Forex analysis review

Forex analysis review |

- Technical analysis recommendations on EUR/USD and GBP/USD for June 1, 2022

- Technical analysis of GBP/USD for June 2022

- Technical analysis of EUR/USD for June 2022

- Technical review for WTI: oil prices will bounce up

- Technical review for EUR/USD: euro may see a local downward correction

- Trading plan for Gold on June 01, 2022

- Technical review for GBP/USD: a local downward correction may occur

- Technical review for XAU/USD: gold will see a local decline

- Venture capital investments may help Bitcoin survive bearish trend

- Analysis and trading tips for GBP/USD on June 1

- Analysis and trading tips for EUR/USD on June 1

- EUR/USD: analysis and forecast for June 1, 2022

- Tips for beginner traders in EUR/USD and GBP/USD on June 1, 2022

- Oil holds steady in positive territory for six straight months and extends its rally into summer

- Stock market rally slows as Fed prepares to cut balance sheet

- Indicator analysis: Daily review of GBP/USD on June 1, 2022

- Technical Analysis of ETH/USD for June 1, 2022

- Technical Analysis of BTC/USD for June 1, 2022

- Technical Analysis of GBP/USD for June 1, 2022

- Technical Analysis of EUR/USD for June 1, 2022

- Daily Video Analysis: USDCAD, H4 Bullish Bounce Opportunity

- Forex forecast 06/01/2022 EUR/USD, USD/CAD, AUD/USD, Gold and Bitcoin from Sebastian Seliga

- Long-term investors continue to accumulate Bitcoin despite a deep correction

- Oil prices rise as EU leaders agree on partial Russian crude ban

- Last-minute chance to earn on gold rally

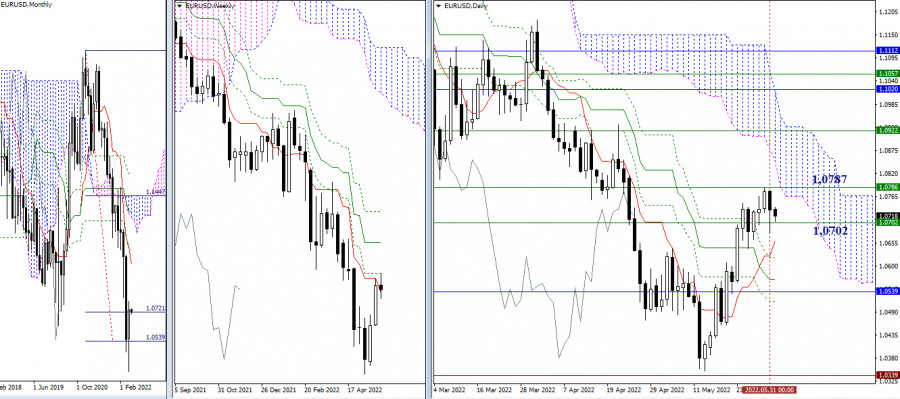

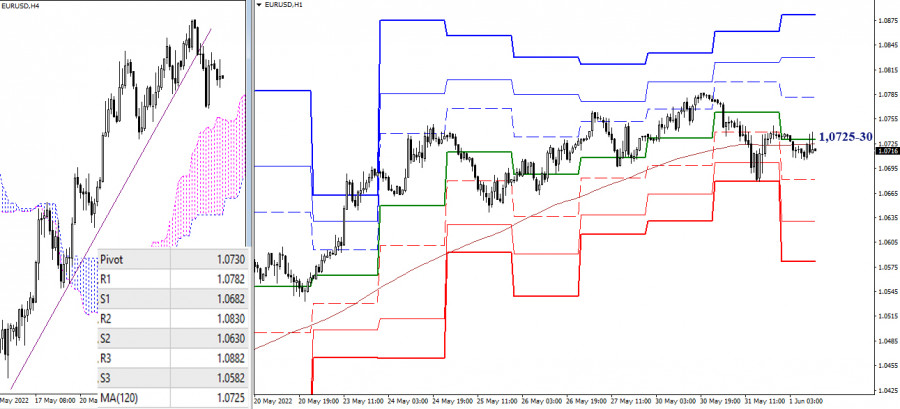

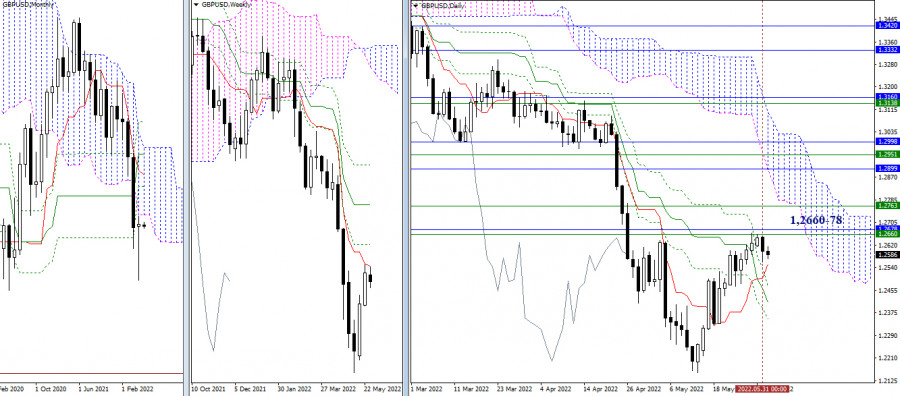

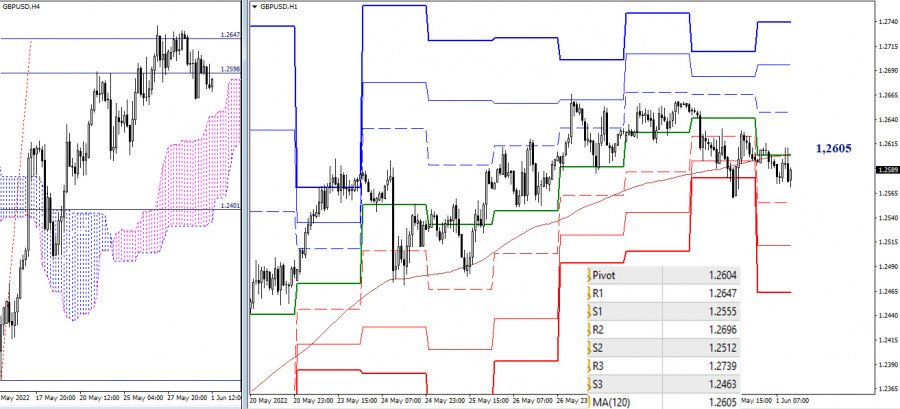

| Technical analysis recommendations on EUR/USD and GBP/USD for June 1, 2022 Posted: 01 Jun 2022 04:14 AM PDT EUR/USD

Higher timeframes Bulls managed to remain optimistic at the close of May. As a result, the month went down in history in the form of a rebound from the fulfilled monthly target for the breakdown of the Ichimoku cloud. During the execution of the rebound, resistance of weekly levels were met—1.0702 (short-term trend) and 1.0787 (Fibo Kijun)–now the situation is developing in their zone of attraction and influence. The breakdown will open up new targets for bulls. The next resistance is the daily cloud, reinforced by the weekly medium-term trend (1.0922).

H4 - H1 At the moment, there is a struggle for the key levels on the lower timeframes, which today are connected in the area of 1.0725–30 (central pivot point of the day + weekly long-term trend). Working above the levels will favor bulls, while working below will strengthen bearish sentiment. Reference points for movement within the day are the classic pivot points. Their resistance today can be noted at 1.0782 – 1.0830 – 1.0882, and support is now at 1.0682 – 1.0630 – 1.0582. *** GBP/USD

Higher timeframes As a result, May became the owner of a long lower shadow. Therefore, bears are unlikely to be able to easily return to the continuation of the downward trend now. However, the fact that the strong resistance encountered remained unconquered in May weakens the bullish outlook. The pair continues to remain in thought under the weekly short-term trend (1.2660) and the lower boundary of the monthly cloud (1.2678). Reliable consolidation above can contribute to new bullish activity in the future. The levels of the daily Ichimoku golden cross (1.2551 – 1.2471 – 1.2410 – 1.2350) are now acting as possible supports.

H4 - H1 The meeting of strong resistance levels of the higher timeframes and working out the target for the breakdown of the H4 cloud provoke the development of a corrective decline. The pair went down to the key levels of lower timeframes (central pivot point + weekly long-term trend), which combined their efforts today at the line of 1.2605, and slowed down. The loss of levels will strengthen bearish sentiment and develop a full-fledged decline, on the scale of higher timeframes. Among the additional reference points for intraday work today we can note the support (1.2555 – 1.2512 – 1.2463) and the resistance of the classic pivot points (1.2647 – 1.2696 – 1.2739). *** In the technical analysis of the situation, the following are used: higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend) The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for June 2022 Posted: 01 Jun 2022 03:56 AM PDT Trend analysis GBP/USD will move up this June, from 1.2598 (the closing of the May monthly candle) to 1.2951, which is the 38.2% retracement level (red dotted line). Upon reaching it, the pair will move to the 50.0% retracement level at 1.3196 (red dotted line), then go downwards.

Fig. 1 (monthly chart) comprehensive analysis: Indicator analysis - uptrend Fibonacci levels - uptrend Volumes - uptrend Candlestick analysis - downtrend Trend analysis - uptrend Bollinger bands - uptrend All this points to an upward movement in GBP/USD. Conclusion: The pair will have an upward trend with no first lower shadow on the monthly white candle (the first week of the month is white) and no second upper shadow (the last week is white). And throughout the month, the pair will climb from 1.2598 (the closing of the May monthly candle) to the 38.2% retracement level at 1.2951 (red dotted line), go further up to the 50.0% retracement level at 1.3196 (red dotted line) , then move downwards. Alternatively, the pair could decrease from 1.2598 (the closing of the May monthly candle) to the lower fractal at 1.2154 (red dotted line), then bounce up to the 14.6% retracement level at 1.2456 (red dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

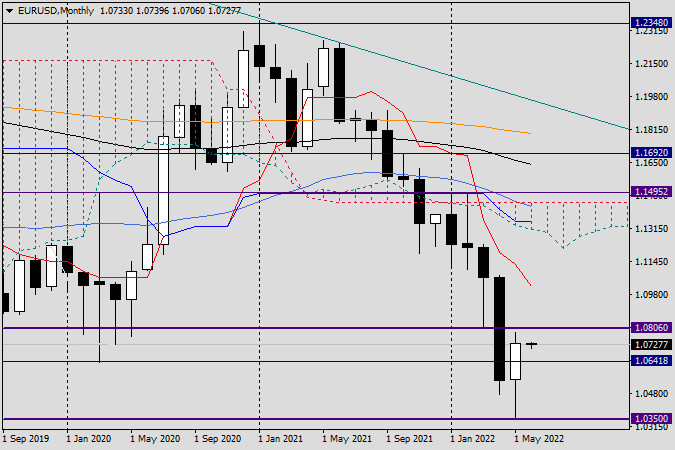

| Technical analysis of EUR/USD for June 2022 Posted: 01 Jun 2022 03:50 AM PDT trend analysis EUR/USD will increase this June, from 1.0732 (closing of the May monthly candle) to 1.0821, the 23.6% retracement level (red dotted line). Upon reaching it, the pair will go to the 38.2% retracement level at 1.1111 (red dotted line), then turn down again.

Fig. 1 (monthly chart) comprehensive analysis: Indicator analysis - uptrend Fibonacci levels - uptrend Volumes - uptrend Candlestick analysis - uptrend Trend analysis - uptrend Bollinger bands - uptrend All this points to an upward movement in EUR/USD. Conclusion: The pair will have an upward trend, with no first lower shadow on the monthly white candle (the first week of the month is white) and no second upper shadow (the last week is white). And throughout the month, the pair will climb from 1.0732 (the closing of the May monthly candle) to the 23.6% retracement level at 1.0821 (red dotted line), move to the 38.2% retracement level at 1.1111 (red dotted line), then turn down again. Alternatively, the pair could decline from 1.0732 (the closing of the May monthly candle) to the historical support level at 1.0514 (blue dotted line), then bounce back to the 23.6% retracement level at 1.0820 (red dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical review for WTI: oil prices will bounce up Posted: 01 Jun 2022 03:43 AM PDT Oil prices managed to stay above 115.00 and are showing upward dynamics even despite the continued high demand, military conflict in Ukraine and sanctions given by the West. Technical picture: The quote is above the middle line of the Bollinger indicator, above the SMA 5 and SMA 14. The relative strength index (RSI) has rebounded from the 50% level and is growing, while the stochastic indicator is turning up in the oversold zone. Possible dynamics: A consolidation above 115.45 will provoke a further growth to 119.00.

|

| Technical review for EUR/USD: euro may see a local downward correction Posted: 01 Jun 2022 03:34 AM PDT EUR/USD is showing a local downward reversal on the wave of new sell-offs in the stock markets, galloping inflation in the Euro area and the unclear position of the ECB regarding interest rates. Technical picture: The quote is under the Bollinger indicator, below the SMA 5 and SMA 14. The relative strength index (RSI) is below 50% and is declining, while the stochastic indicator is above 50% but is moving down. Possible dynamics: A decline and consolidation below 1.0705 is likely to lead to a fall to 1.0650. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for Gold on June 01, 2022 Posted: 01 Jun 2022 03:30 AM PDT

Technical outlook:Gold prices slipped through $1,828 during the Asian session on Wednesday before finding some bids. The yellow metal has moved in line with our earlier projections, hence possibilities still remain for another drop through $1,820 before the price resumes its rally. Bulls will be poised to hold prices above the $1,786 mark to keep the structure intact. Gold prices are developing a counter-trend rally since printing lows at $1,786 on May 16, 2022. The metal is expected to push through $1,920 before resuming its larger degree bearish trend. The yellow metal is further unfolding the second wave towards $1,820 within its corrective phase mentioned earlier. Furthermore, the Fibonacci 0.618 retracement of the recent upswing between $1,786 and $1,870 is seen to be passing through the $1,820 mark. Hence, the probability remains high for a bullish bounce if prices are able to reach there. Traders might be preparing to take profits on short positions and to buy from the $1,820-30 zone. Trading plan:Potential rally through $1,920 against $1,781 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical review for GBP/USD: a local downward correction may occur Posted: 01 Jun 2022 03:27 AM PDT GBP/USD is showing a local downward reversal on the wave of new sell-offs in the stock markets, renewed fears of the global economy falling into a deep recession and expectations of the US employment data, which, if turn out to be no worse than the forecast, may provoke a local increase in dollar demand. technical picture: The quote is under the middle line of the Bollinger indicator, below the SMA 5 and SMA 14. The relative strength index (RSI) is below 50% and is moving down, while the stochastic indicator is at 50% but is declining . Possible dynamics: A decline and consolidation below 1.2560 may lead to a further fall to 1.2475.

|

| Technical review for XAU/USD: gold will see a local decline Posted: 01 Jun 2022 03:22 AM PDT Gold broke out of the ambiguous triangle pattern because demand for dollar rose again yesterday. Most likely, further negative sentiment will lower prices even more. Technical picture: The quote is under the bottom line of the Bollinger indicator, below SMA 5 and SMA 14. The relative strength index (RSI) lies at the border of the oversold zone, while the stochastic indicator is already inside it. Possible dynamics: A decline and consolidation below 1831.00 will provoke further fall first to 1817.65 and then to 1808.00.

|

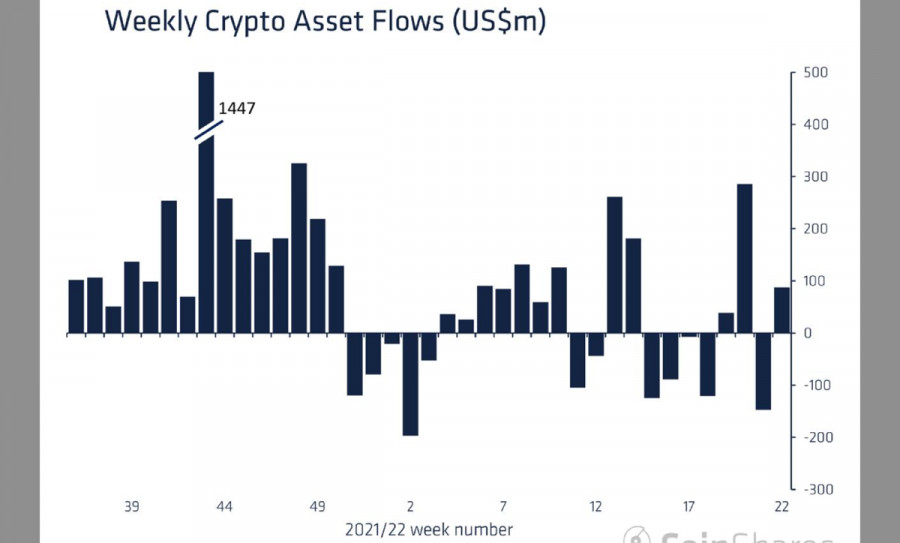

| Venture capital investments may help Bitcoin survive bearish trend Posted: 01 Jun 2022 03:20 AM PDT Bitcoin and the cryptocurrency market have been in a bear market for over six months now. During this time, digital assets have fallen to local lows, losing about 60% of their absolute highs on average. The total market capitalization fell to $1.2 trillion and settled on a solid support zone. Other sectors of the crypto market, such as DeFi and NFT, also lost more than 50% of their volumes at the peak of the bull market. However, the market continues to receive support from long-term hodlers and venture investors.

JPMorgan is completely confident that the cryptocurrency market will emerge victorious from the crypto winter thanks to the significant support of large venture capital investors. Bank analysts said that the number of venture deals in the crypto space remains at a high level, despite a strong correction and a significant decrease in liquidity in the market. The digital asset market peaked in December 2021, and since then, the decline in transactions looks insignificant. The main beneficiaries of venture investments are altcoins, which receive infusions through decentralized products. JPMorgan experts believe that this will allow the crypto market to better respond to rising volatility and survive periods of selling pressure. The impact of venture capital investments on the cryptocurrency market should not be overestimated. As we have already said, the main injections go to decentralized projects based on altcoins. However, at the current stage, it is Bitcoin that is the main force in the crypto market, which determines the further movement of the entire industry. This is evidenced by a significant increase in the level of BTC dominance in the market in recent weeks. With this in mind, venture capital flows help to preserve part of the capitalization, but direct investments in digital coins are still decisive.

JPMorgan experts argue that the surge in venture capital activity was made possible thanks to large volumes of dollar liquidity in the markets, as well as a bull market for cryptocurrencies. In the current situation, there is no doubt that venture capital flows will be reduced, as liquidity is rapidly falling due to the global economic and geopolitical crises. In June, the Fed's program to withdraw more than $45 billion a month starts, and soon this figure will reach $90 billion. Under such conditions, investment activity will be aimed at preserving capital in risk-free assets, such as the US dollar. The crypto market will be able to maintain investment attractiveness, but the records of the bull market period of the industry will not be reached.

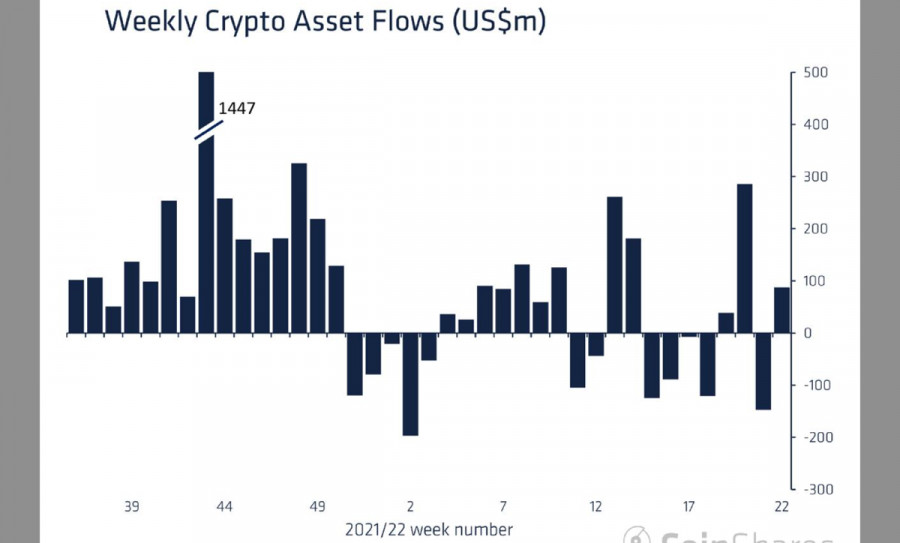

With this in mind, venture investments do not have a sufficient impact on the quotes of the cryptocurrency market and are unable to smooth out the downward trend of digital assets. Last week, an inflow of $87 million into crypto funds was recorded, and the May inflow amounted to about $500 million. This was reflected in the quotes of Bitcoin, which reached a local high at $31.5k, where the upper limit of the $29k–$31.5k range passes. However, at the same time, we see that the price has hit the support zone, and the formation of uncertain candles indicates a decrease in buying activity.

At the same time, if you look at the situation more broadly, you can see a similar situation in the summer of 2021 on the weekly timeframe. Then the price also formed a local bottom in a similar way, after which there was a serious reversal and a bullish trend began. The pattern is similar to what we are seeing now, but the situation is radically different.

Fed policy, liquidity tightening, war, rising inflation and gradually emerging stagflation suggest that an upward movement following the example of 2021 should not be expected. However, if the asset manages to start a bullish engine and gain a foothold above $35k, then the probability of a medium-term trend will increase. In general, there is no doubt that the market is in the stage of an upward correction within the bearish trend.

|

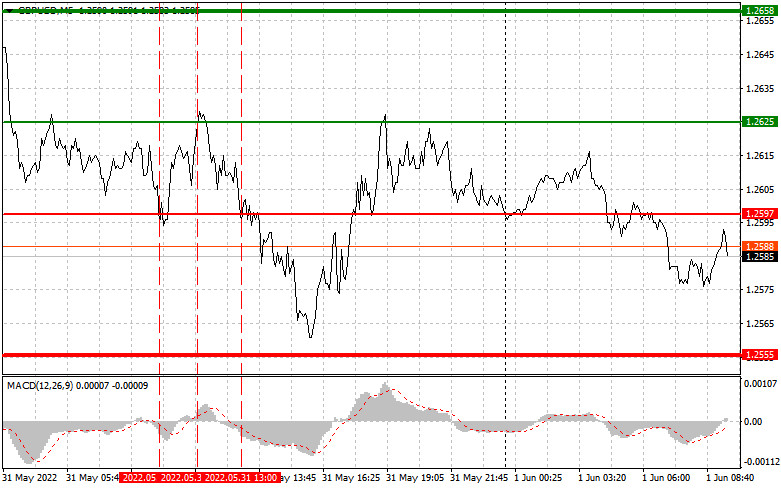

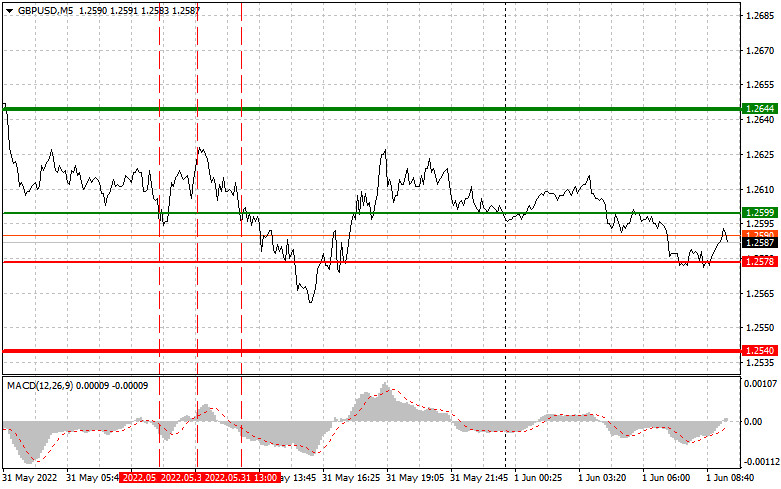

| Analysis and trading tips for GBP/USD on June 1 Posted: 01 Jun 2022 03:16 AM PDT Analysis of transactions in the GBP / USD pair GBP/USD reaching 1.2597 prompted a sell signal in the market, however, having the MACD line far from zero limited the downside potential of the pair. It continued trading to 1.2597, where a buy signal was formed, but since the indicator was still far from zero, the further upside potential became limited. The pair then went back to 1.2597, where another sell signal was formed, but failed again to give the expected profit. No other signal appeared for the rest of the day.

Today, a report on business activity in the UK manufacturing sector will be released, and that will most likely increase pressure on GBP/USD. The US will also publish employment data in the manufacturing and non-farm sector, which could further increase demand for the dollar provided that the values were better than the forecasts. The speech of Fed member James Bullard may also attract the attention of traders, but it is unlikely to provoke large changes in the market. For long positions: Buy pound when the quote reaches 1.2599 (green line on the chart) and take profit at the price of 1.2644 (thicker green line on the chart). There is a chance for a rally today, but only amid strong PMI data on the UK. Nevertheless, note that when buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.2578, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2599 and 1.2644. For short positions: Sell pound when the quote reaches 1.2578 (red line on the chart) and take profit at the price of 1.2540. Pressure will return if statistics in the UK come out weaker than expected. However, note that when selling, make sure that the MACD line is below zero, or is starting to move down from it. Pound can also be sold at 1.2599, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.2578 and 1.2540.

What's on the chart: The thin green line is the key level at which you can place long positions in the GBP/USD pair. The thick green line is the target price, since the quote is unlikely to move above this level. The thin red line is the level at which you can place short positions in the GBP/USD pair. The thick red line is the target price, since the quote is unlikely to move below this level. MACD line - when entering the market, it is important to be guided by the overbought and oversold zones. Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader. The material has been provided by InstaForex Company - www.instaforex.com |

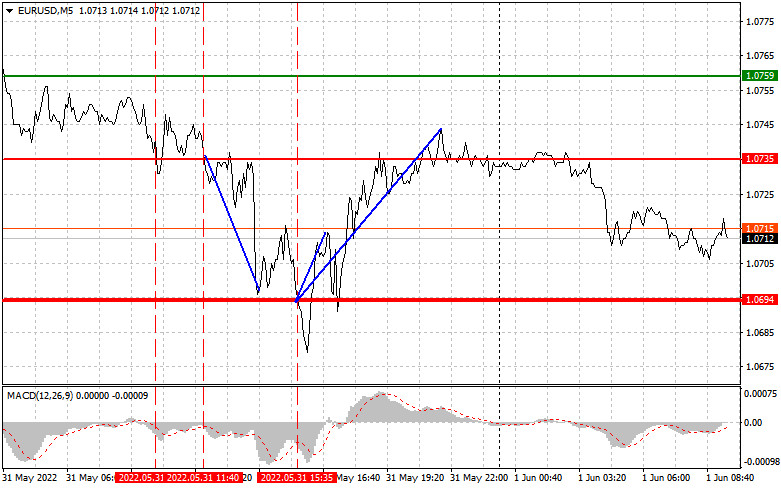

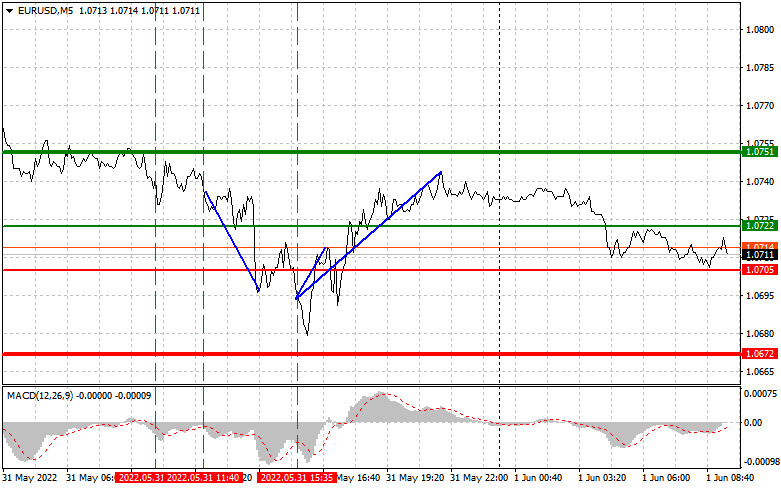

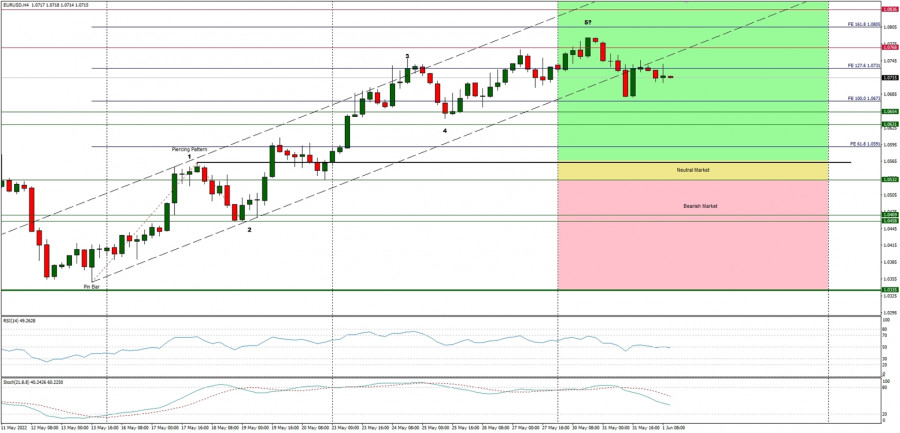

| Analysis and trading tips for EUR/USD on June 1 Posted: 01 Jun 2022 03:02 AM PDT Analysis of transactions in the EUR / USD pair EUR/USD reaching 1.0735 led to a sell signal in the market, however, having the MACD line far away from zero limited the downside potential of the pair. Its second test was more successful as the indicator finally moved below zero, prompting a 40-pip price decrease. The pair then went to 1.0694, where a buy signal was formed, which led to a 15-pip rise. No other signal appeared for the rest of the day.

GDP and CPI data from France, as well as the unemployment report from Germany, did not affect the market as the focus of traders was on the inflation report for the euro area. Consumer prices were shown to have jumped 8.1% in May, higher than the forecasted increase of only 7.7%. The surge was caused by rising food and energy prices. As for core inflation, it rose by 3.8%, also above the ECB's target of about 2.0%. Today, a report on manufacturing activity in the eurozone will be published, and that will most likely increase pressure on EUR/USD. The unemployment rate is unlikely to be of great interest, while the speech of ECB members Christine Lagarde, Fabio Panetta and Philippe Lane will drive the market. In the afternoon, the US will release reports on employment in the manufacturing sector, as well as changes in the number of people employed in the non-farm sector. An increase will raise demand for dollar, leading to a decline in the pair. The speech of Fed member James Bullard may also attract the attention of traders, but it is unlikely that it will provoke large changes. For long positions: Buy euro when the quote reaches 1.0722 (green line on the chart) and take profit at the price of 1.0751 (thicker green line on the chart). There is a chance for a rally today, but only amid strong data on the eurozone and hawkish statements by ECB President Christine Lagarde. Nevertheless, make sure that when buying, the MACD line is above zero or is starting to rise from it. It is also possible to buy at 1.0705, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0722 and 1.0751. For short positions: Sell euro when the quote reaches 1.0705 (red line on the chart) and take profit at the price of 1.0672. Pressure will return if statistics in the EU come out weaker than expected. However, note that when selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.0722, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.0705 and 1.0672.

What's on the chart: The thin green line is the key level at which you can place long positions in the EUR/USD pair. The thick green line is the target price, since the quote is unlikely to move above this level. The thin red line is the level at which you can place short positions in the EUR/USD pair. The thick red line is the target price, since the quote is unlikely to move below this level. MACD line - when entering the market, it is important to be guided by the overbought and oversold zones. Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader. The material has been provided by InstaForex Company - www.instaforex.com |

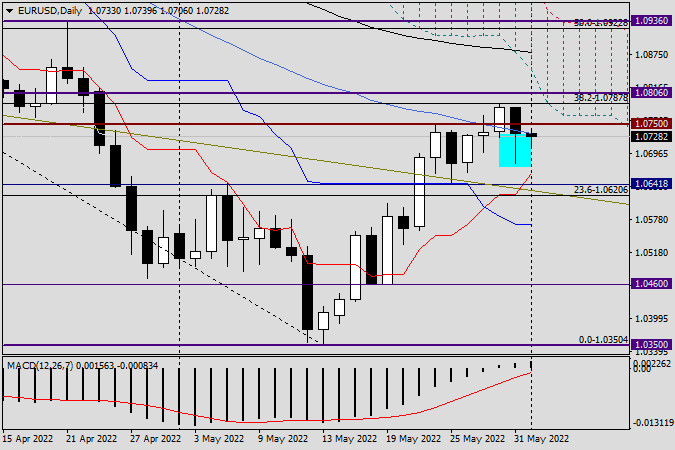

| EUR/USD: analysis and forecast for June 1, 2022 Posted: 01 Jun 2022 02:51 AM PDT Hello, deal colleagues! Yesterday was the last trading day of the spring. The summer is coming, but how hot it can be in the foreign exchange market will become clear in the very near future. Before analyzing the trading results of May, let's find out what information may somewhat affect the market. The European Union has recently announced the sixth package of anti-Russian sanctions that includes an embargo on two-thirds of Russian oil imports. For countries like Hungary that rely on Russian hydrocarbons, this is going to be a serious challenge. As for the macroeconomic calendar, consumer prices in the eurozone rose more than expected, which could push the ECB to adopt aggressive rhetoric and increase the pace of tightening. President Lagarde who delivers a speech today may cast some light on the regulator's future plans. In addition, FOMC members Bullard and Williams will give interviews. Anyway, we will hardly learn anything new from their statements. Let's now turn to the technical picture of EUR/USD. Monthly

The pair was bullish on the last trading day of the month. According to the chart, the price went up from the technical level of 1.0350 and closed the month at 1.0732. In general, the body of the latest candlestick with a very long lower shadow indicates an impending reversal. Meanwhile, the candlestick itself is very similar to the bull hammer pattern. It looks similar because ideally, such a candlestick has no upper shadow. Although the May candlestick has one, it is very small. Nevertheless, based on the monthly chart, EUR/USD is highly likely to continue rising. Daily

Yesterday, the market was volatile as expected. The pair descended to 1.0679 but encountered strong support there. It helped partially recoup losses, as indicated by the long lower shadow of the latest candlestick. In spite of that, the price closed below the blue MA 50 and the strong technical level of 1.0750, which used to be resistance. The important level of 1.0800 is now seen as new resistance. To be more precise, it lies at 1.0787, in line with the highs of May 30. As for the outlook, the previous one turned out to be accurate. As a reminder, it was unwise to go log below resistance, and due to the high likelihood of a pullback, buying could have been considered around 1.0700. Given that the technical picture remains the same, long positions could be opened on small pullbacks to 1.0710, 1.0680, and perhaps 1.0660, which is in line with the red Tenkan line of the Ichimoku indicator. Today, the pair has already pulled back to 1.0706 and is now trying to reverse up. In this light, risky buying could be considered at current prices. Selling should be postponed until strong candlestick signals are made in this or lower time frames. Have a nice trading day! The material has been provided by InstaForex Company - www.instaforex.com |

| Tips for beginner traders in EUR/USD and GBP/USD on June 1, 2022 Posted: 01 Jun 2022 02:50 AM PDT Details of the economic calendar from May 31 Inflation in the eurozone continues to update the record. The consumer price index continued to rise from 7.4% to 8.1% YoY. Inflation exceeds the ECB's target by more than four times. This gives us a clear signal that the regulator will raise the interest rate in the near future. Negative inflation data put pressure on the European currency, which led to its weakening. It is worth considering that hints of an early increase in interest rates may lead to a backlash. Analysis of trading charts from May 31 The EURUSD currency pair has slowed down the corrective move within the lower border of the resistance area of 1.0800/1.0850. This led to a reduction in the volume of long positions and, as a result, to a price rebound. On the trading chart of the daily period, there is a corrective move from the pivot point of 1.0350, which fits into the clock component of the downward trend. The GBPUSD currency pair changed from stagnation within 70 points to a downward move. This movement led to an increase in the volume of short positions, where the corrective move was in danger of being completed. On the trading chart of the daily period, there is a corrective move from the pivot point of 1.2155, which fits into the clock component of the downward trend.

Economic calendar for June 1 The final data on the indices of business activity in the manufacturing sector in Europe, Britain, and the United States will be published today. According to forecasts, the indicators are expected to coincide with the preliminary assessment. Thus, there may not be a proper reaction to statistical data. The most interesting indicator may be the data on the unemployment rate in Europe, where it is predicted to decrease from 6.8% to 6.7%. This is a positive factor for the EU economy, which may well support the euro exchange rate. Time targeting The index of business activity in the manufacturing sector in the EU - 08:00 UTC The index of business activity in the manufacturing sector in Britain - 08:30 UTC Unemployment rate in the EU - 11:00 UTC The index of business activity in the manufacturing sector in the US - 14:00 UTC Trading plan for EUR/USD on June 1 The process of restoring dollar positions is at an early stage. Traders are afraid of the resumption of the corrective course in case the price returns to the resistance area. The subsequent growth in the volume of short positions is expected during the period of price retention below the value of 1.0680. This move may lead to a stronger signal to sell the euro.

Trading plan for GBP/USD on June 1 Stable price retention below the value of 1.2560 will increase the chances of sellers in the subsequent recovery of dollar positions. In the future, this movement may restart the downward trend. An alternative scenario of the market development will be considered by traders if the quote returns to the borders of the previously passed stagnation 1.2600/1.2670. In this case, a new signal about the prolongation of the corrective move may appear.

What is reflected in the trading charts? A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices. Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market. Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future. The up/down arrows are the reference points of the possible price direction in the future. The material has been provided by InstaForex Company - www.instaforex.com |

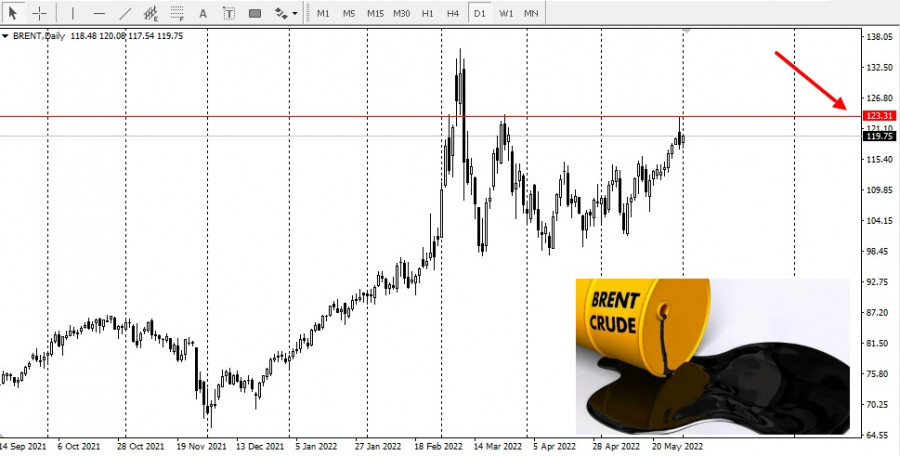

| Oil holds steady in positive territory for six straight months and extends its rally into summer Posted: 01 Jun 2022 02:45 AM PDT On Wednesday, global oil prices are steadily increasing after a short decline a day earlier. The fall in oil prices on Tuesday was caused by speculations that some producers want to suspend Russia's participation in the OPEC+ production deal, as well as by new sanctions against Russia.

At the moment of writing, August Brent oil futures have gained 0.36% and are now hovering near $116.02 per barrel. A day earlier, Brent lost 1.7% and declined to $115.60 per barrel. WTI oil futures for July rose by 0.44% to $115.17 per barrel on Wednesday. Yesterday, the futures contracts fell by 0.35% to $114.67 per barrel.

So, on Tuesday, oil depreciated by about 2% after a report that some OPEC members are exploring the idea of suspending Russia's participation in the deal over the conflict in Ukraine. The key factors in this case are the Western sanctions imposed on Russia and the partial embargo on Russian crude imports. This step will notably limit Russia's ability to ramp up oil production. The next OPEC+ meeting will take place on June 2, 2022. In 2021, Russia, one of the world's top three crude producers, made a deal with OPEC and 9 other non-OPEC members to gradually increase output every month. Yet, amid anti-Russian sanctions, analysts predict an 8% drop in oil production. Oil quotes were steadily rising until the news about Russia's possible suspension appeared in the media. In the early trade on Tuesday, Brent futures for July jumped above $124 per barrel for the first time since March 9. Experts suggest that if the cancellation of Russia's membership is confirmed, the price of oil may drop to $100. Today, markets are focused on supply prospects amid a ban on Russian oil imports to the EU. On May 31, the EU members agreed on the sixth package of sanctions which includes a partial embargo on oil and petroleum products imported by sea. The sanctions ban local companies from providing insurance to Russian oil tankers. This means that from now on, Russia is isolated from the largest export market. Restrictions will deal a heavy blow to oil deliveries to Asia which may disrupt Russia's plan to refocus on exports to China and India. This ban can seriously hit the economy of Russia as the majority of European companies will refuse to transport oil without insurance. The effectiveness of this restriction was previously tested on Iran and proved to be successful. Many European countries involved in shipping have already expressed concern about the ban on insurance for Russian oil tankers. So, the EU decided to implement it gradually within the next six months. The official statement about the new restrictive measures against Moscow is expected in the coming days. The material has been provided by InstaForex Company - www.instaforex.com |

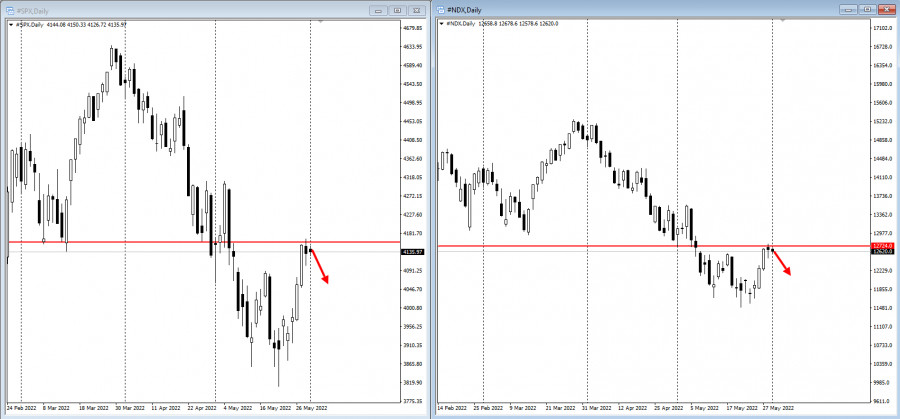

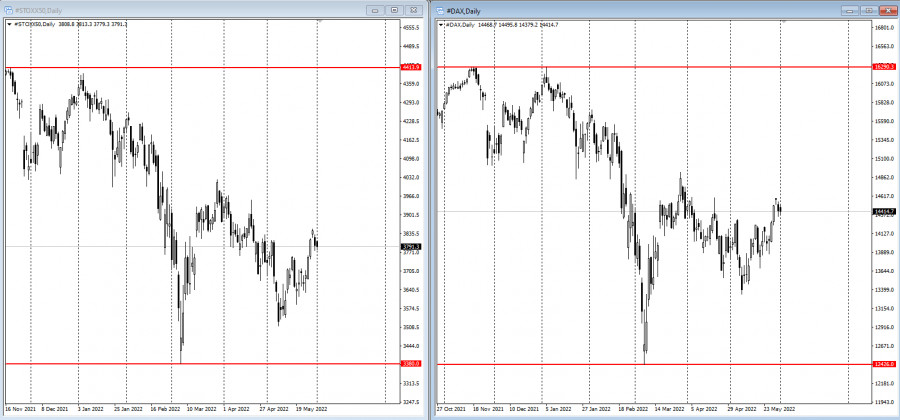

| Stock market rally slows as Fed prepares to cut balance sheet Posted: 01 Jun 2022 02:33 AM PDT

The stock market in Europe and stock futures in the US were looking for direction amid debates over the scale of the Fed's monetary tightening needed to fight inflation. The S&P 500 and Nasdaq 100 futures contracts closed the session near the opening levels as they failed to find the direction at the resistance zone:

Europe's STOXX50 closed with a slight decline as investors evaluated lower estimates against a record surge in eurozone consumer prices reported on Tuesday. European government bonds depreciated, while Treasuries extended a decline, pushing 10-year yields closer to 2.9% as traders expect the Federal Reserve to raise the rates.

Investors are concerned that a rate hike by the US central bank may trigger a recession. These fears make traders doubt the outlook for the US economy as rising food and energy costs put more pressure on consumers, while volatility is picking up. At the latest meeting with Fed Chair Jerome Powell, US President Joe Biden said that he respected the independence of the central bank. At the same time, it seems that he was shifting the responsibility for high inflation running for decades ahead of the November midterm election. Key events to watch this week:

|

| Indicator analysis: Daily review of GBP/USD on June 1, 2022 Posted: 01 Jun 2022 02:26 AM PDT Trend analysis (Fig. 1). The pound-dollar pair may move up from the level of 1.2598 (close of yesterday's daily candle) to the upper fractal at 1.2666 (yellow dotted line). In case of testing this level, the price may continue to move upward with the target of 1.2766, the 61.8% retracement level (red dotted line).

Fig. 1 (daily chart). Comprehensive analysis:

Today the price may move up from the level of 1.2598 (close of yesterday's daily candle) to the upper fractal at 1.2666 (yellow dotted line). In case of testing this level, the price may continue to move upward with the target of 1.2766, the 61.8% retracement level (red dotted line). Alternative scenario: from the level of 1.2598 (close of yesterday's daily candle), the price may move downward to 1.2494, the 23.6% retracement level (yellow dotted line). In case of testing this level, the price may move upward with the target of 1.2725, the 50.0% retracement level (red dotted line).The material has been provided by InstaForex Company - www.instaforex.com |

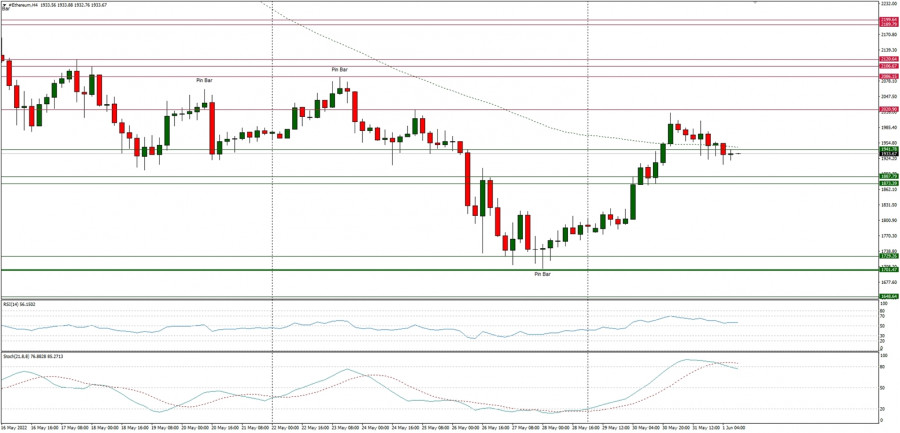

| Technical Analysis of ETH/USD for June 1, 2022 Posted: 01 Jun 2022 02:24 AM PDT Crypto Industry News: Singapore's financial authorities (MAS) have launched Project Guardian, a blockchain-based digital asset test that will use tokenization. The project will include regulated financial institutions serving as "confidence anchors", with pilot participation by JP Morgan, DBS Bank and Marketnode, SGX's bond joint venture. Project Guardian, announced today at the Asia Tech x Singapore Summit, was led by Vice Prime Minister Heng Swee Keat. With this, MAS will explore DeFi applications in wholesale financial markets, establishing a liquidity pool of tokenized bonds and deposits to borrow on a public blockchain-based network. According to MAS director Sopnendu Mohanty, director of fintech, the lessons learned from Project Guardian will serve as a basis for informing political markets about the regulatory barriers required to use DeFi while mitigating its threats. Both DBS and JPMorgan have experience developing digital assets and blockchain technology in their wholesale banking operations. Last year, DBS launched a digital bond worth $ 11 million as part of the STO offering. Since its inception in 2020, JPMorgan's Onyx Digital Assets Network has completed over $ 300 billion in transactions. DBS Bank has been operating in the cryptocurrency industry for several years, establishing its own institutional-grade crypto exchange in December 2020. The company is gradually expanding the range of digital asset services it supports on the stock exchange, and the cryptocurrency solution will debut in May 2021. Technical Market Outlook: The ETH/USD pair continues the bounce towards the technical resistance located at $2,106 after the possible Double Bottom price pattern (still not fully confirmed pattern). The nearest technical resistance seen at $2,019 had been tested, but the market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is still intact. In order to terminate the down trend, the bulls must break through the key short-term technical resistance located at the level of $2,199. Weekly Pivot Points: WR3 - $2,344 WR2 - $2,313 WR1 - $1,970 Weekly Pivot - $1,829 WS1 - $1,578 WS2 - $1,463 WS3 - $1,233 Trading Outlook: The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.

|

| Technical Analysis of BTC/USD for June 1, 2022 Posted: 01 Jun 2022 02:21 AM PDT Crypto Industry News: The UK government has published a consultation paper that outlines a risk reduction strategy for stablecoin investors. The proposal follows the collapse of the TerraUSD algorithmic stablecoin, which lost its 1: 1 link to the US dollar during a sell-off in the cryptocurrency market earlier this month. The government recommends that existing legislation be amended to give the Bank of England the power to appoint administrators to oversee insolvency arrangements with failed stablecoin issuers. "Since the initial commitment to regulate certain types of stablecoins, developments in crypto asset markets have further accentuated the need for appropriate regulation to help mitigate risks to consumers, market integrity and financial stability," the Treasury said in its proposal to be considered by Parliament. Following the Terra implosion, regulators around the world focused on stablecoins, while the European Commission advocates a large-scale ban on this asset class. Technical Market Outlook: The BTC/USD pair relief rally continues and the bulls had tested the key short-term supply zone located between the levels of $32,380 - $32,892. The local high was made at the level of $33,370, but only a sustained breakout above this zone would change the outlook to more bullish in the short-term, because the market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact. The first indication of the deeper correction would be a clear breakout above the range high located at the level of $32,870. Weekly Pivot Points: WR3 - $33,360 WR2 - $32,016 WR1 - $30,581 Weekly Pivot - $29,009 WS1 - $27,632 WS2 - $25,903 WS3 - $24,538 Trading Outlook: The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.

|

| Technical Analysis of GBP/USD for June 1, 2022 Posted: 01 Jun 2022 02:16 AM PDT Technical Market Outlook: The GBP/USD pair has failed to break above the key supply zone located between the levels of 1.2615 - 1.2697. The local high was made at the level of 1.2665 and the bulls keep pushing higher, however they fell out of the channel already. Any violation of this supply zone would change the short-term outlook to more bullish as the market could target even the level of 1.3000 again. The strong and positive momentum support the short-term bullish outlook for Cable, however the market conditions look overbought. As long as the market trades above the level of 1.2466 and is still inside the ascending channel, there are still chances for the breakout higher. The key technical resistance level is located at 1.2697. Weekly Pivot Points: WR3 - 1.2895 WR2 - 1.2786 WR1 - 1.2716 Weekly Pivot - 1.2588 WS1 - 1.2516 WS2 - 1.2399 WS3 - 1.2312 Trading Outlook: The price broke below the level of 1.3000 six weeks ago, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The bulls are now trying to start the corrective cycle, which is welcome after eight weeks of the down move. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

|

| Technical Analysis of EUR/USD for June 1, 2022 Posted: 01 Jun 2022 02:13 AM PDT Technical Market Outlook: The strong and positive momentum support the short-term bullish outlook for EUR/USD, however the bulls failed to break through the key short-term supply zone located at the level of 1.0786 and did not hit the 161% Fibonacci extension of the wave C located at 1.0805 yet. Instead, the market fell out of the channel and now is trading around the immediate technical support located at 1.0654. If this level is clearly violated, the upwards cycle might be terminated. The breakout below the level of 1.0567 invalidates the impulsive wave pattern. Weekly Pivot Points: WR3 - 1.1043 WR2 - 1.0898 WR1 - 1.0827 Weekly Pivot - 1.0691 WS1 - 1.0625 WS2 - 1.0485 WS3 - 1.0411 Trading Outlook: The market had bounced from the key long-term technical support located at the level of 1.0336 and is heading higher. The up trend can be continued towards the next long-term target located at the level of 1.1186 only if bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bearswill push the price lower towards the next long-term target at the level of 1.0336 or below.

|

| Daily Video Analysis: USDCAD, H4 Bullish Bounce Opportunity Posted: 01 Jun 2022 02:11 AM PDT Today we take a look at USDCAD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| Forex forecast 06/01/2022 EUR/USD, USD/CAD, AUD/USD, Gold and Bitcoin from Sebastian Seliga Posted: 01 Jun 2022 02:09 AM PDT Let's take a look at the technical picture of EUR/USD, USD/CAD, AUD/USD, Gold and Bitcoin The material has been provided by InstaForex Company - www.instaforex.com |

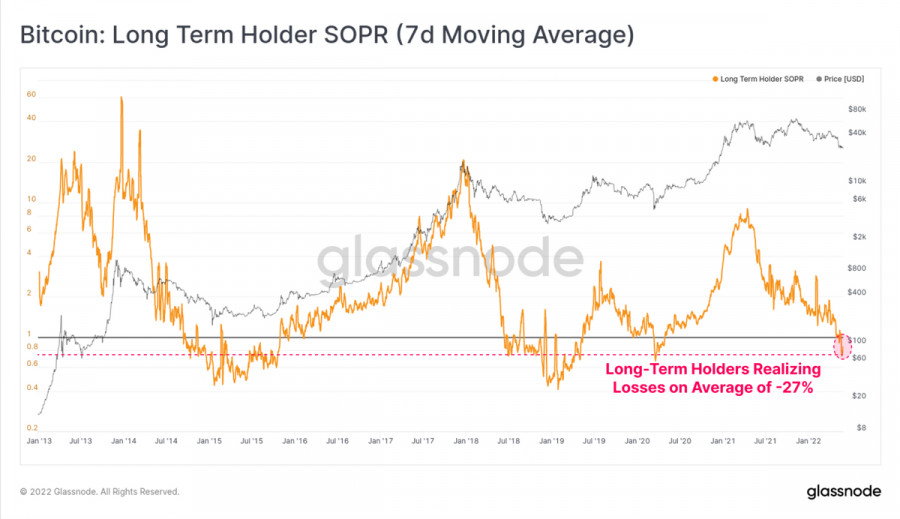

| Long-term investors continue to accumulate Bitcoin despite a deep correction Posted: 01 Jun 2022 02:06 AM PDT Bitcoin and the cryptocurrency market are saying goodbye to one of the most negative months in history on a positive note. It was in May that the main digital asset formed a record nine weekly red candles in a row, and investors massively fled from crypto assets due to the fall of the Luna stablecoin. It became finally obvious that investors were disappointed in Bitcoin as a means of protection. And the final nail in the coffin was hammered by the Federal Reserve, which monetary policy finally turned investors back to Bitcoin. On June 1, the US Federal Reserve's quantitative tightening program will start. Its main task is to reduce liquidity in all available markets due to excessive inflation. The consequences of the last meeting in mid-May are well known to every crypto investor. Bitcoin hit a new low at $25k, retail investors launched a massive capitulation, and some long-term owners joined them. Due to panic, market volatility jumped, which also played against buyers. As a result, investors are still dealing with the consequences of the May Fed meeting and the events that followed.

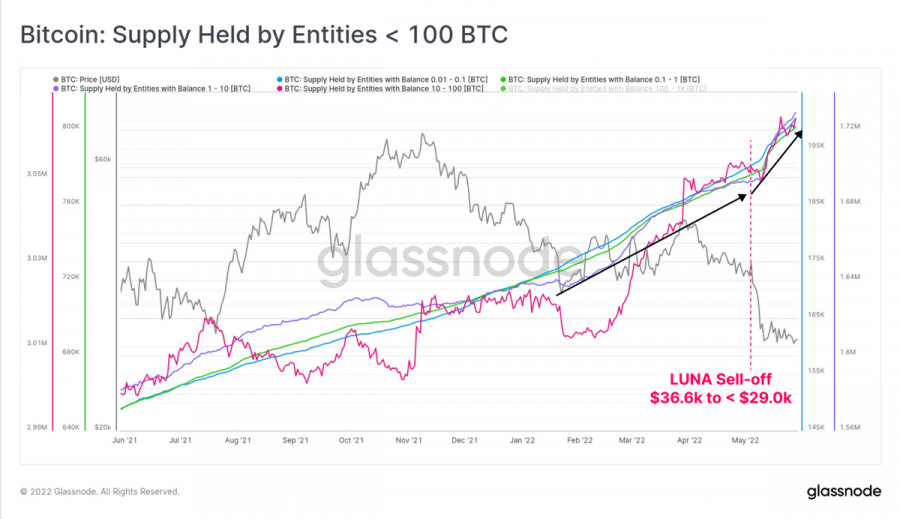

Despite all the negativity around the crypto market, Bitcoin had a significant audience that continued to stubbornly accumulate BTC coins at a good discount. According to leading analytical resources CryptoQuant and Glassnode, the market showed a confident bullish reaction in the $25k–$28k region, which is called "buy the dip." The accumulation phase, which continues to this day, has largely contributed to the successful implementation of this process. According to Glassnode data, during the May crisis, several main categories of investors emerged who actively bought the bottom and continue to accumulate BTC coins.

The first category that actively bought the bottom was investors with a balance of up to 100 BTC. After the drain of Bitcoin reserves from LFG, it was they who began to actively buy cryptocurrency below $28k. In total, this category of buyers purchased more than 80.7 thousand BTC coins. Thanks to this, the asset managed to withstand the selling pressure in the $25k area and start a recovery momentum. The second beneficiaries of the fall of Bitcoin were wallets with a balance of more than 10,000 BTC. Investors also actively purchased the stocks of cryptocurrency sold by Luna, thanks to which they brought their investments in May to 46,000 BTC coins.

We also see that despite the negative May, most venture capital investors continued to actively invest in the cryptocurrency market. In May, crypto funds received more than $500 million in investments, and last week's increase was about $87 million. It may seem that the combination of all these factors indicates a likely change in trend due to the activation of buyers and large investors. Indeed, the number of participants in the futures market is growing, and the volumes of longs prevail on short ones.

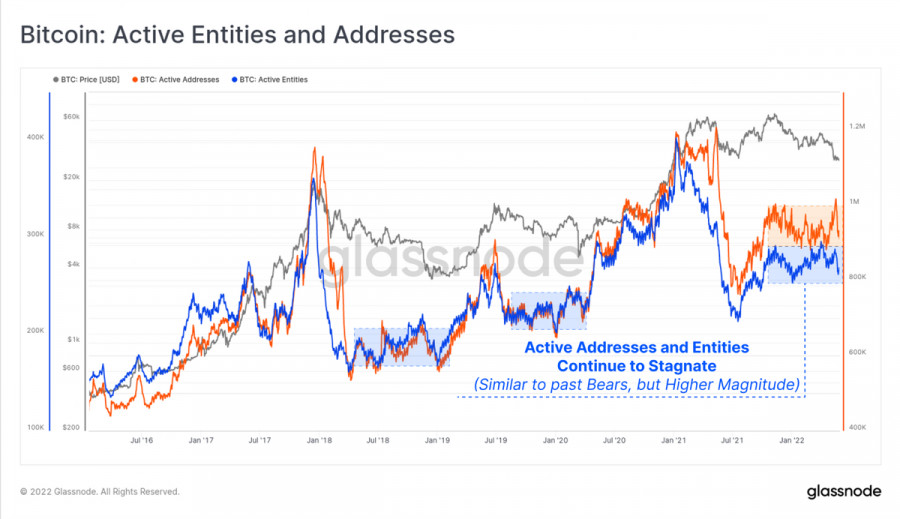

Despite this, it is important to understand that the current weakening of the negative in the market is due to several factors. First of all, the market reached a certain bottom of the negative, which provoked a local upward correction, which we are seeing. In addition, the encouraging news from the WHO regarding monkeypox and the relative lull in hostilities in Ukraine gave the market time to readjust and begin to act in new circumstances. However, the same Glassnode points out that on-chain activity in the BTC network remains at a low level, despite active accumulation.

An important factor indicating an increase in the likelihood of an upward movement will be a bullish breakdown of the fibo level of 0.236 in the $33k–$35k zone. As of June 1, Bitcoin is trading near the challenging $31.5k resistance zone, which is the upper end of the $29k–$31.5k swing range.

A bullish breakdown of this formation will open the way for the coin to the next area, $33k–$35k, and based on the results of its working out, it will be possible to judge the further movement of the BTC/USD price. However, given the start of the QT program and its unpredictable impact on the markets, it is hard to believe in a full-fledged reversal of the Bitcoin trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil prices rise as EU leaders agree on partial Russian crude ban Posted: 01 Jun 2022 01:42 AM PDT

EU leaders have agreed to cut Russian oil imports by 90% by the end of the year. The agreement is already reached, with only the details to be clarified.According to Reuters, about 65% of Russian oil exports to the European Union are delivered to the continent by tankers, with the rest coming through the Druzhba pipeline.Poland and Germany had already committed to end Russian crude imports via the Druzhba pipeline by the end of the year, raising the ban coverage to around 90%. First and foremost, the embargo will affect tanker traffic. This will be a problem for those EU members who receive Russian oil in this way. At the moment there is no clarity on how these EU members will be compensated.Meanwhile, Hungary, the Czech Republic and Slovakia will be exempted from the embargo, leaving 10% of usual Russian oil flows in place. There was no mention of Bulgaria in the Reuters report, but the southern European state was also part of the group of countries opposing any embargo that could threaten the security of its oil supply.The European Commission proposed a full oil embargo against Russia in early May as part of its latest sanction package. Hungary, however, immediately and quite vocally opposed it, arguing it would need hundreds of millions of dollars to transform its pipeline and refinery industry. The Central European state relies on Russia for more than 80% of its oil.The following weeks saw active discussions as more EU members heavily reliant on Russian oil followed Hungary's example, with Bulgaria threatening a veto on any embargo proposal unless it received an extension to reduce and eventually eliminate Russian oil imports.Following the news of the embargo agreement, Brent crude was trading at $122.63 per barrel:

|

| Last-minute chance to earn on gold rally Posted: 01 Jun 2022 01:41 AM PDT

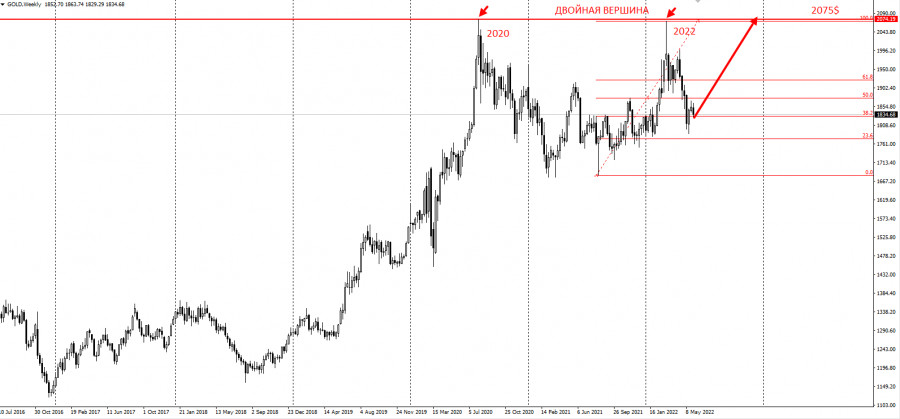

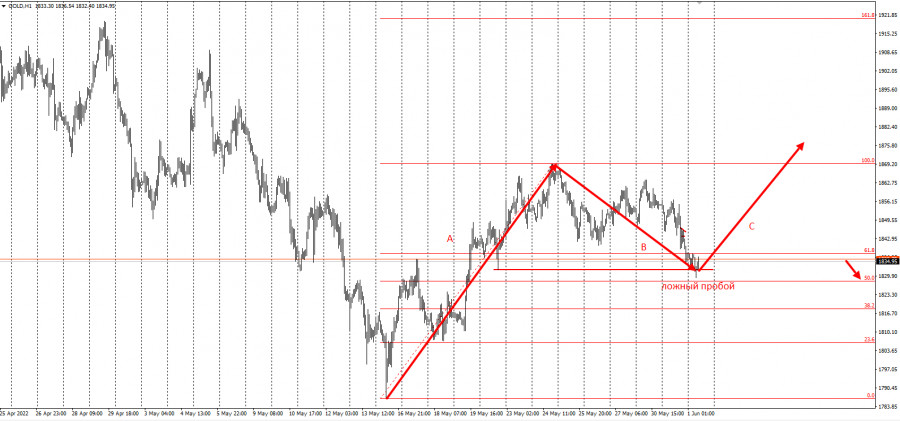

Hi, dear traders! I'd like to share a trading idea for gold with you. Gold remains in the overall large bullish trend. The metal is able to update easily its historic highs in the context of globalgeopolitical jitters. Here is a big plan for gold based on updating the double top of 2020-2022.

Let's consider the buying impulse from May 16 to be a basis represented by wave A. As of today, the gold price declined by 50% and made a false breakout of the low from May 20. I suggest we consider the trading idea based on the gold rally according to this scheme.

In fact, there is a three-wave ABC structure where the buying impulse of mid-May is plotted by wave A. I plan to open long positions during the 50% Fibonacci retracement at the current price levels. We could set a stop loss at $1,810. We could fix a profit during a breakout of $1,870 and $2,075. The trading idea is developed on the grounds of the author's methods of Price Action and Hunting for Stop Orders. Good luck in trading! Manage your risks! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

West Texas Intermediate was trading at $117.99 per barrel:

West Texas Intermediate was trading at $117.99 per barrel:

Comments