Forex analysis review

Forex analysis review |

| Posted: 30 Jan 2022 12:38 AM PST

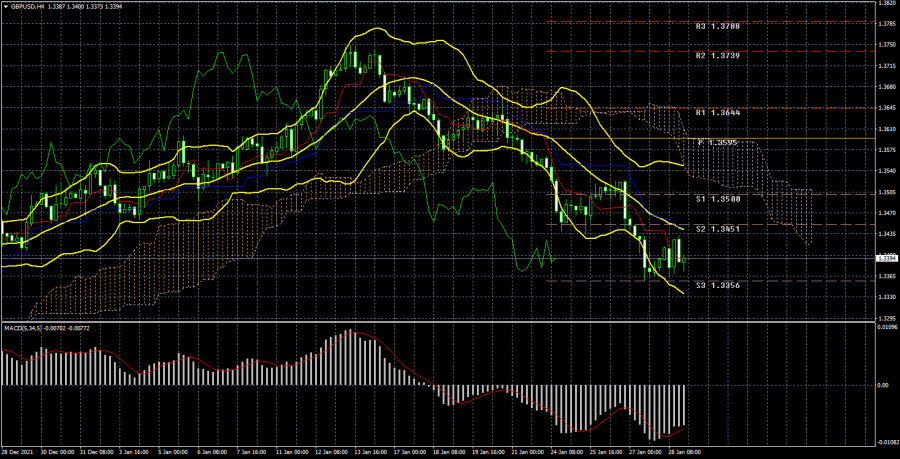

The pound/dollar pair traded the same way as the euro/dollar pair this week. In general, the last two weeks have passed in an identical fall of both currency pairs. Thus, we can make an almost unambiguous conclusion that it is the US dollar that is growing at this time, and not the euro or the pound is depreciating. In principle, it is not difficult to guess why the dollar is growing at this time. After all, by and large, there is now only one factor working in favor of the US currency: the future multiple tightening of the Fed's monetary policy. In principle, this is not even just market expectations, it is practically a fait accompli since the US has no other way to curb inflation. Consequently, the US currency gets an excellent opportunity to continue to grow for a long period. Two factors speak against this scenario. The first is a possible repeated increase in the key rate by the Bank of England. In recent years, there has been an impression that the British economy has slipped almost to the level of Zimbabwe after Brexit. However, as practice shows, the situation in the UK is not much worse than in the same European Union, from where it came out with such pathos a little over a year ago. The Bank of England has now clearly chosen its path of development and is no longer looking back at the ECB or the Fed. However, even if a rate increase of another 0.25% is announced in February, this does not mean that the regulator will raise the rate for the whole of 2022. In the case of BA, it's just more about one or two promotions and that's it. At least, neither Andrew Bailey nor other representatives of the regulator have declared their readiness to start a whole course of raising the key rate. The second factor is the same as the euro. At some point, the markets may fully work out all future Fed rate hikes, so the US regulator may continue to tighten policy, but the dollar will stop its growth in the medium term. Next week, business activity indices in the construction and manufacturing sectors will be published in the UK, and the results of the Bank of England meeting will be announced. As already mentioned, with a probability of 80-90% (judging by current forecasts), the Bank of England will raise the key rate to 0.5%. Moreover, forecasts indicate that all 9 members of the committee will vote "for" the increase. Naturally, such a decision by BA not only can but should provoke the growth of the British currency. Considering that it has been falling for two weeks in a row and non-stop, the correction will not be superfluous. Several important events are planned in the States as well. Next week will generally be very rich in macroeconomic and fundamental events. On Tuesday, the ISM business activity index for the manufacturing sector will be published, on Wednesday - the ADP report on changes in the number of people employed in the private sector, on Thursday - the ISM business activity index for the service sector, and Friday - the unemployment rate and Nonfarm Payrolls. It is hardly necessary to say that the NonFarm Payrolls report is the most important. Over the past two months, it has been much lower than forecast values. This time, forecasts predict an increase in the number of new jobs created outside the agricultural sector by only 150-200 thousand. However, let's recall the words of Jerome Powell: the labor market is now in good condition, and the main thing now is to lower inflation. We also believe that the ISM indices may affect the movement of the pair during the week. In general, almost every day there will be a report or event that can significantly affect the movement of the pound/dollar pair.

Recommendations for the GBP/USD pair: The pound/dollar pair continues a short-term downward trend on a 4-hour timeframe. In general, based on the 24-hour TF, we conclude that the decline may continue, but at least a slight upward correction is needed on the 4-hour TF. In any case, as long as the price is below the critical line, you should sell the pair. Fixing above the Kijun-sen may signal just the correction we talked about. Next week there will be a very strong "foundation" and "macroeconomics", so the pair can often and sharply change the direction of movement. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Jan 2022 12:38 AM PST

The European currency ended last week with a completely logical fall. At this time, it can be concluded that the pair resumed the downward trend after it failed to gain a foothold above the Ichimoku cloud. Thus, theoretically, the strengthening of the US currency may continue this week. And this option remains the most likely scenario. However, next week will be quite rich in various fundamental and macroeconomic events. Therefore, the influence of the "foundation" can be quite strong. Based on this, the euro/dollar pair may not move exactly according to the "technique" or with significant additions to this "technique". However, before analyzing the news calendar for the next week, I suggest once again going through the global fundamental factors. The most important thing to remember now is that it is the US dollar that has the necessary fundamental support. The Fed is ready to raise the rate by 2022 and unload its balance sheet to stop the acceleration of inflation and return it to the value of 2%. And this plan to tighten monetary policy may support the US currency for most of this year. However, it should also be remembered about such a concept as "ahead of the curve". In other words, market participants are already familiar with the Fed's plan for 2022. The development of this plan by the market could have begun long before the start of the implementation of this plan. Consequently, it can be fully taken into account in the euro/dollar exchange rate much earlier than the Fed finishes raising the rate. This is just an assumption because no one can say for sure when the market will fully work out those events that have not even begun yet. At the same time, it is simply not necessary to assume that the dollar will now grow throughout 2022 with a 100% probability. There will be a large number of important events in the European Union next week. The "hit parade" will begin on Monday when the GDP report for the fourth quarter will be published. Recall that in the States, the same indicator increased by 6.9% q/q. Now attention. What is the forecast for GDP for the fourth quarter in the EU? +0.2-0.3% q/q. That is, do you understand how big the difference is at this time between the EU and the US economies? It is not surprising that the ECB does not even think about tightening monetary policy. With such economic growth, it is necessary to continue discussing its stimulation, and not the rejection of incentives and an increase in the rate. However, this is not all that the next week holds in itself. On Tuesday, the index of business activity in the manufacturing sector, as well as the unemployment rate will be published. These are not the strongest indicators, so they are unlikely to interest traders. But on Wednesday, the consumer price index for January will be published and, according to forecasts, inflation is expected to slow down to 4.3%-4.5%. It is difficult to say whether this is good or bad for the euro currency, but the fact that Europe can cope with inflation using the "wait, it will pass by itself" method is a fact. Although the fall in inflation for the euro is probably a negative factor, it further reduces the likelihood of tightening the ECB's monetary policy. The results of the ECB meeting will be announced on Thursday. This is certainly an important event, but it is unlikely that important information will come from it. The parameters of monetary policy will not be changed, so all attention will be paid to the press conference with Christine Lagarde. Here everything will depend on what exactly the ECB head says. On Friday, a report on retail sales will be published, which is also unlikely to interest the markets.

Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair on the 4-hour chart according to the Ichimoku strategy looks extremely eloquent. Over the past two weeks, the pair has been doing nothing but falling. Therefore, after such a strong fall, it would be nice to adjust at least a little. In principle, there will be enough opportunities for a "purely technical correction" next week. The nearest target is the critical line. As long as the price is below it, the downward trend persists, and the dollar can continue to rise in price for almost any period. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments