Forex analysis review

Forex analysis review |

- Visa will not miss the wave of cryptocurrency hype and will launch crypto consulting services

- How to trade GBP/USD on December 9? Simple tips for beginners. The pair is struggling to stay below the trend line

- Euro fired up with hawkish idea, pound leaves monetary distance

- EUR/USD. With an eye on the ECB: bears do not dare to storm down

- USD/CAD throwback post BOC

- GBP/USD imminent upside reversal

- December 8, 2021 : EUR/USD daily technical review and trading opportunities.

- Gold vulnerable after a false breakout

- December 8, 2021 : EUR/USD Intraday technical analysis and trading plan.

- December 8, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

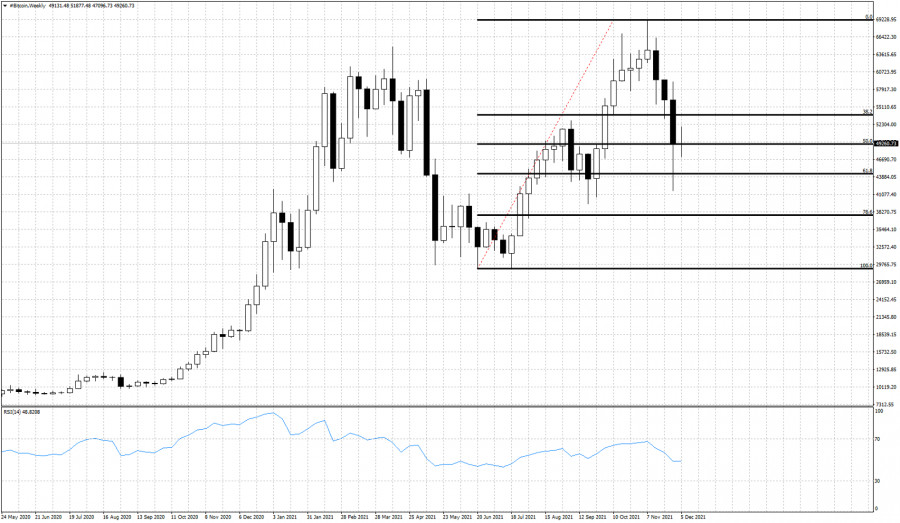

- Bitcoin: Holders don't sell, so what is the reason for the price drop?

- Cryptocurrency traders found new market assessment tool through "Fear and Greed Index"

- Trading signal for BITCOIN on December 08 - 09, 2021: buy above $50,500 (200 EMA)

- Gold confuses traders

- Trading signal for DOW JONES 30 (#INDU) on December 08 - 09, 2021: sell below 35,937 (8/8)

- US Stock market sentiment remains positive

- Bitcoin analysis for December 8, 2021.

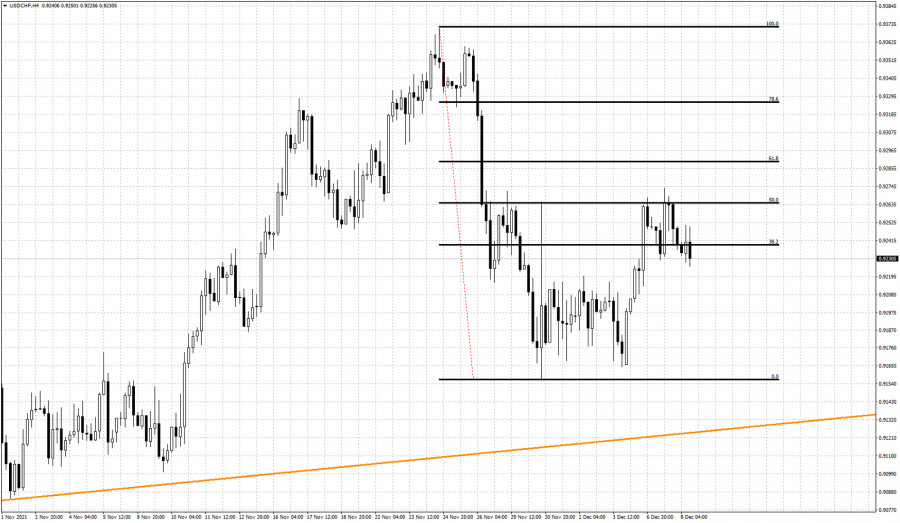

- USDCHF rejected at key Fibonacci retracement.

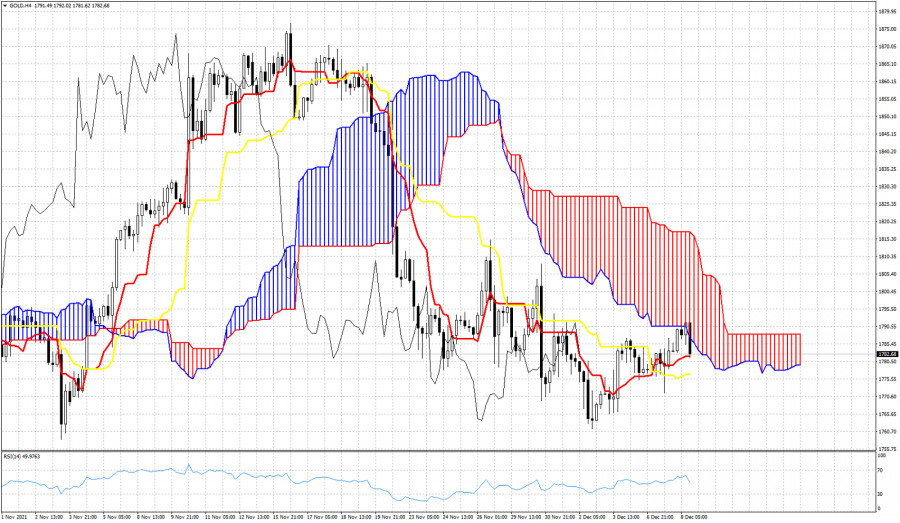

- Gold price gets rejected at cloud resistance.

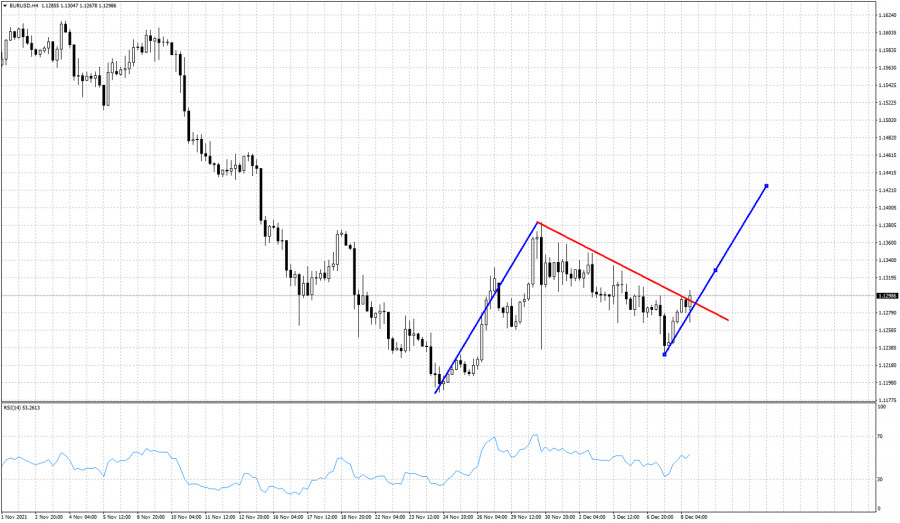

- Short-term bullish signs in EURUSD.

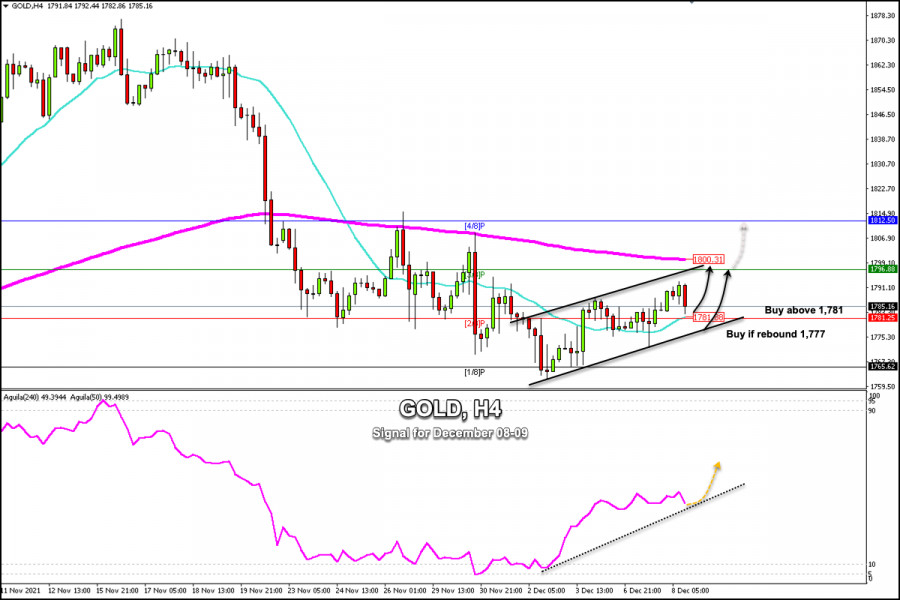

- Trading signal for GOLD on December 08 - 09, 2021: buy above $1,781 (2/8)

- BTC analysis for December 08,.2021 - Downside continuation in the play

- EUR/USD analysis for December 08, 2021 - Fake breakout of the key resistance

- Video market update for December 08,,2021

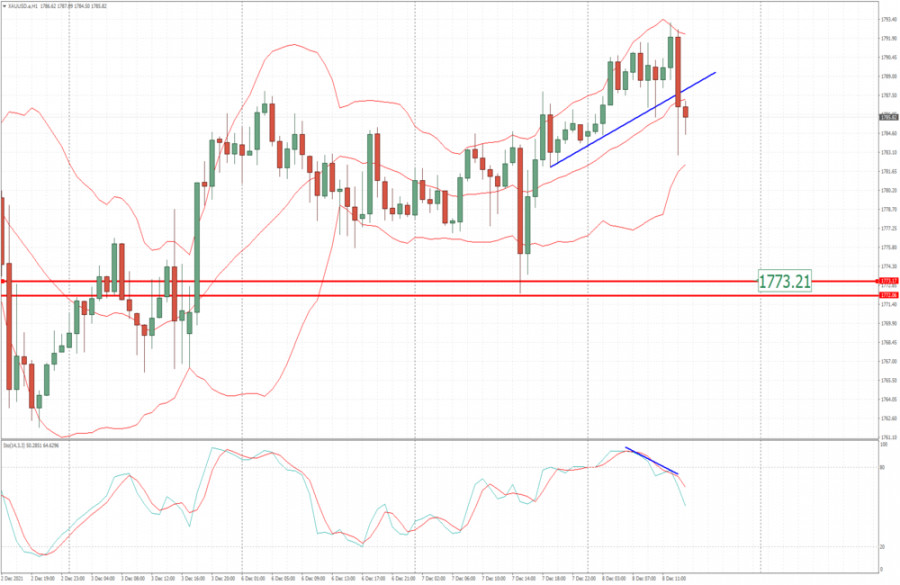

- Analysis of Gold for December 08,.2021 - Breakout of the rising channel

| Visa will not miss the wave of cryptocurrency hype and will launch crypto consulting services Posted: 08 Dec 2021 01:10 PM PST

Of the 6,000 respondents worldwide, 94% knew at least a little about cryptocurrency, while about a third invested or used it as a form of exchange. Visa (NYSE: V) has announced the launch of consulting and advisory services aimed at educating customers about cryptocurrencies and encouraging their scalability. The cryptocurrency consulting business will provide advice to financial institutions, retailers and other firms on all issues related to cryptocurrency, including tokens that cannot be exchanged (NF). The world-famous corporation also develops products for stablecoins, which are virtual coins that are correlated with the value of fiat, for example, the US dollar. "For us, cryptocurrency is a huge new vertical and an opportunity for growth, and we will continue to focus on developing this business moving forward," said Nikola Plecas, Visa's leading European cryptocurrency expert. According to Plecas, for the year ended September 30, Visa made transactions in digital currency worth $3.5 billion using schemes related to cryptocurrencies. Meanwhile, Visa has published a study showing that 94% of the 6,000 respondents worldwide know at least a little about cryptocurrency, and almost a third have conducted transactions, walked, or used it as a form of exchange. This is a huge opportunity for the whole world as Visa can open the way of the shortest road of the crypto market for many citizens from all over the world. Only about 4% of people have only invested in cryptocurrency, so this will greatly help scalability. Visa already cooperates with such a company as crypto.com and they issue their personalized cards for cryptocurrency holders with a different step-by-step reward system. The material has been provided by InstaForex Company - www.instaforex.com |

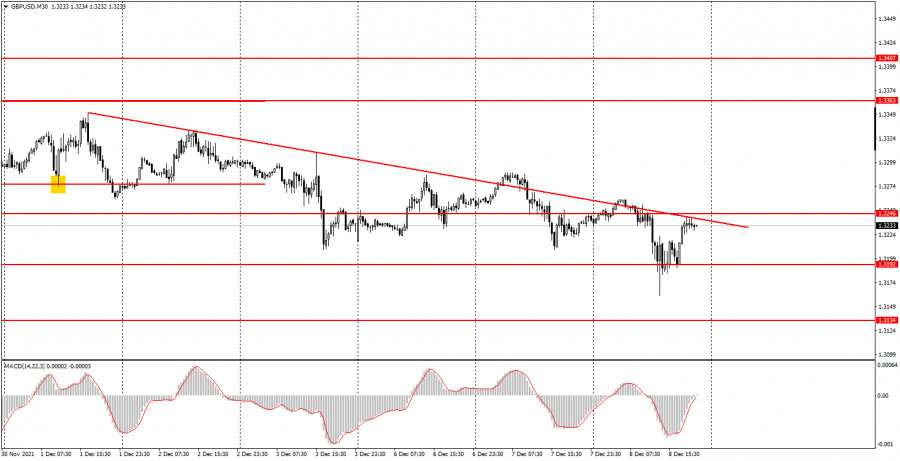

| Posted: 08 Dec 2021 01:10 PM PST Analysis of previous deals: 30M chart of the GBP/USD pair

The GBP/USD pair traded lower on Wednesday and renewed its annual lows. Thus, in general, the pound remains close to them and, therefore, the downward trend continues at this time. However, the trend persists also because traders cannot consolidate the pair above the downtrend line, from which at least six rebounds have already been made. And at this time, the pound quotes are again near this line. If a new bounce follows, then the price may again rush down, as it has done before many times. If traders still manage to settle above the trend line, then, as in the case of the euro currency, the downward trend will be reversed. There were no interesting events and macroeconomic publications in either the UK or the US on Wednesday. Nevertheless, the pair moved quite actively, and in both directions. The volatility of the environment was exactly 100 points. 5M chart of the GBP/USD pair

On the 5-minute timeframe, the movement of the pound/dollar pair was very difficult on Wednesday. This can clearly be seen and without detailed analysis. Nevertheless, let's take a look at these complex movements and understand how one should trade today. The first two sell signals were pretty simple. The price first crossed the 1.3246 level, and then bounced off it. Therefore, beginners could open short positions on these signals. Subsequently, the pair overcame the level of 1.3208, as well as the level of 1.3193 and continued to move downward right up to the level of 1.3160, which was not yet seen today (this is today's low). Thus, a short position should have been closed either by Take Profit 40-50 points, or manually, when the pair settled above the level of 1.3193. One could earn around 30 to 50 points on this trade. Then the pair began to "dance" around the levels 1.3193 and 1.3208. A buy signal (consolidation above the level of 1.3208) should have been ignored, as the pair went up 50 points in 10 minutes. The signal to sell on settling below the level of 1.3208 is also the same, since the price immediately hit the level of 1.3193. The price bounced off the level of 1.3193 twice, then from 1.3208, then again from 1.3193, and only settled above 1.3208 in the middle of the US session. Since the levels 1.3193 and 1.3208 are located very close to each other, all signals about bounces between them should be ignored. The last signal (profitable, by the way) should also be missed, since it was formed too late. How to trade on Thursday: At this time on the 30-minute timeframe, the downward trend persists, although at this time it is already completely ambiguous, since yesterday the downtrend line was broken, and the price bounced off it six times. Thus, today traders can try to overcome it again and change the trend to an upward one. The important levels on the 5 minute timeframe are 1.3160, 1.3193, 1.3208, 1.3246, 1.3260, 1.3286 and 1.3310. We recommend trading on them on Thursday. The price can bounce off them or overcome them. As before, we set Take Profit at a distance of 40-50 points. At the 5M TF, you can use all the nearest levels as targets, but then you need to take profit, taking into account the strength of the movement. When passing 20 points in the right direction, we recommend setting Stop Loss to breakeven. There will be no major events or publications in the UK and America on December 9th. Therefore, the movements may again not be the most pleasant. Basic rules of the trading system: 1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Euro fired up with hawkish idea, pound leaves monetary distance Posted: 08 Dec 2021 01:10 PM PST

The euro and the pound have reversed roles. The pound is now depressed, the likelihood of a decline in the GBP/USD pair to the 1.3100 area by the end of the week is increasing. At the same time, euro bulls began to dream of a hawkish surprise from the European Central Bank. The GBP/USD pair has been quoted at the lowest levels since December 2020. Positive news on Brexit and optimistic comments on the British vaccine failed to cheer up the pound bulls. The local drug Sotrovimab has shown effectiveness in the fight against the new strain. As for the Brexit situation, as it became known, Britain is ready to offer France ways of reconciliation on the issue of fishing. We are talking about an additional agreement that will allow issuing more permits to EU courts. But nothing is nice for the pound, as hopes for tightening policy by the Bank of England are crumbling. The number of people infected with Omicron is growing in the country. For example, 336 cases of the disease were registered on Monday, which is 90 more than the day before. It is unlikely that in the conditions of the deteriorating epidemiological situation, the central bank will decide on an earlier rate increase. Most members of the central bank committee at a meeting on December 16 will decide that they need more time to assess the effects of the new strain. They will vote to keep rates at the historically low level of 0.1% for now. As for the impact of Omicron on gross domestic product, according to most economists, it will be insignificant. Another factor in the decline of the pound is the strong dollar and the Federal Reserve's desire to accelerate the reduction of incentives. The greenback still has chances for further recovery ahead of the release of inflation data. The CPI may have reached a new multi-year peak in November, exceeding 6.7%. On the side of the dollar, the growth of dollar Libor rates on the interbank market. The rate has again updated the 7-month high, which means that bankers have no doubt that the US will quickly curtail the QE program and start raising the rate. It is worth noting that the same interest rates on loans in pounds have fallen. Financiers have stopped believing in a rate hike by the BoE. Technical analysis is also against the pound. The pair's inability to move up reinforces bearish forecasts.

A pullback and a test of levels below 1.3200 will open the way for a fall to the next support near the 1.3125 area, then to 1.3100 and the 1.3050 area. A steady rise above 1.3200 should trigger the closure of short positions on the pound and accelerate the recovery to the 1.3340 zone. Further along the course, the resistance is 1.3370 and 1.3400. The last level acts as a key barrier, its penetration will indicate that the GBP/USD pair has reached the bottom and turned up. The euro has good and bad news, let's start with the bad. The latest report of the ZEW Institute - the index of the current situation in Germany - went into negative territory for the first time in six months. Reduced demand from abroad led to a much larger than expected drop in industrial orders in November. Difficulties with supplies have a negative impact on retail trade, among other things. As a positive, we can highlight the slowdown in the pace of asset purchases by the ECB. Over the past week, the indicator increased by 12.9 billion euros against an increase of 14.7 billion a week earlier. In addition, the ECB has recently been suspected of preparing a surprise for the markets in the form of a rate hike. Why not, the ECB almost always follows the Fed. The refusal at the next meeting to expand the quantitative easing program - APP, together with an increase in the CPI forecast, should support the EUR/USD pair. In this case, instead of the predicted strengthening of the downward trend, there will be an upward reversal of the quote.

The technical picture for EUR/USD is ambiguous, there is potential for further growth, but the sentiment is unstable, and it is not yet possible to assert the fact of a reversal with certainty. The euro has recovered above 1.1300, now we need to develop the upward leap. Support is marked at 1.1265, 1.1220, 1.1185. Resistance - at 1.1310, 1.1345, 1.1380. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. With an eye on the ECB: bears do not dare to storm down Posted: 08 Dec 2021 01:10 PM PST The euro-dollar pair continues to trade on the border of 12 and 13 figures, demonstrating the "disarmament" of both bears and bulls. EUR/USD bears updated the one-and-a-half-week price low yesterday, dropping to the level of 1.1226. But they could not develop their success: the 11th figure turned out to be "too tough for them". The bulls seized the initiative as soon as the downward momentum began to fade. In general, during the first week of December, the pair slowly and gradually slid down, while demonstrating broad upward pullbacks. Traders cannot decide on the vector of price movement, so they do not play "for a long time", taking profits at the first signs of momentum fading. Each side has its own tasks: bulls need to settle within the 13th figure (namely, above the average line of the Bollinger Bands indicator on H4, which corresponds to 1.1330, while bears need to settle at the base of the 12th figure to declare their claims to the 11th figure. However, the prevailing fundamental background does not allow them to fulfill this uncomplicated "mission".

If we look at the weekly EUR/USD chart, we will see that the pair has been steadily declining from the end of October to mid-November, allowing itself only short breaks. Traders have changed the price level of 1.1500-1.1650 to the level of 1.1180-1.1380. If you look at the monthly timeframe, then the trend here becomes more distinct: the pair has been showing a downward trend since the beginning of June, dropping from 1.2254 to a low of 1.1186. This 900-point decrease is due to the divergence of the positions of the European Central Bank and the Federal Reserve. All other fundamental factors, by and large, have played and are playing a supporting role. Now let's go back to the weekly EUR/USD chart. It can be noted that over the past two weeks, the pair has actually been marking time, despite the significant tightening of the rhetoric of Federal Reserve Chairman Jerome Powell, the strengthening of the "hawk wing" of the Fed and the record growth of US inflation. And the latest Nonfarm can be evaluated in different ways – for example, the unemployment rate in the United States fell to a 21-month low (4.2%) in November. Therefore, such indecision of EUR/USD bears looks abnormal. For several months, the pair has been declining on expectations of an early curtailment of QE and a subsequent rate hike. And so, as soon as Powell decided to implement the first part of the hawkish scenario, EUR/USD bears began to show amazing indecision, making only short-term downward "raids". Such an anomaly is most easily explained by the "coronavirus factor". The new Omicron COVID strain in early December really scared many market participants, putting pressure on the US currency (which followed the yield of 10-year treasuries). However, this week the "Omicron factor" has noticeably weakened, against the background of optimistic comments by the chief infectious disease specialist of the United States and representatives of the World Health Organization. What, then, is the reason for the indecision of the EUR/USD bears? In my opinion, the main "culprit" is the ECB. Some experts do not rule out the possibility that at the December meeting the ECB will follow the example of the Fed and tighten its rhetoric. Let me remind you that inflation in the eurozone has reached a record high, having been marked at 4.9%. The strongest CPI growth was recorded in all major economies of the European Union. In particular, in Germany, inflation rose to a 29-year high (6% year-on-year), in France, the indicator broke a 13-year record, rising to 3.4%. It should be noted here that ECB President Christine Lagarde does not tire of repeating the thesis that the increase in inflation is temporary and caused by temporary factors. Until recently, her colleague Powell voiced similar rhetoric, but then he gave up, saying that "it's time to abandon the word "transitional" regarding inflation." At the same time, he announced the early curtailment of QE. It is expected that the pace of reduction of the incentive program will increase from the current $15 billion to $30 billion monthly. Against the background of such an unexpected reversal, some analysts warned that the ECB may also tighten its rhetoric in the foreseeable future. Moreover, the first "alarm bells" in this context have already sounded. For example, the head of the Bank of Estonia and a member of the ECB Council, Madis Muller, said yesterday that the need to increase the volume of APP purchases after March (when the PEPP program ends) "cannot be called obvious." According to him, the growth of European inflation next year may be higher than the target level, and upward risks "prevail". It is noteworthy that a similar position was recently voiced by the head of the central bank of Austria, Robert Holzmann.

Such verbal signals alerted traders. There have been cautious speculations on the market that the ECB will announce at its December meeting that it will end the Emergency Asset Purchase Program (PEPP) in March, but refrain from announcing an increase in the traditional quantitative easing program (APP). It cannot be said that such a result of the December meeting will be hawkish - but the market interprets such a final unequivocally in favor of the European currency. All this suggests that the EUR/USD pair in the medium term (until the end of next week) will be trading within a wide price range. On one side of the scales is the actual tightening of Powell's rhetoric, on the other side of the scales is the alleged tightening of the ECB's rhetoric. The "ceiling" of the corrective pullback is the level of 1.1400 - this is the Kijun-sen line on the D1 timeframe. If the upward momentum begins to fade in this price area, you can consider the option of short positions to the level of 1.1250 (the lower line of the Bollinger Bands on the H4 timeframe). Most likely, the pair will trade in this 150-point range before the announcement of the Fed and ECB verdicts. The material has been provided by InstaForex Company - www.instaforex.com |

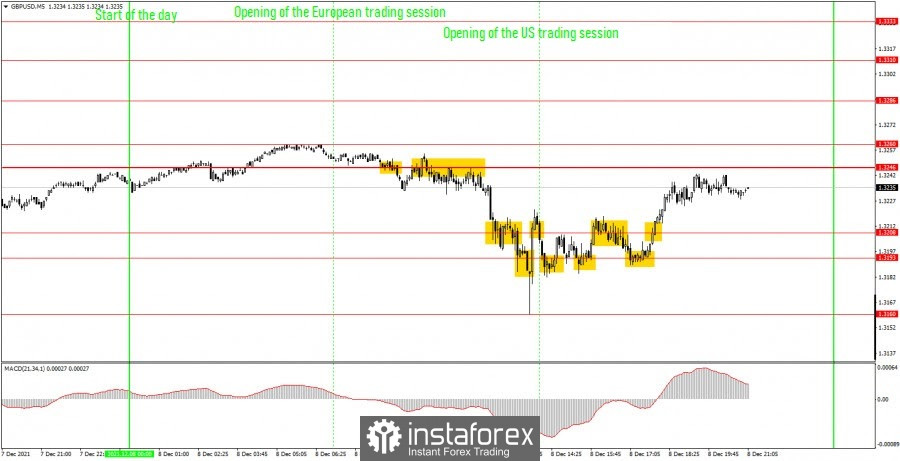

| Posted: 08 Dec 2021 12:45 PM PST The USD/CAD pair rebounded and at the moment of writing it was traded at 1.2647 level above the 1.2606 today's low. After its massive drop, a temporary rebound was natural. Still, in the short term, the bearish pressure remains high, so the currency pair could extend its drop. Technically, it could only test and retest the near-term resistance levels before dropping deeper. USD/CAD turned to the upside after the BOC statement. As you already know, the Bank of Canada maintained its monetary policy unchanged. The Overnight Rate remained steady at 0.25% matching expectations. USD/CAD bearish bias

As mentioned above, USD/CAD was too overbought, so the current rebound is natural and it was expected. It has found support on the 50% Fibonacci line of the Ascending Pitchfork. Now, it continues to stay near the weekly S2 (1.2658). Still, as long as it stays below the Descending Pitchfork's median line (ml) USD/CAD could drop deeper. In the short term, the DXY is bearish, so it's hard to believe that the pair could develop a larger swing higher. USD/CAD predictionThe rebound could be only a temporary one. USD/CAD could drop again as long as it stays under the S2 and below the Descending Pitchfork's median line (ml). The rebound could help the sellers to catch a new sell-off. The USD/CAD pair signaled a downside movement after failing to close and stabilize above the 1.2836. The inside sliding line (SL) stands as a major downside obstacle. You should be careful these days as the US inflation data is likely to have a high impact. The material has been provided by InstaForex Company - www.instaforex.com |

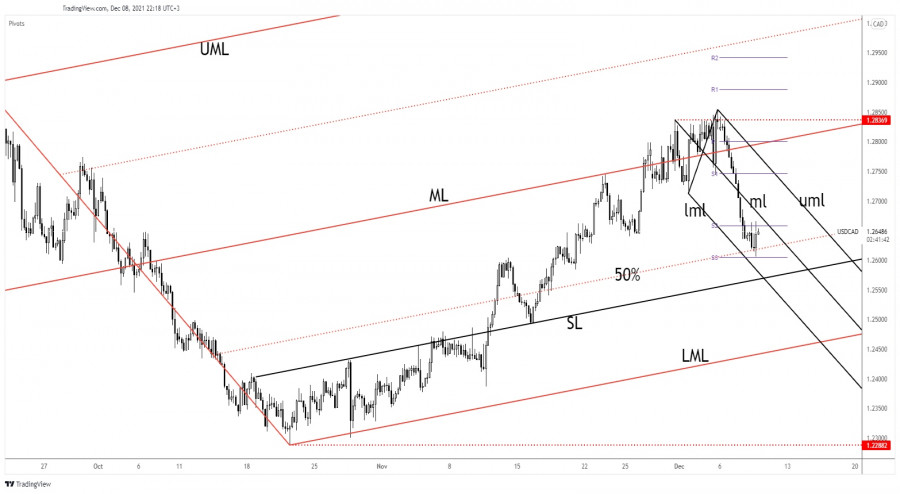

| GBP/USD imminent upside reversal Posted: 08 Dec 2021 12:43 PM PST

GBP/USD sellers seem exhaustedThe GBP/USD pair continues to stay near the downtrend line which stands as dynamic resistance, like an upside obstacle. It has failed to stabilize under the 1.3228 previous low and now it is about to reach and retest the downtrend line again. GBP/USD failed to come back to test and retest the channel's downside line announcing that the price could be oversold and that the sellers could be exhausted. GBP/USD trading conclusionStaying near the downtrend line may signal that the GBP/USD could jump above it. An upside breakout could signal an upside reversal and could bring new buying opportunities. On the other hand, staying below the downtrend line and dropping below the 1.3215 today's low could activate a further drop. The channel's downside line is seen as a major downside target. The material has been provided by InstaForex Company - www.instaforex.com |

| December 8, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 08 Dec 2021 11:16 AM PST

During the past few weeks, the EURUSD pair has been trapped within a consolidation range between the price levels of 1.1700 and 1.1900. In late September, Re-closure below the price level of 1.1700 has initiated another downside movement towards 1.1540 which managed to hold prices for a short period of time before another decline took place towards 1.1200. Currently, the price zone around 1.1500 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon any upcoming ascending movement. Moreover, it is not advised to add new SELL Entries as the pair already looks oversold. The material has been provided by InstaForex Company - www.instaforex.com |

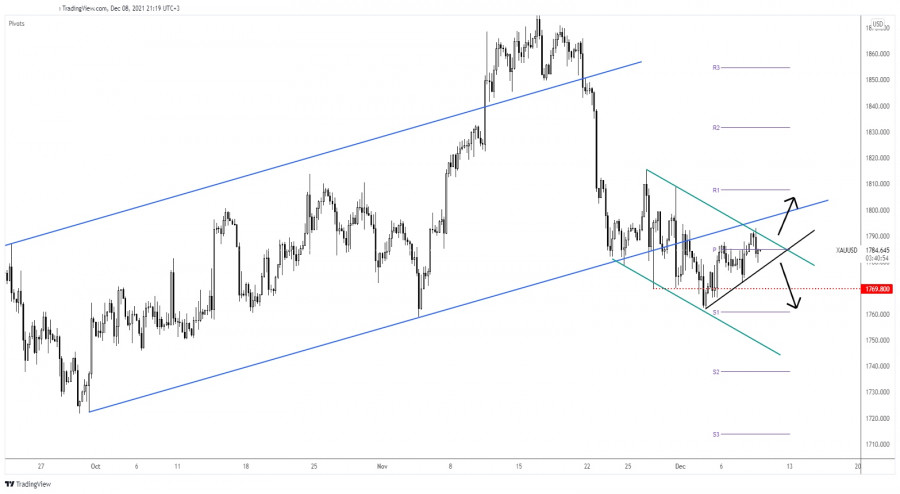

| Gold vulnerable after a false breakout Posted: 08 Dec 2021 11:15 AM PST Gold climbed higher in the short term after failing to stabilize under the 1,769.80 former low. At the moment of writing, it was seen at 1,785.30 far below 1,793.15 today's high. The Dollar Index is strongly bearish, that's why the US dollar falls versus its rivals. USD's further depreciation could help the yellow metal to grow. In the short term, gold could change little. Traders are likely to be focusing on the United States inflation data. The CPI and the Core CPI figures will be released on Friday and may shake the markets. XAU/USD at crossroads

XAU/USD reached the downtrend line but it has registered only a false breakout with great separation through this level. Now, it's fighting hard to be able to stay near the weekly pivot point of 1,784.87. As long as it stays above the immediate uptrend line, gold may try again to take out the dynamic resistance represented by the downtrend line. The major uptrend line stands as dynamic resistance, an upside obstacle. XAU/USD outlookStaying under the downtrend line and dropping below the minor uptrend line could open the door for a new downwards movement. On the contrary, staying above the minor uptrend line and making a valid breakout through the downtrend line could signal potential further growth. The material has been provided by InstaForex Company - www.instaforex.com |

| December 8, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 08 Dec 2021 11:15 AM PST

The bullish swing that originated around 1.1650 in August, failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was reached. Shortly after, significant bullish recovery has originated upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which stood as an Intraday Support zone. Hence, sideway movement was demonstrated until quick bearish decline occurred towards 1.1200. Please note that any bullish movement above 1.1500 should be considered as an early exit signal to offset any SELL trades. The price levels around 1.1520 remain a reference zone that needs to be re-visited when the current bearish momentum ceases to exist. The material has been provided by InstaForex Company - www.instaforex.com |

| December 8, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 08 Dec 2021 11:14 AM PST

The GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline. On the other hand, the nearest SUPPLY level was located around 1.4000 where bearish rejection and a valid SELL Entry was anticipated. Bearish breakout below 1.3680 enabled further bearish decline towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement. This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.3720 which was temporarily bypassed. Shortly after, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market. Currently, the short-term outlook remains bearish as long as the pair maintains its movement within the depicted channel below 1.3400. More bearish extension was expected towards 1.3220 where the lower limit of the current movement channel came to meet with Fibonacci level. Conservative traders should be looking for BUY trades around these price levels. On the other hand, the price level of 1.3570 stands as a key-resistance to be watched either for bearish reversal or a continuation pattern upon any upcoming visit. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin: Holders don't sell, so what is the reason for the price drop? Posted: 08 Dec 2021 09:39 AM PST Hopes for a V-shaped recovery in Bitcoin have not been met yet. At least now, it has not yet been possible to pass the zone of $52,000 - $53,000 per coin. Therefore, a scenario of sideways dynamics within the corridor of $48,000 - $52,000 is more likely, the resistance level of which was confirmed by the main cryptocurrency with a rebound down. But this scenario is not the worst development of events. Mike Novogratz: Bitcoin will not fall below $40,000Galaxy Digital CEO Mike Novogratz, a well-known bitcoin supporter and crypto tycoon, said Wednesday that he would be surprised if the main cryptocurrency dropped below $40,000 per coin. Specifically, as support, he named the same level of $42,000, which was mentioned in Tuesday's forecast and is clearly visible on the chart. If a consolidation above the mentioned level occurs, it will lead to a significant shift in market sentiment. But not everyone is so optimistic. For example, investor Louis Navellier recently stated that Bitcoin could drop to $10,000 if it breaks the $28,500 support level. This is the border that kept the price during the summer fall in the crypto market. Good news: Bitcoin hashrate recoversWhile the price of the main cryptocurrency remains under pressure, an inside look shows a more optimistic picture of the market. Hashrate, the leading indicator of the overall state of the Bitcoin network, has improved significantly over the past six months. If we evaluate the dynamics from its lows reached in May at the height of the Chinese repression, the BTC hashrate has recovered by more than 93%. As of Wednesday, its level has reached 172 Exahash/s, while the record maximum is still close at hand at 180 Exahash/s. Glassnode notes that the network hash rate dropped by more than 50% in May after China banned BTC mining. Since then, it has risen 93% from lows, reaching 172 Exahash/s by Wednesday. Holders don't sell bitcoin. Why then did the price fall?What does it mean? With the growth of the hashrate, the overall profitability of the leading miners of the main cryptocurrency has also increased. The hash rate dynamics affects the supply of cryptocurrencies in the market. Since May 2021, the supply of bitcoins on the leading digital exchanges has declined. Long-term holders now store their coins in cold digital wallets. Now, according to Glassnode, bitcoin holders are not behaving the way they did in previous moments of market weakness. This hints at their confidence and largely confirms that the fall in price was more due to the derivatives market than to spot sales.

|

| Cryptocurrency traders found new market assessment tool through "Fear and Greed Index" Posted: 08 Dec 2021 09:21 AM PST The relatively young cryptocurrency sector continues to develop, acquiring its own instruments. The traditionally meager stock of criteria for evaluating the token market has now been replenished with its own "fear and greed" index. Progressive crypto enthusiasts are now breaking spears in heated battles about the reasons for the 21% drop across the entire web of tokens, including Bitcoin, and to a slightly lesser extent Ether.

In particular, it became known that they are actively promoting the new fear and greed index via Twitter and other social networks to reinforce the view that the recent price drop is actually a great opportunity to support Bitcoin. Recall that in traditional markets, fear and greed indicators are an indicator of investor sentiment based on factors such as volatility, momentum, and demand. The crypto version developed by Alternative.me should help traders and investors determine if traders are overly optimistic (greed polarity) or bearish (fear polarity). Unlike a traditional index, the crypto VIX takes into account several other factors - typically informational, such as social media trends and Google searches. The index ranges from 0 ("Extreme fear") to 100 ("Extreme greed"). It currently stands at 25. When Bitcoin hit an all-time high of nearly $69,000 last month, it was around 80. Crypto VIX traders interpret the index, as well as the relatively lower bitcoin price, as being oversold and that prices are about to rebound and go to "the moon," said Troy Wiipongwii of the blockchain research lab at William & Mary University. The index images posted on Twitter are referred to by some as "sexy" and replace the word "fear" in the image with the word "buy". Many private crypto investors are in favor of the index. "We have so little information about cryptocurrencies that this 'fear and greed' index becomes important for understanding market sentiment," says Ali Yilmaz, an investor. "I buy fear and sell greed." Bitcoin enthusiasts have used a number of reasons in the past to explain why falling Bitcoin prices are perfectly normal, including comparing it to previous bull races or saying that volatility is part of the digital currency's DNA. The experts also shared several unexpected reasons that could trigger the recent drop in BTC and altcoins. Indeed, the market has long been ripe for the introduction of its own tools that will help players assess the market situation quickly and efficiently. However, in this index, an attempt to interpret any drop in digital coins as a reason for buying is alarming. Obviously, this is a clear attempt by the developers and fans of the index to stimulate demand in times of correction. Interestingly, with wider distribution, this index can indeed induce many to buy on the downturn, which means it can really influence the quotes in the future. In addition, while experts say the index can technically be a marker of market sentiment, it has serious flaws. "Ultimately, no indicator or index can fully predict market movements," Wiipongwii said. Indeed, as the market role of Bitcoin and other altcoins changes, it is clear that their relationship with macro factors will change. Index developers will have to constantly introduce new calculation algorithms to keep the index up to date. The material has been provided by InstaForex Company - www.instaforex.com |

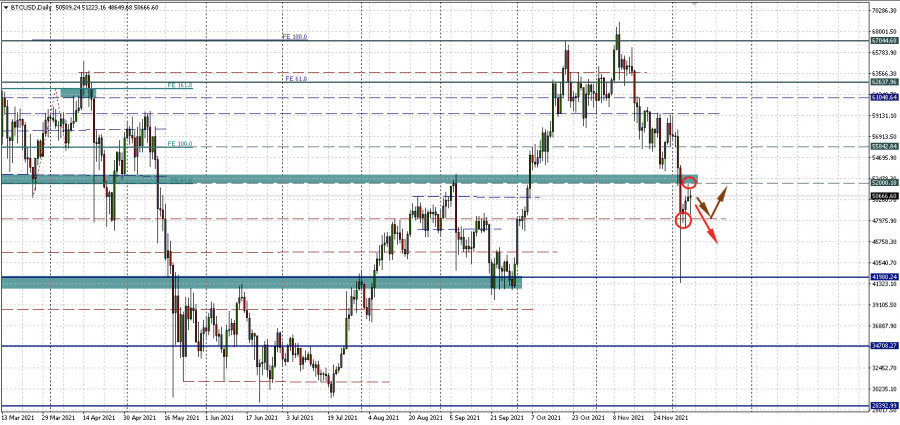

| Trading signal for BITCOIN on December 08 - 09, 2021: buy above $50,500 (200 EMA) Posted: 08 Dec 2021 07:28 AM PST

After the sudden drop on December 4, BTC has entered a constant recovery phase. Altcoins also follow the flagship cryptocurrency. Bitcoin is likely to continue to recover from the loss of more than 30%, only if it consolidates above the psychological level of $ 50,000. At the beginning of the American session, it is trading at 49,107. This represents a negative signal. If the crypto carries on trading below the 200 EMA and below 0/8 of Murray, more falls are expected in the next few days. The short-term resistance barrier that BTC wants to test at 55,201, (21 SMA) remains the target for the bulls. If Bitcoin trades above 50,200 in the next few hours, we will have an opportunity to buy with targets at 55,200 and up to 1/8 of a Murray at 56,250. If BTC breaks above the 55,200 level, it could again reach the psychological level of 60,000 and climb up to the all-time high of 68,962. On the contrary, as long as it remains below the 21 SMA and the 200 EMA, the crypto is expected to decline to -1/8 Murray at 43,750 and down to the psychological level of 40,000. The eagle indicator touched the extremely oversold level around 5 points. Therefore, Bitcoin is expected to continue the technical rebound and may reach the resistance of 56,250 in a few coming days. Support and Resistance Levels for December 08 - 09, 2021 Resistance (3) 53,365 Resistance (2) 52,621 Resistance (1) 50,773 ---------------------------- Support (1) 48,924 Support (2) 47,827 Support (3) 43,750 *********************************************************** A trading tip for BTC on December 08 - 09, 2021 Buy above 50,500 (200 EMA) with take profit at 55,201 (21 SMA) and 56,250 (1/8), stop loss below 49,100. The material has been provided by InstaForex Company - www.instaforex.com |

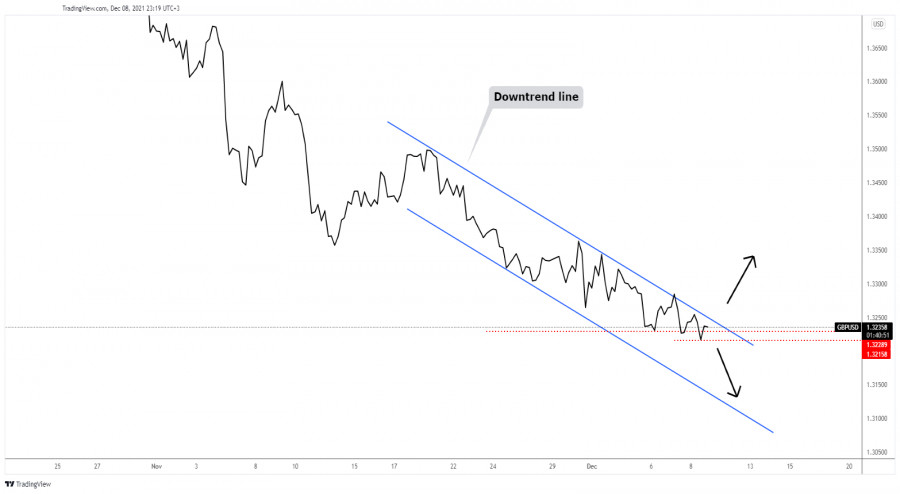

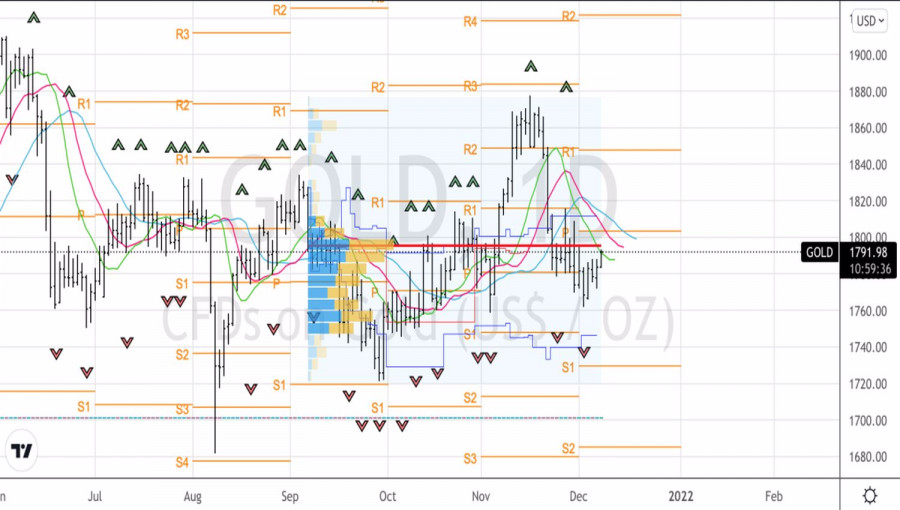

| Posted: 08 Dec 2021 07:06 AM PST The gold market has always been full of paradoxes. December is no exception. Investors are awaiting the release of U.S. inflation data, the acceleration of which should push the Fed to aggressive monetary restrictions, which will strengthen the U.S. dollar and weaken the precious metal. But XAUUSD quotes are growing. Increasingly, Omicron is presented in the news as a virus harmless to Humanity, which should reduce the demand for safe-haven assets, but gold is growing. The precious metal baffles investors, although they continue to pick up the keys to it. According to Metals Focus, the main drivers of the decline in XAUUSD in 2022 will be expectations of an increase in the federal funds rate and a rally in the nominal yield of U.S. Treasury bonds. While low real rates on U.S. debt, new strains of COVID-19, and fears of stagflation will keep gold afloat. According to SaxoBank, the precious metal now looks like a dead in the water metal - and it cannot come to life, that is, rewrite record highs, and does not go to the bottom. Historically, at this stage of the economic cycle, the recovery stage, gold felt out of place. Central banks abandoned the previously introduced monetary incentives, investors were looking for more attractive assets, XAUUSD quotes were falling. The speed of normalization of monetary policy was of great importance. The fear of the Fed's inaction, despite high inflation, was a favorable environment for the precious metal. On the contrary, the aggressively-minded Federal Reserve made it throw the white flag. That is, it was not inflation that determined the dynamics of XAUUSD, which is proved by their correlation, but the way the U.S. Central Bank viewed inflation. Dynamics of inflation in the USA and gold

In this regard, U.S. President Joe Biden's focus on combating high consumer prices and the Fed's willingness to help the president speak of only one thing: hard times will soon come for gold. The year 2021 may be the first of the last three years that it closes in the red zone. But these are just flowers, we will see berries in 2022. Two or three increases in the federal funds rate will be a guilty verdict for the bulls on XAUUSD. And already on December 14-15, after the FOMC forecasts were raised, they will feel the full power of the strong dollar and the growing yields of U.S. Treasury bonds. All the more surprising are the first positive inflows to precious metal-oriented ETFs in November since July. According to the World Gold Council (WGC), investors have increased their stocks of specialized exchange-traded funds on a net basis by 13.6 tonnes. Strange, not uncritical. To be honest, it's a drop in the bucket for expecting a serious pullback in XAUUSD. In my opinion, the best times for precious metals are in the past. Fed Chair Jerome Powell and his colleagues intend to resolutely fight inflation, which will lead to higher Treasury yields and the strengthening of the U.S. dollar. And in such an environment, the analyzed asset, as a rule, does not feel at ease. A technically unsuccessful test of the fair value at $1,795, as well as dynamic resistances in the form of moving averages near $1,805 and $1,812 per ounce, should be used for selling. Gold, Daily chart

|

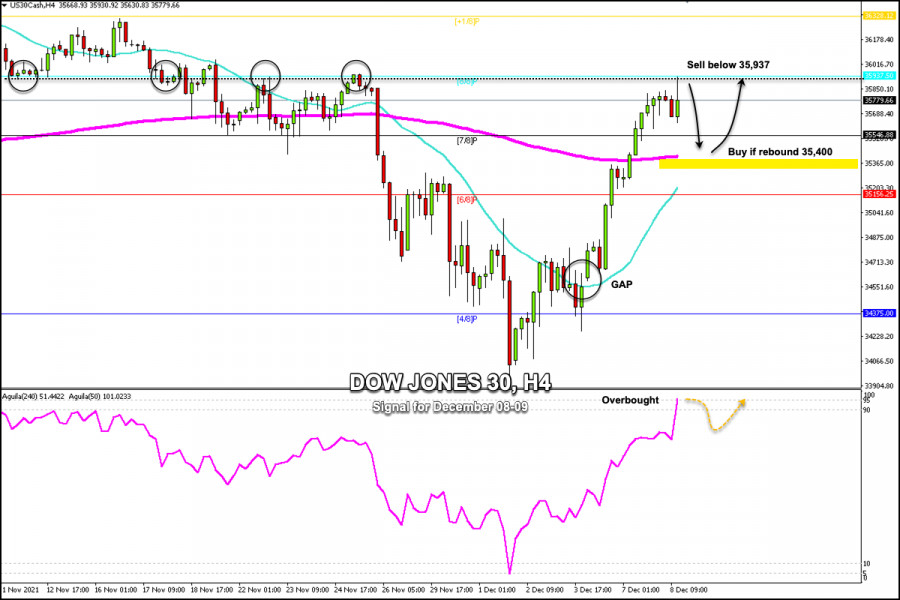

| Trading signal for DOW JONES 30 (#INDU) on December 08 - 09, 2021: sell below 35,937 (8/8) Posted: 08 Dec 2021 06:31 AM PST

On December 7, the Dow Jones 30 (#INDU) managed to break the EMA 200 and quickly reached the resistance zone of 8/8 Murray. The 35,937 zone and the psychological level of 36,000 are located at 8/8 of Murray. In the past, it acted as strong resistance. As you can see, we have circled the attempts to break this zone on the 4-hour chart. Therefore, we expect that below this resistance, the DJ30 can make a technical correction and fall towards the 200 EMA located at 35,450. A technical bounce around the 200-day moving average will give us an opportunity to buy the Dow Jones with targets towards the psychological level of 36,000. If it surpasses this resistance, it could reach the 36,328 zone of +1/8 of Murray, which represents extreme overbought. The eagle indicator reached the 95-point zone,which represents extreme overbought. It is imminent that in the next few hours there will be a technical correction of the Dow Jones. Therefore, you can sell below 8/8 of a Murray with targets at 34,400. Considering that 35.937 is a strong resistance level and the 200 EMA (35,400) is a strong support level, it is expected that the DJ30 may rebound and consolidate in the next few days between the mentioned levels. If it breaks down within the zone above Murray's 8/8 and trades above this resistance, the bullish move to 36,350 is expected to continue. On the contrary, below the 200 EMA, the Dow Jones could resume its bearish movement and fall until covering the GAP that it left at the beginning of this week. Our trading plan for the next few hours is to sell below the 8/8 Murray and wait the technical bounce around the 200 EMA at 34,400. The eagle indicator is showing an overbought signal and could support our bearish strategy. Support and Resistance Levels for December 08 - 09 2021 Resistance (3) 36,328 Resistance (2) 36,219 Resistance (1) 36,004 ---------------------------- Support (1) 35,546 Support (2) 35,390 Support (3) 35,252 *********************************************************** A trading tip for DJ30 on December 08 - 09, 2021 Sell below 35,937 (8/8) with take profit at 35,400 (200 EMA), stop loss above 36,070. Buy in case of a rebound at 35,400 (200 EMA) with take profit at 35,750 and 36,000 (8/8), stop loss below 35,340. The material has been provided by InstaForex Company - www.instaforex.com |

| US Stock market sentiment remains positive Posted: 08 Dec 2021 05:47 AM PST

Yesterday, the US stock indices closed with a rise. Thus, the Dow Jones Industrial Average added 1.4%, the Nasdaq Composite increased by 3.03%, and the S&P 500 advanced by 2.07%. Positive market sentiment was first of all caused by the fresh news about the new virus strain. Experts suppose that Omicron is not as dangerous as they thought earlier. It means that there is no need to introduce tight restrictive measures that could have affected the global economy. Among the components of the Dow, shares of American Express Co. (+3.90%), Apple Inc. (+3.54) and Salesforce Inc. (+3.20%) added more than others did. The biggest losses were recorded in the share price of such companies as Merck & Company Inc. (-1.55%), Verizon Communications Inc. (-0.55%) and 3M Company (-0.36%). Among the components of the S&P 500 index, shares of Fortinet Inc., NVIDIA Corp., and AutoZone Inc. showed positive dynamic, adding 8.63%, 7.96%, and 7.71% respectively. The negative dynamic was recorded in the shares of such companies as Comcast Corp, which fell by 5.29%, and Charter Communications Inc. and Western Union Co., which lost 3.32% and 2.80% respectively. The stock price of AutoZone Inc. reached a record high amid a 25% increase in the company's profit in the previous quarter. Some components of the NASDAQ Composite showed the largest increase in the value of their securities. They are Ensysce Biosciences Inc. (+136.30%), Siyata Mobile Inc. (+66.67%), and Trupanion Inc. (+39.03%). Insignia Systems Inc. (-31.03%), AeroVironment Inc. (-27.48%) and Healthequity Inc. (-24.60%) showed the worst performance. At the New York Stock Exchange, the number of shares that gained in price (2,623) significantly exceeded the number of shares that became cheaper (665). The situation is similar at the NASDAQ stock exchange, where shares of 2,936 companies jumped, and shares of 900 companies fell. The share price of some companies reached maximum values, whereas the value of others dropped to their lows. Thus, shares of Trupanion Inc. reached a record high of 155.41. At the same time, AeroVironment Inc. shares slumped to this year low of 57.98. The value of Healthequity Inc.'s shares also fell to the low of 42.73. The price of Vir Biotechnology shares increased by 3.5% thanks to the company's announcement about positive results of laboratory testing of a new type of coronavirus treatment, which was developed jointly with GlaxoSmithKline. Shares of Tesla Inc. advanced by 3.5% following the previous collapse of 11.9%. It is reported that the Securities and Exchange Commission has launched an investigation into the company's production of solar panels. Thanks to the upwardly revised outlook for Wells Fargo & Co. and The Goldman Sachs Group Inc., the value of their securities increased by 2%. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for December 8, 2021. Posted: 08 Dec 2021 05:42 AM PST Bitcoin is balancing around $50,000 after the sharp weekend decline towards $40,000 and the following bounce towards $52,000. On a weekly basis there is no real progress as price is exactly at the same level we started the week.

Bitcoin has so far retraced more than 61% of the entire rise from $29,000 lows. Price is now at the 50% retracement. Failure to hold above the 61.8% level and a break below recent lows, will be a very bearish sign. Bulls want to see price move higher and break above the short-term resistance at $53,000 which was previously support. Recapturing this resistance level would be an important win for bulls. As long as price is below $53,000, we consider price to be vulnerable to more downside. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCHF rejected at key Fibonacci retracement. Posted: 08 Dec 2021 05:36 AM PST USDCHF is now trading around 0.9226 after reaching as high as 0.9273 after the 0.9156 low. On a weekly basis price continues to hold above the key upward sloping support trend line, now found at 0.9125. In the near term, the rejected at the 50% retracement and the decline below the 38% level is not a good sign for bulls.

Black lines -Fibonacci retracement levels USDCHF could very well have finished the counter trend bounce after the decline from 0.9372 to 0.9156. Price has retraced so far until the 50% level and is now turning lower. This is not a good sign. Support remains at recent low of 0.9164 and a break below it will increase chances of breaking below the major support trend line at 0.9125. Currently it seems more likely that price has formed a lower high at 0.9273 and we resume the downtrend. I believe USDCHF is vulnerable to a move lower towards 0.9125 at least. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price gets rejected at cloud resistance. Posted: 08 Dec 2021 05:27 AM PST Gold price is trading around $1,782 after getting rejected at the lower cloud boundary at $1,790. Gold bulls are not strong enough to keep price inside the cloud and change short-term trend. Price is now testing the $1,780 tenkan-sen (red line indicator) support.

|

| Short-term bullish signs in EURUSD. Posted: 08 Dec 2021 05:23 AM PST Eurusd made a low at 1.1228 and is now above 1.13. Price has broken the short-term resistance levels we mentioned in our last Ichimoku cloud analysis and is now ready to make a higher high. The short-term resistance trend line is broken and price has formed a higher low from which we expect price to move higher towards 1.1440.

Blue lines - expected size of upward move to follow EURUSD is breaking above the red resistance trend line. This is a bullish sign. Next resistance is recent high at 1.1383. Breaking above it, will confirm that we are heading towards our bullish target of 1.1440 at least. As we mentioned many times the last couple of weeks, EURUSD at 1.12-1.13 area is expected to form a major low and start a strong upward move. We continue to believe this is not the time to be bearish EURUSD. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading signal for GOLD on December 08 - 09, 2021: buy above $1,781 (2/8) Posted: 08 Dec 2021 05:19 AM PST

Gold (XAU / USD) is trading above the support of 2/8 Murray and above the 21 SMA. From the low of 1,761, gold is rebounding, having formed an uptrend channel. At this moment, it is trading at 1,785. The correction could slow down around 1,781 or 1,777. If a rebound occurs around 2/8 Murray or at the bottom of the uptrend channel, gold could resume its upward movement and reach the EMA of 200. Optimism around the less severe effects of the new Omicron variant has caused the safe-haven US dollar to fall. Instead, the price of gold hit new weekly highs, also benefiting from weak Treasury yields. Investors are awaiting the policy decision that the Federal Reserve will make next week. For this, the inflation data that will be published on Friday in the US will be important. Given that it is now above the 21-moving average, the yellow metal is likely to try to break the top of bullish channel and the EMA of 200, and thus to rise to the zone of 4/8 Murray around 1,812.50. Above 1,800 (200 EMA), gold could gain momentum and will get more attractive to investors. Above this level, the road will have no obstacles to climb to 1,812. If this level is surpassed, the final target of 1,843 will be reached. On the contrary, if XAU / USD weakens and trades below 1,773, it is likely that the downward pressure will again push it down to the low of 1,765 (1/8) and if it breaks this support towards the psychological level of 1,750. Our trading plan for the next few hours is to buy gold as it consolidates above 2/8 Murray at 1,781 or if the pirce rebounds at 1,777 (uptrend channel) with targets at 1,800 (200 EMA) and through 1,812. The eagle indicator is showing a positive signal, which confirms our bullish strategy. Support and Resistance Levels for December 08 - 09 2021 Resistance (3) 1,807 Resistance (2) 1,796 Resistance (1) 1,790 ---------------------------- Support (1) 1,774 Support (2) 1,775 Support (3) 1,758 *********************************************************** A trading tip for GOLD on December 08 - 09, 2021 Buy above 1,781 or in case of a rebound off at 1,777, with take profit at 1,800 (20 EMA) and 1,812 (4/8), stop loss below 1,773. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for December 08,.2021 - Downside continuation in the play Posted: 08 Dec 2021 04:26 AM PST Technical analysis:

BTC has been trading downside today after the very weak close daily close yesterday. I see further downside continuation. Trading recommendation: Due to strong selling pressure today and the downside trend in the background, my advice is to watch for selling opportunities on the rallies. Downside targets are set at the price of $47,285 and $42,240. Stochastic is showing fresh bear cross , which is another sign and confirmation for the downside rotation. Resistance level is set at the price of $52,000 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for December 08, 2021 - Fake breakout of the key resistance Posted: 08 Dec 2021 04:22 AM PST Technical analysis:

EUR/USD has been trading downside today. There was fake breakout move of the 1,1298. Potential for the further downside movement.... Trading recommendation: Due to fake breakout of the resistance at the price of 1,298, I see potential for further drop. Watch for selling opportunities on the rallies with the next downside targets at 1,1235 and 1,1227. Stochastic is showing fresh bear cross and bearish divergence, which is another sign and confirmation for the downside rotation. Key resistance is set at the price of 1,1300 The material has been provided by InstaForex Company - www.instaforex.com |

| Video market update for December 08,,2021 Posted: 08 Dec 2021 04:17 AM PST Watch for upside continuation on dollar index.... The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for December 08,.2021 - Breakout of the rising channel Posted: 08 Dec 2021 04:16 AM PST Technical analysis:

Gold has been trading downside this morning and I see potential for further downside continuation. Trading recommendation: Due to breakout fo the rising channel and the bearish divergence in the background, watch for selling opportunities on the rallies. The downside target is set at the price of $1,773 Stochastic is showing fresh bear cross and bearish divergence, which is another sign and confirmation for the downside rotation. Key resistance set at the price of $1,793 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments