Forex analysis review

Forex analysis review |

- Weekly USDCHF analysis.

- EURUSD tuns negative on a weekly basis.

- Short-term Gold technical analysis for March 25, 2022.

- Weekly XRPUSD analysis for week ending March 25th.

| Posted: 25 Mar 2022 12:28 PM PDT USDCHF is trading around 0.93 having a second negative week. Last week price got rejected at the horizontal resistance and previous high of 0.9460-0.9470 and closed near its lowest levels. Last week's candlestick pattern was bearish. This week price made new lower lows relative to last week but bulls have managed to reclaim so ground.

Red line - upward sloping trend line support USDCHF is trading inside and upward sloping triangle pattern. Price continues to respect the red trend line coming from the end of 2020. This upward sloping trend line has been confirmed many times so far, it is safe to say that as long as price holds above it, there is no danger for bulls. On the other hand, bulls will need to break above 0.9470 in order to hope for a move higher in the longer-term. Bears will need to defend the horizontal resistance at 0.9460-0.9470 and eventually break below 0.9150 in order to produce a bearish sign. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD tuns negative on a weekly basis. Posted: 25 Mar 2022 12:19 PM PDT EURUSD traded as high as 1.1070 this week but price was unable to break above the short-term resistance trend line. Price remains under pressure. EURUSD also remains inside the downward sloping channel from 1.23.

Black line- short-term resistance trend line Bulls need to break above the short-term downward sloping black trend line. If this happens, then there are increased chances of price bouncing higher towards the upper channel boundary. Support remains key at 1.09. Horizontal resistance by the two recent highs is at 1.11. Bulls need to break first 1.1040 and next 1.1110. This will provide bullish reversal confirmation for a move towards 1.1250. The material has been provided by InstaForex Company - www.instaforex.com |

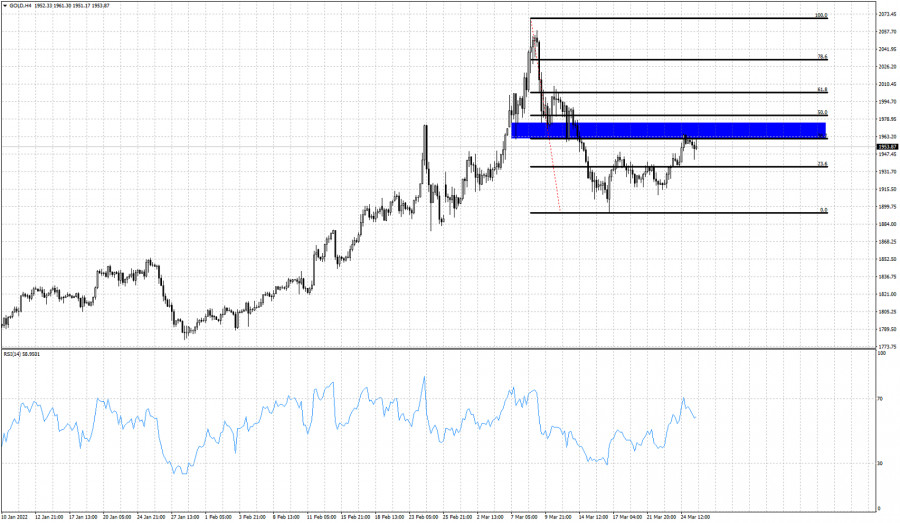

| Short-term Gold technical analysis for March 25, 2022. Posted: 25 Mar 2022 12:15 PM PDT Gold price is found trading at the end of the week near its weekly highs. Price made a low this week at $1,910 and a high at $1,965 while now it is trading around $1,952. Gold price has already retraced 38% of the entire decline. Price stopped the bounce at the 38% Fibonacci retracement.

Black lines -Fibonacci retracements Gold price is making higher highs after this week's low at $1,910. Price can continue higher if we see a break above the 38% Fibonacci retracement. $1,910 is key short-term support. Breaking below it will be a bearish sign and could lead to a decline in Gold price towards $1,894 and lower. If Gold price continues making higher highs and higher lows, our next upside target for Gold is at $2,000. The material has been provided by InstaForex Company - www.instaforex.com |

| Weekly XRPUSD analysis for week ending March 25th. Posted: 25 Mar 2022 12:10 PM PDT XRPUSD continues to grind higher but still inside the long-term triangle pattern. Price mostly moves sideways over the last few weeks and bouncing up and down withing the triangle boundaries. Since the test of the support at $0.50 was successful, our expectation was to see price move higher towards the upper triangle boundary and the $1 price level. This week XRPUSD reached as high as $0.862.

Green line -support With the battle against the SEC still continuing, we do not expect to see any clear trade signal or key trend signal unless something concrete comes out against or in favor of Ripple. Technically trend can continue to follow up and down swings within the tightening range of the triangle pattern. Resistance is found at $0.97-$1. Support remains key at $0.50. Each bounce from the $0.50 level lead to a lower high. This is not a positive sign. Nevertheless bulls continue to hope for a bullish turnaround as long as price holds above $0.50. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments