Forex analysis review

Forex analysis review |

- Bloomberg: Bitcoin will not fall lower.

- Investors' attitude towards bitcoin changed in 2021. Bitcoin was trapped inside a side channel.

- GBP/USD. Preview of the new week. Omicron continues to advance, but the pound sterling is trading according to "its own rules".

| Bloomberg: Bitcoin will not fall lower. Posted: 26 Dec 2021 07:12 AM PST

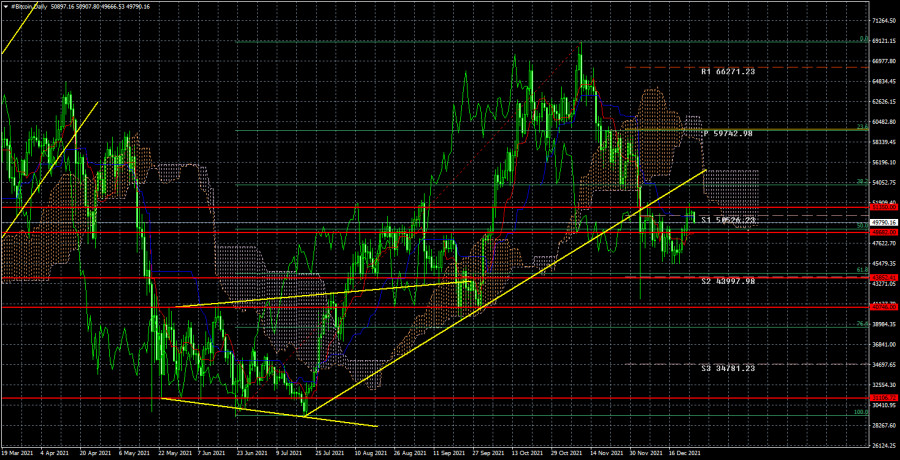

From a technical point of view, the "bullish" trend for bitcoin is broken. Although the absolute majority of cryptocurrency market experts do not believe in this. However, the BTC price has consolidated below the ascending trend line, so we expect a new drop in the cryptocurrency exchange rate. We also remind you that all the forecasts that speak about the growth of bitcoin, absolutely easily and calmly may not come true. Just recently, there was a resonant story: PlanB analysts and its Stock-to-flow model made a mistake and the level of $ 100,000 in 2021 was not taken. The price did not even approach it, so it is hardly possible to talk about a small error in this forecast. The analyst himself, who is quite well-known and popular on the web, immediately stated that his model was a little wrong, but he expects that this level will be reached in the first three months of next year, and in the future bitcoin may rise to $ 288,000 in the future. Therefore, in principle, absolutely any forecast does not guarantee anything to traders. Therefore, we still recommend carefully considering the technical aspects of bitcoin's movement. Mike McGlone: Bitcoin is still in a bull market. Now let's pay attention to the forecast of Bloomberg's leading strategist Mike McGlone, who stated that bitcoin will not fall below $ 45,000 and that this is the new "bottom" of the market. According to a world-renowned expert, in the near future, the crypto asset will again enter the growth stage and reach the level of $ 70,000 per coin. He also recalled that by the end of 2021, bitcoin had risen in price by 66%. "Bitcoin seems to be heading towards $100,000. Adjusted and updated bull market – this is the state bitcoin is in by 2022. We consider the growth of cryptocurrencies as a matter of time," McGlone said. But trader Tom Weiss at the same time said that bitcoin will drop to $ 20,000 in the near future. According to Weiss, bitcoin is trying to gain a foothold below the 50-week moving average line. And if this happens, the quotes may sink to $ 20,000. However, Weiss also noted that this scenario could be implemented in 2024 when a new halving will occur in the bitcoin network. The trader also stated that he hopes that this scenario will not be implemented. Thus, there is no unambiguity in the forecasts of highly respected crypto experts. And if so, then there is no guarantee that BTC will continue to grow while the Fed has begun to tighten monetary policy and cut the QE quantitative stimulus program.

On the 24-hour timeframe, the quotes of "bitcoin" are fixed below the ascending trend line, so the "bullish" trend is broken. Consequently, the fall may continue. The nearest targets are the levels of $43,852 and $40,746. It is impossible to form a descending trend line now since there is simply no second reference point: the downward movement is very strong. However, we pay attention to the rebound from the level of $ 51,350, which is a sell signal. The material has been provided by InstaForex Company - www.instaforex.com |

| Investors' attitude towards bitcoin changed in 2021. Bitcoin was trapped inside a side channel. Posted: 26 Dec 2021 02:35 AM PST At the end of the year, "bitcoin" was inside the flat.

Bitcoin continues to trade as calmly as possible on the eve of the New Year. The trend line on the 4-hour timeframe was overcome, but at the same time, the cryptocurrency quotes continue to remain within a limited range between the levels of $ 46,600 and $ 51,350. As recently as yesterday, the cryptocurrency bounced off the upper limit of this channel, so now a new round of falling to the level of $ 46,600 or slightly lower may begin. Thus, the main thing now is the side channel and not the fact of overcoming the downward trend line. Actually, on the eve of the New Year, this behavior of the cryptocurrency is justified. There is practically no news for the foreign exchange market right now. There are not many of them on the cryptocurrency market either, and market participants are slowly starting to celebrate and leave the market. Thus, until bitcoin leaves the channel limits, we believe that the flat will remain. Bitcoin is now a means against inflation. Meanwhile, many experts have noticed that investors' attitude to bitcoin has changed in 2021. If earlier everyone talked about it as "digital gold", that is, as an asset that sooner or later will be super stable in price and will be used for long-term investments, now the attitude towards bitcoin is as a means of hedging inflation. This does not mean that there will be no longer any long-term investments in bitcoin. This means that when inflation in the States and around the world begins to decline, the demand for bitcoin may begin to fall. We have already said earlier that the Fed's actions to tighten monetary policy are a negative phenomenon for the cryptocurrency market. In addition, inflation will begin to decline in any case, so bitcoin may continue to get cheaper in 2022. However, as soon as a new interpretation of the essence of bitcoin appeared, experts and traders immediately began to abandon its previous version. So now the majority believes that bitcoin has never been "digital gold" because of its excessive volatility. After all, the comparison with gold occurs because, in times of falls in the stock market, the price of gold remains stable, which means it hedges risks. Bitcoin can collapse or grow by 10-15% within one day. So it does not have the characteristics of gold. Michael Saylor also considers bitcoin a means against inflation. At the same time, Michael Saylor, CEO of Microstrategy, spoke out about the main cryptocurrency. Recall that Microstrategy is the largest public investor in bitcoin. Saylor called bitcoin a "global reserve asset" in his last interview, and the US dollar a "world reserve currency", thus noting the fundamental difference between them. The head of Microstrategy also noted that in 2021 the world began to need an inflation hedging tool and urged everyone who owns bitcoin not to sell it. However, as we said earlier, all persons interested in the further growth of bitcoin advise not to sell it, but only to buy it. And Michael Saylor is an interested person.

The trend on the 4-hour timeframe has changed to the side. The side channel $ 51,350 - $ 46,600 plays a key role now. Thus, after the rebound from the level of $ 51,350, we are waiting for a new drop in quotes with a target of $ 46,600 and recommend selling bitcoin. If the price is fixed above the level of $ 51,350, this will suggest the formation of a new upward trend, so purchases with targets of $ 55,754 and $59,177 will become relevant. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Dec 2021 01:27 AM PST

The pound/dollar pair has grown quite significantly this week by 250 points. However, as we have said in previous articles, it is very difficult to find specific and clear reasons for such a movement. Simply because there were no really important events, news, and publications during the week. Of course, something interesting is always happening in the world, but this does not mean that the markets respond to every such event with their actions. For example, in the UK, the number of cases of coronavirus, in particular the omicron strain, continues to grow. The last time 120 thousand new cases of the disease were announced per day. This is the maximum daily number of diseases since the beginning of the pandemic. And although "omicron" is much easier to carry than the same "delta", in absolute terms, there may still be more hospitalizations than with "delta", since the total number of cases may be several times greater. But, as we can see, this did not prevent the British pound from rising in price on the eve of Christmas. Boris Johnson said he would give the British the opportunity to celebrate this holiday in peace, but this week the British government may introduce a "lockdown" or tighten quarantine measures. However, in any case, and any country, the economy in the third and fourth quarters will not be experiencing the best time. This is not a purely British problem. As for the technical picture, unlike the EUR/USD pair, the pound showed excellent volatility and trendiness in the last week. Thus, there is reason to assume that next week will be quite active. However, some groundlessness of the pound's growth by 250 points may lead to the fact that in the New Year's week quotes will fall by the same 250 points to annual lows. Well, there is nothing at all to say about the "foundation" and "macroeconomics", since nothing interesting is planned for the next week either in the UK or in the USA.

Recommendations for the GBP/USD pair: The pound/dollar pair has started an upward trend on a 4-hour timeframe, as evidenced by the Bollinger Bands and Ichimoku indicators. However, this does not mean that next week the pair's quotes will not go down as much as they went up this week. However, we still believe that the pound will be able to go north for a total of about 400-500 points so that it would fit very well into the general nature of the movement in 2021. Thus, after correction to the critical Kijun-sen line, the upward movement may resume with targets near the resistance levels of 1.3464 and 1.3553. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5). The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments