by 75 points at once, at the same time stating that there will be a choice between a 50 and 75-point hike in July. Everything will depend on the dynamics of inflation. It would seem that the bears of EUR/USD had "all the cards in their hands" for the development of the downward trend. But the problem is that the bears were already too close to the aforementioned 1.0340 support level. Market participants decided not to take risks – they closed short positions. The dollar has become a victim of the trading principle "buy on rumors, sell on facts". This explains the corrective pullback of the price after the June Fed meeting. All the fundamental factors in favor of the greenback were played out in advance (during the three trading days before the meeting, the EUR/USD pair decreased by 350 points), while the fact of a 75-point rate hike did not help the bears approach (and even more so overcome) the support level of 1.0340.

However, the corrective surge of Thursday-Friday was of a short-term nature. At the end of the trading week, the pair returned to the area of the fourth figure, once again reminding traders of the riskiness of longs in the circumstances. Abstracting from the first emotional trading decisions, we can come to an unambiguous conclusion: the dollar received significant support from the Fed last week. After all, it is obvious that the Fed will fight high inflation even at the cost of a possible recession. While the ECB will act much more cautiously, prudently, and, apparently, much more slowly. The Fed and the ECB are moving away from each other again in the context of the pace of monetary policy tightening – and this factor will play a dominant role in determining the downward trend of EUR/USD. On Friday, Fed Chairman Jerome Powell spoke at an economic forum dedicated to the dollar's role in the global economy. He again repeated the theses that were announced at the end of the June meeting. In particular, he said that the members of the central bank (including him) clearly aim to return inflation to the target two percent indicator. And although Powell voiced quite general and vague phrases, this was enough for the EUR/USD bears to pull the price to the base of the fourth figure. This suggests that traders did not fully win back the hawkish results of the June meeting. In this context, it should be noted that next week Powell will speak in the Senate with a semi-annual report. And if there he allows the option of a 75-point rate hike at the July and possibly September meetings (which is very likely), EUR/USD bears will receive an important information trump card to test the key support level of 1.0340. In general, it is advisable to use any upward pullbacks on the pair to open short positions: thanks to US inflation and the Fed, the dollar has "returned to the big game" – including paired with the euro. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments