Forex analysis review

Forex analysis review |

- EUR/USD. Preview of the week. July meeting of the ECB and the fate of Mario Draghi

- EUR/USD and GBP/USD weekly results and prospects

- This is indeed a recession, but have we estimated it correctly?

| EUR/USD. Preview of the week. July meeting of the ECB and the fate of Mario Draghi Posted: 17 Jul 2022 09:22 AM PDT The euro-dollar pair ended the trading week at 1.0079, on the wave of another corrective rollback. The results of the past week are mixed: on the one hand, the EUR/USD bears for the first time in 20 years overcame the parity level, standing at 0.9953. On the other hand, they failed to settle in the area of the 99th figure. Such conflicting results can be interpreted in different ways. There is a version that the bears are gradually and carefully mastering the "new territory", because each subsequent downward momentum is stronger than the previous one. At first, the bears only approached the parity level, then they tested it (decreasing only two points below the 1.0000 target), and then unexpectedly plunged almost 50 points down, finding themselves in the middle of the 99th figure. And although in each case the traders came back, the offensive dynamics were tendentious.

But there is another version, according to which the 1.0000 mark will become a springboard for a large-scale offensive to the upside, if the bears fail to settle below the parity level in the near future. If we consider this version as the basic version, then in this case the risk of "catching the price bottom" is quite large, especially if you open short positions under the 1.0000 target. Perhaps, today the key issue for EUR/USD traders is the prospects for the development of the downward trend. We see that the bears rush to take profits below the parity level each time, without the risk of holding open short positions. This circumstance explains the undulating price dynamics last week. Traders need a powerful information impulse that would allow them to make a choice: either they are trying to settle below 1.0000 at their own risk, or they are choosing a protracted corrective path, with targets in the 1.0150-1.0200 area. The central event of the upcoming week is the July meeting of the European Central Bank. Looking ahead, it must be said that the EXB in any case can only provide situational support to the euro, even if it implements an "ultra-hawkish" scenario. And all because of the strengthening of the dollar. After the publication of the latest release of data on inflation growth in the US, rumors began to spread actively in the market that this month the Federal Reserve will raise the rate by 100 basis points at once. These rumors intensified after the "northern neighbor" of the Fed - the Bank of Canada - unexpectedly decided on a 100-point increase. The head of the San Francisco Fed, Mary Daly, also spoke about raising the rate by 100 points at once. Her colleague - James Bullard - similarly did not rule out such a scenario. In my opinion, the scenario of a 100-point increase is still a subject of discussion. On the other hand, the mere fact of such discussions increases the demand for the US currency (the well-known trading principle "buy on rumors..."). In any case, the ECB will look like an outsider: it is too slow, indecisive and cautious. According to general expectations, the ECB will raise interest rates by 25 basis points next week. This was previously discussed by ECB President Christine Lagarde and a member of the Board of Governors, Olli Rehn, and many other representatives of the central bank. Almost all economists polled by Reuters (62 out of 63) are also confident in the 25-point hike. At the same time, most of them predict a rate hike of 50 basis points at the September meeting, after which at two subsequent meetings (in October and December) the central bank will increase the rate in 25-point increments, as a result of which the deposit rate will reach 0.75%. The 25-point increase in July is fully priced in at current prices. Moreover, according to many experts, the ECB needs to increase the rate by 50 points at once this month in order to contain the abrupt inflationary growth. But, apparently, the central bank is not ready for such a step. Therefore, the main intrigue of the July meeting is the further pace of monetary tightening. If the central bank questions a 50-point rate hike in September, the euro will remain under strong pressure. In this case, the EUR/USD bears may again try to settle in the area of the 99th figure.In addition, according to Bloomberg, at the July meeting, the ECB will present an unlimited bond buying tool that will help markets "adjust to sharper and faster interest rate hikes than previously thought." However, the market ignored this information last week, despite the hawkish nature of this message. In other words, the ECB can hypothetically provide situational support to the euro next week only if, for example, it unexpectedly decides on a 50-point rate hike or clearly announces such a move in the context of the September meeting. But the strengthening of the single currency in any case will be temporary, given the growing "information campaign" regarding the 100-point Fed rate hike.

Also, traders of the EUR/USD pair next week should pay attention to the events that will unfold in Italy. Let me remind you that on Thursday Italian President Sergio Mattarello rejected the resignation of Prime Minister Mario Draghi. The former head of the ECB, who later led the "government of technocrats" in Italy, decided to step down due to the loss of support for one of the country's largest political parties, the 5 Star Movement. According to Bloomberg, Draghi is still "determined" to leave office, and as early as next week, as he still does not have the support of all parties in the split coalition. According to journalists' insiders, the prime minister failed to reach a consensus within the ruling union of political forces. The likely political crisis that Italy will face could put additional pressure on the euro. Thus, in my opinion, the EUR/USD pair has not exhausted its downward potential: the downward trend is still in force. At the same time, there is no consensus on the market whether the pair will be able to settle below the parity level in the near future. Therefore, excluding longs in principle, it is advisable to open short positions on corrective rollbacks, and have downward targets above 1.0000. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD and GBP/USD weekly results and prospects Posted: 17 Jul 2022 08:34 AM PDT EUR/USD

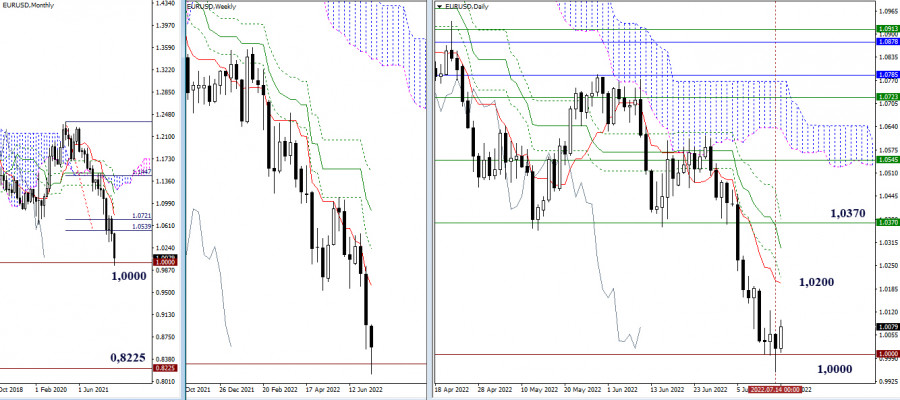

Higher timeframes The pair has been busy testing the important psychological level of 1.0000 for the past week. The level was very accurately noticed, and the main reaction to the meeting with support was braking. By the end of the week, there was a corrective rebound on the daily timeframe, which formed a long lower shadow on the weekly interval. If the pair leaves the zone of stagnation, indicated when testing the level of 1.0000, and the players on the rise manage to continue recovering their positions, then the main task in this direction will be testing the resistance of the daily dead cross (now it is 1.0200 - 1.0216 - 1.0297 - 1.0378), with its subsequent liquidation. At the same time, it will be important for bulls to find support for the weekly short-term trend, at the moment it is located at 1.0370. The players' failure to rise and the breakdown of the 1.0000 support will send the bears to the next significant milestone in history, the lowest extreme in 2000 (0.8225).

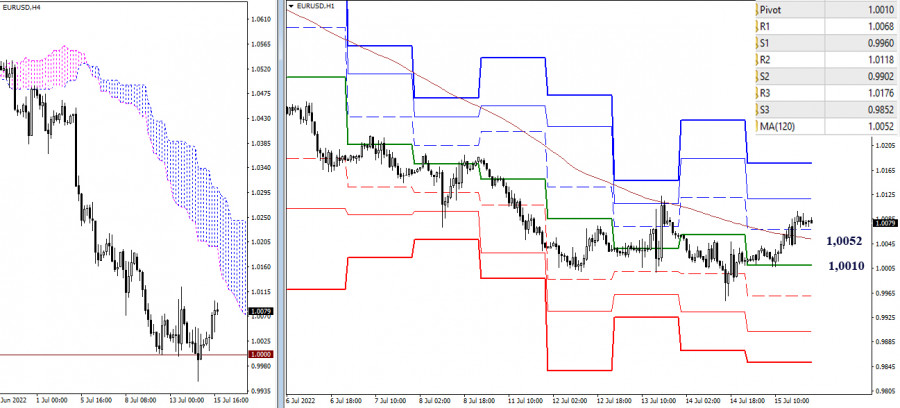

H4 - H1 The daily activity of the players to rise led to the fact that in the lower halves the main advantage passed to the bulls' side. They took over key levels and turned them into supports. Action above the key levels now at 1.0052 (central reference of the day) and 1.0010 (weekly long-term trend) will maintain the bullish edge. To develop a rise, bullish players will use the resistance of the classic Pivot levels as a reference point within the day. The loss of support at key levels will lead to a change in the balance of power in the lower halves. In case of a decrease, reference points within the day will serve as support for the classic Pivot levels. For example, now they are located at 0.9960 - 0.9902 - 0.9852. *** GBP/USD

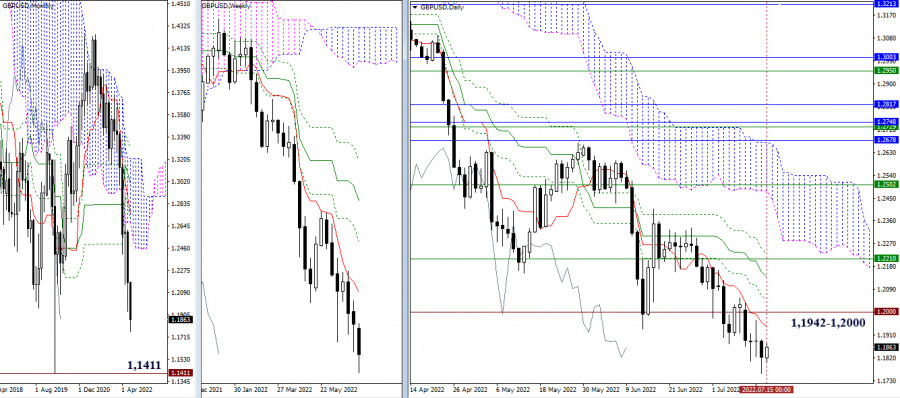

Higher timeframes Shorts weren't very productive last week. However, they maintained the downward trend, marking a new low for it. The reference point for the continuation of the decline in this area is the 1.1411 line (the lowest extremum of 2020). In case of an upward correction for bulls, the next important task will be a breakdown and consolidation above the resistances of 1.1942 (daily short-term trend) and 1.2000 (psychological level). Reliable consolidation above 1.2000 - 1.1942 will allow considering new perspectives.

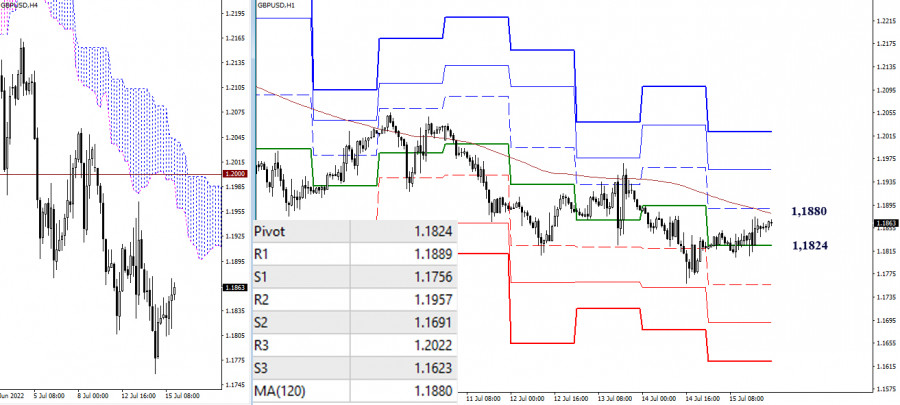

H4 - H1 In the lower halves, the pair is in the correction zone. The key level, which is responsible for the preponderance of forces, is now located in the area of 1.1880 (long-term weekly trend). Consolidation above and reversal of the moving average will change the current balance of forces in favor of the bulls. The reference points for the rise within the day will be the resistance of the classic Pivot levels. Now it is 1.1957 (R2) and 1.2022 (R3). When leaving the correction zone (1.1759 low), the reference points for intraday decline will be the support of the classic Pivot levels, at the moment they are located at 1.1756 – 1.1691 – 1.1623. *** In the technical analysis of the situation, the following are used: Higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend) The material has been provided by InstaForex Company - www.instaforex.com |

| This is indeed a recession, but have we estimated it correctly? Posted: 17 Jul 2022 07:29 AM PDT It is obvious that inflation has raged. Now experts are arguing about where we are: whether the current situation can already be considered a recession or not yet. There are many factors that you should consider before planning future trades. This is indeed a recession, but have we estimated it correctly?One part of the truth is that the more you look at the data, the worse it looks. A year ago, one could study a number of different measures of inflation and come to the conclusion that price pressures are still under control. Now the picture of the economy looks daunting. Let's start with a "truncated average" from the Cleveland branch of the Federal Reserve Bank, in which the highest spikes in prices in any direction are discarded, and the average is taken from the rest. So, now this is the highest figure since this method of counting started in 1984. There are other methods for calculating inflation. For example, the Atlanta branch of the Fed Bank uses indices that divide inflation into flexible prices, which change quickly and at low cost, and rigid (also called sticky) prices, which are expensive to implement and require long-term planning. And if you analyze the dynamics of prices in this context, it turns out that at first this inflationary shock was clearly caused by flexible prices, which grew by the fastest period on record. But now sticky prices are starting to rise, and sticky inflation is the highest in three decades. And this is one of the most serious arguments for those economists who believe that inflation is with us for a long time. If we look at the annual rate for three months, it becomes obvious that hard prices have skyrocketed this spring (it seems to be enough to look at catalogs, for example, furniture, to be convinced of this). Sticky inflation is now nearly 8% year on year, the highest in four decades. What does this tell us? First of all, that situational shocks are beginning to manifest themselves in the economy - and the Fed cannot avoid them yet, although it would very much like to. What other numbers are bothering me? Typically, rental prices rise with a lag, usually because the index takes into account all existing leases, not just those that were signed last month. Everyone was expecting it to grow and, needless to say, it did not disappoint, posting its 36-year highs. Since housing accounts for a third of the total consumer price index, this is a serious problem. You can cut back on a lot of expenses, but you have to live somewhere, no matter what, and preferably pay your utilities. So this is, consider, an obligatory element of inflation, and it is difficult to imagine how it can be combated, except by tightening monetary policy. All things considered, the inflation numbers looked bad at first, and on closer inspection they look even worse.Serious inflationary risks again changed the forecasts from analysts on Fed rates. The Fed: there are tactics, it is difficult with a strategy The latest Fed meeting has left economists wondering whether the next increase at the end of July will be 50 basis points or a 75 basis point surge. Now, most analysts are taking 75 basis points for granted, while the chances of an unprecedented 100 basis point advance are now estimated at 30% probability. This is a big game. And, as always, the principle of knowledge in comparison operates here. Using the tactics of the last meeting, the Fed is betting that the threat of a particularly large increase will make markets optimistic about a rise of "only" 75 points. But in fact, if we compare the 75 points and 50 points that the markets expected back in May, we can conclude that things are going worse than planned. Nevertheless, the effect of optimism, which I call "thank God", from a moderate increase in rates will be short-lived in any case. What's next? If back in June we said that interest rates would increase more gradually, with a peak around April 2023, and then decrease moderately to a level of about 3.2% by the beginning of 2024, now we say that the curve will be more pronounced: rates will soar faster (and possibly higher), peaking by February 2023. And most importantly, after such a sharp rise, the Fed will need all the strength, because the economy will require a sharp decline immediately after the peak through ultra-soft policies to support the manufacturers that survived the meat grinder for the next year and a half. Why is that? Because if in June we were still guessing whether there would be a recession (we didn't guess, we immediately warned you that, yes, there would be), now the markets are absolutely certain that a recession is inevitable. This can be seen in the reaction of many financial markets to this terrible data, which turned out to be surprisingly restrained. Bear market? Well, not for the first time, the traders decided and changed their strategies to carry trading. Stocks didn't move as much as bonds. Given the outbreaks of Covid-19 in China and the already finally protracted conflict between Russia and Ukraine, against which raw materials are growing at a frantic pace, one could expect just a sharp drop in demand for these assets... but in fact, demand for raw materials already started to slowly lose ground. An interesting effect played into the hands of the markets here. Taking into account the fact that the real manufacturing sector barely survived the last two years of the rest of the quarantines and the hopes of experts for a global recovery did not come true, the demand for raw materials also behaved accordingly: having decreased in 2020-21, it recovered weakly in 2022. So many manufacturers simply did not have time to expand production at the pre-pandemic level. It seems that this is what saved the world economy from a more serious collapse. But this does not mean that the inflation-recession link has stopped working, not at all. This can be seen from the inverted yield curve (the gap between the yields paid on 2-year and 10-year bonds). Under standard conditions, a 10-year bond should yield more than a two-year bond to offset the added risk of a longer-term investment in the future. This is true. But what we are seeing now is an inverted curve with higher two-year yields, which signals a recession to the financial markets like nothing else, as rates are expected to rise strongly in the near future and then fall quickly to save what is still possible. Unfortunately, the yield curve is now more inverted than since 2000, and steeper. Market confidence that a recession is imminent, with a worse recession than it was in 2000, now seems overwhelming. Many also use the ratio of the yield of not two-year, but three-month bonds in relation to the benchmark. It shows what the experts expect in the near future (in other words, how seriously events will hit the markets this year). And if until the beginning of May the expectations of bond buyers did not change, now this curve is approaching the level of 2020, when the pandemic broke out. And that in itself speaks volumes. Analyzing this data, one can say unequivocally that all that remains for the Fed is to raise rates. How long will it last? In fact, until the demand for bonds is destroyed (and in fact we are talking about the demand for speculative instruments of financial markets, and even more globally - for goods in general), and only then the banner of dove policy will sharply unfold. A quick stimulus will save the remnants of producers, but bloody tears and sweat will be left from the financial markets by this point. That being said, it should surprise you to see inflationary break-even rates that predict inflation over the next five and 10 years. In fact, this is not a positive signal. This is happening just because inflation is raging right now. And in the future, only recovery awaits us. In other words, this is not a positive sign for a trader, but rather a sign that the markets are sure that the current inflation will be extremely difficult to overturn by any means other than raising rates. From the same series of false positive signals, the collapses in the prices of a number of commodities that I have already mentioned, as well as the rather calm behavior of consumers. We have already talked about commodity prices, but as far as consumer behavior is concerned, it basically has the same effect: there was no recovery from the pandemic. This means that people simply did not have time to change their shopping habits, continuing to save. It's just that before they had to save money because of the impossibility of going to a restaurant once again. Now they are saving because of rising prices. So I urge you to be wary of claims that inflation is less of a threat than it was two years ago. This is not because rising prices have become less dangerous for us. This is because two years ago it was for us in the short term, and now we are in the midst of the process. Importantly, traders' calmness is based on a simple certainty: the Fed will certainly cope with inflation. The percentage in the base rate is there, the percentage is here, it seems like an insignificant fluctuation. In other words, the markets are expecting the Fed to raise rates, and it's not a very painful process. However, it is not. Too much growth in rates will almost certainly collapse the mortgage real estate market (the first signs have been flying in China for a long time), as well as lending to all kinds of mergers and acquisitions (Elon Musk has already felt this well). All this is potentially capable of launching a wave of bankruptcies at all levels. And unlike in 2008, this time the central banks are not going to bail out the financial institutions that over the past two years have been lending money on their own heads using the cheap dollar and now have trouble repaying them. Obviously, by March next year, many companies will be left with horns and legs. But the survivors will receive good conditions for recovery. So this is not at all a sign that inflation is loosening the grip. Rather, markets are now so confident of tighter monetary policy and that higher rates will cause the economy to tumble that they expect inflation to decline over the medium term. But there are pitfalls here too. There is a difference between lowering rates and lowering inflation. At some point, the Fed will be forced to start a systematic decline. And, as we have already said, it will be a faster decline rather than a slower one. But there is always a but. Without dynamics, there is little we can predict how prices will behave. High interest rates should kill demand (and the economy, yes), but the problem is that retail demand may not drop much (because it's already low). And if demand does not decrease, then there is no special need to reduce retail prices. And it may turn out that, despite the increase in rates, some demand remains (especially because of the forecasts of experts that we are waiting for a super-fast recovery). We see how the logic unfolds before us, but we will all need to go through all the stages one by one. First, the Fed must continue raising rates, and then we must see how this affects the economy and prices. Recessions happen from time to time. It is more or less obvious that rates will rise for a while and then start falling again. What is critical in this situation is time, but this factor is the most difficult to predict. If inflation continues to surprise with growth, as it did last month, then rates will have to rise higher than the market now expects, and the subsequent campaign of cuts will have to be postponed. The question of exactly how many months it will take to bring inflation to a tipping point is now critical. And then it's just as unclear how many months the recovery will take, because it is also affected by the volume of supplies from China, military operations and other factors, including new strains of coronavirus. It is true that there is still a lot of confidence that rates will peak at the beginning of next year and should come down quickly after that. But it's troubling that the markets are showing so much confidence about it, especially in light of the latest CPI numbers. Inflationary peaks usually pass quickly and are followed by a sharp decline. The history of inflationary bursts over the last century shows that inflation never remains at the high level it is now for more than a few months (except for the wars and stagflation of the 1970s). But a lot depends on when exactly inflation will drop enough for the Fed to ease, and how gradual this process will be. Ultimately, inflation is not as bad as its consequences. And the feeling that it is them now that we underestimate. I want to emphasize that the fact that the Fed will be forced to cut interest rates more sharply in the near future is by no means a positive factor. It will be, let's say, a straw for a drowning man. And that alone should tell you where the economy will be by then. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments