Forex analysis review

Forex analysis review |

- Crude prices rise for forth week in a row

- US dollar changes its strategy. What to expect next week?

- US stocks close week trading mixed

| Crude prices rise for forth week in a row Posted: 21 May 2022 05:11 AM PDT On Friday, on European stock exchanges, the global price of crude reported an increase on investors' fears about the prospects of declining oil reserves. At the same time, the uptrend in the commodity market was recorded for the fourth week in a row for the first time since early February. As a result, the price of July futures on Brent grew by 0.46% to $112.57 per barrel, while July futures on WTI oil increased by 0.4% to $110.35 per barrel. Yesterday, both contracts rose by 2.7%. The main upward factor for the oil price the day before was the concern of the commodity market participants about the forthcoming shortage of crude against the background of the US Department of Energy data on the fall of its commercial reserves released last week. Thus, according to a recent report from the country's Energy Department, oil reserves slumped by 3.4 million barrels over the week to 420.8 million barrels. At the same time, analysts forecasted an increase in reserves by 1.4 million barrels.

The key reason for such a spectacular downturn of the oil reserves indicator market experts call the approach of the annual hurricane season, when a stock of raw materials for a rainy day becomes the main reassuring factor. An additional reason for market participants' fears about its future shortage continues to be a reduction in supply due to the Russian-Ukrainian armed conflict, which has been going on for almost three months.

European traders did not go unnoticed by the US Federal Reserve's decisive steps to tighten monetary policy against the backdrop of a permanently rising inflation rate. Thus, following its meeting in early May, the US Fed raised its key rate by 50 basis points, now its range is 0.75-1% yearly. Earlier in March, the US regulator raised the rate by 25 basis points. The last time the central bank raised the rate at two meetings in a row was back in 2006. At the same time, an increase by 50 basis points at the same time has not been seen since 2000. Fed Chairman Jerome Powell recently said that the central bank planned to act aggresively to bring the rate of inflation in the states back to the target of 2%. The US Fed's decision, Powell said, would not even be affected by the prospect of a declining economy in the short term. In addition, on Friday, investors assessed the report of the US oil and gas service company Baker Hughes, which reported that over the past week the number of active oil rigs in the United States increased by 13 to 576 units. The material has been provided by InstaForex Company - www.instaforex.com |

| US dollar changes its strategy. What to expect next week? Posted: 21 May 2022 03:16 AM PDT

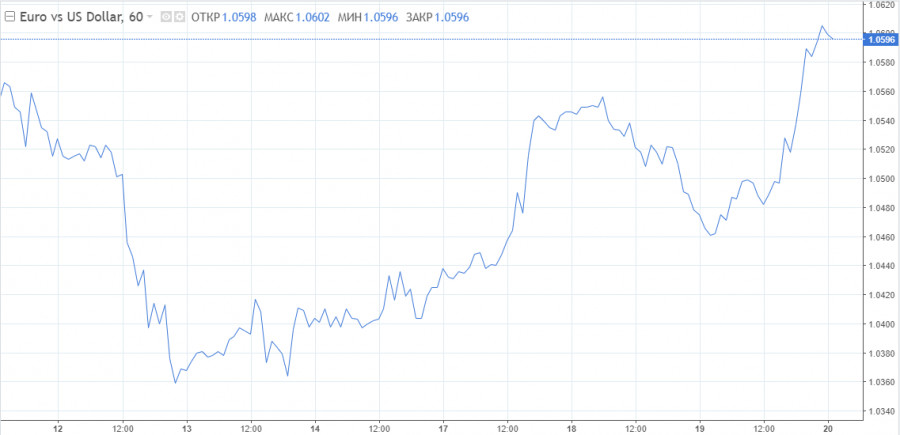

The dollar is trading differently with the index showing some multidirectional moves. The drop to a 2-week low has not been redeemed. However, the dollar tends to rise and the bullish trend is strong. The dollar correction is unlikely to last long as defensive assets will continue to be in high demand in the market. The only question is which asset investors will prefer to purchase. The dollar sentiment has been undermined. Market makers express deep concern over a potential recession. Therefore, incoming economic statistics will be analyzed thoroughly in terms of slowing economic growth. Weekly labor market data released on Thursdays showed gains. Therefore, investors became worried and the dollar also declined significantly. Recessionary risks were the major reason for the dollar to stop its rapid rise in response to the Fed's increased hawkish sentiment. Traders began to focus on other protective assets. The Swiss franc is in a favorable position as it has been correcting from its 3-year lows since the start of the week. It has almost fully recouped its losses to the dollar incurred in early May. Moreover, the Japanese yen has gained considerably. Its exchange rate returned to April levels. However, it still remains near 20-year lows. The USD/JPY pair has been trapped around 128.00. On Friday, the dollar managed to attract buyers at 127.50 due to a combination of favorable factors. China's central bank cut its five-year lending rate by 15 basis points to increase economic growth. Consequently, the stock markets recovered slightly. Nevertheless, the yen's defensive function was undermined. US Treasury bond yields will continue to play a key role in the dollar's performance except other major factors (releases, events). Traders will further focus on signals and estimate risks for trading the USD/JPY pair. Support is located at 126.95, 126.05, and 125.10. Resistance is at 128.85, 129.85, 130.80. Gold gained considerably, though it had traded at its year's low earlier this week. Its prices reached intermediate resistance around $1,850 an ounce. If gold breaks through this mark, it will hit $1,900. In case traders continue to liquidate long positions in the next sessions, it will be easy to reach this level. The euro is likely to rebound. Moreover, it also started consolidating in a wide range following the dollar. On Friday, the EUR/USD pair made some losses near 1.0580. However, then the bears increased their pressure on the pair. The bullish scenario is unlikely as the quotes touched below 1.0550 leading to the pair's decline. Support is located at 1.0495, 1.0410, and 1.0350. Resistance is at 1.0635, 1.0690, 1.0780.

The markets fuel further speculations about the possible parity and its terms. The EUR/USD pair may fall below 1 during the first half of the year and only due to the difference in the Fed and ECB's monetary policies. The second half of 2022 will definitely be more favorable to the euro. The current situation is the following: the Fed has started to tighten its monetary policy, while the ECB is still considering it. Consequently, the dollar may further increase against the euro. Meanwhile, the differential between the US and German short-term rates is declining amid slowing their growth in the US and continuing increase in Germany. Macroeconomic pressures in the EU are likely to persist. Economists expect the euro to recover in the second half of the year. Consequently, the EUR/USD pair will gradually return to 1.1 amid a tighter ECB policy and slowing US inflation. The material has been provided by InstaForex Company - www.instaforex.com |

| US stocks close week trading mixed Posted: 21 May 2022 02:35 AM PDT On Friday, key US stock market indices closed mixed. The maximum results were shown by securities of telecommunication, oil and gas, and healthcare sectors. At the same time, the main outsiders were the shares of industrial and consumer goods and services sectors. In addition, stock indices demonstrated high volatility and constant fluctuations throughout the trading session yesterday. Experts said that the main reason for such market behavior was the investors' attempts to avoid risk against the background of constantly growing uncertainty. Thus, in the afternoon, indices were steadily increasing by 0.5-1% on the news that in May the Central Bank of China decided to reduce the five-year LPR rate to 4.45% from April's 4.6%. Market participants perceived such softening of the monetary policy by the Chinese regulator as a tangible support for the economy, which suffered from the COVID-19 pandemic and the strict restrictive measures. However, later stock exchange indicators began to fall robustly due to traders' concerns about high inflation impact on the financial performance of businesses and consumers. In addition, on Friday, market participants discussed the US Federal Reserve's plans to aggressively increase the benchmark interest rate. Investors are concerned that such decisive measures of the US regulator can not only reduce the impact of inflation on the global economy, but also significantly limit its growth in the future. Yesterday, US Fed Chairman Jerome Powell said that the central bank plans to act more aggressively in order to return the inflation rate in the US to the 2% target. The US Federal Reserve's decision, Powell said, would not be affected even by the prospect of a decline in the economy in the short term. Notably, at the end of the meeting in early May, the Fed raised its key rate by 50 basis points, now its range is 0.75-1% yearly. Earlier in March, the US regulator raised the rate by 25 basis points. The last time the central bank raised the rate at two meetings in a row was back in 2006. At the same time, it was the first 50 basis points hike last seen in 2000. Top gainers and losers As a result, the Dow Jones Industrial Average gained 0.03% on Friday, the NASDAQ Composite high-tech index shed by 0.30% and the S&P 500 broad market index added 0.01%. Yesterday, the key leaders among the Dow Jones Industrial Average index components in trading the day before were securities of Cisco Systems Inc adding 2.92%, Salesforce.com Inc increasing by 2.60%, and McDonald's Corporation gaining 2.14%. Shares of Boeing Co lost 5.07%, Caterpillar Inc declined by 4.32%, and 3M Company dropped by 2.13% showing the weakest results among the index components.

Securities of VF Corporation added 6.07%, American Tower Corp increased by 4.73%, and Eli Lilly and Company gained 4.39%. The companies topped the list of gainers among the components of the S&P 500 index. The main outsiders here were Ross Stores Inc losing 22.47%, Deere & Company dropping by 14.07%, and Advance Auto Parts Inc declining by 7.23%. The leaders among the components of the NASDAQ Composite in yesterday's trading were the securities of GeoVax Labs Inc adding 90.18%, SIGA Technologies Inc soaring by 43.35%, and Redbox Entertainment Inc jumping by 40.00%. Shares of Athersys Inc plummeted by 65.54%, Evofem Biosciences Inc declined by 3.17%, and Lixiang Education Holding Co Ltd tumbled by 51.81%. These stocks were among the top losers among the NASDAQ components. Loud records Yesterday, the securities of the American discount department store chain Ross Stores Inc. plummeted to a 52-week low, losing 22.47% and closing at 71.87 points.Deere & Company, a machinery company that makes agricultural, construction and logging equipment, fell to a 52-week low, dropping by 14.07% and closing at 313.31 points. The capitalization of automotive parts supplier Advance Auto Parts Inc sank to a 52-week low, declining by 7.23% to 181.89 points. The value of securities of one of the world's largest manufacturers of aircraft, space, and military equipment Boeing Co. fell to a 52-week low, losing 5.07% and ending trading at 120.70 points. The stock of US pharmaceutical company SIGA Technologies Inc soared to its highest level, gaining 43.35% and closing at 12.40 points. The capitalization of biopharmaceutical company Evofem Biosciences Inc. fell to an all-time low, losing 63.17% on Friday, and ending trading at 0.41 points. As a result, on the NYSE, 1,670 securities declined and exceeded the number of those that rose in price estimated at 1,486. At the same time, the indicators of 140 shares remained unchanged. On NASDAQ stock exchange, quotations of 2,068 companies declined, 1,648 increased and 267 closed at the level of the previous session. The CBOE Volatility Index, which is based on the S&P 500 options trading, rose by 0.27% to 29.43 points. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments