Forex analysis review

Forex analysis review |

- Forecast for EUR/USD on November 9, 2021

- USDCHF potential bearish drop | 9th Nov 2021

- Forecast for GBP/USD on November 9, 2021

- Forecast for AUD/USD on November 9, 2021

- Forecast for USD/JPY on November 9, 2021

- Forecast and trading signals for GBP/USD for November 9. Detailed analysis of the movement of the pair and trade deals. The

- Forecast and trading signals for EUR/USD on November 9. Detailed analysis of the pair's movement and trade deals. Boring,

- USDCAD bullish bounce | 9th Nov 2021

- AUDUSD facing bearish pressure, potential for more downside!

- Solana: The Ethereum killer has already shown growth of more than 17,000 percent for 2021, but the cryptocurrency is just

- How to trade EUR/USD on November 9? Simple tips for beginners. One day of joy, the rest is despondency

- Bitcoin to hit 67,016.50 all-time high

- USD/JPY downside movement activated

- Analysis of GBP/USD for November 8; The European Union awaits concessions from the UK

- Analysis of EUR/USD for November 8; U.S. Nonfarm Payrolls caused a controversial market reaction

- Bitcoin climbs above $65k but sees new threat through Ethereum

- EUR/USD: correction after slide. Downtrend still valid

- November 8, 2021 : EUR/USD daily technical review and trading opportunities.

- November 8, 2021 : EUR/USD Intraday technical analysis and trading plan.

- November 8, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

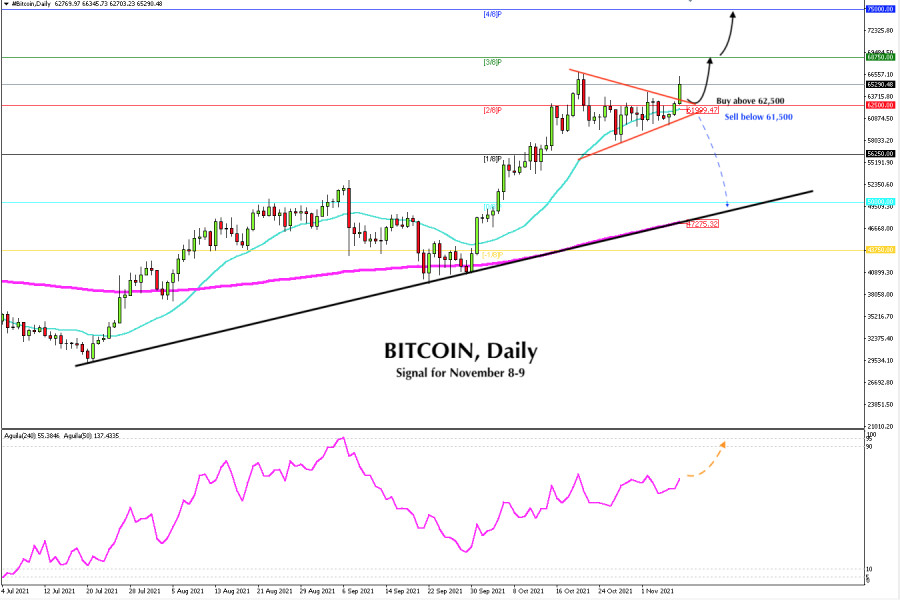

- Trading signal for BITCOIN (BTC) on November 08 - 09, 2021: buy above $ 62,500 (symmetrical triangle)

- Bitcoin approaches all-time high; what do technical indicators say about further price movement?

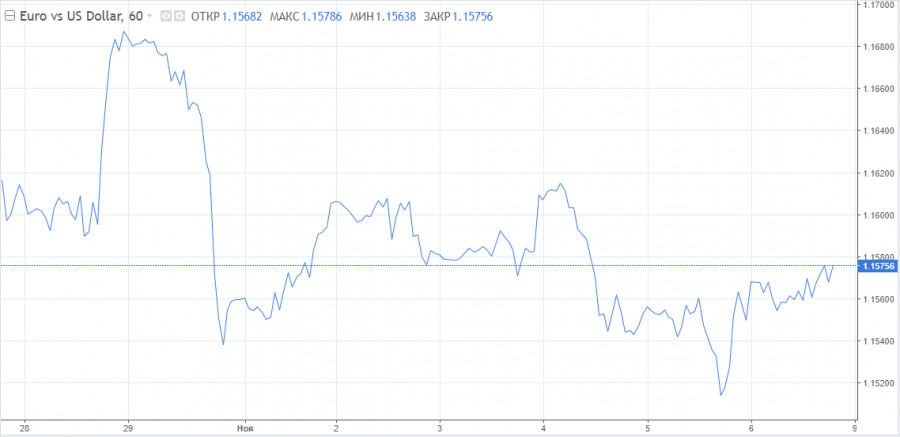

- Trading signal for EUR/USD on November 08 - 09, 2021: buy above 1.1570 (SMA 21)

- USD accumulates power amid weak data on EUR and GBP

- Is GS stock price preparing a major pull back?

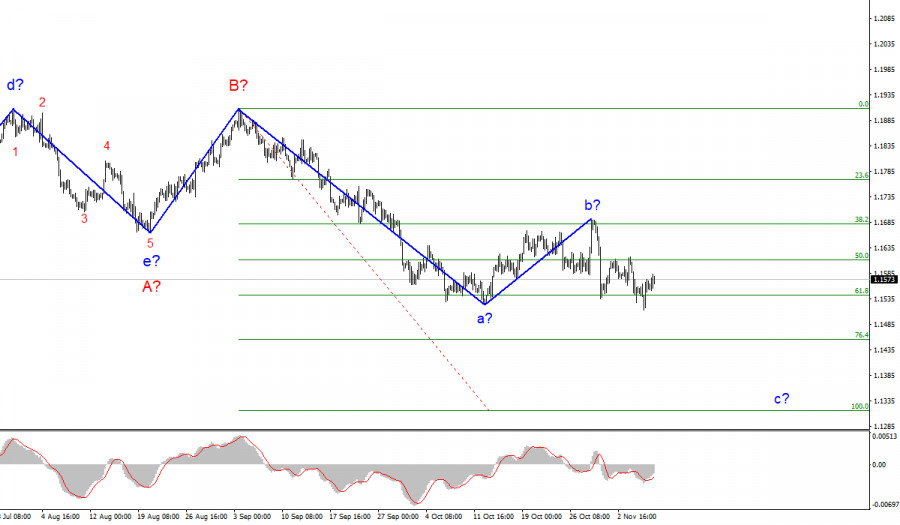

| Forecast for EUR/USD on November 9, 2021 Posted: 08 Nov 2021 07:33 PM PST The euro has an equal chance of rising and falling on November 9. Yesterday, the euro gained 19 points, breaking the technical level of 1.1572 by force and forming a convergence with the Marlin Oscillator on the daily chart. Thus, the euro did not deepen the correction and did not begin to form a sideways range. Although in order to fully form a growing trend, it still needs to go above the MACD indicator line (1.1610). Another point is noteworthy - the index of investor confidence in the eurozone, according to Sentix, did not fall as expected for the current month, but increased from 16.9 to 18.3. And even if this indicator is secondary, its optimistic growth may mean that the ZEW economic sentiment indices published today may turn out to be better than forecasted.

Marlin Oscillator entered the growth zone on the daily. This increases the probability of the price's success in attacking the MACD line. Convergence with the Marlin Oscillator is also formed on the H4 chart. The indicator itself is in the positive area. To strengthen the price consolidation above the level of 1.1572, the price needs to settle above the MACD indicator line (1.1598). And while this is not the case, the price has a chance to renew the low on November 5th and form a double convergence with the oscillator. This option is indicated on the graph with a dashed line.

Both options - continued growth and renewed convergence - have the same chances of being realized. We are waiting for the development of events. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCHF potential bearish drop | 9th Nov 2021 Posted: 08 Nov 2021 07:33 PM PST

On the H4 timeframe, price is now abiding to a descending trendline resistance, signifying bearish momentum. We can now expect price to make a drop from the 1st resistance in line with 61.8% Fibonacci retracement and 61.8 % Fibonacci projection towards the 1st Support in line with 78.6% Fibonacci projection and 78.6% Fibonacci retracement. Price is currently in the middle of the descending trendline resistance and ascending trendline support, hence traders should wait for the price to swing higher or lower before entering into the trade. Trading Recommendation Entry: 0.91690 Reason for Entry: 61.8% Fibonacci retracement and 61.8 % Fibonacci projection Take Profit: 0.91690 Reason for Take Profit: 78.6 % Fibonacci projection Stop Loss: 0.919325 Reason for Stop Loss: 100% FIbonacci projection and 78.6% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

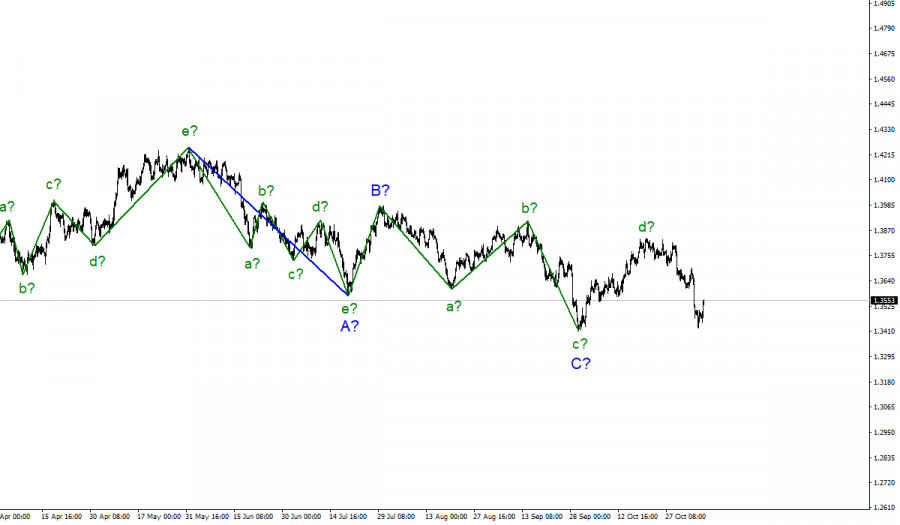

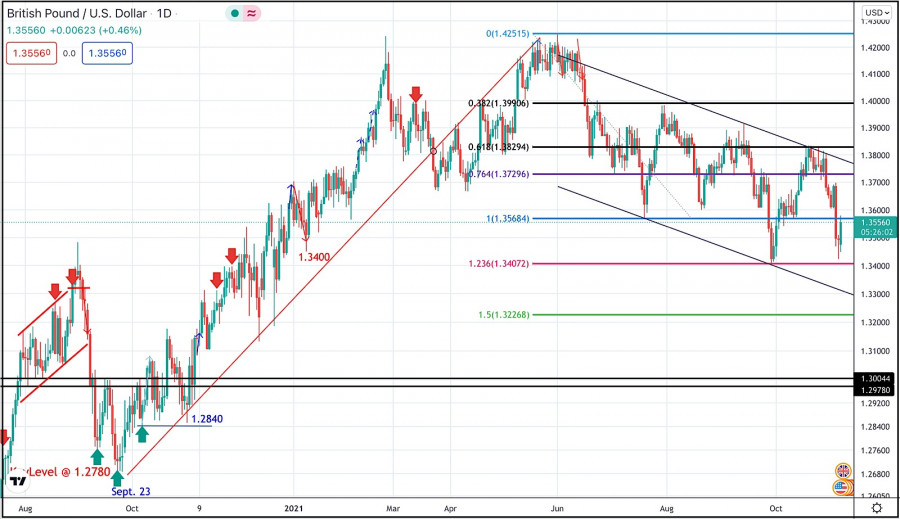

| Forecast for GBP/USD on November 9, 2021 Posted: 08 Nov 2021 07:32 PM PST The British pound added more than 60 points at the end of Monday, marking 100.0% at the Fibonacci level (July 20 low). There is a possibility of a downward reversal from this level to the Fibonacci level of 123.6% (1.3413) or to the level of 138.2% (1.3313). Confirmation of the upward reversal will be the price exit above the MACD indicator line, above 1.3630.

There are no clear signs of an upward or downward price movement on the four-hour chart. But here it can be noted that the resistance of the MACD line at the price of 1.3630 coincides with its resistance on the daily chart.

This circumstance increases the significance of the line (level) and will become a fairly confident signal for a medium-term price rise (1.3910) when it overcomes this level. A decline below the Fibonacci level of 110.0% (1.3503) will be a signal to advance to 1.3413. The material has been provided by InstaForex Company - www.instaforex.com |

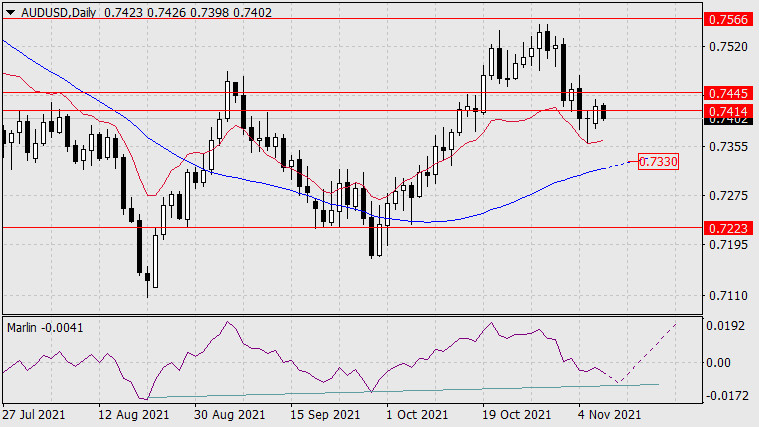

| Forecast for AUD/USD on November 9, 2021 Posted: 08 Nov 2021 07:32 PM PST On Monday, the Australian dollar entered the target range of 0.7414/45, and this morning it has already returned back down from it. There was no consolidation in the range, the price gets an opportunity to reach the support of the MACD line in the area of 0.7330. With the Marlin Oscillator, in this case, a double convergence will be formed. Only if the price breaks above the upper border of the 0.7414/45 range will be a sign of further price growth towards the 0.7566 target.

On the four-hour chart, the price is in a downward position. The last clue - the transition of Marlin to the positive region has melted - Marlin returns to the negative region. A further decline towards the MACD line on the daily chart is likely.

|

| Forecast for USD/JPY on November 9, 2021 Posted: 08 Nov 2021 07:30 PM PST Yesterday, the USD/JPY pair reached the support of the embedded price channel line (green). Consolidation below it opens the way for the price to the MACD line in the area of 111.88. The Marlin Oscillator is aggressively set to further decline.

There are no reversal signs on the four-hour scale chart for the currency pair in question. Yesterday, US stock indexes added around 0.1%, in today's Asian session the indices of Australia, China and Japan also show insignificant growth. The dollar has no external support in the fight against the yen, we expect the pair to decline to the specified target of 111.88.

|

| Posted: 08 Nov 2021 06:37 PM PST GBP/USD 5M

The GBP/USD pair traded much better than the EUR/USD pair on November 8. First, there was a trending move for most of the day. Secondly, the volatility was not the highest, but still very decent - 130 points. Thus, it was a sin not to try to work out such a movement. Moreover, at the weekend we said that the pound would seek to rise due to the fact that last week's fall absolutely does not correspond to the fundamental background, especially from the UK. Thus, we are waiting not just for the British currency to grow by 130 points, but for a much larger upward movement. Unfortunately, there was not a single important line or extreme level in the area where the upward movement started on Monday. Thus, it was not possible to "catch" this movement from its very beginning. Nevertheless, it was possible to open long positions on the buy signal in the form of a breakthrough of the 1.3519 level. Subsequently, the price reached the Kijun-sen line, the resistance level of 1.3563 and the extreme level of 1.3570. All these lines and levels should be considered as a single area. And the price eventually rebounded from it, so it was necessary to take profit on long positions, which amounted to about 20 points. Yes, it's not much, but Monday was, in principle, not the most successful day. It was no longer necessary to work out a sell signal, since it was formed when Federal Reserve Chairman Jerome Powell's speech began (the figure "1" in the chart). And about an hour later, Bank of England Governor Andrew Bailey's speech began (the figure "2" in the chart). Both did not give anything new to the markets, however, these were potentially important events. GBP/USD 1H

The pound/dollar pair maintains a downward trend on the hourly timeframe, however, we have already drawn traders' attention to the fact that the downward trend line is extremely weak, and has a very weak slope angle. Thus, almost any upward movement in strength can fit into the framework of a downward trend. At the moment, the pound's quotes have managed to rise to the critical line. We believe that the upward movement will continue at least to the trend line. We highlight the following important levels on November 9: 1,3424, 1,3519, 1,3570, 1,3601 – 1,3607, 1,3667. The Senkou Span B (1.3717) and Kijun-sen (1.3558) lines can also be signal sources. It is recommended to set the Stop Loss level to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator can move during the day, which should be taken into account when searching for trading signals. Central bankers Bailey and Powell will speak in the UK and the US on Tuesday. However, these events may also not cause any reaction from the markets. Simply because last week there were meetings of both central banks, during the summing up of which both Bailey and Powell spoke. Therefore, it is unlikely that in less than a week, both heads will be able to surprise the markets with something. Moreover, they were not surprised by anything on Monday... We recommend you to familiarize yourself: Overview of the EUR/USD pair. November 9. The dollar is trying to continue growing, but this is not beneficial to the Fed Overview of the GBP/USD pair. November 9. The Bank of England may support the pound, while it may rise by 500 points Forecast and trading signals for EUR/USD for November 9. Detailed analysis of the movement of the pair and trade deals. COT report

The mood of professional traders practically did not change during the last reporting week (October 26-November 1). However, it should be noted that the two most important days of last week – Wednesday and Thursday - when all the strongest movements occurred, were not included in the latest report. That is, in a week we will be able to see how much and in which direction the mood of professional traders has changed. In the meantime, we can only draw the same conclusions as a week ago. The green and red lines of the first indicator continue to constantly change the direction of movement, constantly intersecting. This suggests that big players themselves do not understand what to do with the pound. However, this can be clearly seen from the very schedule of the pair's movement, starting from July. These four months, the pound/dollar pair has been between the levels of 1.3400 and 1.4000, that is, in the horizontal channel. It was during this period of time that commercial and non-commercial traders changed their mood almost every week. Thus, taking into account the previous changes, we would assume that a new growth of the British currency will begin in the near future with the prospect of a 500-point rise. Moreover, the results of the Bank of England meeting were not dovish. The British currency has fallen undeservedly, which means that the markets may soon recoup this injustice. It should also be noted that during the reporting week, professional traders opened 5.8 buy contracts (longs) and 7.5 thousand sell contracts (shorts). Thus, the net position has not changed much. Explanations for the chart: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the non-commercial group. The material has been provided by InstaForex Company - www.instaforex.com |

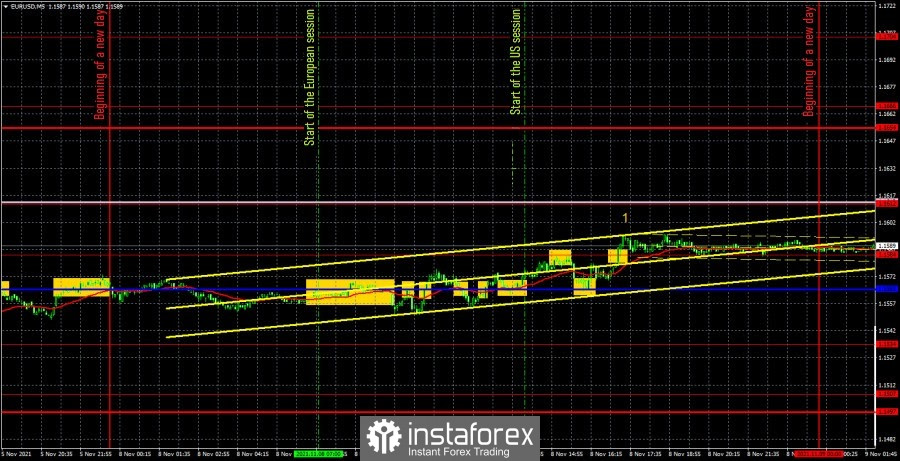

| Posted: 08 Nov 2021 06:30 PM PST EUR/USD 5M

The EUR/USD pair, as expected, showed a low volatility of 43 points during the first trading day of the week. There is nothing surprising in this, yesterday we said that nothing interesting in macroeconomic terms is planned either in the European Union or in the United States for Monday. However, the situation changed on the one hand, but remained the same on the other. It changed because the speech of Federal Reserve Chairman Jerome Powell was included in the calendar of events. It remained the same – because this speech did not provide any new information and did not affect the course of trading in any way (the figure "1" in the chart). But the movement itself during the day was just disgusting. Not only was the volatility "at zero", but there was also no trend movement, which is why a huge number of trading signals were formed, and all false. Nevertheless, let's still try to figure out how to trade on Monday. The first two signals were for shorts. At first, the price settled below the critical line, and then bounced off it. Every time it went down 3 points and that says it all. Naturally, these signals resulted in a loss of 15 points when the price settled above the Kijun-sen line. The buy signals were no better. After the first of them, the price went up the same 3 points, and the long position closed at a loss of 11 points. All other signals near the Kijun-sen line should have been ignored. It would be possible to try to work out a sell signal in the form of a rebound from the level of 1.1584, which was formed at the beginning of the US session, but at the time of the formation of this signal, the price has almost reached the critical line. The next buy signal near the level of 1.1584 was published exactly during the beginning of Powell's speech... In general, these signals should also be ignored. EUR/USD 1H

The downward trend quickly formed and immediately reversed on the hourly timeframe. As we have already said many times, the movements for the euro/dollar pair are extremely confusing. They cannot be called either trendy or flat. Now the price has settled above the trend line, tomorrow it can calmly resume the downward movement, but at the same time it will not go below the level of 1.1534 again. We highlight the following levels for trading on Tuesday - 1.1507, 1.1534, 1.1584, 1.1666, as well as the Senkou Span B (1.1613) and Kijun-sen (1.1564) lines. The Ichimoku indicator lines can change their position during the day, which should be taken into account when looking for trading signals. Signals can be rebounds or breakthroughs of these levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price moves 15 points in the right direction. This will protect you against possible losses if the signal turns out to be false. European Central Bank President Christine Lagarde and Powell will speak in the European Union and the United States. We do not believe that these speeches will give anything new to traders, therefore, most likely, they will be ignored. The only thing to do is just be as careful as possible when the officials speak. We recommend you to familiarize yourself: Overview of the EUR/USD pair. November 9. The dollar is trying to continue growing, but this is not beneficial to the Fed Overview of the GBP/USD pair. November 9. The Bank of England may support the pound, while it may rise by 500 points Forecast and trading signals for GBP/USD for November 9. Detailed analysis of the movement of the pair and trade deals. Analysis of the COT report

The mood of non-commercial traders changed, but not much, during the last reporting week (October 26-November 1). A group of "non-commercial" traders closed 4,000 buy contracts (longs) and 10.5 thousand sell contracts (shorts) during the reporting week. Consequently, the net position of professional players has grown by 6.5 thousand, which is not so much. However, the changes in the mood of non-commercial traders are best seen by the first indicator in the chart above. The red and green lines have been moving towards each other for a long time, and in the last couple of months they have been almost at the same level. This suggests that the previous trend is ending, and the mood of the major players at this time is as neutral as possible. This is confirmed by the data on the total number of contracts. The non-commercial group has 195,000 buy contracts (longs) and 199,000 sell contracts (shorts). The commercial group has 418,000 buy contracts and 442,000 sell contracts. That is, as we can see, the numbers are almost the same. Therefore, there are theoretical chances for the continuation of the downward movement in the pair. The trend began to end (an upward trend) when the red and green lines (net positions of the commercial and non-commercial groups) began to narrow. That is, for quite a long time. And now, logically, the downward trend continues. However, this "trend" is still not too similar to the trend. Rather, a banal three-wave correction. Explanations for the chart: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the non-commercial group. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bullish bounce | 9th Nov 2021 Posted: 08 Nov 2021 06:20 PM PST

On the H4, with price bouncing off the support on the RSI indicator and price moving above the ichimoku cloud, we have a bullish bias that price will rise from 1st support at 1.24286 in line with the 50% Fibonacci retracement levels and the horizontal overlap support to 1st resistance at 1.24796 in line with the graphical swing high resistance and possibly even to 2nd resistance at 1.24964 in line with the graphical swing high from 12th of October. Alternatively, we may see price break 1st support structure and head for 2nd support at 1.24024 in line with the 78.6% Fibonacci retracement level and horizontal overlap support. Trading Recommendation Entry: 1.24286 Reason for Entry: 50% Fibonacci retracement levels and the horizontal overlap support Take Profit:1.24796 Reason for Take Profit: graphical swing high resistance Stop Loss:1.24024 Reason for Stop Loss: 78.6% Fibonacci retracement level and horizontal overlap support The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD facing bearish pressure, potential for more downside! Posted: 08 Nov 2021 05:58 PM PST

Price is trending within a Daily ascending channel and above the Daily descending trendline now support and below the 1st resistance at 0.74313 in line with 61.8% Fibonacci retracement and 100% Fibonacci extension. Price could potentially bearish from 1st resistance at 0.74313 in line with 61.8% Fibonacci retracement and 100% Fibonacci extension to 1st support at 0.73601 in line with Horizontal swing low and 61.8% Fibonacci extension. Our bearish bias is further supported by how Price is holding below the Ichimoku cloud and RSI is abiding to a descending trendline. Otherwise price may continue to bullish to 2nd resistance at 0.74708 in line with Horizontal swing high and 200% Fibonacci extension. Trading Recommendation Entry: 0.74313 Reason for Entry: 61.8% Fibonacci retracement and 100% Fibonacci extension Take Profit: 0.73601 Reason for Take Profit: Horizontal swing low and 61.8% Fibonacci extension Stop Loss: 0.74708 Reason for Stop Loss: Horizontal swing high and 200% Fibonacci extension The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Nov 2021 01:38 PM PST

The growing demand for ethereum, as well as overcoming its historical highs, has caused an extraordinary demand for its main competitor - Solana, which is now showing an incredible upward movement. Solana, often called the Ethereum killer, has grown by more than 17,000 percent over the course of this year. Now the cryptocurrency occupies an honorable fourth place in terms of market capitalization, which is more than $ 75 billion. Thanks to this bullish rally, Solana managed to overtake Tether and push it into fifth place. Solana has overcome its historical maximum and reached the milestone of $ 258, which makes it very popular among investors at the moment. The crypto asset appeared in April 2020, and over the year it grew by more than 30,000 percent, the initial price of the crypto asset was $ 0.75. Solana has developed by leaps and bounds, improved its ecosystem, the speed and functionality of its network, which began to attract investors, it has a very fast blockchain around which you can build a huge number of different projects. Ether and Solana often compete with each other, since both cryptocurrencies provide the possibility of smart contracts. Solana is much faster and more productive than Ethereum, and the commissions within the network are much lower than Ethereum. Smart contracts play a key role in launching decentralized finance applications, as well as NFT. Sharat Chandra, evangelist of Blockchain & Emerging Tech Evangelist, says that Solana can process up to 50,000 transactions per second, and blockchain has become the most popular and preferred protocol for Defi and NFT projects. Solana will continue to grow due to serious innovative solutions and scalability. Analysts are confident that Solana can grow by more than 100 times, especially the cryptocurrency is very good for the average and long-term. Analysts are confident that Solana is capable of curtailing Ethereum in a long-term time frame. Solana will continue to trust its developers, as well as look for even more professional developers in its team to improve the network and to create decentralized applications. The material has been provided by InstaForex Company - www.instaforex.com |

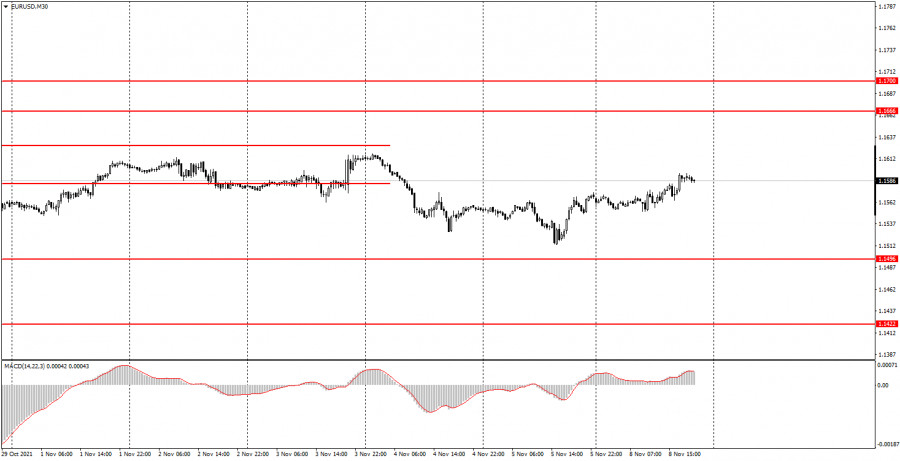

| Posted: 08 Nov 2021 01:17 PM PST Analysis of previous deals: 30M chart of the EUR/USD pair

The EUR/USD pair "died" again on Monday. On the one hand, it was very predictable. After all, not a single important macroeconomic event was scheduled for Monday. On the other hand, Jerome Powell's speech did take place, so the markets could at least pretend that they care. However, no, the pair continued to move in their usual mode, in which they have been for several months. Volatility again amounted to an "unrealistic" 44 points, and there has been no trend movement for several weeks. The pair just moves from one side channel to another, that's all. Thus, it turns out that last Thursday the pair showed more or less good movement, and all the other days - like a carbon copy. Unfortunately, such movements are still very difficult to deal with. There is still no trend line or channel on the 30-minute timeframe. Therefore, it is not recommended for novice traders to trade on it. 5M chart of the EUR/USD pair

On the 5-minute timeframe, the movement on Monday was very eloquent. There was a minimal upward trend, but the pair grew by 20 points in total for the day. That is, the movement was very weak, the volatility was very weak, the trend was very weak, and there were practically no trading signals. And it would be better if they didn't exist at all. The tick in the illustration above marks the start time of the speech by Jerome Powell, chairman of the Fed. As you can see, no special changes have occurred at this time. Well, the only signal of the day was formed when the price was fixed above the level of 1.1585. Formally, it could be worked out, since it was not formed too late. However, novice traders by that time could already understand that there would be no active movements, so this signal could well be skipped. As a result, the price remained just above the level of 1.1585, and tomorrow it may move in any direction, but everything is also sluggish. How to trade on Tuesday: There is still no trend or horizontal channel on the 30-minute timeframe at this time. Therefore, the current movement still defies description. We still do not recommend tracking signals from the MACD indicator, but we advise you to wait for the formation of a trendline or trend channel. On the 5-minute timeframe, the key levels for November 9 are 1.1535, 1.1585, 1.1617 - 1.1622. Take Profit, as before, is set at a distance of 30-40 points. Stop Loss - breakeven when the price passes in the right direction by 15 points. At 5M TF, the target can be the nearest level, if it is not located too close or too far away. If it is located– then you should act on the situation or work on Take Profit. ECB President Christine Lagarde is due to speak in the European Union on Tuesday, and Fed Chairman Jerome Powell is due to speak in America. It is not worth losing sight of these events, however, it is unlikely that both officials will tell the markets anything important. Therefore, most likely, these events will not affect the mood of the market in any way. Basic rules of the trading system: 1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin to hit 67,016.50 all-time high Posted: 08 Nov 2021 12:01 PM PST Bitcoin registered strong growth and now it stands at 66,085.35 level. It has increased by 10.72% from 60,109.91 Saturday's low to 66,555 today's high. Technically, the crypto was bullish, so a new upside momentum was imminent. BTC/USD it's up by 5.82% in the last 24 hours and by 8.45% in the last 7 days. Technically, the rate has shown that the downside is limited and that the outlook remains bullish. In the short term, it has consolidated before jumping higher. After the current rally, we cannot exclude a temporary decline. BTC/USD could come back to test and retest the immediate support levels before jumping higher. BTC/USD looks to trade higher

As you already know from my analysis, BTC/USD was expected to climb towards new highs after escaping from the down channel and after stabilizing above 59,953.74. I've told you in my previous analysis that making a valid breakout through the immediate downtrend line and above 61,781.83 may confirm further growth. As you can see, it has retested the weekly R1 (65,239.29) closing far above it. Now is trading in the red, but the bias remains bullish. 67,016.50 all-time high is seen as the first upside target, as an obstacle. Bitcoin forecastThe bias is bullish, so a temporary consolidation above the 64,895.22 and above the weekly R1 (65,239.29) could bring new long opportunities. A minor accumulation could attract more bullish energy. Making a valid breakout through 67,016.50 historical high validated further growth towards new highs. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY downside movement activated Posted: 08 Nov 2021 11:58 AM PST

USD/JPY extends its dropThe USD/JPY pair was dropping at the time of writing after failing to stay above 113.44 former low which represented a downside obstacle. After falling below the uptrend line, the pair was expected to decline further. Still, in the short term, it has tried to increase a little to retest the broken uptrend line. Personally, I've drawn a downtrend line after the price has failed to reach 114.28 high. As you already know from my previous analysis, USD/JPY could develop a larger downside movement if it drops and stabilizes below 113.44. USD/JPY trading conclusionThe current drop below 113.44 opened the door for a deeper decline. As long as it stays below 113.44, USD/JPY could approach and reach new lows. 113.00 psychological level is seen as the first downside target and obstacle. Besides, a drop below this level may activate a broader downside movement. 112.00 could be used as a potential downside target as well. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of GBP/USD for November 8; The European Union awaits concessions from the UK Posted: 08 Nov 2021 10:39 AM PST |

| Analysis of EUR/USD for November 8; U.S. Nonfarm Payrolls caused a controversial market reaction Posted: 08 Nov 2021 10:19 AM PST |

| Bitcoin climbs above $65k but sees new threat through Ethereum Posted: 08 Nov 2021 10:00 AM PST The new week for the cryptocurrency market started off well. Bitcoin broke out of the triangle and climbed above $65,000 per coin. Now, the coin is gradually approaching an all-time high above $67,000 per coin. What's going on behind the scenes of a price that includes everything? The crushing losses of the crypto bears According to crypto analytic platform Coinglass, Monday's trading session brought the crypto bears the worst losses in three weeks. In the last 24 hours, short and long positions worth 240 million US dollars have been liquidated. In total, bitcoin traders lost $130 million, while Ether traders lost $50 million. And the holders of positions on XRP, DOGE, SHIB, and SOL faced the liquidation of positions worth more than $20 million. Unsurprisingly, 72% of liquidations were "short" during Monday's rally, with a total of 46,831 traders lost their funds. According to Coinglass, the largest single liquidation was recorded on OKEx for the BTC/USDT pair: Bitcoin bears lost $6.57 million in an instant. It is worth noting that on October 19, 2021, when Bitcoin reached an all-time high, the bears lost $254 million in 24 hours. Ethereum is on its heels The second cryptocurrency, Ether, has updated its all-time high and has risen above $4,700 per coin on Monday. Experts point out that the reason for this is the shift of institutional interest from Bitcoin to Ether. Genesis statistics for the third quarter of 2021 show that the demand for bitcoins is falling this time, while institutional investors are looking into DeFi platforms and other altcoins. The rise of DeFi and the NFT craze led to wider institutional adoption of Ethereum. And this creates the preconditions for the second cryptocurrency to be able to greatly distract the market share. First , the Ethereum blockchain processes more transactions than Bitcoin, so payments are faster and more efficient. Second, the Ethereum network supports the creation of multiple applications. Ethereum is known for its smart contracts that allow the creation of decentralized applications such as DeFi (decentralized finance) or NFT (unique tokens). However, if you look at Ethereum as an investment, the only problem, according to analysts, is that it has not yet been fully developed. Therefore, it is difficult to predict what improvements will occur in the next few years. Bitcoin: nearest targets Let's digress from the long-term prospects and see what to expect from bitcoin in the near future. Since the price has risen above the resistance of 62,637.96, having consolidated at this level, now the obvious target remains at the level of 67,044.68 (all-time high). The level 100 of the Fibonacci Expansion is also located there. If Bitcoin can break that border, the next target will be the 161.8 Fibo Expansion level, which passes near $72,000 per Bitcoin. How quickly the price will get there, we can only guess: it can take several days or several months.

|

| EUR/USD: correction after slide. Downtrend still valid Posted: 08 Nov 2021 09:12 AM PST EUR/USD is still trading in the range of 1.1530 – 1.1600, i.e. between the lower and the middle lines of Bollinger bands on the daily chart. EUR/USD buyers are trying to push the pair into a correctional move to test the upper border of the mentioned price range. At present, this is a must-do for the bulls that they still cannot do. The bulls are fighting for every pip. They make one stop forward and two steps back. Multiple downward intraday retracements confirm that long positions are not the best idea at the moment. The fundamental picture is also against the euro, but it benefits the US dollar. After a rapid nosedive on Friday, EUR/USD has to make a correctional climb. EUR/USD sellers have not been able to settle below 1.1530. So, the buyers took the lead and now they can afford to make the pair gyrate in a 70-pips trading range up to 1.16. Looking at the monthly chart, EUR/USD has been developing the downtrend step by step, making pauses. In June, the price sank from 1.2225 to 1.1850. Then the price consolidated for two months until September. During the bearish move, EUR/USD tumbled more than 200 pips from 1.1900 to 1.1664. This time, the currency pair has again got stuck in a wide range which is gradually getting narrower to the lower border. If this dynamic persists, the bears will venture into another breakout. If so, the trading range will shift towards 1.1500 – 1.1430. The Kijun-sen is the lower border of the Kumo cloud on the MN timeframe.

This assumption is not based on technical analysis. The fundamental background encourages a further downtrend of EUR/USD. The main argument of the dollar bulls is the hawkish Federal Reserve. Although Jerome Powell expressed moderately hawkish rhetoric, rejecting the intentions to raise interest rates in July next year, a lot of voting FOMC members do not rule out this scenario. For example, Vice Chairman Richard Clarida stated that apparently, conditions for the first rate hike would be created by the end of 2022. Besides, he said an interesting phrase. Citing his words, the median Fed's forecast will correspond to the regulator's policy provided that current forecasts of inflation and employment are implemented in practice. Let me remind you of the policy update of the September meeting. Half of 18 FOMC members pointed out that they expected a rate hike until the end of 2022. Another argument for is the recent nonfarm payrolls (all components were upbeat) and rising inflation which is printing multi-year highs. Today St. Louis Federal Reserve President James Bullard fueled speculations, saying that he expects two rate hikes next year. Another thing is that he admitted that the Federal Reserve would terminate the stimulus program before July. This fact will enable the regulator to begin tightening monetary policy in the summer 2022. Though James Bullard does not vote in the rate-setting committee this year, his remarks should not be neglected. In 2022, he will regain the voting right in 2022 on a rotation basis. Amid such hawkish stance of the Federal Reserve, the ECB looks polar opposite. The most ECB members state that the regulator will carry on with soft monetary policy despite soaring inflation in the Eurozone. ECB chief economist Philip Lane said that medium-term inflation in the Eurozone remains weak. Besides, he mentioned that disruptions in supply chains and a surge in energy prices bear the major risks for the EU economy. Thus, Mr. Lane again rejected the scenario that QE would be wound up and interest rates would be raised ahead of schedule, i.e. before 2024. All in all, policy differential between the ECB and the Federal Reserve does not allow the bulls to wreck the downtrend of EUR/USD. So, the ongoing spike should be seen as another correctional climb after a nosedive on Friday. If the price approaches the upper border of the trading range, i.e. 1.600, it would be a good idea to open short positions towards support of 1.1530.To break this price barrier, the bears need a fresh newsworthy event. For instance, US inflation data which is due on Wednesday could be beyond analyst expectations. From the technical point, EUR/USD is now between the middle and lower lines of Bollinger bands on the daily chart. Ichimoku indicator generated a bearish signal on the same daily chart. This technical picture tells us that market sentiment favors short positions towards the lower border of Bollinger bands that corresponds to the target of 1.1530. The material has been provided by InstaForex Company - www.instaforex.com |

| November 8, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 08 Nov 2021 08:46 AM PST

Recently, Persistence below the depicted price zone of 1.1990 indicated further downside movement towards 1.1840 and 1.1780 where a sideway consolidation range was established. During last week, the EURUSD pair has been trapped within a narrow consolidation range between the price levels of 1.1780 and 1.1840. A bullish breakout was executed above 1.1840 shortly after. Temporary Upside pullback was expected towards 1.1990. However, re-closure below the price level of 1.1840 has initiated another downside movement towards 1.1780 which failed to hold prices for a short period of time before significant upside movement was presented into market. Intraday traders were advised to wait for candlestick closure above 1.1780 - 1.1840 for another ascending swing to be initiated. However, immediate downside selling pressure brought the pair down below 1.1700. More downside movement took place towards the price level of 1.1600 where significant buying pressure existed. Bearish persistence below 1.1700 and 1.1600 has enhanced further decline towards 1.1500. Currently, the price zone around 1.1700 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon any upcoming ascending movement. The material has been provided by InstaForex Company - www.instaforex.com |

| November 8, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 08 Nov 2021 08:45 AM PST

Bearish persistence below the price zone of 1.2050-1.2000 allowed the recent downtrend to be established. So, the EURUSD pair has expressed significant bearish decline while the price level of 1.1650 stood as a prominent demand level that prevented further bearish decline. The bullish pressure that originated around 1.1650 failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. Bullish signs were expected around the price levels of 1.1650-1.1700 as it corresponded to a recent previous bottom. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was about to be reached if sufficient bearish momentum was maintained. Moreover, significant bullish recovery has originated recently upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which still stands as an Intraday Support zone. Hence, sideway movement maybe expected in the nearest future. Please note that any Bullish movement above 1.1680 should be considered as an early exit signal to offset any SELL trades. The material has been provided by InstaForex Company - www.instaforex.com |

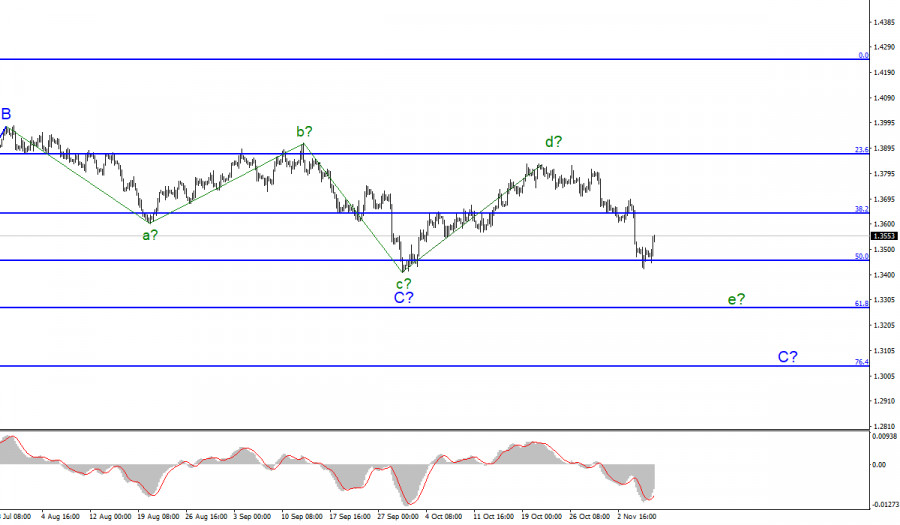

| November 8, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 08 Nov 2021 08:41 AM PST

The GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline. On the other hand, the nearest SUPPLY level was located around 1.4000 where bearish rejection and a valid SELL Entry was anticipated. The recent bullish rejection witnessed around 1.3600 as well as the temporary bullish breakout above 1.3830 indicated a high probability that this bullish movement may pursue towards 1.4025 then 1.4100. However, the pair remained trapped within a fixed price range until significant bearish momentum emerged into the market. Bearish breakout below 1.3680 enabled further bearish decline towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement. This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.3720 which was temporarily bypassed. Shortly after, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market. Currently, the short-term outlook is bearish as long as the pair maintains its movement below 1.3730. Another bearish visit was expected towards 1.3400 where significant bullish rejection was expressed as it corresponded to significant Fibonacci Expansion Level. Currently, the price level of 1.3570 stands as an intraday resistance level to be watched either for bearish reversal or a continuation pattern above it. Next bullish target would be located around 1.3720 The material has been provided by InstaForex Company - www.instaforex.com |

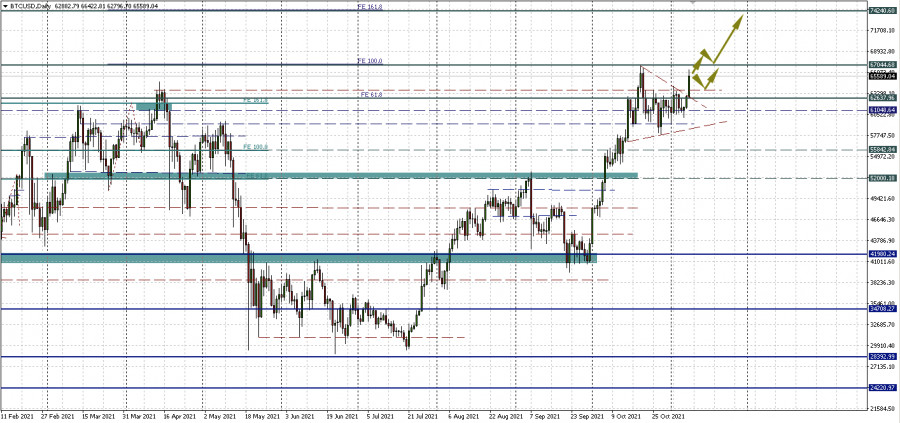

| Posted: 08 Nov 2021 08:00 AM PST

Bitcoin broke above the symmetrical triangle on November 8. Now the chart shows that it is consolidating above 6/8 of murray and it is likely to continue this trend in the coming days until the price reaches the area of 3/8 murray around 68,750 and up to 4/8 murray around 75,000 as their ultimate goal. According to the daily chart, we observe that from October 16 to November 8, Bitcoin has been consolidating within a symmetrical triangle. This pattern was broken a few hours ago which could mean that in the short term Bitcoin could move up to the psychological level of $ 75,000. On the contrary, if BTC consolidates again below the SMA of 21 located at 61,999, a correction movement could occur to 1/8 of murray around 56,250. If this support is broken, BTC could fall to the psychological level of 50,000. The final target it could even test the strength of the support of the 200 EMA is located at 47,275. The eagle indicator is still giving a bullish signal. After it makes a correction towards the 2/8 murray level around 62,500, the crypto could give us a good chance to buy with targets towards 68,750 and up to 75,000. The medium-term outlook for BTC continues to be bullish given that this week Bitcoin broke above the technical triangle pattern and is now consolidating above the 21 SMA. This could increase market optimism and we could expect new all-time highs in the coming days. Our forecast remains bullish for BTC as long as it trades above the 21 SMA and above the 2/8 murray. We can continue buying with targets until 4/8 of murray. The eagle indicator is supporting our strategy. Support and Resistance Levels for November 08 - 09, 2021 Resistance (3) 69,819 Resistance (2) 68,750 Resistance (1) 67,031 ---------------------------- Support (1) 64,913 Support (2) 63,465 Support (3) 62,500 *********************************************************** A trading tip for Bitcoin for November 08 - 09, 2021 Buy above 62,500 (SMA 21) with take profit at 68,750 and 75,000 (4/8), stop loss below 61,000. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin approaches all-time high; what do technical indicators say about further price movement? Posted: 08 Nov 2021 07:55 AM PST Bitcoin starts the trading week with a rebound from the support line of $60.2k, after which the impulse growth is close to the historical maximum. However, as a result, the cryptocurrency cannot continue to grow due to the local correction that inevitably comes after such a powerful impulse growth. Thanks to such a clear rebound, there is no doubt about the imminent start of a bullish rally and the establishment of a new maximum. With this in mind, it is necessary to conduct a technical analysis of BTC horizontal charts in order to determine the likely start of a new period of bitcoin growth. The four-hour chart clearly shows that there was an impulse price increase, which is typical for a rebound from the support zone. Despite this, the asset was close to breaking through this area and continuing to decline. In this case, the nearest key support zones would be $56.3k and $53.2k. However, movement to these levels is canceled due to a confident consolidation above $64k. The coin came close to the resistance line of the historical maximum and began to decline. This was expected, as the quotes reached the zone after the sellers began to defend their positions, as can be seen from the upper wick of the largest bullish candle that appeared.

Despite this, bitcoin confidently broke through the weekly resistance zone and reached the $66k mark, near which it is trying to gain a foothold. An uncertain bearish Doji candle has formed on the four-hour chart, indicating the weakness of sellers in these positions. However, the subsequent bullish candle also looks extremely uncertain, which may mean the start of a consolidation period with a parallel decline within the $63.4k-$65.9k channel. This is also evidenced by the unspoken rule that any impulse movement ends with a local correction period to stabilize the situation. In addition, technical indicators also indicate the beginning of a stabilization period: the MACD still maintains an upward movement, but the level of buyers has fallen significantly. This is signaled by the start of the sideways movement of the stochastic oscillator and the relative strength index. It is worth noting that both indicators are outside the safe zone (above 60), which is also a signal to overbought bitcoin and the need for correction.

A clear pattern has formed on the hourly chart for a further price decrease. After the bears seized the initiative (three red candles in a row), a candle formation consisting of three uncertain Doji candles appeared. This pattern is a clear sign of a price decline. It is most likely that the fall will continue to $65k, where the local support zone passes, and where the price can make an upward rebound. However, the option with a decrease to $65k and further price stabilization looks more plausible. At the same time, there is a possibility of continuing upward movement and a reversal of the local trend. Technical indicators of the cryptocurrency indicate a systematic decline in the price, which indicates a healthy correction after an impulse growth. The MACD is preparing to form a bullish intersection, and the stochastic and the relative strength index are turning in a downward direction. The $65.8-$65.7k range is an excellent area to enter a downside with a stop loss around $65k.

On the daily chart, bitcoin has made an important breakthrough beyond the usual fluctuation corridor, which is a strong bullish signal. If the price is firmly fixed above $64.4k, then we can talk about the continuation of the bullish rally to new heights. Technical indicators are steadily moving up: the MACD is preparing to form a bullish intersection, and the stochastic and the RSI index are moving in a bullish zone, which indicates the activation of buyers. The global bullish trend is beyond doubt, as is the establishment of new price highs this week. Most likely, Bitcoin will be able to reach the $73k mark and continue its upward movement with local pauses on correction.

|

| Trading signal for EUR/USD on November 08 - 09, 2021: buy above 1.1570 (SMA 21) Posted: 08 Nov 2021 06:48 AM PST

EUR/USD has formed a descending wedge pattern. This is a technical trend reversal figure. Only a sharp break above the bearish line that is projected from 1.1690 could confirm the recovery scenario and we could expect the euro to rise to the 200 EMA located at 1.1625. If the EUR / USD pair is not strong enough to break this pattern sharply, we could again expect the euro to consolidate below the 21 SMA located at 1.1565. Below this level sales could again intensify and a drop to the psychological level of 1.15 could occur. On Friday, November 5, the US dollar index reached the 6/8 Murray level, logging an annual high at 94.61. This was the price levels of September 20, 2020. This is a strong resistance area. EUR/USD failed to consolidate above and started a retracement. Later on, the euro rebounded from its annual lows around 1.1512. Therefore, if the dollar index continues with its downward correction, it could favor the upward movement of the euro for the next few days. The market sentiment report shows that there are 60.94% of operators who are buying the EUR / USD pair. This is a negative signal for the pair and a downward movement could occur in the next few days. Before this happens, we hope that the euro will continue bouncing to the 200 EMA (1.1625). At this point, it will be a good opportunity for us to sell with targets at 1.15 and up to 1.1474 (0/8). The eagle indicator is oscillating above an uptrend channel and is now showing a positive signal. It is expected to continue with its upward movement in the next few hours. Amid the upward move, we could see a climb towards the zone of 1.1625 (200 EMA). If the bullish force prevails, EUR/USD could reach the key level of 4/8 murray around 1.1718. Our forecast for the next few hours is that as long as the euro remains above the SMA of 21 located at 1.1565, it will be an opportunity for us to continue buying. The main target will be the EMA of 200. If this level is surpassed, we will continue to buy until 1.17 approximately. Support and Resistance Levels for November 08 - 09, 2021 Resistance (3) 1.1648 Resistance (2) 1.1610 Resistance (1) 1.1588 ---------------------------- Support (1) 1.1528 Support (2) 1.1490 Support (3) 1.1461 *********************************************************** A trading tip for EUR/USD for November 08 - 09, 2021 Buy above 1.1570 (SMA 21) with take profit at 1.1596 and 1.1625 (EMA 200), stop loss below 1.1535. The material has been provided by InstaForex Company - www.instaforex.com |

| USD accumulates power amid weak data on EUR and GBP Posted: 08 Nov 2021 06:33 AM PST

The most important conclusion is that the US regulator will not rush to raise rates. The Fed still considers high inflation to be a temporary phenomenon and the labor market has not fully recovered. For USD, this situation becomes a deterrent. This does not mean that the dollar will be under pressure or fall. New circumstances that emerged last week may keep the US currency from more actively rising against its counterparts. The dollar index is showing a downward correction. On Monday, market players will pay attention to Jerome Powell's speech at an online economic conference. Today, among other things, there are speeches by President and Chief Executive Officer of the New York Fed John Williams, and Vice-Chair of the Fed Richard Clarida. Any unexpected comments about the outlook for monetary policy could cause a little turbulence in the financial markets. If the officials do not address the topic of monetary policy at all, there may be no reaction at all. EUR/USD The EUR/USD pair is showing signs of recovery, but they will be hindered mainly due to the lack of positive fundamental data for the euro. The ECB reminds the markets that it sees no reason to start policy normalization. Today, the ECB economist once again noted the temporary nature of inflation in the country, which does not require a rate hike. The divergence of the ECB and Fed policies became evident after the latter decided to start tapering its QE program. In the short term, the fundamental data is completely on the side of the dollar. This means that the current euro recovery attempts may be restrained by technical levels. The pair is trading below 1.1600 and the situation seems to be under the bear's control trading the euro. If bulls manage to fix the price above 1.1575, it may pave the way to reach 1.1610 and 1.1670. It is important to assess the situation realistically and remember that the current upward movement is purely corrective. At any moment we should be ready to close long positions and return to opening short positions. If the EUR/USD pair fixes below 1.1500 the next targets for the bears are located at 1.1300 and 1.1000.

The initial resistance is located at 1.1575, and the second resistance is at 1.1600. If the session closes above 1.1600, buyers may be attracted and there will be an opportunity for growth to the static resistance at 1.1650. Support is located at 1.1530, 1.1500, and 1.1440. GBP/USD As for the GBP/USD pair, it may become hard to recover the losses after last week's Bank of England meeting, which caused the pound to fall. In an interview with Bloomberg Andrew Bailey, governor of the Bank of England reiterated that the regulator would not manage the financial markets with interest rates. Traders may also be concerned about the pound because of renewed tensions related to Brexit. There have been rumors that the UK may use Article 16. Ireland's Minister for Foreign Affairs, commenting on these rumors, said that the UK wants to deliberately derail the deal because of the Northern Ireland Protocol. According to the Minister, the EU could suspend the entire Brexit deal if the UK does decide to invoke Article 16. The GBP/USD pair began the new week with a decline, but amid the downward correction of the dollar, the pound managed to break through 1.3500. The question is whether the buyers will be able to fix higher. If not, the outlook for the pound may remain negative in the short term. Notably, the closing of the session above 1.3500 may not be enough for a trend reversal. Investors need new fundamental factors.

The Bank of England's refusal to raise rates is a major bearish factor. However, markets did not fully believe the regulator's dovish message. The CME Group's BoEWatch Tool now indicates that markets estimate the probability of a 20bp rate hike in December at nearly 70%. Resistance is located at 1.3500, 1.3570, and 1.3630. Support is located at 1.3400, 1.3360, and 1.3300. The material has been provided by InstaForex Company - www.instaforex.com |

| Is GS stock price preparing a major pull back? Posted: 08 Nov 2021 06:00 AM PST GS stock price has been in a bullish trend since March of 2020. Price is making higher highs and higher lows since then, however over the last few months we observe a warning signal in the weekly chart.

Blue lines- bearish RSI divergence Despite making higher highs, the RSI is making lower highs, suggesting that the weekly trend is weakening. This is an important warning signal and if combined with a technical reversal, we could see a major pull back occur. Last week price made a new higher high but the weekly close was at the lowest of last week's range. It is important for bulls to defend the green upward sloping support trend line. Breaking below it will be another sign of weakness. Confirmation of a trend reversal will come if and when price breaks below $372. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments