Forex analysis review

Forex analysis review |

- November 25, 2021 : EUR/USD daily technical review and trading opportunities.

- November 25, 2021 : EUR/USD Intraday technical analysis and trading plan.

- November 25, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

- European stocks are on the rise. The technology sector and French alcohol boast high profits

- The coin-meme collapsed, giving way to a bright competitor in the rating

- Trading signal for BITCOIN on November 25 - 26, 2021: sell below $61,294 (21 SMA)

- Video market update for November 25,,2021

- Bitcoin whales buy back the fall

- Trading signal for EUR/USD on November 25 - 26, 2021: buy above 1.1230 (4/8)

- Trading signal for CRUDE OIL (WTI - #CL) on November 25 - 26, 2021: buy above 78.12 (bullish pennant)

- US stock indexes close mixed on Wednesday

- Bearish view on Goldman Sachs stock.

- EURUSD: The time of the reversal is close.

- EUR/USD analysis for November 25, 2021 - Breakout of the falling wedge in the background

- Gold short-term chances of a reversal increase.

- Ethereum bulls target $4,520 and $4,700 in the short-term.

- Analysis of Gold for November 25,.2021 - Upside trendline held successfully

- Short-term analysis on XRPUSD.

- BTC analysis for November 25,.2021 - Double bottom in the play

- Technical Analysis of GBP/USD for November 25, 2021

- EUR/USD: dollar has room for growth while euro faces roadblocks

- EURUSD | when will the fall end?

- Technical analysis of GBP/USD on November 25. COT report. Fed can accelerate stimulus cuts

- More hedge funds start to acknowledge bitcoin

- EUR/USD: COT report on November 25, 2021. US GDP gets better in Q3 but still below expectations

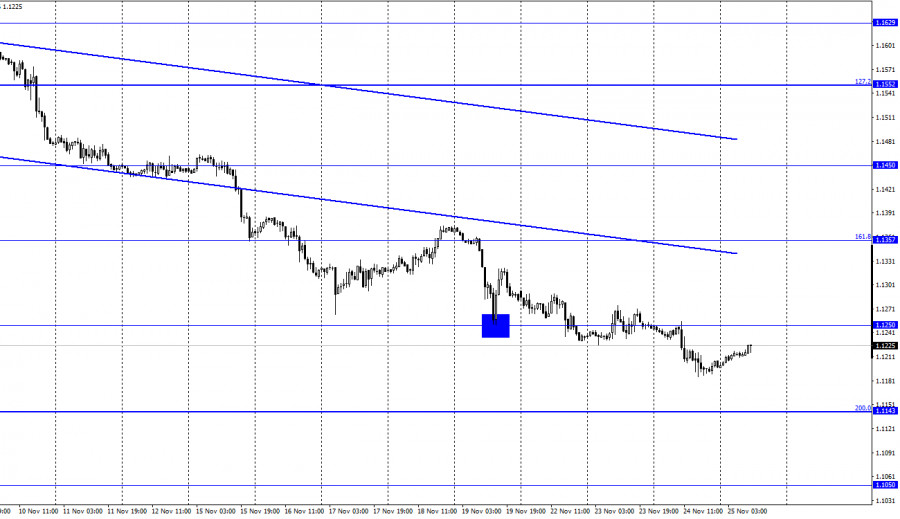

| November 25, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 25 Nov 2021 08:02 AM PST

Recently, Persistence below the depicted price zone of 1.1990 indicated further downside movement towards 1.1840 and 1.1780 where a sideway consolidation range was established. During last week, the EURUSD pair has been trapped within a narrow consolidation range between the price levels of 1.1780 and 1.1840. A bullish breakout was executed above 1.1840 shortly after. Temporary Upside pullback was expected towards 1.1990. However, re-closure below the price level of 1.1840 has initiated another downside movement towards 1.1780 which failed to hold prices for a short period of time before significant upside movement was presented into market. Intraday traders were advised to wait for candlestick closure above 1.1780 - 1.1840 for another ascending swing to be initiated. However, immediate downside selling pressure brought the pair down below 1.1700. More downside movement took place towards the price level of 1.1600 where temporary bullish rejection has been maintained for some time. Shortly after, Market price slided below 1.1700 and 1.1600. This has enhanced further decline towards 1.1500. Currently, the price zone around 1.1500 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon any upcoming ascending movement. Moreover, it is not advised to add new SELL Entries as the pair already looks oversold The material has been provided by InstaForex Company - www.instaforex.com |

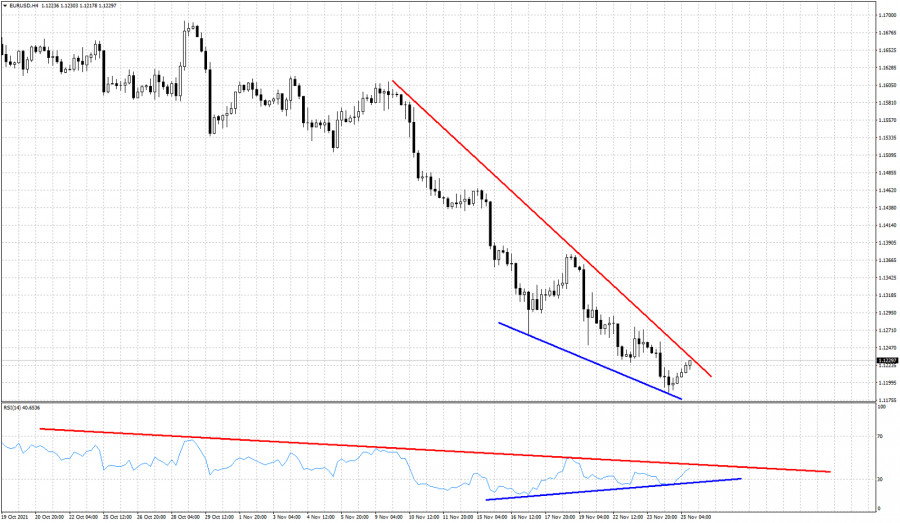

| November 25, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 25 Nov 2021 07:59 AM PST

The bullish swing that originated around 1.1650 in August, failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. Bullish signs were expected around the price levels of 1.1650-1.1700 for sometime as it corresponded to a recent previous bottom. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was reached. Shortly after, significant bullish recovery has originated upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which stood as an Intraday Support zone. Hence, sideway movement was demonstrated until bearish decline occurred towards 1.1325. Please note that any Bullish movement above 1.1500 should be considered as an early exit signal to offset any SELL trades. The price levels around 1.1520 remain a reference zone that needs to be re-visited when the current bearish momentum ceases to exist. The material has been provided by InstaForex Company - www.instaforex.com |

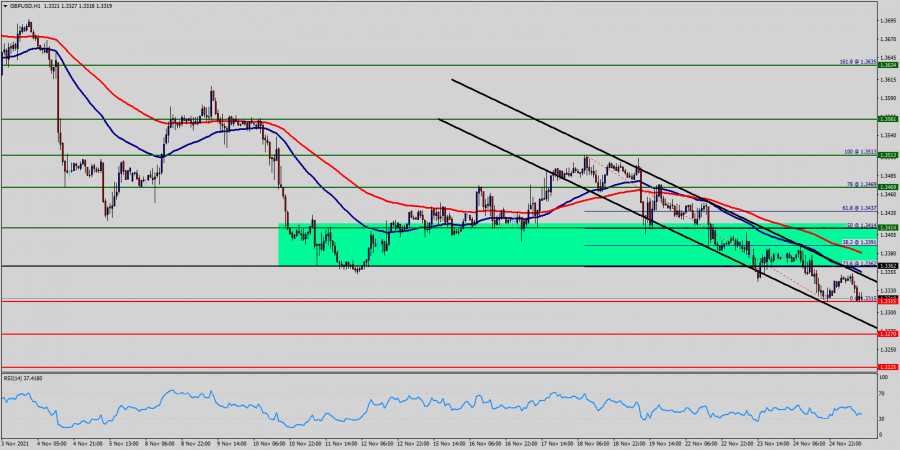

| November 25, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 25 Nov 2021 07:56 AM PST

The GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline. On the other hand, the nearest SUPPLY level was located around 1.4000 where bearish rejection and a valid SELL Entry was anticipated. Bearish breakout below 1.3680 enabled further bearish decline towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement. This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.3720 which was temporarily bypassed. Shortly after, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market. Currently, the short-term outlook is bearish as long as the pair maintains its movement below 1.3400. Another bearish visit is expected towards 1.3400 where significant bullish rejection was expressed as it corresponded to significant Fibonacci Expansion Level. The current bearish momentum will probably enable more downside extensio towards 1.3270. On the other hand, the price level of 1.3570 stands as an intraday resistance level to be watched either for bearish reversal or a continuation pattern upon any upcoming visit. The material has been provided by InstaForex Company - www.instaforex.com |

| European stocks are on the rise. The technology sector and French alcohol boast high profits Posted: 25 Nov 2021 07:51 AM PST

The value of European stocks is rising on Thursday thanks to the growing profits of companies in the technology sector, the record performance of the French manufacturer of alcoholic beverages Remy Cointreau and the steady demand for the products of the Swedish manufacturer of radiation therapy equipment Elekta. The pan-European STOXX 600 index rose 0.5% by the time this material was prepared, thereby rebounding from the three-week lows reached on Wednesday. The German DAX rose by 0.4%, the British FTSE 100 - by 0.1%. The securities of the French liqueur and champagne company Remy Cointreau jumped in price by 12.25% today, reaching €209.8. By the time the review was prepared, the company's share was valued at €207.6. Quarantine restrictions during the summer period were significantly relaxed, home consumption increased significantly, premium cognac produced by the company began to enjoy special demand during this period. For these reasons, the operating profit of Remy Cointreau in the first half of the year, which ended on September 30, unexpectedly jumped by 104.5%, reaching the level of €212.9 million (or $238.8 million). By the way, experts expected the publication of much lower profit figures - approximately at the level of €168 million. The management of Remy Cointreau pleasantly surprised its investors with the announcement of record earnings. From now on, the heads of Remy Cointreau look with confidence into the future of their company and expect that their products will be among the favorites among buyers in the premium spirits market. Technology stocks of the euroregion also determined the overall positive mood of the European securities market. Tech sector shares rose in value by 1.17%. This growth occurred for the first time after a rise in bond yields brought down the fast-growing sector at the beginning of this week. The securities of the Swedish manufacturer of equipment for radiation therapy and radiosurgery Elekta jumped in price by 6.58%, which was facilitated by a positive report on a drop in profits for the period from August to October. Experts expected a much stronger drop in profits. Probably, today there is a growing demand in the world for equipment for the clinical treatment of cancer and brain diseases, which is why Elekta products continue to be in constant demand. The shares of the Swiss company Swiss Life, which specializes in life insurance, also showed growth. The securities added 3.6% to the value, which was facilitated by the announcement of the start of a new buyback of shares for 1 billion Swiss francs (or $1.07 billion) and an increase in the dividend payout ratio. But the shares of the Norwegian company Adevinta, the world's largest operator of online ad portals in Europe, on the contrary, unexpectedly fell by 2.2%. The reason was the news that revenue in the third quarter was less high than analysts expected. According to the statements of the world media, Europe is currently at the epicenter of the pandemic, strict quarantine restrictions have been introduced in many European countries. For example, Italy and Austria have significantly restricted the freedom of people who do not want to take the COVID vaccine. France intends to announce tougher measures. As for Germany, earlier data showed weaker economic growth in the third quarter than analysts predicted. In addition to this, moderate consumer sentiment is noted, despite the onset of the Christmas and New Year shopping season The material has been provided by InstaForex Company - www.instaforex.com |

| The coin-meme collapsed, giving way to a bright competitor in the rating Posted: 25 Nov 2021 07:51 AM PST On Wednesday, the altcoin Shiba Inu (SHIB) collapsed to a minimum level ($0.000036) over the past month and continues to decline for the fourth week in a row. After reaching a historical record above $0.000086 at the end of October, the coin has already lost about 60% and today ranks only 13th in the ranking of leading digital assets by capitalization. By the way, during the past month, an altcoin has increased in price by more than 1000%.

However, today, against the background of a global drop in interest in SHIB, large holders of the asset (crypto-whales) have begun to actively sell the virtual coin to fix profits. In addition, the number of short-term speculative traders selling the meme coin after the previous rise in its price has significantly increased. An additional downward factor for Shiba Inu was the decline in the global crypto market after BTC reached record levels two weeks ago. The day before, thanks to the WhaleStats service, it became known that the number of Shiba Inu holders reached a record high of 995,000. At the same time, the number of wallets transferring SHIB to the addresses of cryptocurrency exchanges has also increased, but the trading volume of the meme coin, which was the most popular asset on exchanges just a month ago, has significantly decreased. Crypto market analysts are confident that SHIB has entered a bearish trend, which may end with the coin falling to the level of $0.000024. Despite such a bright negative trend of SHIB, the number of unique addresses on the balance of which the coin is located continues to increase. So, on November 11, when the fall of altcoin was actively gaining momentum, their number exceeded 1 million. At the same time, the main competitors of Shiba Inu began to confidently shift the altcoin lower and lower. The day before, Decentraland and Sandbox tokens reported a 30% rise in just a day, but they could not match the success of the cryptocurrency Crypto.com Coin, which reached a historical record after a 20% jump. So, over the past 7 days, the price of the token has increased by more than 90%, thanks to which the coin took 12th place (leaving behind Shiba Inu) in the ranking of the leading cryptocurrencies by capitalization. At the same time, the level of market capitalization of Crypto.com Coin exceeded $23 billion. The material has been provided by InstaForex Company - www.instaforex.com |

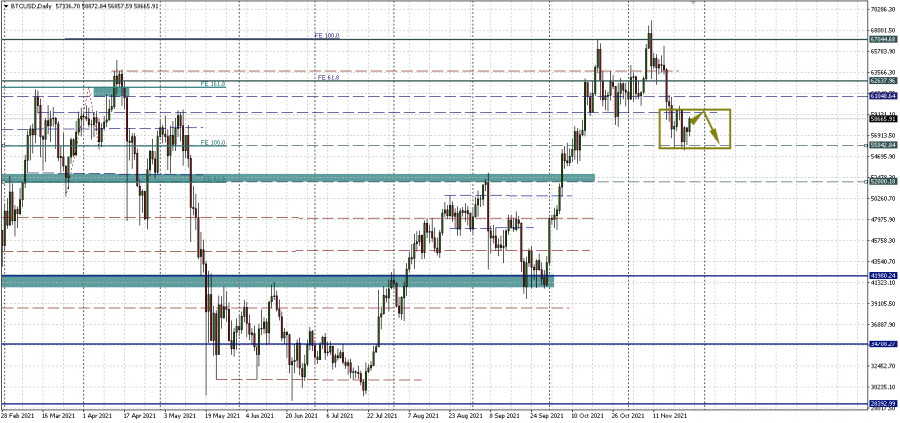

| Trading signal for BITCOIN on November 25 - 26, 2021: sell below $61,294 (21 SMA) Posted: 25 Nov 2021 07:42 AM PST

Bitcoin (BTC/USD) and most of major altcoins are struggling to find bullish momentum, a possible sign that prices could continue to weaken in the coming days. BTC price is trading below the strong resistance of 2/8 murray and below the 21-day moving average, around 61,294. As long as it remains below this zone, BTC is expected to continue oscillating between 56,250 - 62,500. The bulls are trying to stop the correction near 56,250, but the bears are not willing to give up. On the other hand, BTC has a strong barrier around the 21 SMA located at 61,294 - 62,500, indicating that bears are trying to convert this level as strong resistance. Since the beginning of October, Bitcoin has been forming a shoulder head shoulder pattern. According to the daily chart, the formation of the second right shoulder is finishing. A sharp break below 56,250 could result in a loss of 10k in price, towards the level of 45,500. The volume of operations of the cryptocurrency market has decreased as we can see it in the daily chart. The eagle indicator shows a decrease in volume and the strength of the market is likely that a relevant news can send the BTC towards the psychological level of $ 50,000. Our trading plan is to wait for a technical bounce or a pullback towards the resistance at 62,500 or 61,294. At this level, it will be a good opportunity to sell with targets at 56,200 and up to the 200 EMA located at 50,000. Support and Resistance Levels for November 25 - 26, 2021 Resistance (3) 62,500 Resistance (2) 59,885 Resistance (1) 58,777 ---------------------------- Support (1) 56,900 Support (2) 55,022 Support (3) 54,253 *********************************************************** A trading tip for BTC November 25 - 26, 2021 Sell below 61,294 (21 SMA ) with take profit at 56,250 (1/8) and 50,000 (200 EMA), stop loss above 62,500. The material has been provided by InstaForex Company - www.instaforex.com |

| Video market update for November 25,,2021 Posted: 25 Nov 2021 07:26 AM PST Watch for the upside continuation on BTC The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin whales buy back the fall Posted: 25 Nov 2021 06:51 AM PST Bitcoin is slowly and confidently going according to plan - consolidating. The side range 55842.84 - 59283.67 does not lose relevance, volatility remains low. The situation does not look critical, but locally it is somewhat ambiguous. Bitcoin whales buy back the fall The analytical company Santiment reported that cryptocurrencies are using price reduction to replenish stocks. Active Bitcoin whale addresses, which contain from 100 to 10,000 BTC, accumulated about 40,000 bitcoins during the fall of last week. With prices in the region of $ 57,000 per bitcoin, their savings amount is approximately $ 2.26 billion. Coins are leaving cryptocurrency exchanges At the same time, according to Santiment, the supply of bitcoin on the exchange continues to be depleted, although prices are declining. This means that the risk of a mass sale is reduced. There is another interesting fact: the same analysts note that sentiment on the main cryptocurrency has reached the lowest bearish level in seven weeks. The assessment is based on the data of the weighted sentiment tracker Santiment, which analyzes positive and negative comments related to the crypto asset. The analytical company states that prices tend to peak when social sentiment becomes too high and reach a minimum when the indicator becomes too low. Another indicator is the Binance financing rates Analyzing this data, Santiment reports: "When from mid-October to mid-November bitcoin was well above $60,000, Binance's funding rates for most assets were in positive territory. This indicated the trader's excessive confidence and excessive price correction. Now everything looks much more neutral." The "worst" scenario from PlanB A well-known cryptanalyst said that, most likely, his monthly goals for bitcoin will not be justified and bitcoin will close according to the "worst-case scenario". His goal for the end of November was at $98,000. Its achievement in the remaining five days before the end of the month from the current 58,000 is unlikely. The expert himself states that his model for analyzing the ratio of stocks to flow (S2F) has not lost relevance because of this.

|

| Trading signal for EUR/USD on November 25 - 26, 2021: buy above 1.1230 (4/8) Posted: 25 Nov 2021 06:18 AM PST In the European session, the EUR / USD pair fell to the low of 1.1185. From this level, it is rebounding and is now approaching 4/8 of murray located at 1.1230. The overall trend continues to be bearish. Trading volumes are low, with US markets closed due to Thanksgiving holiday. The market is expected to make a strong technical correction next week as it is the end of the month. The minutes of the FOMC meeting in November were published yesterday. Traders found out that the majority of the Committee advocates for increasing the pace at which the Fed will cut its bond purchases. Besides, the FOMC expects an increase in the official funds rate from the second half of 2022.

The US Dollar Index (#USDX) is trading around the 8/8 of murray in 96.70. This is an extremely overbought level. We expect that in the next few days, there will be a correction of the dollar which would enable EUR / USD to gain ground. On the 1-hour chart, the pair is trading below a downtrend channel formed since November 9. A sharp break above this channel and a consolidation above the 4/8 of murray (1.1230) could be the start of a recovery movement and we could expect the euro to rise to the 200 EMA located at 1.1303. The market sentiment report for today, November 25, shows that there is 71.00% of operators who are buying the EUR / USD pair. This data provided a bullish sign so that we could expect a recovery to 1.1303. Then, the price may again resume its downward movement with the target at 1.1108 (3/8). Our forecast in the next few hours for the euro is a consolidation above 1.1230. As long as EUR / USD is trading above this zone, we will have an opportunity to buy with the target at 1.1303. If 200 EMA is broken, we could buy with targets at 1.1420 (top of bearish channel). Support and Resistance Levels for November 25 - 26, 2021 Resistance (3) 1.1306 Resistance (2) 1.1280 Resistance (1) 1.1235 ---------------------------- Support (1) 1.1168 Support (2) 1.1142 Support (3) 1.1108 *********************************************************** A trading tip for EUR/USD November 25 - 26, 2021 Buy above 1.1230 (4/8) with take profit at 1.1305 (200 EMA) and 1.1420 (top bearish channel), stop loss below 1.1185. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Nov 2021 05:47 AM PST

Crude price (WTI - # CL) is trading below the 200 EMA located at 78.82. This zone represents strong resistance that coincides with last week's pivot level. Crude has been consolidating below the 200 EMA and has formed a bullish pennant pattern. A sharp break of this technical pattern could give WTI a strong boost and rise towards the top of the downtrend channel around 80.55. Crude inventories published yesterday increased in reserves by 1.0 million barrels. This reading exceeded market expectations. The market reacted in a negative way, pushing the price down towards the 21 SMA. For now, WTI prices continue to consolidate in the range zone of 79.00 -78.00. In part, it is due to joint efforts with the United States and other countries to free oil from their reserves to prevent rising prices. A sharp break above the 200 EMA located at 78.82 will be the signal to buy WTI crude with targets towards 6/8 murray around 81.25. If the price crosses the level of 81.25, we could expect crude to reach 84.38. In that area, crude oil left a GAP on October 27 and it remains to be covered. On the other hand, if crude falls below 77.51, we can expect there to be a downward movement and the price could reach the level of 75.00. Later, if this strong support is broken, the price could fall to the level of 71.88 (3/8). Support and Resistance Levels for November 25 - 26, 2021 Resistance (3) 79.71 Resistance (2) 79.18 Resistance (1) 78.49 ---------------------------- Support (1) 77.79 Support (2) 77.13 Support (3) 73.57 *********************************************************** A trading tip for WTI November 25 - 26, 2021 Buy above 78.12 or if breaks 78.82 (200 EMA ) with take profit at 80.00 and 81.25 (6/8), stop loss below 77.50. The material has been provided by InstaForex Company - www.instaforex.com |

| US stock indexes close mixed on Wednesday Posted: 25 Nov 2021 05:41 AM PST

On Wednesday, key US stock market indexes closed mixed. The Dow Jones Industrial Average dipped 0.03%, the S&P 500 gained 0.23%, and the NASDAQ added 0.44%. US economic growth in the previous quarter slowed down to 2.1% - the lowest rate since the beginning of the pandemic. Economists forecasted the US economy to grow by 2.2%. The US GDP rose by 6.7% year-on-year in the second quarter. Weekly jobless claims fell by 71,000, reaching 199,000 - the lowest total in 50 years. New filings were projected to decrease to 260,000. Personal income in October grew by 0.5% compared to September, while household spending increased by 1.3%. Economists expected a rise of 0.2% and 1% respectively. New home sales in the US inched higher by 0.4% to 745,000 in November, compared to 742,000 in the previous month. The amount of sales was forecasted to remain steady. Sales in September were originally estimated at 800,000. The UoM consumer sentiment index fell to 67.4 points in November, compared to 71.7 points in October, reaching the lowest mark in 10 years. Economists expected the index to decrease to 66.9 points. The latest Fed meeting minutes indicated the Federal Reverse is concerned about the highest inflation in 30 years. If prices rise further, the Fed would be forced to hike interest rates and reduce asset purchases. On the Dow Jones Industrial Average, the best performers were Visa Inc. Class A shares (+2.40%), Intel Corp. (+1.34%), and Home Depot Inc. (+0.92%). The worst performing stocks were The Goldman Sachs Group Inc. (-1.76%), Honeywell International Inc. (-1.75%), and Walgreens Boots Alliance Inc. (-1.62%). On the S&P 500, HP Inc. (+10.10%), Deere & Co. (+5.32%), and Advanced Micro Devices Inc. (+5.26%) led the upside, with Nordstrom Inc. (-29.03%), Gap Inc. (-24.12%), and Autodesk Inc. (- 15.49%) being the worst performers. Shares of HP Inc. gained 10.1% amid rising revenues in the fourth quarter. Thanks to increased computer sales, the company's revenues increased by 9% year over year. Shares of Gap Inc. slumped by 24.1%, due to falling revenue caused by product delays. The retailer's revenue fell by 1% in the third quarter. On the NASDAQ, the best performers of the session were Longeveron LLC (+145.64%), Biofrontera Inc. (+98.48%) and IM Cannabis Corp. (+37.82%). The worst performing stocks were Qualigen Therapeutics Inc. (-31.64%), Aptevo Therapeutics Inc. (-29.83%), and Pasithea Therapeutics Corp. (-28.75%). Shares of Westlake Chemical went up by 2.4% on the news of its acquisition of Hexion Inc.'s epoxy production division for $1.2 billion. Dell Technologies Inc. stock rose by 4.8% after the company reported strong earnings in the third quarter, driven by high demand for Dell's products. Shares of Apple Inc. added 0.3% amid the corporation's lawsuit against the Israeli cyber firm NSO Group. Apple alleges that NSO Group's hacking tool Pegasus was used to attack Apple customers. Verizon Communications stock lost 0.2% on the news of the company's $6.25 billion acquisition of TracFone Wireless Inc. The material has been provided by InstaForex Company - www.instaforex.com |

| Bearish view on Goldman Sachs stock. Posted: 25 Nov 2021 05:35 AM PST As we mentioned in a previous post, the stock price of Goldman Sachs remained in a bullish trend making higher highs and higher lows. Recently however price formed a lower high and combined with the fact that the RSI has been providing bearish divergence signals, the stock has entered our bearish potential list.

Blue line - bearish divergence The RSI has been making lower highs since the beginning of 2021. I believe there are increased chances that the top is already in and by the end of the year we will see price under pressure. A break below $380 will confirm our bearish view. Our first target will be at $320-$300 area. At current levels I prefer to be neutral if not slightly bearish GS stock. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: The time of the reversal is close. Posted: 25 Nov 2021 05:11 AM PST EURUSD continues to trade in a bearish trend making lower lows and lower highs. Price is clear regarding the trend, but the RSI is also clear in pointing out that the downtrend is weakening. Price is inside the downward sloping wedge pattern and over the next few sessions I expect a major reversal.

Blue lines - bullish divergence EURUSD remains in a bearish trend as long as price is below the red trend line resistance and below 1.1276. Bulls need at least to break the red trend line to the upside in order to squeeze the bears and start hitting stops. Until then I will not be surprised if EURUSD gets rejected today at the resistance trend line and provides a new lower low. Overall price has reached our target area of 1.12-1.13 after our bearish signal at 1.1535 but now I prefer to be neutral if not slightly bullish. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for November 25, 2021 - Breakout of the falling wedge in the background Posted: 25 Nov 2021 05:05 AM PST Technical analysis:

EUR/USD has been trading upside this morning and there is the breakout of the falling wedge in the background, which is sign for the potential upside movement. Trading recommendation: Due to upside brekaout of the resistance trend line in the background, I see potential for the upside movement. Watch for buying opportunities on the dips with the upside objectives at 1,1250 Gold didn't have power to break rising trend line, which is another sign that upside is in the play. RSI is showing oversold condition, which is sign that there is potential for the upside rotation. Support level is set at 1,1185 The material has been provided by InstaForex Company - www.instaforex.com |

| Gold short-term chances of a reversal increase. Posted: 25 Nov 2021 05:02 AM PST Gold price is bouncing as expected after the new lower low by price and the higher low by the RSI. The bullish divergence in the RSI and the fact that price has stopped its decline at the 78.6% Fibonacci retracement, increases the chances of a reversal. Ideally the decline would stop around the 61.8% level, but we do not live in an ideal world.

Blue rectangle - support Red line - expected path Gold price remains in a bearish trend as price remains below $1,796. Bulls need to break above this last high in order to confirm the short-term trend change. Gold price has stopped the decline right at the 78.6% retracement. The RSI provided another bullish divergence and we are optimistic that Gold could start a new upward move. It goes without saying, that bulls do not want to see Gold break below $1,750. The material has been provided by InstaForex Company - www.instaforex.com |

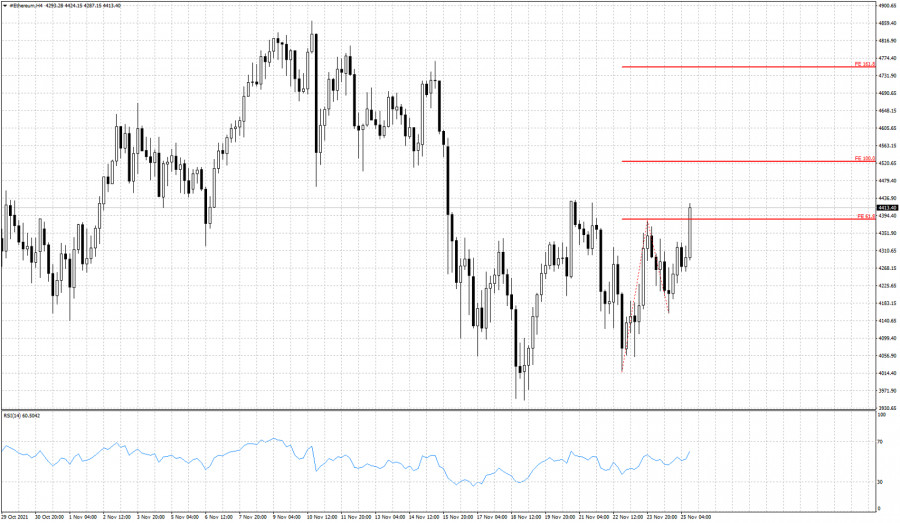

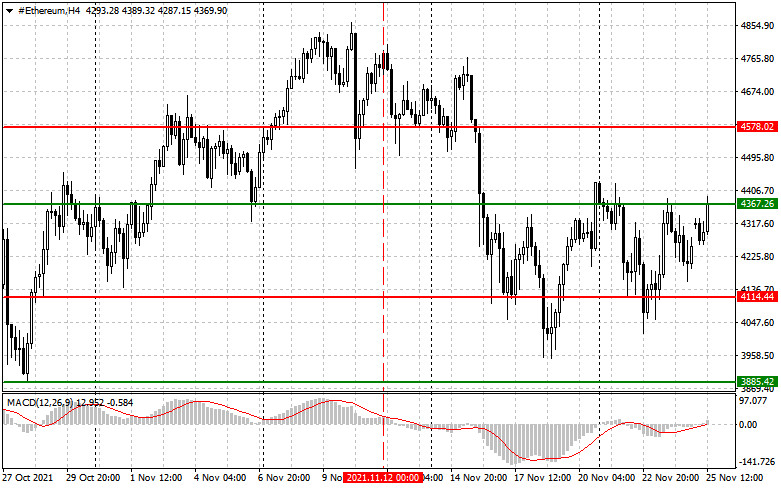

| Ethereum bulls target $4,520 and $4,700 in the short-term. Posted: 25 Nov 2021 04:54 AM PST Ethereum continues to trade above the key support at $3,950-$4,000. Price tested this level twice and both times price bounced higher. This time price only pulled back towards $4,015 and formed a higher low. Price is moving higher with a strong bullish momentum.

Price is close to breaking above November 21st high at $4,431. This will open the way for a move towards our Fibonacci extension targets at $4,523 and $4,750. Support is at yesterday's lows at $4,159 and bulls do not want to see price break below this level. This would be a sign of weakness. Price has started making higher highs and higher lows and that is why we expect the upside move to continue higher over the next couple of sessions. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for November 25,.2021 - Upside trendline held successfully Posted: 25 Nov 2021 04:53 AM PST Technical analysis:

Gold has been trading sideways at the price of $1,790. I see potential for the upside reaction due to oversold condition and test of the support. Trading recommendation: Due to oversold condition and potential for upside movement//// Watch for buying opportunities on the dips with the upside objectives at $1,821. Gold didn't have power to break rising trend line, which is another sign that upside is in the play. Stochastic is showing oversold condition, which is sign that there is potential for the upside rotation. Support level is set at $1,780 The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term analysis on XRPUSD. Posted: 25 Nov 2021 04:50 AM PST XRPUSD continues to respect the key support area around $1. Price tested this support area yesterday once again. Support was held Price has bounced since then and is now challenging the important downward sloping resistance trend line at $1.05.

Blue rectangle - support area XRPUSD remains supported. As long as the blue support zone remains intact, bulls have hopes. On the other hand, in order to see a short-term trend reversal, bulls will need to break above the red downward sloping resistance trend line and stay above it. Next major resistance is at $1.13 and next at $1.25. Breaking above these levels will open the way for a move towards $1.50-$2. Until then, price is vulnerable to a downward break that could push it close to $0.80. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for November 25,.2021 - Double bottom in the play Posted: 25 Nov 2021 04:46 AM PST Technical analysis:

BTC has been trading upside today and there is the breakout of the contraction in the background, which is good sign for further upside movement. Trading recommendation: Due to oversold condition and potential for double bottom, I see potential for the upside movement. Watch for buying opportunities on the dips with the upside objectives at $60,370 and $61,400. Stochastic is showing fresh bull cross, which is another sign and confirmation for the upside movement. Support level is set at $55,500 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of GBP/USD for November 25, 2021 Posted: 25 Nov 2021 04:38 AM PST

The trend of GBP/USD pair movement was controversial as it took place in the down channel, the market showed the signs of instability. Due to the previous events, the price is still moving between the levels of 1.3414 and 1.3300. Also, it should be remembered that the daily resistance and support are at the levels of 1.3270 and 1.3225 respectively. Therefore, it is recommended to be cautious while opening orders in this area. So, it is necessary to wait until the downtrend channel has completed. Yesterday the market has moved from it's top at 1.3114 and continued to fall towards the bottom of 1.1315. Today in the one-hour chart, the current rise will remain in the framework of corrections. However, if the pair fails to pass through the level of 1.1315, the market will indicate a bearish opportunity below the strong resistance level of 1.1315 (the level of 1.1315 coincides with the double bottom too). Since there's nothing new in the path of this pair, it is still not bullish. In this regard, sell deals are recommended lower than the 1.1315 level with the first target at 1.3170. If the trend breaks the support at 1.3170. Thereupon, it is possible that the pair will move downwards continuing the development of the bearish trend to the level 1.3225 in order to test the daily support 2 (horizontal red line). The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: dollar has room for growth while euro faces roadblocks Posted: 25 Nov 2021 03:41 AM PST

On Wednesday, the greenback hit its highest level since July 2020 dragging the EUR/USD pair to an almost 17-month low. Minutes from the Federal Reserve's November meeting, published yesterday, showed that the regulator may accelerate the winding down of its bond-buying program and raise interest rates sooner than expected if inflation in the US continues to remain high above target levels. Increasing price pressures in the country caught the White House and the Fed by surprise and prompted them to take measures. US President Joe Biden and Federal Reserve Chairman Jerome Powell emphasized earlier this week that they would take steps to tackle the rising prices of everyday goods. Although the spike in inflation in the late spring and throughout the summer was considered temporary, concern at the Fed intensified as rates continued to remain elevated during the fall. "Various participants noted that the Committee should be prepared to adjust the pace of asset purchases and raise the target range for the federal funds rate sooner than participants currently anticipated if inflation continued to run higher than levels consistent with the Committee's objectives," the minutes stated. Following the two-day session that concluded November 3, Federal Reserve officials unanimously decided to begin reducing monthly asset purchases estimated at $120 billion. At a given pace ($15 billion a month), asset purchases will be completely reduced by June of next year. However, some Fed policymakers are urging an acceleration of purchases amid continued high inflation and job growth to give the regulator more flexibility to raise its key interest rate from its current near-zero level early next year, if necessary. According to Capital Economics, the FOMC clearly realized that inflation is likely to remain above the target level for a significant amount of time.

However, some Fed officials at the November meeting continued to advocate a more patient approach regarding incoming data, although they also said they would not hesitate to take appropriate actions to address inflation pressures that posed risks to its longer-run price stability and employment objectives. Economic data released in the US over the past three weeks indicate that accelerating reductions in bond purchases is now firmly on the agenda for the Fed's next meeting, which will be held December 14-15. Reports released Wednesday showed that the number of Americans filing new jobless claims fell to its lowest level since 1969 last week, while the Fed's preferred measure of inflation (core PCE) continued to rise, more than doubling the Fed's medium-term target of 2%. San Francisco Federal Reserve Bank President Mary Daly, one of the US Central Bank's most cautious policymakers, said on Wednesday she would be open to accelerating the pace of the central bank's tapering of asset purchases if inflation remained elevated and jobs growth stayed strong and that she may see the FOMC raise rates once or twice next year. Investors now see a 53% chance that the federal funds rate will rise in May 2022, up from the 45% mark on Tuesday, according to CME Group. "The US economy retained its titanium status, buoying the dollar. Slightly hawkish comments from the normally dovish Daly was also a factor," National Australia Bank strategists said. The day before, the greenback was able to get close to the round mark of 97.00, after which it corrected slightly. On Thursday, the USD index is trading 0.2% below its 16-month high of 96.90 reached yesterday. Most likely, the index is experiencing a technical correction, which became possible in the thin markets, as the US is celebrating Thanksgiving today, and this may give some break to the euro. On Wednesday, the EUR/USD pair reached its lowest level since June 2020 at 1.1185, but then managed to recover above 1.1200. While the U.S. economic calendar remains empty on Thursday, the minutes of the ECB's October 28 meeting is to be released.

At the press conference, ECB President Christine Lagarde said that officials had discussed inflation, but had stuck to the view that inflationary forces will prove transitory. However, this week's Eurozone PMI reports raise doubts about the ECB's claim that the rise in inflation is temporary. "The surveys show price pressures remain intense, with the output prices PMIs for both manufacturing and services rising to their highest in almost two decades, consistent with our view that headline inflation will remain high for some time," Capital Economics experts said. Yesterday, ECB Vice President Luis de Guindos hinted at some concern about rising inflation. "The ECB is continuously pointing out that the inflation rebound is of a transitory nature. However, we have also seen how in recent months these supply factors are becoming more structural, more permanent," Luis de Guindos said. Renewed restrictions against resurging COVID-19 cases are outweighing the potential of a shift in ECB rhetoric, ahead of their December meeting and keeping EUR under pressure, economists at Westpac report. "The EUR/USD pair rebounds are unlikely to regain 1.13 unless spreads tighten and the recent break of 1.1250 risks an early test of 1.1000-50 area," the bank stated. The experts see any decline in the USD Index below 95 as an opportunity to buy the dollar. The dollar has room to grow in the coming months amid falling risk appetite and new waves of COVID-19, Scotiabank experts said. They predict that the greenback may rise to 104-105 points. Scotiabank analysts said the risk of an earlier start of the Fed's tightening cycle and a later start of tightening by the ECB has not yet been fully accounted for in quotes. Commerzbank specialists said that the USD index recently broke through key resistance at 94.47-94.80. As long as the index trades above 93.96, a rise of USD to 97.73 may be expected. That said, the main target is located around 99.50. In the longer term, the index may break above 100. According to Saxo Bank analysts, the weakness of the euro has been cyclical and provoked by the deterioration of economic growth prospects in the Eurozone, caused by a nasty jump in production costs related to gas and electricity. But if this situation lasts all winter, and especially if it is accompanied by a German "traffic light" coalition, which includes Christian Lindner of the FDP as finance minister with his stingy stance on fiscal stimulus, euro weakness could begin to take a more serious character - existential. "Temporary support seems to have been found around the 1.1200 area, but the only factor supporting it seems to be oversold technical readings. Presumably more selling interest would emerge as a correction to be seen to the 1.1280-1350 area," strategists of ING said. "Next support is at 1.1170 and below that, we are not getting far from 1.10 at all. This looks the state of play into December when, in the early weeks, we will see if any slowing in the relentless demand for USD funding," they added. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD | when will the fall end? Posted: 25 Nov 2021 03:38 AM PST The EURUSD pair has been falling in price against the US dollar for a long time. This momentum already has a long-term level. When can we expect the end of the downward momentum? If we are guided by the expiration of the quarterly futures contract, then the best time for a reversal will be the week after December 13. Switching to a new contract, as a rule, increases interest in opening opposite positions for hedging risks. This may be the reason for the formation of the first level of reversal on the D1 timeframe. So far, it is not worth considering the pair's growth as a reversal movement, even if the euro strengthens by 1-2%. It is better to use these prices to search for a sell pattern since, before a strong reversal, a false breakout in the direction of the current momentum always follows. A significant medium-term resistance so far is the weekly short-term zone of 1.1379-1.1362. Going beyond the average course of the current month increases the probability of the formation of a corrective upward model. It is growth that will be the key to finding favorable selling prices towards long-term momentum. The probability of a complete reversal from the current levels without the formation of the model discussed above is 20%. The material has been provided by InstaForex Company - www.instaforex.com |

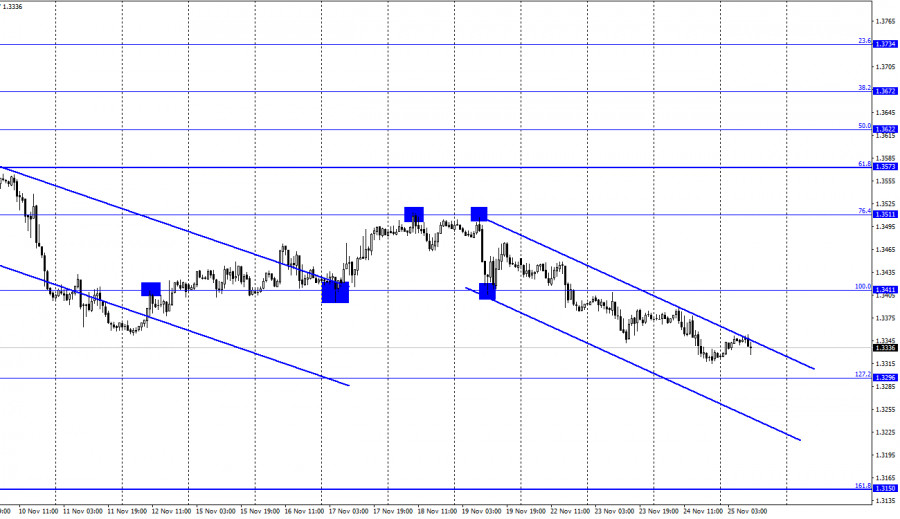

| Technical analysis of GBP/USD on November 25. COT report. Fed can accelerate stimulus cuts Posted: 25 Nov 2021 03:34 AM PST GBP/USD – 1H.

On the hourly chart, GBP/USD continued to fall on Wednesday towards the corrective level of 127.2% or 1.3296. It is still going on today. A new downtrend corridor has also formed, which again characterizes the traders' mood as bearish. The pair's rebound from 1.3296 would be in favour of the British currency and some upside towards the 100.0% level or 1.3411. A close under 127.2% would increase the chances of a further fall towards 1.3150, the next Fibonacci level of 161.8%. In addition to the important data, the minutes of the November Fed meeting were also published in the USA yesterday. This document showed that some committee members are willing to vote to accelerate the pace of the asset purchase programme cuts so that this would lead to earlier completion of the entire QE programme. The minutes also stated that the withdrawal of stimulus was not a signal for a rate hike. For this, more compelling reasons are required. At the same time, some Fed members argued that the regulator should be prepared for an earlier rate hike if inflation continued to remain high. Fed members suggest that inflation could slow down for much longer than previously expected. FOMC members noted that economic growth had slowed in the third quarter and the labour market recovery had been slower. Economic activity is also down compared to the first two quarters of 2021. Although the assessment of the current state of economic conditions is weak, the fact that some FOMC members are willing to move to a faster pace of asset purchase cuts and earlier rate hikes means that the dollar may continue to show gains as this is hawkish rhetoric. Thus, the pound has not waited for a positive information backdrop. Today's possible close above the downward corridor and a speech by Bank of England Governor Andrew Bailey give hope. GBP/USD – 4H.

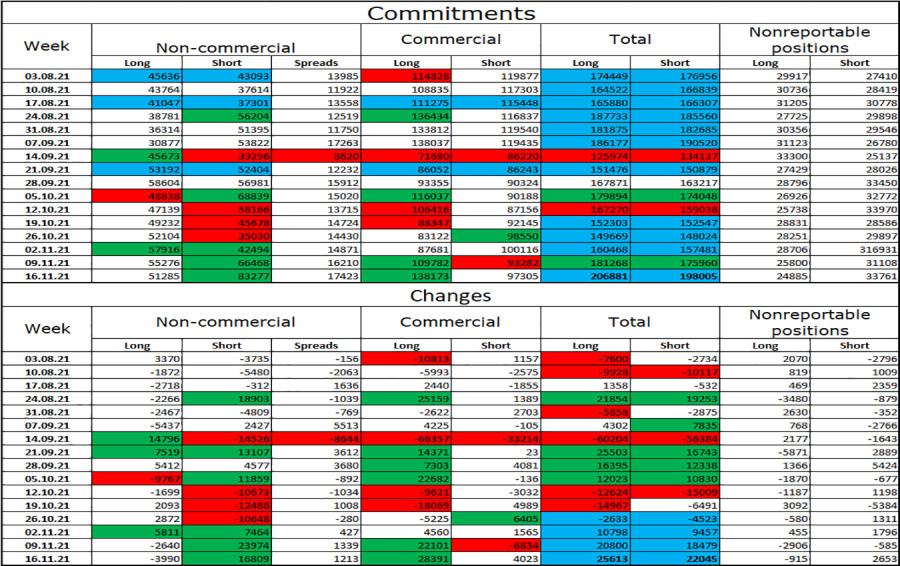

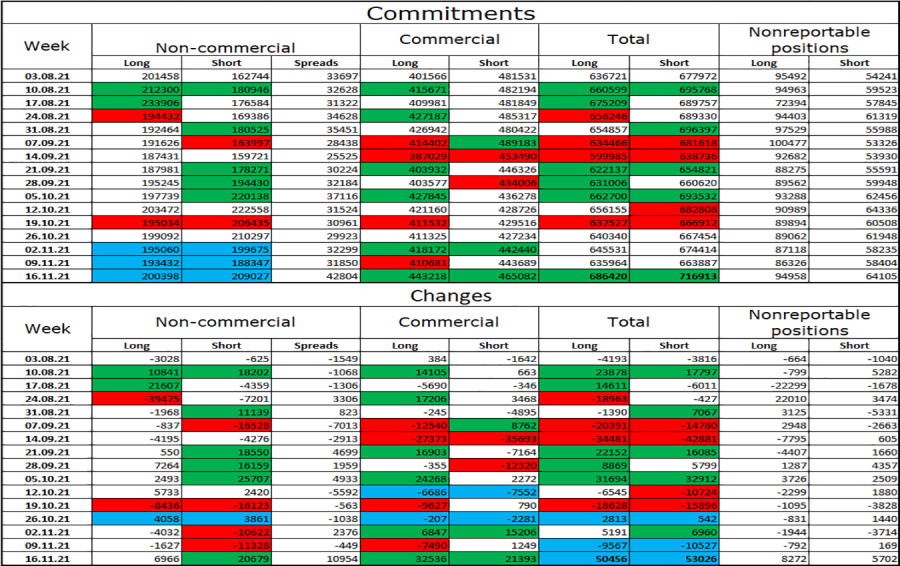

On the 4-hour chart, the GBP continues its decline towards 1.3274, the next Fibonacci level of 61.8%. A new bullish divergence in the MACD indicator allows expecting a reversal in favour of the British currency and some growth towards the 50.0% retracement level of 1.3457. However, a close below its current low would cancel it. A pullback of the quotes from 1.3274 may also allow for some growth in the pair. A consolidation below 1.3274 would increase the chances of further declines. Economic calendar for US and UK UK - Speech of Andrew Bailey, Governor of Bank of England (17-00 UTC). There are no important events on the US economic calendar on Thursday. In the UK, only Andrew Bailey's speech will take place. Therefore, the information backdrop will be weak today. COT(Commitments of traders):

The recent COT report on GBP/USD from November 16 shows that large market players are turning more bearish. On the reported week, speculators closed 3,990 long contracts and opened 16,809 short contracts. Notably, the number of short contracts has been strongly increasing for the second week in a row. All in all, speculators opened almost 40,000 short contracts for two weeks. In other words, half of the newly opened contracts are short ones. A week ago, the number of long contracts was 17,000 more. Nevertheless, speculators are hesitant to express clear market sentiment. They increase buy positions and then suddenly increase sell contracts, but the total number of long and short contracts for all categories of traders remain roughly the same: 206K – 198K. Hence, after a few weeks of active selling GBP/USD, speculators may rush opening long positions. Outlook for GBP/USD and trading tips I would recommend selling GBP/USD if the pair closes below 1.3411 with the target at 1.3296. Alternatively, buy positions are recommended if the price closes above 1,3411 at the daily chart with the target at 1.3511. Terms The Non-commercial category includes major market players: banks, hedge funds, investment funds, private, and large investors. The Commercial category embraces commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations. The category of Non-reportable positions means retail traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| More hedge funds start to acknowledge bitcoin Posted: 25 Nov 2021 03:34 AM PST As bitcoin struggles to reach the lows of the week and ether attempts to break through the resistance of 4,367, EY, one of the four largest consulting and audit firms in the world, found that one in four hedge funds are ready to increase their investments in crypto next year. The 2021 EY Global Alternative Funds Survey showed that digital assets are gradually becoming more common in investor portfolios, albeit to a small extent. Large funds getting used to bitcoin

EY has also identified hedge funds with a particular interest in cryptocurrencies. The study says that more and more companies are planning to start investing in alternative instruments next year, including cryptocurrencies. Currently, hedge funds are one of the most open platforms for investing in bitcoin and ether. Due to the coronavirus pandemic, investors had to face serious challenges, including inflation, which is simply devaluating bond yields, repelling institutional investors from investing in these instruments. The coronavirus also helped investors change their attitude towards alternative instruments, including cryptocurrencies. While crypto is not currently popular with the majority of fund managers, the growing appetite among investors will force more companies to invest in this asset class. The study found that just 1 in 10 hedge fund managers reported having exposure to these assets, indicating that there is room for future growth. The recent performance of these funds has been impressive. About 51 percent of investors surveyed said alternative investments have increased the value of their portfolios and exceeded their expectations. This year has also seen exponential growth in the cryptocurrency industry. The rise of these digital assets has made companies and fund managers turn their attention to cryptocurrencies as relatively profitable instruments in today's confusing markets. Although their actual involvement in cryptocurrencies has not been as big as with other unregulated assets, large players continue to enter this market, which opens up huge growth prospects. The study highlights the resilience of the new industry and key transformations that make it more attractive to managers and investors. In the short term, trading volume is expected to decrease over the next few days, especially on Thursday - Thanksgiving Day in the United States. However, some analysts expect increased volatility in the bitcoin and ether options market by the end of November. Technical picture for bitcoin

After another attempt to rise to the $60,000 area, bitcoin lost its ground very quickly and returned to a strong support level of $56,400. Further growth of the trading instrument will depend on whether bulls will be able to regain control of the $60,000 resistance area. If this is so, we can expect a jump to the $64,000 area. If the price breaks below $ 56,400, this will be bad for us. In this case, the pressure on bitcoin will increase, and the price may retest the lows of $53,600 and $50,900. Technical picture for ether Another retest of the support level of $4,110 increased the demand for ether. This allowed the bulls to drive the instrument up to the resistance level of $4,360, a strong obstacle for altcoin buyers. A breakout of this level will quickly return ether to $4,578. If the breakout of $4,110 takes place, ether will come under pressure again and may head for the lows of $3,885 and $3,682. The material has been provided by InstaForex Company - www.instaforex.com |

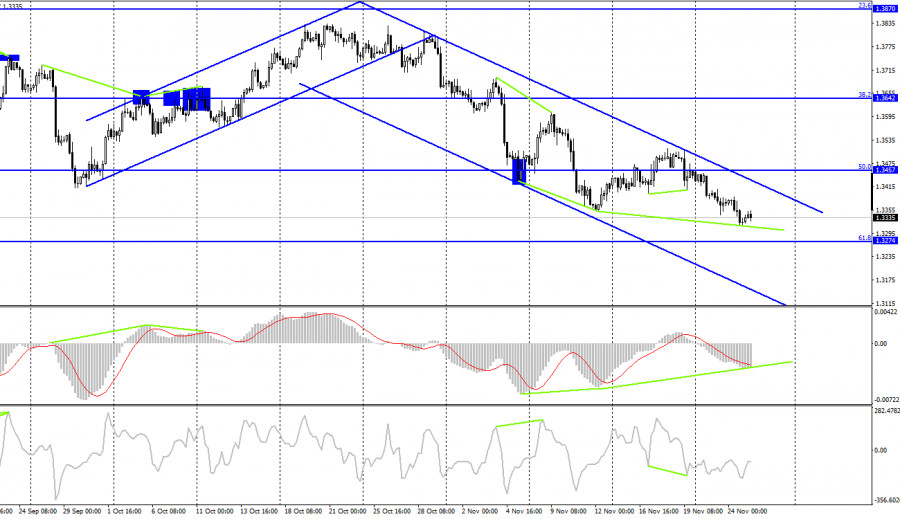

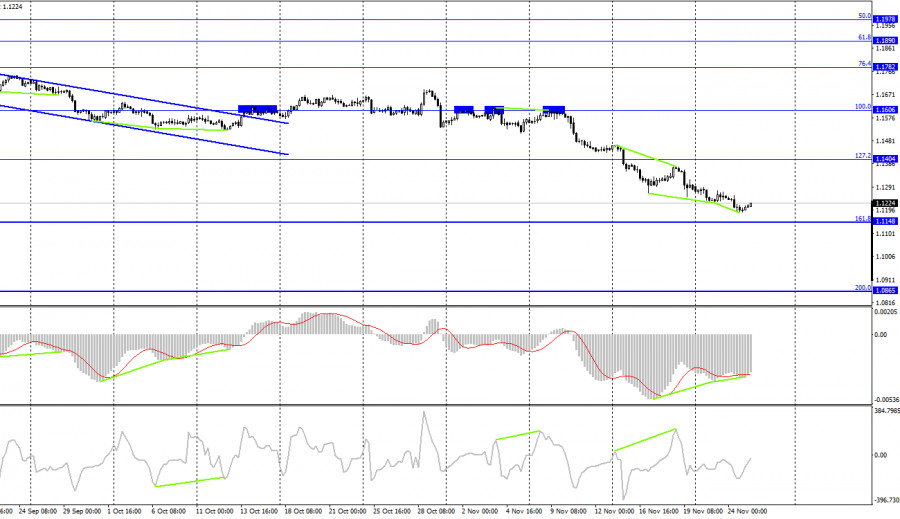

| EUR/USD: COT report on November 25, 2021. US GDP gets better in Q3 but still below expectations Posted: 25 Nov 2021 03:30 AM PST EUR/USD - 1H

On Wednesday, the EUR/USD pair declined below the level of 1.1250. So, the quotes may continue to fall towards the next level of correction at 200.0% - 1.1143. However, tonight there was a trend reversal, so the euro started to rise slightly. Yet, this hardly means that the downtrend is over. The price cannot decline nonstop without a single correction or a pullback. Thus, the current growth looks more like one of such pullbacks. A rebound from the level of 1.1250 will support the US currency and ensure that the downward movement will resume. Yesterday's news background was very strong and informative. There were several important reports in the United States, and the minutes of the FOMC meeting were published. The most important GDP report showed an improvement from 2.0% to 2.1% compared to the previous reading. However, traders expected to see a rise of 2.2% q/q. The report on durable goods orders turned out to be below expectation as well. At the same time, initial jobless claims came out better than expected. The same was true for the report on US personal income and consumer spending in October. The University of Michigan Consumer Sentiment Index was also slightly above forecasts. In general, this set of news and reports can be described as neutral. Nevertheless, it was perceived as positive by traders. It may also be that traders simply paid no attention to it as the US dollar was still rising. These reports brought no insights to the markets. Obviously, the US economy slowed down in the third quarter, but this did not affect the greenback in any way. Thus, the downtrend in the euro may continue until the next important event. For instance, traders are now looking forward to the next Fed's meeting, especially after yesterday's minutes of the FOMC meeting. EUR/USD - 4H

On the 4-hour chart, the pair continues to fall towards the correction level of 161.8% - 1.1148. The bullish divergence of the CCI indicator suggested further growth in the direction of the correction level of 127.2% - 1.1404. Instead, the pair continues to slide to the downside, disregarding correction levels and divergences. The second bullish divergence may repeat the fate of the first one. A rebound from the level of 161.8% will validate the pair's growth. Closing below this level will indicate that the quote is more likely to decline towards the next correction level of 200.0% - 1.0865. Economic calendar for US and EU European Union - ECB President Christine Lagarde speaks (13-30 UTC). On November 25, ECB President Christine Lagarde will give a speech. That is all regarding events in the EU. As for the US, its economic calendar has nothing interesting today. Thus, the information background will be weak on Thursday. COT (Commitments of traders) report

The latest COT report showed that the non-commercial category of traders became more bearish on the pair in the reporting week. Thus, speculators opened 6,966 long contracts and 20,679 short contracts on the euro. So, the total number of long positions increased to 200,000 and 209,000 for short positions. This amount has been almost the same for the third week in a row. So we can assume that the market sentiment is not certain yet. In general, the bearish trend has been strengthening in recent months. I can conclude that neither bulls nor bears have an advantage in the market. At the same time, the European currency continues to decline. Therefore, it will be right to say that the bearish bias still prevails. Outlook and trading tips for EUR/USD I recommend selling the pair when the price closes below the level of 1.1250 with the target at 1.1148. Short positions should be kept open for now. I recommend buying the euro when the price rebounds from the level of 1.1148 on the 4-hour chart with the targets set 50-100 higher. Definitions: Non-commercial traders are large market players, including banks, hedge funds, investment funds, private, and large investors. Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain quick profit, but to ensure current activities or export-import operations. Non-reportable category of traders refers to small speculators who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments