Forex analysis review

Forex analysis review |

- Forecast for AUD/USD on November 10, 2021

- Forecast for USD/JPY on November 10, 2021

- USDCAD bullish bounce | 10th Nov 2021

- Overview of the GBP/USD pair. November 10. The UK continues to calculate losses from leaving the EU

- Overview of the EUR/USD pair. November 10. The US dollar is slowly creeping down

- Dollar is more interested not in inflation, but in Biden's choice. Who will be the new head of the Fed?

- Ethereum hits new all-time high of 4,842.65

- USD/CAD upside reversal coming!

- How to trade GBP/USD on November 10? Simple tips for beginners. The downward trend continues. The bears pulled the pound

- Bitcoin and Ethereum are just warming up and going into a rage: new highs are just around the corner

- Bitcoin: updating the all-time high is not a fix for you! Be careful!

- How to trade EUR/USD on November 10. Simple tips for beginners. EUR moving up today to start sliding tomorrow.

- EUR/USD attention at resistance

- Gold moves towards new highs as DXY remains under pressure

- Analysis of GBP/USD for November 9; The Northern Ireland Protocol was, is, and will be a stumbling block between the EU and

- November 9, 2021 : EUR/USD daily technical review and trading opportunities.

- November 9, 2021 : EUR/USD Intraday technical analysis and trading plan.

- November 9, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

- Analysis of EUR/USD for November 9; Markets do not want to increase demand for the dollar

- XRP price rises amid potential settlement between ripple and SEC: what does this mean for the XRP token?

- Trading signal for Ethereum (ETH) on November 09 - 10, 2021: sell below $4,800 (strong resistance)

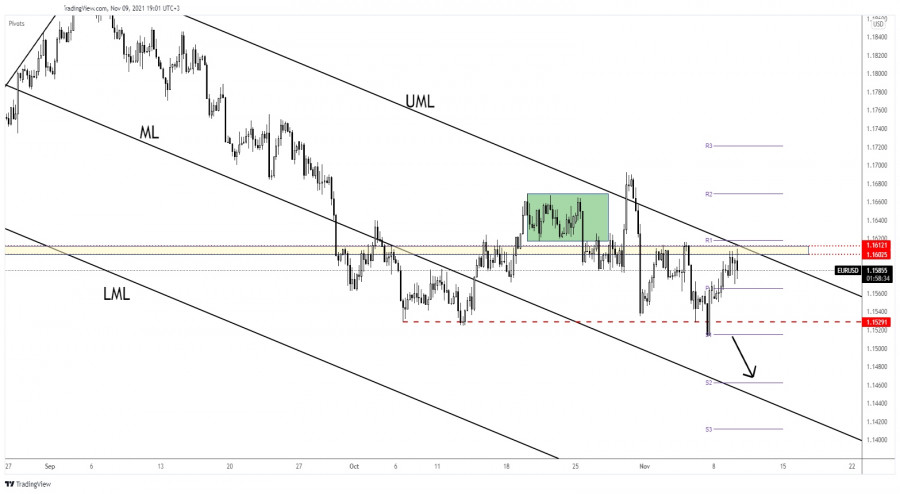

- EUR/USD remains bearish despite strong pressure on USD from euro bulls

- Trading signal for GBP/USD on November 09 - 10, 2021: sell below 1.3575 (top bearish channel)

- Trading signal for USD/JPY on November 09 - 10, 2021: buy above 112.90 (EMA 200)

- U.S. hints on selling oil from strategic reserves do not scare Brent bulls

| Forecast for AUD/USD on November 10, 2021 Posted: 09 Nov 2021 07:38 PM PST The Australian dollar is already close to a mid-term pivot point. On a daily scale, the price with the Marlin Oscillator has almost formed a powerful double convergence. The price only needs to go down a bit, and the signal line of the oscillator will touch the line forming the convergence. The MACD line (0.7330) may not even be reached.

A double convergence is also forming on the four-hour chart. After its completion, the trend is likely to reverse upwards. The price exit above the MACD line, above the level of 0.7433 (yesterday's high), will confirm this reversal in the mid-term trend.

|

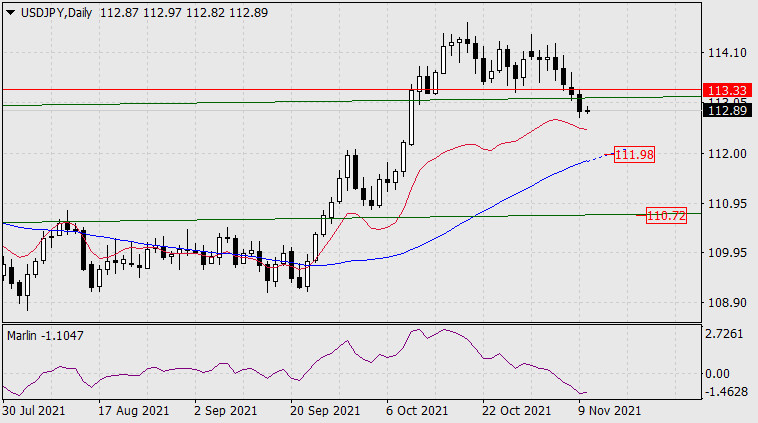

| Forecast for USD/JPY on November 10, 2021 Posted: 09 Nov 2021 07:36 PM PST Yesterday, a significant event took place for the USD/JPY pair - the price broke through the support of the trend line of the price channel of the weekly timeframe (113.13) and, obviously, outlined a further decline towards the 111.98 target - to the MACD line on the daily chart. Overcoming this support will open the target along the lower line of the price channel at 110.72.

On a four-hour chart, the price is decreasing in a narrow price channel, at the moment the price is approaching its upper border, from which we expect a downward reversal. The Marlin Oscillator is growing in the negative area, which in the current conditions means the oscillator is discharging from the oversold zone before the subsequent decline.

To break the current trend, the price needs to go above the MACD indicator line, above 113.33, that is, above the price channel line on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

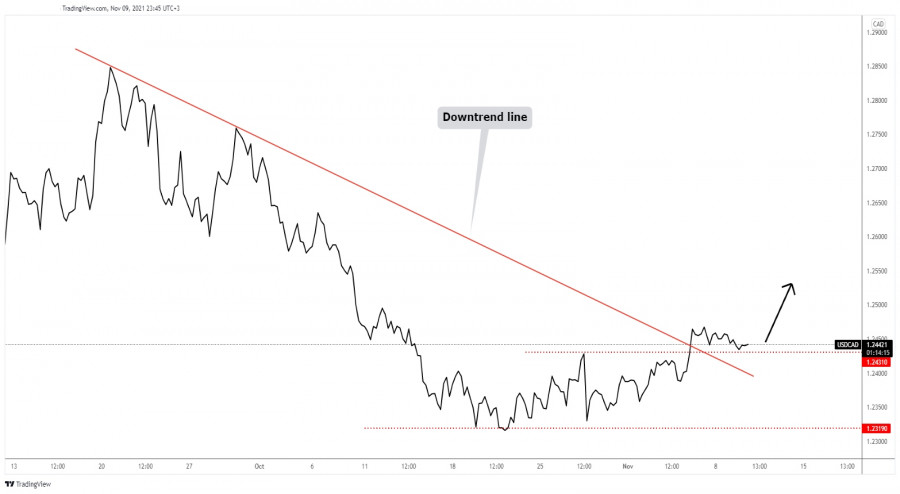

| USDCAD bullish bounce | 10th Nov 2021 Posted: 09 Nov 2021 06:29 PM PST

On the H4, with price bouncing off the support on the RSI indicator and price moving above the ichimoku cloud, we have a bullish bias that price will rise from 1st support at 1.24286 in line with the 50% Fibonacci retracement levels and the horizontal overlap support to 1st resistance at 1.24796 in line with the graphical swing high resistance and possibly even to 2nd resistance at 1.24964 in line with the graphical swing high from 12th of October. Alternatively, we may see price break 1st support structure and head for 2nd support at 1.24024 in line with the 78.6% Fibonacci retracement level and horizontal overlap support. Trading Recommendation Entry: 1.24286 Reason for Entry: 50% Fibonacci retracement levels and the horizontal overlap support Take Profit:1.24796 Reason for Take Profit: graphical swing high resistance Stop Loss:1.24024 Reason for Stop Loss: 78.6% Fibonacci retracement level and horizontal overlap support The material has been provided by InstaForex Company - www.instaforex.com |

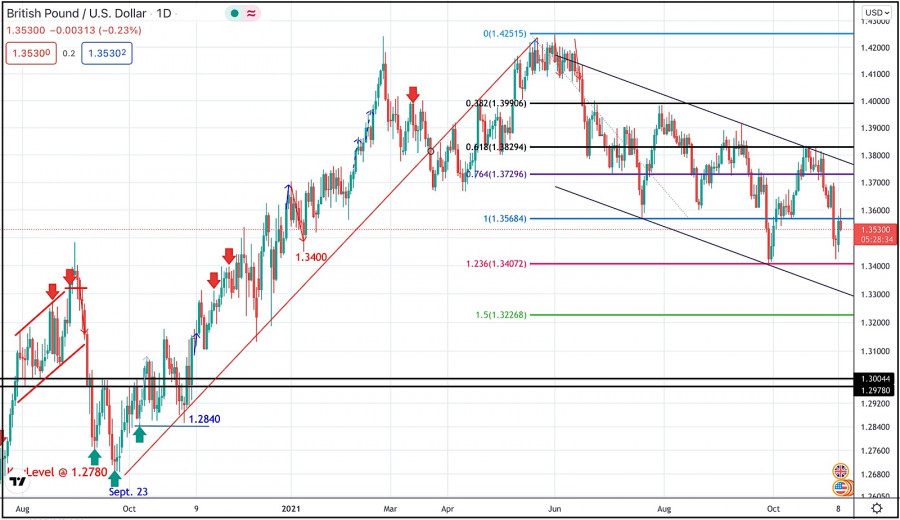

| Overview of the GBP/USD pair. November 10. The UK continues to calculate losses from leaving the EU Posted: 09 Nov 2021 04:14 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. The GBP/USD currency pair on Tuesday tried to continue its recovery after the previous week's failure, however, bumping into a moving average on the way, bounced off it and began a downward correction. In principle, we are still considering the option of continuing the growth of the British currency as the main one, since we still believe that the fall of the pound last week was illogical. Thus, we are waiting for a recovery to the level of 1.3686. But it is still very difficult to guess what will happen next. The fact is that both linear regression channels are still directed downwards now. However, the downward movement itself over the past 8 months has been reluctant. Usually, everything goes according to the following scenario: the pair decreases by 500-600 points, and then it recovers by 400-500. Following this logic, a new round of upward movement has now begun, again by 400-500 points. To continue, it requires overcoming the moving average line. On the other hand, "profitability in the past does not guarantee profitability in the future." Thus, this time, the downward movement may intensify instead of a new round of upward movement being formed. What can help the dollar sharply continue its downward movement? From our point of view, there are no such factors now. The economic, political, and geopolitical situation in the UK remains very difficult, although perhaps many crises are not visible to the naked eye. On the other hand, the Bank of England almost raised the key rate in November. And many experts believe that he will do it next month. At the same time, what will happen to the QE program, which has not yet begun to collapse, is not yet clear. Let me remind you that raising the rate in the absence of a reduction in the QE program is like putting on the brake and gas at the same time. The British are no longer happy with Brexit. Each of them will pay about $ 1,700. A couple of weeks ago, we already wrote that more than half of the Britons who participated in the latest opinion polls expressed their dissatisfaction with the results of Brexit. According to research results, only about 20% are satisfied with the results of Brexit. However, the UK government continues to talk about a "bright future" for the whole country and each of its citizens individually, successfully (or unsuccessfully) trying to disguise the losses from Brexit under the losses from the coronavirus pandemic. As blasphemous as it may sound, Boris Johnson and his cabinet even benefit from a pandemic, because without it, the people and the opposition would clearly understand what Brexit is worth for their country. And since the results of government policy are directly related to the terms of this government's stay in power, it is simply advantageous for Boris Johnson to blame everything on the COVID pandemic. Meanwhile, many experts and the media have long estimated that the losses from the country's exit from the European Union will be at least twice as strong as from the pandemic. Of course, these calculations were made taking into account that the epidemic will no longer cause serious blows to the economy. According to various estimates, the country will miss 4% of GDP due to Brexit. But the Center for the Study of UK Trade Policy has estimated that the losses from Brexit will be 178 times higher than the benefits of independence. It was estimated that in the next 15 years, the country will suffer enormous losses, and every Briton will pay an average of $ 1,700 for the country's exit from the EU. It was also estimated that the benefits of Brexit will bring the country about 0.1-0.2% of GDP is about 3-7 pounds sterling for each Briton. Experts note that the two dozen trade agreements that Boris Johnson has concluded or will conclude with other countries of the world will have virtually no real benefit for London. And there is no trade agreement with the United States, as Johnson promised, and it is unknown when it will appear at all. Thus, so far, Brexit for the UK turns out to be a serious failure.

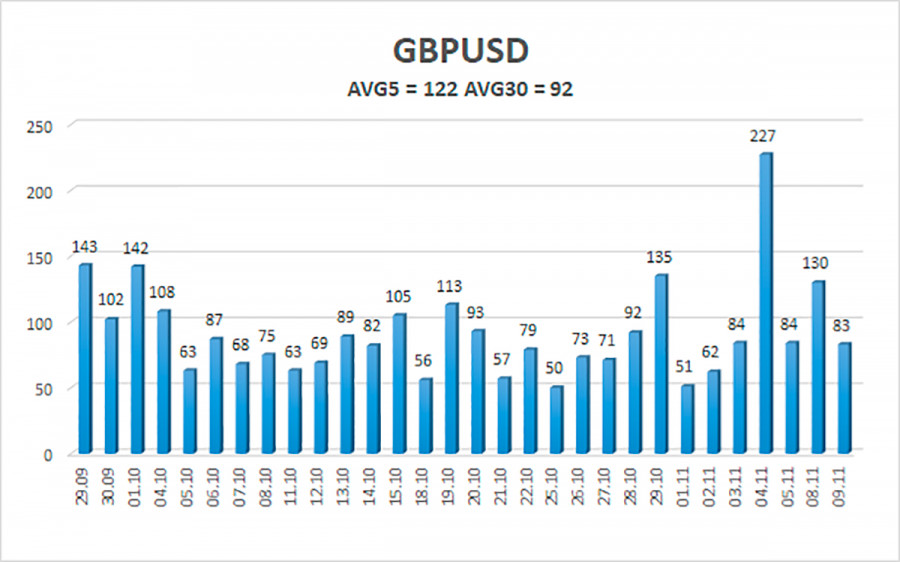

The average volatility of the GBP/USD pair is currently 122 points per day. For the pound/dollar pair, this value is "high". On Wednesday, November 10, we expect movement inside the channel, limited by the levels of 1.3435 and 1.3688. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement. Nearest support levels: S1 – 1.3550 S2 – 1.3489 S3 – 1.3428 Nearest resistance levels: R1 – 1.3611 R2 – 1.3672 R3 – 1.3733 Trading recommendations: The GBP/USD pair continues to be below the moving average on the 4-hour timeframe, so the trend remains downward. Thus, at this time, new short positions with targets of 1.3489 and 1.3435 levels should be considered, as the price bounced off the moving average. Buy orders can be considered if the price is fixed above the moving average line with targets of 1.3672 and 1.3688 and keep them open until the Heiken Ashi turns down. Explanations to the illustrations: Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now. Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now. Murray levels - target levels for movements and corrections. Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators. CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching. The material has been provided by InstaForex Company - www.instaforex.com |

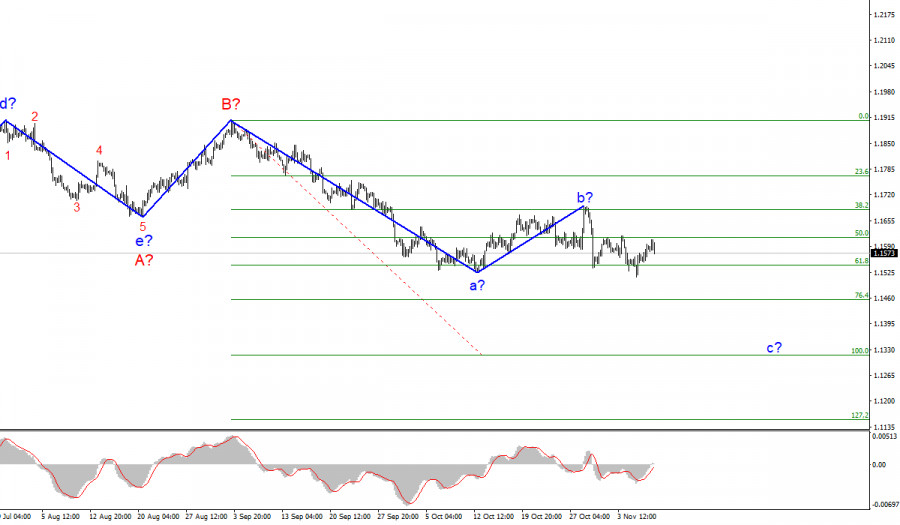

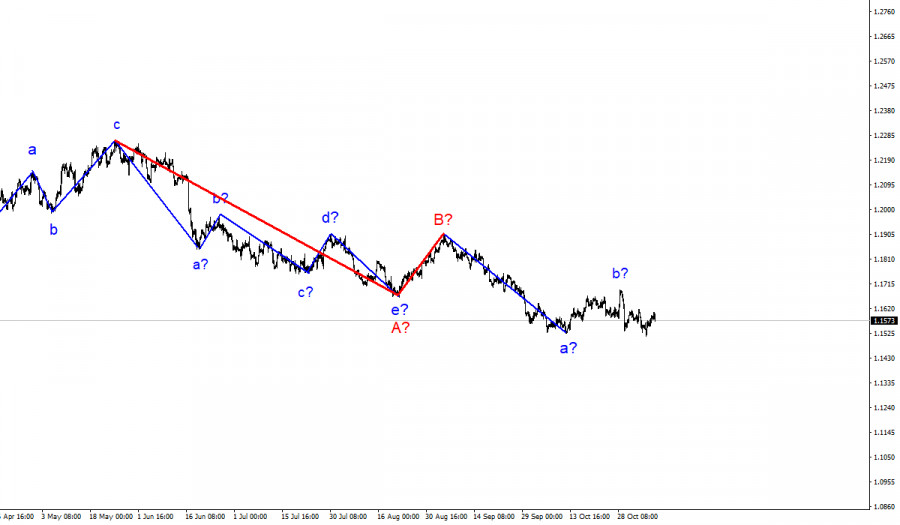

| Overview of the EUR/USD pair. November 10. The US dollar is slowly creeping down Posted: 09 Nov 2021 04:14 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. The EUR/USD currency pair continued indistinct movements on Tuesday. Unfortunately, the more or less powerful movement last week after the Fed meeting remained an isolated case. At this time, it is visible that the bears have not managed to overcome the Murray level of "3/8" - 1.1536. Thus, the prospects for strengthening the US currency remain rather vague. However, if we take into account the fact that the pair continues to move just very sluggishly and very slowly, then the following conclusions can be drawn. For example, can the US dollar rise by 200 points in the next three months? Yes, it can. Can the euro currency rise by 200 points over the next three months? Yes, it can. The problem now is not that the pair cannot or does not want to move up or down, but that all these movements are extremely weak. What's the use of moving 200 points in 2-3 months? In fact, in the current conditions, you either need to use a higher timeframe in trading (a daily or weekly one), and be in one transaction for 5-10 working days, during which you may be able to earn 100 points, or trade at the smallest TF, carefully monitoring any manifestations of the flat. In any case, the technical picture remains as uncomfortable as possible for traders. Recall that this was not always the case. Just a year ago (not to mention earlier periods), the euro/dollar pair regularly passed 60-80 points per day, which allowed it to be traded on any TF. Now, unfortunately, the situation is different. Too much has changed in the world over the past year and a half. What can the markets pay attention to? Unfortunately, there is nothing to pay attention to at this time. Which of the upcoming or recent events can be called trend-forming or at least very important? After the Fed meeting last week, the US dollar rose by 100 points, and after the ECB meeting the week before last - by 150 points. But what has it changed for the pair and traders? Let's take another look at the illustration above: the euro/dollar pair has been between the levels of 1.1536 and 1.1658 for a month and a half. And at the same time, this range cannot even be called a side-channel, since the movement itself is unlike a flat. Now the following option is possible: the price will go down 100-200 points at some point in time, after which it will take a break for another one and a half to two months, during which it will trade in a new sideways range. That's how the pair is moving now. Moreover, this judgment is true for almost all timeframes. It is difficult to distinguish anything at all from the "foundation" now. After the meetings of the EU and US central banks were held, the markets were able to understand where both regulators will look in the coming year, but again, what does this change for the euro/dollar pair? Yesterday it became known that about half of the Fed's monetary committee supports one or even two rate hikes next year, but what does this change for the dollar? If this happens, then next year. It is hardly advisable to buy the dollar now, because, in the second half of 2022, the Fed may raise the rate. And in the European Union, there is no question of raising the key rate at all, as Christine Lagarde openly stated. Thus, monetary policy remains a little more hawkish in the United States. But the US also has a slightly more extensive quantitative stimulus program, as well as a "slightly more huge" public debt, which is likely to continue to grow in the near future. Thus, we would say that it is best now to consider the option with a gradual downward correction on the 24-hour TF, but keep in mind that at any moment an upward reversal may occur and the global upward trend will resume.

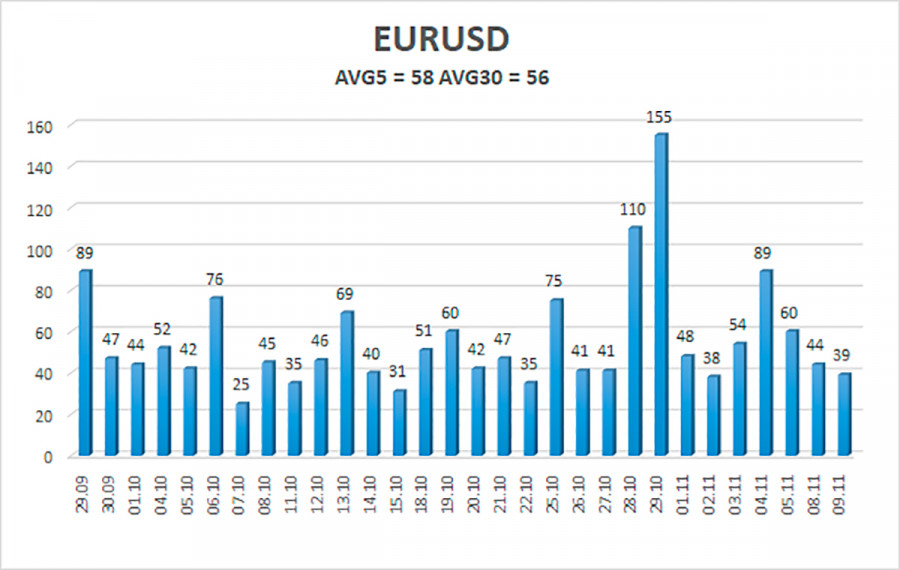

The volatility of the euro/dollar currency pair as of November 10 is 58 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1533 and 1.1649. A reversal of the Heiken Ashi indicator back down will signal a round of downward movement. Nearest support levels: S1 – 1.1536 S2 – 1.1475 S3 – 1.1414 Nearest resistance levels: R1 – 1.1597 R2 – 1.1658 R3 – 1.1719 Trading recommendations: The EUR/USD pair remains just above the moving average line. Thus, today you should stay in long positions with a target of 1.1649 as long as the price is above the moving average. Sales of the pair should be considered if the price is fixed back below the moving average, with a target of 1.1536. However, it should be taken into account that the whole movement is now as "flat-shaped" as possible. Explanations to the illustrations: Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now. Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now. Murray levels - target levels for movements and corrections. Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators. CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2021 01:39 PM PST

This week, the focus of the markets will remain on inflation and policy makers' discussion of interest rates in the United States. Senior members of the Federal Reserve have not yet given the markets new food for thought, the mood in the central bank is rather dovish, which keeps the dollar from further growth. The Fed is "far from considering raising interest rates," Fed Vice Chairman Richard Clarida recalled the day before. However, there are increasingly disputes among politicians about how many more jobs the economy can add and how long high inflation can be tolerated. "If inflation is going to be more sustained than we're talking about right now, then I think we may have to take somewhat faster action to keep inflation under control," says James Bullard of the Federal Reserve Bank of St. Louis. Fed Chairman Jerome Powell is still more than restrained on policy tightening. On Tuesday, at a virtual conference, he made it clear that he was sticking to the same line. In other words, the Fed will take a wait-and-see attitude and pay more attention to further steps towards maximum employment before raising rates, despite dangerously high inflation. The dotted graph suggests that most Fed officials expect a steady rate hike in 2023 and 2024. Anyway, investors are now expecting an interest rate hike in the middle of next year due to galloping inflation. According to the St. Louis Federal Reserve, inflation expectations in the United States rose on Monday to the highest levels since October 27. This indicator is one of the drivers pushing the Fed to start raising rates. On Wednesday, investors' attention will be focused on consumer inflation, where the main indicator may approach 6%. This will once again cause disputes about possible actions of the regulator and will unnerve holders of US government bonds. The dollar may experience support against this background. Until then, short positions will be a priority for the US currency. Before the publication of the data block, traders are likely to refrain from any movements, which means that the dollar index will consolidate around the current levels, according to currency analysts. Both pictures (technical and fundamental) indicate the preservation of the prospects for the growth of the dollar. The October payrolls allowed the greenback to test the area of this year's highs at 94.50 again, but there was not enough strength to break through. If this breakdown is destined to happen in the short term, it will happen more likely in November. In December, as we know, seasonal factors are on the side of bears of the US currency. It is possible that inflation will be the important link in the chain of positive factors for the dollar. The breakdown of an important level may occur this week.

Nevertheless, it is still not worth confidently clinging to the idea of the dollar's growth, since there is also a negative for it. The question is, will it develop further? In addition to soft rhetoric, the pressure comes from an improvement in market sentiment amid expectations of the long-awaited adoption of the law on infrastructure spending. Positive data from China brought to the markets. In October, export growth was 27.1%. The most unpleasant thing for the greenback is the personnel reshuffle at the Fed. According to the information available on the web, two candidates are being considered for the position of Fed Chairman – Jerome Powell and Lael Brainard. The choice in favor of the second candidate is the main risk for the dollar on the short-term horizon. It is unlikely that the Fed will talk about tightening policy or any drastic measures in response to accelerating inflation, until the name of the new head of the central bank is known. Will the euro take advantage of this chance? Too illusory, given high inflation and a reduction in the Fed's asset purchases. The euro's recovery momentum may be exhausted faster than markets expect. The euro currency paired with the dollar risks going to levels below 1.1400. The pressure on the euro against the pound is already noticeable. Support is located at 1.1550, 1.1505, 1.1425. Resistance is at 1.1615, 1.1635 and 1.1690.

|

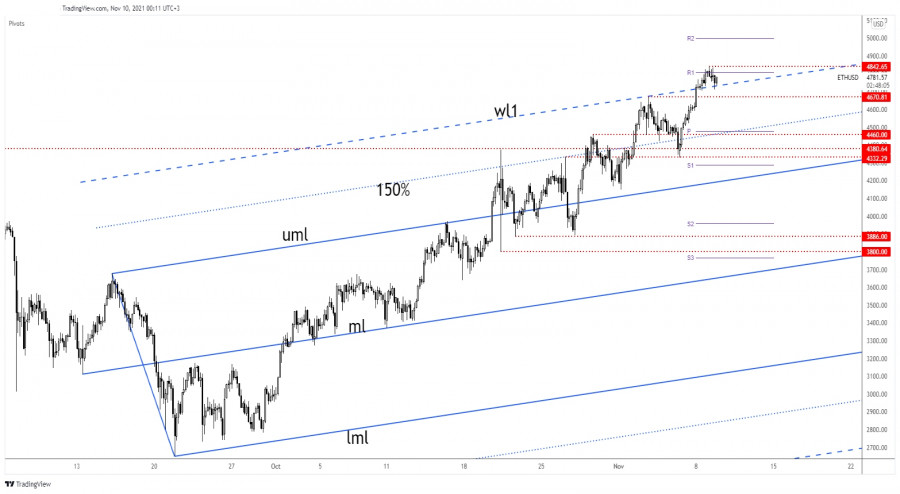

| Ethereum hits new all-time high of 4,842.65 Posted: 09 Nov 2021 01:17 PM PST Ethereum is trading in the red at 4,745.97 at the moment of writing. Still, the current retreat could be only a temporary one after reaching a new all-time high. Bitcoin has retreated a little as well after reaching a new record high of 68,564.40. BTC/USD's rally helped altcoins to climb higher as well. Personally, I am using this correlation in crypto trading. Ethereum is up by 0.14% in the last 24 hours and by 5.38% in the last 7 days. After reaching a new all-time high, we cannot exclude a temporary decline. So, maybe you should wait for a temporary correction before taking action again. ETH/USD Retests Broken Resistance

As you can see on the H4 chart, the price of Ethereum has jumped above the ascending pitchfork's warning line (wl1). It has found resistance right above the weekly R1 (4,808.71). Now, it has decreased a little to retest the warning line (wl1). Staying above this level could signal potential growth. Dropping and stabilizing below this dynamic resistance could announce a larger retreat. On the other hand, making a new higher high, that is, a new historical high, and stabilizing above the weekly R1 could activate potential growth towards the 5,000 psychological level. ETH/USD OutlookThe bias is bullish as long as it stays above the warning line (wl1) and above 4,670.81 former high. Coming back and stabilizing above the R1 (4,808.71) may signal strong buyers and potential further growth. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD upside reversal coming! Posted: 09 Nov 2021 01:09 PM PST

USD/CAD 1.2500 Psychological Level Stands As TargetUSD/CAD is somehow expected to climb higher after jumping above the downtrend line. You already know from my analysis that jumping above the downtrend line could activate an upside reversal. It is now trading at 1.2444 and it was almost about to test the 1.2431 former high. Technically, after failing to test and retest the broken downtrend line, USD/CAD signaled strong buyers. It could resume its growth as long as it stays above 1.2431. USD/CAD Trading ConclusionUSD/CAD dropped a little but the retreat could be a temporary one before resuming its growth. Jumping above 1.2468 Friday's high could confirm further upward growth. 1.2500 could be used as a first upside target. The material has been provided by InstaForex Company - www.instaforex.com |

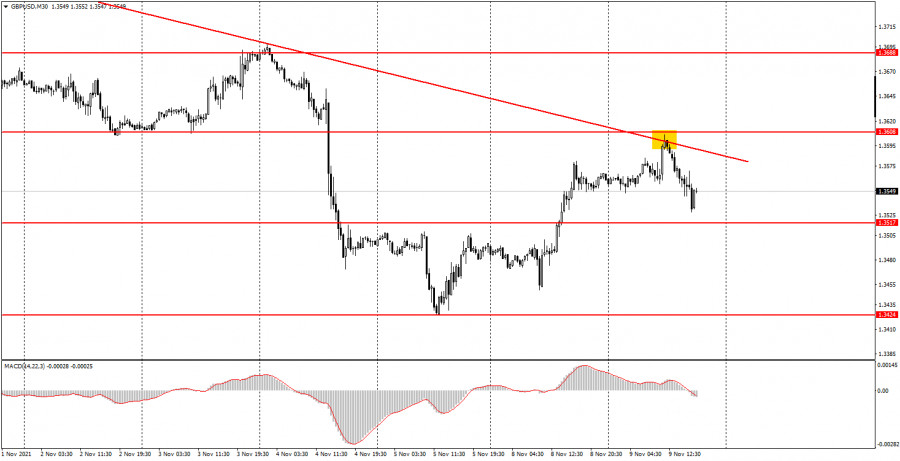

| Posted: 09 Nov 2021 01:03 PM PST Analysis of previous deals: 30M chart of the GBP/USD pair

The GBP/USD pair rose to the downtrend line, bounced off it and corrected slightly downwards on the 30-minute timeframe on Tuesday, November 9. Thus, the downward trend continued. Also, a sell signal was generated today, as the price bounced off the trend line, therefore, at the 30-minute TF, it was also possible to open trades for once. In our case, for short positions. As you can see, this signal turned out to be profitable, and the price went down about 65 points in total, which was more than enough to trigger Take Profit. Thus, before the price settles above the trend line, a downward movement will be preferable. As for the macroeconomic statistics, there were none today. Not in the UK, not in the US. But the fundamental background promised to be strong enough, but neither Federal Reserve Chairman Jerome Powell's speech, nor Bank of England Governor Andrew Bailey's speech provoked any reaction from traders. However, we warned about this yesterday in our articles: all the most interesting from the central banks were announced last week. 5M chart of the GBP/USD pair

On the 5-minute timeframe, the technical picture on Tuesday was almost perfect. A small number of trading signals were generated and almost all of them turned out to be profitable. Let's take a closer look at them. The first two signals were almost identical - the price bounced off the 1.3579 level. That is, a sell signal was formed, which should have been worked out with a short position. However, the price went down by only 10 points and returned to the level of 1.3579, and then overcame it. Therefore, the loss on the first trade was 17 points. Long positions should have been opened on a signal to overcome the level of 1.3579. And since the pair bounced off the next level 1.3606, they should have been closed near it. Profit - 13 points. Close and immediately open new short positions, as there was a rebound from the level of 1.3606. A little later, the pair broke through the level of 1.3579, that is, shorts had to be kept open. As a result, the price went down 75 points in total, so any Take Profit could have triggered this deal. As a result, novice traders could earn at least 50 points today. How to trade on Wednesday: At this time, the downward trend continues on the 30-minute timeframe. Therefore, in case of overcoming the level of 1.3517, the downward movement may continue with the next target of 1.3424. But overcoming the trend line may, on the contrary, signal a very likely growth of the British currency in the coming weeks. The important levels on the 5-minute timeframe are 1.3415, 1.3470, 1.3517, 1.3579, 1.3606, 1.3638. We recommend trading on them on Wednesday. The price can bounce off them or overcome them. As before, we set Take Profit at a distance of 40-50 points. At the 5M TF, you can use all the nearest levels as targets, but then you need to take profit, taking into account the strength of the movement. When passing 20 points in the right direction, we recommend setting Stop Loss to breakeven. Novice traders should only pay attention to the report on US inflation on November 10. The consumer price index threatens to rise to 5.7-5.8%, so the market reaction may follow immediately and be quite strong. There won't be anything interesting in the UK tomorrow. Basic rules of the trading system: 1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin and Ethereum are just warming up and going into a rage: new highs are just around the corner Posted: 09 Nov 2021 01:03 PM PST

Bitcoin and Ethereum are just warming up, and they are still far from their potential new all-time highs. Recently, Bitcoin crossed the $68,000 mark, and Ethereum - $4,800. The market capitalization of the crypto market has crossed the $3 trillion milestone due to the bull run of bitcoin and ethereum, and now the crypto market is completely in the grip of the bulls. Last year, well-known technical analyst Adrian Zdunczyk, who heads The Birb Nest trading group, predicted new highs for bitcoin in the fourth quarter of 2021, and even that it would exceed the $66,000 mark in October. Ethereum is trading at a price of $4,800, and Zdunczyk believes that Ethereum has huge opportunities to set new super-high targets and overcome the $20,000 milestone as early as next 2022. If Zdunczyk turns out to be right, then Ethereum will rise in price by more than 300% by the beginning of 2022. Ethereum has already grown by more than 500% since the beginning of the year, as the demand for NFT and Defi has been enormous. Ethereum will soon fully switch to the new eth 2.0 protocol, which contributes to even greater scalability of the network and will make gas commissions much lower. This can become a catalyst for the increased growth of the main altcoin. However, Ethereum is already breathing down the back of such a competitor as Solana, which also works with smart contracts, but the commissions within the network are much lower. Gemini co-founder Tyler Winklevoss believes that Ethereum is the best financial instrument, and this money will never depreciate. He is sure that the growth of Ethereum is just beginning. Winklevoss believes that the rally that can be observed now is similar to the 2017 market. The analyst is confident that this extreme jump will be at least up to the level of $14,000. Now Ethereum is the second cryptocurrency by capitalization, the main goal of Ether is to overcome the $1 trillion milestone. The material has been provided by InstaForex Company - www.instaforex.com |

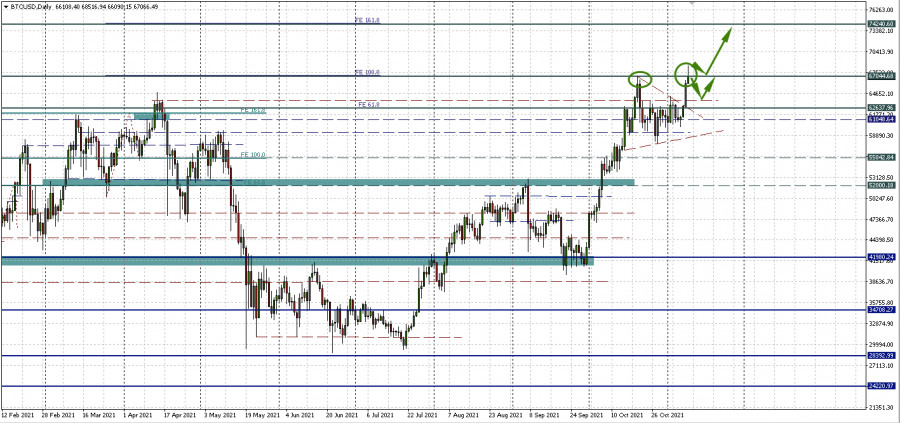

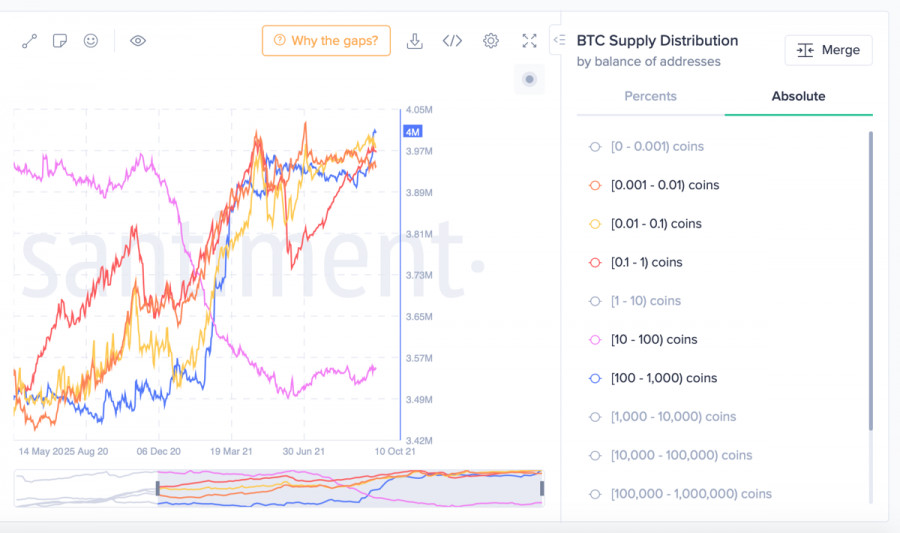

| Bitcoin: updating the all-time high is not a fix for you! Be careful! Posted: 09 Nov 2021 01:02 PM PST Well, we've waited! Bitcoin has updated its record high, reaching 68,500 dollars for one coin today. Fears about a deeper correction were not justified, the triangle was broken to the upside. Will the growth continue now and what catalysts will push the main cryptocurrency to new record values? Institutions flee inflation Only the lazy one doesn't talk about it now. And the Federal Reserve is still very soft on restraining inflationary pressure. Against this background, institutional investors are looking for more reliable assets. Marketing experts believe that this is one of the main factors of interest in the traditional stock market and the new cryptocurrency market for major players. It is worth noting that a report on the US consumer price index will be released on Wednesday, and if it turns out to be stronger than the forecast, bitcoin may get another driver for strengthening. By the way, today's update of the highs may signal the beginning of the final rise in the fourth quarter, before the cryptocurrency market demonstrates a more pronounced consolidation next year. How things are on the web: whales are accumulating, hashrate is growing, bitcoin is preparing an update In yesterday's Glassnode report, it was indicated that the total balances of bitcoins on cryptocurrency exchanges are constantly decreasing. In parallel, it is known that bitcoin whales are increasing their positions. Over the past five days, cryptophytes with a balance of 10,000 to 100,000 BTC have accumulated 43,000 bitcoins on their wallets. Meanwhile, the hashrate has every chance to set new records before the end of the year. And this is after it plummeted in the middle of 2021 due to Chinese repression. Also in line is the biggest bitcoin upgrade in four years, with an emphasis on improving transactions, privacy and efficiency. The Taproot upgrade will also add smart contract functionality - a key feature of blockchain technology. The planned BTC update will occur even with bolder forecasts regarding the prospects for price growth. For example, JP Morgan previously claimed that BTC could reach $146,000 by the end of the year with a short-term target price of $70,000. Bitcoin: where next? Today, at the time of writing, bitcoin has lost some of its morning positions. There are 67,000 left from 68,500. Moreover, the breakdown of the resistance of 67,044.68 now looks like a false one - the level is punctured by a shadow. Of course, it's not evening yet, that is, the day candle is not closed. So it can still be. But consolidating above the level of 67,044.68 now is a key factor for the further growth of the cryptocurrency. If the main cryptocurrency manages to be on the other side of the October high, you can expect a fast or slow growth first to the round level of $ 70,000 per bitcoin, and then to $74,000, where the level of 161.8 Fibo Expansion passes. The second scenario, less optimistic, is consolidation in the range of 63,722.20-67,044.68. And it is likely that tomorrow's inflation data will become a local catalyst or an increase in flight to the main cryptocurrency. But this is not accurate, since bitcoin has not yet reacted as sensitively to the news at the moment as the US dollar.

|

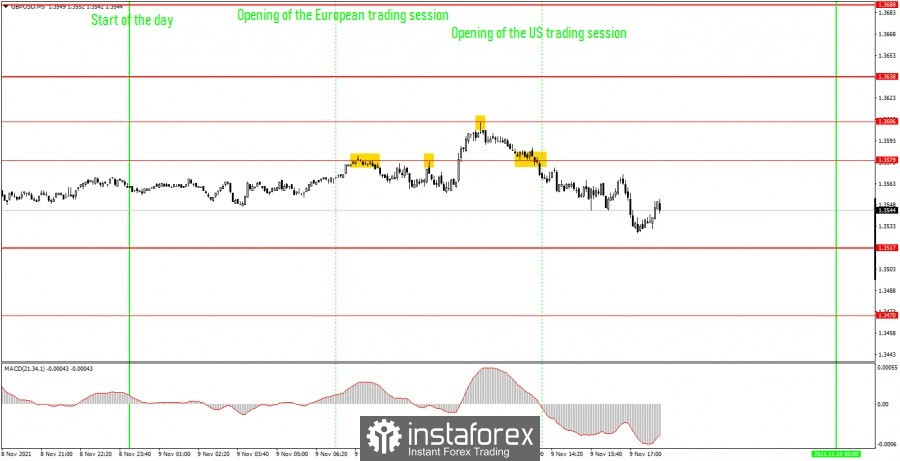

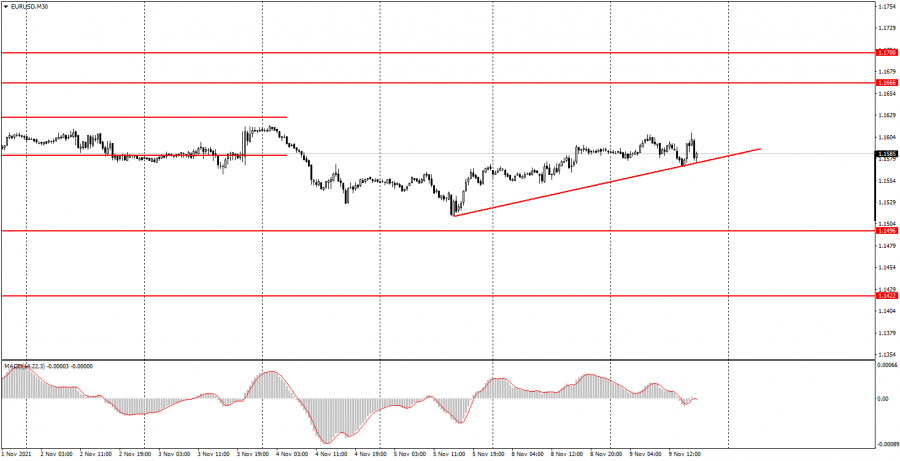

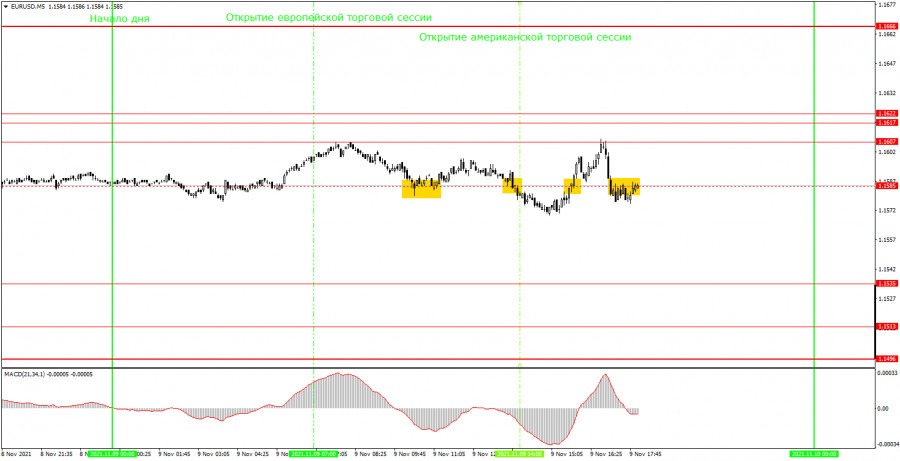

| Posted: 09 Nov 2021 11:35 AM PST Analysis of Tuesday trades EUR/USD on M30

On Tuesday, EUR/USD continued its uptrend and even formed an ascending line. However, we would like to pay your attention to the volatility of the pair. For example, today the volatility range was 40 pips while yesterday it was 44 pips. Thus, the volatility rate is very weak at this time. The same goes for the ascending line which is of a purely formal nature. The price can settle below this line at any moment. The entire range of the price movement between the high and the low of the trend is found within just 95 pips, which took the pair 3 days to overcome. Thus, if the price makes a clear rebound from this trendline, we can consider buying the pair on a 30-minute time frame. But you should be very careful here, otherwise, you'd better give up this idea. I would say that the technical picture on this time frame remains extremely unfavorable for traders as it is the most difficult scenario to trade with. No macroeconomic reports were released on Tuesday in both the United States and the EU. The speeches by Christine Lagarde and Jerome Powell did not give any clues to the markets and, therefore, did not prompt any repose from them. EUR/USD on M5

On the 5-minute time frame, the pair's trajectory was very uneven on Tuesday. As you can see in the illustration above, the price has crossed the level of 1.1585 several times but this level has lost its relevance by the end of the day. When the price repeatedly crosses the same level, this is the first sign of an upcoming flat movement. Actually, this is what we were observing for the whole day. At the moment, the flat movement is clearly distinguished, but during the European session, it was not so obvious. Thus, traders should have tried to use the first two signals near the level of 1.1585. Yet, these signals eventually brought losses to beginners. The first buy trade closed with a loss of 11 pips. The second sell trade brought 10 pips of losses. Both times the price moved in the right direction by only 10 pips, which was not enough even to set Stop Loss to a breakeven point. The last two trading signals also turned out to be false. Novice traders should not have followed them as two false signals had already been formed near the level of 1.1585 by that time. Trading tips for Wednesday An ascending trend line has been formed on the 30-minute time frame at this time. If it stays in place until tomorrow, then you can trade long after the price rebounds from this level. However, it is more likely that the price will consolidate below this trend line as soon as today. On a 5-minute time frame, the key levels for November 10 are found at 1.1535, 1.1607, 1.1617, and 1.1622. As usual, Take Profit should be set at the distance of 30-40 pips. Stop Loss should be placed to a breakeven point as soon as the price passes 15 pips in the right direction. On M5, the nearest level could serve as a target unless it is located too close or too far away. If it is, then you should act according to the situation or trade with the Take Profit. On Wednesday, we would advise beginners to focus on the US inflation report which will be released in the afternoon. Despite the fact that the pair has been holding in the sideways channel for more than a month (as can be clearly seen on higher time frames), the reaction to this report can be very strong. Basic rules of the trading system: 1) The signal strength is determined by the time it took to form the signal (a bounce or a breakout of the level). The quicker it formed, the stronger the signal is. 2) If two or more positions were opened near a certain level based on false signals (which did not trigger Take Profit or reach the nearest target level), then all subsequent signals from this level should be ignored. 3) In a sideways channel, a pair can form multiple false signals or not form them at all. But in any case, at the first sign of a flat movement, it is better to stop trading. 4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually. 5) You can trade using signals from the MACD indicator on the 30-minute time frame only given that volatility is good and there is a clear trend that should be confirmed by a trendline or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels. On the chart Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are channels or trendlines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines). Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD attention at resistance Posted: 09 Nov 2021 11:14 AM PST At the moment of writing, the EUR/USD pair was trading in the red at 1.1576 level after failing to stay near 1.1608 today's high. Technically, the price reached a resistance area, so a new bearish momentum is natural. Also, the currency pair drops as the Dollar Index rallies. The index ended its correction and now it looks to trade higher. Fundamentally, the eurozone ZEW Economic Sentiment was reported higher at 25.9 points versus 20.6 expected and compared to 21.0 in the previous reporting period. Furthermore, the German ZEW Economic Sentiment surged from 22.3 to 31.7 points, whereas specialists expected a potential drop to 20.3 points. Despite positive data, the euro failed to keep the pair higher. On the other hand, the US data came in mixed. The PPI registered a 0.6% growth matching expectations, while the Core PPI rose only by 0.4% versus 0.5% expected. EUR/USD new sell-off

As you can see on the H4 chart, EUR/USD rebounded after registering a major bullish engulfing on the 1.1529 level. Now, it has reached 1.1602 - 1.1612 resistance area where it has found supply again. It has failed to reach and retest the Descending Pitchfork's median line (UML) signaling strong pressure. Still, it remains to see what will really happen as the rate failed to approach and reach the Descending Pitchfork's median line (ML) signaling that the downside movement is over. EUR/USD forecastStaying near the Descending Pitchfork's upper median line (UML) could announce an imminent upside breakout. Making a valid breakout above the upper median line (UML) and taking out the 1.1602 - 1.1612 area, a new higher high, could signal an upside reversal. The material has been provided by InstaForex Company - www.instaforex.com |

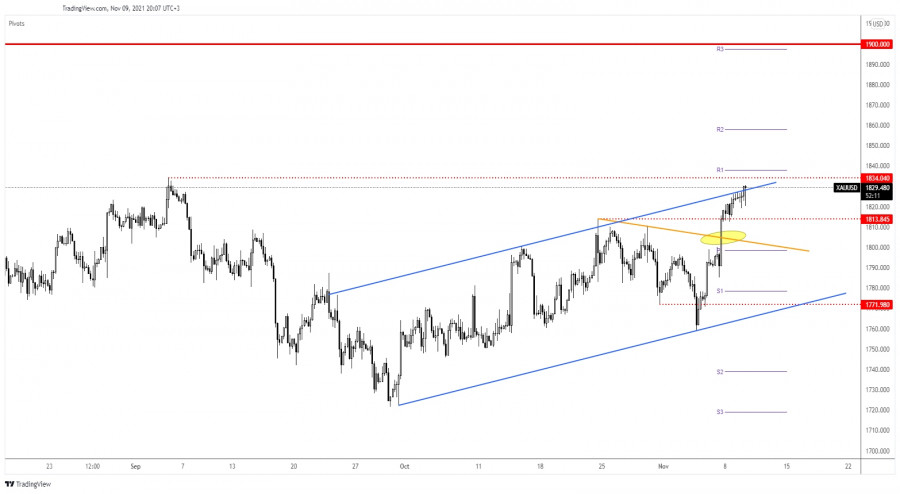

| Gold moves towards new highs as DXY remains under pressure Posted: 09 Nov 2021 11:07 AM PST Gold is trading in the green at 1,829.97 and it seems strong enough to approach and reach new highs. As you already know from my previous analyses, XAU/USD was somehow expected to resume its upside journey after ignoring the 1,800 psychological level. Earlier today, the PPI came in line with expectations while the Core PPI was reported worse than expected. As long as DXY continues falling, the yellow metal may extend its growth. Tomorrow, the US Consumer Price Index is expected to report a 0.6% growth in October versus 0.4% growth in September, while the Core CPI may register a 0.4% growth in the last month compared to only 0.2% in September. The US inflation data could be decisive and could shake the markets. Most likely, XAU/USD will register sharp movements in the short term. Gold up channel breakout

XAU/USD has managed to jump and close above the channel's upside line. The level of 1,834.04 stands as a static resistance, as an upside obstacle. Stabilizing above the upside line and making a valid breakout through 1,834.04 could validate further growth. On the other hand, finding strong resistance at 1,834.04 and failing to stay above the upside line could announce a potential drop. Actually, a temporary decline was somehow expected after its leg higher. Gold predictionPersonally, I would like to see a temporary consolidation above 1,813.84 before the price resumes its growth. Importantly, gold is near the resistance, so you should be careful. Jumping, closing, and stabilizing above 1,834 could confirm an upside continuation and could bring new long opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2021 10:22 AM PST |

| November 9, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 09 Nov 2021 08:53 AM PST

Recently, Persistence below the depicted price zone of 1.1990 indicated further downside movement towards 1.1840 and 1.1780 where a sideway consolidation range was established. During last week, the EURUSD pair has been trapped within a narrow consolidation range between the price levels of 1.1780 and 1.1840. A bullish breakout was executed above 1.1840 shortly after. Temporary Upside pullback was expected towards 1.1990. However, re-closure below the price level of 1.1840 has initiated another downside movement towards 1.1780 which failed to hold prices for a short period of time before significant upside movement was presented into market. Intraday traders were advised to wait for candlestick closure above 1.1780 - 1.1840 for another ascending swing to be initiated. However, immediate downside selling pressure brought the pair down below 1.1700. More downside movement took place towards the price level of 1.1600 where significant buying pressure existed. Market price slided below 1.1700 and 1.1600. This has enhanced further decline towards 1.1500. Currently, the price zone around 1.1700 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon any upcoming ascending movement. The material has been provided by InstaForex Company - www.instaforex.com |

| November 9, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 09 Nov 2021 08:50 AM PST

Bearish persistence below the price zone of 1.2050-1.2000 allowed the recent downtrend to be established. So, the EURUSD pair has expressed significant bearish decline while the price level of 1.1650 stood as a prominent demand level that prevented further bearish decline. The bullish pressure that originated around 1.1650 failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. Bullish signs were expected around the price levels of 1.1650-1.1700 as it corresponded to a recent previous bottom. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was about to be reached if sufficient bearish momentum was maintained. Moreover, significant bullish recovery has originated recently upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which still stands as an Intraday Support zone. Hence, sideway movement maybe expected in the nearest future. Please note that any Bullish movement above 1.1680 should be considered as an early exit signal to offset any SELL trades. The material has been provided by InstaForex Company - www.instaforex.com |

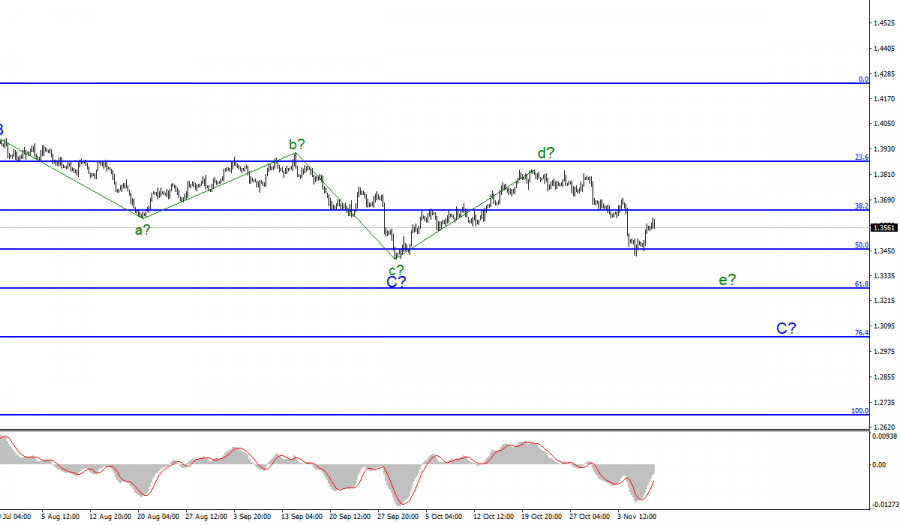

| November 9, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 09 Nov 2021 08:49 AM PST

The GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline. On the other hand, the nearest SUPPLY level was located around 1.4000 where bearish rejection and a valid SELL Entry was anticipated. The recent bullish rejection witnessed around 1.3600 as well as the temporary bullish breakout above 1.3830 indicated a high probability that this bullish movement may pursue towards 1.4025 then 1.4100. However, the pair remained trapped within a fixed price range until significant bearish momentum emerged into the market. Bearish breakout below 1.3680 enabled further bearish decline towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement. This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.3720 which was temporarily bypassed. Shortly after, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market. Currently, the short-term outlook is bearish as long as the pair maintains its movement below 1.3730. Another bearish visit was expected towards 1.3400 where significant bullish rejection was expressed as it corresponded to significant Fibonacci Expansion Level. Currently, the price level of 1.3570 stands as an intraday resistance level to be watched either for bearish reversal or a continuation pattern above it. Next bullish target would be located around 1.3720. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of EUR/USD for November 9; Markets do not want to increase demand for the dollar Posted: 09 Nov 2021 08:39 AM PST |

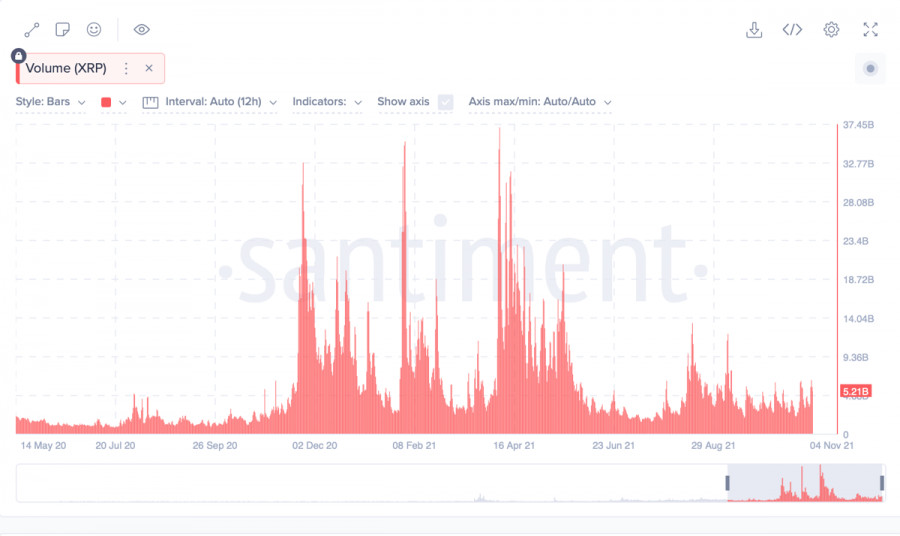

| Posted: 09 Nov 2021 08:10 AM PST Over the past six months, the market may have had an erroneous idea about the problematic nature of the Ripple token, which, due to the SEC's prosecution, significantly slowed down the growth rate. However, if you look at the reporting of the issuing company, you can see a 400% increase in cryptocurrency sales, as well as large-scale plans for the development of the coin ecosystem and the system of cross-border payments. The project is trying in every possible way to refresh the audience with local "rebranding" and distract it from litigation with the regulator. However, taking into account the latest news, there is a high probability that the dispute will end in 2021 with a settlement agreement. Ripple CEO Brad Garlinghouse hinted at such an outcome back in September 2021 during an interview on Fox Business 24. The CEO said that the company was ready to meet the regulator halfway, but only if a point and a common ground for the status and plans for the future current on XRP. The entrepreneur compared the potential of the cryptocurrency to precious metals and emphasized that the project has ambitious plans to expand functionality and additional opportunities for adjacent digital fields. According to a recent statement by a Bloomberg expert, the regulator and Ripple are at an advanced stage of concluding an amicable agreement, according to which the XRP issuer will pay the SEC a certain amount as a fine. It is reported that the litigation may be completed by the end of 2021. An important step towards resolving conflict between the regulator and the company Ripple could be the recent "rebranding" of the cryptocurrency, thanks to which the project managed to distance itself from the legal negativity. This is evidenced by the growth of on-chain activity in the coin network, as well as a 12% increase in the cost of the coin per day and after the announced changes. The market has always reacted positively to the local victories of the project over the SEC, which was reflected in the growth in quotes and gave confidence that investors are still interested in the XRP token. Thanks to the confident actions of Ripple, systematically expanding the possibilities for cryptocurrency, there was a positive trend in the growth of the number of institutional investors and long-term owners in the second half of 2021. The conclusion of the trial could be a catalyst for the growth of a coin unencumbered by the uncertainty of the future. The XRP price continues to rise and over the past week, the asset has grown by 14.5%, which indicates the growing market interest in the coin.

As of 11:00 UTC, the cryptocurrency has risen in price by 1% over the past day and is trading at $1.23. On the hourly chart, the coin is in the framework of consolidation after a powerful upward impulse movement on November 8. The price is confidently moving above the supertrend line and has bounced off it more than once, which indicates the advantage of buyers. At the same time, quotes have tried at least five times to break through the $1.28 milestone, which acts as a key resistance line for the current day, and if the coin manages to break through this milestone, it opens to further local highs. However, first, the coin needs to push off from the support zone, as indicated by technical indicators: the MACD is declining beyond the zero mark and risks falling into the red zone, and the stochastic continues to decline after the formation of a bearish intersection, indicating a retest of the support zone.

The daily chart shows local signals for the weakening of the upward movement, but the formation of two confident green candles in a row indicates serious interest from investors. The coin is approaching the resistance zone, and therefore a local pullback and a planned decline look like a logical price movement. An important resistance level for XRP is the $1.39 mark, after which the operational space opens up to $1.59, which allows us to count on another influx of investors. Technical charts are in the over-crowded zone, and therefore the current decline is logical within the framework of price stabilization. The nearest key support zone will be the $1.15 mark, from where the price will resume its upward movement. The MACD has formed a bullish intersection and is starting to move up, which indicates a large strength of the long-term upward momentum, and the stochastic and relative strength index are declining into the range of 50-70, which is a bullish zone.

And even if the cryptocurrency is far from establishing new ATHs, its progress is obvious compared to the spring of 2021. Investors are returning to an asset that is great for intraday trading by retail traders, as well as promising for long-term storage by institutions. Therefore, we can say that the Ripple project is returning to the big arena and is ready to compete with leading assets and their ecosystems. With this in mind, there is every chance that in December 2021, the altcoin will finally get rid of the negativity that has plagued the project all year and will begin a full-fledged bullish rally to new historical highs. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading signal for Ethereum (ETH) on November 09 - 10, 2021: sell below $4,800 (strong resistance) Posted: 09 Nov 2021 07:55 AM PST

Since September 29, Ethereum started a bullish wave. It still remains within this channel. However, it could be reaching oversold levels and approaching the strong resistance located in the zone of 5/8 of a murray around the psychological level of 5,000. In view of the fact that a doji is forming in the last daily candle, this technical figure signifies market indecision and will be a sign that the bullish force is running out and there could be a correction in the next few days. Therefore, as long as ETH remains below 4,800, we could sell with targets towards the bottom of the uptrend channel around 4,470. The level of 4,470 coincides with the 6/8 of murray and with the SMA of 21. A strong technical rebound is expected around this zone which could give the necessary momentum to reach the psychological level of 5,000. The outlook in the short and medium term for Ethereum continues to be bullish. It is likely that in the next few hours there will be a technical correction only to trigger a new momentum so that ETH can reach the zone of 8/8. Therefore, we must wait for this key level of support around 6/8 of murray with the purpose of buying Ether. The eagle indicator still has bullish ground to reach the overbought levels. Therefore, this selling strategy makes sense only if Ether remains below the 4,800 level. If ETH breaks this zone, we should avoid selling and wait for the next resistance at 8/8 murray. A sharp break and a consolidation through a daily close below the level of 4,375 (6/8) and below 4,330 (SMA 21) will be a negative signal for Ether and the beginning of a bearish scenario. So, ETH could fall down to the level of 3,750 (4/8) and lower to the 200 EMA located at 3,050. Our trading plan for the next few hours is to sell below 4,800 little by little until ETH reaches a key support of 4,375. This level coincides with the lower line of the uptrend channel and will be for us a new opportunity to buy with targets towards the $5,000 (8/8). Support and Resistance Levels for November 09 - 10, 2021 Resistance (3) 5,000 Resistance (2) 4,922 Resistance (1) 4,843 ---------------------------- Support (1) 4,687 Support (2) 4,549 Support (3) 4,476 *********************************************************** A trading tip for Ethereum for November 09 - 10, 2021 Sell below 4,800 (strong resistance) with take profit at 4,470 (SMA 21), stop loss above 4,870. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD remains bearish despite strong pressure on USD from euro bulls Posted: 09 Nov 2021 07:54 AM PST

On Monday, the greenback was trading under moderate downward pressure, extending losses against its main competitors amid positive risk sentiment in the market. At the end of yesterday's trading, key US stock indices rose by an average of 0.1-0.3%. The S&P 500 closed its eighth consecutive session at record highs. Market participants were focused on the speech of Fed Chairman Jerome Powell. Yesterday, the Fed Chair reiterated that the regulator would use its tools to curb inflation only in case it was holding above the target level for a long time. However, dovish comments by the head of the Federal Reserve regarding the interest rate weakened the US dollar. Jerome Powell noted that tapering of the asset purchase program announced earlier in November did not signal a new rate hike. Against this background, the EUR/USD pair rose by almost 0.3%, extending Friday's rebound from 15-month lows and ending Monday's trading at 1.1590. This morning, the US dollar index continued to decline and went below 94.00 for the first time since the announcement of the Fed's decision on its monetary policy last week. The main currency pair did not hesitate to take advantage of this and went above the 21-day moving average at 1.1605. However, it failed to settle above this level and retreated from 3-day highs reached earlier on Tuesday. Apparently, the single European currency is still struggling to win buyers' favor. And this is hardly surprising since the ECB is known for its firm dovish stance. Moreover, statistical data for the eurozone is ambiguous, and the EU members are now struggling with the fourth wave of coronavirus. The ZEW indicator of current economic sentiment in the euro area fell to 11.6 in November from 15.9 points recorded a month earlier, while the index of economic expectations, on the contrary, rose to 25.9 from 21 points recorded in October. "We remain wary of the eurozone and its currency," the National Bank of Canada said. The outlook for EUR/USD remains gloomy due to such factors as supply chain constraints, rising COVID-19 cases and high energy prices/inflation. At the same time, the ECB remains on the sidelines and, most likely, will move at a slower pace than its counterparts, experts say. Mizuho Bank remains bearish on the euro due to political risks, slowing economic growth, and differences in monetary policies in the US and Europe.

According to strategists at Mizuho Bank, market participants continue to count on the ECB to raise the interest rate in the second half of 2022. However, no member of the ECB's Governing Council has supported the rate hike so far. So, the euro will probably revert to its bearish trend if expectations for such a move wane. On the other hand, it looks like the US dollar will continue its upward trend amid expectations of a rate hike next year. Experts added that the number of COVID-19 cases was rising in the UK and other countries close to the Eurozone. So there is a risk that coronavirus cases may likewise increase in Europe in the near future. Meanwhile, the eurozone economic indicators came in worse than expected in October, and from then on, the European economic recovery could slow even further. "Regarding the coalition talks in Germany, the Social Democrats have reached a basic agreement with the Greens and the Free Democratic Party, and then formal negotiations are to take place. If these negotiations end with no progress, this will bring more political risks," Mizuho Bank said. Meanwhile, concerns about inflation remain on the agenda and inspire hope in greenback fans. On Wednesday, markets will be looking ahead for the release of the US CPI data which is forecast to rise to 5.8% in October, a record reading since December 1990. Market expectations that the US central bank will be forced to tighten its monetary policy in order to contain rising inflation are supporting the USD. "The US currency found resistance in the area of 94.47-94.80. A breakout of this range will allow the dollar bulls to first aim at 96.10 and then at 97.73," analysts at Commerzbank said. Only a close below 93.45 will trigger a decline in the US dollar index to the 55-week moving average at 91.88 and further to the low of July at 91.78. According to Credit Suisse, the euro/dollar pair has reached its top and may resume the main bearish trend soon. "EUR/USD remains above the important support level of 1.1495-1.1493 (the high of March 2020 and 50% retracement of the 2020-2021 bullish trend), with short-term momentum remaining increasingly poor," the bank said. "After a breakout of 1.1495-1.1493, the pair will target the 1.1377-1.1377 support area and the range of 1.1300-1.1290, where we would expect to see another pause. Resistance stays at 1.1614-18, with 1.1632-36 ideally capping. We shall maintain an immediate tactical bearish bias though whilst below 1.1689-95," analysts added. The material has been provided by InstaForex Company - www.instaforex.com |

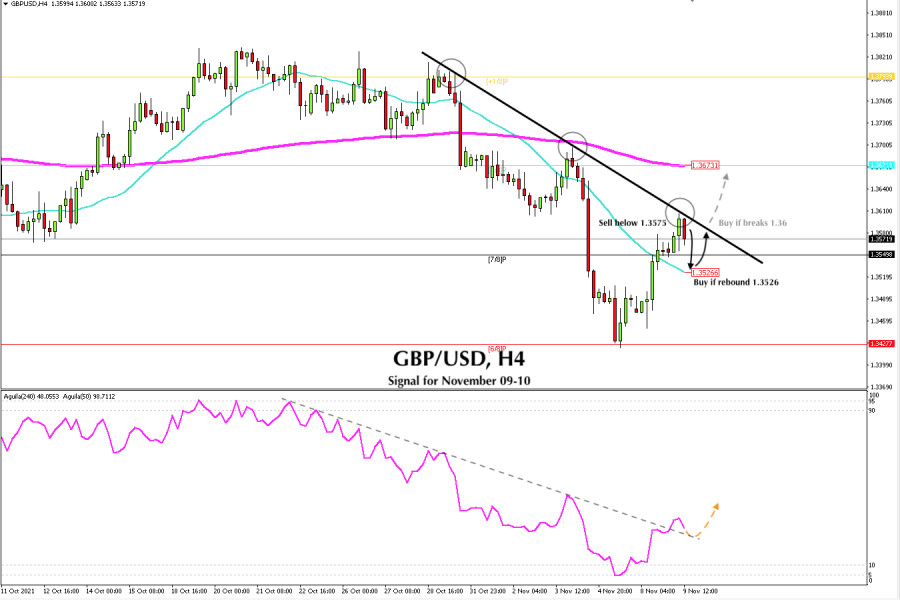

| Trading signal for GBP/USD on November 09 - 10, 2021: sell below 1.3575 (top bearish channel) Posted: 09 Nov 2021 07:05 AM PST

In the European session, the British pound reached the level of 1.36. This level coincides with the top of the downtrend channel that was formed in the 4-hour charts since October 27. You can visualize the three circles that we have drawn which represents a strong resistance for GBP/USD. Below this zone, there will be a correction in the next few hours towards the SMA of 21 located at 1.3526. After falling to 6/8 murray on November 4 around 1.3427, the British pound has made a correction of more than 180 pips. The price now remains above the 21-day moving average and this would represent a positive signal for the pair. As long as GBP/USD remains above this zone, we could expect a technical bounce at 1.3526. If the pair makes a sharp break in the downtrend channel, the price could rise quickly to the zone of 1.3673 where there is the 200 EMA. The market sentiment report shows that there are 64.05% of traders who are buying the GBP/USD pair. This is a negative signal for the pound and more downward pressure is expected in the coming days. Hence, the pair could touch the level of 1.3427. Our trading plan for the next few hours is to sell GBP/USD below the downtrend channel with targets towards the 21 SMA. At this level, we expect a consolidation and it could be an opportunity to buy on a technical rebound with targets towards 1.3580. If the top of the channel is broken, we could continue buying with targets towards 1.3673 where there is the strong resistance of 8/8 of murray. Having fallen on November 4 to the key level of 5-points (extremely oversold market), hte eagle indicator now broke the downtrend channel that originates from October 21. The indicator has managed to move above, which could be a bullish signal. We must wait for a correction to make sure that GBP/USD is set to continue its upward movement to the level of 1.3671. Support and Resistance Levels for November 09 - 10, 2021 Resistance (3) 1.3671 Resistance (2) 1.3649 Resistance (1) 1.3605 ---------------------------- Support (1) 1.3527 Support (2) 1.3476 Support (3) 1.3427 *********************************************************** A trading tip for GBP/USD for November 09 - 10, 2021 Sell below 1.3575 (top bearish channel) with take profit at 1.3526 (SMA 21), stop loss above 1.3610. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading signal for USD/JPY on November 09 - 10, 2021: buy above 112.90 (EMA 200) Posted: 09 Nov 2021 06:26 AM PST

The USD/JPY pair in the European session fell towards the 200 EMA zone located at 112.90. It was trading for a few hours below this zone and now, ahead of the opening of the American market, it is bouncing above this moving average. It could be a good sign that it could reach the 21 SMA around 113.47. Investors' cautious approach supported the Japanese yen acting as a safe haven asset and put some downward pressure on the pair until it reached the price levels of October 11, that is the low of 112.71. Like the Japanese Yen, Gold is another safe haven asset, and yesterday we saw that it reached the 1,828 level, which showed that investors were anticipating any data from the Fed before the end of the month. According to the 4-hour chart, it is seen that the Japanese yen has been consolidating within a downtrend channel since October 8 and on November 8 it reached the key zone of the 200 EMA. Above this level, an upward movement is expected to the area of 114.06, which represents the top of the bearish channel. A sharp break above this level could enable the upward movement to 7/8 around 114.84. On the contrary, a daily close and fixation below the 200 EMA could be the start of a bearish scenario and we could see a pullback towards the 4/8 murray level around 112.50. If this support is broken, a drop to the area of 111.71 located at 3/8 murray could occur. On the other hand, the eagle indicator on November 8 reached the 5-point level that represents extreme oversold coditions. It is possible that in the next few hours there will be a technical rebound. We may take advantage of the situation, only if the pair remains above 112.90. In this case, it will give us a chance to buy with targets at 113.47 and 114.06. The market sentiment report for today, November 9, shows that there are 65.63% of operators who are selling this USD/JPY pair. This is a negative sign and we could see an upward movement in the next few days towards the level of 114.06 and up to 114.84. Our forecast for the next few hours is to buy above the 200 EMA as long as it also remains above the lower line of the downtrend channel with profit taking at 113.47 and 11.406. The eagle indicator is giving bullish signal and supports our strategy of a technical rebound. Support and Resistance Levels for November 09 - 10, 2021 Resistance (3) 113.70 Resistance (2) 113.53 Resistance (1) 113.30 ---------------------------- Support (1) 112.71 Support (2) 112.50 Support (3) 112.35 *********************************************************** A trading tip forUSD/JPY for November 09 - 10, 2021 Buy above 112.90 (EMA 200) with take profit at 113.47 (SMA 21) and 114.07 (6/8), stop loss below 112.55. The material has been provided by InstaForex Company - www.instaforex.com |

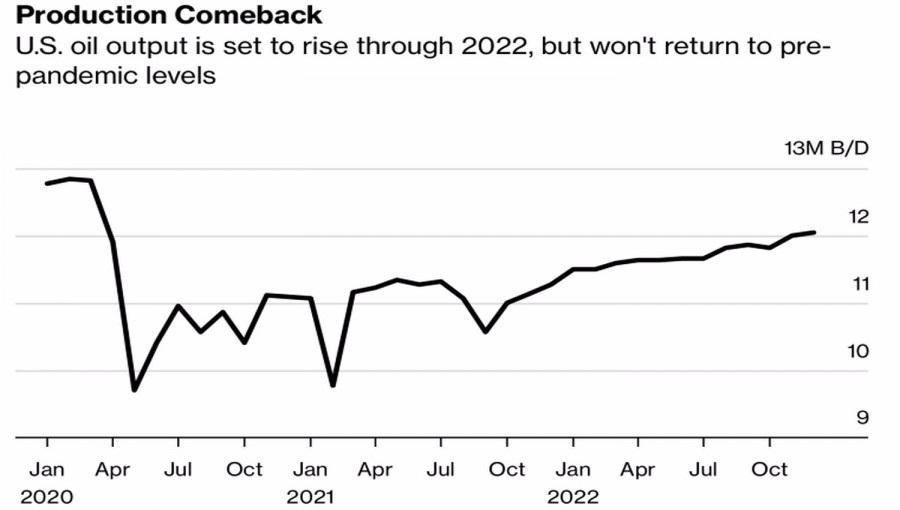

| U.S. hints on selling oil from strategic reserves do not scare Brent bulls Posted: 09 Nov 2021 06:15 AM PST The more Joe Biden throws arrows of criticism at OPEC+, which does not want to intensify oil production and thus impede the recovery of the world economy, the more often investors ask themselves: well, what about? Indeed, the United States is an oil-producing country that could open more taps, but prefers not to do this, but threatens to sell oil from strategic reserves. This circumstance prevents the return of Brent and WTI to the area of 7-year highs. However, the bulls have other trump cards. It is difficult to assess the impact of oil sales from the U.S. strategic reserves. It's all about the scale. Market disappointment with volumes could drive up prices even further. The U.S. does not need to act alone and win over to their side both other IEA members and countries that are not part of the authoritative organization. This is primarily about China. In the meantime, the threat of the White House with a sword of Damocles hung in its head is cooling the ardor of buyers of the North Sea and Texas varieties. The Americans are waiting for the report of the International Energy Agency, and along with them, the whole black gold market is waiting for this information. What prevents the United States from increasing production on its own? The government predicts that the figure will increase to 11.7 million b/d in 2022, which is lower than the 13 million b/d that occurred before the pandemic. Dynamics of American oil production

The answer must be sought in the policy of manufacturing companies, which prefer to spend money, not on the development of new fields, but the payment of dividends to shareholders. As a result, the responsibility for ensuring that production catches up with global demand that has gone significantly ahead falls on the shoulders of OPEC+, and the countries that make up the Alliance are in no hurry to make adjustments to their obligations. They are well aware that their passivity in the face of a rapid recovery in demand for oil (according to JP Morgan, it has almost returned to its previous level of 100 million b/d, which took place before the pandemic) leads to a favorable price increase for local budgets. Even their current high values do not prevent Saudi Arabia from raising premiums on its oil for Asian clients by the maximum value over the past 10 years. While Joe Biden is outraged by the rise in oil prices and the passivity of OPEC+, Brent and WTI continue to receive good news from the U.S. Allowing vaccinated tourists to visit the United States should increase demand for aviation fuel, and the House's passage of the $ 550 billion infrastructure bill is a bullish factor for the North Sea and Texas varieties, according to Bloomberg experts. Let's not forget about the slow normalization of the Fed's monetary policy, which contributes to the correction of dollar pairs and creates preconditions for the purchase of commodity market assets, including oil. Technically, the inability of Brent bears to gain a foothold below the trend line of the Splash stage of the Splash and Shelf pattern is a sign of their weakness and the basis for the formation of long positions with targets at $89.7 and $92.6 per barrel. Brent, Daily chart

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments