Forex analysis review

Forex analysis review |

- EUR/USD. Hot days ahead. EU Summit, European inflation, Nonfarm and the fate of anti-Chinese tariffs

- GBP/USD. Britain introduces a windfall tax on oil and gas producers' profits: pound received temporary support

- EUR/USD. Results of the week. PCE index, increased risk appetite, disappointing Fed minutes

- Dollar drawn into the elimination game, and the euro decided to hedge in advance

| EUR/USD. Hot days ahead. EU Summit, European inflation, Nonfarm and the fate of anti-Chinese tariffs Posted: 29 May 2022 08:20 AM PDT Storming the 8th figure or returning to the base of the 6th price level: it is such a difficult choice that traders of the EUR/USD pair will have to make. The next trading week in this regard will be decisive. If market participants choose the upward direction, this will be a signal for a possible trend reversal. And although this scenario looks unlikely in my opinion, it cannot be ruled out. After all, if the upcoming week is again left for EUR/USD bulls, then a fairly significant picture will appear on the W1 timeframe, which will reflect a consistent three-week price increase. But for this, the bulls of the euro-dollar pair need to overcome at least the resistance level of 1.0760 (the upper line of the Bollinger Bands on the daily chart), and also settle above the 1.0800 mark. Only then will it be possible to talk about the first signs of a real turning point in the situation, with an exit in the medium term to the area of the 10th figure.

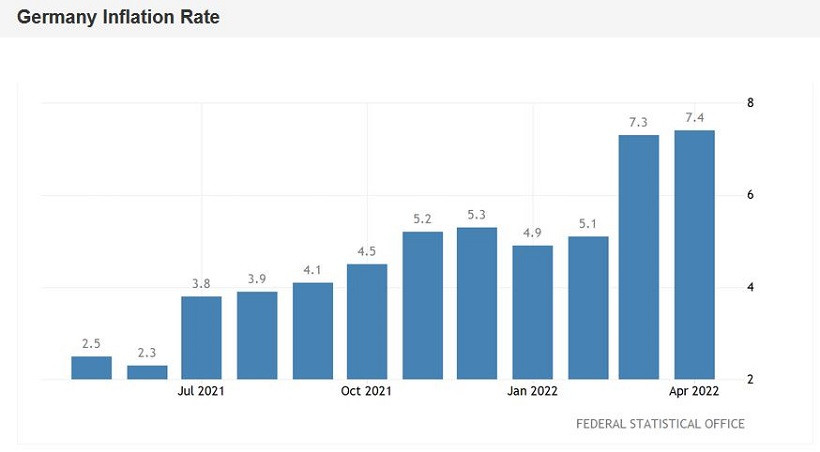

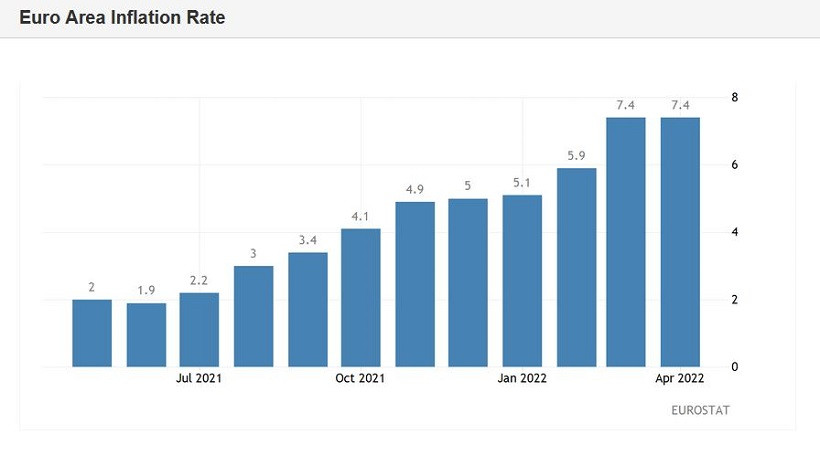

EUR/USD bears face a different task: they need to at least keep the price below 1.0760. The maximum program is to return the pair to the area of the sixth figure, convincing "hesitant" traders of the futility of the upward route. If the large-scale corrective growth stalls this week, the bears of the pair will be able to further pull the price not only to the base of the 6th figure, but also under the level of 1.0600. Everything will depend on the information flow, which will either return the "former demand" for the US currency, or weaken it even more. If we talk about macroeconomic releases, then it is necessary to highlight two points. Firstly, these are releases of data on inflation growth in Germany and in the eurozone, and secondly– Non-Farms. The German consumer price index should show further growth, although in April it reached its 49-year high (7.4%). According to general forecasts, it will reach 7.5% in May. The same applies to the basic CPI. Pan-European inflation should repeat the trajectory of the German one, once again setting a historical record. Let me remind you that in the previous month, the consumer price index rose to 7.4% in April. This is the highest value of the indicator for the entire history of observations (i.e. since 1997). In May, it should rise to the level of 7.7%. If this indicator comes out at least at the level of forecasts (not to mention the green zone), the euro will receive some support, although this support will be limited (short-term). The fact is that the head of the ECB has already announced the expected scenario for further actions (an increase in the rate to zero by September), and it is unlikely that the European Central Bank will tighten it in any way. Therefore, a possible increase in the price of EUR/USD after the release of inflation reports should be treated with great caution.

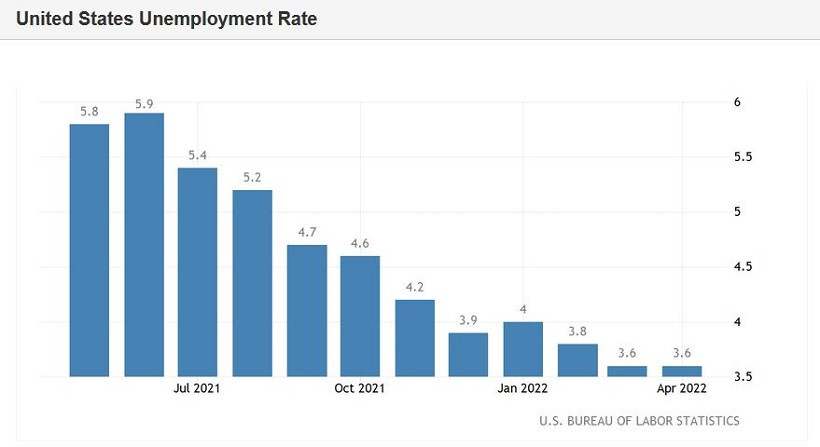

The most important event of the week for traders of the pair will be Nonfarm, which will be published on Friday, June 3. It is worth recalling here that the key components of the previous – April – release did not disappoint, but also did not impress market participants. Despite the "red color" of the main indicator (the unemployment rate remained at 3.6%, contrary to the forecast decline to 3.5%), all other components came out in the green zone. The number of people employed in the non-agricultural sector in April increased by 428,000 (as well as in March), while experts expected to see this indicator slightly lower, at around 390,000. The level of average hourly wages on a monthly basis was supposed to drop to 0.2%, while traders saw an increase to 0.3%. In annual terms, the index, in accordance with the forecast, minimally decreased to 5.5% (after the March value of 5.6%), still remaining at a fairly high level. According to the general forecast, the May Nonfarm will also show a relatively good result. The growth rate of the employed should grow to 350,000, although the growth rate of the average hourly wage on an annualized basis may slow down to 5.2% (in this case, there will be a downward trend). The unemployment rate, in turn, should fall to a two-year low of 3.5%. Let me remind you that the last time this indicator was at such lows was in February 2020, just before the beginning of the global coronavirus crisis. The "task" of Nonfarm is to achieve at least forecast levels. In this case, everything will depend on what aspects the market focuses its attention on – either a decrease in unemployment and an increase in the number of people employed, or a slowdown in the growth rate of average wages (wages will stop "catching up" with inflation) will be in the center of attention. If the release is in the red zone, then the dollar will definitely be under significant pressure.

As for the external fundamental background, there are several issues on the agenda here. So, over the past week, the US stock market has shown positive dynamics on expectations of easing trade restrictions for China. The reason for optimism was the statement of US President Joe Biden, who said that duties on imports of Chinese goods to the United States "are under consideration." According to him, he intends to discuss this issue with the country's Finance Minister Janet Yellen. Since then, the situation has been hanging in the air: the White House keeps the intrigue, saying neither "yes" nor "no". If during the coming week Biden or his heralds make it clear that Washington is not yet ready for such liberalization, the craving for risk will noticeably decrease, and the dollar will be "on the horse" again. If Yellen still convinces the US president to take this step, EUR/USD bulls will certainly use this information guide. Also, among the main fundamental events of the coming week, the EU summit should be highlighted, the results of which may shake the position of the euro if the sanctions confrontation with Russia continues to intensify. In addition, in the coming days, the foreign exchange market may react to the "Ukrainian case". Just today it became known that the Turkish president plans to talk with Vladimir Putin and Vladimir Zelensky on Monday. The press secretary of the Russian president Dmitry Peskov has already confirmed that the Russian president plans to have a conversation with the Turkish leader. If these dialogues move the negotiations off the ground, the EUR/USD pair will get a reason for its growth. Otherwise, the safe dollar will again be in high demand. Thus, the situation for the EUR/USD pair is uncertain. The pendulum can swing both towards the bulls, and towards the bears. Therefore, it is not worth rushing with longs until the pair overcomes the resistance level of 1.0760 and settles above the 1.0800 target. Short positions will be relevant if bears are able to push through the support level of 1.0700 (the average line of the Bollinger Bands on the four-hour chart). In other cases (i.e. if the pair fluctuates in the range of 1.0705-1.0750), it is better to take a wait-and-see position, given the high degree of uncertainty. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 May 2022 07:52 AM PDT The pound-dollar pair balances between 25 and 26 figures, reacting impulsively to the current news flow. Against the background of the general weakening of the greenback, the British currency is trying to develop a corrective growth in order to settle above the 1.2600 mark. But each point won is given to GBP/USD bulls with great difficulty: they meet the resistance of bears, who significantly slow down the progress of moving upwards. Intraday price growth is replaced by a subsequent decline. And vice versa. However, if you look at the weekly chart of GBP/USD, you can come to the obvious conclusion that the total account is on the bulls' side. The correction continues for the second consecutive week, although recently bulls are not as confident as in mid-May. After a series of disappointing releases (weak PMI indices, a slowdown in UK GDP growth in the first quarter amid increased price pressure), the pound received support from the British government. Finance Minister Rishi Sunak just announced that his department is offering a cost-of-living support package worth 15 billion pounds. This package includes a 400-pound discount on electricity bills, as well as a one-time payment of 650 pounds to eight million of the poorest households. In addition, 150 pounds will be paid in a lump sum to all persons receiving disability benefits.

All these financial assistance measures will be partially funded by a levy from oil and gas companies: a temporary 25% tax on excess profits of companies operating in the oil and gas sector will be introduced in the UK. According to the calculations of the Ministry of Finance, this will attract about 5 billion pounds over the next year. It is not known for what period the new tax is being introduced. Sunak rather vaguely commented on the relevant issue, stating that this measure will be gradually abandoned, but only when energy prices "return to a historically normal level." At the same time, the Finance Minister assured that this support package will have a "minimal impact" on inflation. According to the British media, some members of the government have spoken out against the introduction of a new tax: in their opinion, such a step with unpredictable consequences will at least reduce the volume of investments. But their voices remained in the minority after the release of data on the growth of inflation in the country (CPI reached 40-year highs), as well as after the deterioration of macroeconomic forecasts by the Bank of England (BoE). Let me remind you that following the results of the May meeting, the English central bank warned of a sharp slowdown in GDP growth – not only this year, but also next year. In 2023, the central bank expects the economy to shrink by 0.25% (whereas previously it was expected to grow by 1.25%). In 2024, the volume of GDP should increase by 0.25%, while earlier forecasts spoke of one percent growth. Amid such forecasts, which were partially confirmed by data on the growth of the British economy in the first quarter, many experts suggested that the BoE would not implement a too aggressive scenario to tighten monetary policy. In their opinion, the British central bank will take a break after two increases at the next meetings. The pound plunged throughout the market, spurred also by the failed PMI indices. Nevertheless, GBP/USD bulls were able to deploy the pair around the middle of the 24 figure. First of all, due to the weakening of the US currency. Then the Ministry of Finance of Great Britain joined in. The optimism associated with fiscal stimulus drowned out the pessimistic assessments of the British central bank. Here it should be noted at once that this optimism is temporary, such fundamental factors are unable to act for a long time. Therefore, the further growth of the pair may be due only to the weakening of the US currency. Given this factor, we can assume that the ceiling of the current price growth is 1.2660 – this is the upper line of the Bollinger Bands indicator on the four-hour chart. It is risky to keep longs in this price area – without additional information momentum, the pound is unlikely to settle in the area of the 27th figure. You should also pay attention to the fact that on Friday the dollar actually ignored the slowdown in PCE growth. The annual core PCE inflation in the US fell to 4.9% after rising to 5.2% in March. In general, the indicator has been gradually decreasing for the second consecutive month – this may indicate that inflation has reached its peak values. By the way, in one of his speeches, Federal Reserve Chairman Jerome Powell focused his attention on this fact, in the context of indicating the further pace of monetary policy tightening. However, the dollar bulls did not "dramatize" the situation on Friday – partly due to the fact that the report was released at the forecast level, and the fact that the inflation indicator still remains at too high values (thereby justifying a further increase in the Fed's interest rate). Therefore, in my opinion, corrective bursts of GBP/USD to the support level of 1.2660 or even to the borders of the 27th figure should be used to open short positions, with 1.2600 and 1.2570 as targets (the Kijun-sen line coinciding with the average line of the Bollinger Bands indicator on the H4 timeframe). The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Results of the week. PCE index, increased risk appetite, disappointing Fed minutes Posted: 29 May 2022 07:20 AM PDT The last two weeks have seen a weakening of the dollar and the growth of European currencies. The EUR/USD pair moved away from five-year lows and rose by more than 350 points, settling in the area of the 7th figure. At the same time, the bulls could not overcome the resistance level of 1.0760, which corresponds to the upper limit of the Bollinger Bands indicator on the daily chart and the Kijun-sen line on the W1 timeframe. Situational support for the dollar was provided by the core inflation index PCE – it came out at 4.9%, that is, at the forecast level. This fundamental factor can hardly be classified as positive, because the de facto most important inflation indicator has been slowing its growth for the second consecutive month. But the fact that it is still at a high level (in the area of 39-year highs) enabled the EUR/USD bears to organize a small counterattack. As a result, the pair ended the trading week under the resistance level of 1.0760.

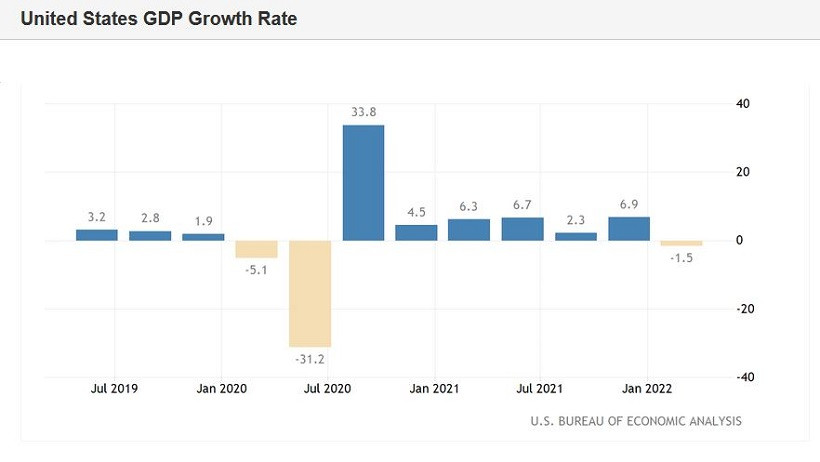

In general, dollar bulls have lost their former confidence. Looking at the weekly chart, we will see that for a month and a half (from the beginning of April to mid–May), the pair was within a pronounced downward trend - in six weeks, the price decreased by almost 700 points. The dollar strengthened its position mainly due to the growth of anti-risk sentiment, as well as against the background of aggressive rhetoric from Federal Reserve members, who vied with each other to announce the active pace of interest rate hikes. The European Central Bank, in turn, showed an indecisive position. This combination of factors enabled EUR/USD traders to come close to the support level of 1.0340. The last time the price was in this area was in 2017. However, here the downward momentum began to fade gradually. The bears did not dare to storm this price line without additional information support. After a pause, bulls seized the initiative, especially since the information background also changed, and not in favor of the greenback. For example, dollar bulls were alerted by the minutes of the Fed's May meeting. The members of the central bank made it clear that they do not rule out the option of revising their aggressively hawkish position. After several (most likely three – including the May increase) rounds of interest rate hikes, the Fed may take a pause to re-assess the state of the economy in the context of further actions. The text of the document contains an unambiguous phrase that is worth quoting in its entirety: "a faster curtailment of accommodation leaves the central bank "in a convenient position" so that the members can assess later this year what further adjustments are needed." It should be noted here that the widely announced 100-point rate hike following the results of the two subsequent meetings (in June and July) has already been partially taken into account in prices. Therefore, such restrained rhetoric of the Fed minutes disappointed EUR/USD bears. Thanks to this fundamental factor, the price overcame the 1.0700 milestone and settled in the area of the 7th figure. The external fundamental background also does not contribute to the strengthening of the greenback. The last week of May was marked by a certain fracture: the craving for risk has increased, and the demand for a safe dollar has decreased. In particular, the US stock market closed again with growth on Friday: The Dow Jones rose 1.76%, the S&P 500 gained 2.47%, and the NASDAQ Composite index rose 3.33%. The reason for optimism was US President Joe Biden's recent statement that the White House is considering the possibility of lifting some duties on Chinese imports. He promised to consult on this issue with the head of the Ministry of Finance Janet Yellen (who is a supporter of partial "amnesty") and make an appropriate decision. And although not everyone in the presidential administration supports this idea (in particular, US Trade Representative Katherine Tai opposes it), Biden's words provoked the growth of stock indices against the background of a general increase in risk appetite. The dollar, accordingly, was under pressure. In addition, updated data on the growth of the American economy in the first quarter of this year were published last week. The indicator was revised downwards. According to the second estimate, the volume of US GDP decreased by 1.5%, while the initial analysis indicated a reduction of 1.4%. This is the worst result since the second quarter of 2020, when the coronavirus pandemic and the economic downturn caused by it led the economy into recession with the US economy falling by almost 32%.

This fact also put pressure on the greenback. According to some experts, signs of a slowdown in economic growth in the United States will force the Fed to reconsider its aggressive policy after two rounds of 50-point hikes. If the US economy also disappoints in the second quarter, Fed members may take a break in the process of tightening monetary policy. Actually, this assumption is consistent with the main theses of the aforementioned minutes of the Fed's last meeting. The European Central Bank also provided support to EUR/USD bulls. On Monday, ECB President Christine Lagarde specified the expected scenario of tightening monetary policy. According to her, the ECB may increase the deposit rate to zero by the end of September, "after which further increases are possible." This means that the ECB will raise rates following the results of the July meeting, as well as in September, then assessing the dynamics of inflationary growth in the eurozone. Thus, the EUR/USD pair is growing quite reasonably: the information background contributes to this. However, it is advisable to open longs only after bulls overcome the resistance level of 1.0760 (the upper limit of the Bollinger Bands indicator on the daily chart and at the same time the Kijun-sen line on the W1 timeframe). On Friday, EUR/USD bulls did not have enough strength to break through this barrier. If they fail to pass this level on impulse next week, short positions with 1.0700 and 1.0650 as targets will be prioritized. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar drawn into the elimination game, and the euro decided to hedge in advance Posted: 27 May 2022 10:08 PM PDT

At the end of this week, the US currency has been struggling to overcome the negative trend. The dollar index failed, creating tension in the markets. At the same time, the European currency remains relatively stable. On Friday, May 27, the greenback collapsed to a one-month low against major world currencies. The reason is the uncertainty of market participants regarding the Federal Reserve's interest rate hike. Investors and traders fear that in the second half of the year, the US central bank will slow down or suspend the running cycle of tightening of the monetary policy. According to the results of the Fed's May meeting, a majority of votes decided to raise rates by 50 basis points (bp) at meetings in June and July. At the same time, market participants have included these two rises in prices (by 0.5% each), believing that the central bank will stop there and will not adjust the current plan. Against this background, the appetite for risk has increased, which is why the US currency has lost the lion's share of its achievements. The greenback fell to the lowest level recorded at the end of April. With regard to the single currency, the situation has hardly changed, since the European Central Bank's assurances about the upcoming rate hike serve as insurance for EUR. As a result, the EUR/USD pair was trading at 1.0709 on Friday, May 27.

In the current situation, the pair took advantage of the selling pressure on USD. A day earlier, on this wave, the EUR/USD pair rose to 1.0765, the highest level in a month, and then moved into the consolidation phase. Experts believe that the pair will finish the second week in positive territory. The concern of market participants caused a significant drop in the dollar index (USDX) to 101.43, which measures the USD exchange rate against a basket of six key currencies. According to experts, this happened for the first time since April 25, 2022. As a result, the demand for the dollar as a safe haven currency was undermined. By the end of this week, the decline in the USDX was 1.49% (after falling by 1.37%), recorded last week. According to analysts, this is the first two-week reduction in this indicator since the beginning of 2022. Earlier, the dollar index reached a 20-year peak, exceeding the threshold of 105, but later capitulated. Experts believe that the reason for this is market concerns about a possible slowdown in economic growth against the backdrop of tightening of the Fed's monetary policy. At the end of the week, cautious sentiment prevailed in the markets, so USD bulls reduced activity. This negatively affected the dynamics of the dollar index. A serious drop in the yield of US Treasury bonds added fuel to the fire. The markets are focused on the upcoming reports on the US Personal Consumer Spending Price Index (PCE), which are under the close attention of the Fed. Additional information will come from the U.S. Bureau of Economic Analysis. The agency will provide information on personal income and expenses of American consumers for April, supplementing them with the University of Michigan consumer sentiment index for May. For market participants, these statistics are very important, since the Fed focuses on them when analyzing the current level of inflation. If the peak of inflation is passed, the pressure on the US currency will increase. At the same time, a slowdown in price growth will allow the central bank to reduce the pace of tightening of the monetary policy. According to analysts, the Fed will need to take a pause in the process of raising rates to assess the consequences of tightening the monetary policy for the country's economy. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments