Forex analysis review

Forex analysis review |

- March 11, 2021 : EUR/USD daily technical review and trading opportunities.

- March 11, 2021 : EUR/USD Intraday technical analysis and trading plan.

- March 11, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

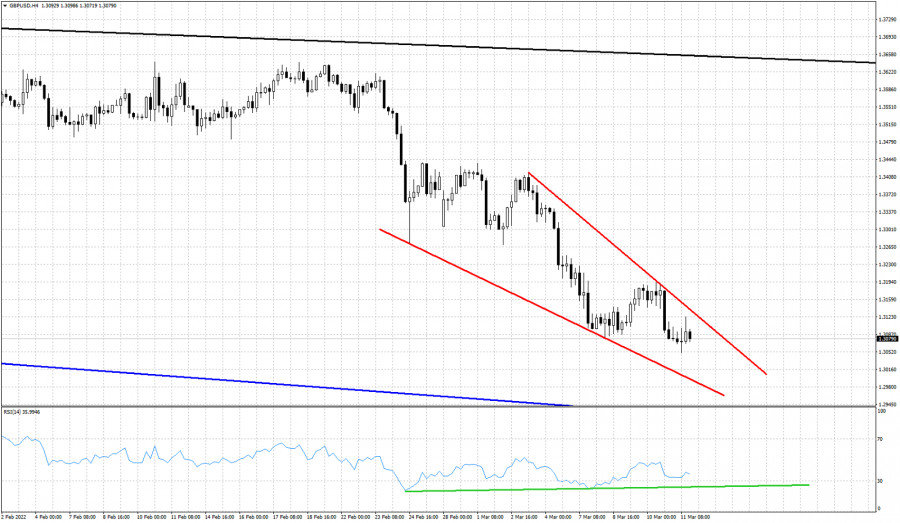

- GBPUSD wedge pattern in play.

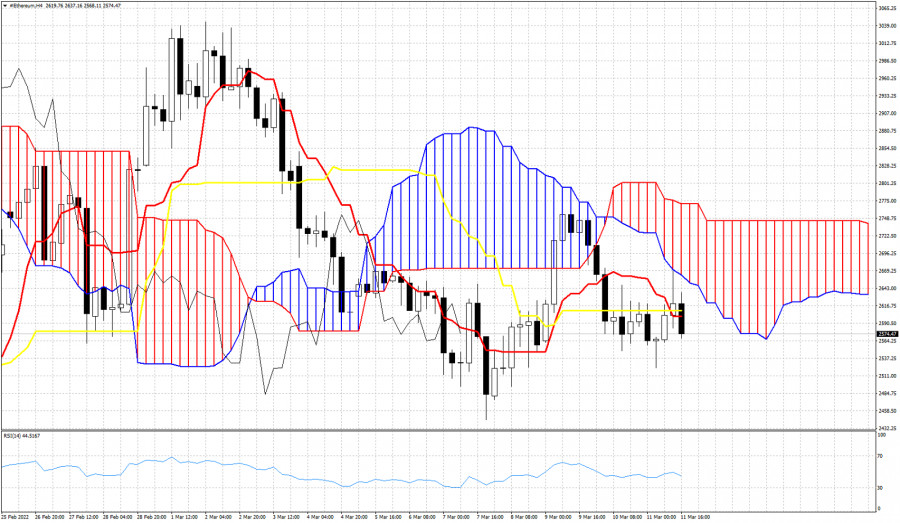

- Ethereum got rejected at cloud resistance.

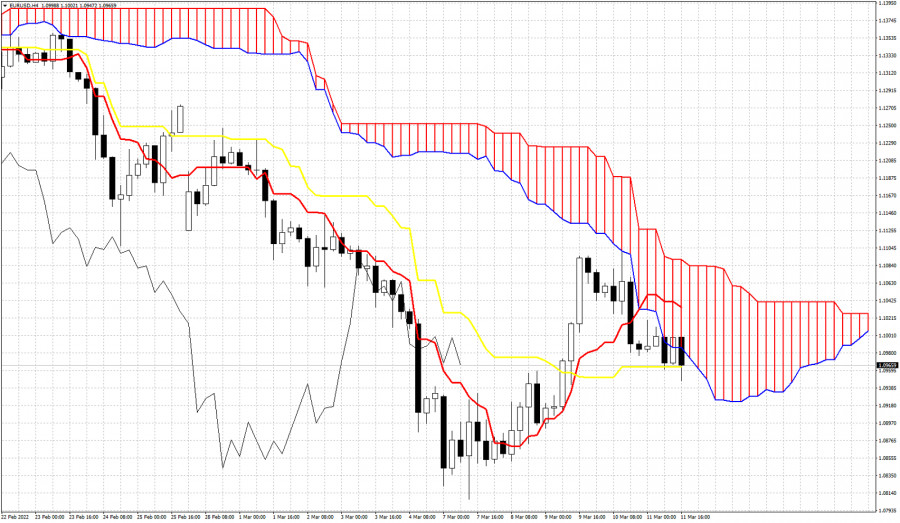

- EURUSD gets rejected again at cloud resistance.

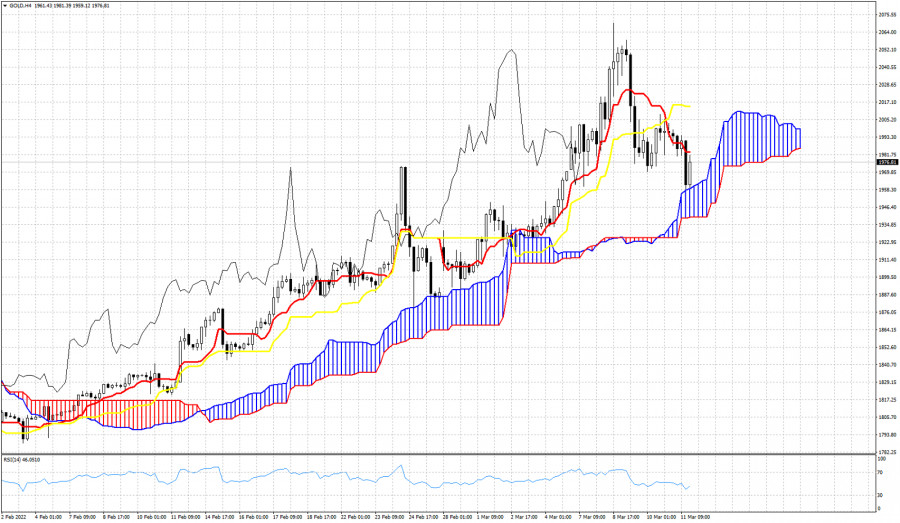

- Ichimoku cloud indicator analysis on Gold for March 11, 2022.

- Platinum demand rises, while its surplus falls

- Ambitious plan to gain 12,000 pips on gold

- XAU/USD Analysis and Trading Plan

- Trading signals for EUR/USD on March 11-14, 2022: key level 1.0980 (2/8 Murray - 21 SMA)

- EUR/USD: ECB sends empty hawkish signals amid continuing downward potential

- USD/CAD pushes lower by upbeat Canadian data

- Trading signals for Gold (XAU/USD) on March 11-14, 2022: buy above $1,960 (double bottom)

- Something is weird about USD, EUR, and oil now

- Fed to become global economy's trendsetter: what awaits crypto market and Bitcoin

- Major Asian stock indices slide

- GBP/USD Analysis on 11 March, 2022

- EUR/USD Hot Forecast on 11 March, 2022

- US premarket on March 11: the US stock market rose sharply on rumors of a cease-fire

- GBP/USD: the plan for the US session on March 11 (analysis of morning deals). The pound was bought off from annual lows,

- EUR/USD: plan for the US session on March 11 (analysis of morning deals). Everything stays in its place

- Gas prices continue to rise in EU

- Forecast for GBP/USD on March 11. The pound also started a new fall under the pressure of American inflation

- USD/JPY analysis and forecast for March 11, 2022

| March 11, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 11 Mar 2022 10:31 AM PST

During the past few weeks, the EURUSD pair has been trapped within a consolidation range between the price levels of 1.1700 and 1.1900. In late September, Re-closure below the price level of 1.1700 has initiated another downside movement towards 1.1540. Price levels around 1.1700 managed to hold prices for a short period of time before another price decline towards 1.1200. Since then, the EURUSD has been moving-up within the depicted movement channel until bearish breakout occurred by the end of last week's consolidations. Few weeks ago, the price zone of 1.1350 failed to offer sufficient bearish rejection that's why it was bypassed until 1.1500 which applied significant bearish pressure on the pair. A possible SELL Entry was offered upon the previous ascending movement towards 1.1500 which provided significant bearish pressure. Shortly after, the EURUSD looked oversold while approaching the price levels of 1.0850. That's where the current upside movement was initiated. Any movement towards 1.1200 should be considered for another SELL trade as long as sufficient SELLING pressure is demonstrated. The material has been provided by InstaForex Company - www.instaforex.com |

| March 11, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 11 Mar 2022 10:29 AM PST

Recent bullish pullback towards 1.1650-1.1680 (upper limit of the previous consolidation range) was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which failed to provide sufficient BUYERS for too long period. Hence, only a short- term sideway movement was demonstrated around 1.1550 before quick bearish decline could occur towards 1.1200. On the other hand, the price levels around 1.1520 stood as a reference zone that applied significant bearish pressure upon two successive bullish visits. Recent Bearish decline below 1.1100 was considered as a bearish continuation sign. That's why, downside movement was expected to proceed towards 1.1000 then 1.0920 where the current bullish pullback was initiated. The price levels around 1.1100 should be watched upon any upcoming bullish move for bearish rejection and a possible SELL Entry. However, failure to do so will probably enable more bullish advancement towards 1.1320. The material has been provided by InstaForex Company - www.instaforex.com |

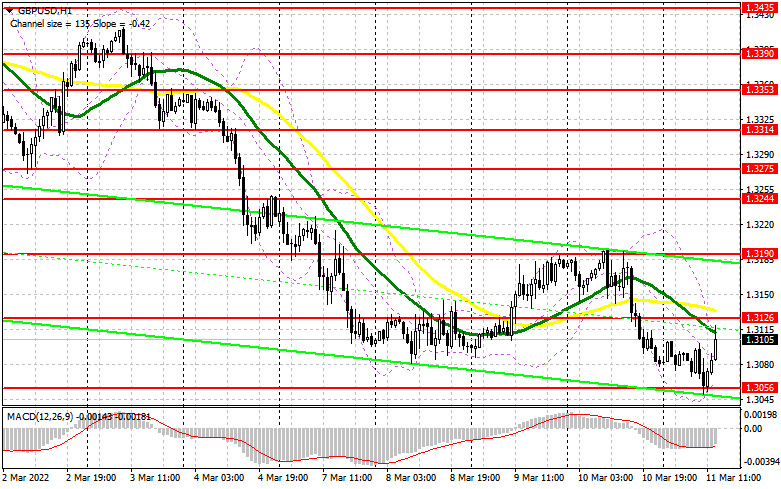

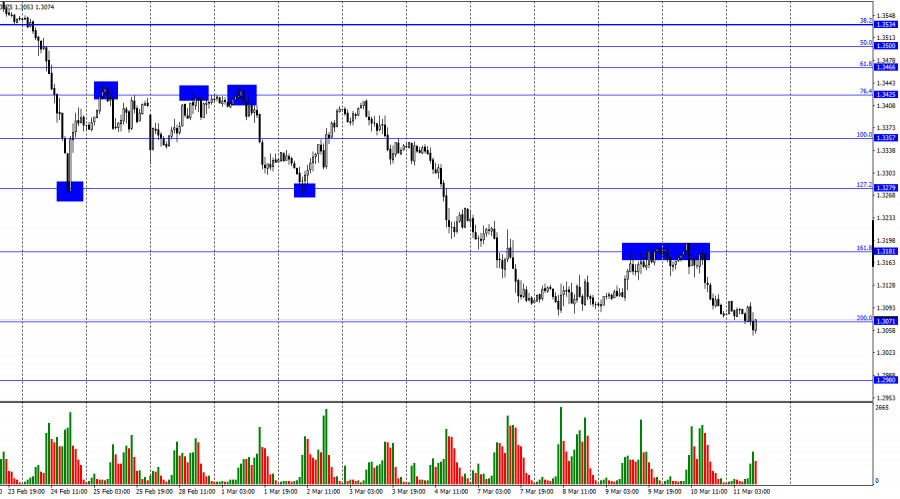

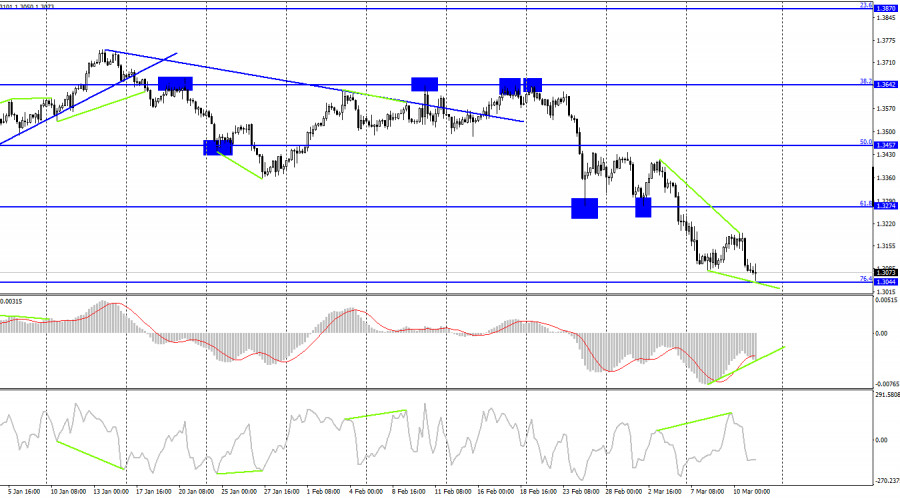

| March 11, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 11 Mar 2022 10:24 AM PST

The GBPUSD pair has been moving within the depicted bearish channel since July. Bearish extension took place towards 1.3220 where the lower limit of the current movement channel came to meet with Fibonacci level. Shortly after, BUYERS were watching the price levels of 1.3730 to have some profits off their trades as it stood as a key-resistance which offered significant bearish rejection recently. The short-term outlook turned bearish when the market went below 1.3600. This enhanced the bearish side of the market towards 1.3400 which brought the pair back towards 1.3600 for another re-test. Hence, the recent bullish pullback towards 1.3600 should have been considered for SELL trades as it corresponded to the upper limit of the ongoing bearish channel. It's already running in profits. Bearish persistence below 1.3220 may enable further downside continuation while initial bearish target is located around 1.3000 (the lower limit of the movement channel). Bullish rejection should be anticipated around 1.3000, please note that bullish breakout above 1.3250 enables quick bullish advancement towards 1.3400. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2022 08:47 AM PST GBPUSD remains in a bearish trend making lower lows and lower highs. Price made a new lower low today but in the 4 hour chart the RSI did not follow. Price is forming bullish divergence signs. This is a warning that the downtrend might soon end.

green line - bullish divergence Blue line- support Black line - resistance Price is also forming a downward sloping wedge pattern as shown in the 4 hour chart above with red lines. Resistance by the wedge is at 1.3140. A break above this level will produce a bullish signal. Combined with the bullish RSI divergence, we should then expect GBPUSD to continue higher towards 1.34. The lower wedge pattern boundary is at 1.30. The material has been provided by InstaForex Company - www.instaforex.com |

| Ethereum got rejected at cloud resistance. Posted: 11 Mar 2022 08:33 AM PST Ethereum price reached as high as $2,678 earlier today where the lower cloud boundary resistance was found. Price got rejected and is now trading around $2,560. Short-term trend remains bearish as price continues to trade below the Kumo (cloud).

|

| EURUSD gets rejected again at cloud resistance. Posted: 11 Mar 2022 08:28 AM PST EURUSD price action is bearish. Price remains in a bearish trend according to the Ichimoku cloud indicator as price is below the Kumo (cloud). However recent price action confirms that bulls remain weak as they are unable to break above the cloud resistance even in the 4 hour chart.

|

| Ichimoku cloud indicator analysis on Gold for March 11, 2022. Posted: 11 Mar 2022 08:25 AM PST Gold price is trading around $1,960 just above the 4 hour Ichimoku cloud (Kumo). As expected when Gold was trading above $2,030, price has turned lower towards the Kumo support. Our pull back target was around $1,950-60 and Gold today reached as low as $1,958.

|

| Platinum demand rises, while its surplus falls Posted: 11 Mar 2022 08:21 AM PST

According to the World Platinum Investment Council (WPIC), platinum investors should prepare for a year of volatility as the supply and demand outlook for 2022 remains solidly volatile. In its latest report on the platinum market, the council described the precious metal as having a challenging 2021 with strong demand but even stronger supply. The WPIC reported that the platinum market saw a supply surplus of 1.232 million ounces last year, driven by the rapid process of stockpiled ore from 2020 and significant outflows of 237,000 ounces from platinum-backed exchange-traded funds. The increase in supply came as platinum demand grew significantly in 2021. The WPIC said that automotive demand increased by 11% last year, industrial demand rose by 27% and jewelry demand grew by 5%. The council predicts that total demand will rise by 7% to 520,000 ounces in 2022. However, the market is still expected to register another surplus, albeit lower than in 2021. Platinum surplus is likely to be reduced by 47% to 652,000 ounces this year. Raymond added that the conflict could fuel demand for platinum. Besides, Russia controls about 40% of the palladium market. Both metals can be used in catalytic converters, reducing harmful emissions in gasoline-powered engines. The threat of imposing sanctions against Russia has already driven palladium prices to a new record high above $3,300 an ounce.

Raymond said that there was evidence that China was buying unprecedented amounts of platinum, which would account for perceived tightness and rising prices. He added that China's appetite for platinum in the physical market had not been captured in the latest data, which is one of the reasons for last year's massive surplus. According to the WPIC, it will not take long to turn this year's expected surplus into a deficit or at least a balanced market. Raymond said that the green energy transition would further support platinum. He added that the precious metal continued to play an important role in reducing harmful greenhouse gas emissions. Some analysts speculate that rising oil prices could lead to a faster transition to electric vehicles. However, consumers should consider not just oil prices; commodity prices from nickel to lithium have already hit record highs, which could lead to higher prices in electric car markets. Raymond said that the cheaper option for automakers in the current environment would be to produce more hybrid vehicles that have smaller batteries and still rely on internal combustion engines. Another factor in the green energy transition is the growing popularity of green hydrogen, which requires platinum as a catalyst. Solar or wind energy separates hydrogen and oxygen molecules in water; the hydrogen is then used as fuel for power generators. Raymond added that higher energy prices could accelerate plans to develop hydrogen fuel cells. As for what is holding platinum prices back, the market needs an infusion of new capital. Platinum has been one of the worst-performing assets in the precious metals sector. However, currently its discount to gold continues to rise. The material has been provided by InstaForex Company - www.instaforex.com |

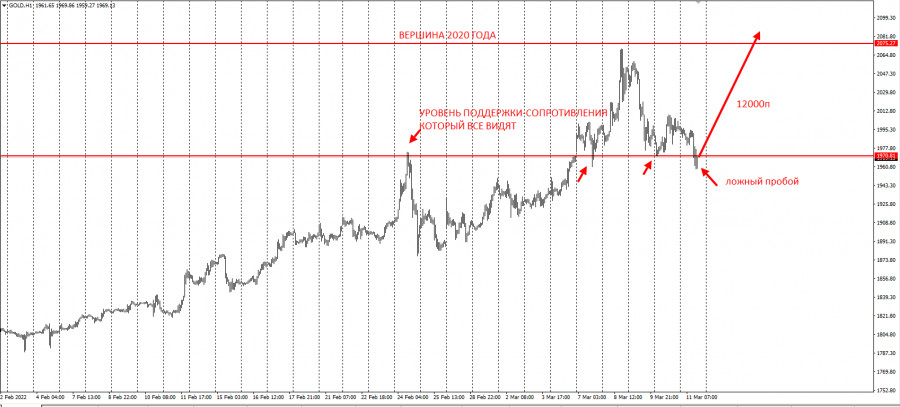

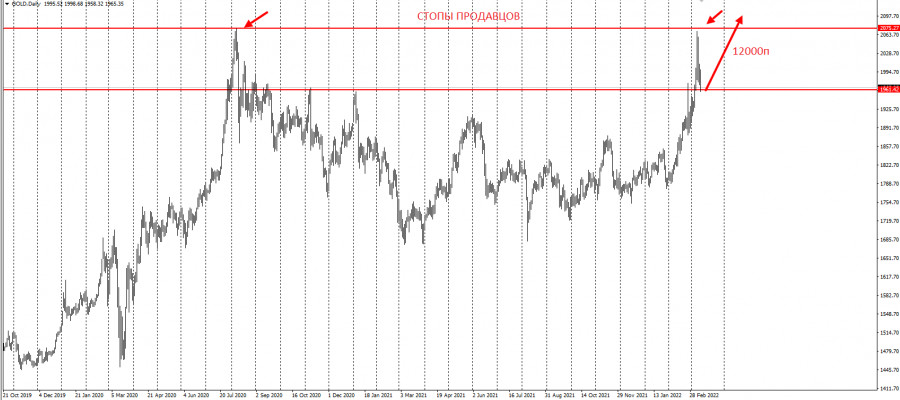

| Ambitious plan to gain 12,000 pips on gold Posted: 11 Mar 2022 07:50 AM PST

Hi, dear traders! Let me present you with my trading idea for gold. After a stunning rally at the beginning of the week, gold considerably retreated to $1,960 with a false breakout of support/resistance. This price action clearly seen by all traders enables us to enter the market accurately with long positions. This trading instrument has the bullish outlook.

The daily chart reveals shows that gold has left the top of 2020 untouched. It makes a nice target for profit taking on long positions.

I suggest that we should trade gold higher from current price levels with a view to hitting the peak of 2020/2022. All in all, the gold price has a huge bullish potential of 12,000 pips. We could plan market entry points according to signals generated by shorter time frames and keep track of our positions through closing levels of daily bars. This trading idea is developed on the basis of my own methods Price Action and Hunting for stop orders. Good luck in trading! Make sure you manage your risks! The material has been provided by InstaForex Company - www.instaforex.com |

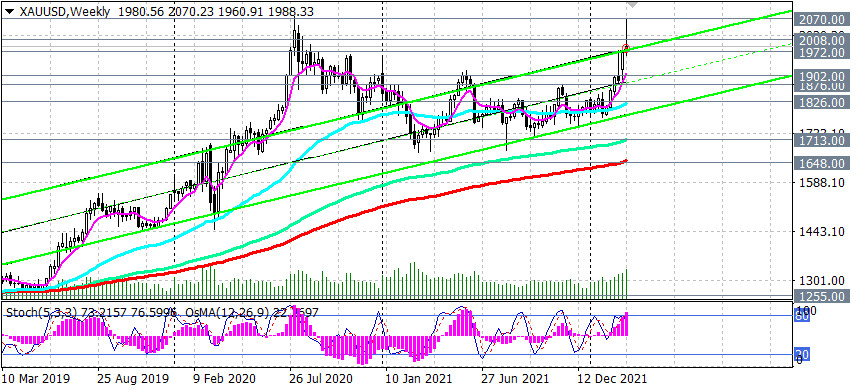

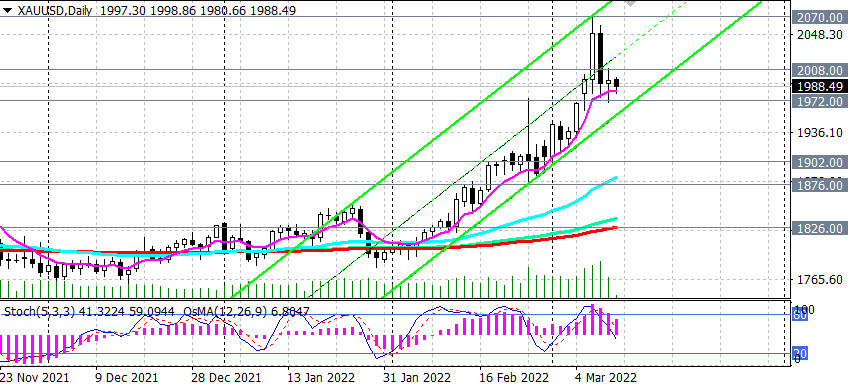

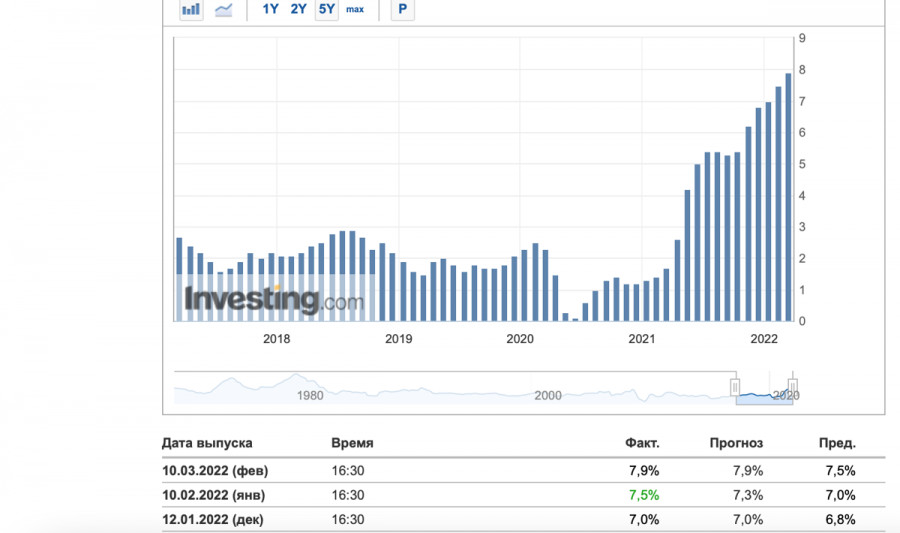

| XAU/USD Analysis and Trading Plan Posted: 11 Mar 2022 07:48 AM PST Futures for major European and U.S. stock indices fell again yesterday, while the dollar strengthened: uncertainty over the events in Ukraine and the rapid rise in inflation continues to worsen investor sentiment. Additional uncertainty is brought about by the results of the ECB meeting and the publication last Thursday of U.S. inflation indicators. On Thursday, the ECB left the current monetary policy unchanged but said it would be winding down its asset purchase program faster than planned, paving the way for higher interest rates this year. ECB President Christine Lagarde acknowledged that "economic activity could be dampened significantly" by military action in Ukraine. ECB leaders cut their 2022 growth forecast for the eurozone economy from 4.2% to 3.7% (a more negative scenario suggests growth of 2.3%). Meanwhile, according to the U.S. Department of Labor, the consumer price index (CPI) in February showed an annual increase of 7.9% (against 7.5% in January and economists' forecast of growth of 7.8%), which is the most significant annual growth since January 1982. The Fed is likely to tighten monetary policy less aggressively this year than expected, given the impact of events in Ukraine on the global economy. Fed Chairman Jerome Powell said during his speech to Congress last week that he would support raising interest rates by a quarter of a percentage point at the March 15-16 meeting. If before the start of the military special operation in Ukraine, the markets expected that rates would be raised seven times, now they predict four to five increases, and the Fed's rate hike by 25 basis points has already been taken into account in the quotes. The increase in inflation increases the demand for gold, which investors consider as a hedging tool for risks associated with the depreciation of the dollar due to rising inflation in the United States and against the background of events in Ukraine. Yesterday's U.S. inflation report provides additional support for gold, while no easing of geopolitical tensions is expected yet. This tension in the short term will further fuel inflation in the eurozone, which in February was 5.8%, almost three times higher than the ECB's target level of 2%. At the beginning of today's European session, the XAU/USD pair is trading near the important short-term support level of 1972.00, providing a good opportunity to increase long positions. As you know, gold is very sensitive to changes in the monetary policy of the world's leading central banks, especially the Fed. When it tightens, the quotes of the national currency (under normal conditions) tend to grow, while the price of gold falls. However, geopolitical uncertainty and accelerating inflation around the world increase demand for gold, which is a popular defensive asset, creating prerequisites for further growth in its quotes. Therefore, it is advisable to search for opportunities for the best entry into long positions. The current correction is one of them. Technical analysis and trading recommendations At the time of this writing, the XAU/USD pair is trading near the 1990.00 mark, just above the important short-term support level of 1972.00 (200 EMA on the 1-hour chart). At the same time, XAU/USD remains in the long-term bull market zone, above the key support level of 1826.00 (200 EMA on the daily chart). In our opinion, it is possible to enter long positions from the current levels, as well as with a decline to the support level of 1972.00. The confirmation signal will be a breakdown of the local resistance level of 2008.00. In this case, XAU/USD will continue to grow within the ascending channel on the daily chart. Its upper limit is above the 2070.00 mark (the recent local almost 2-year high), which will be the nearest target for the growth of XAU/USD.

In an alternative scenario, which looks like a theoretical one so far, XAU/USD will return to the zone of the key long-term support level of 1826.00. The first signal for the implementation of this scenario will be a breakdown of the short-term support level of 1972.00. But even a decline to the important support level of 1902.00 (200 EMA on the 4-hour chart) will be considered as corrective within the bullish trend.

Only a breakdown of the support levels of 1713.00 (144 EMA on the weekly chart and local lows), 1648.00 (200 EMA on the weekly chart) will increase the risks of breaking the long-term bullish trend of XAU/USD.

Support levels: 1972.00, 1902.00, 1876.00, 1826.00, 1800.00, 1713.00, 1700.00, 1648.00 Resistance levels: 2000.00, 2008.00, 2070.00 Trading recommendations XAU/USD: Sell Stop 1967.00. Stop-Loss 2011.00. Take-Profit 1902.00, 1876.00, 1826.00, 1800.00, 1713.00, 1700.00, 1648.00 Buy by-market, Buy Limit 1973.00, Buy Stop 2011.00. Stop-Loss 1967.00. Take-Profit 2050.00, 2070.00, 2100.00, 2200.00 The material has been provided by InstaForex Company - www.instaforex.com |

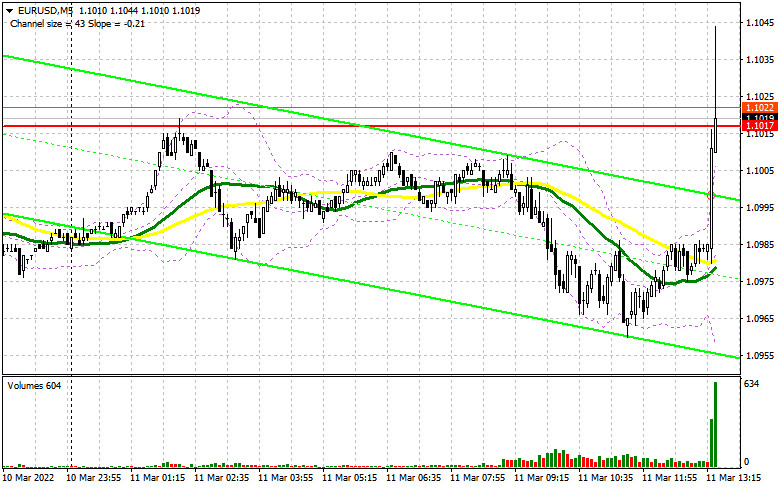

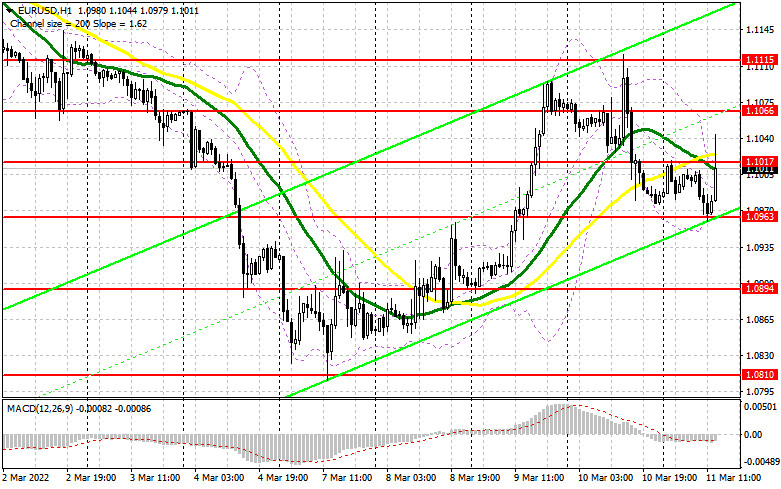

| Trading signals for EUR/USD on March 11-14, 2022: key level 1.0980 (2/8 Murray - 21 SMA) Posted: 11 Mar 2022 07:40 AM PST

On Wednesday, the euro reached the zone 3/8 Murray around 1.1120. Since this level, it has been forming a downtrend channel and now is consolidating above the 21 SMA located at 1.0980. It looks like the market has found resistance at the 1.1084 level (3/8 Murray). So, if the euro breaks sharply below 1.0980, a return to lows March 7 around 1.08 is more likely. There are external factors that affect the European currency, such as the slowdown in economic growth in Germany and the war in Ukraine. If conditions do not change, we think it will still be profitable to sell on rallies, especially if the price approaches the level at 1.1195, where the 200 EMA is located and a little higher where there is the 4/8 Murray at 1.1230 which acts as a strong resistance. On March 7, the euro started a bullish rally from 1.0805 to 1.1220, which was seen as a technical correction. This move left the formation of a bullish pennant, which if is confirmed, has its target at the resistance 200 EMA in 1.1200. In the coming hours, if the euro consolidates above 2/8 Murray and above the SMA 21, there is likely to be a strong bullish move towards 3/8 Murray at 1.1084 and 1.1195 (200 EMA). The eagle indicator is giving a positive signal which supports our strategy. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: ECB sends empty hawkish signals amid continuing downward potential Posted: 11 Mar 2022 06:54 AM PST The reaction of market players to the latest ECB meeting was mixed. On the one hand, EUR/USD reached a new local high after ECB's hawkish signals. On the other hand, the regulator stated it would not increase the interest rate in the near future, despite the expected inflation spikes. Amid mixed signals from the ECB, EUR/USD failed to settle at 1.1100 and slid down, as bearish traders took the initiative. Growing demand for USD by risk-averse investors also pushed down the pair. Despite the best efforts of bulls, EUR/USD only performed a brief upward correction. It remains under pressure, making holding long positions risky.

The March meeting of the ECB was ambiguous. The central bank announced it would accelerate winding down its QE program. Monthly net purchases under the program would amount to €40 billion in April, €30 billion in May and €20 billion in June. Originally, the European Central Bank planned to lower its asset purchases to €20 billion by October. However, growing price pressure forced the regulator to wind down QE by Q3 2022. Earlier, the ECB stated that the proposed interest rates could be lower than the current level. This wording was removed from this meeting's statement, which was interpreted as another hawkish signal by market players. EUR/USD pushed a new weekly high, reaching 1.1120, but retreated following remarks by the ECB's president Christine Lagarde. The wind down of QE has already been priced in, and it did not halt the pair's downtrend. However, market players expected it to be preceding an interest rate increase. These expectations were shattered by Christine Lagarde's remarks yesterday – the ECB's president stated that any adjustments in interest rates will take "some time" after asset purchases end, meaning there would be no automatic rate hike after QE ends. This dovish signal negated investor optimism about the accelerated wind down of QE.

The risk of stagflation and resulting fear in the market is also weighing down on EUR/USD. The 2022 outlook for inflation has been raised to 5.1% from 3.2%, amid the forecasted decrease in production, higher unemployment and falling GDP. Goldman Sachs analysts predicted economic output in the Eurozone would fall significantly. The European economy was expected to grow by 3.7% in 2022, down from 4.2% in the previous outlook. More pessimistic forecasts see the EU economy grow by only 2.3% and expect inflation to jump to 8%. A repeat of stagflation of the 1970s is the biggest and likely risk facing the EU at this moment. The EUR/USD downtrend still has momentum. The euro is clearly vulnerable, while the US dollar is picking up steam in the market thanks to rising risk off sentiment. Short positions could be opened during any significant correction. The pair remains between the middle and lower lines of the Bollinger Bands indicator and below both lines of the Ichimoku cloud, suggesting that downward movement is predominant at the moment. The closest support level for EUR/USD is the psychological level of 1.0900, with the next target being 1.0830 – the lower line of the Bollinger Bands at the D1 timeframe. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD pushes lower by upbeat Canadian data Posted: 11 Mar 2022 06:53 AM PST The USD/CAD pair plunges at the time of writing and it seems unstoppable. It's trading at 1.2695 far below today's high of 1.2793 today's high. The currency pair crashed as the CAD was boosted by the Canadian economic data while the USD was weakened by the DXY's seel-off. The Canadian Unemployment Rate dropped unexpectedly lower from 6.5% to 5.5% far below 6.2% expected, while the Employment Change was reported at 336.6K above 132K expected. In addition, the Capacity Utilization Rate was reported at 82.9% versus 81.9% expected. Later, the Prelim UoM Consumer Sentiment will be released and is expected at 61.4 points. It remains to see how the USD/CAD will react. USD/CAD Down Channel!

USD/CAD dropped as much as the 1.2693 level after failing to retest the downtrend line, the channel's resistance, and after registering only false breakouts above the 38.2% (1.2780). The bias remains bearish as long as it stays within the channel's body, below the downtrend line. Now, it challenges the confluence area formed at the intersection between the 61.8% (1.2706) with the channel's downside line. A valid breakdown through this confluence area may announce a deeper drop towards the median line (ML). USD/CAD Prediction!The breakdown below 1.2750 former low represented a short opportunity with a first downside target at the channel's downside line. A valid breakdown below the 61.8% retracement level or through the confluence area may activate a larger drop. A temporary rebound after the current massive drop could help the sellers to catch a new sell-off. The material has been provided by InstaForex Company - www.instaforex.com |

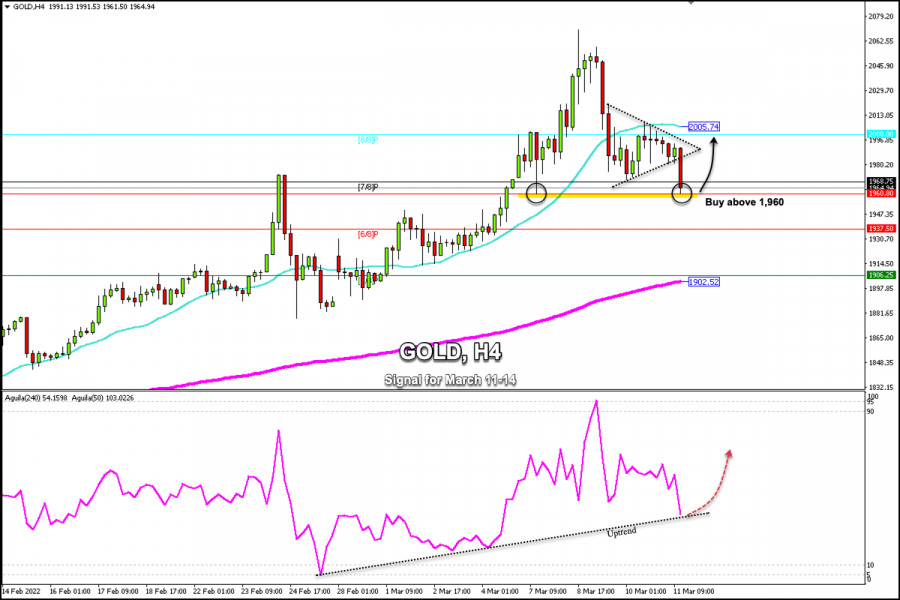

| Trading signals for Gold (XAU/USD) on March 11-14, 2022: buy above $1,960 (double bottom) Posted: 11 Mar 2022 06:22 AM PST

Early in the American session, gold reached the support level of 1,960. This level coincides with the low of March 7. If the price consolidates above this level in the next few hours, it could confirm the formation of a double bottom pattern. Hopes of finding a path that would lead both countries to a peaceful solution caused a sharp pullback in gold and it is now hovering around 1,960. A break and consolidation below this level could accelerate the decline towards the support 6/8 Murray at 1,937. However, the talks held in Turkey did not achieve any progress and, once again, investors could take refuge in gold seeking protection against the possible global recession that the war would generate. In the European session, gold broke out the symmetrical triangle pattern and found support around 7/8 Murray and 1,960. This technical correction in gold is likely to give the bulls a chance for a positive move in the coming days. Given that gold was trading at extremely overbought levels, this correction was expected in the last few hours and could also be part of profit-taking by investors. Another factor that is eroding the strength of gold is the slight increase in demand for risky assets. Wall Street indices are trading in the green which affects the strength of gold. In the medium term, gold should continue its rise if the situation in Ukraine worsens or if inflation gets out of control. Investors have their eye on the expected interest rate hike for part of FED next week as it could dampen the strength of gold, only if the interest rate increase is about 50bp. Our trading plan is to wait for a bounce around 1,960 to buy, with targets at 1,985 and the level SMA 21 at 2,005. The eagle indicator has touched the support level of the uptrend channel which could favor a recovery in gold. The material has been provided by InstaForex Company - www.instaforex.com |

| Something is weird about USD, EUR, and oil now Posted: 11 Mar 2022 05:29 AM PST Hi, dear colleagues! The US dollar, and euro, and crude oil are three pillars among other assets that arouse the most interest among traders and investors. Let's try to figure out their outlook amid such a complicated background in global financial markets. Today I would like to discuss weird things of the current moment indicating that the US dollar is setting a trap for the global financial system. In light of the sanctions on Russia's gold and forex reserves slapped as a punishment for the military intrusion into Ukraine, we can see that the US dollar and the euro are the flip sides of the same coin. This is obvious looking at any currency pair. Forex crosses are an exception, though all currencies in them are traded relative to the US dollar. After Russia had been cut off from SWIFT and after other sanctions had been imposed, the Russian currency lost 50% of its value. At first glance, any troubles with the US dollar compared to the ruble's knockout are insignificant. Nevertheless, we cannot downplay the fallout from the dollar's problems. The ruble hitting rock bottom will cause trouble to the Russians and people from the neighboring countries. If something goes wrong with the US dollar and the euro, this would inflict damage to the whole global economy. First of all, you and I need to understand that a fiat reserve currency system based on the US dollar is a well-balanced mechanism that allows the "golden billion" to benefit from having the very ability to create money from debt. The balance of power is characterized by the dollar exchange rate against other reserve currencies, which has remained unchanged for 50 years. At the moment the US dollar exchange rate is 97.95% against reserve currencies, where the 1973 level is taken as 100% (picture 1).

Pucture 1: USD exchange rate against other major currencies Over the 50 years that have passed since the forex market came into existence, the forex rate of the American currency has not changed dramatically. This does not mean that the dollar exchange rate against a basket of foreign currencies has never changed at all. Over the past 5 years, its values have deviated from the level of 88 to the level of 104, but in general we can see that this deviation is around a constant value. As you know, the euro exchange rate is actually the reverse exchange rate of the US dollar because the denominator of the European currency is the US dollar. In turn, the euro accounts for nearly 60% in the basket of major currencies. Therefore, it is not surprising that the EUR/USD chart looks very much like an inverted dollar index chart. At the same time, the movement of the euro exchange rate mirrors the movement of the dollar index. While the dollar index overcame resistance at 97, the EUR/USD exchange rate overcame support at 1.12 (picture 2). From the point of view of intermarket technical analysis, such a movement is true, and the subsequent return of the rate to resistance or support is nothing more than a confirmation of the breakdown of an important level, which suggests further movement in the direction of the main trend, where in the case of the dollar index, this is growth. In the case of the EUR/USD rate, this is a decrease.

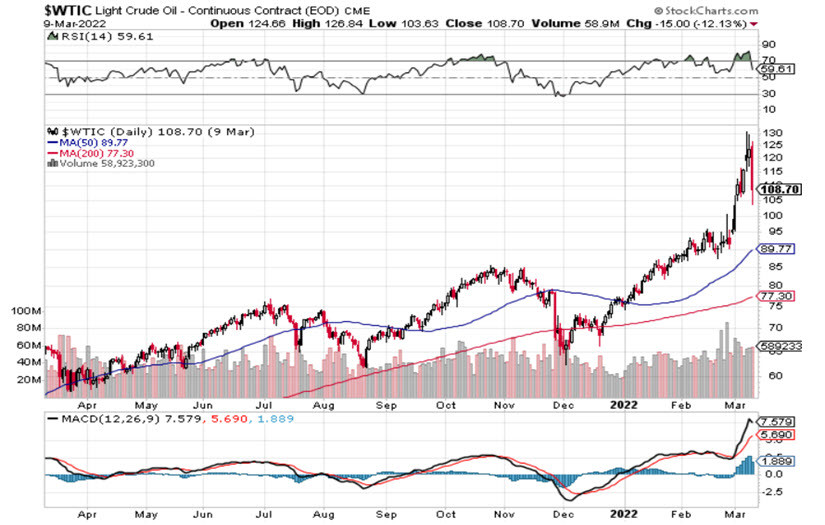

Picture 2: Technical analysis of EUR/USD The reader who has read up to this point may ask: "What is strange here?" Indeed, there is nothing strange so far. All trends develop in line with classical technical analysis, which says that the indices should confirm each other. However, intermarket analysis also tells us that all markets are interconnected and cannot develop in isolation. Therefore, let's add the price of oil to our consideration, taking the American grade WTI, which is designated #CL on InstaForex trading platform. It is common knowledge that oil is traded in US dollars or has a dollar as its equivalent. In fact, the oil quote looks like WTI / USD, where there is an oil contract instead of a currency ticker. This allows us to draw a conclusion about the multidirectional dynamics of the dollar and oil prices. In other words, an increase in the dollar should be accompanied by a decrease in the price of oil. Besides, a decrease in the EUR/USD should also be accompanied by a fall in oil prices. Assets do not correlate with each other, but have a close logical connection. There have been discrepancies in dynamics before, but usually they leveled out within one month. Nowadays, the price of oil has actually been growing non-stop since October 2020 (picture 3), while the euro has been actively declining since June 2021, i.e. already over the past 7 months, which is a critical fundamental factor. In July 2021, the price of WTI oil was 65 euros (80 US dollars). In March 2022, the price of oil is already 100 euros (110 US dollars), an increase of about 54%. The price of oil rose in dollars as well, but in US currency the growth was about 38%.

Picture 3: Technical analysis of WTI #CL The embargo imposed by the United States on imports of Russian oil, as well as the military clashes in Ukraine, caused an acute shortage in the energy market. One of the main Russian ports through which oil produced in Russia was transported for export, the Novorossiysk Commercial Sea Port, actually halted any shipments. At the same time, the cost of freight due to the threat of sanctions increased three and a half times, and the price of oil soared to multi-year records. Therefore, statements that the UAE advocates for ramping up oil output by OPEC countries led to a drop in oil prices. The problem is that there are no reserve capacities for increasing oil production in the world now. Thus, the implementation of the embargo can be carried out only virtually so far, but this will not continue forever. A year later, the world will be able to do without Russian oil. However, the problem is wider than just limiting the supply of energy resources from a single country, albeit a very large one. The problem is that the postulate of world trade based on the US dollar as the equivalent of value no longer works. The rally of oil prices in parallel with the depreciation of the euro testifies to this better than any other signs. The global economy built on the principle of uniform pricing through the market price does not exist anymore. The price can still be measured in dollars, but it will not be set on American or European exchanges, but through direct contracts. Whether this is good or bad, time will tell. We see a reflection of the current situation in inflationary processes in developed Western countries, which threaten or have already gone out of control of central banks. Inflation data in the US and other countries have already conquered multi-decade highs. Central bank tools are very limited. So, in this regard, we should expect a significant decline in global stock markets in the next few months. Be careful and prudent! Follow the rules of money management! The material has been provided by InstaForex Company - www.instaforex.com |

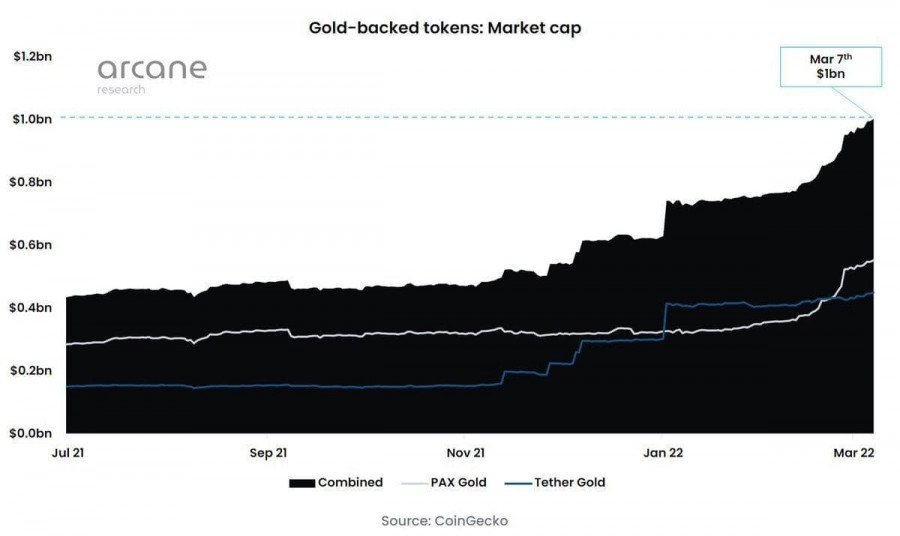

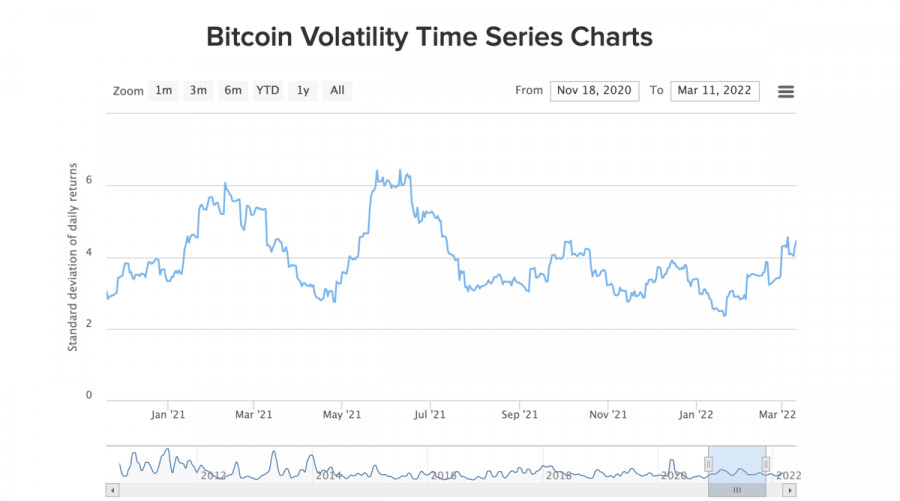

| Fed to become global economy's trendsetter: what awaits crypto market and Bitcoin Posted: 11 Mar 2022 04:57 AM PST The conflict between Russia and Ukraine is damaging the global economy. Due to the record number of sanctions, the usual supply chains are disrupted, and it may take some time for new ones to form. In addition to the humanitarian and resource crisis, this triggers the stagnation of major industries and impacts the US dollar and the euro. Robert Kiyosaki, a famous entrepreneur from the US, recently stated that the stock markets are inflating a bubble due to hyperinflation. The entrepreneur singled out a special role for the Fed in his vision of the future. Indeed, given the growing dependence of the economies of many countries on the US dollar and the euro, the influence of the Fed on global processes is likely to grow.

History shows that during geopolitical turmoil it is the Fed that becomes the main steering wheel of the world economy. During the Gulf War, the benchmark rate reached 6% and triggered an economic crisis in Mexico and Asian countries within a few years. From 2001 to 2008, the Fed was also conducting key rate operations causing the global financial crisis.

This year has already promised the beginning of the global financial crisis, which contributes to a new economic restructuring of the world. Central banks of developed countries are expected to raise their key rates soon. Sanctions against Russia are a deterrent measure affecting the economies of Europe and the US. According to Goldman Sachs, the Fed is going to raise the rate six times in 2022. The first meeting will be held on March 16, and there is every reason to believe that Powell's office may take the sanctions pressure into account and raise the key rate by more than 0.25%. The February inflation rate of 7.9% may become an additional argument for the institution. The main negative factor in raising the key rate is a tightening of liquidity conditions. This directly affects investment flows in the stock and cryptocurrency markets.

Despite the Fed was holding the key rate at the end of the February meeting unchanged, Bitcoin's bullish momentum has stalled. Global markets are assessing a tightening of monetary policy. Investors evaluated the prospects of fiat money while understanding the impending rate hikes by central banks around the world. At this time, BTC began to decline, and major players once again turned to gold, which has outperformed the flagship cryptocurrency in terms of its ability to preserve value in a fiat crisis.

However, in the pessimistic outlook for key rate hikes, liquidity-deficient assets will be a lifesaver. With this in mind, there is no doubt that Bitcoin, Etherium, and other cryptocurrencies, deflationary assets may receive liquidity and become in demand. Notably, all processes are slowing down considerably, which can be seen even now. Bitcoin has been trading in a prolonged consolidation ever since there were rumors about the key rate hikes.

Since November 2021, Bitcoin has been accumulating volumes within two trading ranges: $32,000-$45,000 and $45,000-$60,000. Such prolonged sideways trading was due to tighter liquidity and a more cautious policy towards risky assets. Russia's military operation exacerbated the situation, forcing BTC to compete with gold, which gained liquidity due to historically proven advantages.

If the military and the inflationary situation deteriorate soon, the problems of digital asset volatility may fade. Investors are likely to buy deficit financial assets. With the situation far from being resolved, financial markets await tough times. The material has been provided by InstaForex Company - www.instaforex.com |

| Major Asian stock indices slide Posted: 11 Mar 2022 04:44 AM PST

The main Asian indices fell similarly to the main US indices. The Shanghai Composite and Shenzhen Composite were down by 2.16% and 2.36%, while Hong Kong's Hang Seng Index dropped by 3.4%. Tokyo's Nikkei 225 Index lost 2.37%, South Korea's KOSPI declined by 1.05% and Australia's S&P/ASX 200 slipped by 0.8%. Asia-Pacific indicators are always heavily influenced by the US stock market. Today the situation was the same. US indicators showed a decline amid disappointing inflation statistics. Consumer prices rose by 7.9% last month compared to January's rise of 7.5%. This is a record high for the last 40 years. Another reason for investors' pessimism is the increase in US scrutiny of Chinese companies' securities that are traded on US exchanges. The Securities and Exchange Commission has named a number of companies whose shares will be excluded from trading on US exchanges if they do not bring their accounts into line with US law. The decline in the Japanese indicator was driven by a drop in the value of the securities of the largest companies. Thus, securities of M3 Inc. fell by 6.1%, SoftBank Group lost 6% and Keyence Corp. dropped by 5.3%. Toyota Motor shares slumped by 4.1%, while Sony Corp. and Fast Retailing plunged by 2.8% and 2.3%, respectively. On the Hong Kong exchange, JD.com Inc. posted the biggest declines, losing 13%, China Resources Beer Co., Ltd. shed 9.1% and Sunny Optical Technology Group Co., Ltd. dropped by 8%. Shares of Alibaba Group Holding, Ltd. plunged by 6.6% and Tencent Holdings, Ltd. was down by 4.9%. The South Korean indicator was dragged down by a 1% decline in Samsung Electronics Co. and a 0.3% decline in Hyundai Motor. To combat rising inflation and soaring energy costs around the world, Australia's central bank should prepare to raise interest rates this year, according to a report. BHP shares fell 0.1%, while Rio Tinto gained 1%. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD Analysis on 11 March, 2022 Posted: 11 Mar 2022 04:41 AM PST

GBP/USD touched its weakest level since November 2020 near 1.3050 early Friday but managed to pare its daily losses. In the absence of significant fundamental drivers, the pair stays calm near 1.3100 ahead of US consumer confidence data. On the four-hour chart, the Relative Strength Index is about to cross below 30, suggesting that GBP/USD will turn technically oversold in the short term. Even if the pair makes a technical correction, the technical outlook will remain bearish unless it clears 1.3100 (psychological level).Moreover ,4 hourly MACD has diverged in favor of the bulls. MACD histograms has produced higher lows , contradicting lower lows on the price chart. On the downside, 1.3000 (psychological level) aligns as the next bearish target but the pair needs to close a four-hour candle below 1.3050 (static level) before stretching lower. Above 1.3100, 1.3130 (20-period SMA, static level) could be seen as the next resistance before 1.3200 (psychological level). The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD Hot Forecast on 11 March, 2022 Posted: 11 Mar 2022 04:39 AM PST

EUR/USD is consolidating the ECB-led declines on Friday and fluctuating in a relatively tight range below 1.1000. The US Dollar Index clings to modest daily gains as US T-bond yields stay flat on the day following this week's impressive rally. Investors await UoM Consumer Sentiment Index data from the US. EUR/USD was last seen testing 1.1000 (psychological level, Fibonacci 61.8% retracement of the latest downtrend, 50-period SMA on the four-hour chart). In case a four-hour candle closes below that level, additional losses toward 1.0940 (Fibonacci 23.6% retracement) and 1.0900 (psychological level) could be witnessed. On the upside, 1.1040 (Fibonacci 50% retracement) aligns as the first resistance before 1.1100 (Fibonacci 61.8% retracement of the latest downtrend, psychological level) and 1.1120 (post-ECB high). The material has been provided by InstaForex Company - www.instaforex.com |

| US premarket on March 11: the US stock market rose sharply on rumors of a cease-fire Posted: 11 Mar 2022 04:36 AM PST US stock index futures rose on Friday after reports that Russia and Ukraine may agree on a cease-fire. During a personal meeting in Moscow with the President of the Republic of Belarus Lukashenko, Vladimir Putin said that there are certainly positive developments in the negotiations with Ukraine. Many traders and investors concluded that it was a cease-fire on both sides, which is what the Ukrainian side is asking for. This caused a sharp demand for risky assets - especially shares in the technology sector. Dow Jones Industrial Average futures rose 401 points or 1.2%, S&P 500 - 1.4%, and Nasdaq 100 - about 1.7%.

The growth in energy prices, which was observed yesterday, slowed down again, which adds to the positive markets by the end of the week. West Texas Intermediate rose 1.4% to $ 107.46, while international standard Brent crude jumped 1.6% to $ 111.04. Prices of metals other than copper have fallen sharply. Palladium futures dropped 4% to $ 2,803.50 an ounce. Bond yields remained practical after yesterday's sharp jump above 2.0%, which occurred amid expectations of an increase in interest rates from the Federal Reserve System. Let me remind you that yesterday I embroidered data from the Bureau of Labor Statistics, which reported that the consumer price index rose by 7.9% in February - even more than expected. This is the highest level since January 1982. CPI increased by 0.8% compared to the previous month, which also exceeded estimates. Today, the focus will be on preliminary data from the consumer confidence survey from the University of Michigan. The sentiment is expected to rise to 62 points in March from 61.7 points in February.

At the end of yesterday, the Dow fell by 112.18 points to 33,174.07 after rising by more than 650 points in the previous session, while the S&P 500 lost 0.4%. The Nasdaq Composite index dropped 1% to 13,129.96 points due to a major decline in Apple and Meta Platforms. Despite rumors and talk, tensions in the situation in Ukraine continue to escalate. Against this background, US President Joe Biden is expected to advocate the termination of Russia's status as a preferred trading partner. More recently, Biden, in his interview, accused Russia of the fact that gasoline prices in the United States jumped above $ 5 per gallon, completely forgetting to mention 8.0% inflation and sanctions against Russia, which led to such a sharp jump in energy prices. The US Congress also passed a budget bill that includes $ 14 billion in aid to Ukraine. As for the premarket, Rivian shares fell by more than 11% due to a weak report for the fourth quarter. DocuSign fell by 18% after publishing a weak forecast for the first quarter of 2022. As for the technical picture of the S&P 500 Today, the bulls will again try to gain a foothold above $ 4,292, which they failed to do yesterday. If this cannot be done today, the pressure on the trading instrument will increase, which will lead to a decrease in the area of $ 4,233. The breakdown of this range depends on US inflation data, which will increase pressure on the index and return the bear market with the prospect of updating the lows already: $ 4,175 and $ 4,113. Fixing above $ 4,292 will leave hope for a market recovery. With growth, we can expect new active sales already in the region of $ 4,341 and $ 4,383. A lot will depend on the further development of the situation on the territory of Ukraine and the possible dialogue between the presidents of the two countries. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2022 04:13 AM PST To open long positions on GBP/USD, you need: In my morning forecast, I paid attention to the levels of 1.3111 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Against the background of unsuccessful attempts by bears to fail the annual minimum after the release of fairly good fundamental statistics on the growth rate of the UK economy, bulls tried to take control of the market, which kept trading within a narrow side channel. Considering that we did not reach the levels indicated, I did not wait for signals to enter the market. For the second half of the day, the technical picture has been completely revised. And what were the entry points for the euro this morning?

During the American session, everything will depend on today's inflation data from the University of Michigan, as well as on the mood of US consumers - that's exactly what they promise to spoil the bears all day. As I have repeatedly noted, the fall of the British pound will be limited, at least for the reason that we have clear aggressive actions of the Bank of England about interest rates ahead, since inflation in the UK is almost the most important headache of citizens and politicians governing the country. An increase in rates will lead to a return of demand for the pound. All this balances the Federal Reserve's interest rate hike next week and the geopolitical conflict that has not gone away. An important task of the bulls during the American session remains the protection of the 1.3056 support formed by the results of today. Long positions from this level can be considered only in the case of a decline in the pound and after the formation of a false breakdown since the entry will be carried out against a bear market. The pair's decline to this support may occur if the US data surprises traders. The growth of GBP/USD will be aimed at the resistance of 1.3126. Only a breakthrough and a reverse test of this area from top to bottom will lead to the demolition of several sellers' stop orders, allowing them to continue to increase long positions more actively. The target, in this case, will be the 1.3190 area, which is also the upper boundary of the wide side channel in which the pair has spent all this week. A more difficult task will be to reach the resistance of 1.3244 - this will deal a strong blow to the bearish trend observed since the end of February. I recommend fixing profits there. In the scenario of a decline in GBP/USD in the afternoon and the absence of bulls at 1.3056, it is best to postpone purchases until the next support of 1.2976. But even there, I advise you to open long positions only when a false breakdown is formed. You can buy GBP/USD immediately for a rebound from 1.2914, or even lower - from a minimum of 1.2856, counting on a correction of 20-25 points within a day. To open short positions on GBP/USD, you need: The bears did not achieve their goal, as strong statistics on the UK prevented this. Now, with short positions, I advise you to act very carefully so as not to fall into the trap at the most annual lows. Only after the formation of a false breakdown at 1.3126, it is possible to sell GBP/USD further along with the trend. The main goal, in this case, will be the support of 1.3056. The lack of activity on the part of buyers there, as well as the breakdown and reverse test of this level from the bottom up - all this will give an additional entry point into short positions to fall to the lows: 1.2976 and 1.2914. A more distant target will be the 1.2856 area, where I recommend fixing the profits. However, these levels will be available only next week. If the pair grows during the US session after weak US data, it is best to postpone sales. The demolition of 1.3126 may lead to a sharp increase in the pound against the background of new stop orders from sellers. In this case, I advise you to open short positions of GBP/USD after a false breakdown in the area of 1.3190, but you can sell the pound immediately for a rebound from 1.3244, counting on a correction within the day by 20-25 points.

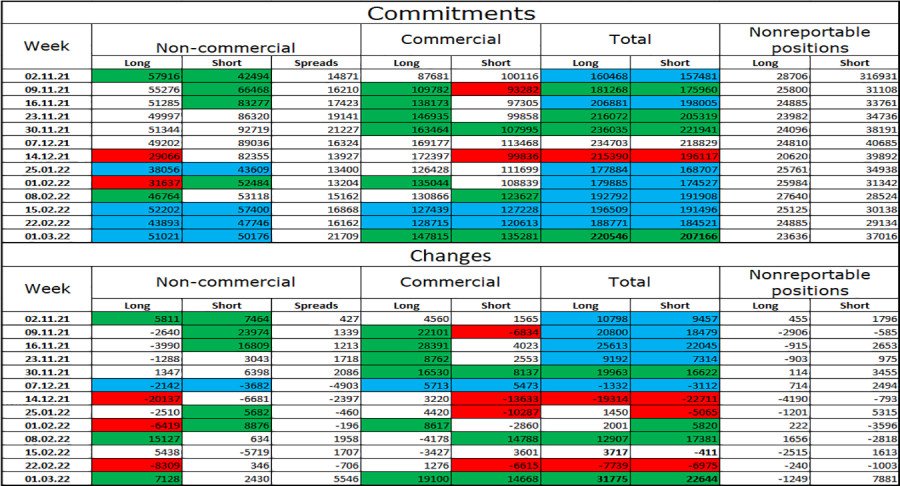

The COT reports (Commitment of Traders) for March 1 recorded a sharp increase in long positions and a reduction in short ones. This led to a reduction of the negative delta value to almost zero. However, you need to understand that now such reports are secondary, and the market is changing almost daily, flying by 100-200 points against the background of the ongoing geopolitical conflict that has affected almost the whole world. Most likely, the report next week will show a sharp demand for short positions, so it's best not to look too closely at the current figures yet. It makes no sense to talk about what the policy of the Bank of England or the Federal Reserve System will be since, in the event of an aggravation of the military conflict, it will not matter at all. Now Russia and Ukraine have sat down at the negotiating table, and much will depend on the results of these meetings - there will be a lot of them. The only thing that is clear for sure is high inflation in the UK, which will force the Bank of England to act more actively. Given the slowdown in economic growth and retaliatory sanctions from Russia, it is unlikely that the regulator will go for a sharper increase in interest rates - and this must be done, otherwise, inflation will devour not only the available incomes of the population but also sharply reduce them. The COT report for March 1 indicated that long non-commercial positions increased from the level of 42,249 to the level of 47,679, while short non-commercial positions decreased from the level of 48,058 to the level of 48,016. This led to the preservation of the negative value of the non-commercial net position at the level of -337 versus -5,809. The weekly closing price dropped to 1.3422 against 1.3592. Signals of indicators: Moving averages Trading is conducted around 30 and 50 daily moving averages, which indicates an active confrontation between buyers and sellers. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break of the lower limit of the indicator in the area of 1.3060 will increase the pressure on the pound. A break of the upper limit of the indicator in the area of 1.3115 will lead to the growth of the pair. Description of indicators

|

| Posted: 11 Mar 2022 04:04 AM PST To open long positions on EURUSD, you need: In my morning forecast, I paid attention to the level of 1.1017 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The German data released in the first half of the day fully coincided with economists' forecasts, which did not provide any support for the European currency. There were no willing to sell euros, so I had to watch the trade in the side channel. It was not possible to achieve an update of the morning levels. For this reason, I have not seen any deals on the pair. For the second half of the day, the technical picture has not changed in any way. And what were the entry points for the pound this morning?

Now the situation is as follows: on the one hand, the ECB and the more aggressive policy that Lagarde talked about so much yesterday, on the other hand, the Federal Reserve System with its interest rate hike next week. Now, who will lead a tougher policy and will win in the current situation - the pair will go there. However, it is very difficult to say how the economies will behave in this case. A stronger United States will certainly force investors to maintain their positions on the dollar, counting on an aggressive increase in interest rates in the future. As for today's statistics, the second half of the day will not please much. An important task of the bulls for the American session will be to protect the new support of 1.0963, which was revised from the morning level of 1.0947. However, to return the market under its control, it would be nice to still get above 1.1017, where the moving averages are already playing on the side of the bears. At the time of writing the forecast, there was a test of this level, but the bears defended it very quickly. In the case of strong data on the consumer sentiment index from the University of Michigan and inflation expectations, as well as another sale of the European currency, only a false breakout at 1.0963 forms the first entry point into long positions in the expectation of the pair returning to the area of 1.1017. To see a larger upward movement in EUR/USD, active actions and a breakout of this range are needed. A decrease in the sentiment of American consumers, and they will be in any case, look at inflation, will lead to a top-down test of 1.1017, which will give a signal to buy the euro and open up the possibility of recovery to area 1.1066 and 1.1115. The breakdown of this range will also cancel out the bearish trend and hit the sellers' stop orders, even more, opening a direct road to the highs: 1.1176 and 1.1229, where I recommend fixing the profits. But do not forget the geopolitical situation: with the further aggravation of the conflict, the demand for the US dollar can quickly return. Given that the recent meeting of representatives of the two countries did not yield any results, it is most likely not necessary to expect serious demand for risky assets. The optimal scenario for buying would be a false breakdown of the minimum in the area of 1.0894, but it is possible to open long positions on the euro immediately for a rebound only below 1.0810 with the aim of an upward correction of 30-35 points within a day. To open short positions on EURUSD, you need: The bears tried to gain a foothold at the daily lows but did not even reach the nearest support of 1.0947. Against this background, there was a return in demand for the European currency - especially after what Christine Lagarde said yesterday at a press conference. Sellers need to think about how to protect 1.1017 now, the first test of which has already occurred. Having released a pair above this range, demand for the euro will return. The formation of a false breakdown after strong US data will lead to a sell signal and the opening of new short positions to reduce the euro to the first important support of 1.0963. A breakdown of this area and a reverse test from the bottom up can take place very quickly, which will give an additional signal to open short positions already with the prospect of falling to the lows: 1.0894 and 1.0810. The downward movement will be fast, as a large number of buyers' stop orders are concentrated at these levels. The farthest target will be the 1.0772 area, where I recommend fixing the profits. In the case of the growth of the euro and the absence of bears at 1.1017, it is best not to rush with sales. It is possible that, like yesterday, the bulls will start acting more aggressively. A breakthrough of this level will also pull the sellers' stop orders. Therefore, the optimal scenario will be short positions when forming a false breakdown in the area of 1.1066. You can sell EUR/USD immediately on a rebound from 1.1115, or even higher - around 1.1176 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for March 1 recorded an increase in both long and short positions. The first ones turned out to be more, which led to an increase in the positive delta. In the context of the ongoing tough geopolitical conflict that has affected almost the whole world, it makes no sense to talk about what position investors held a week ago since everything is changing at lightning speed. The data that was yesterday no longer have any significance today, since no one knows how the sanctions imposed by the United States and EU countries will affect the Russian economy, as well as what the conflict between Russia and Ukraine will eventually lead to. The main question is how long it will all last. Against this background, it does not matter much what the policy of the European Central Bank or the Federal Reserve System will be since, in the event of an aggravation of the military conflict, the markets will fly down again. Now Russia and Ukraine have sat down at the negotiating table, and much will depend on the results of these meetings - there will be a lot of them. This week, the European Central Bank will also hold a meeting and important February data on US inflation will be released, which will lead to a surge in volatility, but it is unlikely to correct the situation in favor of buyers of risky assets. I recommend continuing to buy a dollar. I advise you to be quite careful about risky assets and buy euros only as the tense relations between Russia, Ukraine, the EU, and the USA weaken. Any new sanctions actions against the Russian Federation will have serious economic consequences, which will affect the financial markets, as well as affect not only the Russian ruble but also the European currency. The COT report indicates that long non-commercial positions increased from the level of 214,195 to the level of 228,385, while short non-commercial positions increased from the level of 154,163 to the level of 163,446. At the end of the week, the total non-commercial net position increased to 64,939 against 59,306. The weekly closing price dropped from 1.1309 to 1.1214. Signals of indicators: Moving averages Trading is conducted around 30 and 50 daily moving averages, which indicates an active confrontation between buyers and sellers. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A breakthrough of the lower limit of the indicator in the area of 1.0960 will increase pressure on the euro. A breakthrough of the upper limit of the indicator in the area of 1.1020 will lead to a new wave of growth of the pair. Description of indicators

|

| Gas prices continue to rise in EU Posted: 11 Mar 2022 03:46 AM PST Natural gas futures rose during Friday's European trading session. According to the New York Mercantile Exchange, April natural gas futures are trading at $4.68 per million BTU. Notably, earlier this week, March 7, the April futures at the TTF hub in the Netherlands soared to nearly $3,900 per 1,000 cubic meters. In the UK, the price of the British thermal unit rose to 800 pence. The US Dollar Index measures the value of the US currency against a basket of six major world currencies. At the time of writing the article, it was down 0.05% to $98.35. The EU planned to ban Russian energy imports due to the Russia-Ukraine conflict. However, it was reported today that the EU government was not willing to impose sanctions on Russian oil and gas imports. Hungarian Prime Minister Viktor Orban announced this news, speaking at the informal EU summit in Versailles today. Earlier this week, Dutch Prime Minister Mark Rutte made a similar statement. He believes that the Dutch government soberly assesses the market situation and assumes that these sanctions are harmful to the EU countries. Therefore it does not support the idea of imposing a ban on Russian oil and gas imports. Member of the European Parliament Thierry Marian said that if the EU implements a ban on Russian gas import, it will definitely face a crisis. The Hill assumed that the US ban on Russian oil imports would lead to huge financial losses. US oil and gas prices will surge at least until the country will turn to alternative energy suppliers. Historically, Russia has been the largest supplier of natural gas, mainly to EU countries. Germany, Italy, Hungary and Austria are heavily dependent on Russian gas. However, the EU has been trying to reduce its dependence, it is unlikely in the short term. Currently, Russia accounts for nearly 40% of EU gas imports. For example, Norway, the second-largest exporter of natural gas in the EU, supplies only 19% of the EU gas demand. According to the EU new trend of renewable energy, coal and nuclear power plants have been phased out. Therefore, the significance of gas and the increase in its supply volumes for the EU is only growing every year. It is impossible for the EU to cut Russian gas imports immediately. Therefore, on March 9 the European Commission announced a plan to gradually reduce coal, oil and gas supplies from Russia. Its target is to end Russian natural gas imports. According to a document called REPower EU, Europe is going to diversify gas supplies by increasing imports of liquefied natural gas and pipelines from non-Russian suppliers. The EU intends to implement this plan by 2030. As for alternative energy sources, the EU can increase supplies of liquefied natural gas from the US. For example, US LNG imports have been rising steadily since the first shipment in 2016. Moreover, it has already exceeded 64 billion cubic meters by January 2022. Last year, the US delivered more than 22 billion cubic meters of gas to the EU. In December 2021, the United States became the world's largest exporter of liquefied natural gas for the first time ever, surpassing Qatar. It is evident that as EU countries reduce their heavy dependence on Russian gas imports, Washington is willing to further increase US LNG supplies to the global market. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2022 03:45 AM PST

According to the hourly chart, the GBP/USD pair on Thursday performed a rebound from the corrective level of 161.8% (1.3181), a reversal in favor of the US currency and a fall to the Fibo level of 200.0% (1.3071), from which it began its last growth segment. The consolidation of quotes below the level of 1.3071 will significantly increase the probability of a new fall of the British dollar in the direction of the level of 1.2980. Or much lower. Geopolitical news continues to significantly worsen the mood of bulls, but it increases for the bears. And there is no good news from Ukraine right now. There are serious fears that the entire conflict will drag on for many months or even years. There is no progress in the negotiations between Kyiv and Moscow. At the same time, US inflation continues to break all records, and traders probably believe that this means a higher increase in the Fed's interest rate by the end of 2022. How to resist inflation with rising oil and gas prices in America I do not know. Just as they do not know in the European Union. And oil and gas prices now depend on the development of the situation in Ukraine and on sanctions for the Russian oil and gas industry. It is no secret that America has already refused to buy oil and gas in Russia, although the share of imports from this country to the United States was small. Nevertheless, both the European Union and the United Kingdom are considering such measures. But they are going to act smoothly. Washington is currently negotiating with Iran, Saudi Arabia, and Venezuela to increase production and sales to the international market. We are even talking about lifting sanctions against Venezuela and Iran, just to replace Russian oil with analogs. However, it will take a long time anyway. And during this time, oil can grow up to $ 200 per barrel. In the UK, a report on GDP and industrial production was released today. Both reports turned out to be better than traders' expectations, but, as we can see, the British started falling yesterday and continues it today, despite the statistics.

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a bearish divergence at the CCI indicator and performed a fall to the corrective level of 76.4% (1.3044). The rebound from this level, combined with the bullish divergence of the MACD indicator, may allow us to count on some growth of the pair in the direction of the Fibo level of 61.8% (1.3274). Fixing at 1.3044 will increase the probability of further falling towards the next Fibo level of 1.2674. Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 7,128, and the number of short contracts increased by 2,046. Thus, the general mood of the major players has become more "bullish", but at the same time, in the category of speculators, there is now equality in the number of long and short contracts. Thus, I conclude that the mood is now more neutral than "bearish" or "bullish". But even this does not matter much, since geopolitical factors can continue to have a very big impact on the British rate. Already it turns out that the mood is "neutral", and the pound is falling. News calendar for the USA and the UK: UK - change in GDP (07:00 UTC). UK - change in industrial production (07:00 UTC). US - consumer sentiment index from the University of Michigan (15:00 UTC). On Friday, all the planned reports had already been released in the UK, and they did not have any effect on the mood of traders. The same will happen with the US consumer sentiment index. Only the level of 1.3044 keeps the British from falling again. GBP/USD forecast and recommendations to traders: Yesterday I recommended selling the British dollar with targets of 1.3071 and 1.3044 if the rebound from the level of 1.3181 is completed. Both goals have been achieved. New sales of the British dollar at the close under the level of 1.3044 with targets of 1.2980 and 1.2895. I do not recommend buying a pound today, since all factors remain in favor of the dollar. The material has been provided by InstaForex Company - www.instaforex.com |

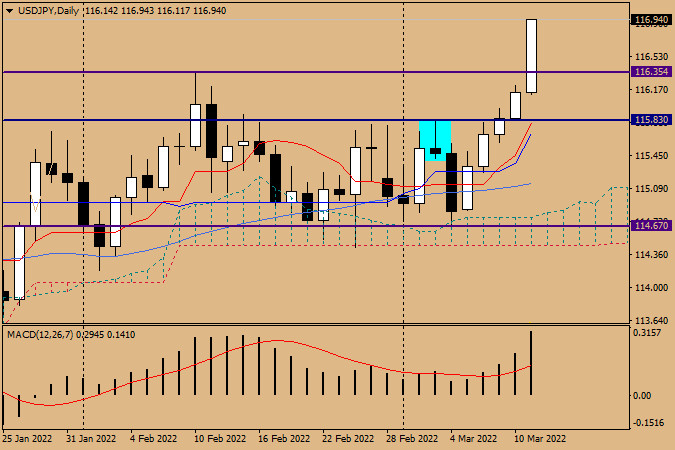

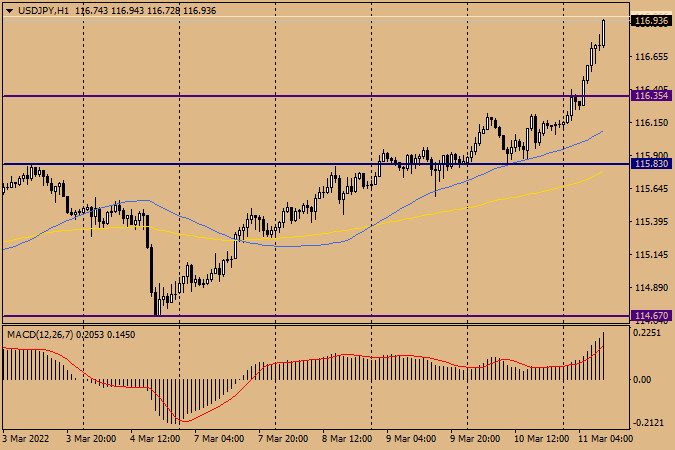

| USD/JPY analysis and forecast for March 11, 2022 Posted: 11 Mar 2022 03:45 AM PST As promised earlier, at the beginning of this week, we return to the consideration of a very peculiar and interesting dollar/yen currency pair. In the current situation, when the geopolitical situation in the world related to Russia's military special operation in Ukraine, to put it mildly, leaves much to be desired, investors decided to give their preference to the US dollar. Let me remind you that both currencies of this pair, depending on the situation and market sentiment, are considered protective assets. I fully admit that market participants decided not to break the technical picture and continue the upward trend for this currency pair. In such a situation, fundamental factors are often ignored or simply ignored by the market. Although yesterday's data on initial applications for unemployment benefits in the US came out worse than expected, and the consumer price index coincided with the forecast values, this did not prevent the US currency from continuing to strengthen against the Japanese yen. In today's economic calendar, you can pay attention only to the American data on the consumer sentiment index from Reuters/Michigan. However, I do not think that this report will have any particular impact on the price dynamics of USD/JPY. To a greater extent, the strengthening of the US dollar is influenced by the expectation of the Fed raising the main interest rate this month. But this is not news anymore, therefore, in my personal opinion, the technical picture is at the forefront of the price dynamics of the dollar/yen pair, which we are moving to right now. Daily

As can be seen on the daily price chart, the pair continues its upward trend for the fifth day in a row. In addition, at the time of writing, there is particularly strong growth. The pair confidently and powerfully breaks through the key resistance of sellers at 116.35, showing readiness and ability to move further north to new highs. The previously highlighted reversal model of candle analysis "Shooting Star" could not break the upward trend, but only provoked a corrective pullback to 114.67, where the pair found strong support and turned up again. If the quote is fixed above the resistance of 116.35, its breakdown can be considered true, and prepare for purchases on a rollback to the broken level, if it takes place, of course. Naturally, it will not be today, so for possible recommendations today, we will turn our attention to smaller time intervals. H1

It is the hourly chart, in the personal opinion of the author, that is the most suitable timeframe for opening positions and determining the price at which it is worth entering the market. However, in this case, despite the increased bullish trend, it is risky to buy at the very peak of the market, especially on the last day of weekly trading, when a corrective pullback may take place against the background of profit-taking. In this regard, I suggest not to rush and wait for Monday, when, taking into account the closing of weekly trading, perhaps the situation for opening positions will become more interesting and understandable. In the meantime, on the hourly chart, I recommend waiting for a corrective pullback towards the broken resistance level of 116.35, and already near this mark, consider opening long positions on USD/JPY. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Director of research at the WPIC Trevor Raymond said that while platinum's surplus was expected to remain elevated, there was still a lot of uncertainty in the market, especially with the ongoing tense geopolitical situation in Ukraine. He noted that Russia accounted for about 10% of the world's platinum supply.

Director of research at the WPIC Trevor Raymond said that while platinum's surplus was expected to remain elevated, there was still a lot of uncertainty in the market, especially with the ongoing tense geopolitical situation in Ukraine. He noted that Russia accounted for about 10% of the world's platinum supply. Despite the market's large surplus, there is a deficit in the market as precious metal prices remain high.

Despite the market's large surplus, there is a deficit in the market as precious metal prices remain high.

Comments