Forex analysis review

Forex analysis review |

- Technical analysis of GBP/USD for May 26, 2022

- Technical analysis of EUR/USD for May 26, 2022

- Bitcoin's pin bar signals bullish pressure

- GBP/USD: more gains in cards

- Trading Signal for Nasdaq-100 (#NDX) on May 26-27, 2022: buy above 12,000 points (21 SMA - symmetrical triangle)

- EUR/USD: upside pressure growing

- Gold signals deeper drop

- May 26, 2022 : EUR/USD daily technical review and trading opportunities.

- May 26, 2022 : EUR/USD Intraday technical analysis and trading plan.

- May 26, 2022 : GBP/USD Intraday technical analysis and significant key-levels.

- EU agrees to pay for Russian natural gas in rubles

- EUR/USD: Recession fears lead to falling bond yields and sell-offs in US dollar

- Trading Signal for Gold (XAU/USD) on May 26-27, 2022: sell below $1854 (21 SMA - symmetrical triangle)

- Stock Asia showed mainly a fall to 1%

- Forecast for GBP/USD on May 26. The Fed rate is 2%. The issue has already been resolved

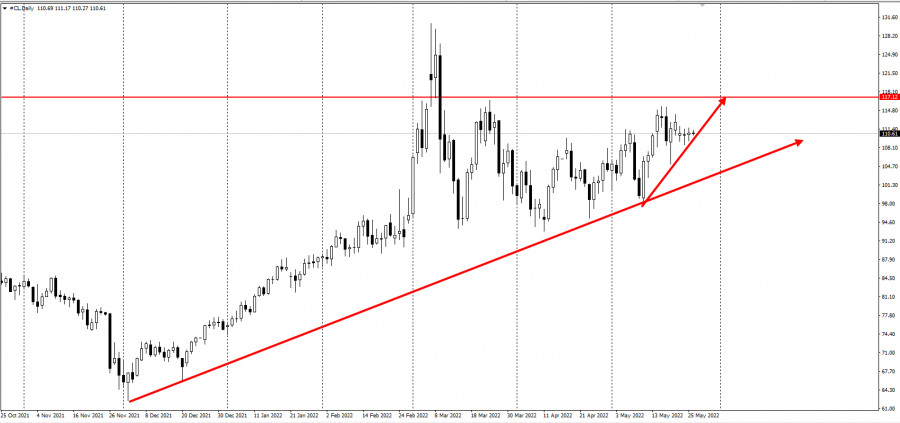

- Daily Video Analysis: BCOUSD, H4 Bearish Reversal Opportunity

- Food crisis threatens Europe

- EUR/USD on May 26, 2022

- European markets rise as US stocks edge up

- EUR/USD analysis for May 26, 2022 - Potential for bigger drop and breakout of upside channel

- Analysis of Gold for May 26,.2022 - Breakout of the upside channel and potential for the bigger drop

- USD/CHF Technical Analysis and Trading Tips on May 26, 2022

- Trading plan for Ethereum on May 26, 2022

- BTC update for May 26,.2022 - Potential for the downside continuation

- Diesel shortage fears grow

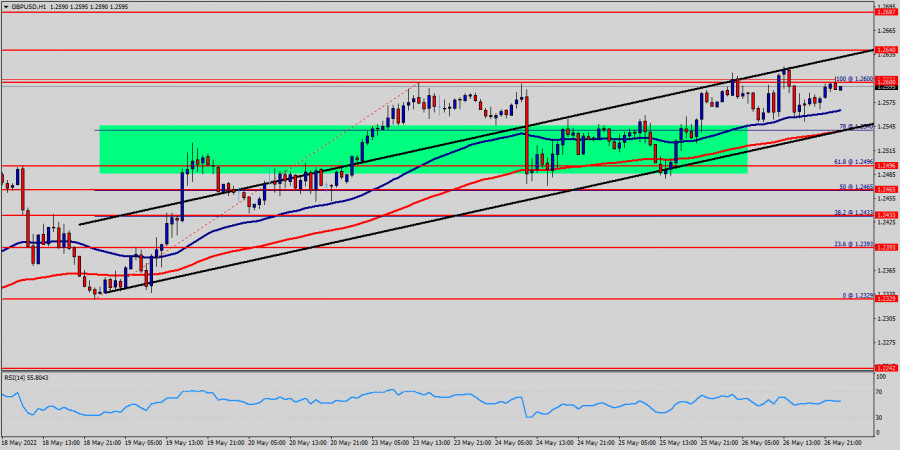

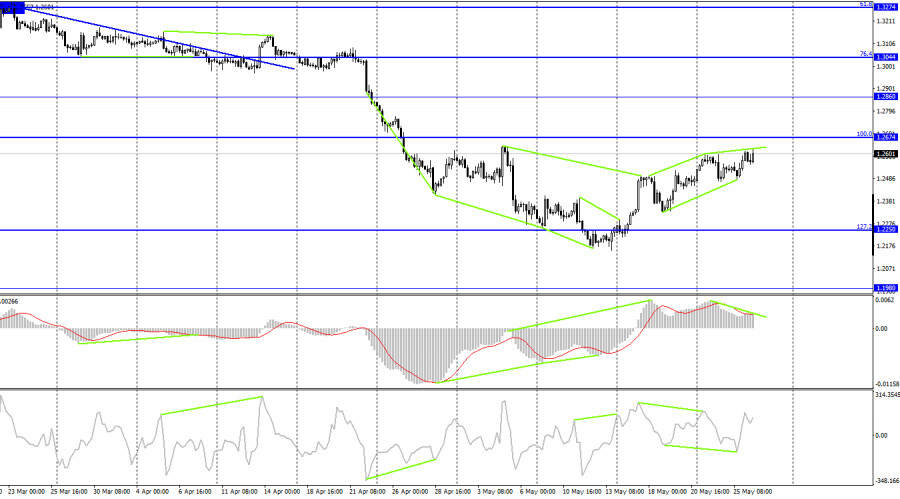

| Technical analysis of GBP/USD for May 26, 2022 Posted: 26 May 2022 02:27 PM PDT

The GBP/USD pair continued moving upwards from the level of 1.2496. Last week, the pair rose from the level of 1.2496 (weekly support) to the top around 1.2600. Today, the first support level is seen at 1.2496 followed by 1.2465, while daily resistance is seen at 1.2640. According to the previous events, the GBP/USD pair is still moving between the levels of 1.2496 and 1.2640; for that we expect a range of 144 pips on Friday. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. Moreover, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). This suggests that the pair will probably go up in coming hours.Furthermore, if the trend is able to break out through the first resistance level of 1.2600, we should see the pair climbing towards the new double top (1.2640) to test it. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.2600. So, buy above the level of 1.2600 with the first target at 1.2640 in order to test the daily resistance 2. The level of 1.2687 is a good place to take profits. If the trend is able to break the level of 1.2640, then the market will call for a strong bullish market towards the objective of 1.2687 today. On the contrary, if a breakout takes place at the support level of 1.2496, then this scenario may become invalidated. Remember to place a stop loss; it should be set below the second support of 1.2433. The material has been provided by InstaForex Company - www.instaforex.com |

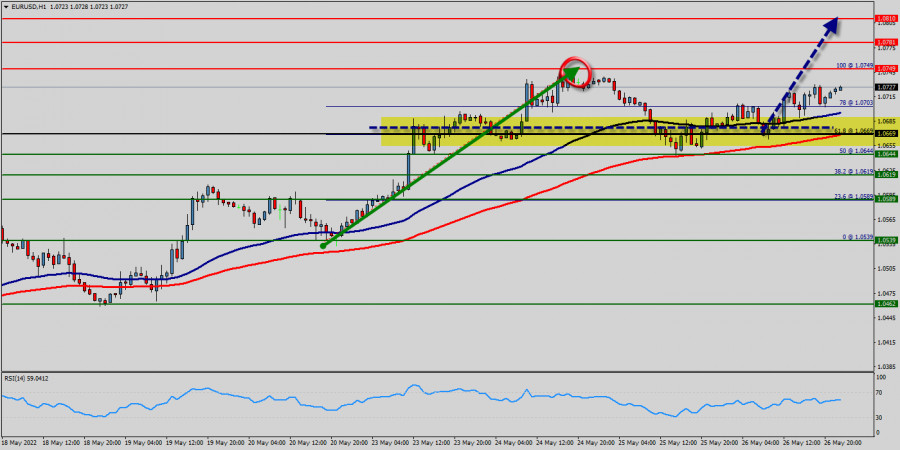

| Technical analysis of EUR/USD for May 26, 2022 Posted: 26 May 2022 01:19 PM PDT

The EUR/USD pair continues to move upwards from the level of 1.0669. Yesterday, the pair rose from the level of 1.0669 (the level of 1.0669 coincides with a ratio of 61.8% Fibonacci retracement) to a top around 1.0728. Today, the first support level is seen at 1.0669 followed by 1.0619, while daily resistance 1 is seen at 1.0749. According to the previous events, the EUR/USD pair is still moving between the levels of 1.0669 and 1.0781; for that we expect a range of 112 pips (1.0781 - 1.0669). On the one-hour chart, immediate resistance is seen at 1.0749, which coincides with a ratio of 100% Fibonacci retracement - the last bullish wave. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100 - red trend) and (50 - blue trend). Therefore, if the trend is able to break out through the first resistance level of 1.0749, we should see the pair climbing towards the daily resistance at 1.0781 to test it. Additionally, the price is in a bullish channel now. Amid the previous events, the pair is still in an uptrend. From this point, the EUR/USD pair is continuing in a bullish trend to tthe next target of 1.0710 It would also be wise to consider where to place stop loss; this should be set below the second support of 1.0619. The material has been provided by InstaForex Company - www.instaforex.com |

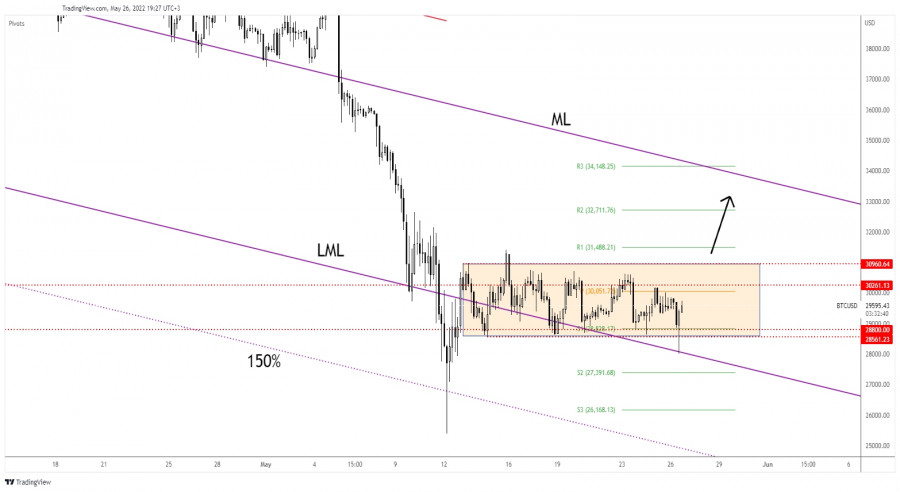

| Bitcoin's pin bar signals bullish pressure Posted: 26 May 2022 10:06 AM PDT The price of bitcoin plunged in the first part of the day. It has registered a 7.24% drop from 30,189.70 yesterday's high to 28,003 today's low. In the short term, the crypto continues to move sideways. Technically, the price action signaled exhausted sellers, so a new bullish momentum is in cards. In the last 24 hours, BTC/USD is up by 0.57%but it's in the red by 1.93% in the last 7 days. During its massive drop, the altcoins plunged as well. BTC/USD Downside Seems Limited!

BTC/USD registered only a false breakdown with great separation below 28,800 - 28,561 static support and below the lower median line (LML) signaling strong demand. Now, it's trading in the green but it remains to see if will have enough bullish energy to be able to take the 30,261 resistance. 30,000 psychological level is seen as an upside obstacle as well. 30,960 represents a critical static resistance. Only escaping from the range pattern between 30,960 and 28,561 could bring new trading opportunities. BTC/USD Forecast!The false breakdown with great separation below the support levels followed by a valid breakout above 30,960 may signal further growth towards the median line (ML), up to 33,000 and 34,000 psychological levels. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2022 10:04 AM PDT

GBP/USD Uptrend!The GBP/USD pair increases at the time of writing and it could try to approach and reach the 1.2639 key level, the former high which stands as a potential upside obstacle. As long as it stays above the uptrend line, the pair could resume its growth. As you can see on the H4 chart, after jumping above the downtrend line, the price was expected to develop a new uptrend, an upside reversal, so the current upwards movement is natural. GBP/USD Trading Conclusion!Staying above the uptrend line and jumping above 1.2639 could activate an upside continuation. The upside scenario could be invalidated by a valid breakdown below the uptrend line and below the 1.2484 immediate low. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2022 09:39 AM PDT

The Nasdaq-100 Tech Index (#NDX) is trading at 11,970 in the American session above the 21 SMA and above 3/8 Murray with a slightly bullish bias. The NDX has strong resistance at 12,000, which coincides with the top of the symmetrical triangle. A sharp break above the symmetrical triangle and consolidation above 12,000 could mean the advance of the Nasdaq-100 and it could reach the top of the downtrend channel around 12,300 formed on May 5. The optimism in the equity market is due to the last meeting of the FED. The minutes of the FOMC meeting on May 3-4 showed that policymakers unanimously felt that the US economy was very strong as they struggled to control inflation without triggering a recession. In addition, they said a 50-basis point rate hike would likely be appropriate in June and July. This dovish tone from the FED is boosting the price of the top 100 tech stocks reflected in the Nasdaq-100 index, which since the early Asian session is showing strong upward momentum and is likely to continue for the rest of the day. The main trend is down according to the daily chart. A trade through 12,811 where the 200 EMA is located will turn the main trend to the upside. Conversely, if the Nasdaq-100 fails to break the 200 EMA around 12,700 - 12,811, it will signal a resumption of the main downtrend. According to the 4-hour chart, we can see that the Nasdaq-100 left a GAP on May 20 at 12,053 and the other GAP on May 5 at 12,666. Therefore, it is likely that if it continues with its uptrend, it may cover both gaps in the coming days. Our trading plan for the next few hours is to buy above the 21 SMA at 11,874 or wait for a sharp break above 12,000 to buy, with targets at 12,300 and 12,500 (4/8 Murray). The material has been provided by InstaForex Company - www.instaforex.com |

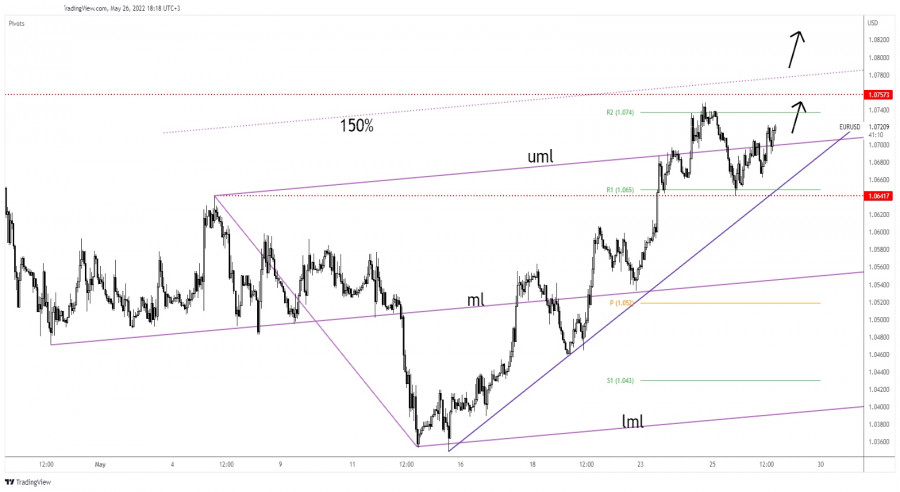

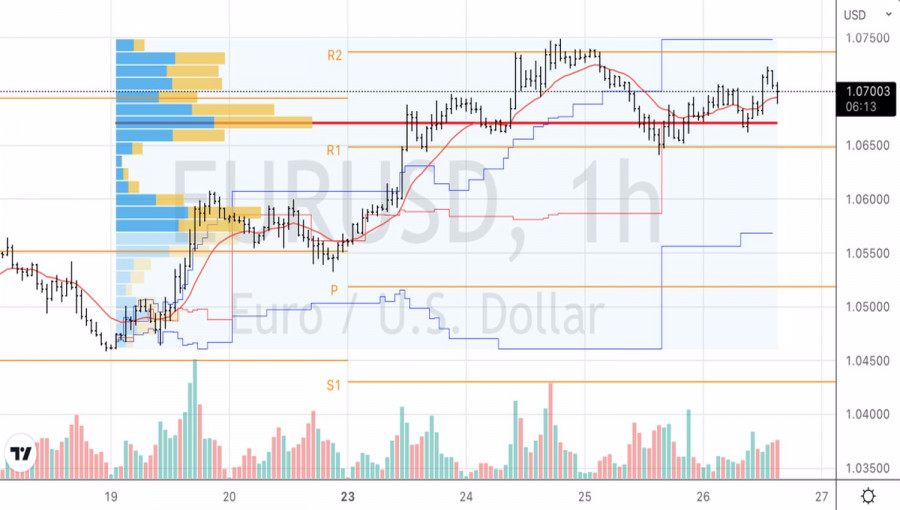

| EUR/USD: upside pressure growing Posted: 26 May 2022 09:25 AM PDT The EUR/USD pair rallied at the time of writing as the Dollar Index extended its drop. It was trading at 1.0825 and it seems determined to approach and reach new highs. DXY's further drop may force the greenback to lose more ground versus its rivals. Fundamentally, the USD took a hit from the US Prelim GDP which dropped by 1.5% versus 1.3% expected, while the Pending Home Sales dropped by 3.9% versus 1.9% expected. The Unemployment Claims indicator was reported at 210K in the last week versus the 217K expected. EUR/USD Strongly Bullish!

The EUR/USD pair retreated a little but it has found support on the 1.0641 and now it has started to grow again. It has validated its breakout above the upper median line (uml) and it seems poised to approach and reach the weekly R1 (1.0740) which stands as a static resistance. Its failure to test and retest the uptrend line signaled strong upside pressure, and strong buyers. 1.0757 stands as a major static resistance, it remains to see how it will react when reaches this key level. EUR/USD Outlook!In the short term, the bias is bullish, still, an upside continuation needs strong confirmation. False breakouts above R2 (1.0740) and through the 1.0757 may signal that the leg higher ended and that the rate could turn to the downside. Actually, only a valid breakdown below the uptrend line could activate a new sell-off. Jumping, closing, and stabilizing above the 1.0757 could signal a larger upwards movement and could bring new long opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2022 09:24 AM PDT Gold dropped in the last hours signaling that today's rebound could be only a temporary one. It was trading at 1,846 at the time of writing. In the short term, it is trapped within a narrow range. Technically, the price action signaled a potential downside movement after escaping from an up channel. Today, the US data disappointed investors but XAU/USD remains under pressure after the FOMC Meeting Minutes report that was released last night. As you already know, the FED is expected to increase the Federal Funds Rate by 50bps in the next monetary policy meetings. In the short term, XAU/USD increased a little only because the US Prelim GDP dropped by 1.5% more versus 1.3% estimates. XAU/USD Distribution!

As you can see on the H4 chart, the yellow metal is trapped between 1,853 and 1,841 levels. It has retested the broken uptrend line but it has failed to take out the static support represented by the 1,841. In the short term, it could continue to move sideways. XAU/USD registered a false breakout above 1,849 former high signalings that bearish pressure is high. After breaking below the uptrend line, Gold was somehow expected to develop a strong drop. XAU/USD Forecast!Gold could activate a larger drop if it drops and closes below 1,841 former low. This scenario could bring new selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

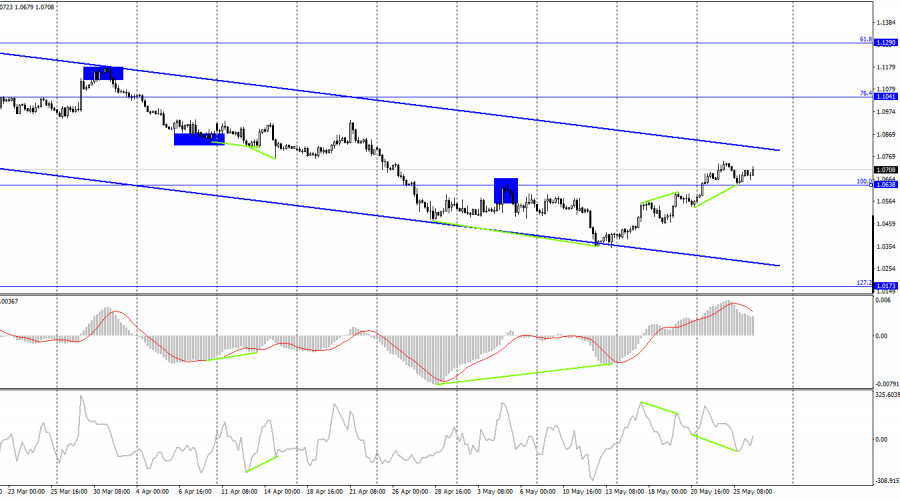

| May 26, 2022 : EUR/USD daily technical review and trading opportunities. Posted: 26 May 2022 09:20 AM PDT

In late September, Re-closure below the price level of 1.1700 has initiated downside-movement towards 1.1500 where some recovery was witnessed. Shortly after, Price levels around 1.1700 managed to hold prices for a short period of time before another price decline took place towards 1.1200. Then the EURUSD has temporarily moved-up within the depicted movement channel until downside breakout occurred recently. Since then, the price zone around 1.1500 has applied significant SELLING pressure when a valid SELL Entry was offered upon the previous ascending movement towards it. Shortly after, the EURUSD looked oversold while approaching the price levels of 1.0800. That's where the recent upside movement was previously initiated. That's why, the recent movement towards 1.1200 was considered for another SELL Trade which is already running in profits now. For beginners, the current price levels are too low to have SELL trades around. Hence, intraday BUY trades are considered a better option. Any ascending movement above 1.0600 will probably enable more advancement towards 1.0700 and 1.0850. Otherwise, conservative traders should stay out of the market. The material has been provided by InstaForex Company - www.instaforex.com |

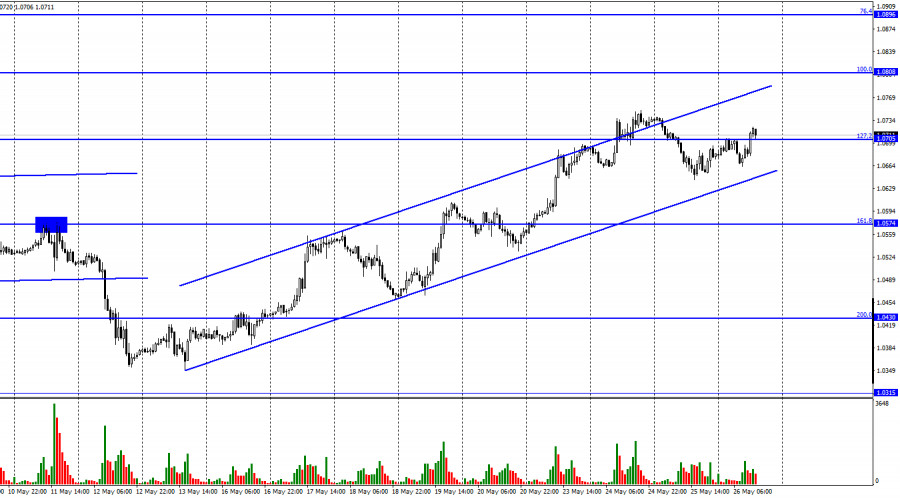

| May 26, 2022 : EUR/USD Intraday technical analysis and trading plan. Posted: 26 May 2022 09:19 AM PDT

A short- term sideway movement was demonstrated within the highlighted zone around 1.1600 before quick bearish decline could occur towards 1.1200. On the other hand, the price zone around 1.1500 - 1.1600 remained a reference zone that applied significant bearish pressure upon two successive bullish visits before another bearish continuation sign was expressed. Hence, downside movement proceeded towards 1.1000 then 1.0920 where short-term bullish pullback was initiated. The price levels around 1.1150 hindered further bullish movement before another bearish move was aggressively expressed towards 1.0500. Failure to persist below the newly-recorded LOW at 1.0350 will probably enable another bullish pullback at least towards 1.0800 and probably 1.1150 where bearish trades can be offered. Until then, Intraday traders shouldn't have any BUY trades unless bullish persistence above 1.0650 is achieved first. The material has been provided by InstaForex Company - www.instaforex.com |

| May 26, 2022 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 26 May 2022 09:18 AM PDT

The GBPUSD pair has been moving within the depicted bearish channel since July. Sideway movement was expressed above 1.3600 while the price levels around 1.3730 - 1.3800 were considered as they offered significant bearish rejection. The short-term outlook turned bearish when the market went below 1.3600. This enhanced the bearish side of the market towards 1.3200 which brought the pair back towards 1.3600 for another re-test. Hence, the recent bullish pullback towards 1.3600 should have been considered for SELL trades as it corresponded to the upper limit of the ongoing bearish channel. Shortly after, Bearish persistence below 1.3360 enabled bearish continuation towards 1.2980 - 1.3000. Bullish rejection has arised many times around 1.3000 standing as a significant Daily Support. This happened before another bearish decline could take place earlier last week. Another bearish breakout below 1.2980 has enabled quick bearish extension towards 1.2600-1.2550 where some bullish recovery and a short-term sideway movement could be established before another downside movement was expressed. Previous bearish decline was expected to extend towards 1.2100 where bullish reversal could be expected. However, considerable bullish rejection was expressed around 1.2200. Currently, bullish breakout above 1.2550 is needed to abolish the short-term bearish scenario and may enable quick bullish advancement towards 1.2750, 1.3300 and probably 1.3600 if sufficient bullish momentum is maintained. Otherwise, the GBP/USD pair remains under bearish pressure to challenge the new low around 1.2150 again. Hence, any bearish reversal signs around 1.2550 should be considered for SELLING the pair. The material has been provided by InstaForex Company - www.instaforex.com |

| EU agrees to pay for Russian natural gas in rubles Posted: 26 May 2022 09:14 AM PDT

According to the Washington Post, some European energy companies finally accepted Russian President Vladimir Putin's demand to pay for natural gas in rubles. According to the Washington Post, European energy companies finally accepted Russian President Vladimir Putin's demand to pay for natural gas in rubles. It was a difficult decision. However, it helped to avoid disruptions in the supply of the necessary raw materials.In general, the new Kremlin's demands are beneficial to both Russia and the EU. Under the new mechanism, European companies will have to open two accounts: one in rubles and one in euros in Gazprombank. Technically, this means that the EU will still pay for Russian natural gas in euros. Moreover, Russia will not incur any losses as it will receive the required payment in rubles.The West managed to reduce its anxiety over violating its own sanctions. However, the fact that the EU countries bent to Putin's new payment demands means that they are not still dependent on Russian gas despite their plan to impose a total ban on Russian energy imports.In fact, the current situation is very complicated. The EU has agreed to pay for gas in rubles. However, at the same time it strongly condemns Putin's regime and imposes sanctions against Russian businessmen. On top of that, the EU continues to supply arms to Ukraine.Russia in turn has imposed strict capital controls and raised interest rates to stabilize the ruble. Consequently, the EU has conceded and moderated its ambitions so far. Moreover, the bill payment deadline is coming this week. Therefore, a significant strengthening of the ruble is most likely.If the EU rejected the Kremlin's new demands, mostly European consumers would be hard hit as they would have to face soaring electricity prices. Moreover, they are already forced to pay higher prices for electricity than in the past years.At the same time, only Poland and Bulgaria suffered severely out of all the European consumers of Russian gas as Gazprom cut off gas supplies to them at the end of April. This decision was taken by the Russian energy concern in response to the refusal of the governments of these countries to switch to a new payment system. Russian gas deliveries were also terminated to Finland, which has now decided not to take into account Russia's interests and has applied to join NATO.The policy of the rest of the EU countries turned out to be more rational; their reconciliation with the new arrangement will obviously save them from new economic difficulties.As for the issue of EU countries violating their own sanctions, everything is not so unambiguous. Last week, Chief Press Secretary of the European Commission Eric Mamer confidently stated that opening an account in rubles would be a gross violation of the sanctions against Russia. However, only a day later, EU Economy Minister Paolo Gentiloni did not invent another scheme and simply gave the go-ahead for a new payment scheme.Italian officials admitted that the new scheme does not violate the European sanctions, since the process of converting euros into rubles does not involve the Central Bank of Russia, which Eni received written assurances about. But even if one were to imagine that a European company suddenly decided to pay for gas directly in rubles, there would be no violation of the sanctions either, because the Russian ruble itself is not under sanctions.Alexander Novak, Russia's deputy prime minister, said last week that about half of the 54 foreign gas buyers have already opened ruble accounts.So far, all of the EU's decisions to abandon Russian energy resources remain mere words. The very ambitious plan to phase out oil imports is supported by most EU countries, but not implemented because of the countries that are still unable to give up Russian raw materials, such as Hungary. And things are even more complicated with gas, since it is an extremely important raw material for the continent: 40% of the gas burned in Europe depends on supplies from Russia. The European Union only declared its intention to cut its gas supplies by two-thirds by the end of the year, but did not dare to impose a total ban on imports.Meanwhile, Henry Hub gas futures have risen above $9 for the first time since 2008, stopping short of the long-awaited $10.Despite the promise of a future supply buildup, the heat and risks of a debilitating summer have already exhausted the patience of market participants, who have set out to find ways to curb short-term demand. According to forecasts, the coming summer promises to be hotter than usual, which will further raise expectations of increased demand. The material has been provided by InstaForex Company - www.instaforex.com |

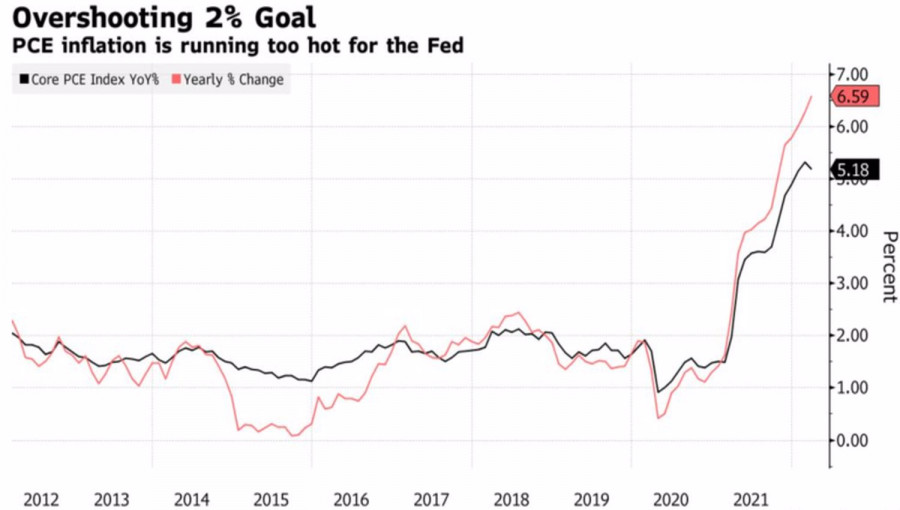

| EUR/USD: Recession fears lead to falling bond yields and sell-offs in US dollar Posted: 26 May 2022 08:38 AM PDT Investors went back to selling the US dollar after the minutes of the last FOMC meeting were released. Recession fears are snowballing through the market, fueling talk of 10-year US Treasury yields peaking at 3.2% in mid-May. Since then, debt rates have been falling for five of the last six trading sessions, depriving the USD index of a key trump card. When GDP growth is likely to slow and inflation to ease, buyers for Treasury bonds will be easy to find. Their price moves in the opposite direction of profitability. The decrease in the latter at the beginning of the year was due to fears of an aggressive tightening of the Fed's monetary policy due to rising inflation by leaps and bounds. In April, growth in the index of personal consumption expenditures stalled, which shifted investors' attention from inflation to recession. And this is a completely different story and financial market conditions. Dynamics of American inflation

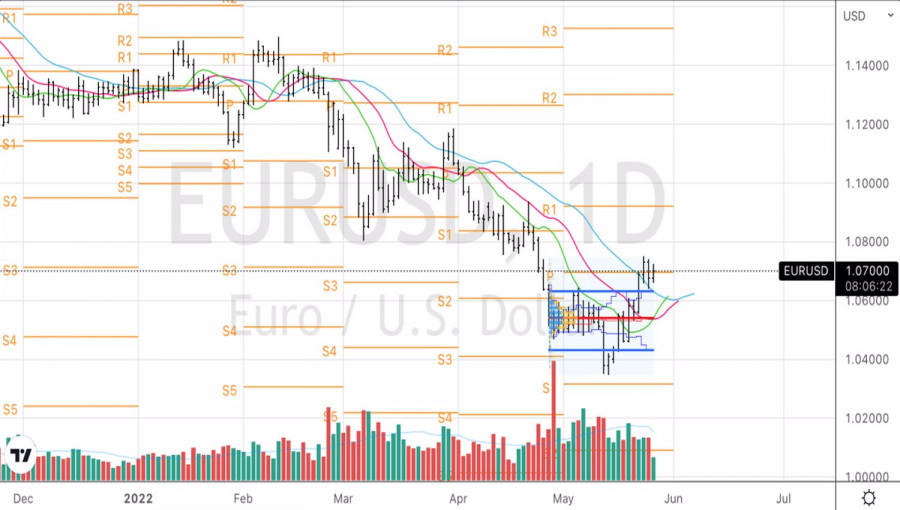

The forecasts of the US Congressional Budget Office also speak of favorable conditions for the purchase of debt obligations. It expects US GDP to slow down from 5.5% in 2021 to 3.1% in 2022 and 2.2% in 2023. The inflation growth rate will decrease from 4.7% this year to 2.7% next year. Such estimates by the agency suggest that, firstly, the Fed will be able to implement its plan to suppress PCE and at the same time achieve a soft landing. Secondly, by the end of 2022, price growth will slow down significantly. If this continues, Fed Chair Jerome Powell and his colleagues will have good reason to pause the monetary tightening process. The most likely scenario is a 50 bps increase in the federal funds rate in June, then another such big move in July, followed by flat borrowing costs in September. Rumors that the Fed will want to sit on the sidelines by the end of the third quarter allowed the rival currencies of the US dollar to raise their heads. The euro has been especially successful in this. The clear plan outlined by Christine Lagarde calls for the ECB to pull the deposit rate out of negative territory at the end of September, which is hot news for financial markets. At the same time, the "hawks" of the Governing Council do not exclude its increase by 50 bps at once. at one of the meetings of the European Central Bank, which adds fuel to the fire of the EURUSD rally. The main currency pair has a good chance of developing a correction, however, in my opinion, the upward movement of the euro has its ceiling. The EU embargo on Russian oil will deepen the energy crisis, bring back talk of stagflation in the eurozone and sell the euro. Technically, the consolidation of EURUSD above the moving averages and the pivot point at 1.07 creates prerequisites for the continuation of the rally. There was no close of the day below 1.065, so the previous recommendation is no longer valid. A break of resistance at $1.0735 could be grounds for buying the euro. EURUSD, Daily chart

EURUSD, Hourly chart

|

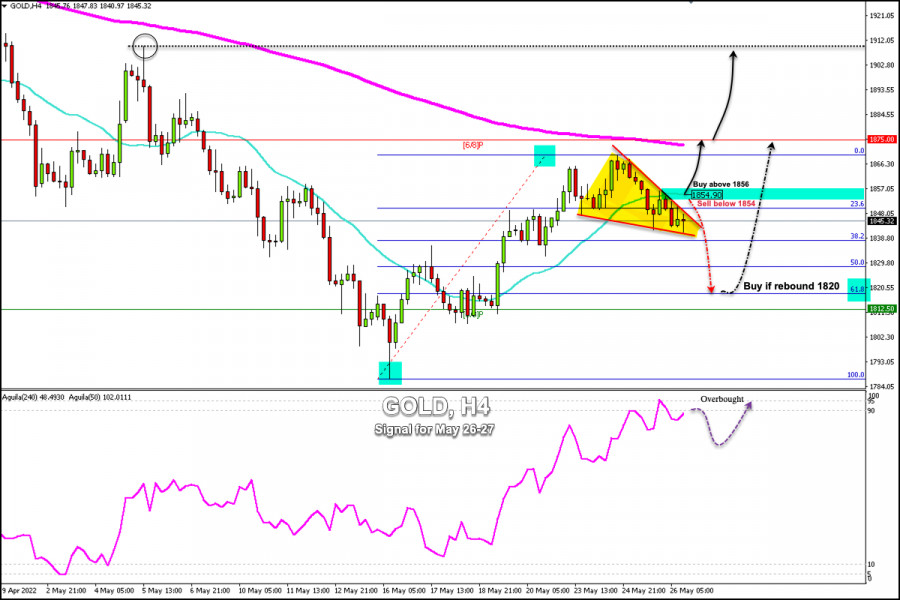

| Posted: 26 May 2022 07:58 AM PDT

Gold (XAU/USD) is extending the pullback from the highs of 1,870, while the US dollar is holding on to small recovery gains amid an environment of cautious risk. The US dollar index is trading at 101.94. The convergence of the 23.6% Fibonacci retracement on the 4-hour chart located at 1,851 and the 21 SMA at 1,854.90 are the immediate barrier. On the 4-hour chart, we can see the formation of a symmetrical triangle. A sharp break above this triangle could cement the bullish strength of gold, but for this, it should consolidate above the pivot point of 1,854. On the other hand, a break below the Fibonacci 38.2% around 1,838 could accelerate the bearish move and it could drop towards the Fibonacci 61.8% around 1,820. The 61.8% Fibonacci level will be a good opportunity for the bulls to buy in the short term and the price could reach the zone of 1,875 and even 1,910. On the other hand, if gold manages to consolidate and make a daily close above the 21 SMA located at 1,854, it may continue its uptrend and it could reach the high of 1,870 and even reach the EMA 200 and 6/8 Murray that converge around 1,875. Our trading plan for the next few hours is to wait until gold tests the zone of 1,855. If the price breaks sharply and consolidates above this zone, it will be an opportunity to buy with targets at 1,875. On the contrary, if gold fails to consolidate above this level, we can sell with targets at 1,840 and 1,820. Since May 24, the eagle indicator has entered an overbought zone. Gold is likely to take advantage of this small correction that is taking place in order to resume its uptrend. However, we must wait for confirmation above 1,855 to buy. The material has been provided by InstaForex Company - www.instaforex.com |

| Stock Asia showed mainly a fall to 1% Posted: 26 May 2022 06:36 AM PDT

Stock Asia showed mainly a fall to 1%. However, some indicators showed an increase: Shanghai Composite by 0.68%, and Shenzhen Composite - by 0.79%. Other indicators declined: Hong Kong's Hang Seng Index - by 0.41%, Korea's Hang Seng Index - by 0.13%, Australia's S&P/ASX 200 - by 0.51%, and Japan's Nikkei 225 - by 0.9%. Investors are concerned about a possible further interest rate hike by the US Federal Reserve. Recall that at the May meeting, the base rate was increased by 50 points, to the level of 0.75-1%. However, this decision did not come as a surprise to market participants, as this was the forecast presented by analysts. Most of the participants in the meeting are ready to further raise rates by another 50 points during the next meetings. Many market participants believe that such a sharp tightening of monetary policy may lead to a slowdown in the pace of economic recovery and growth. Other reasons for investors' pessimism are still the conflict between Russia and Ukraine and the spread of COVID-19 in China, which may lead to the introduction of further restrictions. Among the companies included in the Hang Seng Index indicator, a significant drop was noted in the securities of CSPC Pharmaceutical Group, Ltd., which fell by 5.7%, Wuxi Biologics (Cayman) Inc., which decreased by 4.6%, and Country Garden Services Holdings Co., Ltd., which decreased by 4.5%. BYD (by 0.4%) and Geely (by 2.9%) also showed a decline in the share price, while CNOOC added 1.1% and Sinopec - by 0.7%. Among the largest Japanese companies, the share price of DeNA Co., Ltd. (-8.1%), Mitsubishi Electric Corp. (-4.6%), and Advantest Corp. (-3.2%) decreased. At the same time, the value of securities of other companies increased: SoftBank Group - by 1.2%, Sony - by 0.9%, and Fast Retailing - by 0.2%. The largest companies from South Korea, as usual, do not show significant shifts in quotations: shares of Samsung Electronics Co. They fell by 0.6%, while the cost of Hyundai Motor increased by 0.5%. Of the Australian companies included in the S&P/ASX 200 indicator, Endeavour Group, Ltd. showed a significant drop in quotations, losing 5.3%. Securities of other companies showed a smaller decline: BHP - by 0.8%, and Rio Tinto - by 1.1%. The material has been provided by InstaForex Company - www.instaforex.com |

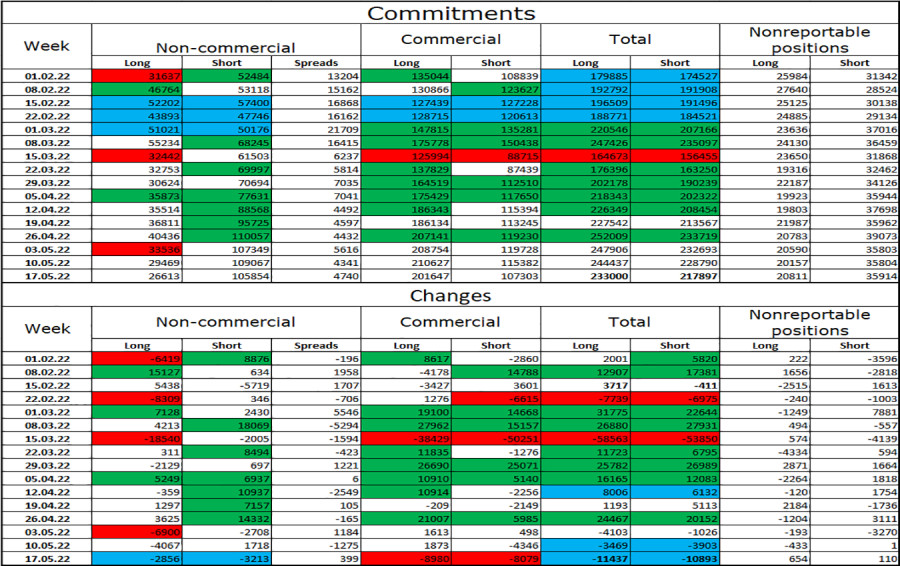

| Forecast for GBP/USD on May 26. The Fed rate is 2%. The issue has already been resolved Posted: 26 May 2022 06:36 AM PDT

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British yesterday and resumed the growth process, ending up at the level of 1.2600, from which it twice rebounded a day earlier. At the time of writing, the pair has already completed three rebounds from this level and is currently making a new attempt to close higher. I believe that this level will not withstand the pressure of bull traders. Each time the pair retreated from the specified level by no more than 100 points, which means that the mood of traders remains unchanged. Quotes have left the upward trend corridor, but they continue to grow. The mood of traders can still be characterized as "bullish". There was not a single piece of news worth attention in the UK today. Around this time, the US releases a report on GDP in the first quarter. This is not the first report on the first quarter, as in the US, three estimates are published for each quarter. Already the first assessment clearly showed what traders should expect. The US economy shrank by 1.4% in the first quarter, and it is unlikely that the next two estimates will be much better. Today, this report can once again help bull traders. And last night, the minutes of the last Fed meeting, which took place in May, when the rate rose to 1%, was released. From my point of view, it contained the information that traders were waiting for. For example, it was said that at the next two meetings, the majority of Fed members will support a rate increase of 1% at once. This is exactly the approach that FOMC representatives have repeatedly voiced in their speeches, and therefore the protocol did not become some kind of revelation. Jerome Powell continues to convince us that the American economy is not in danger of a recession, and in this case, it is even more necessary to raise the rate, because the economy is facing the highest inflation. It is already so, but the slower the regulator acts, the longer it will remain the highest in 40 years. Thus, two rate increases of 0.50% at once are almost inevitable.

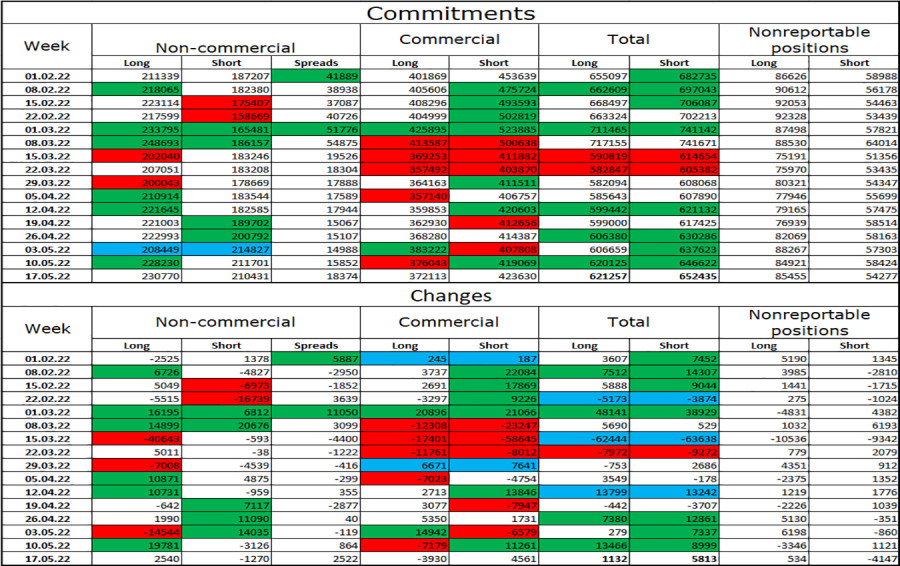

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator. And then a reversal in favor of the British after the formation of "bullish" divergences in the CCI indicator. And now the MACD indicator is brewing a new "bearish" divergence, which may again work in favor of the US currency and a new fall in the direction of the corrective level of 127.2% (1.2250). Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed too much over the past week. The number of long contracts in the hands of speculators decreased by 2,856 units, and the number of shorts - by 3,213. Thus, the general mood of the major players remained the same, "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 4 times more than shorts (105,854-26,613), and large players continue to get rid of the pound. Thus, I expect that the pound may resume its decline in the coming weeks. But also such a strong gap between the number of longs and shorts may indicate a change in the trend in the market. Therefore, I do not rule out the fact that the pound has completed its long fall. News calendar for the US and the UK: US - number of initial applications for unemployment benefits (12:30 UTC); US - change in the volume of GDP for the quarter (12:30 UTC). On Thursday, the calendar of economic events in the UK is empty. There are two reports in the USA today, and the most important one is on GDP. I believe that the information background in the afternoon can have a restrained effect on the mood of traders. GBP/USD forecast and recommendations to traders: I recommended selling the pound if a rebound from the 1.2600 level is performed on the hourly chart with the goals of the lower boundary of the corridor and 1.2432. And I continue to recommend it since the fourth rebound from this level is already possible. I do not recommend buying a pound yet, as the fall may continue in the next couple of days due to divergence on the 4-hour chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: BCOUSD, H4 Bearish Reversal Opportunity Posted: 26 May 2022 06:30 AM PDT Today we take a look at BCOUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2022 06:18 AM PDT

The largest food crisis in Europe, unseen since World War II, is looming. This was recently reported by the Chinese newspaper Xinhua, blaming not only the military situation in Ukraine but also the European government, which has imposed harsh sanctions against Russia. Russia and Ukraine together account for nearly one-third of the world's wheat supply. Ukraine is also a major exporter of corn, barley, sunflower oil, and rapeseed oil. Russia and Belarus, which is also under sanctions, account for more than 40% of global crop nutrient potash exports. The Chinese newspaper Xinhua writes that EU countries have already started to feel the food crisis. For example, due to the disruptions of wheat and corn exports from Russia and Ukraine, the prices of many food products have soared in European stores, and in some countries, there is a shortage of certain types of products.In addition, sales of fertilizers from Russia and Belarus stopped, which caused the prices of commodities to soar as well. Maximo Torero, chief economist of the UN Food and Agriculture Organization, has already admitted that if this problem is not solved, next year most European countries will have difficulties with food supply.In turn, the head of the European Commission, Ursula von der Leyen, said on Tuesday that Russia was to blame because it confiscates grain stocks and special equipment and blocks Ukrainian ships with wheat and sunflower seeds in the Black Sea. Speaking at the annual World Economic Forum in Davos, Switzerland, von der Leyen called on all countries of the world to unite and open alternative routes in order to get as much of the important food commodity - grain - out of Ukraine as possible. This idea was fully supported by the EU agriculture ministers at the meeting in Brussels. The start of Russia's military operation in Ukraine and the subsequent attempt by Western European countries to economically hurt Moscow, isolating it from the global market, provoked an unprecedented jump in prices not only for grain and fertilizers but also for vegetable oil and energy. Moscow argues the opposite, blaming Western countries for the artificial creation of a global food crisis, which is being implemented because of the harshest sanctions ever. The European Commission assures the public that European food stocks are under control, but admits that with the deficit of Ukrainian exports of corn, wheat, vegetable oil, and rapeseed, food and animal feed prices in all EU countries will skyrocket, thus putting pressure on farmers as well. Clearly, sentiment in Europe remains unstable and even depressed. Global economic growth is in great doubt, especially as a number of central banks are trying to fight rampant inflation by tightening monetary policy. European Central Bank head Christine Lagarde announced this week that the ECB's negative deposit rate would begin to rise in July. By the end of September, this rate is expected to be at zero or "slightly higher," and then it is expected to continue rising "toward neutral rate." The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2022 06:13 AM PDT

Hi, dear traders! EUR/USD reversed upwards on Wednesday and has extended its uptrend on Thursday. At the time of writing, the pair returned to the retracement level of 127.2% (1.0705), but failed to settle above it. The current ascending channel indicates that traders remain bullish on EUR/USD. However, the latest economic events have been mixed and could not have triggered the pair's 400 points increase. The PPI data releases in both the US and the EU, as well as US durable goods orders generally do not influence traders significantly. The pair's upwards reversal is very likely a typical upward correction after a lengthy downtrend period of the past few months. The situation in Ukraine has not improved, and the euro's long-term downtrend could resume once again. According to the H4 chart, the pair bounced off the retracement level of 100.0% (1.0638) upwards, forming a bullish CCI divergence. EUR/USD has begun to move towards the Fibo level of 76.4% (1.1041). However, the pair remains within a descending trend channel, indicating bearish sentiments among traders. As stated above, the pair's upturn could likely be a correction - the pair remains in a downtrend on the H4 chart. Commitments of Traders (COT) report:

Last week, traders opened 2,540 Long positions and closed 1,270 Short positions, indicating an increasingly bullish sentiment in the market. The total number of open Long positions is not 230,000 against 210,000 Short positions. The gap between Open and Short positions is quite small and does not match the prolonged downward trend of EUR/USD. The European currency has been sliding down, despite the bullish trader sentiment. The situation remains roughly the same this week, with trader positioning not matching the actual situation in the market. US and EU economic calendar:US: initial jobless claims (12-30 UTC):US: GDP growth rate QoQ (12-30 UTC). There are no economic events in the EU today. Today's US GDP data is the main data release of the day. Events on the economic calendar could have an indirect impact on traders in the second half of the day. Outlook for EUR/USD: Short positions can be opened if the pair closes above the price channel on the H1 chart, targeting 1.0574 and 1.0430. Earlier, traders were recommended to open long positions if the pair bounced off 1.0638 on the H4 chart, with 1.0705 being the target. These positions can now be closed. The material has been provided by InstaForex Company - www.instaforex.com |

| European markets rise as US stocks edge up Posted: 26 May 2022 05:14 AM PDT Major European indexes advanced slightly early on Thursday, following gains in the US stock market. At the time of writing, the STOXX Europe 600 increased by 0.2% to 435.18 points. The index lost 0.6% over the past week due to investor anxiety about global economic growth amid rising inflation, monetary tightening by major central banks, the conflict in Ukraine, and the lockdowns in China. The best-performing stock on the STOXX Europe 600 early on Thursday was Intermediate Capital Group PLC, which was propelled upwards by a strong fiscal year report. Ted Baker PLC also increased after the company reported lower annual loss in this fiscal year.The market cap of Johnson Matthey PLC slumped following the release of a weak outlook for the next year. The CAC 40 gained 0.56%, the DAX increased by 0.5%, and the FTSE 100 rose by 0.11%.

European investors focused on the yesterday's upsurge in the US markets. US indexes closed in positive territory yesterday as traders became less concerned about aggressive Fed monetary tightening. According to the latest Fed meeting minutes, most Federal Reserve policymakers backed increasing the interest rate by 50 basis points at several upcoming policy meetings, easing trader anxiety. Many market players earlier expected larger rate moves by the US regulator. Wednesday's trading session On Wednesday, major European indexes went upwards, recovering some of their earlier losses. Strong macroeconomic data from leading eurozone countries gave support to the stock market. The STOXX Europe 600 increased by 0.63% to 434.31 points. The index lost 1.1% on Tuesday. On the STOXX Europe 600, Wednesday's best performing stock was Verbung AG, which jumped by 9.4%. The worst performers were BHP Group (-10,5%), which recently closed its share register, and JD Sports (-6%) The CAC 40 gained 0.73%, while the DAX and the FTSE 100 increased by 0.63% and 0.51% respectively. Shares of TotalEnergies SE rose by 2.9% on Wednesday after the company acquired a 50% stake in the US renewable energy company Clearway. Marks & Spencer Group Plc increased by 4.8%, thanks to strong quarterly earnings report. The market cap of Glencore Plc edged up by 0.3% Strong macroeconomic data from Germany gave support to European indexes on Wednesday. The IFO business climate index unexpectedly increased to 93 points in May from 91.8 points in April, despite anxiety over rising inflation and the war in Ukraine. The index was expected to fall to 91.4 points. According to preliminary estimates, Germany's GDP has increased by 4% YoY in the first quarter of 2022. Furthermore, the GfK consumer confidence index edged up to -26 points from a downwardly revised -26.6 in the previous month. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for May 26, 2022 - Potential for bigger drop and breakout of upside channel Posted: 26 May 2022 05:13 AM PDT Technical analysis:

EUR/USD has been sideways today but I see potential for the downside breakout of the rising channel. Watch for potential downside breakout. Trading recommendation: Due to the strong downside cycle on the higher time-frame and very defined upside channel, I see potential for the downside breakout. In case of the downside breakout ,watch for potential selling opportunities with the downside objective at 1.0540. Stochastic is showing fresh bear cross, which is sign for the downside movement. Key resistance is set at the price of 1.0760 The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for May 26,.2022 - Breakout of the upside channel and potential for the bigger drop Posted: 26 May 2022 05:07 AM PDT Technical analysis:

Gold has been trading downside as expected but there is still space for potential test of lower references. Selling opportunities still preferable. Trading recommendation: Due to the strong downside cycle and the breakout of the upside channel, I see potential for the downside continuation. Watch for potential selling opportunities with the downside objectives at the price of $1.836 and $1.811. MACD oscillator is showing upside reading but decreasing in the upside momentum, which is sign for upside exhaustion. Key resistance is set at the price of $1.870 The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CHF Technical Analysis and Trading Tips on May 26, 2022 Posted: 26 May 2022 05:01 AM PDT

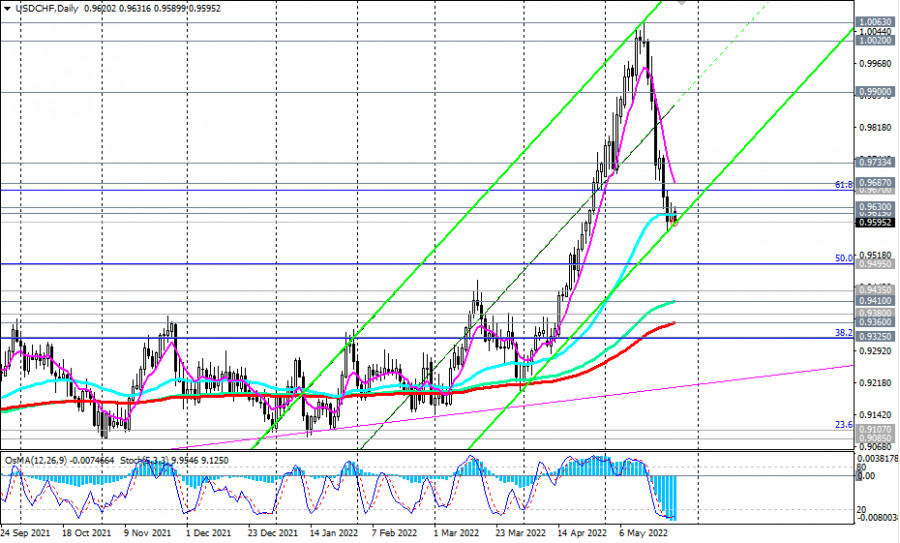

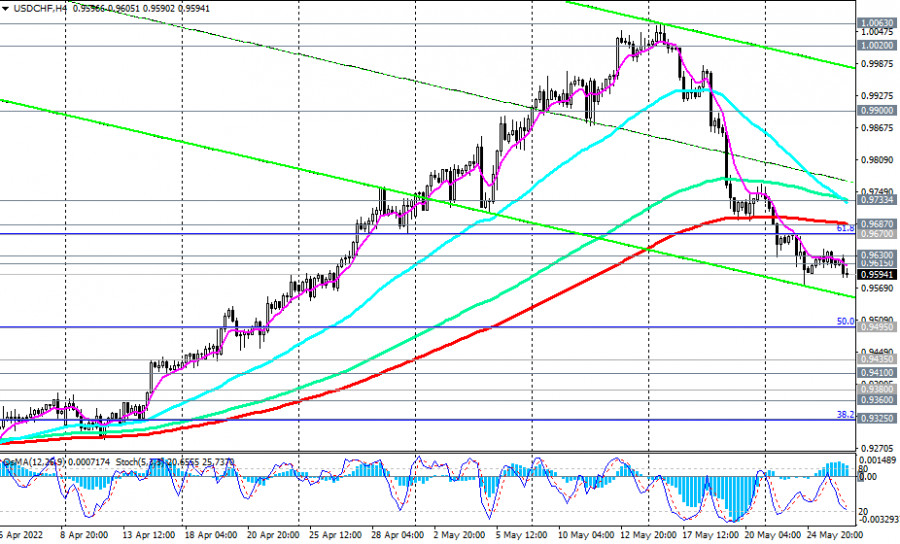

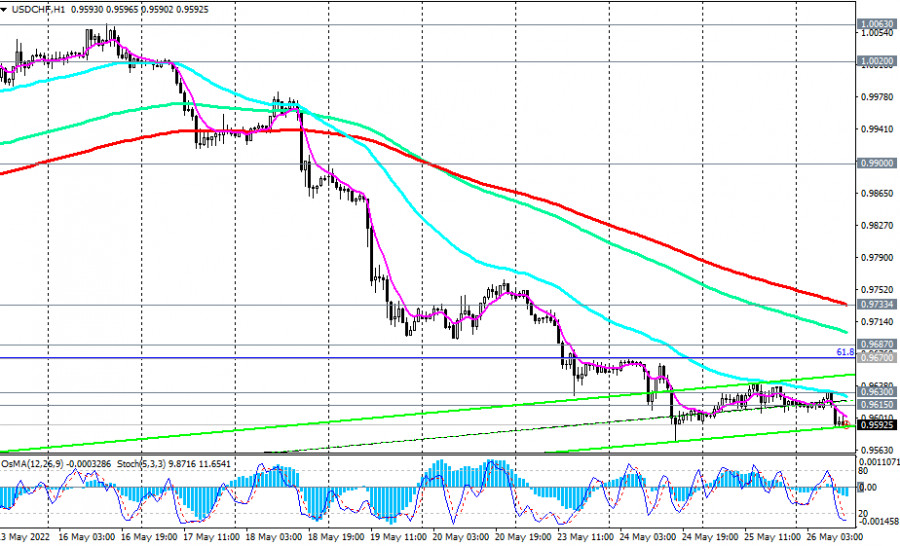

USD/CHF is trading near 0.9592 as of this writing, down from a nearly 2-week high at 1.0020.

Despite the decline, the long-term upward trend of USD/CHF remains, while the pair reached important support levels at 0.9615 (50 EMA on the daily chart), and 0.9595 (the lower limit of the ascending channel on the daily chart), from which a rebound and resumption of growth is possible. A strong upward impulse prevails, which is provided primarily by the prospects for further strengthening of the dollar against the backdrop of the Fed's monetary policy, the most aggressive in comparison with the policies of other major world central banks.

If, as we assumed, there is a rebound from the current support levels, then the first ("fast") signal for entering long positions will be a breakdown of the local resistance levels at 0.9630, 0.9642, and the confirming one will be a breakdown of the resistance levels at 0.9687 (200 EMA on the 4-hour chart), and 0.9733 (200 EMA on the 1-hour chart).

In an alternative scenario, and if the fundamental background still pushes the USD/CHF quotes lower, the downward correction may continue up to the support levels 0.9435 (200 EMA on the weekly chart), and 0.9410 (144 EMA on the daily chart). A breakdown of support levels 0.9360 (200 EMA on the daily chart), and 0.9325 (38.2% Fibonacci retracement of the upward correction to the downward wave that began in April 2019 near 1.0235) may once again push USD/CHF into the bear market zone. It should be noted that today's publication (at 12:30 GMT) of the report of the US Bureau of Economic Analysis with data on the country's GDP can become a new driver of movement. Support levels: 0.9615, 0.9595, 0.9500, 0.9495, 0.9435, 0.9410, 0.9380, 0.9360, 0.9325, 0.9300 Resistance levels: 0.9630, 0.9642, 0.9670, 0.9687, 0.9733, 0.9900, 1.0000, 1.0020, 1.0063 Trading tips Sell Stop – 0.9565. Stop-Loss – 0.9655. Take-Profit –0.9500, 0.9495, 0.9435, 0.9410, 0.9380, 0.9360, 0.9325, 0.9300 Buy Stop – 0.9655. Stop-Loss – 0.9565. Take-Profit – 0.9670, 0.9687, 0.9733, 0.9900, 1.0000, 1.0020, 1.0063 The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for Ethereum on May 26, 2022 Posted: 26 May 2022 04:59 AM PDT

Technical outlook:Ethereum dropped through the $1,797 lows intraday on Thursday before finding support. The crypto is quickly pulling back through the $1,810-20 zone at this point in writing and is expected to turn higher towards $3,000 in the near term. The corrective drop since the $2,165 highs seems to be complete now as bulls remain poised to come back in control. Ethereum structure is constructive for bulls until prices stay above $1,700. The crypto has produced an Up Gartley terminating around $1,895. It should be now ready to push higher towards $3,000 and up to $3,500 going forward. Also, note that prices have bounced off the Fibonacci 0.789 retracement of its recent upswing between $1,700 and $2,165. Ethereum is unfolding a counter-trend rally from $1,700. It is expected to terminate through $3,500 in the next several trading sessions. Importantly, the $3 500-3 600 zone is close to the Fibonacci 0.618 retracement of the entire drop between $4,850 and $1,700 respectively. A high probability remains for a bearish turn thereafter. Trading plan:Potential rally through $3,500 against $1,700 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| BTC update for May 26,.2022 - Potential for the downside continuation Posted: 26 May 2022 04:59 AM PDT Technical analysis:

BTC has been trading downside as expected and there is potential for the major breakout of the key multi day flag. Selling opportunities are preferable due to strong downside cycle in the background. Trading recommendation: Due to the strong downside cycle potential continuation al pattern, I see potential for fuhrer drop on BTC. Watch for potential selling opportunities on the intraday rallies with the downside objectives at $25.700 and $20.00. MACD oscillator is showing downside reading, which is good sign that sellers are in control. Stochastic oscillator is showing fresh bear cross, which is another sign for further downside movement. Key resistance is set at the price of $31.300 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2022 04:46 AM PDT

The Energy Information Administration reported crude oil inventories in the country had shed 1 million barrels in the week.They now stand at 419.8 million barrels, 14% below the five-year average for this time of the year. Last week's inventory change compared with a draw of 3.4 million barrels estimated for the previous week. As for gasoline, the EIA reported a decline of 500,000 barrels for the week, with gasoline production averaging 9.4 million bpd.The week before, gasoline inventories shed 4.8 million barrels and production averaged 9.6 million barrels daily. In middle distillates, the authority estimated an inventory increase of 1.8 million barrels. Production stood at an average of 5.1 million bpd. This compared with an inventory build of 1.2 million barrels and a production rate of 4.9 million bpd a week earlier. According to AAA, gasoline prices continued to hit all-time highs last week, reaching $4.598 per gallon on Tuesday. Diesel prices were lower, however, at $5.549 per gallon on Tuesday, down from $5.573 per gallon a week ago. The diesel fuel situation in the US and other countries remains almost critical due to the tightness of available inventory. To quench concerns, the Biden administration announced it was considering a release from the emergency diesel reserve. According to the Wall Street Journal, diesel fuel supplies are particularly tight on the East Coast. There, inventories have fallen to the lowest since at least 1990. Crude oil prices are also staying higher as the supply and demand situation remains unchanged, even though worry about recession has served to limit the upside potential of benchmarks.

OPEC's de facto leader Saudi Arabia signaled once again it had no plans to boost production further, and the EU continued to discuss an oil embargo on Russia. On Tuesday, CNBC quoted Secretary of Energy Jennifer Granholm as saying that the US was considering an export ban in an attempt to curb domestic fuel prices. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments