Forex analysis review

Forex analysis review |

- How to trade GBP/USD on November 2? Simple tips for beginners. The pair has been flat all day

- How to trade EUR/USD on November 2? Simple tips for beginners. The pair calmed down after the "storm" at the end of last

- Peter Thiel: Mad inflation is coming, which will absorb and devalue fiat, so prices and demand for bitcoin and ethereum are

- Dollar shows teeth, the euro may collapse to new lows even before the Fed meeting

- November 1, 2021 : EUR/USD daily technical review and trading opportunities.

- November 1, 2021 : EUR/USD Intraday technical analysis and trading plan.

- November 1, 2021 : GBP/USD Intraday technical analysis and significant key-levels.

- Trading signal for Ethereum (ETH) on November 01 - 02, 2021: sell below 4,375 (strong resistance of 6/8)

- Gold price bounces off cloud support.

- Ichimoku cloud indicator analysis on EURUSD for November 1, 2021.

- USDCHF approaching trend line target and support.

- Trading signal for CRUDE OIL (#CL) on November 01 - 02, 2021: sell below 84,85 (strong resistance)

- Ethereum remains inside bullish channel since mid September.

- Major news on crypto market for November 1, 2021

- GBP/USD: Pound in the hands of the Bank of England

- Trading signal for GBP/USD on November 01 - 02, 2021: buy above 1.3660 (4/8)

- Goldman Sachs confirms correlation between rising inflation and bitcoin

- Technical Analysis of EUR/USD for November 01, 2021

- BTC analysis for November 01,.2021 - Potential for the upside continuation

- Oil market under strong pressure

- EUR/USD analysis for November 01, 2021 - Key price gap zone on the test

- Analysis of Gold for November 01,.2021 - Key resistance on the test

- Video market update for November 01,2021

- Forecast for EUR/USD on November 1 (COT report). A tumultuous week for the US dollar

- Forecast for GBP/USD on November 1 (COT report). The Briton collapsed on Friday and continues to fall on Monday

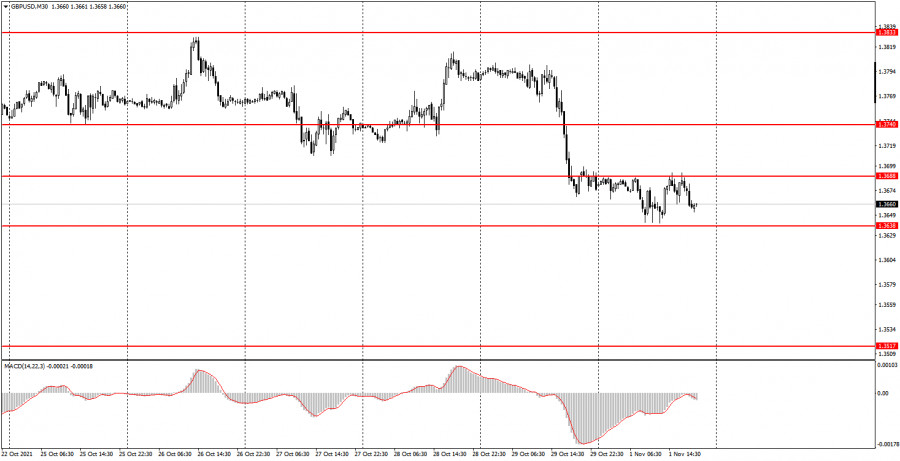

| How to trade GBP/USD on November 2? Simple tips for beginners. The pair has been flat all day Posted: 01 Nov 2021 02:16 PM PDT Analysis of previous deals: 30M chart of the GBP/USD pair

The GBP/USD pair on the 30-minute timeframe spent the entire first trading day of the week in a horizontal channel between the levels of 1.3638 and 1.3688. Thus, all day long, signals were formed near the upper and lower boundaries of this channel. As in the case of the euro/dollar pair, after quite active Thursday and Friday, today everything is back to square one, and the volatility was only 50 points. This value is extremely weak for the pound. A single US ISM manufacturing business report was published during the day. However, it had no effect on the pair's movement. Thus, Monday passed in a complete flat, and the trend or any of its manifestations is now absent. Based on this, we still do not recommend considering trading signals from the MACD indicator, which requires a clear trend and trend movement. 5M chart of the GBP/USD pair

The technical picture on the 5-minute timeframe was even more eloquent on Monday. Typical flat. And novice traders are still very lucky that the price almost perfectly reached the boundaries of the horizontal channel, and in the middle of this channel there was no level near which a pack of false signals could form. And so only three sell signals were formed, all three near the level of 1.3688. Three buy signals could also have formed near the level of 1.3638, but each time the price did not reach literally a few points to this level. However, novice traders could make a profit only in case of profit taking near the level of 1.3638, without waiting for a rebound from it. The problem is that each time out of three the price went down at least 20 points, which was enough to place a Stop Loss order at breakeven. Therefore, no loss was received for any of the open trades. However, the highest that the pair went down on Monday was 30 points, so the least Take Profit could not be triggered, and the closest target level - 1.3638 - was not reached even once. Consequently, in the worst case, the beginners simply did not make any profit or loss on Monday. In the best case, they could have earned several dozen points. How to trade on Tuesday: At this time, there is still no trend on the 30-minute timeframe, and the volatility increased rapidly at the end of last week and quickly fell at the beginning of the new one. Since there is no trend, we do not advise beginners to follow the signals on the MACD indicator for some time. A trend movement is required for these signals to be relevant. The important levels on the 5-minute timeframe are 1.3612, 1.3638, 1.3688, 1.3708, 1.3740. We recommend trading on them on Tuesday. The price can bounce off them or overcome them. As before, we set Take Profit at a distance of 40-50 points. At the 5M TF, you can use all the nearest levels as targets, but then you need to take profit, taking into account the strength of the movement. When passing 20 points in the right direction, we recommend setting Stop Loss to breakeven. Novice traders can pay attention only to the index of business activity in the manufacturing sector of the European Union on November 2. This is not the most important report, so it is unlikely that it will have at least some impact on the movement of the currency pair. Basic rules of the trading system: 1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Nov 2021 02:16 PM PDT Analysis of previous deals: 30M chart of the EUR/USD pair The EUR/USD pair passed as much as 50 points from low to high on Monday, which is already more usual for this pair. Thus, everything returns to normal. The over-volatile movements on Thursday and Friday of the last week were left behind, and the EUR/USD pair is now returning to its usual trading mode. Unfortunately, it is far from the most pleasant for traders. There is still no trend on the 30-minute timeframe, and even a trend line cannot be formed at this time. Moreover, a new horizontal channel cannot be built either. Therefore, now - neither flat nor trend. Let us remind novice traders that in recent weeks the pair has been trading alternately in three horizontal channels at once, but the movement of the last days is generally very difficult to attribute to any specific pattern. We assume that the last two trading days of the past week could have unsettled the currency pair. Therefore, now we need to wait a little so that the situation calms down, and the price can show how it is going to move in the future. 5M chart of the EUR/USD pair Monday's move was not the worst in reality on the 5-minute timeframe. Yes, the volatility was low, but there was a trend movement for most of the day. If the trading signal was formed not at the very end of the day, but somewhere at the beginning, then it would be much more profitable. However, the only buy signal was formed in the middle of the US trading session and after the only macroeconomic report of the day was published. The ISM Manufacturing PMI, which is generally considered quite an important report, exceeded analysts' forecasts, but instead of a fall in the pair (a rise in the dollar), we saw a resumption of the upward movement (a rise in the euro). Thus, this report had no impact. And the buy signal could be ignored, since at that time it was already clear that novice traders would not wait for any strong movement. Even if newbies opened long positions on this signal, then after an hour and a half they should have been closed in any profit, since the movement faded altogether, and the price began to move exactly along the level of 1.1585. How to trade on Tuesday: The volatility fell to its usual values and at this time there is no trend or horizontal channel on the 30-minute timeframe. Therefore, the current movement is generally very difficult to describe in words. Thus, it is still not very convenient to trade on the 30-minute TF, and we still do not recommend tracking signals from the MACD indicator. We advise you to wait for the formation of a trend line or trend channel. The key levels for November 2 on the 5-minute timeframe are 1.1496, 1.1535, 1.1585, 1.1617 - 1.1622. Take Profit, as before, is set at a distance of 30-40 points. Stop Loss - to breakeven when the price passes in the right direction by 15 points. At the 5M TF, the target can be the nearest level if it is not too close or too far away. If it is located - then you should act according to the situation or work according to Take Profit. On Tuesday, novice traders can turn their attention to the report on business activity in the EU manufacturing for October. However, we remind you that earlier the markets ignored much more important data from the EU on inflation and GDP. Basic rules of the trading system: 1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal. 2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored. 3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading. 4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually. 5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel. 6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Nov 2021 02:16 PM PDT

The cryptocurrency market has performed very well and is starting this week on a positive track. Over the past day, bitcoin has grown by almost 3%, ethereum by 4%, and dogecoin by more than 5%. Among other things, the famous billionaire and co-founder of PayPal, Peter Thiel, said that he regretted that he did not buy cryptocurrency when it was on the decline. Thiel said that the rapid rise in prices for Bitcoin and other altcoins is due to the fears of institutional investors about the upcoming inflation, which could be an irreparable blow to world economies. He is sure that now it is possible to observe verified impulse trading. Investors invest their personal savings in the crypto market based on the factor that they are confident in their security during the upcoming inflation, since fiat funds will be devalued and absorbed by the impending inflation, and cryptocurrency savings will remain intact. Investors should pass by those coins that are in unlimited quantities, and instead it is worth carefully analyzing and investing only in those cryptocurrencies that have a limited crypto-coin circulation. In particular, digital gold has a limited reserve of 21 million. And if all Bitcoin in the world is mined, then the price will rise accordingly. According to Thiel, Ethereum will follow bitcoin, its annual production volume is limited to 18 million, but in general it has no limit restrictions. The billionaire believes that dogecoin will be the worst cryptocurrency and a means of saving, because it has an unlimited supply and will be the least effective hedge fund against the coming inflation. Today's small increase can be attributed to the fact that Coindesk subsidiary Coinme has stated that from now on November will be the month of crypto literacy. Coinme, which is a subsidiary of Coindesk, said that throughout November, they will promote basic knowledge about cryptocurrencies in order to increase awareness and literacy of novice investors. The company wants to see as many interested ordinary citizens as possible who want to discover the crypto world and start investing, because now there are the best opportunities for this. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar shows teeth, the euro may collapse to new lows even before the Fed meeting Posted: 01 Nov 2021 02:16 PM PDT

The dollar index is trading lower on Monday intraday, but judging by Friday's movement, the bulls have not lost control of the situation at all. As anticipated earlier, the dollar's decline is just a tactical retreat and temporary difficulty. The greenback is a tough nut to crack, the fact that it jumped 1% against the euro at the end of the last trading session just speaks of its unconditional strength. Now there is no point in dragging the dollar further up. Traders will be cautious ahead of the biggest events this week - the Fed meeting, from which the markets are expecting a belated reduction in stimulus, and the publication of the monthly labor market data. To confirm the trend, traders will most likely wait for the EUR/USD pair to fall below local lows around 1.1530. On the eve of the euro almost reached this level, at the moment the decline reached the level of 1.1540. Today the pair has grown slightly, which, in fact, is facilitated by the consolidation of the dollar in the area of Friday's highs. This environment should be favorable for the further growth of the American currency. The dollar index may receive support from buyers and head towards 97.50. The EUR/USD pair, therefore, may collapse to the 1.1200 area. At what development of the scenario can we expect such a growth in the dollar?

So, the two-day meeting of the US Central Bank is expected to end with the announcement of the termination of the purchase of bonds, which currently amount to $120 billion per month. QE should be completely phased out by the middle of next year. These forecasts are already included in the quotes. Therefore, investors will be watching closely for comments that will adjust these expectations. It is precisely these changes that can radically change the current picture in the markets. Judging by Friday's statistics, changes in the tone of the regulator may well occur. Prices for personal consumer spending (an important indicator for the Fed) jumped 4.4% over the year. These are the fastest growing rates over the past few years. Against this backdrop, the yields on short US bonds jumped sharply, and analysts at Goldman Sachs raised their forecast for the first Fed rate hike. Now the bank expects to tighten the policy by July next year. New expectations served as an impetus for the dollar's growth at the end of last week, if market players hear something similar from the Fed officials, then it will be difficult to stop the dollar. In any case, the greenback is now on the verge of an important stage, the risks of volatility should increase significantly ahead of the historic meeting. Another important event for the dollar, as we noted above, will be the final report on the labor market for October. Previous reports were rather weak, so market players are quite anxiously awaiting the new publication of the indicator. The growth of new jobs is expected to be within 400,000, which is twice more than in September and than the average long-term rise. It is possible that the October payrolls will turn out to be even more positive. The end of additional payments to the unemployed and increased inflation could stimulate an inflow into the ranks of the employed. Until Wednesday, no big moves are expected in the EUR/USD pair. The euro is likely to correct rather than decline. If on Tuesday the quote continues to trade in the range of 1.1530-1.1585, it is quite possible that the new low will be updated before the Fed meeting.

The euro is too tough for the dollar, which looks more ambitious and attractive anyway. The Fed is ready to tighten monetary policy, and the ECB has maintained a dovish position, despite the expected further acceleration of inflation. Support is marked at 1.1525, 1.1505, 1.1425. Resistance - at 1.1635, 1.1690, 1.1725. The material has been provided by InstaForex Company - www.instaforex.com |

| November 1, 2021 : EUR/USD daily technical review and trading opportunities. Posted: 01 Nov 2021 11:20 AM PDT

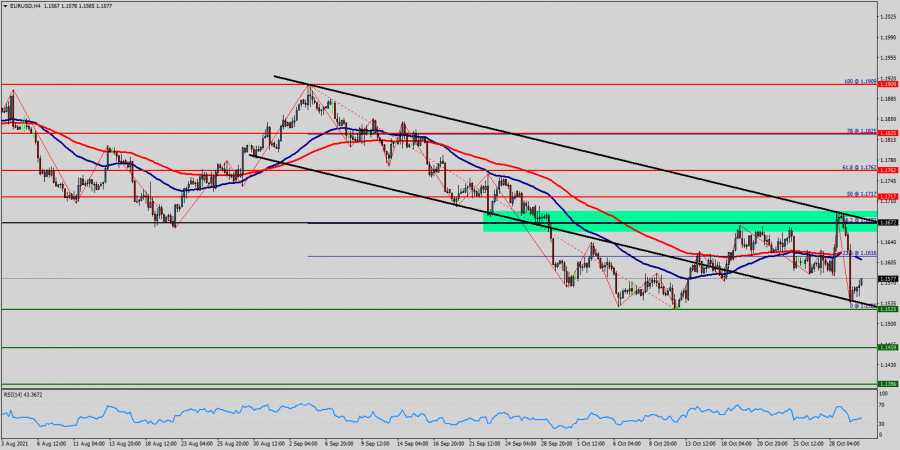

Recently, Persistence below the depicted price zone of 1.1990 indicated further downside movement towards 1.1840 and 1.1780 where a sideway consolidation range was established. During last week, the EURUSD pair has been trapped within a narrow consolidation range between the price levels of 1.1780 and 1.1840. A bullish breakout was executed above 1.1840 shortly after. Temporary Upside pullback was expected towards 1.1990. However, re-closure below the price level of 1.1840 has initiated another downside movement towards 1.1780 which failed to hold prices for a short period of time before significant upside movement was presented into market. Intraday traders were advised to wait for candlestick closure above 1.1780 - 1.1840 for another ascending swing to be initiated. However, immediate downside selling pressure brought the pair down below 1.1700. More downside movement took place towards the price level of 1.1600 where significant buying pressure existed. Bearish persistence below 1.1700 and 1.1600 has enhanced further decline towards 1.1500. Currently, the price zone around 1.1700 stands as a prominent supply-zone to be watched for SELLING pressure and a possible SELL Entry upon any upcoming ascending movement. The material has been provided by InstaForex Company - www.instaforex.com |

| November 1, 2021 : EUR/USD Intraday technical analysis and trading plan. Posted: 01 Nov 2021 11:19 AM PDT

Bearish persistence below the price zone of 1.2050-1.2000 allowed the recent downtrend to be established. So, the EURUSD pair has expressed significant bearish decline while the price level of 1.1650 stood as a prominent demand level that prevented further bearish decline. The bullish pressure that originated around 1.1650 failed to push higher than the price level of 1.1900. That's why, another bearish pullback towards 1.1650 was executed. Bullish signs were expected around the price levels of 1.1650-1.1700 as it corresponded to a recent previous bottom. However, extensive bearish decline has pushed the EURUSD pair towards 1.1600 and lower levels was about to be reached if sufficient bearish momentum was maintained. Moreover, significant bullish recovery has originated recently upon testing the price level of 1.1570. The recent bullish pullback towards 1.1650-1.1680 was expected to offer bearish rejection and a valid SELL Entry. Significant bearish decline brought the EURUSD pair again towards 1.1550 levels which still stands as an Intraday Support zone. Hence, sideway movement maybe expected in the nearest future. Please note that any Bullish movement above 1.1680 should be considered as an early exit signal to offset any SELL trades. The material has been provided by InstaForex Company - www.instaforex.com |

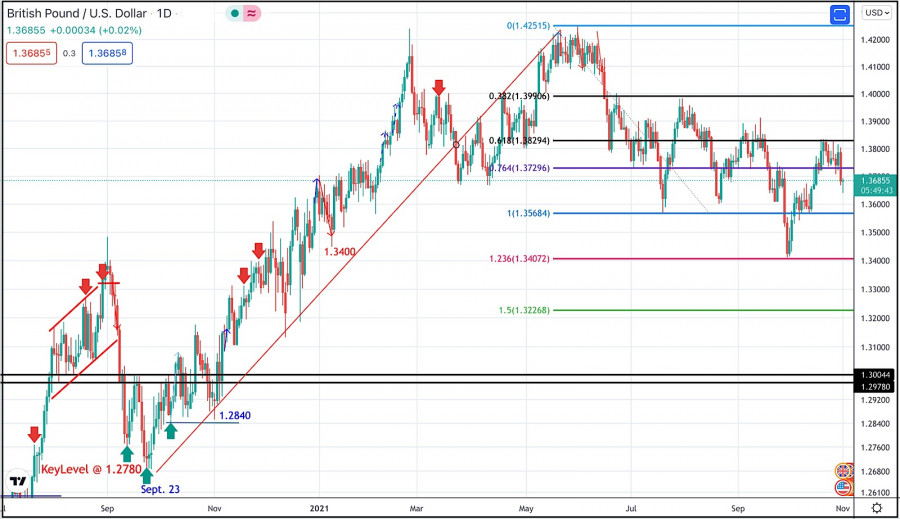

| November 1, 2021 : GBP/USD Intraday technical analysis and significant key-levels. Posted: 01 Nov 2021 11:01 AM PDT

The GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline. On the other hand, the nearest SUPPLY level was located around 1.4000 where bearish rejection and a valid SELL Entry was anticipated. The recent bullish rejection witnessed around 1.3600 as well as the temporary bullish breakout above 1.3830 indicated a high probability that this bullish movement may pursue towards 1.4025 then 1.4100. However, the pair remained trapped within a fixed price range until significant bearish momentum emerged into the market. Bearish breakout below 1.3680 enabled further bearish decline towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement. This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.373 which was temporarily bypassed. Recently, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market. Currently, the short-term outlook is bearish as long as the pair maintains its movement below 1.3730. Another bearish visit is expected towards 1.3570 and 1.3400 as they correspond to significant Fibonacci Expansion Levels. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Nov 2021 08:40 AM PDT

Since October 21, Ethereum has been consolidating below the strong resistance of 6/8 of murray around 4,375. The crypto made an attempt to break above this level on October 29. However, it could not manage to stay above. Since then, it has made make several attempts to break this level, but has so far has been unsuccessful. The moving average of 21 is located at 4,313. Below this level and below the line of 6/8 of murray, there is strong downward pressure. If Ether manages to consolidate below this zone in the next few hours, the price is likely to drop to 5/8 murray that converges with the bottom of the uptrend channel around 4,062. A sharp break below the uptrend channel that was formed since September 27 could be the beginning of a bearish scenario. For this, we should wait for a daily close below the 200 EMA that is located at 3,846. After trading below these levels, we should expect a drop to the psychological level of $ 3,000 and up to 1/8 of a murray around 2,812. On the contrary, if Ether manages to overcome the level of 4,375 and consolidates above it, it is very likely that the market will become optimistic and increase buyers who will push ETH to 4,687 where there is the 7/8 of murray which means a technical reversal. If the upward force prevails, it could push ETH up to the psychological level of $ 5,000. Since October 26, the eagle indicator is oscillating below a downtrend channel. It has not been able to overcome this channel. Each time it touches the resistance, the market volume decreases. This serves as a negative signal for Ethereu which is likely to fails to overcome 4,375. A correction is expected in the next few days. Support and Resistance Levels for November 01 - 02, 2021 Resistance (3) 4,515 Resistance (2) 4,408 Resistance (1) 4,375 ---------------------------- Support (1) 4,284 Support (2) 4,177 Support (3) 4,062 *********************************************************** A trading tip for ETH for November 01 - 02, 2021 Sell below 4,375 (6/8) with take profit at 4,062 (bottom uptrend) and 3,846 (EMA 200), stop loss above 4,515. The material has been provided by InstaForex Company - www.instaforex.com |

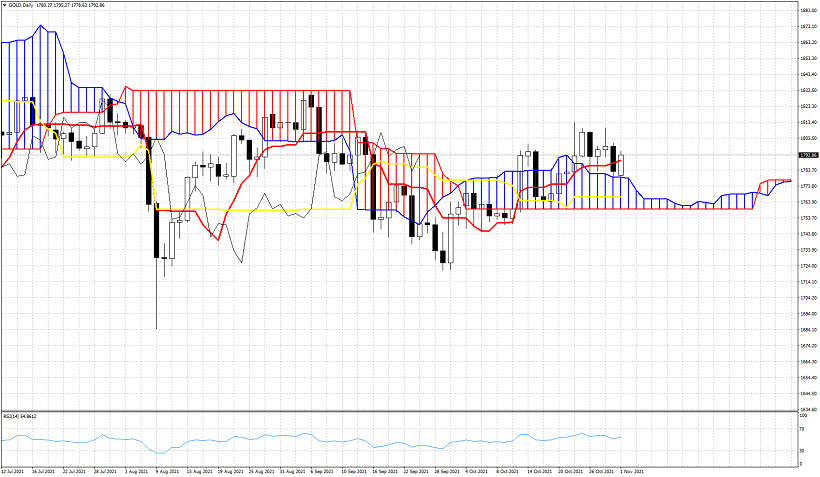

| Gold price bounces off cloud support. Posted: 01 Nov 2021 08:20 AM PDT In our previous analysis on Gold, we noted that price was challenging the Daily cloud support. Price is now bouncing off this support and this is a bullish sign. Holding above last week's lows is key for the near term trend.

|

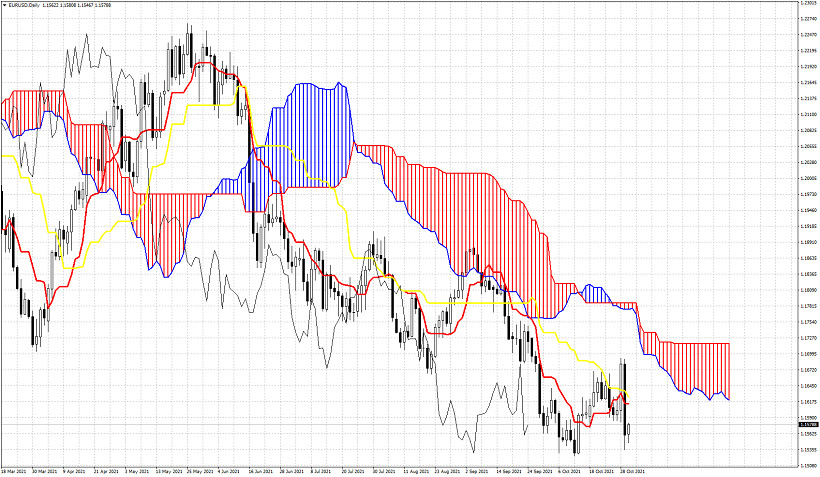

| Ichimoku cloud indicator analysis on EURUSD for November 1, 2021. Posted: 01 Nov 2021 08:15 AM PDT EURUSD remains in a bearish trend according the Ichimoku cloud indicator in the Daily chart. Price continues to trade below the Daily Kumo. Last week's sell off pushed price below the tenkan-sen and kijun-sen indicators providing another sign of weakness.

|

| USDCHF approaching trend line target and support. Posted: 01 Nov 2021 08:11 AM PDT USDCHF provided us with a bearish signal on mid October when price broke the upward sloping support trend line at 0.9250-0.9240 area. At that time price also broke below the horizontal support at 0.9250 adding to the bearishness of the two signals. Back then our target was first at 0.92, next at 0.9150 and finally at 0.9050.

Red line- support (broken) Green line -horizontal support (broken) In ouranalysis on October 14th we noted the bearish signal and the targets. Support now by the orange upward sloping trend line is at 0.9085. I expect the orange trend line to be tested soon. Short-term trend remains bearish after breaking below the support area of 0.9240-0.9250. Breaking below the orange trend line would be an added bearish signal. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading signal for CRUDE OIL (#CL) on November 01 - 02, 2021: sell below 84,85 (strong resistance) Posted: 01 Nov 2021 08:07 AM PDT

According to the 4-hour chart, a strong uptrend has been going on from August 20. In the early American session, the price of crude oil is trading higher. The odds are that it is set to rise and try to do a double top around 84.85 or up to the annual high of 85.39. On the other hand, technical indicators show that the market is very overbought and there could be a correction in the coming days. The report of commercial crude inventories published last week showed an increase of 4.3 million barrels. This data limited the rise of crude oil and there was a fall to the level of 81.25. Because this area is strong support, the price managed to rebound and is now approaching the price level of October 25th. Another factor that has given crude upward momentum has been the rally of the main Wall Street indices that closed at historical records on Friday. The situation also benefits crude oil. However, we could expect a technical correction this week. Since it is the beginning of the month, we could see a correction again to the 81.25 area which is 6/8 of a murray. Because it is above the 21 SMA, crude is likely to extend its rise. We should wait for the resistance zone of 85.84 or 85.39 and a consolidation around this level. If the bullish force is exhausted in this area, it would be a good opportunity to sell WTI. On the other hand, while it is below 7/8 of murray which represents a technical reversal, we could sell with targets to the bottom of the uptrend channel and up to 6/8 of murray around 81.25. The technical reading of the eagle indicator shows that the moving average of the indicator is moving below a downtrend channel. The indicator is likely to touch the top of this channel. If WTI fails to surpass this level, it will also be a bearish signal for us and we could expect a drop in crude oil in the next few days Our trading plan is to sell only if it finds resistance in the area between 84 38 - 85 38. Above this level, there is strong resistance and it could give us an opportunity to sell during the correction to the level of 82.90 (SMA21) to the levels of 81.30. Support and Resistance Levels for November 01 - 02, 2021 Resistance (3) 85.63 Resistance (2) 84.14 Resistance (1) 84.25 ---------------------------- Support (1) 83.12 Support (2) 82.83 Support (3) 81.94 *********************************************************** A trading tip for CRUDE OIL for November 01 - 02, 2021 Sell if pullback 84.85 (strong resistance) with take profit at 82.90 (SMA 21) and 82.00 (bottom uptrend), stop loss above 85.40. The material has been provided by InstaForex Company - www.instaforex.com |

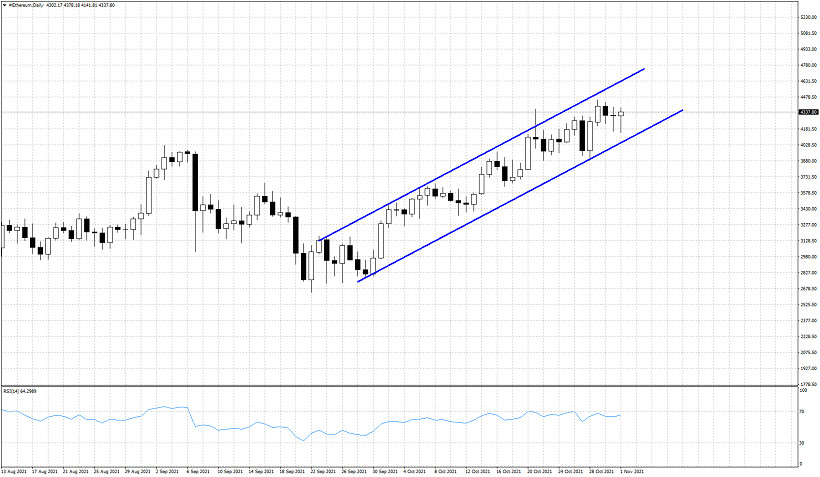

| Ethereum remains inside bullish channel since mid September. Posted: 01 Nov 2021 07:54 AM PDT Ethereum is trading at $4,339 and continues making higher highs and higher lows. Price is still inside the upward sloping channel that was created after the low in mid September around $2,639. As long as price continues to respect the channel boundaries, bulls will remain in control of the trend.

Ethereum as we said above is clearly in a bullish trend. Support by the lower channel boundary is at $4,045. A break below this level will be a sign of weakness and could signal the start of at least a pull back. Until then bulls remain in full control of the trend and should target the upper channel boundary at $4,625. The material has been provided by InstaForex Company - www.instaforex.com |

| Major news on crypto market for November 1, 2021 Posted: 01 Nov 2021 07:48 AM PDT

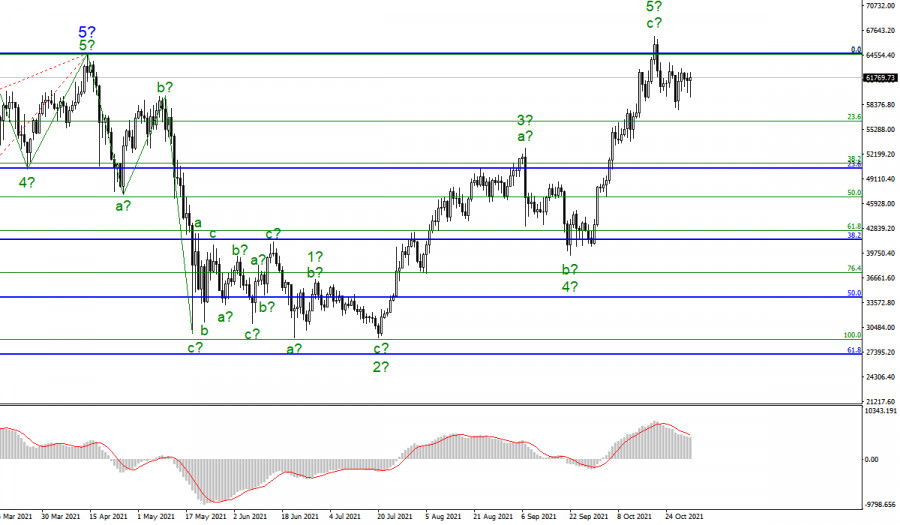

Bitcoin has paused in its rise in the last few days. An attempt to break through the previous peak, located around $64,706, was unsuccessful. Thus, at this time, the quotes began to move away from the maximums reached. This retreat of quotes can be either a new downward wave or a new downward trend section. I would say that now almost everything for bitcoin depends on the $64,706 mark. Starting from June 22, 2021, the BTC/USD instrument has already built a five-wave structure. And if this is so, then the construction of a downward set of waves, a three-wave minimum, will begin or has already begun. And the targets of this set of waves are located near the $51,000 mark. Thus, a new increase in bitcoin quotes can be expected either after a successful attempt to break through the $64,706 mark or after the completion of the construction of a three-wave section. Bitcoin fell to $8,000 on the Binance exchange.A rather remarkable and even funny event happened last week. Bitcoin quotes dropped to $8,000 per coin on the Binance cryptocurrency exchange. Naturally, this was an algorithm error, and only in the terminal of a single user. However, when this happened, some analysts again began to speculate about the likelihood of Bitcoin dropping 80-90% from current peaks. The fact is that after almost every upward trend, there was a decrease in bitcoin quotes, which should not be surprising since corrections are an integral part of trading. However, in the case of Bitcoin, these corrections accounted for up to 90% of the entire trend. When markets realized that the upward trend was over, they got rid of bitcoin at almost any price, which led to a strong fall in cryptocurrency. So now, when bitcoin has been growing for a year and a half, many analysts began to talk about a possible new collapse of the first cryptocurrency. Moreover, the wave analysis shows the completion of the construction of the next five-wave structure, therefore, it can be changed not only by the corrective, three-wave structure but also by the five-wave, impulsive one. The outflow of bitcoin from the Binance exchange.There was a large outflow of bitcoin coins amounting to $2 billion from the cryptocurrency exchange Binance last week. This means that bitcoin was actively bought and there was a shortage on the exchanges. That is, a fairly large number of coins were bought from the exchanges, so there are much fewer coins on sale. This could contribute to the growth of the bitcoin rate. And given this market behavior, markets and analysts continue to expect further cryptocurrency growth. This year the figure of $100,000 per coin was mentioned more than once. Thus, the course of the main cryptocurrency may eventually strive for this figure. But first, we need to clarify the wave counting, which can take both a three-wave form and a more extended five-wave one.

|

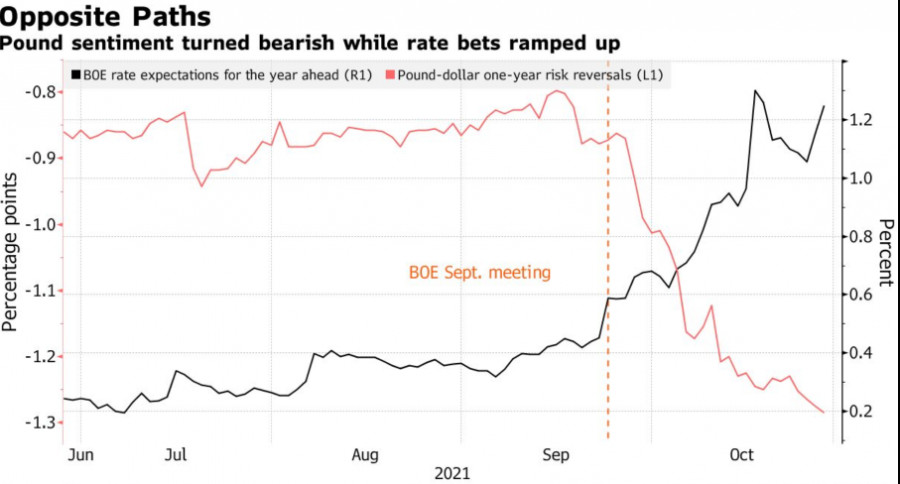

| GBP/USD: Pound in the hands of the Bank of England Posted: 01 Nov 2021 07:15 AM PDT Will the Bank of England raise the repo rate at the November 4 meeting? Money markets believe that yes, predicting its growth to 1.25% by the end of 2022. Bloomberg experts, no, as it could slow down the already slowly rising economy of the UK. What will be the result of the MPC meeting and how will the pound react to this or that verdict? Every first investor racks their head about this. Judging by the dynamics of British bond yields, the factor of the first act of monetary restriction has already been taken into account in the sterling rate. Indeed, it is difficult to expect more hawkish rhetoric from BoE than is currently implied in the quotes of financial instruments. Deutsche Bank is confident that the Bank of England will go even further - it will not only begin the cycle of raising the repo rate but also complete the quantitative easing program a month earlier than forecast. In addition, the regulator can give a signal about the growth rate of borrowing costs. Investec believes that most members of the Monetary Policy Committee will consider that there will be no particular harm in raising the rate by 15 basis points. But if the Central Bank does not do this, trust in it can be seriously shaken. Unlike the debt market, the urgent market, on the contrary, does not expect active action from the Bank of England at the meeting on November 4 - the risks of a reversal in the pound are at their lowest levels over the past few months. Dynamics of Repo Rate Expectations and Pound Reversal Risks

As a result, the so-called binary result is returned to the UK. Previously, a referendum on Scotland's membership in the United States, Brexit, and other events went along the same path. Currently, the situation for GBPUSD is complicated by the fact that the US dollar looks very good. And if the Bank of England refrains from active action, the pair will surely collapse. It's another matter if it accepts them. Strong statistics on the index of personal consumption expenditures, which rose to 4.4% in September, the highest level since 1991, as well as on average salaries of Americans for the third quarter returned interest in the dollar. Moreover, it has such potentially bullish drivers on its nose as the FOMC meeting and the release of US labor market data for October. In the first case, no one will blame the Fed for a more aggressive tapering of $120 billion of QE, in the second, employment growth outside the agricultural sector, the 450,000 expected by Bloomberg experts, is good news for the US currency. Thus, whether the GBPUSD bulls will resist their opponents depends entirely on the Bank of England, or rather on Ben Broadbent and John Cunliffe, who have not yet expressed their opinion on the repo rate hike. So far, investors expect that two more supporters of monetary restriction, including Andrew Bailey, will join the two MPC hawks. There are three doves on the opposite side of the barricades. Technically, the drop in GBPUSD quotes below fair value and moving averages suggest that the bulls are weak. Sell the pound on the rebound from 1.3755 and on the breakdown of the support at 1.365. On the contrary, growth above 1.378 is a reason to take a closer look at purchases. GBPUSD, Daily chart

|

| Trading signal for GBP/USD on November 01 - 02, 2021: buy above 1.3660 (4/8) Posted: 01 Nov 2021 07:12 AM PDT

Rebounding off the low of 1.3641, GBP/USD is recovering part of the losses of the European session and is now located above 4/8 murray. The pair is likely to continue the technical rebound and the price could reach the area of the 200 EMA and up to the SMA 21 around 1.3740. At this level, 23.6% of the Fibonacci retracement is located that could be a strong barrier for GBP / USD. Last Friday, the British pound sharply broke the 200 EMA. This is a negative sign. The odds are that the rebound we are seeing in these hours is only a correction or a pullback towards the 1.3740 resistance. So, the currency pair could again resume the downtrend. Therefore, a good point to sell would be the SMA of 21 or 23.6% Fibonacci with targets at 1.3671 (4/8) and up to the 61.8 Fibonacci at 1.3570. The dollar index (#USDX) last week sharply rose to the 94.27 area, surpassing the 200 EMA that suggests bullish prospects. At the beginning of this week, it left a GAP and is making a correction which could favor the British pound. However, investors are still cautious regarding the Fed's monetary policy, in particular the decision to tame the soaring inflation. Such speculations may continue and the rise of the British pound is likely to be short-lived. In the short term, the GBP / USD pair is expected to trade lower because it is located below the SMA of 21 and the EMA of 200. There is strong downward pressure below this zone. Therefore, any pullback towards this level will be considered a good opportunity to continue selling. It is likely that the GBP bearish movement will push it down to the zone of the 61.8 Fibonacci retracement around 1.3570. The technical reading of the eagle indicator shows that since October 20 after having consolidated around 95, GBP/USD made a negative movement guided by a bearish channel. A correction may follow in the next few hours due to the fact that indicator is generating a positive signal at the moment which could benefit GBP. If it fails to break this channel, it will only mean a correction and we could consider selling the pair in the next few days. The market sentiment report for today shows that there are 55.48% of traders who are selling the British pound. This is a neutral sign. If this figure decreases and falls below 40%, it could be a negative sign for the GBP / USD pair and a drop to the psychological level of 1.35 could occur. Support and Resistance Levels for November 01 - 02, 2021 Resistance (3) 1.3785 Resistance (2) 1.3726 Resistance (1) 1.3705 ---------------------------- Support (1) 1.3658 Support (2) 1.3623 Support (3) 1.3564 *********************************************************** A trading tip for GBP/USD for November 01 - 02, 2021 Sell if pullback 1.3740 (23,6%) with take profit at 1.3671 (4/8) and 1.3570 (61,8%), stop loss above 1.3780. The material has been provided by InstaForex Company - www.instaforex.com |

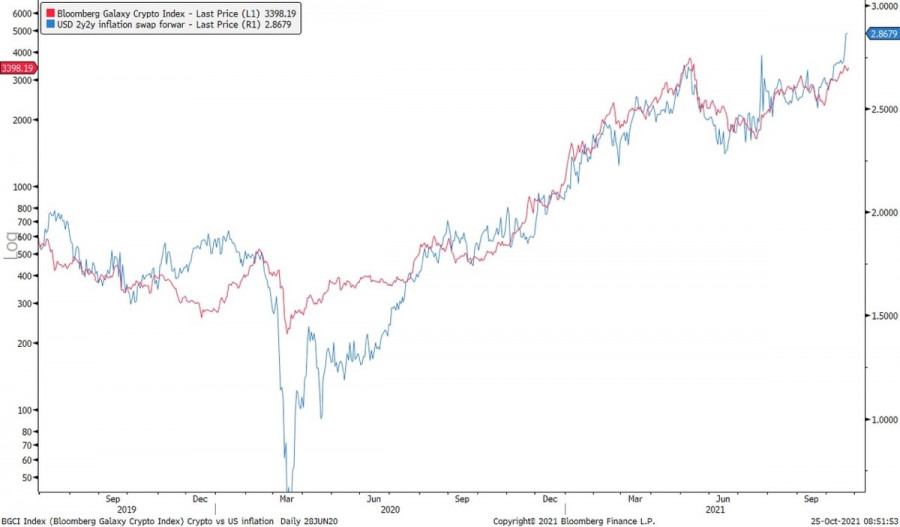

| Goldman Sachs confirms correlation between rising inflation and bitcoin Posted: 01 Nov 2021 07:10 AM PDT Bitcoin begins another trading week, stabilizing in a narrow range of $60,500-$63,500. At the same time, onchain activity and market activity continue to remain at record high levels. The cryptocurrency's hash rate also continues to recover and has returned to values prior to the "great migration" from China. However, the main reason for bitcoin's continued bullish rally is the worsening crisis of the fiat markets and the weakness of gold being a safe haven asset.

This simple conclusion was made by Goldman Sachs experts, conducting a study, according to which the growth of BTC price is directly related to the rate of inflation growth. This suggests that investors use bitcoin to protect their funds from the inflationary crisis triggered by supply disruptions due to coronavirus. A similar opinion was expressed by analysts at JPMorgan, examining the main factors for bitcoin reaching a new all-time record. According to experts, it was fear of inflation, but not the launch of the bitcoin ETF, which caused a bullish rally. Peter Peel, head of PayPal, is confident that the current price of the asset is a direct consequence of worsening inflationary processes around the world.

If we put aside the inflation problem for a while, we can note an important event for the leading digital asset. The growing correlation between BTC and the fiat currencies' depreciation suggests that bitcoin has become a major risk hedge instead of gold. The current rally in crypto is direct evidence of this, and the growing demand for bitcoin among customers of major US banks indicates the desire of investors to have more opportunities to operate with the asset. As the crisis worsens due to another wave of pandemics and the gradual acceptance of BTC as a traditional asset, the minimum growth expectation for bitcoin this year is $100,000. With the continued downward trend in financial market indices, as well as a consistently high flow of investment from all categories of investors, there is no doubt that the asset may reach $100,000 as early as November.

Meanwhile, bitcoin continues to hover within the narrow stabilization range after rebounding from the $57,000-$60,500 area. Over the past 24 hours, bitcoin gained by 2.5% and showed daily trading volumes of $36.3 billion, which is a good indicator for the current stage of the market. Despite all the fundamental positive factors, it is not yet supported by technical charts, on which the asset only enters the phase of consolidation and further accumulation. The main indicators of the cryptocurrency are moving sideways with no hints of an upward breakout. The MACD indicator maintains the current momentum and stays above zero. The RSI is moving along 60, indicating bullish market sentiment. The stochastic oscillator has formed several bullish crossovers in a short period of time, but all of them were formed by weak buyers, so it is impossible to develop a full medium-term upward movement. It is likely that it is in the waiting phase and accumulates volumes before the upcoming Taproot update. The first attempts to start a full-fledged movement to new highs may appear soon, but as of November 1, the market is not ready to support such bullish momentum due to the lack of proper support on the onchain metrics.

|

| Technical Analysis of EUR/USD for November 01, 2021 Posted: 01 Nov 2021 05:24 AM PDT

After breaking the support at 1.1672. The EUR/USD pair has set strong resistances at the levels of 1.1672 because the support has become a resistance on the 4h chart. So, the price has already formed the strong resistance at the level of 1.1672 and the pair probably will try to approach from it in order to test it again. However, if the pair fails to pass through the level of 1.1672, the market will indicate a bearish opportunity below the new strong resistance level of 1.1672 (the level of 1.1672 coincides with the ratio of 38.2% Fibonacci). Moreover, the RSI is becoming to signal a downward trend, as the trend is still showing strong above the moving average (100) and (50). Thus, the market is indicating a bearish opportunity below the 1.1672 level so it will be a good sign to sell at 1.1672 with the first target of 1.1525. It will also call for a downtrend in order to continue towards 1.1459. The daily strong support is seen at 1.1396. On the other hand, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the price of 1.1762. It is also worth noting that the price at 0.8521 will possibly form a strong support. Accordingly, saturation around 1.1396 to rebound the pair is likely to occur. Furthermore, it is possible that the market is going to start showing the signs of bullish market. Hence, it will be a good sign to buy above 1.1396 to retest the levels of 1.1650-1.1675. The material has been provided by InstaForex Company - www.instaforex.com |

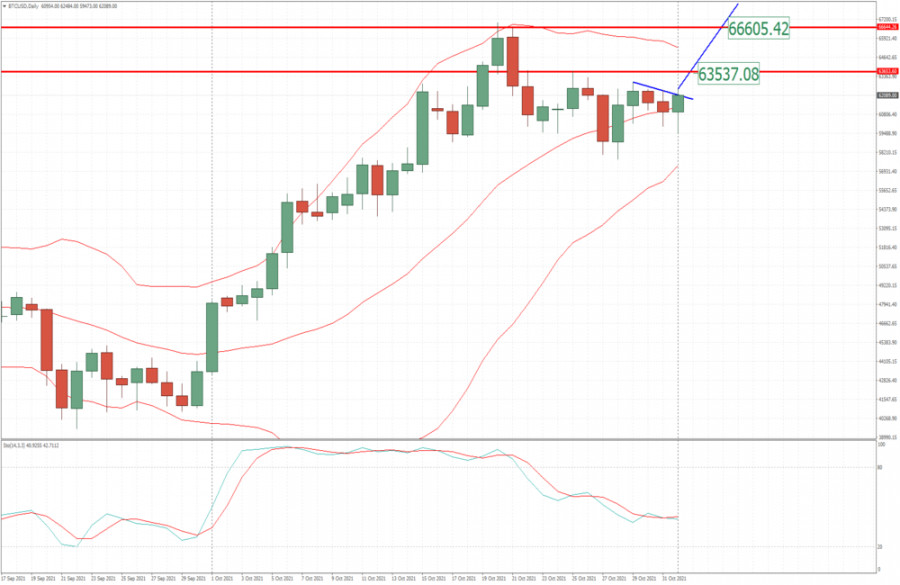

| BTC analysis for November 01,.2021 - Potential for the upside continuation Posted: 01 Nov 2021 05:20 AM PDT Technical analysis:

BTC has been trading flat in last few days at the price of $62,000 but I see today is the breakout day. Trading recommendation: Due to uptrend in the background and contraction in the last few days, I see potential for the upside continuation movement. Watch for buying opportunities on the pullbacks with the upside objectives at the price of $63,540 and $66,600 Key support is set at the price of 59,500 The material has been provided by InstaForex Company - www.instaforex.com |

| Oil market under strong pressure Posted: 01 Nov 2021 05:17 AM PDT Oil prices are rapidly declining in Monday's trading session amid the commodity market's expectation of the OPEC+ alliance meeting scheduled for this week.

At the time of writing, January Brent crude oil futures fell in price by 0.4% to $83.35 per barrel. At the same time, oil quotations rose by 0.1% to $83.72 per barrel on Friday. December WTI crude oil futures dropped by 0.7% to $83.01 per barrel on Monday. On Friday these contracts closed at $83.57 per barrel, gaining 0.9%. WTI crude oil declined by 0.2% and Brent crude oil fell by 1.3% last week. The price of Brent grew by 7.5%, and WTI - by 11% during October.

Experts explain the decline in the oil market on Monday by investors' uncertainty ahead of the forthcoming OPEC+ meeting scheduled for November 4. The OPEC+ members will meet on Thursday to discuss the need to increase oil production by more than the previously agreed upon 400,000 bpd amid domestic statistics from the United States. According to the US data, gasoline volumes in the US have shown a sharp drop and commercial reserves of oil in the Cushing oil field are rapidly approaching the minimum levels. Commodity market participants assume that this may trigger a debate among OPEC+ member countries on the need to increase production. Meanwhile, market analysts merely agree with them, assuming that the alliance will not change its decision at the upcoming meeting. In case OPEC+ sticks to its earlier plans to increase production, the oil market will receive significant support in the short term, analysts believe. Another downward factor for the global price of oil this week was the concerns about new outbreaks of COVID-19 in China. Thus, the number of new cases in China could significantly slow down the global oil demand recovery. On Sunday, Beijing publicly announced that it was emptying diesel and gasoline reserves in order to increase supply in the oil market and stabilize its prices. The decision instantly triggered a rise in the price of oil in the trading session on Monday. In addition, the day before the major media in China reported about the permanently falling level of supply of diesel fuel, which provoked large queues at gas stations in October. Experts attribute this to the fact that previously oil refining companies in China have significantly reduced fuel production amid falling margins. The Chinese authorities decided not to disclose the volume of fuel sales. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for November 01, 2021 - Key price gap zone on the test Posted: 01 Nov 2021 05:09 AM PDT Technical analysis:

EUR has been trading upside this morning towards the 1,1575but I see potential for the downside continuation due to strong downside breakout from Friday. Trading recommendation: Due to the strong breakdown in the background and strong supply, my advice is to watch for selling opportunities near the resistance. Key resistance zone is set at 1,1575-1,1619 Watch for selling opportunities with the downside targets at 1,1540 and 1,1420 Stochastic oscillator is showing overbought condition, which is sign that downside might be in the play later today. The material has been provided by InstaForex Company - www.instaforex.com |

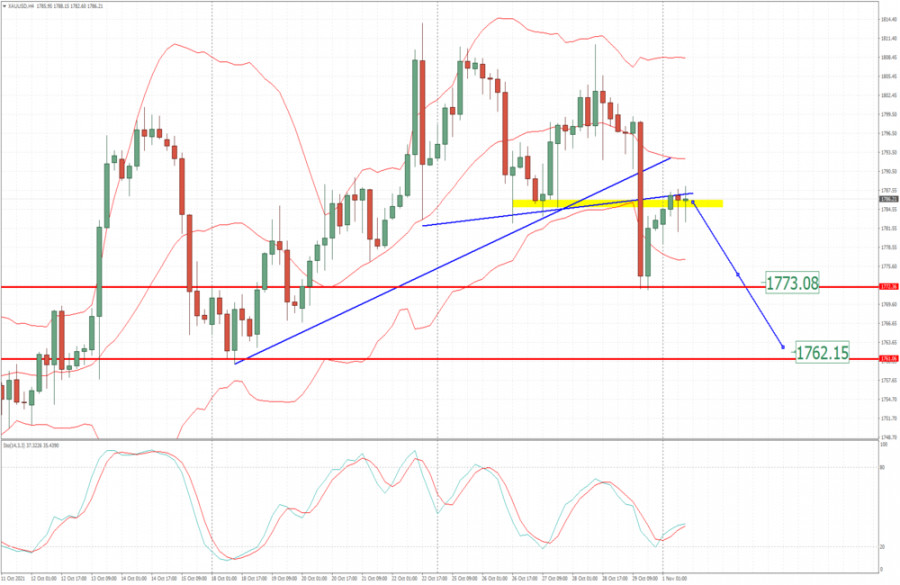

| Analysis of Gold for November 01,.2021 - Key resistance on the test Posted: 01 Nov 2021 05:03 AM PDT Technical analysis:

Gold has been treading upside this morning towards the $1,786 but I see potential for the downside continuation due to breakout fo the rising trendline in the background. Trading recommendation: Due to the breakout of the upside trendline in the background and strong supply, my advice is to watch for selling opportunities. Downside targets are set at the price of $1,773 and $1,762. Stochastic oscillator is is showing bull condition the not the oversold... Key resistance is set at the price of $1,787 The material has been provided by InstaForex Company - www.instaforex.com |

| Video market update for November 01,2021 Posted: 01 Nov 2021 04:47 AM PDT Watch for continuation al patterns... The material has been provided by InstaForex Company - www.instaforex.com |

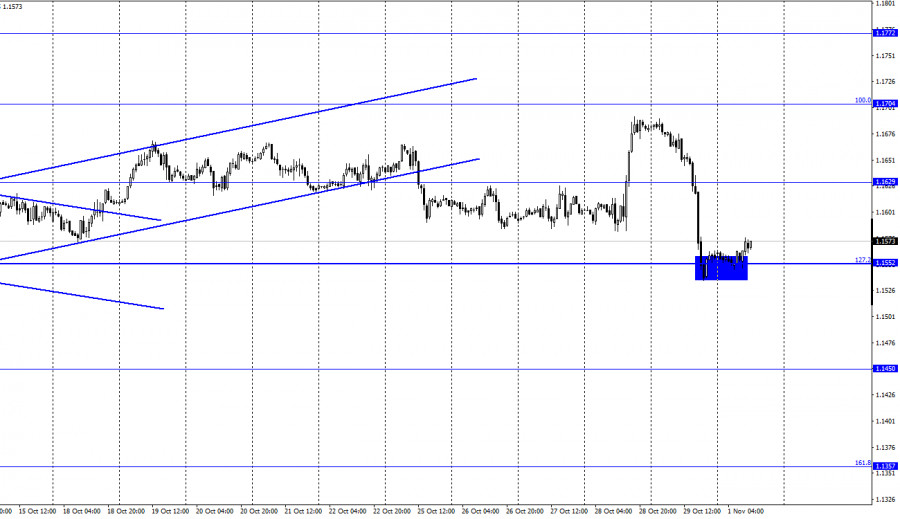

| Forecast for EUR/USD on November 1 (COT report). A tumultuous week for the US dollar Posted: 01 Nov 2021 04:23 AM PDT EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the US currency on Friday and began an even stronger decline than the growth on Thursday. As a result, the quotes dropped to the corrective level of 127.2% (1.1552). Thus, some growth of the pair is possible in the direction of the level of 1.1629, around which the quotes have been spinning for a couple of weeks. The information background on Friday was quite strong, but not as strong as on Thursday. Nevertheless, on Thursday we learned the results of the ECB meeting, as well as GDP in the United States. On Friday, the European Union also released a report on GDP for the third quarter, and also an inflation report for October. And these two reports could be treated as anything, but not the way traders did it. The fall of the European currency began late at night and at first corresponded to the graphic picture since a strong growth was to be followed by a pullback. But what was the reason for the fall of the European currency in the daytime, when the GDP report exceeded traders' expectations, and inflation accelerated to 4.1% y/y? After all, both of these reports were supposed to cause new growth of the European currency, but instead, we saw an even stronger drop than Thursday's growth. Thus, on Friday, bear traders completely blocked all the efforts of bulls Thursday. It turns out that the US GDP report, which turned out to be significantly weaker than traders' expectations, did not matter much, since it did not prevent the US currency from showing strong growth the very next day. This week, however, the movement may be even more fun than at the end of last week. On Wednesday, the results of the Fed meeting will be announced in America, and on Friday a standard set of reports on the labor market and wages will be released, within which the Nonfarm Payrolls report. It will be released two days after the Fed meeting, although the Fed relies on this report when making a decision. And the last two nonfarm reports left much to be desired. Thus, there are fears that the Fed will again decide to wait for the acceleration of the labor market recovery and only after that will announce the end of QE. EUR/USD – 4H.

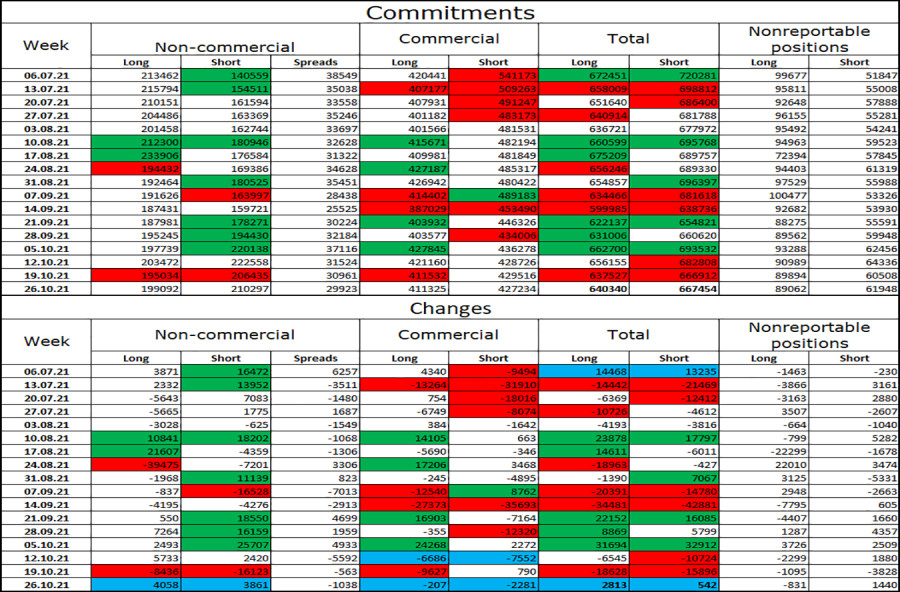

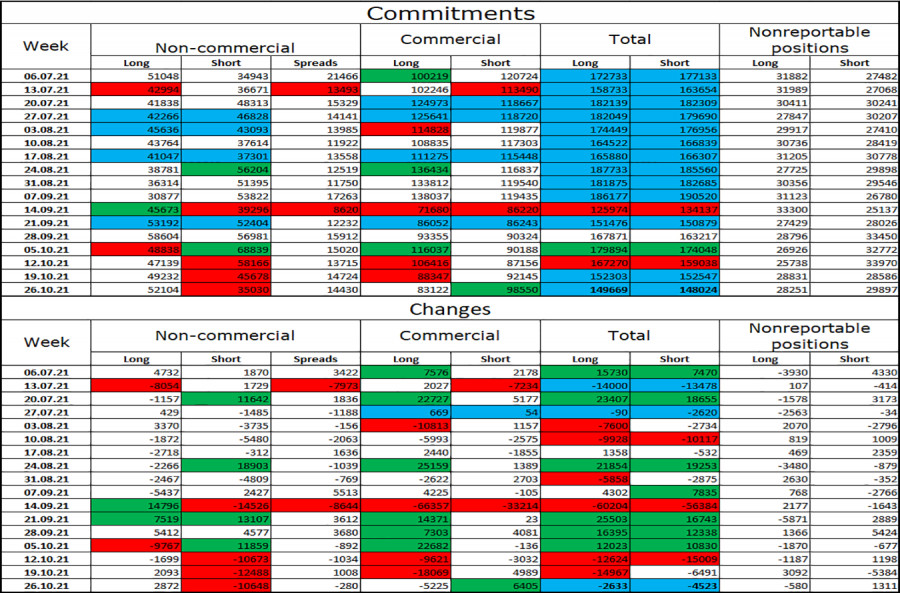

On the 4-hour chart, the quotes closed under the corrective level of 100.0% (1.1606). Thus, the process of the fall of the euro quotes can be continued in the direction of the next Fibo level of 127.2% (1.1404). However, the pair has been spinning around the level of 1.1606 for a long time, and the movements in the last two days of the past week do not fit into the current picture of things at all. News calendar for the USA and the European Union: US - ISM manufacturing index (14:00 UTC). On November 1, the calendar of economic events in the European Union is empty, and in the United States there will be one, but important, ISM index of business activity in the manufacturing sector. The information background for the pair today will be medium-weak. COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders did not change. Speculators have opened 4,058 long contracts on the euro and 3,861 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 199 thousand, and the total number of short contracts - up to 210 thousand. Over the past few months, the "Non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but in the last three weeks, the European currency has been leaning towards weak growth (if we do not take into account the last day of last week). In general, the fall of the euro still looks more preferable. EUR/USD forecast and recommendations to traders: Traders are still not trading the pair too actively. On Thursday and Friday, the movements were strong, but it looks more like a one-time action. I recommend buying a pair if there is a rebound from the level of 1.1552 on the hourly chart, with a target of 1.1629. I recommend selling the pair if a close is made under the level of 1.1552, with a target of 1.1450. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations. "Non-reportable positions" are small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

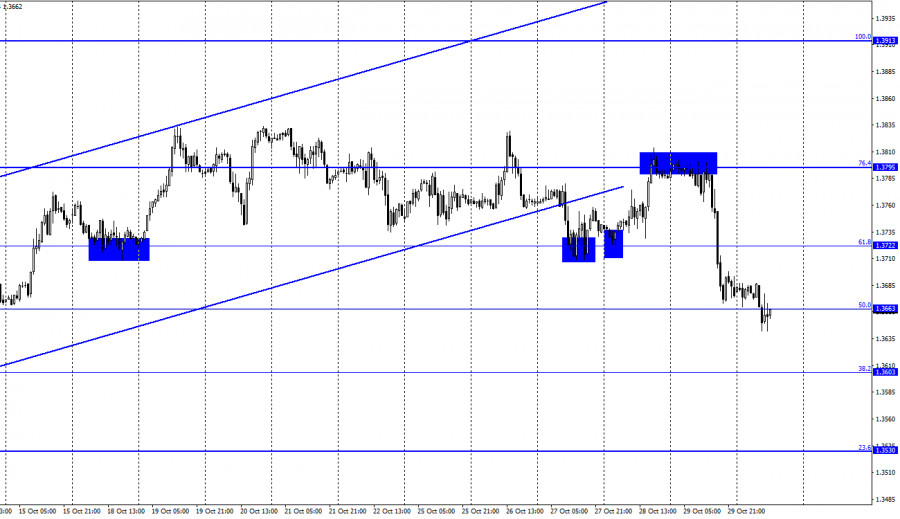

| Posted: 01 Nov 2021 04:23 AM PDT GBP/USD – 1H.

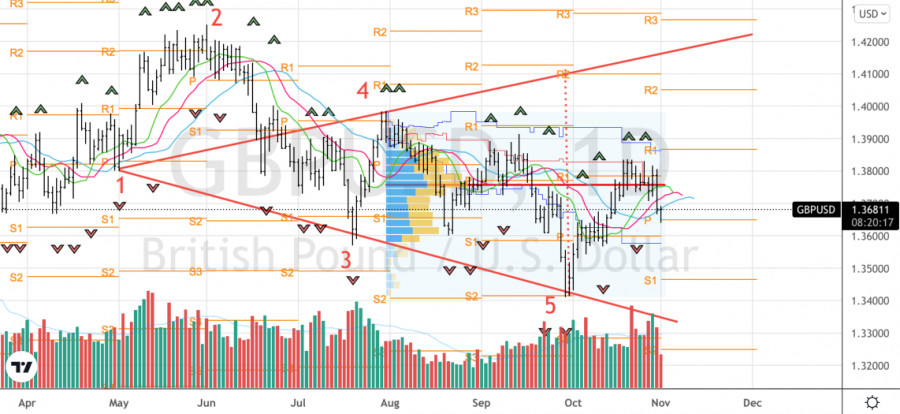

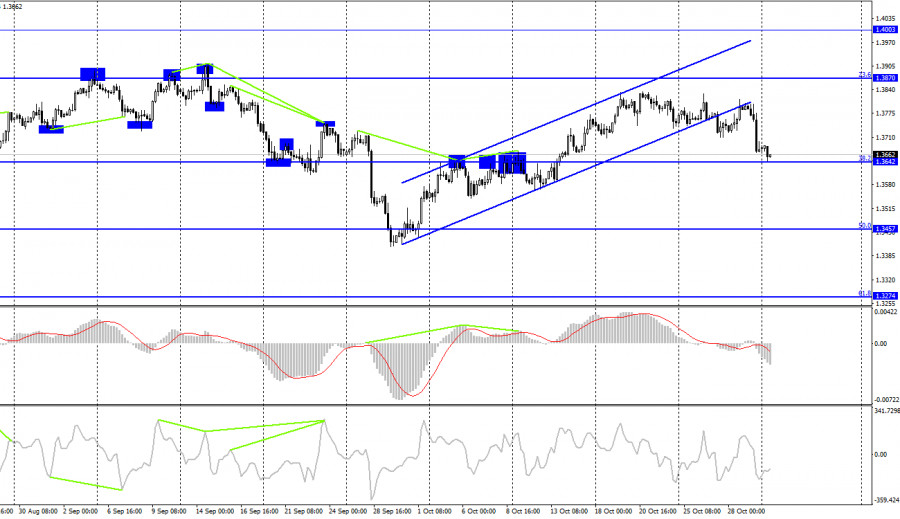

According to the hourly chart, the GBP/USD pair performed a rebound from the corrective level of 76.4% (1.3795) and then the process of falling continues. The quotes have already closed at the levels of 1.3722 and 1.3663. Thus, the fall in quotes continues in the direction of the next corrective level of 38.2% (1.3603). Last Thursday, there was a fairly strong growth in the British dollar, which was due to a poor report on GDP in America. But why the British started falling on Friday and continues it on Monday, when even the European currency is trying to pull back up, is a big question. On Friday, the information background in the UK was completely absent, and in the US there were only two far from the most important reports on income and expenses of Americans in October. It is unlikely that this data could bring the pair down by 120 points. And today, on Monday, not a single report has yet been released either in the UK or in the USA. Therefore, why the pound is falling today is even more difficult to say. However, this week, the results of the Fed meeting will be summed up. And one of the most anticipated solutions is the curtailment of the economic stimulus program. Thus, the dollar may be growing on expectations of curtailing the QE program. Also this week, on Thursday, the results of the Bank of England meeting will be summed up, from which traders also expect certain "hawkish measures". Or at least an increase in the number of those voting "for" a reduction in the incentive program for board members. Both can support the British, but traders now seem to be in a state of euphoria about the Fed's future decisions. At least, it is quite difficult to explain the growth of the dollar against the British and the European with something else. But I want to note that the Fed may postpone the decision to curtail QE at a later date. And on Friday, Nonfarm Payrolls may be worse than expected for the third time in a row. Thus, the growth of the dollar may be short-lived. GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed consolidation under the upward trend corridor and fell to the corrective level of 38.2% (1.3642). The rebound of the pair's rate from this level will allow traders to expect a reversal in favor of the British and some growth in the direction of the Fibo level of 23.6% (1.3870). Fixing quotes below the correction level of 38.2% will increase the probability of a further fall in the direction of the next level of 50.0% (1.3457). News calendar for the USA and the UK: US - ISM manufacturing index (14:00 UTC). On Monday, the information background in the US will be quite weak, and in the UK - zero. Thus, today the activity of traders will be much weaker than on Friday. Graphic factors will be in the first place in importance. COT (Commitments of Traders) report:

The latest COT report on October 26 for the pound showed that the mood of the major players has become much more "bullish" again. In the reporting week, speculators opened 2,872 long contracts and closed 10,648 short contracts. Thus, the number of long contracts in the hands of major players now exceeds the number of short contracts by 17 thousand. Now we can say that the mood of the "Non-commercial" category of traders has become "bullish". However, at the same time, the graphic picture suggests a possible drop in the quotes of the British, since two trend corridors were abandoned at once. In recent weeks, major players have not had any clear mood and are now increasing purchases, then increasing sales, and the total number of long and short contracts is the same for all categories of traders. Thus, after four weeks of an active build-up of longs, it may be the turn of shorts. GBP/USD forecast and recommendations to traders: I recommend new purchases of the British if the rebound from the level of 38.2% (1.3642) is made on the 4-hour chart with a target of 1.3722. I recommended selling if there is a rebound from the 1.3795 level on the hourly chart, with a target of 1.3722. As a result, both this level and the 1.3663 level were reached. I do not recommend new sales now. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations. "Non-reportable positions" are small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments