Forex analysis review

Forex analysis review |

- Technical analysis of ETH/USD for January 01, 2022.

- Technical analysis of BTC/USD for January 01, 2022.

- GBP/USD upside continuation

- Litecoin imminent upside breakout

- Bitcoin: the price and address activity are growing, the level of fear is decreasing. Arguments in favor of growth in January

- 2021 is the year of mergers and acquisitions: how a trader can use this information

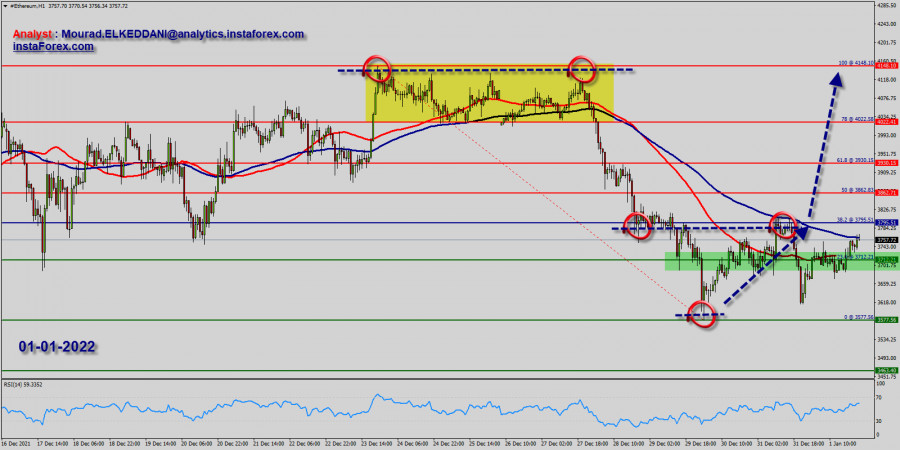

| Technical analysis of ETH/USD for January 01, 2022. Posted: 01 Jan 2022 02:13 PM PST ETH/USD - Ethereum US Dollar Crypto Chart

Trading Ethereum (ETH/USD) : Ethereum is at an all-time lowest against the dollar around the spot of $ 3,577 - $ 3,600 - Ethereum is inside in downward channel. Since three weeks ETH/USD decreased within an down channel, for that Ethereum hits new lowest $ 3,577 and $ 3,600. Consequently, the first support is set at the level of $ 3,600. Hence, the market is likely to show signs of a bullish trend around the area of $ 3,577 and $ 3,600. Ethereum price could be awaiting a major upswing if the digital savings manages to slice above a fatal line of the first resistance that sets at the price of $ 3,795 (Horizontal blue line). The prevailing chart pattern suggests that if the leading cryptocurrency could be expecting to rebound from the levels of $ 3,463 and $ 3,577. Moreover, if the ETH/USD fails to break through the support prices of $ 3,463 and $ 3,577 today, the market will rise further to $ 3,795 so as to try to break it. Ethereum is one the best overall investment for 2022. However, if you want to try to improve the growth of Ethereum, thus it seems great to buy above the last bearish waves of $ 3,463 and $ 3,577. Buy orders are recommended above the majors sypport rates of ($ 3,463 or $ 3,577) with the first target at the level of $ 3795. Furthermore, if the trend is able to breakout through the first resistance level of $ 3795. We should see the pair climbing towards the next target of $ 3,860 (to test the 50% of Fibonacci retracement levels). The pair will move upwards continuing the development of the bullish trend to the level $ 3,930 - golden ratio 61.8%. It might be noted that the level of $ 4,148 is a good place to take profit because it will form a new double top in coming hours. ---------------------------- Please contact me if you have any questions or comments - I'd be delighted to hear from you. With kind regards, Mourad EL KEDDANI mourad.elkeddani@analytics.instaforex.com ---------------------------- The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of BTC/USD for January 01, 2022. Posted: 01 Jan 2022 04:40 AM PST

Trading Cryptocurrency BTC/USD (Bitcoin) : Weekly Forecast : between 01-01-2022 and 07/01/2022. Piot Point : 48,027. As we know that :

Thereby, one Ethereum is only worth 0,0789918483493442 Bitcoin (January 01, 2022). Bitcoin price prediction : Remember that Cryptocurrencies are the new money! so, Bitcoin is really a great fortune. Hence, our target $ 70,000 in the next few weeks. Today, BTC/USD is trading below the weekly pivot point $ 48k. Because BTC/USD broke support which turned to a minor resistance at the price of $ 48,027 last week in 2021. The price of $ 48,027 is expected to act as minor resistance in the first week of 2022. As long as there is no daily close below$ 45k, there are no chances of a fresh decrease below $ 45,555 (Support 2) in the H1 time frame. The support levels will be placed at the prices of $ 44k and $ 45k. As long as there is no daily close below $ 44k or/and $ 45k, there are no chances of breaking the bottom of $ 45,555. The volatility is very high for that the BTC/USD is still moving between $ 45,555 and $ 48,027 in coming hours. As a result, the market is likely to show signs of a bullish trend again. Hence, it will be good to buy above the level of $ 45k with the first target at $ 47,500 and further to $48,027 in order to test the weekly pivot point. However, if the BTC/USD is able to break out the daily support at $ $ 45,555, the market will decline further to $ 44,601 to approach support 2 today. Weekly Forecast : According to the previous events the price is expected to remain between $ 45,555 and $ 48,027 levels. Buy-deals are recommended above $ 45,555 with the first target seen at $ 47,000. The movement is likely to resume to the point $ 47,500 and further to the point $ 48,027. *************************************************** Crypto industry news (Ethereum News - (Source : cryptonews - coindesk)) *************************************************** 1) - 1-1) : "Binance will maintain its position as the biggest bitcoin futures exchange by open interest," but it will also "face fierce competition" from FTX. 1-2) : "Binance will maintain its position as the biggest bitcoin futures exchange by open interest," but it will also "face fierce competition" from FTX. 2) - Investors are buying options against falling prices ahead of a major expiry. Grayscale Investments has $43.6 billion in crypto assets under management (AUM), the digital asset manager tweeted on Friday – a more than 28% decline from the $61 billion the digital asset manager held in early November. ---------------------------------------------------- Please contact me if you have any questions or comments - I'd be delighted to hear from you. With kind regards,

|

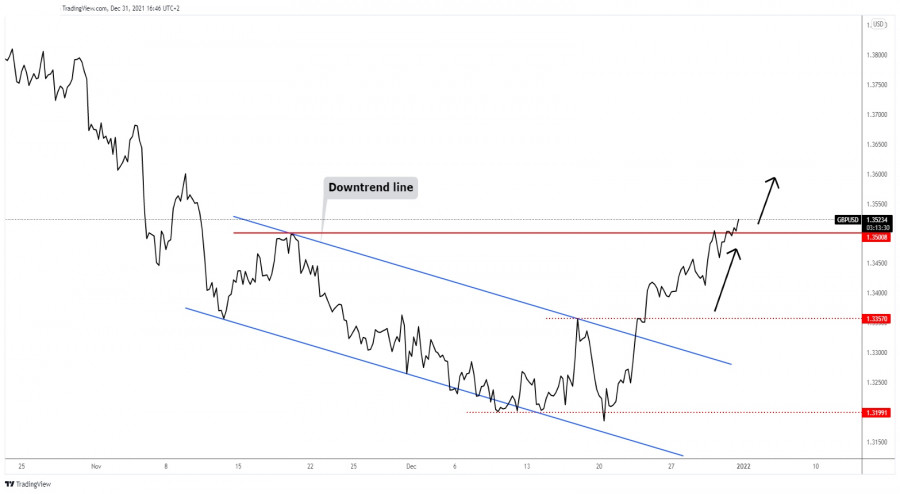

| Posted: 31 Dec 2021 07:38 AM PST

GBP/USD Valid Breakout!GBP/USD resumed its upwards movement after registering a temporary decline from above 1.3500. I've told you in my previous analysis that the pair could retreat after reaching the 1.35. Also, you knew from my analyses that the currency pair could extend its upwards movement if it jumps and stabilizes above the 1.35 psychological level. The 1.3500 psychological level represented a strong upside obstacle. After jumping above the downtrend line and bove the 1.3357, GBP/USD was expected to approach and reach the 1.35 level. GBP/USD Trading Conclusion!The current breakout above the 1.3500 and above yesterday's high of 1.3506 could activate an upside continuation and is seen as a new buying opportunity with potential target at the 1.3600 psychological level. The material has been provided by InstaForex Company - www.instaforex.com |

| Litecoin imminent upside breakout Posted: 31 Dec 2021 07:36 AM PST Litecoin is fighting hard to rebound and recover after its most recent drop. It's traded at 150.62 level at the time of writing above 142.84 yesterday's low. LTC/USD registered a 6.90% growth from yesterday's low to 152.71 today's high. Litecoin started to grow as the price of Bitcoin rallied in the short term. As you already know from my previous analyses, BTC/USD's growth helps the altcoins to grow as well. This is not a perfect correlation but you can still use it in trading. LTC/USD Sellers Seems Exhausted!

LTC/USD has found support on the weekly S1 (145.23) level and now it approaches the immediate downtrend line and the weekly pivot point (155.94). Personally, I would have liked the price to reach the 141.65 support and the 140.00 psychological level before turning to the upside. Technically, as long as it stays under the downtrend line, it could still reach these major downside obstacles. A major bullish pattern around the 141.65 could announce a new leg higher. Litecoin Outlook!We have a strong confluence area at the intersection between the immediate downtrend line with the weekly pivot point (155.94). A valid breakout through this confluence area could announce strong buyers and potential upside continuation. Such a breakout could bring us new long opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 31 Dec 2021 06:22 AM PST On the last day of the outgoing 2021, bitcoin is quietly and technically recovering. Forecasts and technical guidelines do not change at the same time. And although few people are trading at this time, let's see what's going on behind the scenes of the market and leave a small reserve for returning to trading after the holidays. Addressable activity in the bitcoin network is growing Data from the network analytics company Santiment show that at the end of the year, there is a trend towards an increase in address activity in the BTC network. The bullish mood of the DAA/price ratio indicator has historically correlated with price growth. According to the online review, on December 28, the highest activity of addresses in four weeks was noted. The level of fear is decreasing After yesterday there was an increase in the level of concerns in the market, today the situation has leveled off a little. According to the Crypto Fear & Greed Index, traders are less scared. And on December 31, the index shifted to the level of 28, which means a shift from yesterday's "extreme fear" to "fear". In parallel, Glassnode notes that there is a small volume of bitcoin trading on centralized exchanges. The holidays are affecting, the "thin market" is confirmed. There is other good news: Bitcoin shows a negative NetFlow of -658.3 million dollars in the last 24 hours. In the case when NetFlow is negative, outflow exceeds inflow. This means that investors withdraw more bitcoins from exchanges than they deposit. And this may be an optimistic sign for the main cryptocurrency. Getting ready for the beginning of the year: technical and fundamental forecast Technically, for bitcoin, recovery is probable to the range of $47,000 - $51,600 per coin. So far, this forecast looks very plausible. But you can't renounce anything, especially in the thin market and especially in the case of cryptocurrency. Therefore, we are mindful of an alternative scenario - a deeper correction in the area of $ 42,000. And also remember that in the first week of the year, many traders expect BTCUSD to grow.

|

| 2021 is the year of mergers and acquisitions: how a trader can use this information Posted: 31 Dec 2021 06:22 AM PST Economists are confident that global transactions will continue to grow rapidly next year after a historic year for mergers and acquisitions (M&A) activity, which was largely fueled by the availability of cheap loans and bullish stock markets. 2021 is the year of mergers and acquisitions: how a trader can use this information

According to the research company Dealogic, the global volume of mergers and acquisitions exceeded $5 trillion for the first time in history. The previous record was $4.55 trillion in 2007. According to Refinitiv, the total value of mergers and acquisitions in 2021 amounted to $5.8 trillion, which is 64% more than a year earlier. In 2021, large buyout funds, corporations, and financiers, who gained access to cash and were encouraged by the rapid growth of stock markets, concluded 62,193 transactions, which is 24% more than a year earlier, as record figures fell during each month of the year. Investment bankers expect that the rush to conclude deals will continue next year, despite the impending increase in interest rates. Higher interest rates increase the cost of borrowing, which may slow down the activity in the field of mergers and acquisitions. However, transaction consultants still expect a flurry of large mergers to occur in 2022. The soft monetary policy of the US Federal Reserve System provoked the growth of the stock market and provided the management of companies with access to cheap financing, which, in turn, encouraged them to achieve major goals. In terms of regions, the United States was in the lead. They account for almost half of global volumes - the cost of mergers and acquisitions has almost doubled to $2.5 trillion in 2021, despite a tougher antitrust environment under the Biden administration. The biggest deals of the year included AT&T Inc's $43 billion deal to merge its media business with Discovery Inc; the $34 billion buyouts of Medline Industries Inc; the $31 billion deal between Canadian Pacific Railway, which is in Warren Buffett's portfolio, with Kansas City Southern; and the breakup of American giant corporations General Electric Co and Johnson & Johnson. According to a survey of transaction participants and consultants, more than two-thirds of respondents believe that the volume of transactions will grow, despite the problems associated with regulations and the pandemic. Transactions in sectors such as technology, finance, industry, energy, and electricity accounted for the bulk of mergers and acquisitions. According to Refinitiv, this year the buyout financed by private investment companies has more than doubled and exceeded the $1 trillion mark for the first time. Despite the slowdown in activity in the second half of the year, the conclusion of deals involving special purpose companies further increased the volume of mergers and acquisitions in 2021. SPAC deals accounted for about 10% of global mergers and acquisitions, and they added several billion dollars to the total. Such information is very useful to traders who are interested in trading stocks. Since acquisitions always indicate inflows of finance, usually after the announcement of the transaction, the shares go up. So, John Outers, one of the leading analysts at Bloomberg and, in the past, the Financial Times, recommends buying stocks and corporate bonds of such companies this year. In addition, mergers guarantee an increase in liquidity, which the markets necessarily take into account when evaluating certain aggregate assets. Therefore, if you are interested in the stock market, start with conglomerates that have spent money on mergers and acquisitions this year – these companies have a good rating, financial profile and will be an excellent acquisition. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments