Forex analysis review

Forex analysis review |

- Technical analysis of BTC/USD for July 23, 2022

- Gold price ends the week on a positive note.

- Technical analysis on EURUSD for July 22ND, 2022.

- Technical bearish signal in USDJPY.

- Cardano remains asleep for the last two months and a half.

- Weekly analysis on Bitcoin.

- July 22, 2022 : EUR/USD daily technical review and trading opportunities.

- July 22, 2022 : EUR/USD Intraday technical analysis and trading plan.

- July 22, 2022 : GBP/USD Intraday technical analysis and significant key-levels.

- EUR/USD: Failed PMIs and political crisis in Italy

- GBP/USD analysis on July 22. The market did not expect such weak data from the USA

- EUR/USD analysis on July 22. The dollar fell sharply in price after the failed business activity indices

- GBP/USD: plan for the US session on July 22 (analysis of morning deals). The pound returned losses after data on activity

- GBP/USD Technical Analysis and Trading Tips for July 22, 2022

- Technical analysis of GBP/USD for July 22, 2022

- Technical analysis of EUR/USD for July 22, 2022

- US premarket on July 22: Stock market continues to rise due to strong corporate reports

- Stock markets extends gains

- Trading Signal for USD/JPY for July 22 - 25, 2022: buy above 136.49 (weekly support)

- GBP/USD on July 22, 2022

- Analysis of EUR/USD on July 22. EUR unable to climb despite ECB's rate hike

- EUR/USD: trading plan for New York session on July 22. Overview of morning trading. EUR tumbles after dismal PMIs for Eurozone

- Trading Signal for GOLD (XAU/USD) for July 22 - 25, 2022: buy above $1,713 (downtrend channel)

- Trading plan for EURUSD on July 22, 2022

- Asia's main indices trading mixed

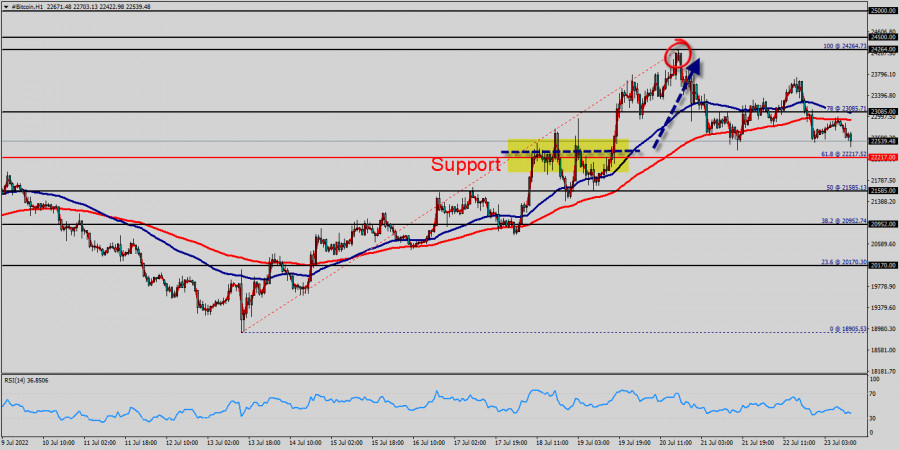

| Technical analysis of BTC/USD for July 23, 2022 Posted: 23 Jul 2022 04:19 AM PDT

The bullish trend is currently very strong on BITCOIN - BTC/USD. As long as the price remains above the support levels of 22k, 21k, you could try to benefit from the growth. The first bullish objective is located at the price of 23,085 USD. The bullish momentum would be boosted by a break in this resistance (23,085 USD). The hourly chart is currently still bullish. At the same time, some stabilization tendencies are visible between 22,217 USD and 24,264 USD. Together with the relatively large distance to the fast-rising 100-day moving average (22,2172 USD), there are some arguments for a relief rally in coming months on the table. Bitcoin is at highest against the dollar around the spot of 22,2172 USD since two weeks - Bitcoin is inside in upward channel. Since three weeks BTC/USD decreased within an up channel, for that Bitcoin its new highest 22,2172 USD. Consequently, the first support is set at the level of 22,2172 USD. Hence, the market is likely to show signs of a bullish trend around the area of 22,2172 USD. Our sentiment on BTC/USD - Bitcoin US Dollar : - Short term : Bullish market in short term. - Tacit : Bullish market in long term. Buyers would then use the next resistance located at 23,085 USD as an objective. Crossing it would then enable buyers to target 24,264 USD (the double top - last bullish week). Be careful, given the powerful bullish rally underway, excesses could lead to a possible correction in the short term. If this is the case, remember that trading against the trend may be riskier. It would seem more appropriate to wait for a signal indicating reversal of the trend. Bitcoin price could be awaiting a major upswing if the digital savings manages to slice above a fatal line of the first resistance that sets at the price of 24,264 USD (Horizontal balck line). The prevailing chart pattern suggests that if the leading cryptocurrency could be expecting to rebound from the levels of 22,2172 USD and 24,264 USD. BITCOIN - BTC/USD rating 22,475 USD. On the day, this instrument gained about +2% and was traded between 22,217 USD and 24,264 USD over the period. The price is currently at +2% from its lowest and -1% from its highest. Conclusion : If the BTC/USD fails to break through the support prices of 22,217 USD today, the market will rise further to 23,085 USD so as to try to break it. Bitcoin is one the best overall investment for July, 2022. However, if you want to try to improve the growth of Bitcoin, thus it seems great to buy above the last bearish waves of 23,085 USD. Re-buy orders are recommended above the majors sypport rates of (23,085 USD) with the second target at the level of 24,264 USD. Furthermore, if the trend is able to breakout through the second resistance level of 24,264 USD. We should see the pair climbing towards the next target of 24,264 USD The pair will move upwards continuing the development of the bullish trend to the level $24,264 USD. It might be noted that the level of 24,264 USD is a good place to take profit because it will form a new double top in coming hours. The general bullish opinion of this analysis is in opposition with technical indicators. As long as the invalidation level of this analysis is not breached, the bullish direction is still favored, however the current short term correction should be carefully watched. The bulls must break through 23,085 USD in order to resume the up trend. The material has been provided by InstaForex Company - www.instaforex.com |

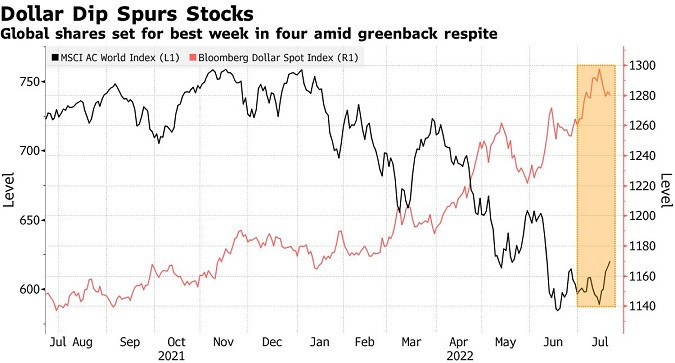

| Gold price ends the week on a positive note. Posted: 22 Jul 2022 01:23 PM PDT

Blue lines- bullish RSI divergence Red lines- bearish medium-term channel Gold price finally bounced after yesterday's reversal candlestick. Price today reached as high as $1,740 and Gold is getting closer towards our bounce target area of $1,750-70. Gold price is still inside the medium-term bearish channel, but still has upside potential to test the channel's upper boundary. Although this past week started with Gold price making new 2022 lows, price has bounced off $1,680 towards $1,740 in two sessions. Gold price has potential to move towards $1,750-70. The material has been provided by InstaForex Company - www.instaforex.com |

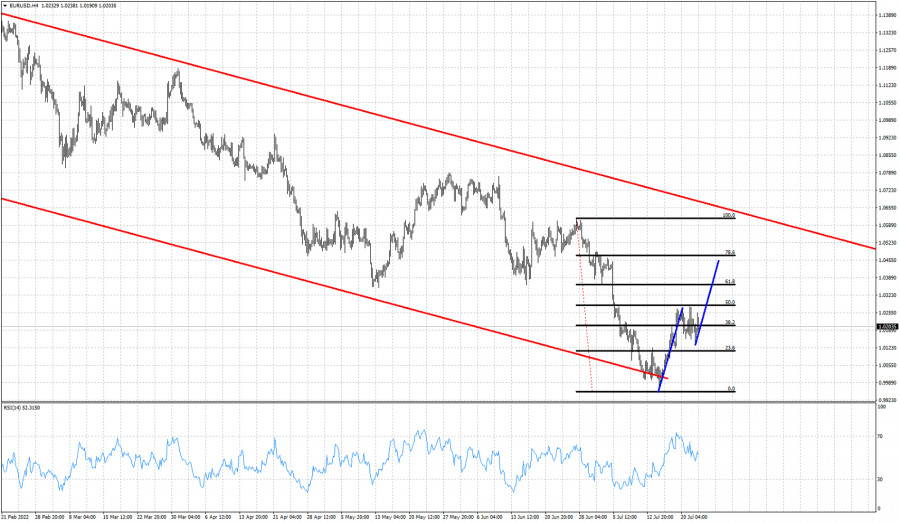

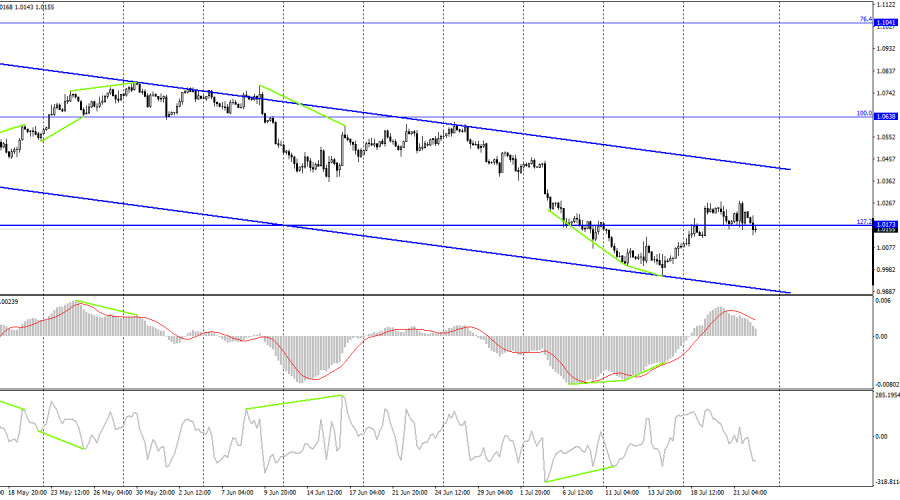

| Technical analysis on EURUSD for July 22ND, 2022. Posted: 22 Jul 2022 01:19 PM PDT

Red lines- bearish medium-term channel Black lines -Fibonacci retracements Blue lines- possible path higher EURUSD remains inside the medium-term bearish channel. Price as expected has started to bounce off the lower channel boundary. The RSI has provided us with the early warnings and the break out of the short-term channel confirmed the short-term reversal. From parity, EURUSD has managed to climb towards 1.0255. So far price has retraced 50% of the last leg down. Bulls need to show more signs of strength. Short-term resistance is the 50% retracement at 1.0280. Bulls need to break above this level. This could lead them towards 1.0450. EURUSD has the potential to bounce much higher towards the upper channel boundary. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical bearish signal in USDJPY. Posted: 22 Jul 2022 01:14 PM PDT Yesterday USDJPY broke below the key wedge pattern support at 137.90 and provided us with the first bearish signal after a long time. We warned several times before with our analysis that although technically trend remained bullish, the signs of a weakening up trend were there and we should have expected a pull back. I know believe we are the beginning of this pull back.

Green line -support trend line Yesterday USDJPY broke below the key wedge pattern support at 137.90 and provided us with the first bearish signal after a long time. We warned several times before with our analysis that although technically trend remained bullish, the signs of a weakening up trend were there and we should have expected a pull back. I know believe we are the beginning of this pull back. The combination of the bearish RSI divergence with the break of the green trend line provided us with a bearish signal. So far price has lost nearly 200 pips and we expect to see more downside. We are bearish USDJPY as long as price is below 139. The material has been provided by InstaForex Company - www.instaforex.com |

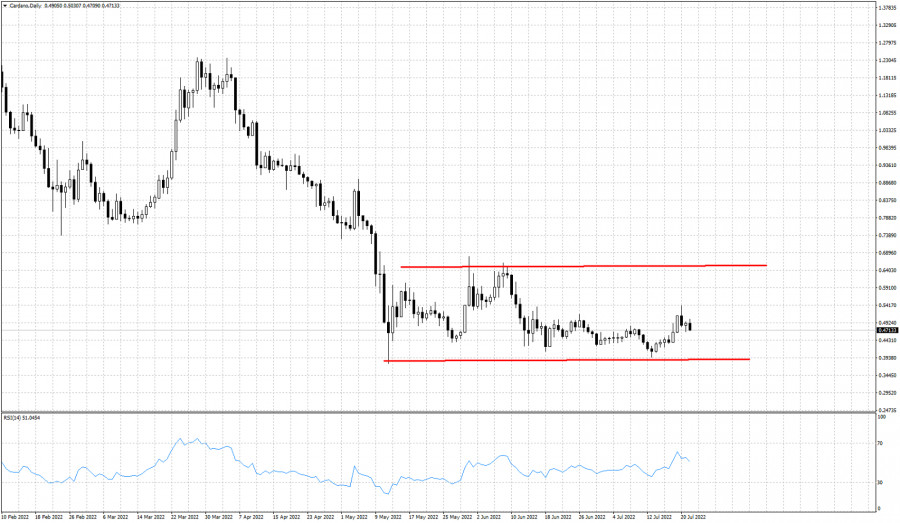

| Cardano remains asleep for the last two months and a half. Posted: 22 Jul 2022 01:10 PM PDT

Red lines- trading range Cardano price continues to move sideways since May. Price has made several attempts to break below $0.39 but it has now formed a lower trading range boundary there as support. On the other hand attempts to push price above $065 have also failed. When price is trading close to the lower trading range boundary, we prefer short-term bullish positions targeting at least the upper range boundary close to $0.65. A break below $0.39 will be a bearish sign and will imply more selling pressures to come. The material has been provided by InstaForex Company - www.instaforex.com |

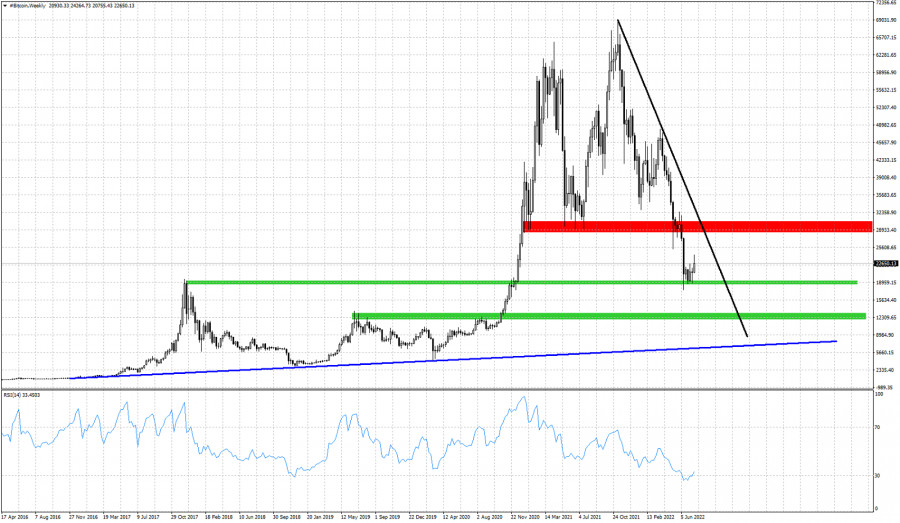

| Posted: 22 Jul 2022 01:07 PM PDT

Blue line -long-term support trend line Green rectangles- horizontal support levels Red rectangles- horizontal resistance Black line -resistance trend line Bitcoin has so far retraced more than 61.8% of its entire upward movement from its lows to the recent all time highs. Price technically remains in a bearish trend making lower lows and lower highs. The last few weeks price is stuck around $18,000-$23,000 with no real progress. Price has stopped its decline right on top of the horizontal support by the 2017 highs. Trend will remain bearish on a weekly basis as long as price is below the black trend line and below the red horizontal resistance around $28,000. If Bitcoin price breaks below the recent lows, we should then see price fall towards the next green horizontal support around $12,000. The material has been provided by InstaForex Company - www.instaforex.com |

| July 22, 2022 : EUR/USD daily technical review and trading opportunities. Posted: 22 Jul 2022 10:02 AM PDT

In late September, Re-closure below the price level of 1.1700 has initiated downside-movement towards 1.1500 where some recovery was witnessed. Shortly after, Price levels around 1.1700 managed to hold prices for a short period of time before another price decline took place towards 1.1200. Then the EURUSD has temporarily moved-up within the depicted movement channel until downside breakout occurred recently. Since then, the price zone around 1.1500 has applied significant SELLING pressure when a valid SELL Entry was offered upon the previous ascending movement towards it. Shortly after, the EURUSD found support while approaching the price levels of 1.0800 few weeks ago. That's where the recent upside movement was previously initiated. However, the recent movement towards 1.1200 was considered for another SELL Trade which already reached its targets. Any ascending movement towards 1.0800 should be watched for selling pressure where a new downside movement can be established. The material has been provided by InstaForex Company - www.instaforex.com |

| July 22, 2022 : EUR/USD Intraday technical analysis and trading plan. Posted: 22 Jul 2022 10:01 AM PDT

The recent movement towards 1.1200 was suggested for another SELL opportunity which already reached its targets beyond the price level of 1.0400. The previous ascending movement above 1.0600 enabled further advancement towards 1.0800 where evident bearish rejection arised again. The EURUSD pair had been trapped between 1.0350 (the newly recorded Low) and 1.0750 which corresponds to the nearest existing SUPPLY level until bearish breakout below 1.0350 was recently achieved. Shortly after, the pair was approaching new price levels around 1.0000 that haven't been visited since 2002. That's where price action was watched for significant bullish recovery especially around such an important psychological support. The nearest supply level is located around 1.0350 where bearish rejection should be anticipated. The material has been provided by InstaForex Company - www.instaforex.com |

| July 22, 2022 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 22 Jul 2022 10:00 AM PDT

Recently, the GBP/USD pair remained under bearish pressure to challenge the new low around 1.2150 again which was temporarily bypassed few days go. Immediate bullish rejection was expressed around 1.1950 bringing the pair back above 1.2150 again towards higher price levels. Bullish persistence above 1.2300 (when achieved) will probably enable further bullish continuation towards 1.2550 and probably 1.2650 where further decisions can be taken. On the other hand, more bearish visits were expected to challenge the price level of 1.1950 when sufficient bearish momentum was expressed. Significant bullish recovery has been witnessed during the recent bearish dip that took place earlier few weeks ago. Recently the pair looked oversold while approaching these price levels. This favours the bullish scenario at least towards 1.2520 unless bearish persistence below 1.1900 is achieved towards 1.1650. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Failed PMIs and political crisis in Italy Posted: 22 Jul 2022 08:56 AM PDT The EUR/USD pair has lost its offensive potential. On the eve of the ECB meeting, the euro was in high demand, according to the trading principle "buy on rumors, sell on facts." However, after the announcement of the results of the July meeting, the euro fell under a wave of sales. Insider information about a 50-point rate hike, published on the eve of the meeting, leveled the effect of surprise, so the very fact of the increase did not impress investors. Market participants focused their attention on further prospects for tightening monetary policy, while in this part, the European Central Bank failed to please buyers of EUR/USD. ECB President Christine Lagarde clearly avoided specifics, stating that further rate hikes would depend on incoming macroeconomic data.

Traders didn't like this "blurring": market participants lost interest in the euro, after which the sellers seized the initiative for the EUR/USD pair. Today the pressure on the pair increased after the publication of European statistics. So, today PMI indices were published in key European countries, which, as a selection, came out in the "red zone." For example, in France, the index of business activity in the manufacturing sector fell and crossed the key 50-point mark, reaching 49 points. The indicator shows a downward trend for the second month in a row. A similar situation has developed in the services sector, which slowed down to 52.1 points, while it rose to 54 points in June. The German figures were also disappointing. The manufacturing PMI in the country fell to 49 points, down to a two-year low, the weakest result since July 2020. The indicator has been consistently decreasing for the past five months. Services PMI also slowed down to 49 points (against the expected growth to 52 points). Pan-European PMI indices repeated the trajectory of French and German indicators: manufacturing PMI slowed down to 49 points (after rising to 52 points), services PMI to 50.6 points, that is, almost to the verge of a foul. The published figures had a significant pressure on the euro because almost all its components crossed the red line of the 50-point mark, reflecting the deterioration of the situation. In addition, the euro reacted to the latest political events in Italy. Note that almost a year and a half ago—in February 2021—the former head of the ECB, Mario Draghi, after long negotiations, stitched together a broad government coalition by forming and heading the cabinet of ministers. Thus, he then did not allow the dissolution of parliament and the holding of early elections. In other words, Italy managed to avoid the worst-case political scenario at the beginning of last year, thereby supporting the euro.

Today, however, the situation is reversed. Draghi, on his own initiative, resigned from his post (and on the second attempt), provoking the dissolution of parliament and the appointment of early parliamentary elections. Thus, a political crisis erupted in the country during a looming recession and energy crisis. According to economists interviewed by Deutsche Welle, the economic reforms launched by Draghi will slow down again, negatively affecting both the economy and society. Markets are already reacting to his resignation with falling stock prices and pressure on Italian banks. In other words, the prevailing fundamental background does not contribute to the development of a correction for the EUR/USD pair. The European Central Bank only situationally supported the euro: the buyers of the pair played this trump card yesterday, having lost the initiative after that. Now the focus is on the July meeting of the Fed, the results of which will be summed up next Wednesday. In anticipation of this event, EUR/USD traders are unlikely to decide on active offensive actions—both downward and upward. Bears will not dare to re-storm the parity level, while bulls will not conquer the area of the third figure, even though these actions are necessary for the development of the downward/upward trend. Traders are stuck within a wide-range flat, the lower border of which corresponds to the Tenkan–sen line on the daily chart (1.0110), and the upper one corresponds to the Kijun-sen line on the same timeframe (1.0290). Most likely, the pair will hold within this price corridor until the announcement of the results of the July meeting of the Fed (July 27). From a technical point of view, the situation is uncertain. The EUR/USD pair on the daily chart is between the middle and lower lines of the Bollinger Bands indicator, under the Kumo cloud, but between the Tenkan-sen and Kijun-sen lines. In other words, trend indicators do not signal any priority: the pair is at a crossroads. In my opinion, in the medium term, it is advisable to open short positions on the upward pullbacks with the downward target of 1.0110 (the Tenkan-sen line of the Ichimoku indicator on D1). The material has been provided by InstaForex Company - www.instaforex.com |

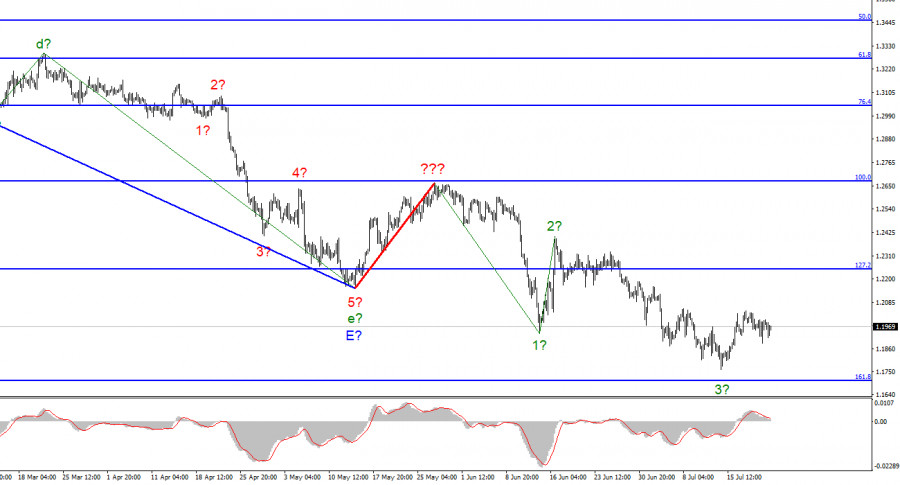

| GBP/USD analysis on July 22. The market did not expect such weak data from the USA Posted: 22 Jul 2022 08:40 AM PDT

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be regarded as a segment of the downward trend. Thus, we can now definitively state that the building of the upward correction phase of the trend has been canceled, and the downward component of the trend will have a longer and more complex shape. I'm not a big fan of continually complicating the wave marking when dealing with a highly elongating trend zone. I believe it would be far more efficient to recognize rare corrective waves, following which new impulse structures can be constructed. Now that waves 1 and 2 have been completed, we may infer that the instrument is in the process of constructing wave 3. However, this wave proved unconvincing (if finished now), as its low is not significantly lower than wave 1's low. Consequently, the current downturn cannot be characterized as impulsive, but it may be a complex correction. Focus on the wave marking of the EUR/USD instrument in this regard. Furthermore, British data was far from perfect. The pound and dollar exchange rates jumped by 40 basis points on July 22. The instrument increased by 140 points in the last few hours, although the British pound declined in the first half of the day. I want to point out that the market's reaction to the dismal British and American numbers has been appropriate today. It's only that the American one was a flop, and the British one was ineffective. But let's start in order. June's retail sales volume in the United Kingdom was the first to be revealed. The indicator declined by 0.1% monthly and 5.8% annually. Excluding fuel purchases, the indicator increased 0.4% monthly and is down 5.9% yearly. The market's anticipations were roughly the same. The business activity indices followed. The service sector decreased by 1.0 points, the production sector by 0.6 points, and the overall index fell by 0.9 points. Consequently, none of the British figures exceeded market expectations, and demand for the British decreased until the release of American statistics, which turned out to be much worse. As stated in the article on the euro currency, two of the three business activity indices went below the 50.0 threshold, resulting in a decline in afternoon demand for the US dollar. This week has been filled with news and reports, but next week promises to be even more exciting. According to the present markup, the euro and the pound must continue to lose demand to develop five-wave structures. At first look, this will be a simple task, as the Fed will nearly entirely increase the rate by 75 basis points. Some analysts estimate that the surge might reach 100 points. From my perspective, this is sufficient to initiate the formation of new downward waves for both instruments. Otherwise, the wave pattern could grow even more complex.

General conclusions The increased complexity of the wave structure of the pound/dollar pair signals a further downturn. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1.1708, corresponding to 161.8 percent Fibonacci. Now, there is a prospect of an upward wave forming, but I do not anticipate it to be robust and protracted. The material has been provided by InstaForex Company - www.instaforex.com |

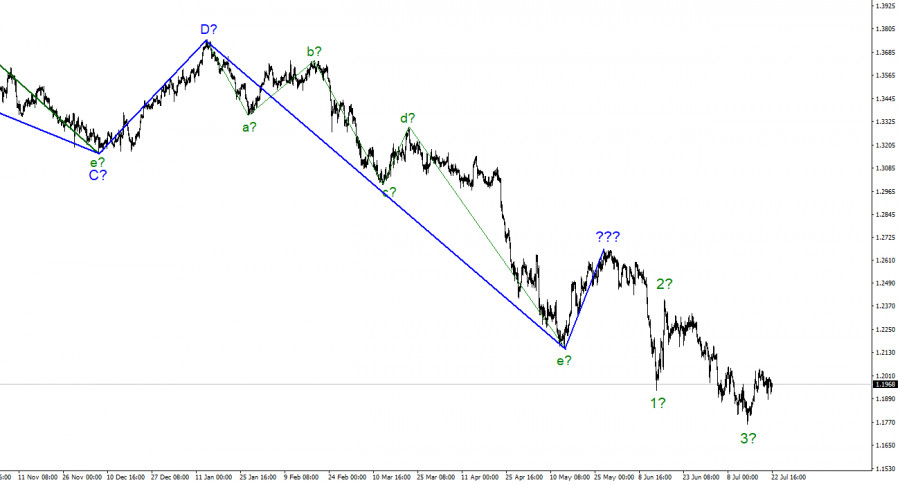

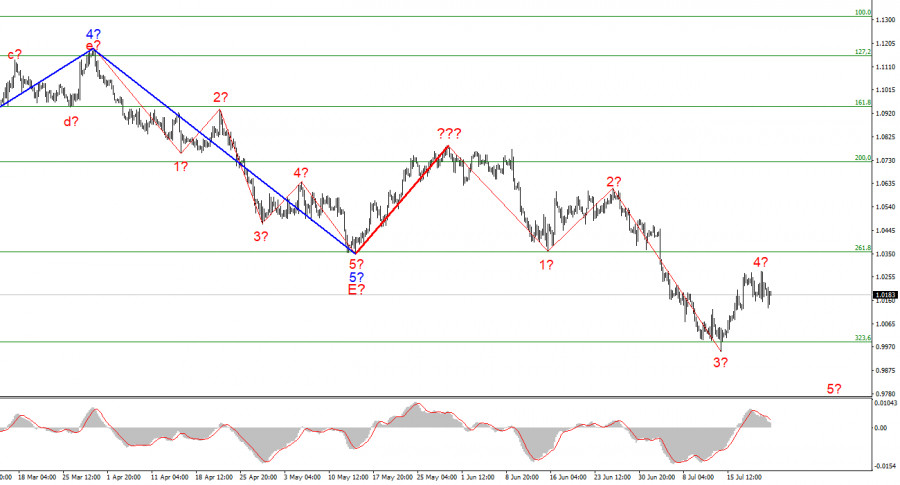

| Posted: 22 Jul 2022 08:40 AM PDT

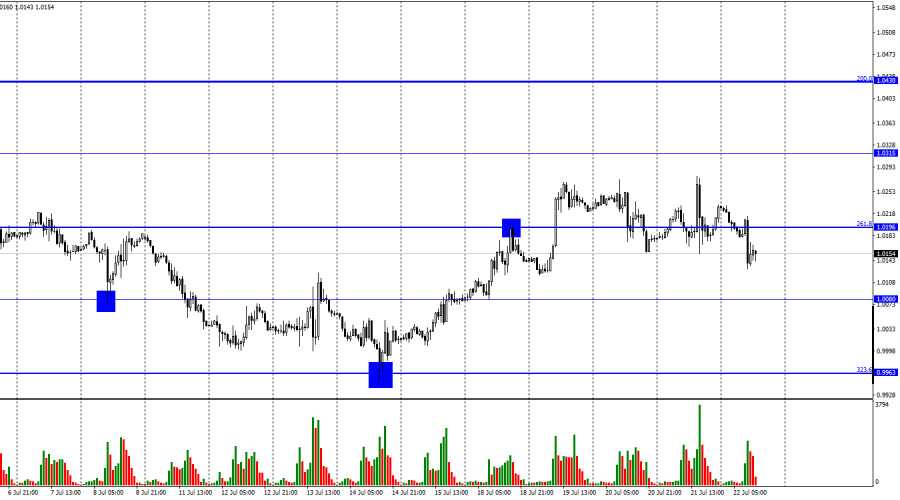

A few weeks ago, the wave markings on the 4-hour chart for the euro/dollar instrument got more complex and no longer had a holistic appearance. There was a successful attempt to break through the 261.8 percent Fibonacci level, which was also the low of the E and b waves; hence, these waves are no longer E and b. Thus, I have constructed a new wave markup that does not yet account for the ascending wave indicated by a bold red line. I've already stated that the entire wave structure can be complicated indefinitely. This is the drawback of wave analysis, as any structure is always capable of assuming a more complicated and extensive shape. Consequently, I propose to now focus on simpler wave structures, including waves of a smaller scale. As shown, the creation of an upward wave, which may be wave 4 of a new downward trend section, is proceeding. If this estimate is accurate, the instrument might gain another 100-150 basis points before resuming its slide within wave 5 with objectives below 1.0000. Additionally, the development of the fifth wave may have already begun. So far, I see no reason to anticipate additional instrument moves.The business activity index for the US services sector unexpectedly dropped. On Friday, at the time of writing, the euro/dollar exchange rate had neither decreased nor climbed. However, the instrument has been decreasing for nearly the entirety of the trading day, and a very robust gain began only a few hours ago that negated the sellers' efforts. Although the dollar's slide began a few hours ago, the major movement happened following the release of business activity indices for several regions of the United States. Consequently, the service sector index fell to 47 points, the composite index to 47.5 points, and the production sector index to 52.3 points. Remember that any figure above 50 is regarded as positive, while any value below 50 is considered negative. Thus, we are already observing an appropriate market response to US numbers. Indicators of corporate activity in the European Union were also presented today, and they proved to be anything but "optimistic." The service sector index fell to 50.6 points, the manufacturing sector index fell to 49.6 points, and the composite index fell to 49.4 points. Thus, the drop in the value of the European currency during the first part of the trading day has unique causes. And if we consider the entire movement, the instrument merely dropped 100 basis points and then rose by the same amount. Since these moves did not affect the wave pattern, I continue to believe that correction wave 4 has concluded. Nonetheless, if demand for the euro currency continues to rise, this wave may become more problematic. In this regard, the upcoming week will put a lot into perspective. The Federal Reserve meeting is nearly the most significant event of the month. If demand for the dollar continues to decrease, wave 4 becomes more convoluted, and the entire structure of the most recent segment of the downward trend, since the top of wave 4 may exceed the bottom of wave 1. I anticipate that demand for the US dollar will increase next week. General conclusions I infer based on my findings that construction of the downward trend segment continues. If this is the case, it is now viable to sell the instrument with goals at the estimated 0.9397 level, which corresponds to 423.6 percent Fibonacci, for each "down" MACD signal generated during the development of wave 5. Wave 4 is currently completeable. At the larger wave size, the wave marking of the descending trend segment becomes considerably more complex and extends in length. It can be of virtually any length. Therefore, I believe it's preferable to focus on three and five-wave typical wave shapes for the time being. The material has been provided by InstaForex Company - www.instaforex.com |

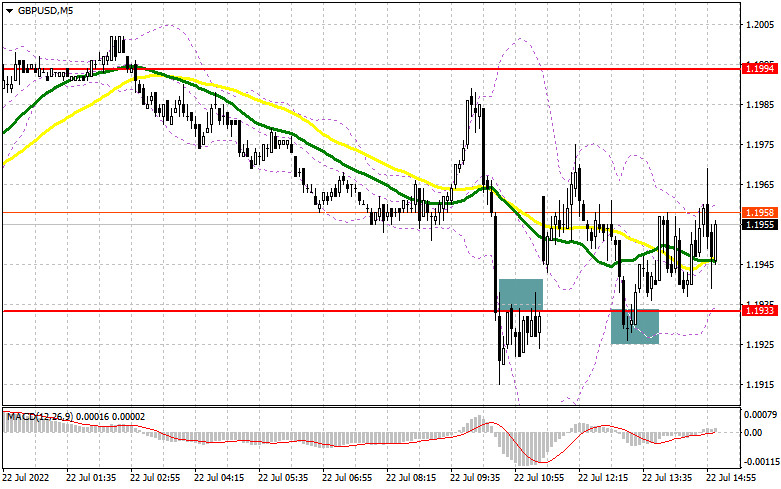

| Posted: 22 Jul 2022 08:40 AM PDT I highlighted the 1.1933 level in my morning forecast and advocated making market entry selections. Let's examine the 5-minute chart to determine what transpired there. The breach and retest of 1.1933 support in the first half of the day provided a great signal to sell the pound, but the release of positive UK economic data muddled the deck. As a result, we were required to repair losses and await new indications. A recovery to 1.1933 and a top-to-bottom retest of this level served as a buy signal for the pound, which at the time of writing was up 40 points from the entry point. From a technical standpoint, little has changed since the morning.

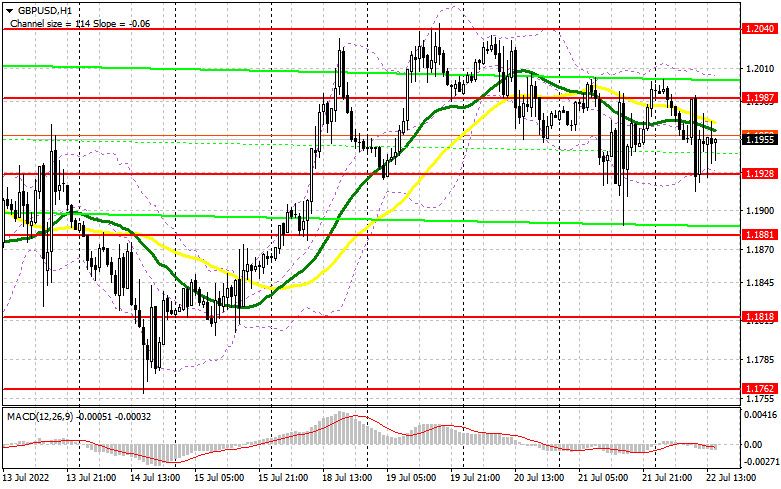

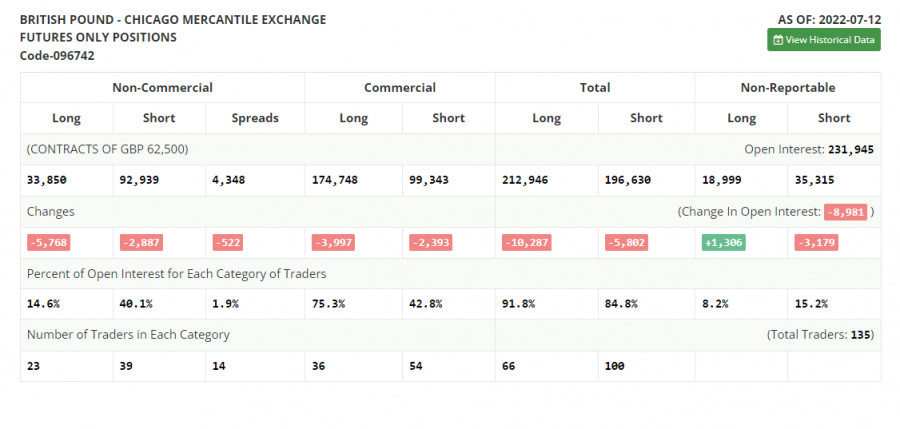

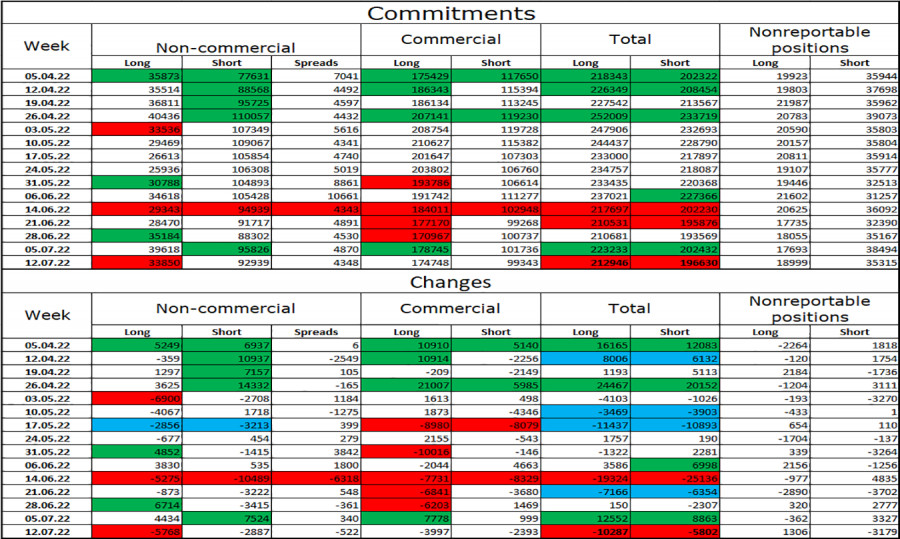

To establish long positions on the GBP/USD, you must: The indicator of business activity in the manufacturing sector, the index of business activity in the services sector, and the composite index of business activity from Markit will determine the market's direction after the week during the American session. Do not be shocked if the pressure on the pound reappears after the numbers are released, as strong indicators are anticipated. When the pair declines, only the formation of a false breakdown in the area of the new support 1.1928 constitutes a new signal to begin long positions in anticipation of a further pair recovery. In this situation, the goal will be the nearest resistance at 1.1987. A breakthrough and reversal test from the top to the bottom of this level will provide a stronger upward momentum, signaling a buy to jump and update 1.2040. A similar breach of this level would open the door to 1.2081 and 1.2119, where I would propose locking in profits. The 1.2160 region will serve as a further-off objective. If GBP/USD falls and there are no buyers at 1.1928, pressure will rise on the pound. I suggest delaying long positions until 1.1881. I encourage you to only purchase there on a fake decline. It is conceivable to initiate long bets on GBP/USD immediately for a rebound from 1.1818, or even lower – around 1.1762, with the goal of a 30-point-per-day drop. To open short GBP/USD positions, you must have: In the initial half of the day, sellers attempted to remind themselves, but robust data prevented them from establishing a broader negative trend. The optimum scenario for establishing short positions will be a false breakdown in the vicinity of the nearest resistance at 1.1987, which is very dependent. Beyond this range, the bulls can establish new long positions as the upswing continues. Strong US data will reapply pressure on the pair, with a target of 1.1928 as the morning support. Everything will depend on whether or not the bulls are still present. In the absence of their activity and the consolidation of GBP/USD below 1.1928, a reverse test from the bottom up of this level will provide an additional entry point to sell with a decline to 1.1881, where I advise partially locking in profits. The 1.1818 region will serve as a further-off objective. With the possibility of GBP/USD appreciation and the absence of bears with short positions at 1.1987, I encourage you not to rush. Only a false breakout at the weekly high of 1.2040 will provide an entry point for short options anticipating a pair comeback. If there is no activity there, there may be another upward jerk. With this option, I recommend delaying short positions between 1.2081 and 1.2119, where you can sell GBP/USD immediately for a comeback, betting on a 30-35-point drop within a day. The COT report (Commitment of Traders) for July 12 revealed a decline in both short and long holdings. However, the fall in short positions was significantly larger, resulting in a rise in the negative delta. Another attempt to buy back the yearly minimum failed, but towards the end of the week, traders began to take profits using robust statistics on the United States, resulting in a minor correction of the pound, which has been asking for quite some time. The cost of living crisis in the United Kingdom persists, and the government has been unable to intervene. Simultaneously, the Federal Reserve System policies and the pace of increase in interest rates in the United States, paired with the next predicted increase of nearly 1 percent, provide a great deal of support for the dollar, causing the pound to fall more and farther. According to the COT report, long non-commercial positions declined by 5,768 to 33,850. In contrast, short non-commercial positions decreased by 2,887 to 92,939, resulting in an increase in the negative value of the non-commercial net position to -59,089 from -56,208. The weekly closing price declined to 1.1915 compared to 1.1965.

|

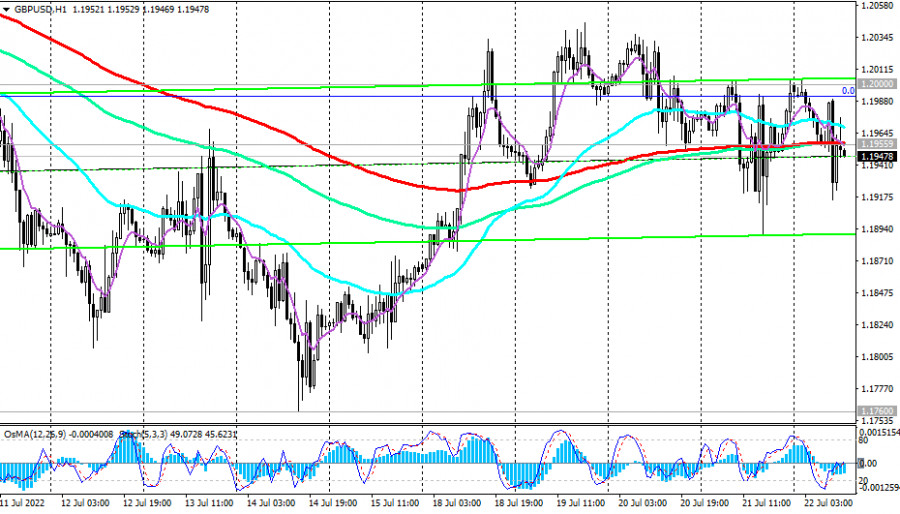

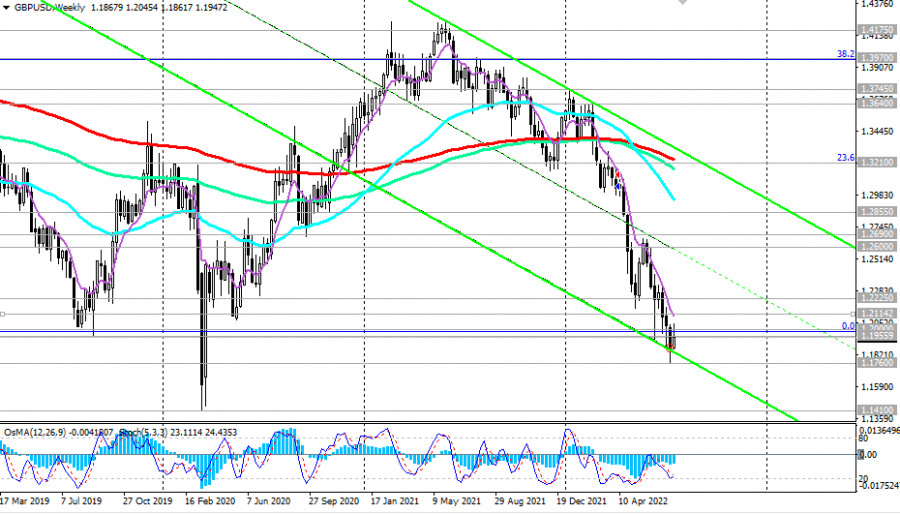

| GBP/USD Technical Analysis and Trading Tips for July 22, 2022 Posted: 22 Jul 2022 08:38 AM PDT

The GBP/USD has gained momentum this week from the dollar's downward correction. At the time of writing this article, GBP/USD is trading near the 1.1948 mark, again attempting to break through the important short-term support level of 1.1955 (200 EMA on the 1-hour chart).

At the same time, the currency pair remains in the zone of a long-term bearish market, below the key resistance levels of 1.2855 (200 EMA on the daily chart), 1.3210 (200 EMA on the weekly chart), 1.4580 (200 EMA on the monthly chart). Only short positions should be opened below the mentioned level of 1.1955, and the breakdown of yesterday's local low of 1.1890 may be an additional signal for building up short positions.

Alternatively, and after the breakdown of the resistance levels 1.1955, 1.2000, 1.2045 (this week's high), the growth of GBP/USD will continue towards the resistance level 1.2114 (200 EMA on the 4-hour chart), and in case of its breakdown—to 1.2200, the upper limit of the descending channel on the daily chart. The limit of the upward correction is at the area of the resistance level 1.2225 (50 EMA on the daily chart). One way or another, the GBP/USD dynamics is still dominated by bearish momentum, which forced the pair to update this month its more than 2-year low (since April 2020) near 1.1760. And since the trends "do not break" so quickly, it is logical to assume the resumption of the downward dynamics of GBP/USD.

Next week, the dynamics of the GBP/USD pair will be determined mainly by the dynamics of the dollar. The focus will be on the Fed meeting. Support levels: 1.1900 , 1.1880 , 1.1800 , 1.1760 Resistance levels: 1.1955, 1.2000, 1.2114, 1.2200, 1.2225, 1.2400, 1.2600, 1.2690, 1.2800, 1.2855, 1.2900, 1.3000, 1.3100, 1.3210, 1.3300 Trading Tips Sell Stop 1.1880. Stop-Loss 1.2015. Take-Profit 1.1800, 1.1760, 1.1700 Buy Stop 1.2015. Stop-Loss 1.1880. Take-Profit 1.2100, 1.2114, 1.2200, 1.2225, 1.2400, 1.2600, 1.2690, 1.2800, 1.2855, 1.2900, 1.3000, 1.3100, 1.3210, 1.3300 The material has been provided by InstaForex Company - www.instaforex.com |

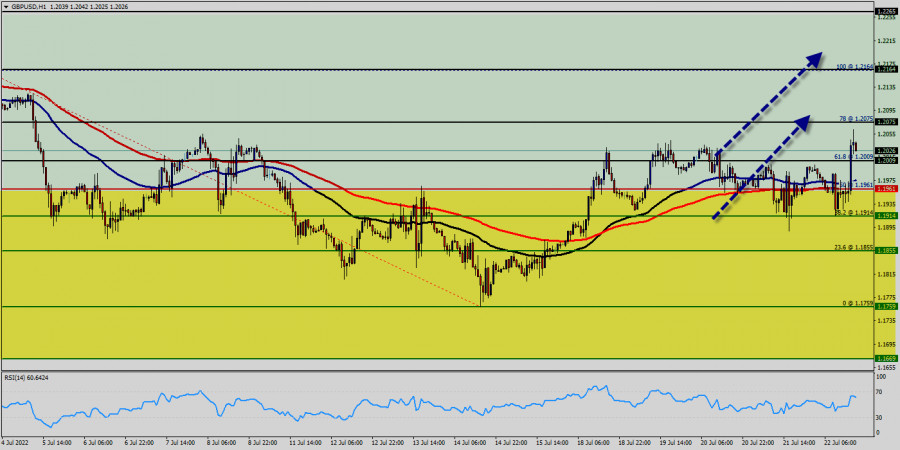

| Technical analysis of GBP/USD for July 22, 2022 Posted: 22 Jul 2022 08:16 AM PDT

The GBP/USD pair broke resistance which turned to strong support at the level of 1.1961 yesterday. The level of 1.1961 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today. The Relative Strength Index (RSI) is considered overbought because it is above 60. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend. On the one-hour chart, the GBP/USD pair continues moving in a bullish trend from the support levels of 1.1961 and 1.2009. As the price is still above the moving average (100), immediate support is seen at 1.1961, which coincides with a golden ratio (61.8% of Fibonacci). Consequently, the first support is set at the level of 1.1961. So, the market is likely to show signs of a bullish trend around the spot of 1.1961 and 1.2009. In other words, buy orders are recommended above the golden ratio (1.1961) with the first target at the level of 1.2075 . Furthermore, if the trend is able to breakout through the first resistance level of 1.2075. We should see the pair climbing towards the double top (1.2164) to test it. However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.1914. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for July 22, 2022 Posted: 22 Jul 2022 08:06 AM PDT

The EUR/USD pair hit the weekly pivot point and resistance 1, because of the series of relatively equal highs and equal lows. But, the pair has dropped down in order to bottom at the point of 1.0203. Hence, the major support was already set at the level of 1.0203. Moreover, the double bottom is also coinciding with the major support this week. Additionally, the RSI is still calling for a strong bullish market as well as the current price is also above the moving average 100. Equally important, the RSI and the moving average (100) are still calling for an uptrend from the levels of 1.0203 and 1.0113. Therefore, it will be advantageous to buy above the support area of 1.0203 with the first target at 1.0274. From this point, if the pair closes above the weekly pivot point of 1.0274, the EUR/USD pair may resume it movement to 1.0350 to test the weekly resistance 2. Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss below the last bottom at 1.0113. The material has been provided by InstaForex Company - www.instaforex.com |

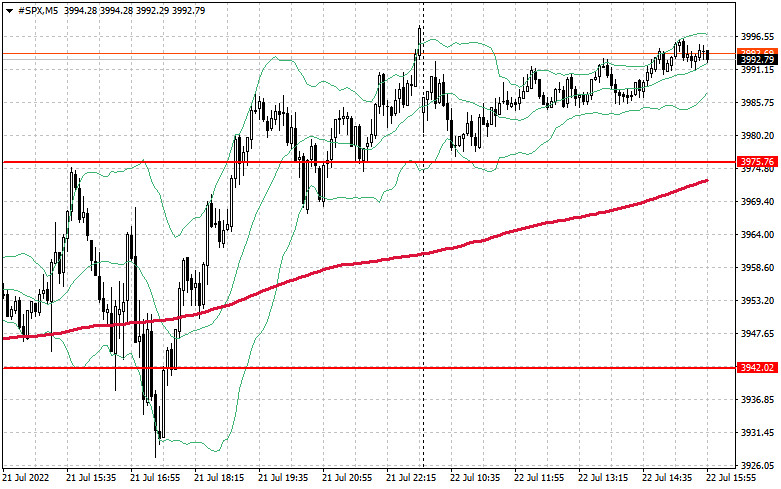

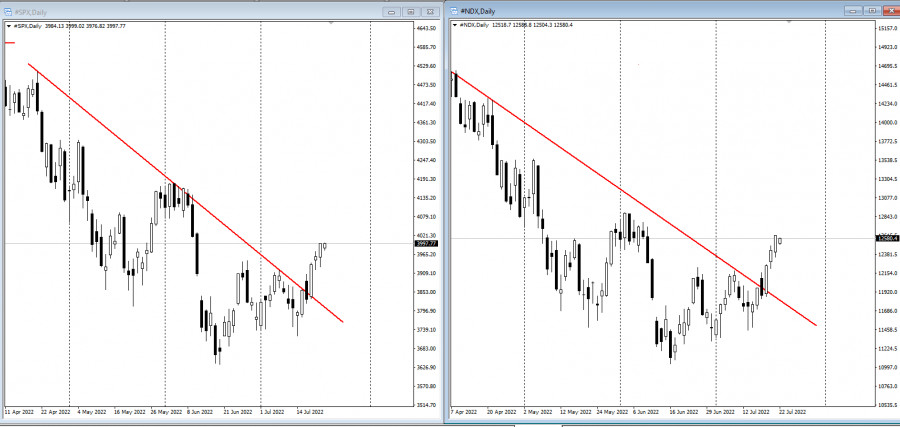

| US premarket on July 22: Stock market continues to rise due to strong corporate reports Posted: 22 Jul 2022 07:10 AM PDT US stock futures are trading mixed on Friday. Apparently, investors stay optimistic due to strong corporate reports. This fact favors the market and serves as stimulus for buying, even despite numerous challenges due to the highest US inflation in 40 years. Dow Jones Industrial Average futures added 42 points, or 0.2%. S&P 500 futures were down 0.1% and Nasdaq 100 futures fell by 0.3%.

The high-tech Nasdaq Composite is likely to close the week 5.3% higher. The Dow Jones Industrial Average is poised for a weekly gain of 2.4%, while the S&P 500 is due to advance by 3.5%. Dow Jones Industrial Average futures rose on a strong report from American Express. The company's stock jumped 3% at the premarket after it reported excessive profits due to high consumer spending on travel and entertainment. Currently, nearly 21% of the S&P 500 companies have reported earnings. According to FactSet, 70% of them have exceeded analysts' expectations. Yesterday, the reports on manufacturing PMI and services PMI for July were due. Positive outcome will be the catalyst for the market's further growth. Premarket Verizon shares fell by 4.4% in the premarket after quarterly earnings had been below economists' estimates and the company lowered its annual forecast. Verizon's management said its subscriber base growth was affected by rising prices. Snap was the top loser yesterday. Its shares plummeted by 30.3% in the premarket after its parent company Snapchat reported larger-than-expected quarterly losses and its slowest sales growth since it went public. It also noted that current-quarter sales remained unchanged from 2021 amid tougher economic conditions and growing competition. Shares of Seagate Technology fell by 11.8% in premarket after the company missed its quarterly net income estimates. It also issued a weaker-than-expected outlook and reported a significant drop in demand for personal computers.

Technical picture of S&P500 The bulls reached the level of $3,975 on Thursday and targeted for a continued rally yesterday. However, new positive reports as well as strong fundamental statistics are the key point. Currently, bulls focus on the next resistance, i.e. $4,013. A rapid growth of the index to the area of $4,050 is possible above this level, as large sellers will return to the market. There will be at least some traders who want to lock in profits on long positions. A level of $4,089 will be considered a more distant target. In case the pressure formed by weak corporate reports returns, buyers will have to defend the nearest support levels of $3,975 and $3,945. Their breakout would push the index back to $3,905. If buyers miss that level, the index will go down to the area of $3,835. A more stable level of $3,801 is slightly below, where buyers will again act more aggressively. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Jul 2022 06:48 AM PDT

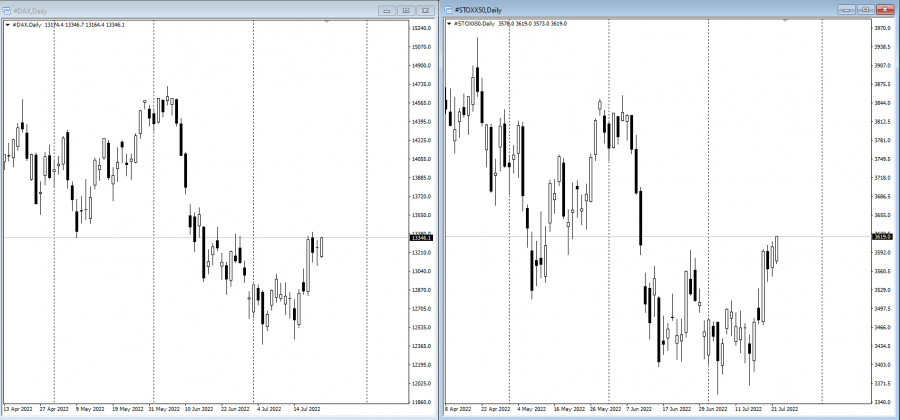

US stock futures are rising weakly amid choppy trading as investors analyze a series of high-profile second-quarter earnings, looking for clues about the impact of high inflation on companies. Bonds have also surged. Contracts on the tech-heavy Nasdaq 100 slumped by about 0.3% under pressure from Snap Inc.'s poor results. Futures on the S&P 500 fell from session lows after American Express Co. reported record earnings and raised full-year forecasts.

The Stoxx50 index added 0.6%, closing the week in positive territory.

Global stocks remain on course for their best week in a month, paring this year's equity market rout to about 18%. Speculation that the worst of the selloff has passed is partly behind the move. Angst about the damage from inflation and rapidly rising interest rates is proving hard to shake, despite a tempering in expectations of just how aggressive the Federal Reserve will be. "It's still very early days but we've seen numerous cases now of earnings surprises driven by the 'it's not as bad as we feared' argument," Craig Erlam, a senior market analyst at Oanda, said. "That's a relief of course, but surely not a case for a sustainable rebound."

Underscoring recession fears, Treasuries extended an advance, pushing the 10-year yield to around 2.8%. Meanwhile, German short-term bonds soared as investors trimmed bets on European Central Bank rate hikes after weaker-than-expected PMI data in the region fanned fears of a recession. US PMIs are due at 9:45 a.m. The focus will now be on next week's Fed meeting. The central bank is expected to raise interest rates again to curb soaring inflation. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for USD/JPY for July 22 - 25, 2022: buy above 136.49 (weekly support) Posted: 22 Jul 2022 06:05 AM PDT

Early in the American session, the Japanese Yen is trading at around 136.69. This level represents the low of July 12. On July 20, USD/JPY reached the resistance zone of 138.85. Having failed to break above the high of 139.38, it made a strong technical correction and is now reaching support levels. Since the beginning of the week, investors have been waiting for the policy update from the Bank of Japan, which defied the world tightening trend and maintained its ultra-loose monetary policy. The central bank reiterated its commitment to continue buying Japanese government bonds at an annual rate of about 80 trillion yen. In the next few hours, we expect the Japanese to bounce off 136.50 and reach the 21 SMA zone located at 137.94. The Eagle indicator is approaching the oversold zone. Consolidation above 136.50 is likely to be seen as a buying opportunity. On the other hand, should there be a pullback towards 137.94, it will be a positive signal to sell with targets at 136.50 and the 200 EMA at 135.50. The material has been provided by InstaForex Company - www.instaforex.com |

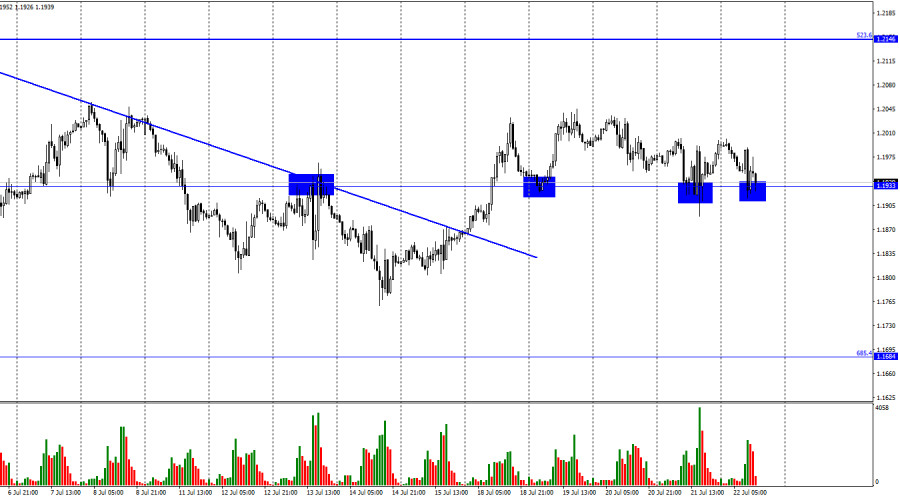

| Posted: 22 Jul 2022 05:47 AM PDT

Hi, dear traders! According to the H1 chart, GBP/USD tested 1.1933 twice, only to bounce upwards. However, the pair did not rise significantly afterwards. At the moment of writing, GBP/USD continues to move near this level. If the pair settles below it, it could then fall towards the retracement level of 685.4% (1.1684). There are no serious factors that really could have prompted today's dip of GBP/USD. In the EU, the ECB meeting results were mixed, and PMI data showed a strong decline. In the UK, on the other hand, the Bank of England's policy meeting is yet to come - it will only take place in a week and a half. The UK business activity indexes did not decrease significantly: services PMI reached 53.3 points, manufacturing PMI eased to 52.2 points, and composite PMI hit 52.8 points. All business activity indexes remained above 50 and only lost about 1 point. As a result, GBP/USD declined slightly, but remained above the key level of 1.1933. US PMI data could also drop below 50 points for one or two indexes, amid continuing speculation about a possible recession in the US and falling GDP. It should give support to the pound sterling, but currently traders do not seem to actively open longs on GBP/USD. Market players are awaiting the results of meetings of the Fed and the BoE, which will take place next week. Both central banks could hike interest rates by more than 0.25%, as even the ECB has increased interest rates by 0.50%. However, USD is very likely to go up against GBP next week, perhaps even on Monday. Few market players doubt the Fed would increase the interest rate by at least 0.75%.

According to the H4 chart, GBP/USD has reversed downwards. If the pair settles below 1.1980, it could continue to fall towards the retracement level of 161.8% (1.1709). The descending trend line indicates that the sentiment of traders remains bearish. Indicators show no signs of emerging divergences today. Commitments of Traders (COT) report:

Non-commercial traders became slightly more bearish last week. Traders closed 5,768 Long and 2,887 Short positions. Market players remain bearish on GBP/USD, and Short positions continue to outnumber Long ones greatly. Major players continue to decrease their exposure to GBP, and their sentiment has remained unchanged recently. GBP/USD could continue to fall in the next several weeks. While the pair could move upwards, it could still be only a 2-3 day correction followed by a renewed decline. US and UK economic calendar:UK – Services PMI (08-30 UTC).UK – Manufacturing PMI (08-30 UTC).UK – Composite PMI (08-30 UTC).US – Services PMI (13-45 UTC).US – Manufacturing PMI (13-45 UTC).US – Composite PMI (13-45 UTC). The pound sterling decreased slightly following the release of UK PMI data. The same could happen to the US dollar after the release of US PMI data. Overall, the data release could have a limited influence on traders. Outlook for GBP/USD:New short positions can be opened if GBP/USD settles below 1.1933 on the H1 chart targeting 1.1684. Long positions can be opened if the pair bounces off 1.1933 on the H1 chart with 1.2146 being the target. The material has been provided by InstaForex Company - www.instaforex.com |

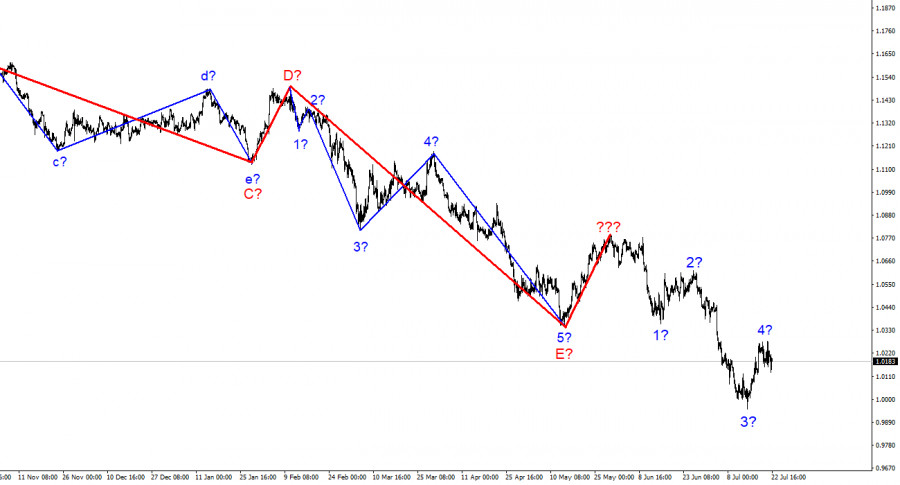

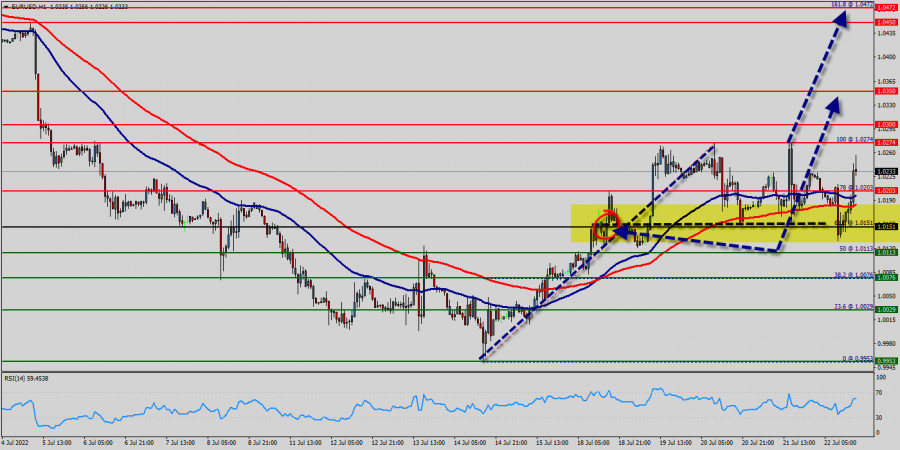

| Analysis of EUR/USD on July 22. EUR unable to climb despite ECB's rate hike Posted: 22 Jul 2022 05:46 AM PDT

Good afternoon, dear traders! Yesterday, the EUR/USD pair performed an upward reversal to 1.0315. Shortly after, it dropped sharply to the Fibo level of 261.8% - 1.0196. On Friday morning, it dipped below 1.0196. So, traders are expecting the pair to tumble to 1.0080. After the ECB raised the interest rate by 0.50%, the euro lost momentum. Let's discuss in detail yesterday's ECB meeting and its results. The regulator decided to raise the key rate by 0.50% to curb soaring inflation. Consumer prices accelerated to 8.6% in June. Christine Lagarde noted that there had been a slowdown in economic expansion in recent months. These two statements somewhat contradict each other. In order to cap inflation, the ECB will have to hike the key rate more than once. However, how to do this if economic growth began to slow down even before the first rate increase in the last 11 years. As a reminder, GDP in the first quarter was only 0.3%. It means that after one or two rate hikes, the economy may dwindle even more. This is what the ECB wants to avoid. In this case, it is impossible to raise the interest rate further. The central bank has almost no room for maneuver. If the regulator hikes the key rate, a recession may begin. The ECB will have to decide how to tighten monetary policy and avoid a recession. There are also other negative factors. The Services PMI Index dropped to 50.6), the Manufacturing PMI tumbled to 49.6, and the Composite PMI totaled 49.4. All three indexes lost several points compared to the previous month. Two out of three indexes fell below the 50.0 level, which signals a recession. So, it is hardly surprising that the euro has lost steam over the past two days.

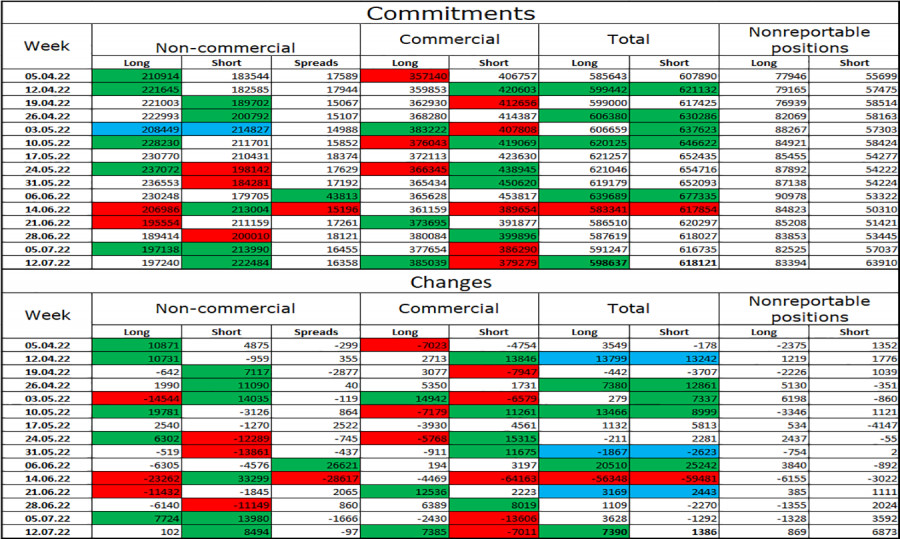

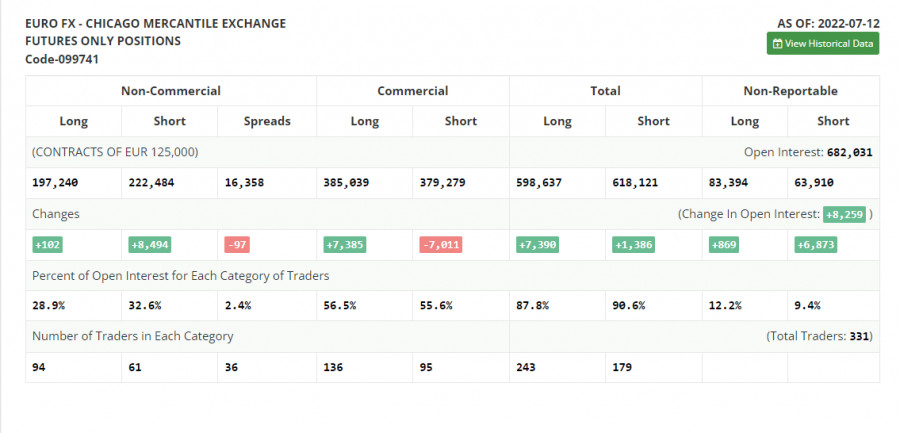

On the 4H chart, the pair performed a downward reversal, sliding below the Fibonacci correction level of 127.2% - 1.0173. The price may reach the correction level of 161.8% - 0.9581. The euro failed to grow even to the upper border of the descending channel. It means that the bearish bias prevails. The euro is likely to rebound only if it consolidates above the descending channel. Commitments of Traders (COT):

Last week, speculators opened 102 Long contracts and 8,494 Short contracts. It means that the bearish mood has intensified again. The total number of Long contracts is now 197,000 and the total number of Short ones totals 222,000. The difference is not too big but it is not in favor of the bulls. In recent months, "Non-commercial" traders, have remained mainly bullish on the euro. Yet, it did not significantly help the euro. In the last few weeks, the likelihood of a rally has been gradually growing. However, recent COT reports have shown that a new sell-off may take place as the sentiment has changed from bullish to bearish. This is exactly what we are witnessing at this moment. Economic calendar for US and EU: EU – Services PMI Index (08:00 UTC). EU– Manufacturing PMI Index (08:00 UTC). EU – Composite PMI Index (08:00 UTC). US – Services PMI Index (13:45 UTC). US – Manufacturing PMI Index (13:45 UTC). US – Composite PMI Index (13:45 UTC). On July 22, the EU has already unveiled its economic reports. In a couple of hours, the United States is going to release the same data. However, the impact of fundamental factors on the market sentiment will be muted today. Outlook for EUR/USD and trading recommendations: It is better to open short positions if the pair drops below 1.0173 on the 4H chart, aiming at the target levels of 1.0080 and 0.9963. It is recommended to open short positions if the price consolidates above the downward channel on the 4H chart with the prospects of a rise to 1.0638. The material has been provided by InstaForex Company - www.instaforex.com |

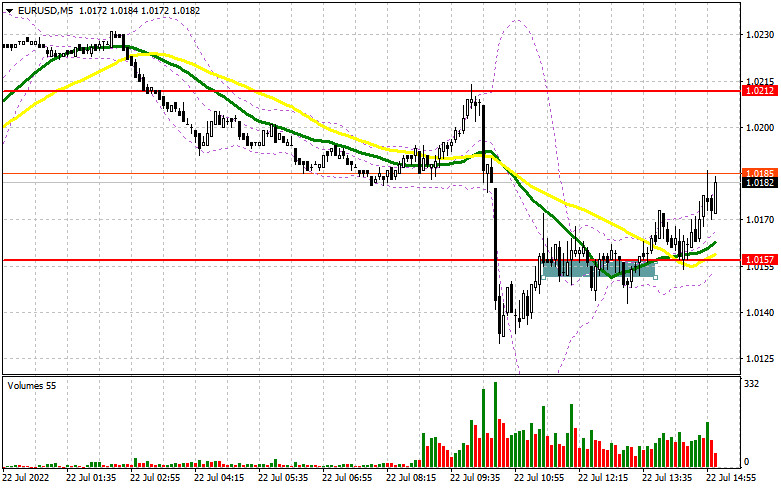

| Posted: 22 Jul 2022 05:42 AM PDT In the morning article, I highlighted the level of 1.0157 and recommended making decisions with this level in focus. Let's take a look at the 5-minute chart and try to figure out what has happened. Weak PMIs for the Eurozone pushed the euro sharply down against the US dollar. EUR/USD broke support at 1.0157. However, the bulls rushed to buy the pair at intraday lows. As a result, EUR/USD rebounded to the previous levels and generated a buy signal. At the moment of writing the article, the price has climbed about 20 pips. The technical picture has changed for the second half of the day.

What is needed to open long positions on EUR/USD During the New York session, the economic calendar reminds us about important data from the US. The Markit think tank will report the US manufacturing, services PMI, and composite PMI. The crucial data will determine the market trajectory at the end of the week. The data is expected to be strong. Thus, don't be surprised that the euro will come under pressure again following the statistics. To prove their strength, the bulls should act in confidence at around 1.0156, the technical level which came into being in the first half of the day. After a false breakout there, we will predict further growth and the update of the nearest resistance at 1.0212. Further developments will depend on this level. Only a breakout and a test of this level downwards will trigger stop losses of the sellers. The currency pair will generate a signal to enter the market with long positions, reckoning a rebound to the upper border of the range at 1.0247. A more distant target is seen at 1.0321 where I recommend profit taking. If EUR/USD declinesand the buyers lack activity at 1.0156 in the second half of the day, pressure on the euro will escalate. In this case, I wouldn't recommend you hurry up to enter the market. It would be reasonable to open long positions at a false breakout at around 1.0106. It would be better to buy EUR/USD immediately at a dip from 1.0045 or lower at about 1.0008, bearing in mind an intraday30-35-pips correction. What is needed to open short positions on EUR/USD In case EUR/USD makes efforts to grow in the second half of the day following US PMIs, abreakout at 1.0212 will provide an excellent signal to open short positions expecting EUR/USD to decline again to support at 1.0156. A breakout and consolidation below this level and the opposite test upwards will generate another sell signal that will trigger the buyers' stop loss orders. The price will move down to 1.0106 which will affect speculators who want the pair to stay at highs. If the price settles below 1.0106, the door will be open to 1.0045 where I recommend leaving sell positions. A lower target is seen at 1.0008. In case EUR/USD moved up in the American session and the bears lack activity at 1.0212, I would advise you to cancel short positions until more attractive resistance at 1.0274. Only a false breakout there will be the pivot point to sell theeuro. We could open short positions immediately at a bounce off 1.0321 or higher at 1.0374, bearing in mind a 30-35-pips downward correction intraday.

The COT (Commitment of Traders) report from July 12 logs an increase in both long and short positions, but the latter are much more numerous. It indicates that the bearish sentiment is setting the tone. Besides, it caused a larger negative delta because there are few traders willing to buy even at current lows. The reason is upbeat statistics from the US. Inflation acceleration and robust retail sales reinforced the bullish outlook on the US dollar. In turn, traders are reluctant to buy risky assets. As long as the Federal Reserve pursues its hawkish policy, the US dollar is set to assert strength. Traders are alert to a fresh report on inflation in the EU. The CPI is expected to show another spike in consumer prices. If the forecast comes true, don't be surprised about a moderate upward correction of EUR/USD. However, the euro will hardly avoid another fall and the second test of the parity level. According to the COT report, long non-commercial positions grew just 102 to 197,420 whereas short non-commercial positions jumped by 8,494 to 222,484. Despite the undervalued euro, the hawkish stance of major central banks, and a recession in many developed economies, traders are poised to buy the US dollar. The overall non-commercial net positions remained negative and came in at -25,244 against 016,852. EUR/USD closed lower last Friday at 1.0094 against 1.0316 a week ago.

Indicators' signals: Trading is carried at around the 30 and 50 daily moving averages. It means that buyers and sellers are in equilibrium. Moving averages Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the daily D1 chart. Bollinger Bands If EUR/USD grows, the indicator's upper border at 1.0245 will serve as resistance. A breakout of the indicator's lower border at 1.0156 will escalate pressure on the currency pair. Description of indicators Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between short and long positions of non-commercial traders. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for GOLD (XAU/USD) for July 22 - 25, 2022: buy above $1,713 (downtrend channel) Posted: 22 Jul 2022 05:35 AM PDT

XAU/USD is breaking the downtrend channel formed on July 5th and is now trading at around 1,818 just above 3/8 Murray. It is expected that in the next few hours it will consolidate above this level and could reach 1,730 and 4/8 Murray at 1,750. The main factor for the advance of the metal can be seen in the sovereign bond market. Yields of US 10-year Treasuries are retreating, trading at 2.82%, the lowest since July 6. As long as Treasuries remain in technical correction, gold could gain upward momentum. In less than 24 hours, gold has recovered more than $40 after falling to $1,680 on Thursday, the lowest level since August 2021. This rapid recovery is a positive sign of a possible change in trend in the short term. 21 SMA is giving the pair a positive outlook. As long as it trades above the level of around 1,707, the bullish bias is expected to prevail. The eagle indicator is approaching overbought levels. As long as the metal trades below 4/8 Murray, any bullish momentum approaching this zone will be seen as an opportunity to sell. The short-term picture has a bullish bias, which will change if the price returns to levels below 1,707-1,700 (21 SMA). A daily close below this level will be considered a negative sign, so the metal could resume the bearish trend and it could fall back towards the area 2/8 Murray at 1,687. Conversely, as long as it trades above 1,713, which has now become its support of the downtrend channel that was broken, could give gold a strong boost. In case the price consolidates above this level, gold could reach 1,730 and could even break 4/8 Murray at 1,750 and finally reach the 200 EMA at 1,776. Our trading plan for the next few hours is to buy above 1,713 or above 3/8 Murray at 1,718 with targets at 1,730, 1,750 (4/8) and 1,770 (200 EMA). The material has been provided by InstaForex Company - www.instaforex.com |

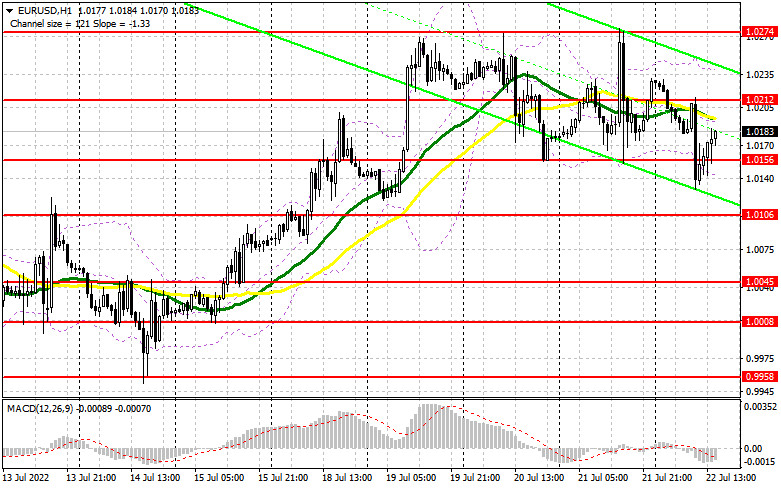

| Trading plan for EURUSD on July 22, 2022 Posted: 22 Jul 2022 05:15 AM PDT

Technical outlook:EURUSD dropped to the 1.0130 lows intraday on Friday before bouncing back towards 1.0170. The single currency pair is trading close to the 1.0180 level at this point in writing and is expected to drag towards the 1.0100 mark going forward. A push-through of the 1.0273 interim resistance will confirm that the price has hit a bottom and the bulls are back in control. EURUSD has been preparing to produce a counter-trend rally towards the 1.0800-1.0900 zone in the medium term. Prices have been dropping from the 1.2350 high since January 06, 2021, and might have terminated a meaningful larger-degree downswing at 0.9952 recently. The potential target for a rally is close to the Fibonacci 0.382 retracement of the entire drop. EURUSD bulls have been in control since the 0.9952 lows, pushing prices through 1.0273, which acts as interim resistance now. The recent upswing is being worked upon right now and its Fibonacci 0.618 retracement is seen through 1.0100. A drop towards that mark is expected to produce a bullish reversal and resume higher again. Going forward:EURUSD is now expected to remain in control of bulls and push towards 1.0900 in the medium term. The bottom line is that prices should stay above the 0.9952 mark to keep the above-proposed structure intact. The near-term target potential remains through the 1.0615 mark, which is the initial resistance on the daily chart. Trading plan:Potential rally towards 1.0620 and 1.0900 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Asia's main indices trading mixed Posted: 22 Jul 2022 04:59 AM PDT

Major stock indices in Asia are trading mixed today. Some indices are declining, including the Shanghai Composite, which is down by 0.33%, and the Shenzhen Composite, which shed 0.62%. Korea's KOSPI also lost 0.31%. Meanwhile, other indices of the region showed growth up to 1%. Australia's S&P/ASX 200 gained 0.03%, Hong Kong's Hang Seng Index added 0.16%, and Japan's Nikkei 225 went up by 0.43%. On the one hand, Asian stocks are supported by the US stock market which posted gains yesterday on positive quarterly earnings reports. Yet, investors are still worried about the global economic downturn that may come as a result of interest rate hikes implemented by central banks. Yesterday, the European Central Bank announced its decision to raise the rate by 50 basis points to 0.5% year-on-year from the previous level of 0% which has been left unchanged for the past 10 years. The US Federal Reserve will meet next week to raise the rate for the fourth time in a row. Most experts predict a rise of 75 basis points although some of them think the Fed will lift the rate straight by 100 points. China's indices remain under pressure due to a new coronavirus outbreak. Traders are worried that it may slow down the economic growth of the country. Among companies trading on the Hong Kong stock exchange, Xtep International Holdings Ltd. depreciated by 4.2%. This drop came after one of the company's main shareholders GroupSuccess Investments Ltd. announced it was planning to sell a part of its stake in the company. Other companies managed to show growth. Thus, Sands China Ltd. rose by 2.4%, Haidilao International Holding Ltd. gained 1.4%, China Construction Bank Corp. was up by 1.2%, while China Merchants Bank Co. Ltd. appreciated by 1.1%. Another factor to shape investors' sentiment is the inflation data from Japan. Consumer prices slowed down in June to 2.4% compared to 2.5% a month earlier. At the same time, the core consumer price index which excludes food prices rose by 2.2%, coming in line with the forecast. According to the Bank of Japan's fresh outlook, core inflation will run at the level of 2.3% in 2022. The regulator decided to keep the key rate unchanged at -0.1%. The shares of the Japanese company Kawasaki Kisen Kaisha Ltd. gained 11.9% thanks to a positive forecast for its net profit. The company is expected to earn 690 billion yen during this financial year, which is up from the previous forecast of 460 billion yen. Following the trajectory of the main Korean index, the shares of other major companies of the country also slid. Thus, the value of Samsung Electronics Co. stock dropped by 0.65%, while Kia Corp. lost 2%. Among the components of the Australian S&P/ASX 200 index, Rio Tinto Ltd. showed modest growth of 0.3%. Its competitor, BHP Group Ltd. saw a 0.1% decrease in the value of its stock. The shares of Insurance Australia Group Ltd. depreciated by 1.4% after it was revealed that the company failed to meet the forecast on earnings results for this financial year. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments