Forex analysis review

Forex analysis review |

| Posted: 28 Nov 2021 06:46 AM PST Analysis of previous deals: 30M chart of the EUR/USD pair

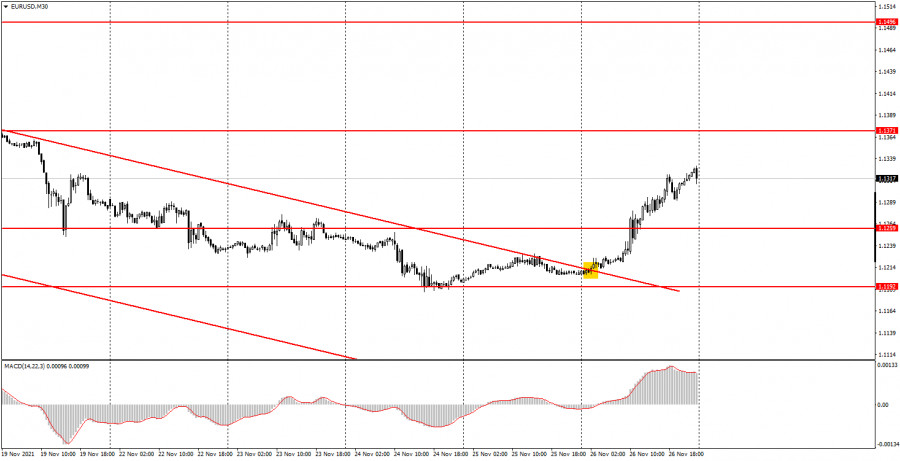

The EUR/USD pair abruptly and unexpectedly began an upward movement on Friday. However, one can talk about surprises for a long time, but strong movements are often unexpected. The main thing is that novice traders had to be ready for an upward movement, as the pair settled above the descending channel at night, thus forming a buy signal. Therefore, at that moment, on the 30-minute timeframe, it was possible to open long positions. What is important: at the time when the European trading session opened, the price moved away from the point of formation of a buy signal by only 5-7 points. Therefore, even with a delay of several hours, long positions could be opened. As a result, the pair passed about 120 points in a day, which could be obtained on this TF. There is absolutely nothing to single out from macroeconomic statistics or fundamental events. Another speech by European Central Bank President Christine Lagarde gave absolutely nothing to the markets. Thus, it was only possible to rely on "technique" when making trading decisions. From our point of view, the euro started to rise due to the need to correct from time to time. 5M chart of the EUR/USD pair

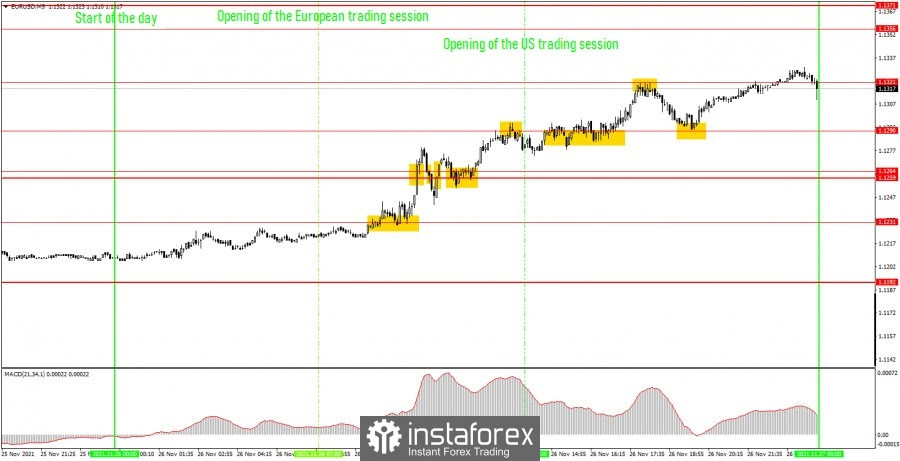

The picture was very interesting on the 5-minute timeframe on Friday. Despite the fact that at the end of the day the pair rose by as much as 120 points, which is a lot for it, it cannot be said that the movement was one-way. During the day, many levels were overcome and worked out and a lot of signals were formed. But here it is very important to understand that from the very morning we already had a buy signal at the 30-minute TF. Consequently, since we do not expect a profit of 30-40 points by Take Profit on the higher chart, the deal could be kept open until the evening. In this case, all signals from the 5-minute TF should be ignored. However, let's consider an option in which novice traders traded on the 5-minute TF. The first buy signal was formed after breaking the level of 1.1231. It was necessary to open long positions, and close them - after the price settled below the level of 1.1259. Profit - 13 points. The same signal should have been used to open short positions, but the signal turned out to be false, so the upward movement resumed, and the price almost immediately re-settled above the levels of 1.1259 - 1.1264. Subsequently, the nearest target level at 1.1290 was reached. As a result, a loss of 15 points was obtained on a short position, and a profit of 10 on a long position. Since a rebound followed from the level of 1.1290, it should also have been worked out by selling. But this signal also turned out to be false, and the upward movement resumed again. As a result, there is still a loss of 17 points. At the US session, the level of 1.1290 was overcome again - a buy signal - new longs and being able to perfectly reach the 1.1321 level. Profit 16 points. A rebound from the level of 1.1321 - a sell signal - development of the level of 1.1290 - profit for another 10-15 points. The last buy signal should not have been worked out. As a result, newcomers were left with low profits. How to trade on Monday: The downward trend reversed on the 30-minute timeframe. Thus, the euro may now continue to rise, but the movement is unlikely to be as strong as on Friday. The key levels for November 29 on the 5-minute timeframe are 1.1259, 1.1290, 1.1321, 1.1356, 1.1371. Take Profit, as before, is set at a distance of 30-40 points. Stop Loss - to breakeven when the price passes in the right direction by 15 points. At the 5M TF, the target can be the nearest level if it is not too close or too far away. If it is, then you should act according to the situation or work according to Take Profit. Neither the European Union nor the United States will have any interesting events and publications on Monday. Thus, novice traders will have nothing to pay attention to, and the volatility may be low. Basic rules of the trading system: 1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. "Hot" early December: ECB meeting, Nonfarm and Omicron Posted: 28 Nov 2021 06:45 AM PST History, as you know, repeats itself twice - first in the form of a tragedy, then in the form of a farce. This catch phrase can also be applied to the ongoing events in the foreign exchange market. With one significant exception: the recurring events this year can hardly be called a farce. Again a wave of lockdowns, again a new strain and again panic in the markets. The topic of the spread of coronavirus in the world is becoming the No. 1 topic again – including for traders of the foreign exchange market, overshadowing macroeconomic reports and/or comments of central bank officials. On the one hand, market participants are not interested in medical reports, but the reaction of the authorities to these reports. Let's say that in the fall of this year, the epidemiological situation in key countries of the world remained difficult, but the market brushed off this factor, as the authorities called the next COVID wave a "pandemic of the unvaccinated", strengthening quarantine restrictions only for those citizens who refuse to be vaccinated against coronavirus. Traders saw a positive side to this tactic (since the authorities did not resort to lockdowns).

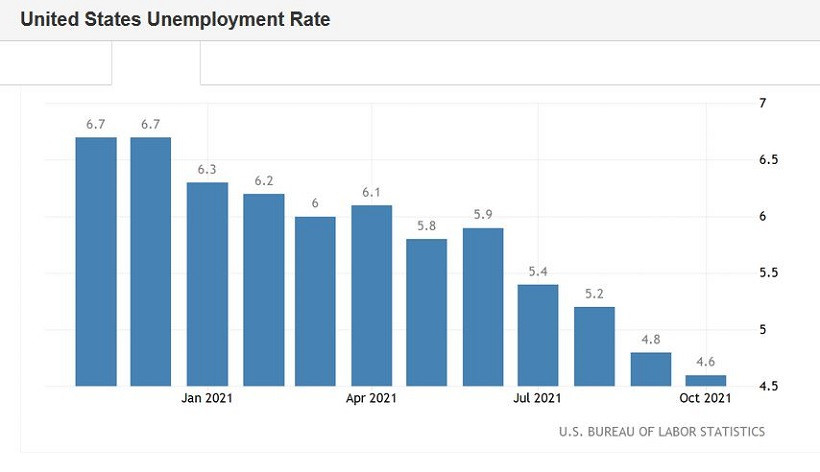

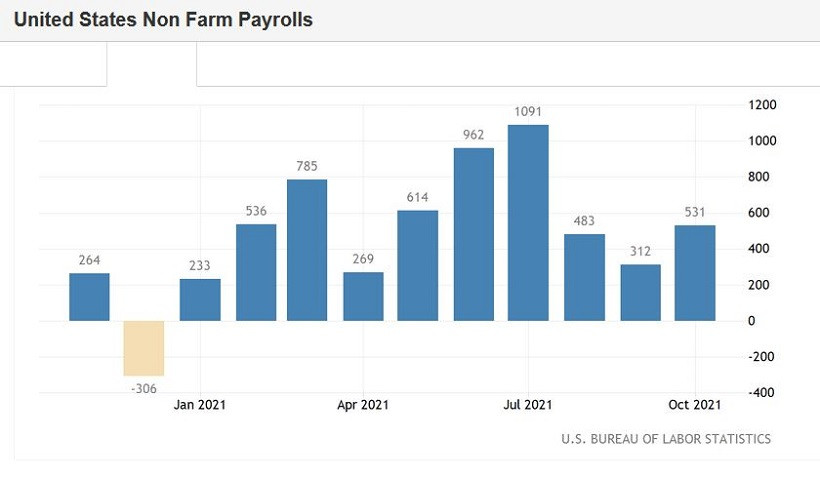

But the situation changed dramatically last week. Firstly, Austria announced a strict lockdown. Quarantine restrictions there apply to both unvaccinated and vaccinated citizens. Secondly, South African scientists have identified a new strain of coronavirus, which is called "Omicron". According to the initial assumptions of virologists, this type of Covid can be much more contagious and more severe in terms of consequences relative to the infamous Delta strain. Against the background of such news, the yield of 10-year treasuries fell sharply, pulling the greenback with it. In turn, the bulls of the EUR/USD pair took advantage of the situation and organized a correction, thanks to which the price returned to the area of the 13th figure (and this despite the fact that two months before the pair had updated the 17-month low, reaching 1.1186). The upcoming week will also be held "under the sign of Covid". Experts may clarify the situation around the new strain, followed by a "domino effect" - depending on the verdict of scientists. If virologists come to the conditional conclusion that Omicron is no more dangerous than Delta (which the created vaccines cope with), EUR/USD traders will return to the "turnover" of a macroeconomic nature. The issue of divergence of the positions of the European Central Bank and the Federal Reserve will come to the fore, in the light of the release of Nonfarm data (Friday, December 3) and the ECB meeting (Thursday, December 2). The most important macroeconomic reports of the week will also be in the spotlight. For example, data on the growth of German inflation in November is expected to be published on Monday (CPI is expected to decrease on a monthly basis and increase in annual terms). Also on the first day of the new week, speeches by Christine Lagarde, Jerome Powell and John Williams are expected. Key data on the growth of inflation in the eurozone will be published on Tuesday (both the general consumer price index and the base index are projected to grow). During the US session on Tuesday, an indicator of consumer confidence will be published in America (a slight decline is expected, up to 110 points from the previous level of 113). Wednesday's central release is the US ISM manufacturing index (a minimal decline is also expected relative to the previous value). In addition, Fed Chairman Powell will speak on Wednesday. Separately, it is worth dwelling on the last two working days of the upcoming trading week. So, on Thursday, the ECB will summarize the results of its last meeting this year. It should be noted here that there are still "hawkish hopes" among some experts. Such thoughts appeared after the publication of the minutes of the October ECB meeting. It states that the members of the central bank recognize the importance that the Governing Council should maintain "sufficient variability" of future steps in monetary policy. In other words, the members of the central bank agree that the ECB should be open to "different options" for further actions. The reason for such conversations was inflation, which is breaking long-term records in the eurozone. The general position of the ECB is that this growth is due to temporary factors, and, therefore, the central bank does not need to rush to normalize monetary policy (and even more so with a rate increase). In addition, representatives of the dovish wing point to weak wage growth. Their opponents - representatives of the "conservative" wing of the ECB - are confident that salaries will "catch up" with inflation at the beginning of next year, causing its further growth on a sustainable basis. And here it should be noted that both "camps" of the ECB agree that it is premature to raise the interest rate next year. Therefore, the internal discussion revolves around the question of what the ECB should do after the completion of the emergency asset purchase Program (RERR). At the December meeting, ECB members will consider the possibility of increasing the purchase of other assets. It is expected that the central bank will increase the volume of the APP program. But just how big is an open question. And judging by the previous rhetoric of the ECB representatives, the members of the central bank did not come to a preliminary compromise on adjusting the volume of the main program. At the moment, the prevailing opinion in the market is that the ECB will supplement the monthly pace of purchases by 20 billion euros. However, there are other figures among experts (an increase in the program by 10 billion euros). It is unknown in which direction the scales will tilt. In my opinion, in the end, representatives of the dovish wing will take over, but according to the results of the December meeting, the fate of the APP program will remain in limbo. This fact will put pressure on the euro. And finally, Friday's central release is the Nonfarm data. Let me remind you that the number of people employed in the non-agricultural sector increased by 531,000 in October – this is the strongest growth rate since July of this year. The unemployment rate dropped to 4.6% (the best result since April 2020). The growth rates of salaries (0.4% m/m and 4.9% y/y) did not disappoint either. According to preliminary forecasts, November Nonfarm will also be "on top". The unemployment rate in the United States should decrease to 4.5%, and the number of people employed in the non-agricultural sector should grow by 528,000 (similar to the October result).

It is important for dollar bulls that macroeconomic fundamentals "work" and not be ignored by the market amid the panic around Omicron. If scientists voice optimistic theses, the market will again return to its daily "routine". The World Health Organization said that it may take several weeks to obtain more complete information about the dangers of a new strain. Preliminary evidence suggests that current vaccines are likely to be "less effective" against Omicron, but still provide some degree of protection. In addition, the head of the National Institute of Infectious Diseases of South Africa today announced that the Omicron strain does not cause severe forms of the disease. He said the sharp increase in the number of new cases of Covid in South Africa over the past few weeks has not led to a significant increase in the number of hospitalizations. According to the scientist, "this is a good enough sign." In the context of the foreign exchange market, this suggests that the "Omicron factor" may soon recede into the background, "skipping ahead" of classical fundamental factors. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments