Forex analysis review

Forex analysis review |

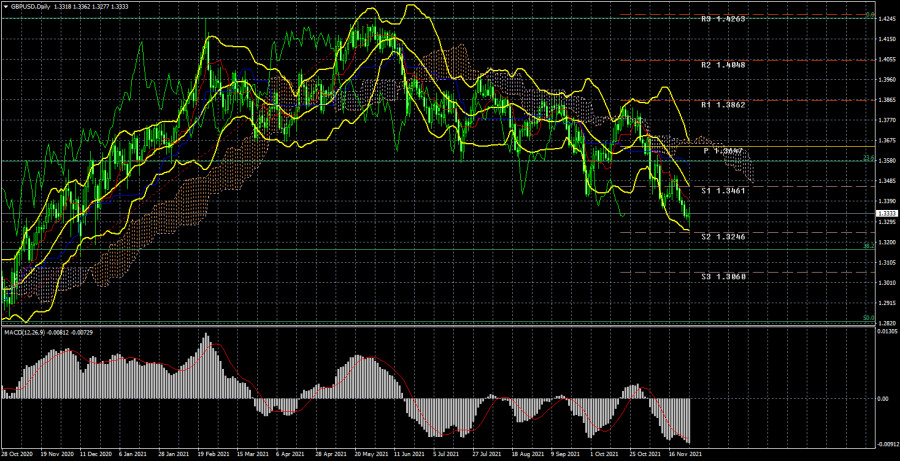

| Posted: 26 Nov 2021 11:47 PM PST Analysis of GBP/USD 24-hour TF.

The GBP/USD currency pair continued its steady decline during the current week. If the euro currency significantly adjusted on Friday, then the pound sterling did not. It turns out that traders have not found any grounds for correction for the pound. And this is quite strange since it is the pound sterling that has been declining much less willingly than the euro in recent months. Nevertheless, the pound is also maintaining a downward trend, which is visible to the naked eye. However, the general movement is again not as strong as in the euro. In total, the pound/dollar pair did not adjust against the global upward trend of 2020 even by 38.2%. And the euro/dollar adjusted by more than 61.8%. Thus, we still believe that the British currency has a better chance of starting a new upward trend. As for the reason for this, the Bank of England can help the pound, which in November unexpectedly showed its readiness to raise the key rate. If the number of members of the monetary committee voting for an increase increases in December, this may support the pound. Also, do not forget that the pound/dollar pair has already fallen by 550 points over the past 5 weeks. Therefore, given the nature of the pair's movement in 2021, it is high time to start a new round of upward movement. We have been waiting for it for several weeks, but the current fundamental background from the UK does not seem to allow traders to seriously consider buying the British currency. The fact is that London continues to conflict with Brussels, Paris and cannot come to a common denominator on the issues that provoke these conflict situations. Yesterday, Paris again accused London of refusing to issue licenses to all French vessels to fish in British waters, and Maros Sefcovic said that at such a pace negotiations on the "Northern Ireland protocol" will continue next year. And while the situation does not improve, the pound can count on corrective growth. But, as we saw on Friday, he has problems even with that. Analysis of the COT report.

During the last reporting week (November 15-19), the mood of professional traders became much more "bearish". However, this should not be surprising, since the mood of major players has been constantly changing over the past few months, which perfectly reflects the first indicator in the illustration above. The green and red lines, which indicate the net positions (in other words, the mood) of non-commercial and commercial traders, constantly change the direction of movement and constantly change their position relative to the zero level. The last reporting week only confirmed these conclusions. The green line has dropped significantly again, and the red line has increased significantly, although a couple of weeks ago it was the opposite. Thus, formally, the mood of professional traders has become more "bearish", but in reality, it changes every couple of weeks, so it is impossible to make a long-term conclusion. During the reporting week, the Non-commercial group closed 4 thousand buy contracts and opened 17 thousand sell contracts. Thus, the net position decreased by 21 thousand contracts at once, which is a lot for the pound. However, this does not matter much, since the net position of non-commercial traders also constantly jumps up and down, which is eloquently signaled by the second indicator in the illustration above. It should also be noted that in the long term, the pound/dollar exchange rate itself also constantly jumps up and down. Thus, it is not possible to make a long-term forecast based on COT reports. The new COT report was not released on Friday, so we are waiting for it at the beginning of next week. Analysis of fundamental events. The current week has been very boring for the British currency. There was not a single important macroeconomic report during the week. There was not a single important fundamental event, although the Chairman of the Bank of England, Andrew Bailey, made a speech several times, but with the same success as Christine Lagarde. Reports on business activity in the service and manufacturing sectors can hardly be considered important in the current conditions. Thus, the pound continued to fall to a greater extent due to factors related to the dollar and America. But one cannot deny the harmful influence of the British fundamental background, which presents negative surprises almost every week. Trading plan for the week of November 29 - December 3: 1) The pound/dollar pair continues its steady decline. Therefore, purchases are now impractical. To begin with, you need to wait until the pair is fixed above the critical line, or better - above the Ichimoku cloud. Since the price is now very far from these lines, it is unlikely that this will happen in the near future. On the lower timeframe, the pair may change the downward trend to an upward one, which may be the beginning of a round of upward movement on the 24-hour TF. We assume that the pair may go up 400-500 points in the next month or two. But so far there are no signals about the beginning of such a movement. 2) The bears managed to keep the pair below the Ichimoku cloud and now continue to develop their success. The support level of 1.3461 has been overcome, so the chances of further movement to the South are high, and the target is the support level of 1.3246. However, we should be careful: we still expect the formation of a new round of upward correction, based on the general nature of the pair's movement for the whole of 2021. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5). Indicator 1 on the COT charts - the net position size of each category of traders. Indicator 2 on the COT charts - the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

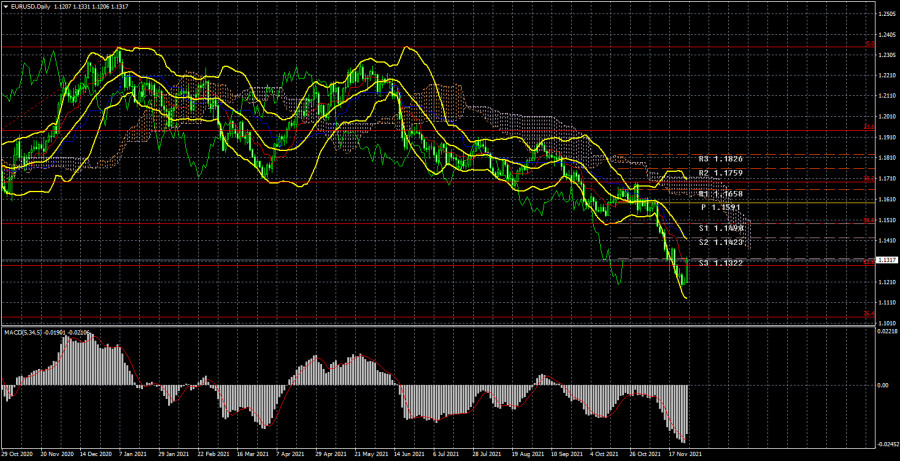

| Posted: 26 Nov 2021 11:47 PM PST EUR/USD 24-hour TF analysis.

The EUR/USD currency pair has fallen by another 80 points during the current week. However, we say "it has fallen yet" since in general the downward movement of the last weeks and even months has continued. On Friday, the quotes of the euro currency rose by 110 points, thus, formally, the euro closed the week in the black. Nevertheless, hardly anyone has any doubts now that our trend is downward. And it is unlikely that just one day will be enough for the pair to break it. We continue to believe that the US dollar is growing in some way unfairly, but at the same time not unreasonably. In other words, there have been grounds for strengthening the dollar in recent weeks. Do not go far and dig deep: the Fed's monetary policy is tightening and looks like it will tighten in the next six months; the ECB's monetary policy does not seem to tighten, and if it does, then formally, for show. Otherwise, there is no way to explain the ECB's desire to curtail the PEPP program on time, at the end of March 2022, and immediately expand the APP program. Thus, such an imbalance between the monetary policies of the two central banks is a good reason for the growth of the dollar and the fall of the euro. Of course, we can also recall that the fourth "wave" of the pandemic is raging in the European Union. And if a couple of months ago the number of diseases was simply growing, now Austria has gone into another "lockdown", Germany updates the anti-records for the number of new diseases every day, the Netherlands is not far away from it. And we are talking about those countries where there are no special problems with vaccines. Hardly anyone doubts that Germany was one of the first to receive vaccines and in sufficient quantity. But people in Germany are not in too much of a hurry to get vaccinated, which, according to the government, is the reason for the high rate of spread of the virus. However, it turns out a strange situation: the virus spread more slowly when there were no vaccines at all. Due to the difficult situation with the "crown" in the European Union, the euro currency could also decline in recent weeks. Analysis of the COT report.

During the last reporting week (November 15-19), the mood of non–commercial traders has changed quite a lot. A group of "Non-commercial" traders opened 7 thousand contracts for purchase and 20.5 thousand contracts for sale during the week. Thus, the net position for professional traders decreased by 13.5 thousand, and the mood became more "bearish". It should be noted that the European currency has fallen quite seriously in the last few weeks. But the net position for the "Non-commercial" group, starting from October, practically does not change. This is indicated by the green line of the first indicator in the illustration above. Almost all this time it has been near the zero level, indicating the absence of serious changes in the mood of major players. Thus, if the general trend remains the same - over the past 10 months, major players have seriously reduced the number of longs and increased the number of shorts, then nothing like this has been observed in the last few weeks, and the European currency has been falling anyway. This suggests that what is happening on the market now does not quite correspond to the actions of major players. The second indicator (a net position for professional traders in the form of a histogram) shows at all that in the last 6 weeks the mood of traders has become less "bearish." In theory, at this time, the euro currency should have been growing, not falling. Thus, if we conclude only from COT reports, then the further fall of the euro currency is completely unobvious. The new COT report was not released on Friday, most likely due to Thanksgiving in the United States. Analysis of fundamental events. The current week has been as boring as possible in terms of macroeconomic and fundamental events. In the European Union, Christine Lagarde again made speeches almost every day and, of course, she did not tell the markets anything new and interesting. Simply because the head of the ECB cannot please traders with new, important information every day. But Lagarde assured the markets even more strongly that the ECB is not going to raise rates in 2023 and will just wait until inflation starts to decline by itself. In the States, the second estimate of GDP for the third quarter was published, as well as a relatively important report on orders for long-term goods. Both reports turned out to be worse than forecasts, but the dollar continued to grow. And only on Friday, when the calendars of the European Union and the United States were empty, the pair show good growth, with a probability of 99% is a banal correction provoked by profit-taking on short positions. Trading plan for the week of November 29 - December 3: 1) On the 24-hour timeframe, the trend remains downward. At the moment, the quotes remain below the Kijun-sen line, and the markets continue to show that they are not ready to buy the euro currency. Thus, the downward movement may resume with a target of 1.1038. The fundamental background supports the further fall of the euro and the growth of the dollar at this time, but we also believe that all factors have long been worked out by the market, so we allow the downward trend to end. 2) As for purchases of the euro/dollar pair, in the current conditions, they should be considered no earlier than fixing the price above the critical line. And ideally - above the Ichimoku cloud, because the price has already overcome the Kijun-sen several times, but then could not continue moving up. There are a few prerequisites for a new uptrend to begin in the near future. First of all, technical. Explanations to the illustrations: Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them. Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5). Indicator 1 on the COT charts - the net position size of each category of traders. Indicator 2 on the COT charts - the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments