Forex analysis review

Forex analysis review |

- Bitcoin collapse: Kazakhstan, China, Turkey, and the Fed.

- Bitcoin: the only hope is for the institutionalists.

- GBP/USD. Preview of the new week. A large package of macroeconomic statistics in the UK. But won't it be ignored?

- EUR/USD. Preview of the new week. Will the euro continue to grow on an empty calendar of macroeconomic events?

| Bitcoin collapse: Kazakhstan, China, Turkey, and the Fed. Posted: 16 Jan 2022 01:54 AM PST

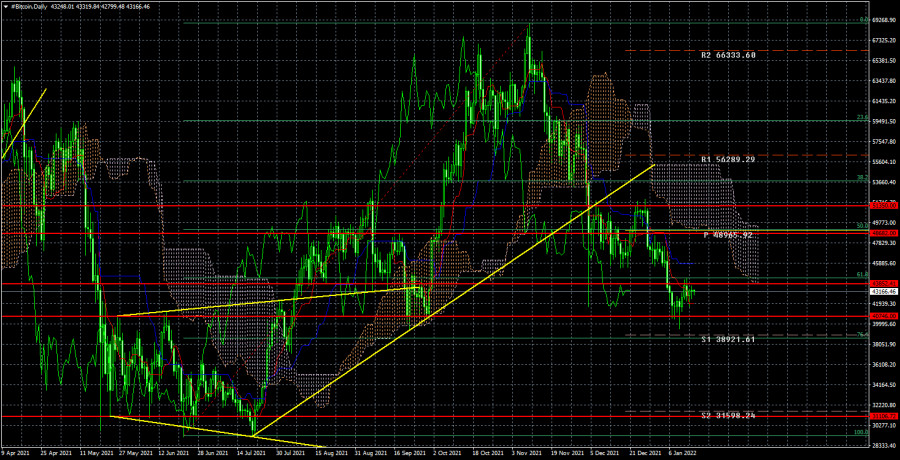

The technical picture of bitcoin on the 24-hour timeframe is even more eloquent. The price fell to the support level of $ 40,746 and bounced off it. It has risen to the resistance level of $ 43,852 and has bounced off it at the moment. Thus, we can even talk about the formation of a side channel. In general, the picture looks like this. The cryptocurrency has gained a foothold below the ascending trend line, so the downward trend remains at this time. The bitcoin exchange rate is below all the lines of the Ichimoku indicator, so there is no reason to expect the end of the "bearish" trend at this time. Now we are not even talking about a correction, since the cryptocurrency managed to move away from the local minimum by only $ 3,600. What is $ 3,600 for Bitcoin? The daily volatility is far from the most volatile day. At the same time, it is still necessary to adjust, since the total drop in bitcoin in recent months is already $ 30,000, which is about 40% of its last maximum value. However, if we can say with currency pairs that a correction will happen, then in the case of bitcoin, the market is much more "thin" and susceptible to any shocks. For example, if mining and operations with digital assets are banned in China, bitcoin drops by 20-30% in value. Can you imagine anything like this in the foreign exchange market? Bitcoin is mired in problems. In Turkey, meanwhile, the government is going to seriously tighten the regulation and taxation of cryptocurrencies. This is due to the strong growth in the number of cryptocurrency transactions. The Turks faced not just inflation, but a strong drop in the lira in the foreign exchange market, so for them cryptocurrencies are not only a salvation from the depreciation of capital from inflation. In China, cryptocurrencies want to completely ban and eliminate the entire sector. According to various sources, illegal mining continues in China, which accounts for up to 20% in total. This is a lot, considering that mining is prohibited in the country. Kazakhstan still remains a source of risk for "bitcoin". At the beginning of the year, there were mass riots in the country on a political basis, so the authorities had to turn off the Internet, which also affected the hashrate of the network since Kazakhstan is one of the leaders in the world in terms of mining facilities located on the territory. And, of course, the Fed, which is going to raise the key rate three or four times this year, and also start unloading its balance sheet, which means in practice selling bonds and withdrawing money from the economy.

On the 24-hour timeframe, the quotes of the "bitcoin" are fixed below the ascending trend line, so the "bullish" trend is broken. At the moment, the quotes have fallen to the level of $ 40,746, so overcoming this level will open the way to the level of $ 31,106 - the lows of 2021. Please note that bitcoin has been falling for 2 months and so far this fall is almost recoilless and very strong. This clearly suggests that investors are getting rid of coins, and not increasing purchases in any way. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin: the only hope is for the institutionalists. Posted: 16 Jan 2022 01:54 AM PST

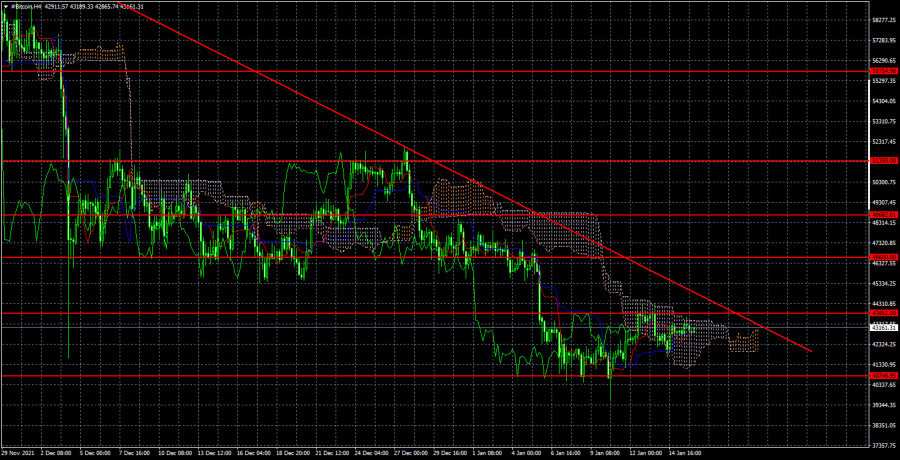

The beginning of the year for bitcoin, as well as the end of the previous one, were not the best. From our point of view, this is not surprising, since the fundamental background remains far from the most favorable. We have already said that bitcoin began its decline around the time when it became clear to all market participants: The Fed has embarked on the path of tightening monetary policy. Therefore, we believe that bitcoin logically fell by $ 30,000 from its absolute highs. With each passing month, the amount of monetary injections into the economy from the Fed will only decrease and this process will not take much time. Already in March, the Fed plans to completely abandon monetary stimulus and start raising the rate. Therefore, bitcoin is losing its main growth factor over the last two years. Recall that two years ago, bitcoin began to rise in price from the $ 4,000 mark. During this time, it managed to grow by $ 66,000. Naturally, not least because of the huge amounts of money that central banks poured into the economy. Now the reverse process begins, when rates will rise, and excess liquidity will be withdrawn from the economy. Consequently, investments will decrease. Therefore, the cryptocurrency market may experience serious problems in 2022. Bitcoin's hope is in inflation hedging. We believe that only high inflation in the States (and not only) can help bitcoin at least not collapse by 80-90%, as it usually happens after the end of the "bullish" trend. The fact is that inflation in the States continues to remain high and this is the only factor that can continue to force investors to buy bitcoin. But for this inflation protection scheme to work, bitcoin must continue to grow in price. Otherwise, there is no special point in buying bitcoin. And now, as we have already said, the fundamental background is not the best, so few investors expect growth in 2022. According to various surveys, only 50% of investors expect growth from cryptocurrencies this year. At the same time, only 10 percent believe that bitcoin will be able to grow above $ 60,000 per coin. All this suggests that this growth factor can also be leveled. Separately, I would like to note that institutional and large investors may try to keep "bitcoin" from falling again. For example, last week bitcoin failed to gain a foothold below the important support of $ 40,746. But here it is completely unclear whether they will be able to redeem the entire volume of coins that will flow to cryptocurrency exchanges. And even if so, after a while, only large investors will own bitcoin, whose coins will lie on their wallets for years. The turnover of bitcoin will be minimal and the cryptocurrency will move further away from the status of "currency". It is already making not so many calculations. It performs an exclusive investment function.

On the 4-hour timeframe, the trend remains downward. Three times last week, the cryptocurrency failed to overcome the level of $ 40,746, so for now, we are talking about an upward correction. The descending trend line still signals that the fall may resume at any moment. The price at the moment could not even grow to the trend line, let alone overcome it. And overcoming the level of $ 40,746 will allow the cryptocurrency to continue moving south up to the level of $ 31,106. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Jan 2022 12:25 AM PST

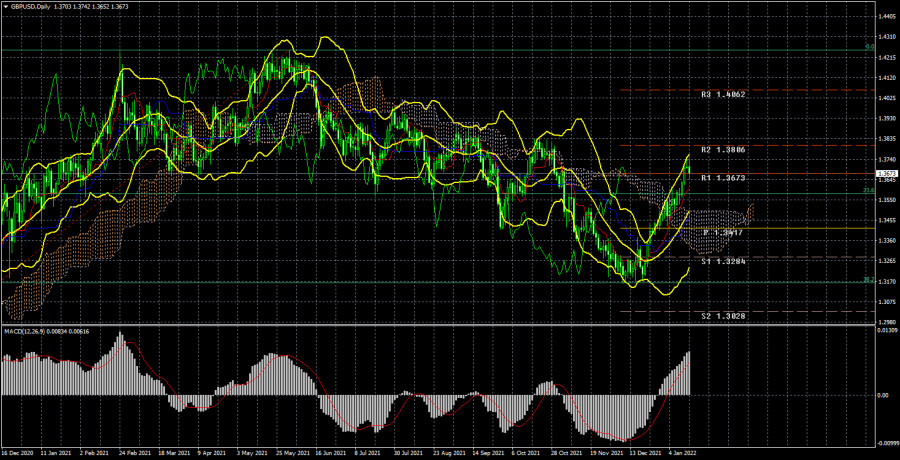

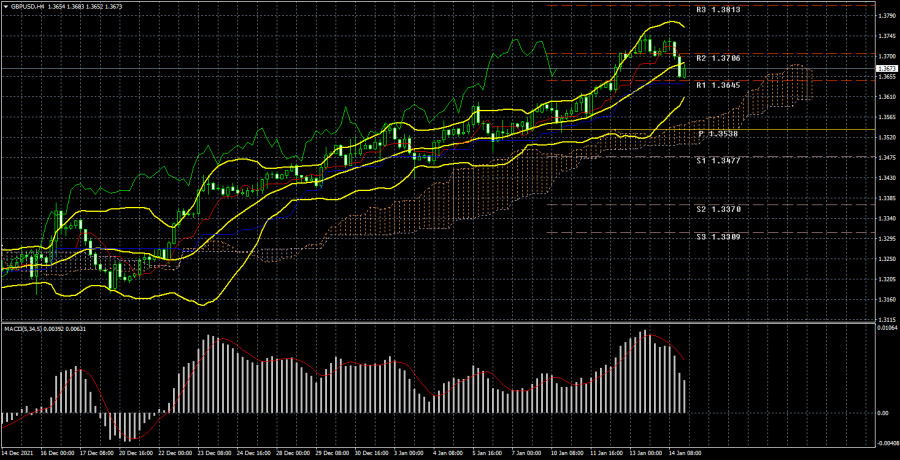

\The pound/dollar pair continued to grow this week, despite the macroeconomic background. The upward trend continues. In previous articles, we have already said that this week, if we take into account the "macroeconomics", the pair should have fallen most of it, and on Friday it should have grown. However, in reality, the movement was the exact opposite. Thus, we can say that market participants ignored all the most important events and reports. And this applies not only to American data and speeches by Fed members. This also applies to British statistics. On Friday, reports on industrial production and GDP were published, which turned out to be better than forecasts, and in the States, on the same day a disastrous report on retail sales was released, but at the end of the day, it was the American currency that rose in price. Thus, it is far from a fact that all the macroeconomic statistics of the next week will be taken into account by traders. The pound sterling is now really ready for the formation of a new upward trend, since, unlike EUR/USD, it has overcome all the important lines of the Ichimoku indicator. But at the same time, its growth is already almost 600 points in a few weeks and now it's time to adjust at least a little. We want to say that at this time "technology" is more important than the macroeconomic background. The markets also continue to ignore the fundamental background. What has been happening in the UK over the past few years cannot be called anything other than a farce. Even if we do not take into account all the events related to Brexit, the country constantly finds itself in the center of political scandals related to the current government, which is quietly having fun during "lockdowns". Of course, this news does not affect the economy. But for that, the economy is influenced by the decisions that the government makes. Of course, we are talking about a pandemic and its next "wave". Boris Johnson did not want to close the country to quarantine and therefore at this time the daily number of diseases exceeds 100,000. Over the past week, the average daily value has begun to decline, which may indicate the passage of the peak of the "wave". Now it remains only to understand what the consequences for the economy will be. There will be a lot of macroeconomic statistics in Britain next week. An unemployment report, applications for unemployment benefits, and wages will be published on Tuesday. These are not the most important data, but they can't be called "passable" either. On Wednesday morning, the consumer price index for December will be published and, according to forecasts, this indicator will continue to accelerate and will amount to 5.2% y/y. On Friday, the retail sales report for December will be published. Please note that it was in December that a new "wave" of the pandemic began, so we should expect a deterioration in macroeconomic indicators. There are no important macroeconomic publications scheduled in the States next week. In Britain, a speech by the chairman of the Bank of England, Andrew Bailey, is also scheduled for Wednesday, the first in the new year. Therefore, this may be an interesting event, especially because the British regulator raised the rate in December and now the markets are waiting for information about further actions. Thus, all the most interesting things in the new week will happen in the UK. But will traders react to these events?

Recommendations for the GBP/USD pair: The pound/dollar pair continues its upward trend on the 4-hour timeframe, as evidenced by the Bollinger Bands and Ichimoku indicators. A small correction on Friday failed to break it. Thus, a rebound from the critical line may provoke a resumption of upward movement. However, we still expect that a more tangible correction will begin, at least 200-250 points down, after which we will count on the resumption of the upward trend if the key lines of the Ichimoku indicator on the 24-hour TF resist the onslaught. So far, there are no technical prerequisites for completing the upward trend on the 4-hour TF, which means that trading should continue to increase. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Jan 2022 12:25 AM PST

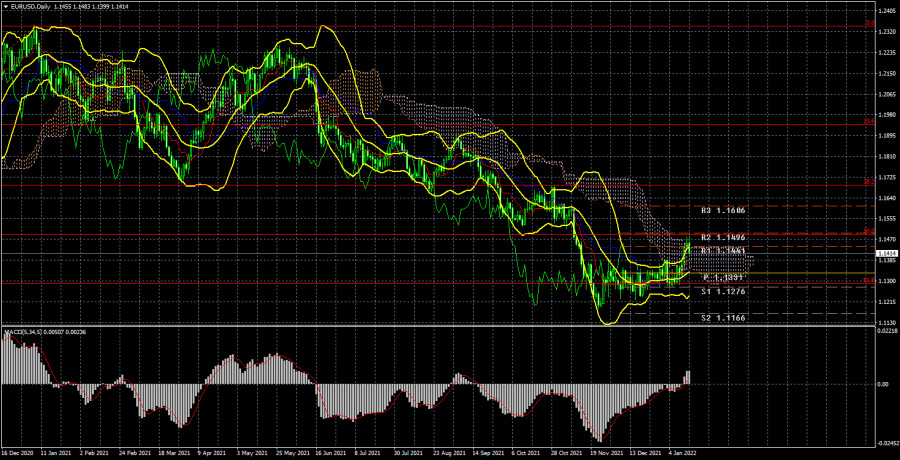

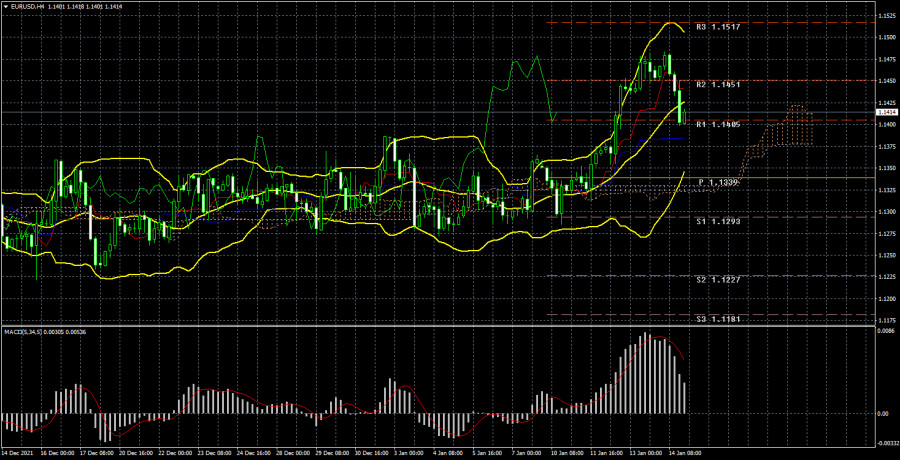

The European currency ended last week with a significant increase. It wasn't too big, but at the same time, the pair hadn't shown such growth for quite some time. We also drew the attention of traders to the fact that the pair had no fundamental reasons for growth. Rather, on the contrary. There were new good reasons for the US dollar to grow. This is a whole series of speeches by representatives of the Fed, who only intensified their "hawkish" rhetoric. This is also the speech of Jerome Powell, who confirmed the Fed's intentions to continue tightening monetary policy. This is also the inflation report, which showed another acceleration of it. From a technical point of view, growth has been brewing for a long time. However, this growth is either corrective or growth based on the fact that all the "dollar" factors have already been worked out by the market. This is the moment we have to deal with next week. If what we have seen this week is just a correction, then it will probably end soon. Already, the pair ran into the Senkou Span B line on the 24-hour TF and could not overcome it. Therefore, a rebound from this line can trigger a new round of the downward trend. If the second assumption is true, then the Senkou Span B line will be overcome and the growth of the European currency will continue, which, from a fundamental point of view, is not based on anything. Recall that there is nothing in the European Union now that could support the European currency. Traders are most depressed by the passivity of the ECB, which does not even plan to raise the key rate in the coming year. Last week, as already mentioned, traders ignored almost the entire fundamental and macroeconomic background. Thus, it is far from a fact that they will start paying attention to it in the new week. However, also, with some delay, they can begin to work out the "foundation" of last week. Therefore, I consider the Senkou Span B line to be the key in analyzing what is happening. However, you should also consider those events that are scheduled for next week. Nothing interesting is planned in the European Union on Monday, Tuesday, and Wednesday. Only on Thursday will the inflation report for December be published, but this will be its second, final assessment. That is, the markets are already ready for the value of 5.0% YoY and are unlikely to react to this data. On Friday, the calendar in the European Union is empty. Among other important events, we note the speech of Christine Lagarde on Friday, but, as usual, the head of the ECB is unlikely to "shock" the markets with important information. Now everyone understands that the European economy is not ready for a strong tightening. The "wave" of Omicron is in full swing and no one knows what its consequences will be. Doctors and epidemiologists say that up to 50% of the population in the European Union may get sick in the next two months. And this means that there is no talk about the imminent end of this "wave" yet. Consequently, the ECB at its next meeting is unlikely to pour right and left "hawkish" theses. The same goes for Christine Lagarde's Friday speech. It turns out that next week we are not waiting for anything interesting in the European Union. All the more interesting, since there will be mainly technical factors in the case, and the mood of traders will be influenced by a minimum of external factors.

Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair on the 4-hour chart according to the Ichimoku strategy looks extremely eloquent. The pair made an impressive upward leap last week, and on Friday it began to adjust to the critical line. If there is a rebound from it, then the upward movement may resume. But more important now is the rebound from the Senkou Span B line on the 24-hour TF. Based on it, it is more likely that the pair will overcome the Kijun-sen line. In this case, the price may rush back to its annual lows. In case of a rebound from the critical line, the pair may once again try to grow to the 15th level. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments